Authored by Aaron Day via The Brownstone Institute,

he United States has had a Central Bank Digital Currency (CBDC) since the late 1990s—or possibly even as far back as the 1970s, depending on how you define it. Definitions matter. Just as the bestselling novel 50 Shades of Gray explores the complex dynamics of control and submission in a relationship, our financial system has evolved into what could be called “50 Shades of Central Bank Tyranny.”

Each layer of our digital currency system peels back the seductive mask of freedom, revealing progressively darker shades of control. As we delve deeper, what seems like autonomy at first glance is only an illusion where more intricate and pervasive forms of dominance lay hidden, its grip tightening with every layer.

Our politicians work their sleight of hand by manipulating language itself to give a false impression, masking either a different intent or simply trying to gain the appearance of a victory with little or no actual underlying achievement. After all, the Patriot Act was anything but “patriotic.” The CARES Act, while sounding warmly empathetic, cared more about large multinational corporations than small businesses, about Big Pharma over American health, and above all, about the expansion of the surveillance state and protection of the censorship industrial complex over the liberty and free speech of the American people.

Just as 50 Shades of Gray reveals the intricate power plays in a seemingly consensual relationship, so too does our current financial system reveal its true nature as a digital dominatrix—one that has been steadily adding links to the chain of financial enslavement, tightening its grip on our autonomy for decades.

In this article, I will define what a Central Bank Digital Currency is by exploring its major categories. I’ll demonstrate that the US already operates with a form of CBDC, albeit without the flashy labels. I will also show that the Federal Reserve (the Fed) can introduce more dystopian elements into this system—such as programming restrictions on when, how, and where you can spend your money without requiring Congressional approval.

However, the fear of central bank control over your transactions is, in fact, a red herring. The real threat lies with our government, which has already perfected the art of surveillance. Adding programmability is just the next logical step. Ultimately, both Republicans and Democrats are steering us toward the same destination: total digital control. They may use different words and different propaganda, but their goals converge. While we can’t simply vote out of this predicament, we can opt out entirely.

Context

If you have been following me at all, you know that I have been laser-focused on warning people about the threats of CBDCs for the past two years. This dedication led me to write a book, The Final Countdown, and even run for President to raise awareness about the issue. I handed a copy of my book to Vivek Ramaswamy, and after reading it, our conversations helped bring the CBDC issue to Donald Trump’s attention. Since exiting the race last October and becoming a Brownstone Fellow, I’ve traveled to 22 states to discuss the dangers of CBDCs.

Currently, I’m hosting over 15 four-hour workshops nationwide—and soon internationally—educating people on using alternative currencies to avoid CBDCs and evade The Great Taking, the carefully engineered process that could strip us of our stocks, bonds, and 401(k)s to benefit the largest banks through legal maneuvers across all 50 states.

I entered the crypto space in 2012, but it wasn’t until I saw friends and people I admired being arrested, imprisoned, or having their businesses destroyed by the federal government that I became truly passionate about this issue. Since I exited my personal bank account in 2019, this has impacted me personally. I started to research the topic and discovered that the crackdown on crypto was directly related to CBDCs. Put simply, the government needed to crack down on crypto to usher in a CBDC.

For two years, I have been traveling around the country (and soon the world) to warn people about the perils of CBDCs that could come right around the corner. But as I’ve dug deeper into the technical and legal aspects of this, I’ve come to the conclusion that we already have a CBDC. We have for decades. Our transactions are already surveilled. Banks and the government can censor our accounts. The money in our bank accounts is already digital (at least 92%). There is no need to worry about the future threat of CBDCs. We already have them. At this point, we are just fighting over our degrees of slavery.

The Dollar Is Just an Entry in a Database

It becomes clear that we already have CBDCs when you start examining how money is created.

As explored in my previous article, “You Might Own Nothing Sooner Than You Think,” modern commerce now flows through vast, centralized databases. These databases form the backbone of our financial system, housing everything from our bank account balances to our stock holdings. Money is no different.

Let’s start with the basics of money creation: government borrowing. The government sells IOUs in the form of Treasury securities (bills, notes, and bonds) to the Federal Reserve. Where does the Federal Reserve get the money to buy these securities? They create it out of thin air. Or, to be more accurate, they simply add some ones and zeros in the database – an Oracle database, no less (thanks, Larry Ellison!).

The Federal government then pays its bills through its account at the Federal Reserve. When checks are written for projects like a $3.4 million turtle tunnel in Florida or a $600,000 study on why chimpanzees throw feces, the funds are transferred from the Fed’s Oracle database to the accounts of vendors and employees at commercial banks, each maintaining their own separate databases. Some use Oracle, and others use Microsoft.

Here’s where it gets even more absurd: for every dollar deposited by its customers, a commercial bank can create nine new dollars in its database to loan out to other customers. We have a fractional reserve system, and for years (since 1992), banks were required to send 10% of the deposits back to the Federal Reserve to be held as reserves. Covid-19 legislation removed this requirement, and now banks aren’t required to have 10% at the Federal Reserve (although for a variety of other reasons they do still keep about that level at The Fed).

The government issues an IOU to the Federal Reserve, which creates digital money in a database. The government pays its bills, the checks are deposited in commercial banks that create additional money, and a portion of it is sent back to the Fed—all in the form of digital entries in databases. If you add up the number of Central Bank and Commercial Bank databases globally, you wind up with more than 60,000 separate databases sending entries back and forth.

What’s a CBDC?

When someone asks me, “What is a CBDC?” I start by examining the grammar of the question. A CBDC is a Central Bank Digital Currency. The Federal Reserve is our central bank, and our currency is already digital—the 1s and 0s are created out of thin air in an Oracle database. By this definition, we’ve had a CBDC for decades.

As of 2024, only 8% of US currency exists physically, leaving the other 92% digital. So, are we a 92% CBDC? We become a CBDC at the point at which greater than 50% of our currency exists digitally.

Politicians and central bankers claim we don’t currently have a CBDC and wouldn’t likely agree with my definition. I have tried to understand their definitions and isolate the discrepancies.

