By Russell Clark of the Capital Flows and Asset Markets Substack,

As I and many of my subscribers have noticed, many of the key commodity drivers of inflation have seeming rolled over.

European gas prices, Chinese pork prices, oil prices, US corn prices among others have weakened to levels seen before Russia’s invasion of Ukraine. Strangely, weak commodity prices should be disastrous for my key trade, long GLD short TLT, and yet strangely it has breached new cycle highs. Why is this?

The first thing that should be said is that commodity investing is hard. Surprises in short term demand and supply can drive huge moves in spot markets. A good example is pork prices. Pork is particularly big driver of Chinese inflation. Chinese and US pork prices have recently fallen significantly.

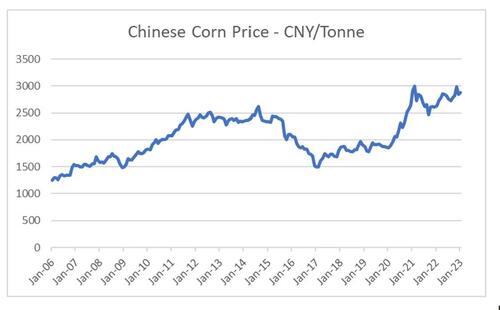

I have no idea why pork prices have fallen. The reopening of China would have made me think short term demand for pork would be higher, and hence prices would be rising. That they are falling, suggests maybe supply is robust. Confusing the picture is that Chinese corn price have not weakened, meaning that profitability for pig farmers has collapsed. All a bit confusing to be honest.

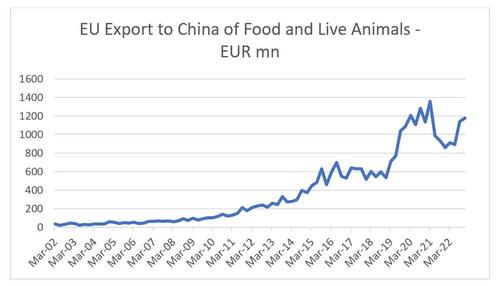

However, my core argument is that China has turned into a net food importer, and this should be putting upward pressure on food prices, as long as China does not devalue. The data on China being a net food importer remains compelling. European exports of meat to China remain strong.

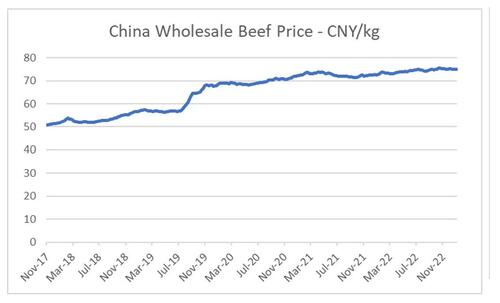

Chinese pork prices can be greatly effected by swings in supply. However during the African Swine Flu crisis, beef consumption in China grew significantly.

China grows very little beef (very little pasture land).

Robust pricing for beef would point to food inflation in China still having an upward bias in my mind.

The key argument of China becoming a food importer seems intact.

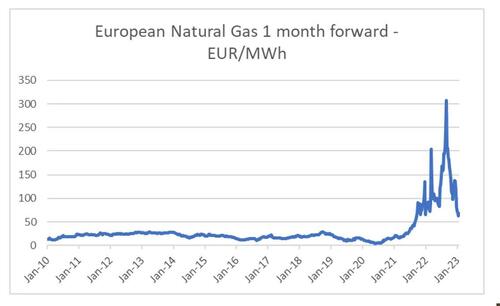

The other end of inflation argument you could make is that energy price inflation is done. European gas prices have collapsed in recent months. In part driven by a very warm winter.

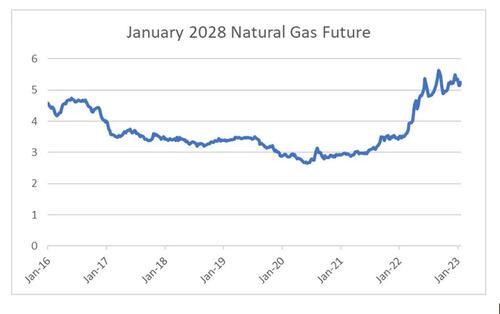

Even more so than Chinese pork prices, natural gas prices are very susceptible to short term fluctuations in demand and supply. To get around this I look at 5 year forward futures on US natural gas. The long dated futures have yet to show an inflection in pricing to indicate we are going back to a sustained bear market.

