Coming just hours after the May CPI print, tomorrow's - and the month's - main event is the FOMC decision due at 2pm ET, when the Fed is widely expected to leave rates on hold at 5.25-5.50%, and the statement will likely also largely be reiterated after slight tweaks in the May statement. Attention will fall on the Summary of Economic projections, and more specifically, the Dot Plot, where the number of projected rate cuts in 2024 will be trimmed from 3 to 2. After a string of hot inflation reports in Q1, the Fed has been stressing that the luxury of a strong economy gives the Fed time to be patient before acting, and the hot NFP released (assuming of course that a drop of 625,000 full-time jobs is viewed as "strong"), last week only gives the Fed more time. Therefore, it is likely the 2024 median FFR will be revised up from the 4.6% - or equivalent to 3 rate cuts over the remainder of 2024 - pencilled in at the March meeting.

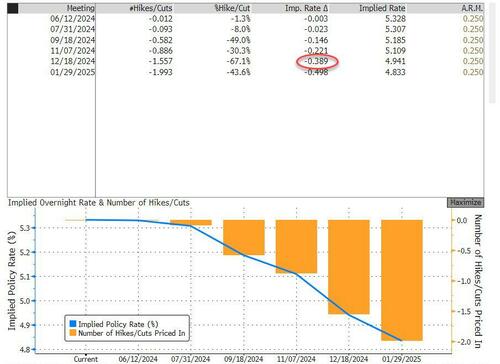

Indeed, money markets currently look for between one or two rate cuts this year, with WSJ's Fed mouthpiece Nick "Nikileaks" Timiraos confirming "they know that we know that they know that we know", or that "most sell-side economists and other professional Fed watchers now anticipate one or two rate cuts this year in either September or December". In other words, the ground is set for the dots to tighten, but the question is by how much: one, two or three cuts? It is also worth noting that the May US CPI report will be released on the morning of the FOMC, which will impact expectations of the dot plot going into the rate decision. With FOMC members already in possession of the May CPI report, Powell has previously said that the Fed is allowed and encouraged to update their forecasts until late morning of the meeting, therefore the data will likely be incorporated into the Fed's decision-making and forecasts. Then, once the rate decision, statement and SEPs are released, attention will turn to Fed Chair Powell's Press conference at 19:30 BST / 14:30 EDT.

POLICY: The Fed is widely expected to leave rates on hold at its June meeting with the Fed not yet convinced inflation is returning to target in a sustained manner, despite rate cuts from global peers such as the ECB and BoC last week. Given tweaks to the statement at the last meeting, noting there has been a lack of further progress towards the 2% goal and that risks to the mandate have moved towards better balance, they will unlikely alter the statement much. It will also likely repeat "The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent." Nonetheless, the focus of this meeting will be on the updated Summary of Economic Projections (SEPs), or "Dot Plots''.

FOMC POLICY STATEMENT

Current conditions: Morgan Stanley look for an important change to the characterization of inflation that is an acknowledgement of improvement in inflation data through April, though still not enough improvement to be convincing.

Risk to the statement: Since the last FOMC meeting, there has been a single improved inflation print in April. The risk is that FOMC officials have not yet gained enough conviction, and that they pair unchanged inflation language with a more concentrated move in the dot-plot to fewer cuts this year.

SUMMARY ECONOMIC PROJECTIONS: With the Fed recently stressing that the luxury of a strong economy gives the Fed time to be patient before acting, it is likely the 2024 dot will be revised up, particularly after the May NFP report. WSJ's Timiraos highlights that "Most sell-side economists and other professional Fed watchers now anticipate one or two rate cuts this year in either September or December". Money markets are currently pricing in 38bps of rate cuts by year-end (fully priced for one cut, with a c. 50% probability of another 25bp cut), however, this is subject to change with the US CPI to be released on the morning of the FOMC. Which may have some sway on Fed officials' thinking when entering their dot plots. Powell has previously said FOMC members are encouraged to update their forecasts up until mid/late morning, once the Fed has seen the data.