Generally speaking, when central banks, the World Economic Forum (WEF), United Nations (UN), World Bank, International Monetary Fund (IMF), and Bank for International Settlements (BIS) talk about CBDCs, at their core, they are defined as being digital, being a liability of the central bank (as opposed to being the liability of commercial banks), and if you recall from earlier, create their own money in their own separate database and provide only the small amount (10%) back to the central bank in the form of reserves.

This has always struck me as a difference without a distinction. Why? Because it’s the commercial banks that own the Federal Reserve—or at least, that’s the common belief. As a private entity, the true ownership of the Federal Reserve remains shrouded in secrecy, but by all accounts, it appears to be controlled by a cartel of private banks. I recommend G. Edward Griffin’s The Creature from Jekyll Island for more insight into this.

Here’s how it works: The money is initially created in the Federal Reserve’s database, and then it’s deposited into the separate databases of the very banks that own the Federal Reserve. These banks, in turn, create even more money based on those deposits.

Having dispensed with the idea that a currency issued by a central bank and a currency issued by a central bank that is then used as backing for the issuance of more currency by a commercial bank is effectively given the same thing given that the banks own the Federal Reserve, let’s address some other misconceptions about a CBDC.

Myth: If I have a CBDC, I will have an account directly with the Federal Reserve, and my bank will disappear.

Most people have the fear/belief that a Central Bank Digital Currency means they would have an account directly with the Federal Reserve, and the commercial banks would go away altogether. This is also one of the reasons many think CBDCs will never happen—because commercial banks will resist and fight to the death for their very survival. Yet none of the CBDCs launched (including China’s) have this structure. In China, the People’s Bank of China (PBOC) creates the CBDC and then issues it to commercial banks.

The consumers don’t deal directly with the central bank. There are 134 countries pursuing a CBDC, and we haven’t seen any (including the US) contemplating cutting out the commercial banks. Therefore, I don’t think you can reasonably say that consumers having an account directly with the central bank constitutes a critical requirement for being a CBDC.

When you hear talking heads from the UN, WEF, World Bank, IMF, and others talk about CBDCs, you often hear programmability, surveillance and control, financial inclusion, and essential elements. Let’s do a test and see if the current dollar has or could have these “features.”

Programmability: The most dystopian fears about CBDCs revolve around their ability to be programmed. In theory, with their nebulous owners, governments, or central banks could embed rules dictating how, when, where, and even if you can spend your digital money. People often associate this kind of programmability with blockchain technologies like Bitcoin and Ethereum, using smart contracts and tokens (unique digital representations of assets, which I discuss in detail in this article).

You don’t need new blockchain technology to enable programming. The Federal Reserve’s Oracle database and the Microsoft and Oracle systems used by commercial banks are programmable right now. Companies and individuals have been using Application Programming Interfaces (APIs) with these databases for years. Rules are already in place to flag certain transactions based on specific criteria—exactly what programmability is all about. So, while having a single, centralized digital currency might make it easier for Big Brother to enforce spending rules, the tech to do it is already alive and kicking in our current system.

The existing financial system relies heavily on complex algorithms and automated decision-making processes, influencing everything from payment processing to credit scoring. But what’s truly astonishing is the extent to which programming has already permeated our financial lives, with examples including credit cards that can shut off access to money based on carbon emissions, health savings accounts that only allow purchases of pre-approved medical expenses, transaction routing algorithms that prioritize certain merchants over others, anti-money laundering systems that flag suspicious activity in real time, and payment processors that can dynamically adjust interest rates and fees based on individual credit scores.

A complex series of algorithms and automated decision-making processes are already at work as you head to the home goods store to buy a new gas stove (while it is still legal). When you swipe your credit card to make the purchase, the payment processor’s algorithm checks your credit score to determine whether you’re eligible for the purchase, while the bank’s system reviews your account balance to ensure you have enough funds to cover the transaction.

Meanwhile, the anti-money laundering (AML) system runs in the background, flagging any suspicious activity that might indicate money laundering or other illicit activities. The algorithm also checks the merchant category code (MCC) for the home goods store, verifies that the purchase is within your approved spending limits, and calculates the interest rate and fees associated with your credit card based on your individual credit score. As the transaction is processed, the payment processor’s algorithm routes the payment to the store’s bank, and the funds are transferred, all in a matter of seconds, allowing you to take your new gas stove home and start cooking up a storm.

The Doconomy Mastercard, a co-branded card with the United Nations, takes programmability a step further by tying financial transactions to carbon emissions. The card uses algorithms to track the carbon footprint of every purchase, and if a user’s carbon spending exceeds a certain limit, the card can be declined or even shut off. This social engineering is achieved through a complex system that assigns a carbon score to each merchant and transaction, considering factors such as the type of goods or services being purchased, the location, and the mode of transportation used. The algorithm then calculates the user’s total carbon footprint and compares it to a predetermined limit, which can be adjusted based on the user’s individual carbon budget. If the limit is exceeded, the card can be restricted or shut off, limiting the user’s access to their money.

Health Savings Accounts (HSAs) are another example of programmability in the financial system. HSAs are tax-advantaged savings accounts that allow individuals to set aside funds for medical expenses. However, these accounts come with strict rules and limitations on what products and services can be purchased. The funds in an HSA can only be used for pre-approved health expenses, such as doctor visits, prescriptions, and medical equipment.

The account is linked to a debit card or checkbook, but the funds can only be used at merchants that have been pre-approved by the HSA administrator. This is achieved through a system of merchant category codes (MCCs) identifying the type of business or service provided. When an HSA card is swiped, the MCC is checked against a list of approved codes to ensure that the transaction is eligible for reimbursement. If the MCC is not approved, the transaction is declined, limiting the user’s ability to access their own funds for non-medical expenses. This programmability ensures that HSA funds are used only for their intended purpose while providing a convenient and tax-efficient way to save for medical expenses.

