By Peter Tchir of Academy Securities

First Fridays & Gell-Mann Amnesia Effect

Last weekend’s Fog of War T-Report listed “lack of liquidity” as our number one fear, and even Friday’s “positive” price action was highly suspect! We remain incredibly concerned about liquidity and market structure (leveraged ETFs, momentum strategies masquerading as passive, 0DTE, etc.).

Much of the rest of last weekend’s report focused on jobs and the economy – which to us crystallized on Friday as – 25 bps in September. We think markets will struggle with a “plodding” Fed and that seemed to play out. This isn’t about what “we” think the Fed “should” do, but what the Fed “will” do. Maybe they will surprise us and come out with a 50 bp cut, but given all their messaging, and the preponderance of data, that doesn’t seem likely (yet).

Backtracking a touch, we went out early in the week with (More) Things to Watch – which focused on Bitcoin and Single Stock Leveraged ETFs. Both of which are still topical this weekend.

First Fridays

I remain bearish on equities (based on my economic outlook, the Fed response function, and some valuations). I’m also convinced that investors became overly bullish and overly complacent believing that the “worst was behind us” based on the VIX Hit 65 – Not so Much report.

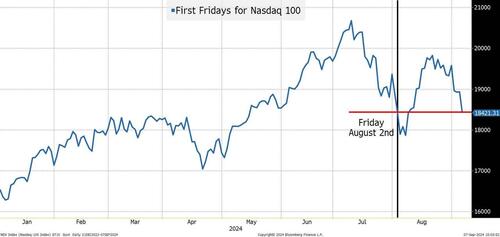

While I suspect that we won’t get a repeat of Sunday August 4th or the morning of Monday August 5th (our jobs aren’t that easy), it is interesting to note that the Nasdaq 100 closed at 18,421, which was lower than the close of 18,441 on August 2nd (both days occurring with 400 or so point drops).

I know no one talks about the yen carry trade (and we do think that its importance is overstated), but the yen closed Friday at 142.30, lower than the close of 144.2 on August 5th, and just above its intraday low of 141.7 at 1am ET on August 5th.

The price of Bitcoin, with $1 trillion of market capitalization, encourages spending (the “HODLERS” may or may not sell, but they spend “fiat” based on their wealth). Bitcoin also closed near its price on Friday August 2nd and is at its lowest level since February.

The first Friday in August (and the trading leading up to it) is eerily similar to what we’ve just lived through in the first week of September.

While I doubt that we will see a similar trading pattern over the weekend, or on Monday (Bitcoin has bounced from Friday’s lows at the time of publication, for example), I do think that we did not have this capitalization on August 5th. The belief that we did has only reset the market to being aggressively long risk in all the ways possible (including those most susceptible to pain – leverage, vol selling, etc.).

I fully expect us to break through the August 5th lows (intraday and closing) in the coming days, or maybe weeks, but I’m leaning towards days.

One thing that I think is extremely important to highlight is that most of the extreme moves in early August occurred prior to U.S. stock markets officially being open. While that may sound “trite” or “naïve,” it is an important distinction. My experience tells me that it is much easier to ignore volatility (and not get stopped out) when markets are closed! The worst was behind us on August 5th by the time the U.S. markets officially opened (including the bogus, in my opinion, print on VIX, which then became a “buy the dip” rallying cry). This was a very different situation from seeing markets sell off as everyone is tuning into financial media to figure out what is going on.

Gell-Mann Amnesia Effect

I provide a link to Epsilon Theory’s take on Gell-Mann Amnesia. It appears to be something coined by Michael Crichton, and all descriptions basically state:

“You open the newspaper to an article on some subject you know well and read the article and see the journalist has absolutely no understanding of either the facts or the issues. It may get it so wrong that it reverses cause and effect. Then, after reading that article, in total frustration, you move on to the next article. An article where you are not a subject matter expert and accept the article as accurate.”

It is natural, and I’m probably overstating the errors in areas where we are subject matter experts (we aren’t tasked with writing to a novice client base, or being extremely limited on word count, etc.), but the effect rings with some degree of truth.

