US equity futures are lower, as are European and Asian markets, with sentiment after the latest batch of earnings after yesterday’s close were mostly mixed or negative (particularly Fedex and Nike, both of which guided lower again). S&P500 futs are down 0.2%, off session lows, with the index facing an additional test on Friday in the form of a huge option expiration quad-witching. Nasdaq futures dropped 0.3% with all Lag 7 names lower led by NVDA -1.2%, and TSLA -0.7%. Micron reversed an earlier gain after reporting earnings after hours and was down 3%-premarket amid margin weakness. 10Y Treasury yields are down 4bps while the dollar reversed an earlier gain. In commodities, oil markets are already feeling the effect of the first effort to target a vast private processing industry, with traders preparing for significant disruption after Washington’s move to sanction a Chinese refiner over its Iranian links. London’s Heathrow airport will be closed all day Friday and service interruptions are likely to continue for days after a nearby fire cut power to the hub and brought travel to a standstill. Today, the macro data calendar is largely quiet, with eyes on any additional headlines from the White House.

In premarket trading, TSLA stock was down even as Elon Musk sought to reassure Tesla employees that despite “rocky moments,” they should “hang onto” their stock. Other Mag 7 names were also mostly lower (Alphabet -0.2%, Amazon -0.2%, Apple -0.7%, Microsoft -0.2%, Meta +0.2%, Nvidia -0.7% and Tesla -0.1%). Nike tumbled 6% as the company signaled further declines in revenue and profitability due to an ongoing merchandise reset and the impact of US tariffs on products from China and Mexico. FedEx was just as ugly, sliding 7% after the parcel delivery company lowered its full-year guidance for a third consecutive quarter, citing inflation and uncertain demand for shipments. Here are some other notable premarket movers:

- Alnylam Pharmaceuticals Inc. (ALNY) gains 5% after the company won expanded approval for a heart drug that could be the biggest boon yet for the 23-year-old biotech and put it in competition with Pfizer Inc.

- Lennar Corp. (LEN) declines 4% after the homebuilder’s margin guidance came in below expectations amid a challenging US housing market.

- Lockheed Martin (LMT) inches 2% higher after Bloomberg reported the White House is poised to announce on Friday the winner of its contest to build the next-generation fighter jet, choosing between the aerospace giant and peer Boeing.

- Luminar (LAZR) climbs 8% after the automotive technology company reported revenue for the fourth quarter that beat the average analyst estimate.

- Nio Inc. (NIO) ADRs slip 4% after the Chinese electric vehicle maker now expects to deliver only as many as 43,000 cars in the three months that will end March 31; that’s short of the around 65,000 units the market was looking for.

- Ouster Inc. (OUST) rises 5% after the maker of sensors used in robotics posted 4Q revenue that increased 23% from the year-ago period and beat estimates.

- Planet Labs (PL) slides 9% after the Earth imaging company’s revenue outlook disappointed.

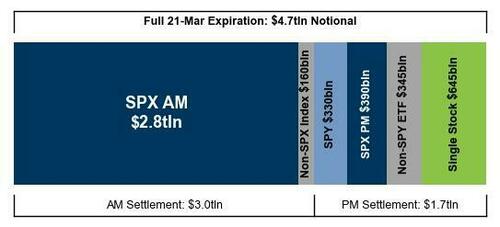

The S&P 500 is up slightly this week, following four weeks of losses. As previewed yesterday, stocks face a big test today in the form of another massive quad-witching , an event that can stoke volatility as options contracts worth $4.7 trillion head for expiry, including $2.8 trillion of S&P index and $645 billion of single stock options. Goldman doesn't see the gamma picture getting meaningfully better as we continue to be well below most call overwriting strikes. Interesting to note that since the close on March 10, S&P is up 48pts, but VIX spot is down more than 8pts. This demonstrates the vol destruction the past week, even as the market itself has not recovered much. Further, we have seen fixed strike vol compression every day this week as vol supply has not let up for even 1 day

Not helping matters was the latest batch of dour earnings from FDX and NKE which added to concerns over a worsening global economic outlook, especially ahead of Trump’s April 2 deadline for a series of broad reciprocal tariffs. While the Federal Reserve has indicated it sees room to cut interest rates, many economists fear the inflationary impact of tariffs will hinder central banks from delivering support to slowing economies.

“The Fed revised their growth forecast lower earlier this week, so the whole street is moving their forecast lower. But they could have further to go,” said Michael Metcalfe, head of macro strategy at State Street Global Markets. “We just need to see whether what we’ve seen so far this year is the start of something more serious in terms of slow growth.”

Despite the challenges, investors haven’t entirely given up on equities with US stock funds enjoying the largest weekly inflows this year on a view that the trade war won’t derail the economy or equity market, BofA's Michael Hartnett said.

Meanwhile, the Turkish lira headed for its biggest weekly crash in nearly two years, shrugging off an emergency rate increase in the face of mounting political tensions. Istanbul stocks were halted again, after plunging as much as 7%, having shed $30 billion in value this week.

European stocks decline, with the Stoxx 600 down 0.7%. Regional airline stocks underperform after London’s Heathrow airport was shuttered by a major fire nearby. Here are some of the biggest movers on Friday:

- Asos shares jump as much as 25%, their best day in nearly five years, after the online fashion retailer reiterated it expects a “significant improvement” in profitability in the first half.

- Energean shares rise as much as 5.8% after the oil and gas company said it has terminated a deal to sell natural gas assets to a unit of Carlyle Group.

- Tele2 shares gain as much as 3.4%, the most since January, after the Swedish telecommunications firm was upgraded to overweight from neutral at JPMorgan.

- IAG shares fall as much as 4.3% after British Airways hub Heathrow Airport was forced to close all day Friday after a nearby fire caused a power outage.

- Douglas shares fall as much as 23.5%, the most ever and to a record low, after the German beauty product retailer issued a profit warning.

- Wetherspoon shares slide as much as 12%, hitting a two-year low, after Shore Capital said it expects consensus estimates to fall after the pub chain’s results came in softer than anticipated in the first half.