When a politician gives a speech claiming they are fighting the good fight against these horrible CBDCs on the basis of protecting Americans from having their money programmed, inform them about how the existing system works. No major technical upgrade is needed, and no significant laws have been passed to add more programmability. New rules and algorithms are developed every day, all without any public hearing, Congressional approval, or even a shoutout on your favorite financial news channel.

Surveillance: If there’s one thing Americans are increasingly worried about, it’s that every single transaction will be under the government’s watchful eye. Ted Cruz didn’t mince words when he said, “The Biden Administration is actively working to create a new digital currency that will allow the government to spy on our transactions and control our financial freedom. We must stop this now.” Ron DeSantis has also made his stance crystal clear, declaring, “The Biden administration’s push for a Central Bank Digital Currency is all about surveillance and control. Florida won’t stand for it—we will protect Floridians’ financial privacy and security.”

And let’s not forget Senator Cynthia Lummis, Wyoming’s Republican senator, who’s a favorite among Bitcoin enthusiasts. She has also sounded the alarm: “I’m deeply concerned about the Biden Administration’s push for a CBDC. It could be used to gather information on Americans and potentially even control their spending. We need to ensure any digital currency system protects privacy and individual liberty.”

It’s not just Republicans waving the flag while bleating about privacy. Even Elizabeth Warren, who has advocated for CBDCs, has said, “If we’re going to create a digital dollar, we have to make sure it works for everyone, not just the wealthy, and that it protects consumer privacy.”

How noble. How patriotic. How completely divorced from the reality of their voting records. Our current digital dollar is and has been highly tracked and censored for decades.

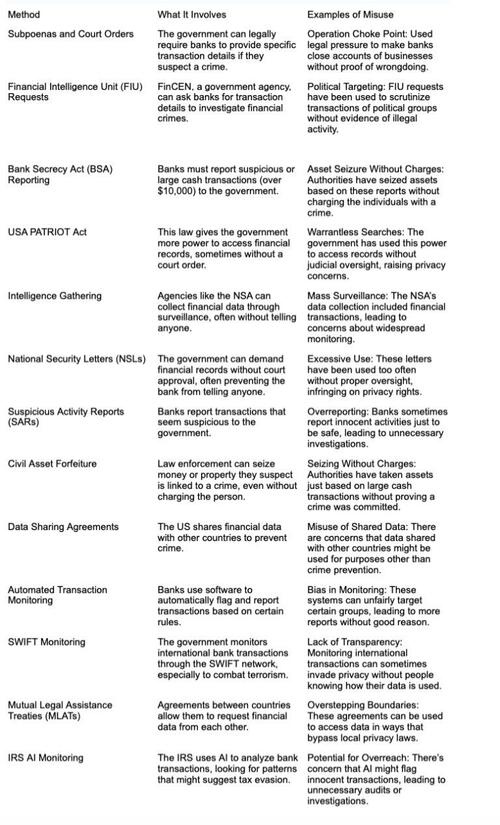

In the US, the government has various methods to gain access to financial transaction information, depending on the type of information and the circumstances. Here are some of their methods:

Let’s put this into more personal terms. I could write an entire book with just case studies about how the government has used surveillance techniques to target people. I have friends in prison for non-violent crimes made possible by this very surveillance.

I’ve picked these two gems because they highlight just how extreme the surveillance measures are with our banking system as it is today.

The Case of Rebecca Brown: Civil Asset Forfeiture Gone Wrong

In 2015, Rebecca Brown’s father, Terry Brown, was driving from their home in Michigan to visit family in New Jersey. He was carrying $91,800 in cash, and his daughter spent years saving to buy a house. Terry didn’t trust banks (wise man), so he withdrew the money and carried it with him for safekeeping.

While driving through Pennsylvania, a state trooper pulled him over for a minor traffic violation. When the officer discovered the cash, he immediately became suspicious, despite Terry’s clear explanation that the money belonged to his daughter and was intended to buy a house. Without any charges or evidence of a crime, the police seized the entire $91,800 under civil asset forfeiture laws.

Rebecca and her father spent over a year and thousands of dollars fighting to get their money back. The case garnered national attention, highlighting the abusive nature of civil asset forfeiture laws that allow law enforcement to take money from innocent people without any proof of wrongdoing. Eventually, the money was returned, but only after a long and costly legal battle that left the family financially strained and emotionally exhausted.

The Story of Nick Merrill: Gagged by a National Security Letter

Nick Merrill owned a small New York internet service provider (ISP). Out of the blue, one day in 2004, his life completely changed when the FBI served him with a National Security Letter (NSL). The letter demanded that he turn over confidential customer records, and it came with a gag order. He wasn’t allowed to tell anyone, including his lawyer, about the request.

Merrill was horrified. The FBI didn’t provide any evidence or court order—just the NSL. He couldn’t challenge the letter in court because the gag order made it illegal to speak about it. Merrill felt his constitutional rights had been violated, but had no visible recourse.

For years, Merrill fought the gag order in secret, unable to tell even his closest friends what was happening. It wasn’t until 2010—six years later—that Merrill finally won the right to speak publicly about his case, becoming the first person to challenge an NSL gag order successfully. The experience left him deeply shaken. And as he was the first to challenge an NSL successfully, we don’t know how many people have had a similar experience.

So, let me recap this for you: the NSA already bulk collects our financial data, the IRS uses AI in conjunction with the IRS to monitor our spending, the banks already have rules (programming) to track for suspicious behavior, and between the Patriot Act and National Security Letters, we can be spied on without court approval and may not even be able to talk about it (even with a lawyer).

Our money is digital, and it’s already under heavy surveillance. How much worse can it get? At first, I thought maybe folks like Cruz, DeSantis, and Warren didn’t realize how deep the surveillance rabbit hole already goes. But then I dug deeper. Despite their public outcry about privacy, Ted Cruz voted for the US FREEDOM Act, which reauthorized parts of the Patriot Act, including those pesky NSLs. Warren backed it too, while pushing to strengthen the Bank Secrecy Act. DeSantis? Same deal—he voted for the US FREEDOM Act and supported efforts to tighten the Bank Secrecy Act’s grip.