My postulation is that generative AI has hit this point for a lot of users.

The initial appeal of “this is so awesome” is wearing off! Mistakes are found. Facts aren’t always correct or presented correctly. The time to check something produced by generative AI is real. Worse (and my biggest frustration) has been that you didn’t learn anything from using some form of generative AI, unlike the process of researching your own piece, where you stumble down rabbit holes, make wrong turns, even waste some time, but come away more informed with sources to check for future pieces.

Then there is the cost side of the equation. No matter how good generative AI might become, it is only at a certain level today. But, because of the massive demand for it, the cost increased rapidly! The cost of chips, storage, implementers, and energy, etc. all rose far more rapidly than the improvements in the technology were occurring. If the cost benefit worked a year ago, does it work today? Heck, I’m told there are now jobs for “prompt engineers” which seems both cool, and weird at the same time.

Whatever the future of AI is, are we paying too much “here and now” for what it can deliver?

That is a huge question for the markets!

Spend some time with Google Trends. While it isn’t universal, and is more of a dip than a drop, search for phrases like “Gen AI” has been dropping off. Have we moved past the “peak” of what this current cycle of development can deliver? As companies have plowed money into the space for a year or so, and are now evaluating the results, are they finding out that it was money well spent? Or are they deciding that money spent elsewhere might have seen a better return on investment?

I do not know the answers to these questions, but I suspect that many are also confused, which could lead to pullbacks. I am old enough to remember when anyone who announced a “China Strategy” saw their stock pop, which didn’t always work out well.

While I’ve been arguing that we should take out the August lows, all you have to do is look at the “First Friday” graph and see that there is a lot more downside left if we just get back to the April lows, or even to where we were at the start of the year.

Is positioning so aggressive that these levels are attainable?

My poor compliance department (and corporate coverage team) cringes every time I bring up NVDL because it has nothing to do with my views on NVDA, but everything to do with my views on froth and the insanity of approving single name stock ETFs (which don’t help investors, or the companies included in this relatively new breed of ETFs).

If you invested in NVDA on May 23rd, you are basically breakeven. The $100 is still $100 (or close enough).

But if you bought NVDL, your $100 is only worth $83. My math isn’t great, but a 0% return times any amount of leverage is still 0%. But the path dependent nature of daily leveraged ETFs (they need to buy shares on up days and sell shares on down days) means that “investors” in NVDL have lost 17% while true NVDA investors have broken even! Yet, this ETF, with all this drag, continues to get inflows and see its share count rise – which I cannot help but view as a sign of froth below the surface of the market as a whole and why positioning is still too aggressive and is fraught with danger.

Bottom Line

Too many Fed cuts are still priced in, but the data is declining fast enough that they may yet prove to be right, though for now I’d fight the number of cuts.

2s vs 10s closed the week positive (5.7 bps) and I think that 20 bps is the next major target. With 10s and 30s auctioning this week, expect weakness in Treasuries!

Credit spreads, my old friend. I still think the market is largely pricing in that the “soft” landing scenario is no longer the base case. The market is getting to our “bumpy landing” scenario but is a long way off from pricing in a recession (though commodities have caught my eye on that front). I think that spreads will drift wider from here. Well supported and far more stable than equities, but wider, nonetheless. If I was worried about recession risk and felt that private credit and banks weren’t still looking to put money to work, I’d worry more about high yield and leveraged loans, but I think that the selloff will be more of a general widening, appropriately distributed across ratings/products, and not a serious repricing of recession risk, which would cause high yield/leveraged loans to widen far faster.

Equities. I’m looking to take out the August lows, and while I think we could see outperformance in small caps, value, etc., the fact that indices are so heavily weighted to so few stocks and have become the weapon of choice for traders, means that it will be difficult to get positive performance out of those sectors and I think there will be better times to buy!

Now all I can think of is how many people experience the Gell-Mann Amnesia Effect when reading T-Reports? Talk about a depressing way, at least from my perspective, to end this report!

