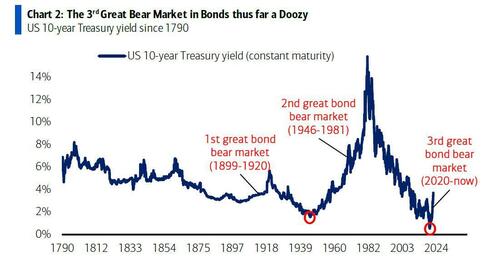

Friday was a bad day for stocks, and while spoos managed to stage a tiny end-of-day bounce to avoid sliding below the 2022 June closing low of 3,666, one can only describe Friday's action as a crash - which is what we did - especially in the bond world where things are starting to break, as Michael Hartnett explained in "The Bond Crash of 2022"

But even just looking at equities, it was a full-blown capitulation: as Goldman's flow trader John Flood observed, the last day of trading saw continued Long Only (L/O) derisking in broken names (Goldman's asset manager sell skew peaked at 21% Friday which was 91st $-ile vs 52 week look back), at the same time as Goldman saw meaningful supply in growth complex.

Away from L/Os, hedge funds added to macro shorts (this dynamic keeping grosses higher than expected in this tape). And while stocks remain in a buyback blackout until the start of earnings season in roughly 3 weeks time, month-end pension rebalance sees a modest $7bn for sale, while CTAs are now at -100% net shorts, and are mostly done shorting here (Goldman calculates some -$1BN a day for the next week but doesn't get much bigger even if the market breaks lower). Still, the lack of major forced selling is hardly sufficient to bring buyers back into the market, especially ahead of another low-liquidity week where ascendant bears will again set the market tone - as a reminder, with Rosh Hashanah on Monday and Tuesday, attendance will be light and liquidity will be tough to come by.

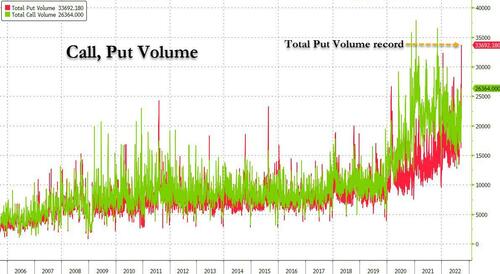

However, what was perhaps the most notable market feature of Friday's (orderly) selloff is the record surge in hedging: while call buying has collapsed, Friday saw the highest put option volume in historyat just shy of 34 million contracts.

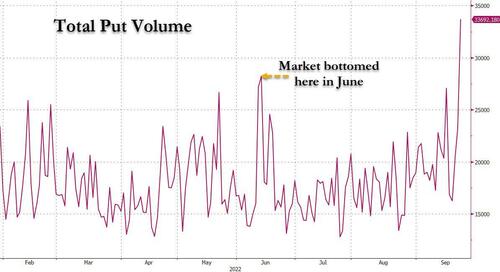

Of course, the last time put buying soared to a fresh high, was June 13 which also marked the market's lows for the year.

That's why as Goldman's Flood writes, "we are now officially primed for a nasty move higher at some point next week that will promptly be re-shorted."

Still, absent a dovish pivot by the Fed - which will come the moment the BLS admits it missed some 10 million unemployed workers in a gross, pre-midterm election "oversight" - the broader market trend into year-end still points lower as neither depressed sentiment not positioning alone can push market higher for a sustained period of time (although they certainly can for a several day stretch).

Meanwhile, as we noted extensively on Friday, the move higher in yields - both int he US and across the pond - is starting to get some real attention as the "market is sniffing out that these European Governments are between a rock and a hard place: adding fiscal support to safeguard from higher energy prices is making inflation problem worse and leading CB's to be more aggressive."