Financial Inclusion: One of the most absurd claims and a perfect demonstration of Orwellian doublespeak from globalist organizations like the WEF, UN, and Bank of International Settlements is that CBDCs will promote financial inclusion.

When they say CBDC, what they really mean is banning physical cash. Remember that no formal definition states that you can’t have a CBDC alongside physical cash. The very definition of CBDC itself is not only contested between these groups, but it also has shifted and become more narrowly defined as time progresses. In part, I think this is to deflect from how authoritarian the existing system already is. You can have both cash and a CBDC like we already do in America, and many of the other pilot programs worldwide contemplate either having physical cash alongside CBDCs or gradually phasing out cash. So, again, definitions matter. BIS and WEF “inclusion” means they’ll strip away cash and call it progress.

Here’s the kicker: about 4.5% of Americans are unbanked and depend on physical cash to survive. Under a CBDC system, use of the system and carrying out transactions require permission, and that permission can be denied. Banks could completely exclude these people from the economy—left without any means of exchange. That’s not inclusion; it’s worse than the current situation. It’s explicit exclusion.

Tokenization: The IMF and BIS have been peddling a semantic argument that a central bank digital currency (CBDC) is only truly “digital” if it’s tokenized, i.e., assigned a unique, trackable token to each unit of currency. However, this distinction is largely a matter of terminology rather than substance. The vast majority of money already exists in digital form, stored in databases such as the Federal Reserve’s Oracle database or commercial banks’ Oracle/Microsoft databases. The real debate is not about whether money is digital but about who controls the digital ledger. In the US, the divide seems to be along party lines, with Democrats advocating for a central bank-issued, tokenized currency, while Republicans, led by Cynthia Lummis, push for commercial bank-issued stablecoins. However, this distinction needs to be more precise, as both options are equally programmable, surveillable, and controllable by the government.

Moreover, commercial banks own central banks, rendering the distinction between the two largely moot. Tokenization doesn’t magically make something “digital;” it’s simply a different type of digital representation. Ultimately, whether it’s a central bank-issued token or a commercial bank-issued stablecoin, the result is a programmable, trackable, and potentially oppressive digital currency threatening individual freedom and autonomy.

CBDC Finally Defined

We have a central bank digital currency. Politicians and globalist organizations like the UN/WEF/BIS like to shift the goalposts, adding narrow definitions that get more tyrannical with each new redefinition.

Central Bank Digital Currencies (CBDCs) are no longer a future concept but a present reality. We’re not waiting for their implementation; they’re already here, and we’re now measuring the degrees of tyranny that come with them. The CBDC Tyranny Index is a tool designed to help us understand the level of control and surveillance that comes with these digital currencies.

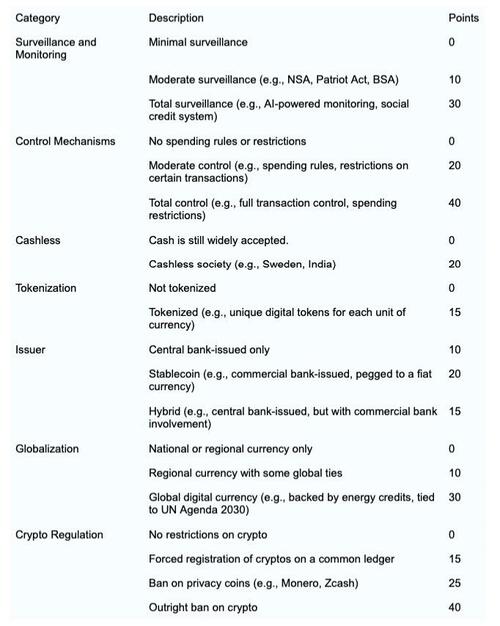

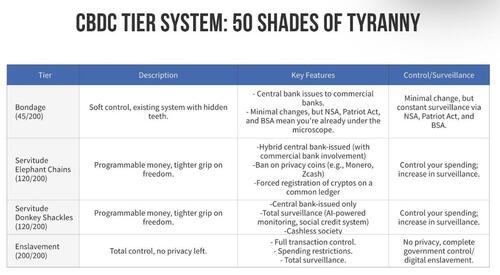

Instead of letting them frame the debate by adding new bells and whistles to the definition of CBDC, I’ve created an index issued as a scoring system to determine the level of tyranny. The index consists of several categories: surveillance and monitoring, control mechanisms, cashless society, tokenization, issuer, globalization, and crypto regulation. Each category has a score, and the sum of these scores indicates the level of tyranny. The higher the score, the more oppressive the CBDC.

We’re already at the Bondage Level, with a score that indicates a significant loss of freedom and autonomy. But it’s not going to stop there. The cut-off for the Servitude Level is 120 points, and there are multiple ways to reach that threshold. One way is through the increased use of AI-powered monitoring, combined with a cashless society and tokenization. But make no mistake; this is just one possible path to Servitude. We know the end game: a global digital currency tied to a social credit system where every transaction is tracked and controlled. This is the dystopian future that’s discussed in my book, The Final Countdown.

How We Can Fight Back

I wrote this article to make one thing perfectly clear: we already have a CBDC. CBDCs aren’t a future threat, they are a present reality. The existing system is already digital, programmable, and trackable. Politicians, central bankers, and globalist organizations keep shifting the definition of CBDC to deflect from the fact that we already have one and to groom us for even deeper shades of tyranny.

We need to take ownership of the definition of CBDCs to make their intentions clear – which is that they are moving towards absolute digital enslavement and a global technocracy.

We must hammer and meme the bondage, servitude, and enslavement CBDC tiers and explain the different elements of the CBDC tyranny index. We need to bring awareness to the fact that Republicans and Democrats are both complicit in bringing about this tyranny, both complicit in the semantic manipulation of the definition of CBDCs, and both are actively working towards passing legislation that elevates the level of tyranny from bondage to servitude.