Maybe we’ll get some smooth sailing, but I suspect more bumps and lower lows, because I really think there has been a major disconnect between people believing that we had capitulation (hence they are good to go), versus having seen any actual capitulation!

By Peter Tchir of Academy Securities

First Fridays & Gell-Mann Amnesia Effect

Last weekend’s Fog of War T-Report listed “lack of liquidity” as our number one fear, and even Friday’s “positive” price action was highly suspect! We remain incredibly concerned about liquidity and market structure (leveraged ETFs, momentum strategies masquerading as passive, 0DTE, etc.).

Much of the rest of last weekend’s report focused on jobs and the economy – which to us crystallized on Friday as – 25 bps in September. We think markets will struggle with a “plodding” Fed and that seemed to play out. This isn’t about what “we” think the Fed “should” do, but what the Fed “will” do. Maybe they will surprise us and come out with a 50 bp cut, but given all their messaging, and the preponderance of data, that doesn’t seem likely (yet).

Backtracking a touch, we went out early in the week with (More) Things to Watch – which focused on Bitcoin and Single Stock Leveraged ETFs. Both of which are still topical this weekend.

First Fridays

I remain bearish on equities (based on my economic outlook, the Fed response function, and some valuations). I’m also convinced that investors became overly bullish and overly complacent believing that the “worst was behind us” based on the VIX Hit 65 – Not so Much report.

While I suspect that we won’t get a repeat of Sunday August 4th or the morning of Monday August 5th (our jobs aren’t that easy), it is interesting to note that the Nasdaq 100 closed at 18,421, which was lower than the close of 18,441 on August 2nd (both days occurring with 400 or so point drops).

I know no one talks about the yen carry trade (and we do think that its importance is overstated), but the yen closed Friday at 142.30, lower than the close of 144.2 on August 5th, and just above its intraday low of 141.7 at 1am ET on August 5th.

The price of Bitcoin, with $1 trillion of market capitalization, encourages spending (the “HODLERS” may or may not sell, but they spend “fiat” based on their wealth). Bitcoin also closed near its price on Friday August 2nd and is at its lowest level since February.

The first Friday in August (and the trading leading up to it) is eerily similar to what we’ve just lived through in the first week of September.

While I doubt that we will see a similar trading pattern over the weekend, or on Monday (Bitcoin has bounced from Friday’s lows at the time of publication, for example), I do think that we did not have this capitalization on August 5th. The belief that we did has only reset the market to being aggressively long risk in all the ways possible (including those most susceptible to pain – leverage, vol selling, etc.).

I fully expect us to break through the August 5th lows (intraday and closing) in the coming days, or maybe weeks, but I’m leaning towards days.

One thing that I think is extremely important to highlight is that most of the extreme moves in early August occurred prior to U.S. stock markets officially being open. While that may sound “trite” or “naïve,” it is an important distinction. My experience tells me that it is much easier to ignore volatility (and not get stopped out) when markets are closed! The worst was behind us on August 5th by the time the U.S. markets officially opened (including the bogus, in my opinion, print on VIX, which then became a “buy the dip” rallying cry). This was a very different situation from seeing markets sell off as everyone is tuning into financial media to figure out what is going on.

Gell-Mann Amnesia Effect

I provide a link to Epsilon Theory’s take on Gell-Mann Amnesia. It appears to be something coined by Michael Crichton, and all descriptions basically state:

“You open the newspaper to an article on some subject you know well and read the article and see the journalist has absolutely no understanding of either the facts or the issues. It may get it so wrong that it reverses cause and effect. Then, after reading that article, in total frustration, you move on to the next article. An article where you are not a subject matter expert and accept the article as accurate.”

It is natural, and I’m probably overstating the errors in areas where we are subject matter experts (we aren’t tasked with writing to a novice client base, or being extremely limited on word count, etc.), but the effect rings with some degree of truth.

My postulation is that generative AI has hit this point for a lot of users.