- Amadeus Fire shares plunge as much as 13% after the German recruiter said it expects a significant fall in profit this year as the economic environment continues to deteriorate

- Ceres Power shares fall as much as 13% after the British fuel-cell technology company reported revenue that came in short of expectations and a guidance for 2025 that suggests no major commercial developments near term, according to RBC

- Polish Banks fall after Poland’s EU Funds Minister Katarzyna Pelczynska-Nalecz, member of junior coalition party, floated the idea of windfall tax for banks amid the industry’s record profit

Earlier in the session, Asian stocks fell as a selloff in Chinese shares extended amid a lack of catalysts, while traders braced for US President Donald Trump’s upcoming tariffs. The MSCI Asia Pacific Index declined as much as 0.7%, with Alibaba and TSMC among the biggest drags. Benchmarks in Taiwan, mainland China and Hong Kong declined, while South Korea gained. MSCI’s regional gauge is still headed for a nearly 2% advance this week. Chinese shares in Hong Kong posted their biggest two-day drop since October as traders digested earnings and awaited further policy catalysts.

“With the ‘Two Sessions’ now behind us, market attention has shifted to looming tariff risks set to take effect in less than two weeks, which may prompt investors to adjust their positioning amid the uncertainty,” said Jun Rong Yeap, market strategist at IG Asia.

In FX, the Bloomberg Dollar Spot Index rose 0.2% but was off session highs. The yen reversed a 0.3% drop against the greenback and was now higher. The pound and the euro lose 0.2% each. Spot gold drops $13 to around $3,032/oz.

In rates, treasuries inch higher, pushing US 10-year yields down about 2 bps to 4.22%. Euro-area government bonds also advance with traders now pricing in two more quarter-point European Central Bank reductions this year. Gilts fall, underperforming peers across the curve, after UK government borrowing topped estimates in February. UK 10-year yields rise 4 bps to 4.69%.

In commodities, European natural gas futures rise over 2% after an attack on a pumping station in Russia’s Kursk region. Oil prices dip, with WTI down 0.4% near $67.81 a barrel. Gold held near record highs, as several banks raised their price forecasts for the haven asset. Gold funds have seen the biggest four-week inflow ever, the BofA data showed.

Looking to the day ahead, data releases include the UK GfK consumer confidence for March whilst in France there’s the manufacturing confidence for March and retail sales for February. Additionally, Eurozone consumer confidence for March and Italy’s current account balance for January will also be published. Outside of the Eurozone, we have Canada retail sales for January. Otherwise from central banks, we’ll hear from the Fed’s Williams and the ECB’s Escriva.

Market Snapshot

- S&P 500 futures down 0.4% to 5,638.25

- STOXX Europe 600 down 0.9% to 548.14

- MXAP down 0.5% to 188.95

- MXAPJ down 0.8% to 588.93

- Nikkei down 0.2% to 37,677.06

- Topix up 0.3% to 2,804.16

- Hang Seng Index down 2.2% to 23,689.72

- Shanghai Composite down 1.3% to 3,364.83

- Sensex up 0.6% to 76,786.38

- Australia S&P/ASX 200 up 0.2% to 7,931.23

- Kospi up 0.2% to 2,643.13

- German 10Y yield little changed at 2.76%

- Euro down 0.2% to $1.0825

- Brent Futures up 0.2% to $72.14/bbl

- Gold spot down 0.4% to $3,031.74

- US Dollar Index up 0.21% to 104.07

Top Overnight News

- Britain's Heathrow Airport was shut on Friday after a huge fire at a nearby substation knocked out its power, stranding passengers around the world and angering airlines who questioned how such crucial infrastructure could collapse

- Germany’s new era of big spending is pulling up borrowing costs across Europe, reigniting jitters around fiscal stability on the continent’s periphery.

- Trump posted "Egg prices are WAY DOWN from the Biden inspired prices if just a few weeks ago. “Groceries” and Gasoline are down, also. Now, if the Fed would do the right thing and lower interest rates, that would be great!!!"

- Trump posted "Unlawful Nationwide Injunctions by Radical Left Judges could very well lead to the destruction of our Country!... STOP NATIONWIDE INJUNCTIONS NOW, BEFORE IT IS TOO LATE".

- Trump and Defense Secretary Hegseth are to deliver remarks from the Oval Office today at 11:00EDT/15:00GMT, according to the White House.

- President Trump denied a report that the Pentagon was going to brief Elon Musk about the US military's plan for any war with China.

- Elon Musk sought to reassure Tesla Inc. employees during what he referred to as “a little bit of stormy weather,” after the carmaker’s shares plunged more than 50% in just three months.

- White House has commenced a review of Federal Agency plans for a 2nd round of mass layoffs: RTRS

- The Israeli cabinet voted early on Friday to dismiss the head of the Shin Bet domestic intelligence service effective April 10, Prime Minister Benjamin Netanyahu's office said, after three days of protests against the move.

- Chancellor of the Exchequer Rachel Reeves is set to overshoot her borrowing forecasts significantly for the current fiscal year, highlighting the fragile state of the UK’s public finances ahead of a key economic statement next week.

- Germany’s move to unlock hundreds of billions of euros in debt-financed defense and infrastructure spending passed its final legislative hurdle on Friday when lawmakers in the upper house of parliament in Berlin approved the measures.

- The financial industry is abandoning caution and chasing the rally in European stocks, hiking their targets and looking to the upside.

- President Xi Jinping’s government is set to welcome a US senator close to Donald Trump for talks in China, as the world’s largest economies try to move forward trade negotiations that have stalled at lower levels.

- China’s imports of US cotton, cars and some energy products all plunged in the first two months of the year after President Donald Trump started imposing tariffs and Beijing retaliated. In a prelude to what could be widespread disruption to global trade, Chinese purchases of cotton fell almost 80% from a year earlier, according to Bloomberg analysis of data released Thursday. Imports of large-engined cars were down nearly 70%, while purchases of crude oil and liquefied natural gas dropped more than 40%.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks ultimately traded mixed following the choppy performance stateside in the aftermath of the Super Thursday deluge of central bank announcements and ahead of quad witching. ASX 200 was just about kept afloat by notable outperformance in Consumer Staples as shares of Coles and Woolworths rallied after a report by the competition regulator which noted the supermarket retailers along with discount rival Aldi, were among the most profitable supermarket businesses in the world. Nikkei 225 initially traded higher on favourable currency moves but then reversed course after hitting resistance ahead of the 38,000 level and as the mostly firmer-than-expected Japanese inflation data supported the case for the BoJ to continue policy normalisation in the future. Hang Seng and Shanghai Comp were pressured despite the lack of fresh catalysts and as earnings results trickled in, while trade uncertainty continued to cloud over risk sentiment and NYT recently reported that Elon Musk is set to get access to a top-secret US plan for a potential war with China although President Trump later refuted this.