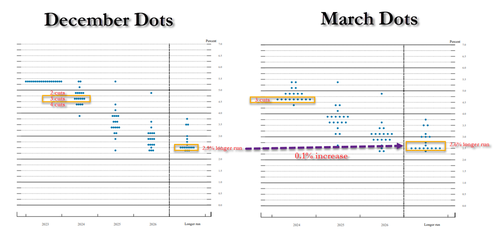

The March dot plot was unchanged from December, with the median view looking for three rate cuts in 2024, with rates ending the year at 4.5-4.75% vs the current 5.25-5.50%. Nonetheless, the composition of dot plots was more hawkish, with nine members pencilling in the year-end rate at 4.6%, vs six in the December dot plots, with more dovish dots aligning with the Median. Nonetheless, it would have only taken one of the median dots to pencil in a higher rate to have lifted the median, with 8 on the FOMC pencilling in a rate above the current median. Therefore, that, accompanied by a string of hot inflation reports in 2024, as well as plenty of Fed speak suggesting they can afford to be patient before cutting rates, it is likely the 2024 median dot plot will be revised up. It is likely to pencil in just one or two rate cuts this year, instead of three. Note, the median 2025 dot is currently at 3.9% (vs December's 3.6%), the 2026 dot is at 3.1% (vs December's 2.9%), with the longer run rate, or neutral rate, at 2.6% (vs December's 2.5%). Some on the Fed have suggested it is possible the Neutral Rate has risen from before (Bowman), while others suggest the neutral rate is relatively low (Waller).

Aside from rate forecasts, the SEP will also show the updated views for Core PCE, PCE, Unemployment and real GDP. FOMC Vice Chair Williams gave his personal expectations, noting he sees inflation at 2.5% this year (vs the Fed March median SEP of 2.6% on Core, 2.4% on headline), before being closer to 2% in 2025 (vs Fed median of 2.2%). He sees 2024 growth between 2.0-2.5% (vs Fed March Median SEP of 2.1%). Williams expects unemployment of 4.0% this year (vs Fed March Median of 4.0%).

ECONOMY: The prior statement saw a slight language tweak to suggest that risks to achieving its mandate have moved towards better balance (prev. moving into better balance), reflecting some of the concerns about an employment downturn. However, it also added a line that there has been a lack of further progress towards the committee's 2% inflation goal. Since then, there have been mixed signals from the labor market, with the April NFP and JOLTS coming in soft, while the May NFP was much hotter than expected, although the Household survey was a disaster with full-time jobs plunging and the unemployment rate hitting 4.0%. The Fed has made it clear they are willing to hold rates higher for longer given the strength of the economy, and only in the case of an unexpected weakening of the labor market, or signs that inflation is convincingly returning to target, would they be prepared to lower rates. Meanwhile, after the hot inflation reports in Q1, the April reports were on net softer, and were seen as a welcome sign to the Fed, but still a reminder that the return to target will still be slower than initially expected.

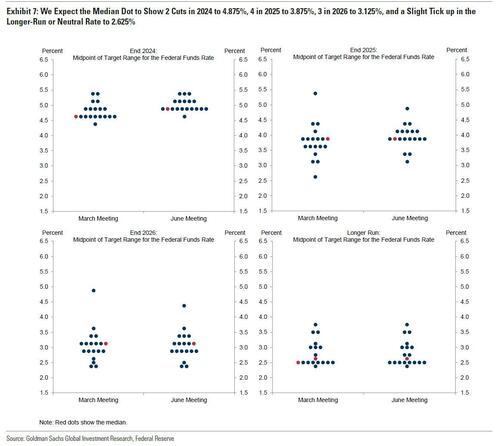

DOT PLOT: Goldman, along with many on Wall Street, expects the median forecast to show two cuts in 2024 (vs. three in March) to 4.875%, four cuts in 2025 (vs. three in March) to 3.875%, and three cuts in 2026 (unchanged) to 3.125%. Goldman suspects that the Fed leadership would prefer for the median dot to show a two-cut baseline in 2024 in order to retain greater flexibility to cut in Q3 if the inflation data warrant it. But the key risk is that the median could instead show just one cut in 2024, especially if the May core CPI print comes in well above the 0.3% forecast or if more FOMC participants see a 2.8% year-on-year rate of core PCE inflation as too high to justify two rate cuts. Goldman also thinks the median longer-run or neutral rate dot could tick up a touch further. FOMC participants are likely to raise their longer-run dots gradually over time because both market-based approximations of the neutral rate, namely distant forward interest rates, and the econometric models of neutral that the Fed staff tracks suggest that the neutral rate is higher than the current median estimate of 2.56%. Finally, the bank expects that in addition to gradually raising their longer-run neutral rate estimates, FOMC participants will continue to show terminal rate projections that are above their neutral rate estimates on the grounds that non-monetary policy tailwinds are boosting aggregate demand (i.e. Joe Biden's debt tsunami) and offsetting the impact of higher interest rates on the economy.

