Authored by Jaran Mellerud via BitcoinMagazine.,com,

Bitcoin miners are uniquely flexible energy consumers we can use as energy tools to help solve several energy problems..

Most people disregard bitcoin miners as simply yet another energy-intensive industry, but there is one big difference: Bitcoin miners are uniquely flexible concerning when and where they consume energy. Arcane Research's new report titled "How Bitcoin Mining Can Transform the Energy Industry" found five factors making bitcoin miners unique energy consumers, which I will explain here.

BITCOIN MINERS ARE PRICE-RESPONSIVE ENERGY CONSUMERS

A price-responsive energy consumer is financially incentivized to adjust its energy consumption based on the energy price. Bitcoin miners refine energy into bitcoin and are only financially incentivized to do this if the energy input is priced lower than the bitcoin output.

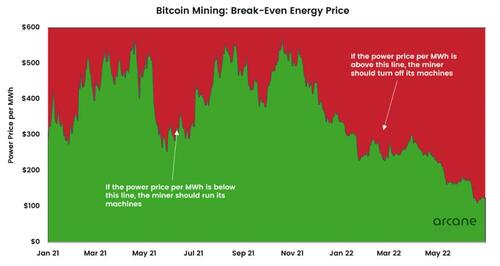

The chart below shows the break-even energy price of mining bitcoin during 2021 and parts of 2022. This break-even energy price is the dollar-denominated income per MWh of energy fed into a bitcoin mining machine (Antminer S19). Suppose a bitcoin miner's price per MWh increases above this line. In that case, the miner is financially incentivized to turn off its machines as it would earn less by using this energy for bitcoin mining than it would pay for the energy.

Source: Hashrate Index

Since energy is such a significant component of the cost structure, miners always pay attention to their energy prices and can calculate their break-even energy prices with certainty. During energy scarcity events, the spot energy price will rise far higher than miners' break-even energy price, incentivizing miners to curtail production and let the energy flow to less price-responsive energy consumers, like households.

BITCOIN MINING IS AN INTERRUPTIBLE PROCESS

Not only are bitcoin miners financially incentivized to stop consuming energy if spot energy prices rise above their break-even energy price, but they are also fully able to do so due to the interruptible nature of the bitcoin mining process.

A bitcoin miner can interrupt its production and energy consumption at a moment's notice without losing more money than the alternative cost of not producing bitcoin. It can not only interrupt its consumption but also granularly adjust it up or down in kilowatt increments.

The interruptibility of the bitcoin mining process becomes apparent when comparing a bitcoin mining facility to a conventional data center. A conventional data center performs many complex processes and must maintain uptime due to its customers. Uptime is so crucial for data centers that they are categorized from tier one to four based on their uptime guarantees and power redundancies. Bitcoin miners, and some other high-performance computing processes, are the only interruptible data center processes.

Since bitcoin mining is an interruptible and price-responsive load, the process is exceptionally suitable as a demand response tool that can help strengthen electricity systems.

BITCOIN MINING OPERATIONS ARE LOCATION-AGNOSTIC

Most energy-intensive industries produce physical products that require access to supply chains. On the other hand, Bitcoin miners produce hashes sold through the internet. Therefore, a bitcoin mining facility can generally be built in any location with cheap energy and internet access.

The location agnosticism of bitcoin mining makes it possible to take the energy consumer directly to the energy source. Bitcoin miners are the ultimate customers of previously stranded energy resources, which is why oil producers have started to use natural gas that they otherwise would flare to mine bitcoin.

Source: Arcane Research

The location agnosticism of bitcoin mining becomes clear when looking at a map of Texas' bitcoin mining operations. They are almost all located in the desert in the far west of the state, where they feed on the region's stranded wind and solar.

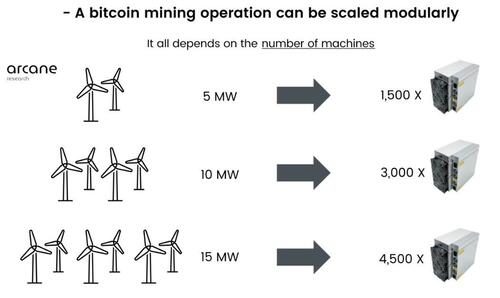

BITCOIN MINING OPERATIONS CAN BE SCALED MODULARLY

A bitcoin mining machine consumes a specific amount of electricity, and it's possible to combine different amounts of these machines into different levels of load. Whether an energy asset owner wants a bitcoin mining load of 5 MW, 20 MW, or 100 MW doesn't matter: All load sizes are possible by changing the number of machines.

Source: Arcane Research

The modularity of bitcoin mining makes it possible to design a bitcoin mining load to match the available energy generation capacity. This is especially relevant when matching the bitcoin mining load with the excess production capacity of a stranded renewable energy generator to improve its economics.

A BITCOIN MINING OPERATION CAN BE DESIGNED TO BE PORTABLE

We can design a bitcoin mining load in specific ways to maximize portability. Filling specially designed shipping containers with mining machines has recently emerged as a way to optimize portability. These container solutions are designed after the plug-and-play principle and can quickly be shipped to other locations if needed.

Source: Arcane Research

The portability of bitcoin mining makes it easy to move a mining facility to soak up excess energy and quickly move the facility to another location if the energy stops being in excess in the first location.