Top Asian News

- Elon Musk was initially reported to get access to a top-secret US plan for a potential war with China, according to the New York Times. However, President Trump later refuted the report which he said was fake news.

- Japan's Rengo says second round data shows avg. wage hike of 5.4% for Fiscal 2025 vs 5.46% in the first-round data.

- Meituan (3690 HK) FY24 (CNH) Net Income 35.8bln (exp. 37.8bln), Revenue 337.6bln (exp. 337bln); Q4: Adj. Net Income 9.85bln (exp. 9.91bln), Revenue 88.5bln (exp. 87.9bln).

- Nio Inc (NIO) Q4 (CNY): EPS -3.17 (exp. -2.4) Revenue 19.7bln (exp. 20.07bln); sees Q1 total revenue 12.367-12.859bln

Top European News

- London's Heathrow Airport said it is experiencing a significant power outage due to a fire at an electrical substation supplying the airport and will be closed until 23:59 GMT today, while it stated significant disruption is expected over the coming days and passengers should not travel to the airport under any circumstances until it reopens.

- Denmark is reportedly open to joint European projects and funding if required, via FT citing sources

- UK says it is pausing the publication of Service Producer Price Index and Producer Price Index; planning to recommence publication in the summer and will keep users informed of progress; CPI unaffected.

- German Bundesrat has passed the debt reform bill and EUR 500bln fund, according to the vote tally cited by Reuters

FX

- USD is slightly firmer and trading within a 103.74-104.15 range in what has been a quiet session thus far - the US data docket remains light for the remainder of the. Focus however, will be on Fed speak from Williams, Waller and Goolsbee; the former will see the release of an accompanying text release and a Q&A thereafter. Elsewhere, US President Trump is to speak with Hegseth at 15:00GMT.

- EUR is a little lower and trades towards the bottom end of a 1.0820-35 range, continuing the losses seen this week. Aside from EZ Consumer Confidence, the docket remains light with no ECB speakers scheduled - though some focus will be on DBRS, who will review France's credit rating today.

- USD/JPY has edged higher and reclaimed the 149.00 handle despite the cautiousness in the region and with the pair also unfazed by the mostly firmer-than-expected Japanese inflation data.

- GBP is on the backfoot vs. the USD in an extension of yesterday's downside. Despite yesterday's mildly hawkish skew to the BoE announcement in which external member Mann reverted back to the unchanged camp, the pound has fallen victim to the broadly firmer USD. This morning's public sector net borrowing data showed a further deterioration in the nation's finances.

- Antipodeans are both struggling for direction after recent losses and with price action contained amid a quiet calendar and the mixed risk sentiment.

Fixed Income

- USTs are slightly firmer, in-fitting with action in Bunds as the risk tone remains under pressure this morning. US specifics a little light thus far though the docket ahead is packed. Firstly, POTUS is due to give remarks from the Oval Office at 15:00GMT alongside his Defence Secretary. Given Hegseth’s inclusion the remarks may be focussed on Iran, with rhetoric from the Supreme Leader this morning punchy. As it stands, USTs are at the upper-end of a 111-00 to 111-09 band, with yields softer across the curve which itself is incrementally steeper.

- Bunds are firmer and at the top-end of a 128.15-128.58 band. Strength this morning comes from the downbeat risk tone which broadly speaking appears to be a continuation of the recent narrative of taking risk off the table into the April 2nd tariff announcement. German Bundesrat has passed the debt reform bill and EUR 500bln fund, as expected.

- Gilts gapped higher by a handful of ticks given the lead from EGBs but then succumbed to the morning’s borrowing data and slumped to a 91.73 trough. However, as the risk tone deteriorated, the benchmark lifted off worst and briefly got back to within reach of the 92.00 mark in a 91.73-92.12 band; though, ultimately, Gilts remain under notable pressure. PSNB showed a larger-than-expected borrowing figure alongside a downward revision to the prior which has taken borrowing for the 11-months of the current FY to the GBP 132bln mark, exceeding the GBP 127.5bln forecast by the OBR for the entire FY period.

Commodities

- Crude is incrementally lower, after spending the majority of the European morning around the unchanged mark; WTI'May now trades towards the lower end of a USD 67.80-68.65/bbl range. Energy-specific newsflow has been light today, whilst punchy rhetoric from Iran's Supreme Leader Khamenei failed to lift prices.

- Natural gas prices have been boosted today after Kyiv Post reported "Putin’s forces shelled the Sudzha gas metering station in Russia’s Kursk region with artillery in order to blame Ukraine — the General Staff of the Ukrainian Armed Forces". In response to this attack, Russia's Kremlin said Ukrainian President Zelensky cannot be trusted.

- Precious metals are on the backfoot, with spot gold pulling back from best levels in overnight trade; into the European session, price action has been fairly contained and currently sits towards the mid-point of a USD 3,021.73-3,047.51/oz range.

- Base metals are entirely in the red given the downbeat risk tone and poor Chinese performance overnight. 3M LME Copper currently trades towards the lower end of a USD 9,842.2-10,001.8/t.

- China is to add cobalt and copper to its state metal reserves.

Geopolitics: Middle East

- Hamas says it is still studying the US proposal and the other proposed ideas in order to reach a deal that ensures hostage releases, the end of the war, and Israeli withdrawal.

- Iran's Supreme Leader Khamenei says the "US need to know if they mess around with Iran, it will receive a hard slap"; "has no proxies in the region, those groups act independently".

- Israel's cabinet voted to fire the head of Shin Bet Ronen Bar, according to AP.