The Dems will get us to the servitude level through a Central Bank-issued, tokenized dollar under the guise of financial inclusion. This is the current policy under President Biden’s Executive Order 14067. The Republicans will get us there through enhanced surveillance and by giving monopoly control of tokenized commercial bank digital currency to the largest banks, most likely under the guise of stopping illegal immigration, terrorism, and money laundering.

I highlight the behavior of politicians on both sides of the aisle, not because I think you should write or call your Congressman. We can’t vote our way out. All of the legislation that added the programmability and surveillance has been bipartisan. Every fiat currency in human history has failed, and even the last 5 global reserve currencies only lasted 84 years. The difference this time is that it is a controlled demolition. They are doing it intentionally to bring in a wholly digital control system.

The way forward is through radical non-compliance and adopting monetary alternatives that are outside the state’s control. In 2019, I stopped using a personal bank account and started using self-custody crypto, gold, and silver. In light of the recent revelations about the hijacking of Bitcoin (I recommend reading Hijacking Bitcoin for more information) and its traceability, I have moved to privacy coins like Zano and Monero and use physical gold, goldbacks, and silver as well. I am currently hosting 4-hour workshops in cities across the US and soon internationally as well where I show people exactly how to obtain and use alternative currencies as a substitute for the dollar. .

By exiting the dollar now, we can end our bondage, stave off complete digital enslavement, and build a future based on free will and centralization. We need not cry about the loss of our current system. We should set fire to tears and begin a freer, decentralized future.

Authored by Aaron Day via The Brownstone Institute,

he United States has had a Central Bank Digital Currency (CBDC) since the late 1990s—or possibly even as far back as the 1970s, depending on how you define it. Definitions matter. Just as the bestselling novel 50 Shades of Gray explores the complex dynamics of control and submission in a relationship, our financial system has evolved into what could be called “50 Shades of Central Bank Tyranny.”

Each layer of our digital currency system peels back the seductive mask of freedom, revealing progressively darker shades of control. As we delve deeper, what seems like autonomy at first glance is only an illusion where more intricate and pervasive forms of dominance lay hidden, its grip tightening with every layer.

Our politicians work their sleight of hand by manipulating language itself to give a false impression, masking either a different intent or simply trying to gain the appearance of a victory with little or no actual underlying achievement. After all, the Patriot Act was anything but “patriotic.” The CARES Act, while sounding warmly empathetic, cared more about large multinational corporations than small businesses, about Big Pharma over American health, and above all, about the expansion of the surveillance state and protection of the censorship industrial complex over the liberty and free speech of the American people.

Just as 50 Shades of Gray reveals the intricate power plays in a seemingly consensual relationship, so too does our current financial system reveal its true nature as a digital dominatrix—one that has been steadily adding links to the chain of financial enslavement, tightening its grip on our autonomy for decades.

In this article, I will define what a Central Bank Digital Currency is by exploring its major categories. I’ll demonstrate that the US already operates with a form of CBDC, albeit without the flashy labels. I will also show that the Federal Reserve (the Fed) can introduce more dystopian elements into this system—such as programming restrictions on when, how, and where you can spend your money without requiring Congressional approval.

However, the fear of central bank control over your transactions is, in fact, a red herring. The real threat lies with our government, which has already perfected the art of surveillance. Adding programmability is just the next logical step. Ultimately, both Republicans and Democrats are steering us toward the same destination: total digital control. They may use different words and different propaganda, but their goals converge. While we can’t simply vote out of this predicament, we can opt out entirely.

Context

If you have been following me at all, you know that I have been laser-focused on warning people about the threats of CBDCs for the past two years. This dedication led me to write a book, The Final Countdown, and even run for President to raise awareness about the issue. I handed a copy of my book to Vivek Ramaswamy, and after reading it, our conversations helped bring the CBDC issue to Donald Trump’s attention. Since exiting the race last October and becoming a Brownstone Fellow, I’ve traveled to 22 states to discuss the dangers of CBDCs.

Currently, I’m hosting over 15 four-hour workshops nationwide—and soon internationally—educating people on using alternative currencies to avoid CBDCs and evade The Great Taking, the carefully engineered process that could strip us of our stocks, bonds, and 401(k)s to benefit the largest banks through legal maneuvers across all 50 states.

I entered the crypto space in 2012, but it wasn’t until I saw friends and people I admired being arrested, imprisoned, or having their businesses destroyed by the federal government that I became truly passionate about this issue. Since I exited my personal bank account in 2019, this has impacted me personally. I started to research the topic and discovered that the crackdown on crypto was directly related to CBDCs. Put simply, the government needed to crack down on crypto to usher in a CBDC.

For two years, I have been traveling around the country (and soon the world) to warn people about the perils of CBDCs that could come right around the corner. But as I’ve dug deeper into the technical and legal aspects of this, I’ve come to the conclusion that we already have a CBDC. We have for decades. Our transactions are already surveilled. Banks and the government can censor our accounts. The money in our bank accounts is already digital (at least 92%). There is no need to worry about the future threat of CBDCs. We already have them. At this point, we are just fighting over our degrees of slavery.

The Dollar Is Just an Entry in a Database

It becomes clear that we already have CBDCs when you start examining how money is created.

As explored in my previous article, “You Might Own Nothing Sooner Than You Think,” modern commerce now flows through vast, centralized databases. These databases form the backbone of our financial system, housing everything from our bank account balances to our stock holdings. Money is no different.

Let’s start with the basics of money creation: government borrowing. The government sells IOUs in the form of Treasury securities (bills, notes, and bonds) to the Federal Reserve. Where does the Federal Reserve get the money to buy these securities? They create it out of thin air. Or, to be more accurate, they simply add some ones and zeros in the database – an Oracle database, no less (thanks, Larry Ellison!).

The Federal government then pays its bills through its account at the Federal Reserve. When checks are written for projects like a $3.4 million turtle tunnel in Florida or a $600,000 study on why chimpanzees throw feces, the funds are transferred from the Fed’s Oracle database to the accounts of vendors and employees at commercial banks, each maintaining their own separate databases. Some use Oracle, and others use Microsoft.

