By John Kingston of FreightWaves,

The RailTrends conference for 2023, last week’s gathering of many of the industry’s operating executives as well as those who finance, analyze or try to sell goods and services to the sector, had a cautiously optimistic tone that rail may soon be able to start to snag some market share from the trucking industry.

It’s not a meeting at which unbridled optimism is usually present. Rail has not seen significant organic growth at the expense of 18-wheelers for a long time. That time span might be viewed as forever, if you have listened to some of the speakers at RailTrends over the years.

Whereas the meeting in 2022 seemed almost like a gathering of people who thought an exorcism might be in order, after railroads failed to capitalize on one of the greatest freight markets ever and had a huge number of complaints about bad service to boot, RailTrends 2023 might mark at least a turnaround in outlook that would still need to be backed up by actual performance.

What has been lost was starkly laid out by Rob Cannizzaro, COO of the Intermodal Association of North America (IANA).

According to Cannizzaro, intermodal rail has lost about 1.4 million intermodal loads since 2017, which translates to about $3.5 billion in revenue.

Keith Creel, president and CEO of Canadian Pacific Kansas City Southern (CPKC), came to the meeting as the CEO of the merged Class I railroad between its two namesakes (NYSE: CP), a deal that was not concluded by RailTrends a year earlier. He said the combined railroad, which stretches from Mexico into Canada — the only Class I that can make that claim — is creating competition.

“This industry is getting stronger as a result,” he said. “Not just us. I think if you look across the board at every railroad, we’re in a better place today than a year ago. There’s motivation, there’s excitement, there’s energy and there’s investment.”

Specifically, Creel said the Midwest Express intermodal service that was announced in May to provide four-day service between Chicago and Mexico has been turning in a performance that has exceeded that goal on average by several hours.

Referring to other competing services between the U.S. and Mexico that have been announced in the last year, Creel said these expansions were signs that “competition is undoubtedly changing and driving a stronger industrial network to the benefit of the customer and commerce.”

Creel said CPKC has “a very robust pipeline plan for next year, and the following year, there’s no shortage of demand.” But he cautioned that while he saw the road map to more growth, “if you get ahead of yourself, and you’re putting too much traffic on your network, you destroy your value proposition.”

Another change from the 2022 meeting is that a year ago, railroad and union negotiators had agreed upon a contract but the road to ratification had plenty of bumps in it before full worker acceptance. That didn’t come for several weeks after the meeting.

Ian Jefferies, president and CEO of the Association of American Railroads, noted that difference between this year’s RailTrends conference and last year’s. “In the weeks following [the 2022] conference, we were able to get [contracts] across the finish line.”

He called it the “richest contract for our employees,” with provisions on leave that “created much more work-life balance.”

Even Adrienne Bailey was positive. The partner at Oliver Wyman’s rail consulting group, a fixture on the agenda at RailTrends, has been strongly critical of the rail sector at earlier gatherings. Although her address was about “green propulsion,” the use of alternative fuels in power units, she prefaced her remarks by saying that she hoped “by next year I will be talking about the shining successes” of the industry after reviewing positive steps taken in the past year.

Chuck Baker, on the same panel as Jefferies, is the president of the American Short Line Rail and Regional Railroad Association. He said it’s “been a rough, I guess I would probably say, about six years at this point.”

But he also said that “you’re starting to see a lot of green shoots in the industry. It feels like we’re turning a corner.”

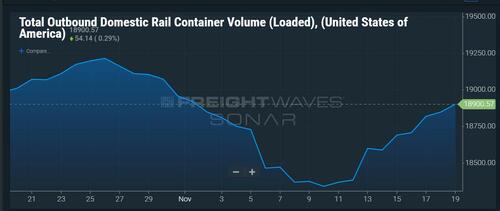

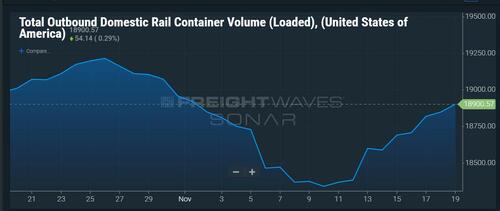

There were several references during the conference to recent gains on the rails.

Beth Whited, president of Union Pacific (NYSE: UNP), echoed that view of recently stronger markets, saying the railway was having “a really very strong run through about the end of September, maybe even into early October.” And while grain and coal shipments have slowed recently, Union Pacific had a “really strong” October in both its industrial and premium divisions.

It was the address by Joe Hinrichs, president and CEO of CSX (NASDAQ: CSX), that sounded more like some of the gloomier forecasts of the past. Its themes were familiar: Good service is necessary for growth and we’ve got a long way to go.

Hinrichs lamented that railroading is the type of activity that many people have had a “love affair” with “and somehow we lost that.” That fact has made it more difficult to attract and retain talent.

Another result is that railroads’ reputation (damaged in part by the February accident in East Palestine, Ohio, that was mentioned several times over the course of the meeting) has taken a hit, with the industry sometimes being seen as “bad guys,” Hinrichs said.

Part of the solution for safety and technology shortcomings is more and better cooperation, Hinrichs said.

“What in our railroads’ DNA inhibits us from working together on stuff like that?” Hinrichs asked. That the fate of the railroads is linked is obvious. Every railroad has derailments and when they occur, “we all feel the effects of that.”