CONCLUSION

Bitcoin mining possesses a combination of properties that makes it a uniquely flexible energy consumer. This flexibility allows bitcoin miners to provide positive externalities to various energy systems globally, including strengthening vulnerable electricity grids, improving the economics of renewable energy, mitigating natural gas flaring and lowering heating costs by repurposing waste heat.

What makes bitcoin mining such an aspiring energy tool isn't simply that it's a uniquely flexible energy consumer but that the financial incentives add up. With similar incentives, the bitcoin mining and energy industries are destined to work together to solve some of our biggest energy problems. You can read more about this in Arcane Research's full report.

Authored by Jaran Mellerud via BitcoinMagazine.,com,

Bitcoin miners are uniquely flexible energy consumers we can use as energy tools to help solve several energy problems..

Most people disregard bitcoin miners as simply yet another energy-intensive industry, but there is one big difference: Bitcoin miners are uniquely flexible concerning when and where they consume energy. Arcane Research’s new report titled “How Bitcoin Mining Can Transform the Energy Industry” found five factors making bitcoin miners unique energy consumers, which I will explain here.

BITCOIN MINERS ARE PRICE-RESPONSIVE ENERGY CONSUMERS

A price-responsive energy consumer is financially incentivized to adjust its energy consumption based on the energy price. Bitcoin miners refine energy into bitcoin and are only financially incentivized to do this if the energy input is priced lower than the bitcoin output.

The chart below shows the break-even energy price of mining bitcoin during 2021 and parts of 2022. This break-even energy price is the dollar-denominated income per MWh of energy fed into a bitcoin mining machine (Antminer S19). Suppose a bitcoin miner’s price per MWh increases above this line. In that case, the miner is financially incentivized to turn off its machines as it would earn less by using this energy for bitcoin mining than it would pay for the energy.

Source: Hashrate Index

Since energy is such a significant component of the cost structure, miners always pay attention to their energy prices and can calculate their break-even energy prices with certainty. During energy scarcity events, the spot energy price will rise far higher than miners’ break-even energy price, incentivizing miners to curtail production and let the energy flow to less price-responsive energy consumers, like households.

BITCOIN MINING IS AN INTERRUPTIBLE PROCESS

Not only are bitcoin miners financially incentivized to stop consuming energy if spot energy prices rise above their break-even energy price, but they are also fully able to do so due to the interruptible nature of the bitcoin mining process.

A bitcoin miner can interrupt its production and energy consumption at a moment’s notice without losing more money than the alternative cost of not producing bitcoin. It can not only interrupt its consumption but also granularly adjust it up or down in kilowatt increments.

The interruptibility of the bitcoin mining process becomes apparent when comparing a bitcoin mining facility to a conventional data center. A conventional data center performs many complex processes and must maintain uptime due to its customers. Uptime is so crucial for data centers that they are categorized from tier one to four based on their uptime guarantees and power redundancies. Bitcoin miners, and some other high-performance computing processes, are the only interruptible data center processes.

Since bitcoin mining is an interruptible and price-responsive load, the process is exceptionally suitable as a demand response tool that can help strengthen electricity systems.

BITCOIN MINING OPERATIONS ARE LOCATION-AGNOSTIC

Most energy-intensive industries produce physical products that require access to supply chains. On the other hand, Bitcoin miners produce hashes sold through the internet. Therefore, a bitcoin mining facility can generally be built in any location with cheap energy and internet access.

The location agnosticism of bitcoin mining makes it possible to take the energy consumer directly to the energy source. Bitcoin miners are the ultimate customers of previously stranded energy resources, which is why oil producers have started to use natural gas that they otherwise would flare to mine bitcoin.

Source: Arcane Research

The location agnosticism of bitcoin mining becomes clear when looking at a map of Texas’ bitcoin mining operations. They are almost all located in the desert in the far west of the state, where they feed on the region’s stranded wind and solar.

BITCOIN MINING OPERATIONS CAN BE SCALED MODULARLY

A bitcoin mining machine consumes a specific amount of electricity, and it’s possible to combine different amounts of these machines into different levels of load. Whether an energy asset owner wants a bitcoin mining load of 5 MW, 20 MW, or 100 MW doesn’t matter: All load sizes are possible by changing the number of machines.

Source: Arcane Research

The modularity of bitcoin mining makes it possible to design a bitcoin mining load to match the available energy generation capacity. This is especially relevant when matching the bitcoin mining load with the excess production capacity of a stranded renewable energy generator to improve its economics.

A BITCOIN MINING OPERATION CAN BE DESIGNED TO BE PORTABLE

We can design a bitcoin mining load in specific ways to maximize portability. Filling specially designed shipping containers with mining machines has recently emerged as a way to optimize portability. These container solutions are designed after the plug-and-play principle and can quickly be shipped to other locations if needed.

Source: Arcane Research

The portability of bitcoin mining makes it easy to move a mining facility to soak up excess energy and quickly move the facility to another location if the energy stops being in excess in the first location.

CONCLUSION

Bitcoin mining possesses a combination of properties that makes it a uniquely flexible energy consumer. This flexibility allows bitcoin miners to provide positive externalities to various energy systems globally, including strengthening vulnerable electricity grids, improving the economics of renewable energy, mitigating natural gas flaring and lowering heating costs by repurposing waste heat.

What makes bitcoin mining such an aspiring energy tool isn’t simply that it’s a uniquely flexible energy consumer but that the financial incentives add up. With similar incentives, the bitcoin mining and energy industries are destined to work together to solve some of our biggest energy problems. You can read more about this in Arcane Research’s full report.