The initial appeal of “this is so awesome” is wearing off! Mistakes are found. Facts aren’t always correct or presented correctly. The time to check something produced by generative AI is real. Worse (and my biggest frustration) has been that you didn’t learn anything from using some form of generative AI, unlike the process of researching your own piece, where you stumble down rabbit holes, make wrong turns, even waste some time, but come away more informed with sources to check for future pieces.

Then there is the cost side of the equation. No matter how good generative AI might become, it is only at a certain level today. But, because of the massive demand for it, the cost increased rapidly! The cost of chips, storage, implementers, and energy, etc. all rose far more rapidly than the improvements in the technology were occurring. If the cost benefit worked a year ago, does it work today? Heck, I’m told there are now jobs for “prompt engineers” which seems both cool, and weird at the same time.

Whatever the future of AI is, are we paying too much “here and now” for what it can deliver?

That is a huge question for the markets!

Spend some time with Google Trends. While it isn’t universal, and is more of a dip than a drop, search for phrases like “Gen AI” has been dropping off. Have we moved past the “peak” of what this current cycle of development can deliver? As companies have plowed money into the space for a year or so, and are now evaluating the results, are they finding out that it was money well spent? Or are they deciding that money spent elsewhere might have seen a better return on investment?

I do not know the answers to these questions, but I suspect that many are also confused, which could lead to pullbacks. I am old enough to remember when anyone who announced a “China Strategy” saw their stock pop, which didn’t always work out well.

While I’ve been arguing that we should take out the August lows, all you have to do is look at the “First Friday” graph and see that there is a lot more downside left if we just get back to the April lows, or even to where we were at the start of the year.

Is positioning so aggressive that these levels are attainable?

My poor compliance department (and corporate coverage team) cringes every time I bring up NVDL because it has nothing to do with my views on NVDA, but everything to do with my views on froth and the insanity of approving single name stock ETFs (which don’t help investors, or the companies included in this relatively new breed of ETFs).

If you invested in NVDA on May 23rd, you are basically breakeven. The $100 is still $100 (or close enough).

But if you bought NVDL, your $100 is only worth $83. My math isn’t great, but a 0% return times any amount of leverage is still 0%. But the path dependent nature of daily leveraged ETFs (they need to buy shares on up days and sell shares on down days) means that “investors” in NVDL have lost 17% while true NVDA investors have broken even! Yet, this ETF, with all this drag, continues to get inflows and see its share count rise – which I cannot help but view as a sign of froth below the surface of the market as a whole and why positioning is still too aggressive and is fraught with danger.

Bottom Line

Too many Fed cuts are still priced in, but the data is declining fast enough that they may yet prove to be right, though for now I’d fight the number of cuts.

2s vs 10s closed the week positive (5.7 bps) and I think that 20 bps is the next major target. With 10s and 30s auctioning this week, expect weakness in Treasuries!

Credit spreads, my old friend. I still think the market is largely pricing in that the “soft” landing scenario is no longer the base case. The market is getting to our “bumpy landing” scenario but is a long way off from pricing in a recession (though commodities have caught my eye on that front). I think that spreads will drift wider from here. Well supported and far more stable than equities, but wider, nonetheless. If I was worried about recession risk and felt that private credit and banks weren’t still looking to put money to work, I’d worry more about high yield and leveraged loans, but I think that the selloff will be more of a general widening, appropriately distributed across ratings/products, and not a serious repricing of recession risk, which would cause high yield/leveraged loans to widen far faster.

Equities. I’m looking to take out the August lows, and while I think we could see outperformance in small caps, value, etc., the fact that indices are so heavily weighted to so few stocks and have become the weapon of choice for traders, means that it will be difficult to get positive performance out of those sectors and I think there will be better times to buy!

Now all I can think of is how many people experience the Gell-Mann Amnesia Effect when reading T-Reports? Talk about a depressing way, at least from my perspective, to end this report!

Maybe we’ll get some smooth sailing, but I suspect more bumps and lower lows, because I really think there has been a major disconnect between people believing that we had capitulation (hence they are good to go), versus having seen any actual capitulation!

Loading…