Even if that could be overcome, “the standards are too low in this industry for customer service.” And if better service were provided, “a lot of our problems would go away,” Hinrichs said.

“We should want our customers to be enthusiastic about doing business with us to be excited about their business,” Hinrichs said. “And the standards we set for that bar are too low in our industry.”

By John Kingston of FreightWaves,

The RailTrends conference for 2023, last week’s gathering of many of the industry’s operating executives as well as those who finance, analyze or try to sell goods and services to the sector, had a cautiously optimistic tone that rail may soon be able to start to snag some market share from the trucking industry.

It’s not a meeting at which unbridled optimism is usually present. Rail has not seen significant organic growth at the expense of 18-wheelers for a long time. That time span might be viewed as forever, if you have listened to some of the speakers at RailTrends over the years.

Whereas the meeting in 2022 seemed almost like a gathering of people who thought an exorcism might be in order, after railroads failed to capitalize on one of the greatest freight markets ever and had a huge number of complaints about bad service to boot, RailTrends 2023 might mark at least a turnaround in outlook that would still need to be backed up by actual performance.

What has been lost was starkly laid out by Rob Cannizzaro, COO of the Intermodal Association of North America (IANA).

According to Cannizzaro, intermodal rail has lost about 1.4 million intermodal loads since 2017, which translates to about $3.5 billion in revenue.

Keith Creel, president and CEO of Canadian Pacific Kansas City Southern (CPKC), came to the meeting as the CEO of the merged Class I railroad between its two namesakes (NYSE: CP), a deal that was not concluded by RailTrends a year earlier. He said the combined railroad, which stretches from Mexico into Canada — the only Class I that can make that claim — is creating competition.

“This industry is getting stronger as a result,” he said. “Not just us. I think if you look across the board at every railroad, we’re in a better place today than a year ago. There’s motivation, there’s excitement, there’s energy and there’s investment.”

Specifically, Creel said the Midwest Express intermodal service that was announced in May to provide four-day service between Chicago and Mexico has been turning in a performance that has exceeded that goal on average by several hours.

Referring to other competing services between the U.S. and Mexico that have been announced in the last year, Creel said these expansions were signs that “competition is undoubtedly changing and driving a stronger industrial network to the benefit of the customer and commerce.”

Creel said CPKC has “a very robust pipeline plan for next year, and the following year, there’s no shortage of demand.” But he cautioned that while he saw the road map to more growth, “if you get ahead of yourself, and you’re putting too much traffic on your network, you destroy your value proposition.”

Another change from the 2022 meeting is that a year ago, railroad and union negotiators had agreed upon a contract but the road to ratification had plenty of bumps in it before full worker acceptance. That didn’t come for several weeks after the meeting.

Ian Jefferies, president and CEO of the Association of American Railroads, noted that difference between this year’s RailTrends conference and last year’s. “In the weeks following [the 2022] conference, we were able to get [contracts] across the finish line.”

He called it the “richest contract for our employees,” with provisions on leave that “created much more work-life balance.”

Even Adrienne Bailey was positive. The partner at Oliver Wyman’s rail consulting group, a fixture on the agenda at RailTrends, has been strongly critical of the rail sector at earlier gatherings. Although her address was about “green propulsion,” the use of alternative fuels in power units, she prefaced her remarks by saying that she hoped “by next year I will be talking about the shining successes” of the industry after reviewing positive steps taken in the past year.

Chuck Baker, on the same panel as Jefferies, is the president of the American Short Line Rail and Regional Railroad Association. He said it’s “been a rough, I guess I would probably say, about six years at this point.”

But he also said that “you’re starting to see a lot of green shoots in the industry. It feels like we’re turning a corner.”

There were several references during the conference to recent gains on the rails.

Beth Whited, president of Union Pacific (NYSE: UNP), echoed that view of recently stronger markets, saying the railway was having “a really very strong run through about the end of September, maybe even into early October.” And while grain and coal shipments have slowed recently, Union Pacific had a “really strong” October in both its industrial and premium divisions.

It was the address by Joe Hinrichs, president and CEO of CSX (NASDAQ: CSX), that sounded more like some of the gloomier forecasts of the past. Its themes were familiar: Good service is necessary for growth and we’ve got a long way to go.

Hinrichs lamented that railroading is the type of activity that many people have had a “love affair” with “and somehow we lost that.” That fact has made it more difficult to attract and retain talent.

Another result is that railroads’ reputation (damaged in part by the February accident in East Palestine, Ohio, that was mentioned several times over the course of the meeting) has taken a hit, with the industry sometimes being seen as “bad guys,” Hinrichs said.

Part of the solution for safety and technology shortcomings is more and better cooperation, Hinrichs said.

“What in our railroads’ DNA inhibits us from working together on stuff like that?” Hinrichs asked. That the fate of the railroads is linked is obvious. Every railroad has derailments and when they occur, “we all feel the effects of that.”

Even if that could be overcome, “the standards are too low in this industry for customer service.” And if better service were provided, “a lot of our problems would go away,” Hinrichs said.

“We should want our customers to be enthusiastic about doing business with us to be excited about their business,” Hinrichs said. “And the standards we set for that bar are too low in our industry.”

Loading…