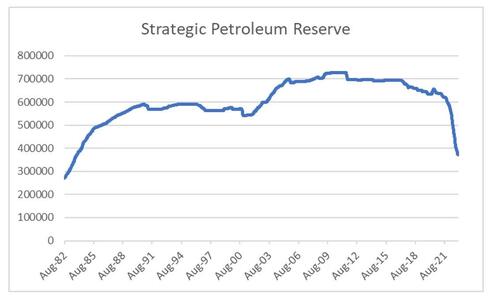

What I think is happening is that in early 2022, the US seemed very determined to counter inflation through what ever measure were necessary. We saw the sharpest increase in short term rates in a generation. And we also saw the biggest sell down of the strategic petroleum reserve. This sell down added about 600k barrels a day of supply to oil markets.

As argued previously, food inflation forces wage inflation. And China becoming a food importer is creating food inflation globally.

This means that central banks have to run aggressive interest rate policy, or inflation will return.

GLD/TLT reflects that. When TLT is weak, which happens when the market pricing in aggressive interest rate policy, GLD is also weak. But as soon as TLT reflects a slackening of central bank resolve, GLD shoots higher. My best guess we are a short term lull in inflation, making short TLT and other bond trades look attractive here.

By Russell Clark of the Capital Flows and Asset Markets Substack,

As I and many of my subscribers have noticed, many of the key commodity drivers of inflation have seeming rolled over.

European gas prices, Chinese pork prices, oil prices, US corn prices among others have weakened to levels seen before Russia’s invasion of Ukraine. Strangely, weak commodity prices should be disastrous for my key trade, long GLD short TLT, and yet strangely it has breached new cycle highs. Why is this?

The first thing that should be said is that commodity investing is hard. Surprises in short term demand and supply can drive huge moves in spot markets. A good example is pork prices. Pork is particularly big driver of Chinese inflation. Chinese and US pork prices have recently fallen significantly.

I have no idea why pork prices have fallen. The reopening of China would have made me think short term demand for pork would be higher, and hence prices would be rising. That they are falling, suggests maybe supply is robust. Confusing the picture is that Chinese corn price have not weakened, meaning that profitability for pig farmers has collapsed. All a bit confusing to be honest.

However, my core argument is that China has turned into a net food importer, and this should be putting upward pressure on food prices, as long as China does not devalue. The data on China being a net food importer remains compelling. European exports of meat to China remain strong.

Chinese pork prices can be greatly effected by swings in supply. However during the African Swine Flu crisis, beef consumption in China grew significantly.

China grows very little beef (very little pasture land).

Robust pricing for beef would point to food inflation in China still having an upward bias in my mind.

The key argument of China becoming a food importer seems intact.

The other end of inflation argument you could make is that energy price inflation is done. European gas prices have collapsed in recent months. In part driven by a very warm winter.

Even more so than Chinese pork prices, natural gas prices are very susceptible to short term fluctuations in demand and supply. To get around this I look at 5 year forward futures on US natural gas. The long dated futures have yet to show an inflection in pricing to indicate we are going back to a sustained bear market.

What I think is happening is that in early 2022, the US seemed very determined to counter inflation through what ever measure were necessary. We saw the sharpest increase in short term rates in a generation. And we also saw the biggest sell down of the strategic petroleum reserve. This sell down added about 600k barrels a day of supply to oil markets.

As argued previously, food inflation forces wage inflation. And China becoming a food importer is creating food inflation globally.

This means that central banks have to run aggressive interest rate policy, or inflation will return.

GLD/TLT reflects that. When TLT is weak, which happens when the market pricing in aggressive interest rate policy, GLD is also weak. But as soon as TLT reflects a slackening of central bank resolve, GLD shoots higher. My best guess we are a short term lull in inflation, making short TLT and other bond trades look attractive here.

Loading…