Via Newsquawk,

JULY MEETING:

The FOMC left rates unchanged, but it made tweaks to its statement that appeared to leave the door open to a September rate cut. The Committee is now attentive to risks on both sides of its mandate, a change from the June statement, where it said it was 'highly attentive' to inflation risks. The statement said there has been ’some further progress' towards its inflation goal, whereas in June it said there had been 'modest' progress.

And it now says that risks to achieving its employment and inflation goals continue to move into better balance, whereas in June it said it was moving ’towards’ better balance. The Fed did however reiterate that it does not expect that it will be appropriate to lower rates until it has gained greater confidence that inflation is moving sustainably towards target, suggesting that the Committee still wants to see favourable data before pivoting to rate cuts.

At his post-meeting press conference, Chair Powell revealed that there was a real discussion about the case for reducing rates at this meeting; a strong majority supported not moving (he later said that overwhelmingly' policymakers felt it was not the time yet). The Fed Chair noted that the policy rate is clearly restrictive, and it is coming to the point where it will be appropriate to start rate cuts and dial back restrictions to support the continued progress of the economy. He added that the Fed does not need to be 100% focused on inflation given upside risks to prices have decreased while downside risks to employment mandate are real now, noting that the chances of a hard landing are low as the economy was neither overheating nor sharply weakening. A theme throughout Powell's Q&A was that he tied any future move on the incoming data.

The Chair was coy on giving any specific nod to rate cuts, noting that it could reduce rates zero times this year, or even several - it all depended on incoming data.

COMMENTARY:

Recent Fed commentary has been focused on when the next rate cut will come, and generally, September seems on the table.

Members continue to stress the importance of data dependence, however, and how the balance of risks has shifted towards both sides of its dual mandate, rather than just the inflation side of the equation.

Highlighting this, Bostic (voter) recently stated that he is open to a September rate cut as inflation cools, adding that price pressures have eased, and therefore officials also need to be conscious of their mandate of maintaining full employment; Kashkari (2026 voter) noted the balance of risks has shifted more towards labor market and away from inflation side.

RECENT DATA:

Since the last FOMC meeting, data has been mixed, but some concerns surrounding the labor market and growth have diminished in recent weeks. As mentioned above, the Fed's focus is now shifting more towards its dual mandate, not just inflation, and the recent inflation data continues to suggest that the Fed has got it under control. Highlighting this, the July PPI was cooler-than-expected across the board, while CPI was as forecasted (aside from core Y/Y, which was also shy of consensus). However, employment data has been more mixed: July’s NFP and ISM Manufacturing PMI disappointed expectations, stoking recessionary fears, and saw money markets at its peak price in 130bps of rate cuts by year-end (vs 66bps post-Fed); since then, the last two weekly initial jobless claims reports have come in beneath expectations, while retail sales were much better than forecast in July, helping to sooth the recent economic concerns, and push back against expectations for a larger 50bps rate cut from the Fed in September.

MINUTES:

The minutes will reveal the extent to which a rate reduction was considered at the July meeting, as well as officials’ views on the labour market and the subsequent impact on monetary policy.

However, as always, the minutes are stale by a couple of weeks.

Additionally, Chair Powell is due to speak at the Jackson Hole Economic Symposium (on Friday at 10:00EDT/15:00BST), which will likely overshadow the minutes, with traders likely to put greater weight on his remarks to gauge how the Fed may respond in September.

* * *

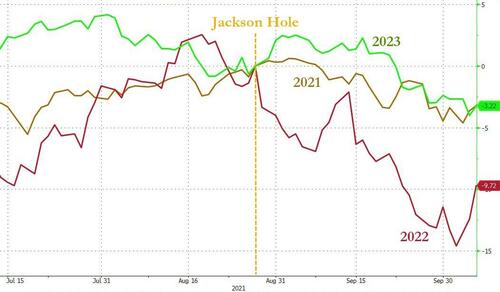

Bear in mind that Jackson-Hole has tended to be a 'sell-the-news' moment in recent years...

Via Newsquawk,

JULY MEETING:

The FOMC left rates unchanged, but it made tweaks to its statement that appeared to leave the door open to a September rate cut. The Committee is now attentive to risks on both sides of its mandate, a change from the June statement, where it said it was ‘highly attentive’ to inflation risks. The statement said there has been ’some further progress’ towards its inflation goal, whereas in June it said there had been ‘modest’ progress.

And it now says that risks to achieving its employment and inflation goals continue to move into better balance, whereas in June it said it was moving ’towards’ better balance. The Fed did however reiterate that it does not expect that it will be appropriate to lower rates until it has gained greater confidence that inflation is moving sustainably towards target, suggesting that the Committee still wants to see favourable data before pivoting to rate cuts.

At his post-meeting press conference, Chair Powell revealed that there was a real discussion about the case for reducing rates at this meeting; a strong majority supported not moving (he later said that overwhelmingly’ policymakers felt it was not the time yet). The Fed Chair noted that the policy rate is clearly restrictive, and it is coming to the point where it will be appropriate to start rate cuts and dial back restrictions to support the continued progress of the economy. He added that the Fed does not need to be 100% focused on inflation given upside risks to prices have decreased while downside risks to employment mandate are real now, noting that the chances of a hard landing are low as the economy was neither overheating nor sharply weakening. A theme throughout Powell’s Q&A was that he tied any future move on the incoming data.

The Chair was coy on giving any specific nod to rate cuts, noting that it could reduce rates zero times this year, or even several – it all depended on incoming data.

COMMENTARY:

Recent Fed commentary has been focused on when the next rate cut will come, and generally, September seems on the table.

Members continue to stress the importance of data dependence, however, and how the balance of risks has shifted towards both sides of its dual mandate, rather than just the inflation side of the equation.

Highlighting this, Bostic (voter) recently stated that he is open to a September rate cut as inflation cools, adding that price pressures have eased, and therefore officials also need to be conscious of their mandate of maintaining full employment; Kashkari (2026 voter) noted the balance of risks has shifted more towards labor market and away from inflation side.

RECENT DATA:

Since the last FOMC meeting, data has been mixed, but some concerns surrounding the labor market and growth have diminished in recent weeks. As mentioned above, the Fed’s focus is now shifting more towards its dual mandate, not just inflation, and the recent inflation data continues to suggest that the Fed has got it under control. Highlighting this, the July PPI was cooler-than-expected across the board, while CPI was as forecasted (aside from core Y/Y, which was also shy of consensus). However, employment data has been more mixed: July’s NFP and ISM Manufacturing PMI disappointed expectations, stoking recessionary fears, and saw money markets at its peak price in 130bps of rate cuts by year-end (vs 66bps post-Fed); since then, the last two weekly initial jobless claims reports have come in beneath expectations, while retail sales were much better than forecast in July, helping to sooth the recent economic concerns, and push back against expectations for a larger 50bps rate cut from the Fed in September.

MINUTES:

The minutes will reveal the extent to which a rate reduction was considered at the July meeting, as well as officials’ views on the labour market and the subsequent impact on monetary policy.

However, as always, the minutes are stale by a couple of weeks.

Additionally, Chair Powell is due to speak at the Jackson Hole Economic Symposium (on Friday at 10:00EDT/15:00BST), which will likely overshadow the minutes, with traders likely to put greater weight on his remarks to gauge how the Fed may respond in September.

* * *

Bear in mind that Jackson-Hole has tended to be a ‘sell-the-news’ moment in recent years…

Loading…