- US National Security Adviser Waltz said Israel has every right to defend its people from Hamas terrorists and the ceasefire would have been extended if Hamas released all remaining hostages, but they chose war instead.

Geopolitics: Ukraine

- Russia's Kremlin says Russian President Putin's order not to strike Ukrainian energy infrastructure remains in force; attack on Russian Gas transit station in Sudzha shows Ukrainian President Zelensky cannot be trusted.

- Kyiv Post reports "Putin’s forces shelled the Sudzha gas metering station in Russia’s Kursk region with artillery in order to blame Ukraine — the General Staff of the Ukrainian Armed Forces".

- Explosions were reported in the sky of Ukraine's capital and air defences were working to counter a large-scale attack with drones, while it was also reported that Russian drones hit civilian targets in Odesa on Thursday night.

- US reportedly seeks to reopen terms of a Ukraine minerals deal, according to FT.

- Germany, Italy, Poland, UK, and Canada leaders are to meet in Paris next week to discuss Ukraine, while French President Macron said the European meeting next week is to discuss ways to accelerate immediate military support for Ukraine and will discuss plans to strengthen the Ukrainian army if an agreement is reached with Russia.

- EU's Costa said he believes EU member states will increase pledges of support to Ukraine.

- Russia's presidential security adviser Shoigu arrived in North Korea and is to meet with North Korea's leader.

- Russian Investigative Committee opens a case over explosion at Sudzha gas metering station in Russia's Kursk region organised by Ukraine; station significantly damaged in a blast.

US Event Calendar

- Nothing scheduled

DB's Jim Reid concludes the overnight wrap

As London basks in temperatures warmer than Ibiza, a renewed focus on trade fears derailed a recovery in risk assets yesterday, with the S&P 500 closing -0.22% lower last night, though it’s still up +2.56% from last Thursday’s close, having so far only spent that one day in -10% correction territory. Yesterday was also the first day in a while where European stocks bore the brunt of the negativity with the FTSE-MIB (-1.32%) and the DAX (-1.24%) leading the declines. The Stoxx 600 (-0.43%) was helped by exposure to UK stocks with the FTSE (-0.05%) outperforming even after a slightly hawkish hold from the BoE (more later).

European markets had seen a sharp slide lower just before 9am GMT yesterday with no real explanation but by mid-morning they had stabilised and range traded into the close. There was no associated story but there was a lot of chatter about Mr Trump’s social media post from the early hours of the London morning that suggested the Fed should be cutting rates as “.... US Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”. In an era of analysing every nuance of every post, the clear suggestion was that this implied that tariffs would cause some economic pain ahead. And while markets recovered during the US morning session, they then turned lower again with the S&P falling from +0.63% at the peak to close down -0.22%. So a modest but fairly broad-based decline, with 65% of the S&P lower on the day and the equal-weighted version of the index down -0.37%.

Bonds also had a topsy-turvy session, with 10yr Treasuries yields a mere -0.5bps to 4.24% by the close after having traded as low as 4.17% amid the earlier risk-off tone. The reversal of the bond rally was helped by a decent batch of US data. Existing home sales saw an unexpected acceleration in February (4.26m vs 3.95m expected and 4.08m previous), although there may be some residual seasonality in the data as sales have seen large February spikes for the past three years. Meanwhile, the latest initial jobless claims (223k vs 224k expected) painted a steady picture of the US labour market.

Looking forward to today, the vote on the debt brake reform in the Bundesrat starts at 9.30am CET this morning with news at the start of the week that Bavaria will support the bill meaning that its safe passage probability is even higher than it was in the Bundestag where it passed comfortably on Tuesday. Assuming it passes, it is theoretically possible that the AfD and the Left could seek an abstract judicial review at the Federal Constitutional Court as soon as the new Bundestag is constituted, which sits for the first time next Tuesday, but the Left have said they won’t file a complaint alongside the AfD. The potential legal challenges have steadily fallen away over the last couple of weeks and the story will likely move onto coalition talks next week with the expectations that this will be completed before the end of March and Friedrich Merz to be sworn in as chancellor shortly after Easter.

As for the BoE, our economist Sanjay Raja, believes the on-hold decision (at 4.5%) was on the hawkish side with the MPC's vote tally and messaging highlighting growing concern around the disinflation progress in the midst of weaker demand. The biggest surprise was that only one member voted for a cut with 8 voting for unchanged. We thought there would be 2 doves. Sanjay still thinks there’ll be four 25bps cuts this year but his conviction levels have fallen. The risk is now that they could pause between May and November when CPI is expected to push up against 4% YoY. Ultimately, Sanjay thinks that beyond that the labour market will cool, pay settlements fall, tariffs will bite, and a terminal rate of 3.25% will be hit. See his report here. The hawkish lean left the probability of a cut in May at 64% down from 72% at the prior close. 10yr Gilts slightly underperformed, climbing +1.0bps with 2yr yields +3.5bps in contrast with German and French 2yr yields which were -2.3bps and -2.5bps lower, respectively.

Elsewhere in Europe, the SNB cut rates by 25bps as expected to 0.25%, their lowest since September 2022, but signalled that it doesn’t anticipate further easing as things stand. And in Sweden, the Riksbank kept rates on hold at 2.25% and also reiterated that it expects stable rates ahead. In other central bank news, Bank of Canada Governor Macklem said that the hotter inflation print the previous day “got our attention”.

Sticking with Canada, the Globe and Mail reported that new Prime Minister Mark Carney is expected this weekend to call a snap election for late April. An election is due by October at the latest. The former Bank of England and Bank of Canada governor took over from Trudeau as the head of the Liberal party earlier this month, and while the Liberals had been more than 20pts behind the opposition Conservatives in opinion polls at the turn of the year, the latest polls now show them in a slight lead in a dramatic turnaround since Trudeau’s decision to step down and amid increased tensions with the US.

Turkish markets remained in the headlines yesterday as Türkiye's central bank raised its overnight lending rate by 2pp to 46% in a surprise meeting. The Turkish lira saw modest rebound (+0.25%) and has been trading in a narrow range close to 38 on the dollar, hinting at a concerted effort to stabilise the currency after its initially sharp sell-off on Wednesday.