Here’s where it gets even more absurd: for every dollar deposited by its customers, a commercial bank can create nine new dollars in its database to loan out to other customers. We have a fractional reserve system, and for years (since 1992), banks were required to send 10% of the deposits back to the Federal Reserve to be held as reserves. Covid-19 legislation removed this requirement, and now banks aren’t required to have 10% at the Federal Reserve (although for a variety of other reasons they do still keep about that level at The Fed).

The government issues an IOU to the Federal Reserve, which creates digital money in a database. The government pays its bills, the checks are deposited in commercial banks that create additional money, and a portion of it is sent back to the Fed—all in the form of digital entries in databases. If you add up the number of Central Bank and Commercial Bank databases globally, you wind up with more than 60,000 separate databases sending entries back and forth.

What’s a CBDC?

When someone asks me, “What is a CBDC?” I start by examining the grammar of the question. A CBDC is a Central Bank Digital Currency. The Federal Reserve is our central bank, and our currency is already digital—the 1s and 0s are created out of thin air in an Oracle database. By this definition, we’ve had a CBDC for decades.

As of 2024, only 8% of US currency exists physically, leaving the other 92% digital. So, are we a 92% CBDC? We become a CBDC at the point at which greater than 50% of our currency exists digitally.

Politicians and central bankers claim we don’t currently have a CBDC and wouldn’t likely agree with my definition. I have tried to understand their definitions and isolate the discrepancies.

Generally speaking, when central banks, the World Economic Forum (WEF), United Nations (UN), World Bank, International Monetary Fund (IMF), and Bank for International Settlements (BIS) talk about CBDCs, at their core, they are defined as being digital, being a liability of the central bank (as opposed to being the liability of commercial banks), and if you recall from earlier, create their own money in their own separate database and provide only the small amount (10%) back to the central bank in the form of reserves.

This has always struck me as a difference without a distinction. Why? Because it’s the commercial banks that own the Federal Reserve—or at least, that’s the common belief. As a private entity, the true ownership of the Federal Reserve remains shrouded in secrecy, but by all accounts, it appears to be controlled by a cartel of private banks. I recommend G. Edward Griffin’s The Creature from Jekyll Island for more insight into this.

Here’s how it works: The money is initially created in the Federal Reserve’s database, and then it’s deposited into the separate databases of the very banks that own the Federal Reserve. These banks, in turn, create even more money based on those deposits.

Having dispensed with the idea that a currency issued by a central bank and a currency issued by a central bank that is then used as backing for the issuance of more currency by a commercial bank is effectively given the same thing given that the banks own the Federal Reserve, let’s address some other misconceptions about a CBDC.

Myth: If I have a CBDC, I will have an account directly with the Federal Reserve, and my bank will disappear.

Most people have the fear/belief that a Central Bank Digital Currency means they would have an account directly with the Federal Reserve, and the commercial banks would go away altogether. This is also one of the reasons many think CBDCs will never happen—because commercial banks will resist and fight to the death for their very survival. Yet none of the CBDCs launched (including China’s) have this structure. In China, the People’s Bank of China (PBOC) creates the CBDC and then issues it to commercial banks.

The consumers don’t deal directly with the central bank. There are 134 countries pursuing a CBDC, and we haven’t seen any (including the US) contemplating cutting out the commercial banks. Therefore, I don’t think you can reasonably say that consumers having an account directly with the central bank constitutes a critical requirement for being a CBDC.

When you hear talking heads from the UN, WEF, World Bank, IMF, and others talk about CBDCs, you often hear programmability, surveillance and control, financial inclusion, and essential elements. Let’s do a test and see if the current dollar has or could have these “features.”

Programmability: The most dystopian fears about CBDCs revolve around their ability to be programmed. In theory, with their nebulous owners, governments, or central banks could embed rules dictating how, when, where, and even if you can spend your digital money. People often associate this kind of programmability with blockchain technologies like Bitcoin and Ethereum, using smart contracts and tokens (unique digital representations of assets, which I discuss in detail in this article).

You don’t need new blockchain technology to enable programming. The Federal Reserve’s Oracle database and the Microsoft and Oracle systems used by commercial banks are programmable right now. Companies and individuals have been using Application Programming Interfaces (APIs) with these databases for years. Rules are already in place to flag certain transactions based on specific criteria—exactly what programmability is all about. So, while having a single, centralized digital currency might make it easier for Big Brother to enforce spending rules, the tech to do it is already alive and kicking in our current system.

The existing financial system relies heavily on complex algorithms and automated decision-making processes, influencing everything from payment processing to credit scoring. But what’s truly astonishing is the extent to which programming has already permeated our financial lives, with examples including credit cards that can shut off access to money based on carbon emissions, health savings accounts that only allow purchases of pre-approved medical expenses, transaction routing algorithms that prioritize certain merchants over others, anti-money laundering systems that flag suspicious activity in real time, and payment processors that can dynamically adjust interest rates and fees based on individual credit scores.

A complex series of algorithms and automated decision-making processes are already at work as you head to the home goods store to buy a new gas stove (while it is still legal). When you swipe your credit card to make the purchase, the payment processor’s algorithm checks your credit score to determine whether you’re eligible for the purchase, while the bank’s system reviews your account balance to ensure you have enough funds to cover the transaction.

Meanwhile, the anti-money laundering (AML) system runs in the background, flagging any suspicious activity that might indicate money laundering or other illicit activities. The algorithm also checks the merchant category code (MCC) for the home goods store, verifies that the purchase is within your approved spending limits, and calculates the interest rate and fees associated with your credit card based on your individual credit score. As the transaction is processed, the payment processor’s algorithm routes the payment to the store’s bank, and the funds are transferred, all in a matter of seconds, allowing you to take your new gas stove home and start cooking up a storm.