RECENT FED SPEAK: Fed speakers have been mostly singing from the same hymn sheet, still stressing a higher-for-longer

approach and no rush to cut rates, noting they will be letting the data dictate decisions. Many said that a rate hike is not in the baseline outlook, although some are refusing to rule it out in case inflation were to surprisingly accelerate again. Nonetheless, although after the hot inflation reports in Q1, the April reports have started to bring some optimism that inflation is still easing, albeit at a slower pace than before, perhaps indicating it will take longer for inflation to return to the Fed's 2% target. Officials have stressed that inflation does not need to return exactly to 2% before they cut rates, but they need to be confident that it is convincingly and sustainably on its way to target, something which they do not have at the moment, and they would need a string of good inflation reports for them to gain that confidence. Some, including Chair Powell, have noted that an unexpected weakening in the labour market could also be a reason to cut rates, even if they did not have the inflation confidence yet, but so far the labour market still shows signs of tightness and is in no way classified as an "unexpected weakening", particularly after the May jobs report. Powell stated it would take more than "a couple of tenths" to move higher in the unemployment rate for an unexpected weakening.

Coming just hours after the May CPI print, tomorrow’s – and the month’s – main event is the FOMC decision due at 2pm ET, when the Fed is widely expected to leave rates on hold at 5.25-5.50%, and the statement will likely also largely be reiterated after slight tweaks in the May statement. Attention will fall on the Summary of Economic projections, and more specifically, the Dot Plot, where the number of projected rate cuts in 2024 will be trimmed from 3 to 2. After a string of hot inflation reports in Q1, the Fed has been stressing that the luxury of a strong economy gives the Fed time to be patient before acting, and the hot NFP released (assuming of course that a drop of 625,000 full-time jobs is viewed as “strong”), last week only gives the Fed more time. Therefore, it is likely the 2024 median FFR will be revised up from the 4.6% – or equivalent to 3 rate cuts over the remainder of 2024 – pencilled in at the March meeting.

Indeed, money markets currently look for between one or two rate cuts this year, with WSJ’s Fed mouthpiece Nick “Nikileaks” Timiraos confirming “they know that we know that they know that we know”, or that “most sell-side economists and other professional Fed watchers now anticipate one or two rate cuts this year in either September or December”. In other words, the ground is set for the dots to tighten, but the question is by how much: one, two or three cuts? It is also worth noting that the May US CPI report will be released on the morning of the FOMC, which will impact expectations of the dot plot going into the rate decision. With FOMC members already in possession of the May CPI report, Powell has previously said that the Fed is allowed and encouraged to update their forecasts until late morning of the meeting, therefore the data will likely be incorporated into the Fed’s decision-making and forecasts. Then, once the rate decision, statement and SEPs are released, attention will turn to Fed Chair Powell’s Press conference at 19:30 BST / 14:30 EDT.

POLICY: The Fed is widely expected to leave rates on hold at its June meeting with the Fed not yet convinced inflation is returning to target in a sustained manner, despite rate cuts from global peers such as the ECB and BoC last week. Given tweaks to the statement at the last meeting, noting there has been a lack of further progress towards the 2% goal and that risks to the mandate have moved towards better balance, they will unlikely alter the statement much. It will also likely repeat “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” Nonetheless, the focus of this meeting will be on the updated Summary of Economic Projections (SEPs), or “Dot Plots”.

FOMC POLICY STATEMENT

Current conditions: Morgan Stanley look for an important change to the characterization of inflation that is an acknowledgement of improvement in inflation data through April, though still not enough improvement to be convincing.

Risk to the statement: Since the last FOMC meeting, there has been a single improved inflation print in April. The risk is that FOMC officials have not yet gained enough conviction, and that they pair unchanged inflation language with a more concentrated move in the dot-plot to fewer cuts this year.

SUMMARY ECONOMIC PROJECTIONS: With the Fed recently stressing that the luxury of a strong economy gives the Fed time to be patient before acting, it is likely the 2024 dot will be revised up, particularly after the May NFP report. WSJ’s Timiraos highlights that “Most sell-side economists and other professional Fed watchers now anticipate one or two rate cuts this year in either September or December”. Money markets are currently pricing in 38bps of rate cuts by year-end (fully priced for one cut, with a c. 50% probability of another 25bp cut), however, this is subject to change with the US CPI to be released on the morning of the FOMC. Which may have some sway on Fed officials’ thinking when entering their dot plots. Powell has previously said FOMC members are encouraged to update their forecasts up until mid/late morning, once the Fed has seen the data.