In commodities, Brent crude oil prices (+2.13%) rose to their highest level since the end of February at $72.29/bbl after the US for the first time sanctioned a Chinese refinery for allegedly buying Iranian oil, raising the prospect of stricter US sanctions enforcement against Iran. Meanwhile, copper (+0.03%) hovered within 1% of its record high from last May, after extending its YTD gains to +26% YTD on risks of US duties and stronger China data.

Asian equity markets are sharply lower in China but generally slightly higher elsewhere. The Hang Seng (-2.14%) is leading losses in the region followed by the CSI (-1.30%) and the Shanghai Composite (-1.06%). Elsewhere, the Nikkei (+0.17%) is trading slightly higher with the KOSPI (+0.06%) and the S&P/ASX 200 (+0.16%) also hanging on to gains. US stock futures are a fraction lower and 10yr US yields around a basis point higher.

Coming back to Japan, Japan’s core inflation came in at 3.0% y/y in February (v/s +2.9% expected) but lower than January’s figure of 3.2%. At the same time, headline inflation rose +3.7% y/y in February (v/s +3.5% expected) easing from a two-year high of+ 4.0% seen last month, thus staying above the BOJ’s 2% target for 35 straight months. The “core-core” inflation rate climbed to +2.6% y/y from +2.5% in the month before and maybe a touch above expectations especially as the print nearly rounded up to 2.7%. Following the data release, yields on the 10yr JGBs are +1.3bps higher trading at 1.52%. See our economist’s take on the inflation release here.

Now to the day ahead, the Bundesrat is voting today on the huge fiscal package ahead of the new Bundestag session starting next Tuesday. Data releases include the UK GfK consumer confidence for March whilst in France there’s the manufacturing confidence for March and retail sales for February. Additionally, Eurozone consumer confidence for March and Italy’s current account balance for January will also be published. Outside of the Eurozone, we have Canada retail sales for January. Otherwise from central banks, we’ll hear from the Fed’s Williams and the ECB’s Escriva.

US equity futures are lower, as are European and Asian markets, with sentiment after the latest batch of earnings after yesterday’s close were mostly mixed or negative (particularly Fedex and Nike, both of which guided lower again). S&P500 futs are down 0.2%, off session lows, with the index facing an additional test on Friday in the form of a huge option expiration quad-witching. Nasdaq futures dropped 0.3% with all Lag 7 names lower led by NVDA -1.2%, and TSLA -0.7%. Micron reversed an earlier gain after reporting earnings after hours and was down 3%-premarket amid margin weakness. 10Y Treasury yields are down 4bps while the dollar reversed an earlier gain. In commodities, oil markets are already feeling the effect of the first effort to target a vast private processing industry, with traders preparing for significant disruption after Washington’s move to sanction a Chinese refiner over its Iranian links. London’s Heathrow airport will be closed all day Friday and service interruptions are likely to continue for days after a nearby fire cut power to the hub and brought travel to a standstill. Today, the macro data calendar is largely quiet, with eyes on any additional headlines from the White House.

In premarket trading, TSLA stock was down even as Elon Musk sought to reassure Tesla employees that despite “rocky moments,” they should “hang onto” their stock. Other Mag 7 names were also mostly lower (Alphabet -0.2%, Amazon -0.2%, Apple -0.7%, Microsoft -0.2%, Meta +0.2%, Nvidia -0.7% and Tesla -0.1%). Nike tumbled 6% as the company signaled further declines in revenue and profitability due to an ongoing merchandise reset and the impact of US tariffs on products from China and Mexico. FedEx was just as ugly, sliding 7% after the parcel delivery company lowered its full-year guidance for a third consecutive quarter, citing inflation and uncertain demand for shipments. Here are some other notable premarket movers:

- Alnylam Pharmaceuticals Inc. (ALNY) gains 5% after the company won expanded approval for a heart drug that could be the biggest boon yet for the 23-year-old biotech and put it in competition with Pfizer Inc.

- Lennar Corp. (LEN) declines 4% after the homebuilder’s margin guidance came in below expectations amid a challenging US housing market.

- Lockheed Martin (LMT) inches 2% higher after Bloomberg reported the White House is poised to announce on Friday the winner of its contest to build the next-generation fighter jet, choosing between the aerospace giant and peer Boeing.

- Luminar (LAZR) climbs 8% after the automotive technology company reported revenue for the fourth quarter that beat the average analyst estimate.

- Nio Inc. (NIO) ADRs slip 4% after the Chinese electric vehicle maker now expects to deliver only as many as 43,000 cars in the three months that will end March 31; that’s short of the around 65,000 units the market was looking for.

- Ouster Inc. (OUST) rises 5% after the maker of sensors used in robotics posted 4Q revenue that increased 23% from the year-ago period and beat estimates.

- Planet Labs (PL) slides 9% after the Earth imaging company’s revenue outlook disappointed.

The S&P 500 is up slightly this week, following four weeks of losses. As previewed yesterday, stocks face a big test today in the form of another massive quad-witching , an event that can stoke volatility as options contracts worth $4.7 trillion head for expiry, including $2.8 trillion of S&P index and $645 billion of single stock options. Goldman doesn’t see the gamma picture getting meaningfully better as we continue to be well below most call overwriting strikes. Interesting to note that since the close on March 10, S&P is up 48pts, but VIX spot is down more than 8pts. This demonstrates the vol destruction the past week, even as the market itself has not recovered much. Further, we have seen fixed strike vol compression every day this week as vol supply has not let up for even 1 day

Not helping matters was the latest batch of dour earnings from FDX and NKE which added to concerns over a worsening global economic outlook, especially ahead of Trump’s April 2 deadline for a series of broad reciprocal tariffs. While the Federal Reserve has indicated it sees room to cut interest rates, many economists fear the inflationary impact of tariffs will hinder central banks from delivering support to slowing economies.

“The Fed revised their growth forecast lower earlier this week, so the whole street is moving their forecast lower. But they could have further to go,” said Michael Metcalfe, head of macro strategy at State Street Global Markets. “We just need to see whether what we’ve seen so far this year is the start of something more serious in terms of slow growth.”

Despite the challenges, investors haven’t entirely given up on equities with US stock funds enjoying the largest weekly inflows this year on a view that the trade war won’t derail the economy or equity market, BofA’s Michael Hartnett said.