The Doconomy Mastercard, a co-branded card with the United Nations, takes programmability a step further by tying financial transactions to carbon emissions. The card uses algorithms to track the carbon footprint of every purchase, and if a user’s carbon spending exceeds a certain limit, the card can be declined or even shut off. This social engineering is achieved through a complex system that assigns a carbon score to each merchant and transaction, considering factors such as the type of goods or services being purchased, the location, and the mode of transportation used. The algorithm then calculates the user’s total carbon footprint and compares it to a predetermined limit, which can be adjusted based on the user’s individual carbon budget. If the limit is exceeded, the card can be restricted or shut off, limiting the user’s access to their money.

Health Savings Accounts (HSAs) are another example of programmability in the financial system. HSAs are tax-advantaged savings accounts that allow individuals to set aside funds for medical expenses. However, these accounts come with strict rules and limitations on what products and services can be purchased. The funds in an HSA can only be used for pre-approved health expenses, such as doctor visits, prescriptions, and medical equipment.

The account is linked to a debit card or checkbook, but the funds can only be used at merchants that have been pre-approved by the HSA administrator. This is achieved through a system of merchant category codes (MCCs) identifying the type of business or service provided. When an HSA card is swiped, the MCC is checked against a list of approved codes to ensure that the transaction is eligible for reimbursement. If the MCC is not approved, the transaction is declined, limiting the user’s ability to access their own funds for non-medical expenses. This programmability ensures that HSA funds are used only for their intended purpose while providing a convenient and tax-efficient way to save for medical expenses.

When a politician gives a speech claiming they are fighting the good fight against these horrible CBDCs on the basis of protecting Americans from having their money programmed, inform them about how the existing system works. No major technical upgrade is needed, and no significant laws have been passed to add more programmability. New rules and algorithms are developed every day, all without any public hearing, Congressional approval, or even a shoutout on your favorite financial news channel.

Surveillance: If there’s one thing Americans are increasingly worried about, it’s that every single transaction will be under the government’s watchful eye. Ted Cruz didn’t mince words when he said, “The Biden Administration is actively working to create a new digital currency that will allow the government to spy on our transactions and control our financial freedom. We must stop this now.” Ron DeSantis has also made his stance crystal clear, declaring, “The Biden administration’s push for a Central Bank Digital Currency is all about surveillance and control. Florida won’t stand for it—we will protect Floridians’ financial privacy and security.”

And let’s not forget Senator Cynthia Lummis, Wyoming’s Republican senator, who’s a favorite among Bitcoin enthusiasts. She has also sounded the alarm: “I’m deeply concerned about the Biden Administration’s push for a CBDC. It could be used to gather information on Americans and potentially even control their spending. We need to ensure any digital currency system protects privacy and individual liberty.”

It’s not just Republicans waving the flag while bleating about privacy. Even Elizabeth Warren, who has advocated for CBDCs, has said, “If we’re going to create a digital dollar, we have to make sure it works for everyone, not just the wealthy, and that it protects consumer privacy.”

How noble. How patriotic. How completely divorced from the reality of their voting records. Our current digital dollar is and has been highly tracked and censored for decades.

In the US, the government has various methods to gain access to financial transaction information, depending on the type of information and the circumstances. Here are some of their methods:

Let’s put this into more personal terms. I could write an entire book with just case studies about how the government has used surveillance techniques to target people. I have friends in prison for non-violent crimes made possible by this very surveillance.

I’ve picked these two gems because they highlight just how extreme the surveillance measures are with our banking system as it is today.

The Case of Rebecca Brown: Civil Asset Forfeiture Gone Wrong

In 2015, Rebecca Brown’s father, Terry Brown, was driving from their home in Michigan to visit family in New Jersey. He was carrying $91,800 in cash, and his daughter spent years saving to buy a house. Terry didn’t trust banks (wise man), so he withdrew the money and carried it with him for safekeeping.

While driving through Pennsylvania, a state trooper pulled him over for a minor traffic violation. When the officer discovered the cash, he immediately became suspicious, despite Terry’s clear explanation that the money belonged to his daughter and was intended to buy a house. Without any charges or evidence of a crime, the police seized the entire $91,800 under civil asset forfeiture laws.

Rebecca and her father spent over a year and thousands of dollars fighting to get their money back. The case garnered national attention, highlighting the abusive nature of civil asset forfeiture laws that allow law enforcement to take money from innocent people without any proof of wrongdoing. Eventually, the money was returned, but only after a long and costly legal battle that left the family financially strained and emotionally exhausted.

The Story of Nick Merrill: Gagged by a National Security Letter

Nick Merrill owned a small New York internet service provider (ISP). Out of the blue, one day in 2004, his life completely changed when the FBI served him with a National Security Letter (NSL). The letter demanded that he turn over confidential customer records, and it came with a gag order. He wasn’t allowed to tell anyone, including his lawyer, about the request.

Merrill was horrified. The FBI didn’t provide any evidence or court order—just the NSL. He couldn’t challenge the letter in court because the gag order made it illegal to speak about it. Merrill felt his constitutional rights had been violated, but had no visible recourse.

For years, Merrill fought the gag order in secret, unable to tell even his closest friends what was happening. It wasn’t until 2010—six years later—that Merrill finally won the right to speak publicly about his case, becoming the first person to challenge an NSL gag order successfully. The experience left him deeply shaken. And as he was the first to challenge an NSL successfully, we don’t know how many people have had a similar experience.

So, let me recap this for you: the NSA already bulk collects our financial data, the IRS uses AI in conjunction with the IRS to monitor our spending, the banks already have rules (programming) to track for suspicious behavior, and between the Patriot Act and National Security Letters, we can be spied on without court approval and may not even be able to talk about it (even with a lawyer).

Our money is digital, and it’s already under heavy surveillance. How much worse can it get? At first, I thought maybe folks like Cruz, DeSantis, and Warren didn’t realize how deep the surveillance rabbit hole already goes. But then I dug deeper. Despite their public outcry about privacy, Ted Cruz voted for the US FREEDOM Act, which reauthorized parts of the Patriot Act, including those pesky NSLs. Warren backed it too, while pushing to strengthen the Bank Secrecy Act. DeSantis? Same deal—he voted for the US FREEDOM Act and supported efforts to tighten the Bank Secrecy Act’s grip.