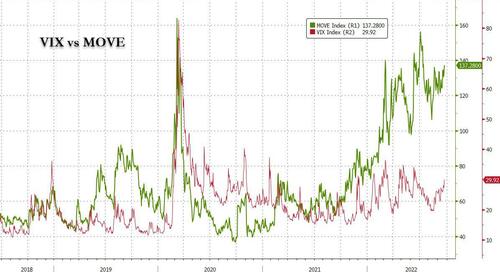

And while the VIX will likely stay below 30 next week, especially if those who just bought puts in record amounts are forced to monetize (i.e., sell) should we avoid another trapdoor move lower, and we get another poweful delta meltup, the real volatility these days is in the "bond VIX", the MOVE, which is about to take out its March 16, 2020 covid all time highs, even as stock VIX simply refuses to move above 30 in any sustained move.

Still, an eventual convergence between these two series is the only option - unless the market is terminally broken - and either VIX will explode to the 60-80 zone in the coming days, or else yields will have to tumble down on either recession fears or a hint by central banks that QE is coming back even as rate hikes persist for a few more months, until the entire global economy tumbles into a very steep and very disinflationary recession.

Friday was a bad day for stocks, and while spoos managed to stage a tiny end-of-day bounce to avoid sliding below the 2022 June closing low of 3,666, one can only describe Friday’s action as a crash – which is what we did – especially in the bond world where things are starting to break, as Michael Hartnett explained in “The Bond Crash of 2022“

But even just looking at equities, it was a full-blown capitulation: as Goldman’s flow trader John Flood observed, the last day of trading saw continued Long Only (L/O) derisking in broken names (Goldman’s asset manager sell skew peaked at 21% Friday which was 91st $-ile vs 52 week look back), at the same time as Goldman saw meaningful supply in growth complex.

Away from L/Os, hedge funds added to macro shorts (this dynamic keeping grosses higher than expected in this tape). And while stocks remain in a buyback blackout until the start of earnings season in roughly 3 weeks time, month-end pension rebalance sees a modest $7bn for sale, while CTAs are now at -100% net shorts, and are mostly done shorting here (Goldman calculates some -$1BN a day for the next week but doesn’t get much bigger even if the market breaks lower). Still, the lack of major forced selling is hardly sufficient to bring buyers back into the market, especially ahead of another low-liquidity week where ascendant bears will again set the market tone – as a reminder, with Rosh Hashanah on Monday and Tuesday, attendance will be light and liquidity will be tough to come by.

However, what was perhaps the most notable market feature of Friday’s (orderly) selloff is the record surge in hedging: while call buying has collapsed, Friday saw the highest put option volume in historyat just shy of 34 million contracts.

Of course, the last time put buying soared to a fresh high, was June 13 which also marked the market’s lows for the year.

That’s why as Goldman’s Flood writes, “we are now officially primed for a nasty move higher at some point next week that will promptly be re-shorted.”

Still, absent a dovish pivot by the Fed – which will come the moment the BLS admits it missed some 10 million unemployed workers in a gross, pre-midterm election “oversight” – the broader market trend into year-end still points lower as neither depressed sentiment not positioning alone can push market higher for a sustained period of time (although they certainly can for a several day stretch).

Meanwhile, as we noted extensively on Friday, the move higher in yields – both int he US and across the pond – is starting to get some real attention as the “market is sniffing out that these European Governments are between a rock and a hard place: adding fiscal support to safeguard from higher energy prices is making inflation problem worse and leading CB’s to be more aggressive.”

And while the VIX will likely stay below 30 next week, especially if those who just bought puts in record amounts are forced to monetize (i.e., sell) should we avoid another trapdoor move lower, and we get another poweful delta meltup, the real volatility these days is in the “bond VIX”, the MOVE, which is about to take out its March 16, 2020 covid all time highs, even as stock VIX simply refuses to move above 30 in any sustained move.

Still, an eventual convergence between these two series is the only option – unless the market is terminally broken – and either VIX will explode to the 60-80 zone in the coming days, or else yields will have to tumble down on either recession fears or a hint by central banks that QE is coming back even as rate hikes persist for a few more months, until the entire global economy tumbles into a very steep and very disinflationary recession.