Meanwhile, the Turkish lira headed for its biggest weekly crash in nearly two years, shrugging off an emergency rate increase in the face of mounting political tensions. Istanbul stocks were halted again, after plunging as much as 7%, having shed $30 billion in value this week.

European stocks decline, with the Stoxx 600 down 0.7%. Regional airline stocks underperform after London’s Heathrow airport was shuttered by a major fire nearby. Here are some of the biggest movers on Friday:

- Asos shares jump as much as 25%, their best day in nearly five years, after the online fashion retailer reiterated it expects a “significant improvement” in profitability in the first half.

- Energean shares rise as much as 5.8% after the oil and gas company said it has terminated a deal to sell natural gas assets to a unit of Carlyle Group.

- Tele2 shares gain as much as 3.4%, the most since January, after the Swedish telecommunications firm was upgraded to overweight from neutral at JPMorgan.

- IAG shares fall as much as 4.3% after British Airways hub Heathrow Airport was forced to close all day Friday after a nearby fire caused a power outage.

- Douglas shares fall as much as 23.5%, the most ever and to a record low, after the German beauty product retailer issued a profit warning.

- Wetherspoon shares slide as much as 12%, hitting a two-year low, after Shore Capital said it expects consensus estimates to fall after the pub chain’s results came in softer than anticipated in the first half.

- Amadeus Fire shares plunge as much as 13% after the German recruiter said it expects a significant fall in profit this year as the economic environment continues to deteriorate

- Ceres Power shares fall as much as 13% after the British fuel-cell technology company reported revenue that came in short of expectations and a guidance for 2025 that suggests no major commercial developments near term, according to RBC

- Polish Banks fall after Poland’s EU Funds Minister Katarzyna Pelczynska-Nalecz, member of junior coalition party, floated the idea of windfall tax for banks amid the industry’s record profit

Earlier in the session, Asian stocks fell as a selloff in Chinese shares extended amid a lack of catalysts, while traders braced for US President Donald Trump’s upcoming tariffs. The MSCI Asia Pacific Index declined as much as 0.7%, with Alibaba and TSMC among the biggest drags. Benchmarks in Taiwan, mainland China and Hong Kong declined, while South Korea gained. MSCI’s regional gauge is still headed for a nearly 2% advance this week. Chinese shares in Hong Kong posted their biggest two-day drop since October as traders digested earnings and awaited further policy catalysts.

“With the ‘Two Sessions’ now behind us, market attention has shifted to looming tariff risks set to take effect in less than two weeks, which may prompt investors to adjust their positioning amid the uncertainty,” said Jun Rong Yeap, market strategist at IG Asia.

In FX, the Bloomberg Dollar Spot Index rose 0.2% but was off session highs. The yen reversed a 0.3% drop against the greenback and was now higher. The pound and the euro lose 0.2% each. Spot gold drops $13 to around $3,032/oz.

In rates, treasuries inch higher, pushing US 10-year yields down about 2 bps to 4.22%. Euro-area government bonds also advance with traders now pricing in two more quarter-point European Central Bank reductions this year. Gilts fall, underperforming peers across the curve, after UK government borrowing topped estimates in February. UK 10-year yields rise 4 bps to 4.69%.

In commodities, European natural gas futures rise over 2% after an attack on a pumping station in Russia’s Kursk region. Oil prices dip, with WTI down 0.4% near $67.81 a barrel. Gold held near record highs, as several banks raised their price forecasts for the haven asset. Gold funds have seen the biggest four-week inflow ever, the BofA data showed.

Looking to the day ahead, data releases include the UK GfK consumer confidence for March whilst in France there’s the manufacturing confidence for March and retail sales for February. Additionally, Eurozone consumer confidence for March and Italy’s current account balance for January will also be published. Outside of the Eurozone, we have Canada retail sales for January. Otherwise from central banks, we’ll hear from the Fed’s Williams and the ECB’s Escriva.

Market Snapshot

- S&P 500 futures down 0.4% to 5,638.25

- STOXX Europe 600 down 0.9% to 548.14

- MXAP down 0.5% to 188.95

- MXAPJ down 0.8% to 588.93

- Nikkei down 0.2% to 37,677.06

- Topix up 0.3% to 2,804.16

- Hang Seng Index down 2.2% to 23,689.72

- Shanghai Composite down 1.3% to 3,364.83

- Sensex up 0.6% to 76,786.38

- Australia S&P/ASX 200 up 0.2% to 7,931.23

- Kospi up 0.2% to 2,643.13

- German 10Y yield little changed at 2.76%

- Euro down 0.2% to $1.0825

- Brent Futures up 0.2% to $72.14/bbl

- Gold spot down 0.4% to $3,031.74

- US Dollar Index up 0.21% to 104.07

Top Overnight News

- Britain’s Heathrow Airport was shut on Friday after a huge fire at a nearby substation knocked out its power, stranding passengers around the world and angering airlines who questioned how such crucial infrastructure could collapse

- Germany’s new era of big spending is pulling up borrowing costs across Europe, reigniting jitters around fiscal stability on the continent’s periphery.

- Trump posted “Egg prices are WAY DOWN from the Biden inspired prices if just a few weeks ago. “Groceries” and Gasoline are down, also. Now, if the Fed would do the right thing and lower interest rates, that would be great!!!”

- Trump posted “Unlawful Nationwide Injunctions by Radical Left Judges could very well lead to the destruction of our Country!… STOP NATIONWIDE INJUNCTIONS NOW, BEFORE IT IS TOO LATE”.

- Trump and Defense Secretary Hegseth are to deliver remarks from the Oval Office today at 11:00EDT/15:00GMT, according to the White House.

- President Trump denied a report that the Pentagon was going to brief Elon Musk about the US military’s plan for any war with China.

- Elon Musk sought to reassure Tesla Inc. employees during what he referred to as “a little bit of stormy weather,” after the carmaker’s shares plunged more than 50% in just three months.

- White House has commenced a review of Federal Agency plans for a 2nd round of mass layoffs: RTRS

- The Israeli cabinet voted early on Friday to dismiss the head of the Shin Bet domestic intelligence service effective April 10, Prime Minister Benjamin Netanyahu’s office said, after three days of protests against the move.

