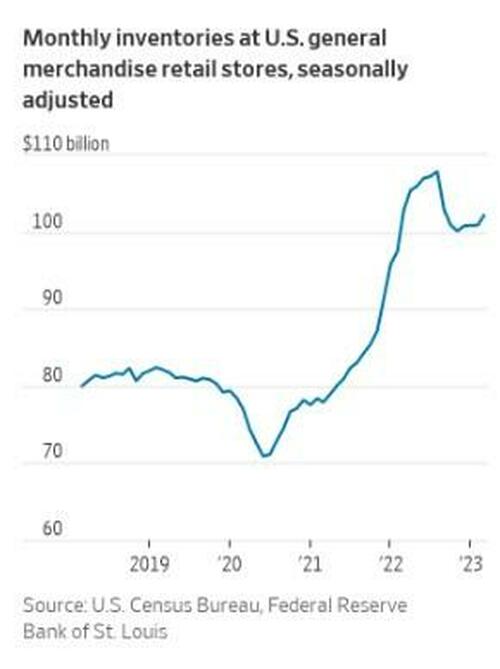

Freight carriers are in focus after a new report by the Wall Street Journal indicates that retailers - stuck with tons of inventory coming out of the Covid pandemic - have finally started to chip away at their excess goods and may be looking to take on new product this fall.

Inventories at retailers like Walmart and Target are lower by 9% and 16% respectively from a year ago as cutting prices has helped open up space in their supply chains and make room for new product.

Product first started to back up after retailers took on more supply to try and quench the massive increase in demand they saw during Covid, thanks to stimulus payments and pandemic relief funds.

Walmart Chief Executive Doug McMillon said a couple weeks ago on Walmart's conference call: “In terms of inventory, we’re in good shape. In-stock is improving, and excess inventory keeps coming down. We see it in the numbers, and I’m seeing it on store and [Sam’s Club] visits.”

At one point last year, the report says, Walmart had 100,000 shipping containers backed up at ports waiting for the company's supply chain to open up.

And Target Chief Operating Officer John Mulligan similarly said that overstocking was “in the rearview mirror”, though it is unclear how the recent controversy surrounding the company's "Pride Month" merchandise may currently be affecting the company's inventory.

Before Target lost nearly $10 billion in value due to the recent "Pride Month" controversy, in Mid-May, Target CEO Brian Cornell said: “As we sit here, today we’re excited about back-to-school and back-to-college. We’ve got great plans for the holiday season.”

Drew Wilkerson, CEO of Charlotte, N.C.-based logistics services company RXO told The Wall Street Journal: “We’re seeing that the retailers are in a much better position than they were a year ago. Now the question is around the consumer. With everything going on with the macro economy, we still have to make sure the demand is there from the consumer.”

Hapag-Lloyd said on its most recent conference call that it is starting to send trends pick up: “I don’t think that means that we’re now going to see a very quick recovery. But I do think that underlines the point that destocking is slowly but steadily coming to an end, and at some point in time we quite likely will see a bit of pickup in demand.”

J.B. Hunt said this month that while customers are talking about restocking, larger shipping volumes have yet to materialize: “Many of them are reporting or sharing with us that they feel like, by and large, their inventory issues are or have been mostly corrected. But we’re not yet seeing that inbound flow.”

Freight carriers are in focus after a new report by the Wall Street Journal indicates that retailers – stuck with tons of inventory coming out of the Covid pandemic – have finally started to chip away at their excess goods and may be looking to take on new product this fall.

Inventories at retailers like Walmart and Target are lower by 9% and 16% respectively from a year ago as cutting prices has helped open up space in their supply chains and make room for new product.

Product first started to back up after retailers took on more supply to try and quench the massive increase in demand they saw during Covid, thanks to stimulus payments and pandemic relief funds.

Walmart Chief Executive Doug McMillon said a couple weeks ago on Walmart’s conference call: “In terms of inventory, we’re in good shape. In-stock is improving, and excess inventory keeps coming down. We see it in the numbers, and I’m seeing it on store and [Sam’s Club] visits.”

At one point last year, the report says, Walmart had 100,000 shipping containers backed up at ports waiting for the company’s supply chain to open up.

And Target Chief Operating Officer John Mulligan similarly said that overstocking was “in the rearview mirror”, though it is unclear how the recent controversy surrounding the company’s “Pride Month” merchandise may currently be affecting the company’s inventory.

Before Target lost nearly $10 billion in value due to the recent “Pride Month” controversy, in Mid-May, Target CEO Brian Cornell said: “As we sit here, today we’re excited about back-to-school and back-to-college. We’ve got great plans for the holiday season.”

Drew Wilkerson, CEO of Charlotte, N.C.-based logistics services company RXO told The Wall Street Journal: “We’re seeing that the retailers are in a much better position than they were a year ago. Now the question is around the consumer. With everything going on with the macro economy, we still have to make sure the demand is there from the consumer.”

Hapag-Lloyd said on its most recent conference call that it is starting to send trends pick up: “I don’t think that means that we’re now going to see a very quick recovery. But I do think that underlines the point that destocking is slowly but steadily coming to an end, and at some point in time we quite likely will see a bit of pickup in demand.”

J.B. Hunt said this month that while customers are talking about restocking, larger shipping volumes have yet to materialize: “Many of them are reporting or sharing with us that they feel like, by and large, their inventory issues are or have been mostly corrected. But we’re not yet seeing that inbound flow.”

Loading…