Financial Inclusion: One of the most absurd claims and a perfect demonstration of Orwellian doublespeak from globalist organizations like the WEF, UN, and Bank of International Settlements is that CBDCs will promote financial inclusion.

When they say CBDC, what they really mean is banning physical cash. Remember that no formal definition states that you can’t have a CBDC alongside physical cash. The very definition of CBDC itself is not only contested between these groups, but it also has shifted and become more narrowly defined as time progresses. In part, I think this is to deflect from how authoritarian the existing system already is. You can have both cash and a CBDC like we already do in America, and many of the other pilot programs worldwide contemplate either having physical cash alongside CBDCs or gradually phasing out cash. So, again, definitions matter. BIS and WEF “inclusion” means they’ll strip away cash and call it progress.

Here’s the kicker: about 4.5% of Americans are unbanked and depend on physical cash to survive. Under a CBDC system, use of the system and carrying out transactions require permission, and that permission can be denied. Banks could completely exclude these people from the economy—left without any means of exchange. That’s not inclusion; it’s worse than the current situation. It’s explicit exclusion.

Tokenization: The IMF and BIS have been peddling a semantic argument that a central bank digital currency (CBDC) is only truly “digital” if it’s tokenized, i.e., assigned a unique, trackable token to each unit of currency. However, this distinction is largely a matter of terminology rather than substance. The vast majority of money already exists in digital form, stored in databases such as the Federal Reserve’s Oracle database or commercial banks’ Oracle/Microsoft databases. The real debate is not about whether money is digital but about who controls the digital ledger. In the US, the divide seems to be along party lines, with Democrats advocating for a central bank-issued, tokenized currency, while Republicans, led by Cynthia Lummis, push for commercial bank-issued stablecoins. However, this distinction needs to be more precise, as both options are equally programmable, surveillable, and controllable by the government.

Moreover, commercial banks own central banks, rendering the distinction between the two largely moot. Tokenization doesn’t magically make something “digital;” it’s simply a different type of digital representation. Ultimately, whether it’s a central bank-issued token or a commercial bank-issued stablecoin, the result is a programmable, trackable, and potentially oppressive digital currency threatening individual freedom and autonomy.

CBDC Finally Defined

We have a central bank digital currency. Politicians and globalist organizations like the UN/WEF/BIS like to shift the goalposts, adding narrow definitions that get more tyrannical with each new redefinition.

Central Bank Digital Currencies (CBDCs) are no longer a future concept but a present reality. We’re not waiting for their implementation; they’re already here, and we’re now measuring the degrees of tyranny that come with them. The CBDC Tyranny Index is a tool designed to help us understand the level of control and surveillance that comes with these digital currencies.

Instead of letting them frame the debate by adding new bells and whistles to the definition of CBDC, I’ve created an index issued as a scoring system to determine the level of tyranny. The index consists of several categories: surveillance and monitoring, control mechanisms, cashless society, tokenization, issuer, globalization, and crypto regulation. Each category has a score, and the sum of these scores indicates the level of tyranny. The higher the score, the more oppressive the CBDC.

We’re already at the Bondage Level, with a score that indicates a significant loss of freedom and autonomy. But it’s not going to stop there. The cut-off for the Servitude Level is 120 points, and there are multiple ways to reach that threshold. One way is through the increased use of AI-powered monitoring, combined with a cashless society and tokenization. But make no mistake; this is just one possible path to Servitude. We know the end game: a global digital currency tied to a social credit system where every transaction is tracked and controlled. This is the dystopian future that’s discussed in my book, The Final Countdown.

How We Can Fight Back

I wrote this article to make one thing perfectly clear: we already have a CBDC. CBDCs aren’t a future threat, they are a present reality. The existing system is already digital, programmable, and trackable. Politicians, central bankers, and globalist organizations keep shifting the definition of CBDC to deflect from the fact that we already have one and to groom us for even deeper shades of tyranny.

We need to take ownership of the definition of CBDCs to make their intentions clear – which is that they are moving towards absolute digital enslavement and a global technocracy.

We must hammer and meme the bondage, servitude, and enslavement CBDC tiers and explain the different elements of the CBDC tyranny index. We need to bring awareness to the fact that Republicans and Democrats are both complicit in bringing about this tyranny, both complicit in the semantic manipulation of the definition of CBDCs, and both are actively working towards passing legislation that elevates the level of tyranny from bondage to servitude.

The Dems will get us to the servitude level through a Central Bank-issued, tokenized dollar under the guise of financial inclusion. This is the current policy under President Biden’s Executive Order 14067. The Republicans will get us there through enhanced surveillance and by giving monopoly control of tokenized commercial bank digital currency to the largest banks, most likely under the guise of stopping illegal immigration, terrorism, and money laundering.

I highlight the behavior of politicians on both sides of the aisle, not because I think you should write or call your Congressman. We can’t vote our way out. All of the legislation that added the programmability and surveillance has been bipartisan. Every fiat currency in human history has failed, and even the last 5 global reserve currencies only lasted 84 years. The difference this time is that it is a controlled demolition. They are doing it intentionally to bring in a wholly digital control system.

The way forward is through radical non-compliance and adopting monetary alternatives that are outside the state’s control. In 2019, I stopped using a personal bank account and started using self-custody crypto, gold, and silver. In light of the recent revelations about the hijacking of Bitcoin (I recommend reading Hijacking Bitcoin for more information) and its traceability, I have moved to privacy coins like Zano and Monero and use physical gold, goldbacks, and silver as well. I am currently hosting 4-hour workshops in cities across the US and soon internationally as well where I show people exactly how to obtain and use alternative currencies as a substitute for the dollar. .

By exiting the dollar now, we can end our bondage, stave off complete digital enslavement, and build a future based on free will and centralization. We need not cry about the loss of our current system. We should set fire to tears and begin a freer, decentralized future.

Loading…