- Chancellor of the Exchequer Rachel Reeves is set to overshoot her borrowing forecasts significantly for the current fiscal year, highlighting the fragile state of the UK’s public finances ahead of a key economic statement next week.

- Germany’s move to unlock hundreds of billions of euros in debt-financed defense and infrastructure spending passed its final legislative hurdle on Friday when lawmakers in the upper house of parliament in Berlin approved the measures.

- The financial industry is abandoning caution and chasing the rally in European stocks, hiking their targets and looking to the upside.

- President Xi Jinping’s government is set to welcome a US senator close to Donald Trump for talks in China, as the world’s largest economies try to move forward trade negotiations that have stalled at lower levels.

- China’s imports of US cotton, cars and some energy products all plunged in the first two months of the year after President Donald Trump started imposing tariffs and Beijing retaliated. In a prelude to what could be widespread disruption to global trade, Chinese purchases of cotton fell almost 80% from a year earlier, according to Bloomberg analysis of data released Thursday. Imports of large-engined cars were down nearly 70%, while purchases of crude oil and liquefied natural gas dropped more than 40%.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks ultimately traded mixed following the choppy performance stateside in the aftermath of the Super Thursday deluge of central bank announcements and ahead of quad witching. ASX 200 was just about kept afloat by notable outperformance in Consumer Staples as shares of Coles and Woolworths rallied after a report by the competition regulator which noted the supermarket retailers along with discount rival Aldi, were among the most profitable supermarket businesses in the world. Nikkei 225 initially traded higher on favourable currency moves but then reversed course after hitting resistance ahead of the 38,000 level and as the mostly firmer-than-expected Japanese inflation data supported the case for the BoJ to continue policy normalisation in the future. Hang Seng and Shanghai Comp were pressured despite the lack of fresh catalysts and as earnings results trickled in, while trade uncertainty continued to cloud over risk sentiment and NYT recently reported that Elon Musk is set to get access to a top-secret US plan for a potential war with China although President Trump later refuted this.

Top Asian News

- Elon Musk was initially reported to get access to a top-secret US plan for a potential war with China, according to the New York Times. However, President Trump later refuted the report which he said was fake news.

- Japan’s Rengo says second round data shows avg. wage hike of 5.4% for Fiscal 2025 vs 5.46% in the first-round data.

- Meituan (3690 HK) FY24 (CNH) Net Income 35.8bln (exp. 37.8bln), Revenue 337.6bln (exp. 337bln); Q4: Adj. Net Income 9.85bln (exp. 9.91bln), Revenue 88.5bln (exp. 87.9bln).

- Nio Inc (NIO) Q4 (CNY): EPS -3.17 (exp. -2.4) Revenue 19.7bln (exp. 20.07bln); sees Q1 total revenue 12.367-12.859bln

Top European News

- London’s Heathrow Airport said it is experiencing a significant power outage due to a fire at an electrical substation supplying the airport and will be closed until 23:59 GMT today, while it stated significant disruption is expected over the coming days and passengers should not travel to the airport under any circumstances until it reopens.

- Denmark is reportedly open to joint European projects and funding if required, via FT citing sources

- UK says it is pausing the publication of Service Producer Price Index and Producer Price Index; planning to recommence publication in the summer and will keep users informed of progress; CPI unaffected.

- German Bundesrat has passed the debt reform bill and EUR 500bln fund, according to the vote tally cited by Reuters

FX

- USD is slightly firmer and trading within a 103.74-104.15 range in what has been a quiet session thus far – the US data docket remains light for the remainder of the. Focus however, will be on Fed speak from Williams, Waller and Goolsbee; the former will see the release of an accompanying text release and a Q&A thereafter. Elsewhere, US President Trump is to speak with Hegseth at 15:00GMT.

- EUR is a little lower and trades towards the bottom end of a 1.0820-35 range, continuing the losses seen this week. Aside from EZ Consumer Confidence, the docket remains light with no ECB speakers scheduled – though some focus will be on DBRS, who will review France’s credit rating today.

- USD/JPY has edged higher and reclaimed the 149.00 handle despite the cautiousness in the region and with the pair also unfazed by the mostly firmer-than-expected Japanese inflation data.

- GBP is on the backfoot vs. the USD in an extension of yesterday’s downside. Despite yesterday’s mildly hawkish skew to the BoE announcement in which external member Mann reverted back to the unchanged camp, the pound has fallen victim to the broadly firmer USD. This morning’s public sector net borrowing data showed a further deterioration in the nation’s finances.

- Antipodeans are both struggling for direction after recent losses and with price action contained amid a quiet calendar and the mixed risk sentiment.

Fixed Income

- USTs are slightly firmer, in-fitting with action in Bunds as the risk tone remains under pressure this morning. US specifics a little light thus far though the docket ahead is packed. Firstly, POTUS is due to give remarks from the Oval Office at 15:00GMT alongside his Defence Secretary. Given Hegseth’s inclusion the remarks may be focussed on Iran, with rhetoric from the Supreme Leader this morning punchy. As it stands, USTs are at the upper-end of a 111-00 to 111-09 band, with yields softer across the curve which itself is incrementally steeper.

- Bunds are firmer and at the top-end of a 128.15-128.58 band. Strength this morning comes from the downbeat risk tone which broadly speaking appears to be a continuation of the recent narrative of taking risk off the table into the April 2nd tariff announcement. German Bundesrat has passed the debt reform bill and EUR 500bln fund, as expected.

- Gilts gapped higher by a handful of ticks given the lead from EGBs but then succumbed to the morning’s borrowing data and slumped to a 91.73 trough. However, as the risk tone deteriorated, the benchmark lifted off worst and briefly got back to within reach of the 92.00 mark in a 91.73-92.12 band; though, ultimately, Gilts remain under notable pressure. PSNB showed a larger-than-expected borrowing figure alongside a downward revision to the prior which has taken borrowing for the 11-months of the current FY to the GBP 132bln mark, exceeding the GBP 127.5bln forecast by the OBR for the entire FY period.