The March dot plot was unchanged from December, with the median view looking for three rate cuts in 2024, with rates ending the year at 4.5-4.75% vs the current 5.25-5.50%. Nonetheless, the composition of dot plots was more hawkish, with nine members pencilling in the year-end rate at 4.6%, vs six in the December dot plots, with more dovish dots aligning with the Median. Nonetheless, it would have only taken one of the median dots to pencil in a higher rate to have lifted the median, with 8 on the FOMC pencilling in a rate above the current median. Therefore, that, accompanied by a string of hot inflation reports in 2024, as well as plenty of Fed speak suggesting they can afford to be patient before cutting rates, it is likely the 2024 median dot plot will be revised up. It is likely to pencil in just one or two rate cuts this year, instead of three. Note, the median 2025 dot is currently at 3.9% (vs December’s 3.6%), the 2026 dot is at 3.1% (vs December’s 2.9%), with the longer run rate, or neutral rate, at 2.6% (vs December’s 2.5%). Some on the Fed have suggested it is possible the Neutral Rate has risen from before (Bowman), while others suggest the neutral rate is relatively low (Waller).

Aside from rate forecasts, the SEP will also show the updated views for Core PCE, PCE, Unemployment and real GDP. FOMC Vice Chair Williams gave his personal expectations, noting he sees inflation at 2.5% this year (vs the Fed March median SEP of 2.6% on Core, 2.4% on headline), before being closer to 2% in 2025 (vs Fed median of 2.2%). He sees 2024 growth between 2.0-2.5% (vs Fed March Median SEP of 2.1%). Williams expects unemployment of 4.0% this year (vs Fed March Median of 4.0%).

ECONOMY: The prior statement saw a slight language tweak to suggest that risks to achieving its mandate have moved towards better balance (prev. moving into better balance), reflecting some of the concerns about an employment downturn. However, it also added a line that there has been a lack of further progress towards the committee’s 2% inflation goal. Since then, there have been mixed signals from the labor market, with the April NFP and JOLTS coming in soft, while the May NFP was much hotter than expected, although the Household survey was a disaster with full-time jobs plunging and the unemployment rate hitting 4.0%. The Fed has made it clear they are willing to hold rates higher for longer given the strength of the economy, and only in the case of an unexpected weakening of the labor market, or signs that inflation is convincingly returning to target, would they be prepared to lower rates. Meanwhile, after the hot inflation reports in Q1, the April reports were on net softer, and were seen as a welcome sign to the Fed, but still a reminder that the return to target will still be slower than initially expected.

DOT PLOT: Goldman, along with many on Wall Street, expects the median forecast to show two cuts in 2024 (vs. three in March) to 4.875%, four cuts in 2025 (vs. three in March) to 3.875%, and three cuts in 2026 (unchanged) to 3.125%. Goldman suspects that the Fed leadership would prefer for the median dot to show a two-cut baseline in 2024 in order to retain greater flexibility to cut in Q3 if the inflation data warrant it. But the key risk is that the median could instead show just one cut in 2024, especially if the May core CPI print comes in well above the 0.3% forecast or if more FOMC participants see a 2.8% year-on-year rate of core PCE inflation as too high to justify two rate cuts. Goldman also thinks the median longer-run or neutral rate dot could tick up a touch further. FOMC participants are likely to raise their longer-run dots gradually over time because both market-based approximations of the neutral rate, namely distant forward interest rates, and the econometric models of neutral that the Fed staff tracks suggest that the neutral rate is higher than the current median estimate of 2.56%. Finally, the bank expects that in addition to gradually raising their longer-run neutral rate estimates, FOMC participants will continue to show terminal rate projections that are above their neutral rate estimates on the grounds that non-monetary policy tailwinds are boosting aggregate demand (i.e. Joe Biden’s debt tsunami) and offsetting the impact of higher interest rates on the economy.

RECENT FED SPEAK: Fed speakers have been mostly singing from the same hymn sheet, still stressing a higher-for-longer

approach and no rush to cut rates, noting they will be letting the data dictate decisions. Many said that a rate hike is not in the baseline outlook, although some are refusing to rule it out in case inflation were to surprisingly accelerate again. Nonetheless, although after the hot inflation reports in Q1, the April reports have started to bring some optimism that inflation is still easing, albeit at a slower pace than before, perhaps indicating it will take longer for inflation to return to the Fed’s 2% target. Officials have stressed that inflation does not need to return exactly to 2% before they cut rates, but they need to be confident that it is convincingly and sustainably on its way to target, something which they do not have at the moment, and they would need a string of good inflation reports for them to gain that confidence. Some, including Chair Powell, have noted that an unexpected weakening in the labour market could also be a reason to cut rates, even if they did not have the inflation confidence yet, but so far the labour market still shows signs of tightness and is in no way classified as an “unexpected weakening”, particularly after the May jobs report. Powell stated it would take more than “a couple of tenths” to move higher in the unemployment rate for an unexpected weakening.

Loading…