Commodities

- Crude is incrementally lower, after spending the majority of the European morning around the unchanged mark; WTI’May now trades towards the lower end of a USD 67.80-68.65/bbl range. Energy-specific newsflow has been light today, whilst punchy rhetoric from Iran’s Supreme Leader Khamenei failed to lift prices.

- Natural gas prices have been boosted today after Kyiv Post reported “Putin’s forces shelled the Sudzha gas metering station in Russia’s Kursk region with artillery in order to blame Ukraine — the General Staff of the Ukrainian Armed Forces”. In response to this attack, Russia’s Kremlin said Ukrainian President Zelensky cannot be trusted.

- Precious metals are on the backfoot, with spot gold pulling back from best levels in overnight trade; into the European session, price action has been fairly contained and currently sits towards the mid-point of a USD 3,021.73-3,047.51/oz range.

- Base metals are entirely in the red given the downbeat risk tone and poor Chinese performance overnight. 3M LME Copper currently trades towards the lower end of a USD 9,842.2-10,001.8/t.

- China is to add cobalt and copper to its state metal reserves.

Geopolitics: Middle East

- Hamas says it is still studying the US proposal and the other proposed ideas in order to reach a deal that ensures hostage releases, the end of the war, and Israeli withdrawal.

- Iran’s Supreme Leader Khamenei says the “US need to know if they mess around with Iran, it will receive a hard slap”; “has no proxies in the region, those groups act independently”.

- Israel’s cabinet voted to fire the head of Shin Bet Ronen Bar, according to AP.

- US National Security Adviser Waltz said Israel has every right to defend its people from Hamas terrorists and the ceasefire would have been extended if Hamas released all remaining hostages, but they chose war instead.

Geopolitics: Ukraine

- Russia’s Kremlin says Russian President Putin’s order not to strike Ukrainian energy infrastructure remains in force; attack on Russian Gas transit station in Sudzha shows Ukrainian President Zelensky cannot be trusted.

- Kyiv Post reports “Putin’s forces shelled the Sudzha gas metering station in Russia’s Kursk region with artillery in order to blame Ukraine — the General Staff of the Ukrainian Armed Forces”.

- Explosions were reported in the sky of Ukraine’s capital and air defences were working to counter a large-scale attack with drones, while it was also reported that Russian drones hit civilian targets in Odesa on Thursday night.

- US reportedly seeks to reopen terms of a Ukraine minerals deal, according to FT.

- Germany, Italy, Poland, UK, and Canada leaders are to meet in Paris next week to discuss Ukraine, while French President Macron said the European meeting next week is to discuss ways to accelerate immediate military support for Ukraine and will discuss plans to strengthen the Ukrainian army if an agreement is reached with Russia.

- EU’s Costa said he believes EU member states will increase pledges of support to Ukraine.

- Russia’s presidential security adviser Shoigu arrived in North Korea and is to meet with North Korea’s leader.

- Russian Investigative Committee opens a case over explosion at Sudzha gas metering station in Russia’s Kursk region organised by Ukraine; station significantly damaged in a blast.

US Event Calendar

- Nothing scheduled

DB’s Jim Reid concludes the overnight wrap

As London basks in temperatures warmer than Ibiza, a renewed focus on trade fears derailed a recovery in risk assets yesterday, with the S&P 500 closing -0.22% lower last night, though it’s still up +2.56% from last Thursday’s close, having so far only spent that one day in -10% correction territory. Yesterday was also the first day in a while where European stocks bore the brunt of the negativity with the FTSE-MIB (-1.32%) and the DAX (-1.24%) leading the declines. The Stoxx 600 (-0.43%) was helped by exposure to UK stocks with the FTSE (-0.05%) outperforming even after a slightly hawkish hold from the BoE (more later).

European markets had seen a sharp slide lower just before 9am GMT yesterday with no real explanation but by mid-morning they had stabilised and range traded into the close. There was no associated story but there was a lot of chatter about Mr Trump’s social media post from the early hours of the London morning that suggested the Fed should be cutting rates as “…. US Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”. In an era of analysing every nuance of every post, the clear suggestion was that this implied that tariffs would cause some economic pain ahead. And while markets recovered during the US morning session, they then turned lower again with the S&P falling from +0.63% at the peak to close down -0.22%. So a modest but fairly broad-based decline, with 65% of the S&P lower on the day and the equal-weighted version of the index down -0.37%.

Bonds also had a topsy-turvy session, with 10yr Treasuries yields a mere -0.5bps to 4.24% by the close after having traded as low as 4.17% amid the earlier risk-off tone. The reversal of the bond rally was helped by a decent batch of US data. Existing home sales saw an unexpected acceleration in February (4.26m vs 3.95m expected and 4.08m previous), although there may be some residual seasonality in the data as sales have seen large February spikes for the past three years. Meanwhile, the latest initial jobless claims (223k vs 224k expected) painted a steady picture of the US labour market.

Looking forward to today, the vote on the debt brake reform in the Bundesrat starts at 9.30am CET this morning with news at the start of the week that Bavaria will support the bill meaning that its safe passage probability is even higher than it was in the Bundestag where it passed comfortably on Tuesday. Assuming it passes, it is theoretically possible that the AfD and the Left could seek an abstract judicial review at the Federal Constitutional Court as soon as the new Bundestag is constituted, which sits for the first time next Tuesday, but the Left have said they won’t file a complaint alongside the AfD. The potential legal challenges have steadily fallen away over the last couple of weeks and the story will likely move onto coalition talks next week with the expectations that this will be completed before the end of March and Friedrich Merz to be sworn in as chancellor shortly after Easter.

As for the BoE, our economist Sanjay Raja, believes the on-hold decision (at 4.5%) was on the hawkish side with the MPC’s vote tally and messaging highlighting growing concern around the disinflation progress in the midst of weaker demand. The biggest surprise was that only one member voted for a cut with 8 voting for unchanged. We thought there would be 2 doves. Sanjay still thinks there’ll be four 25bps cuts this year but his conviction levels have fallen. The risk is now that they could pause between May and November when CPI is expected to push up against 4% YoY. Ultimately, Sanjay thinks that beyond that the labour market will cool, pay settlements fall, tariffs will bite, and a terminal rate of 3.25% will be hit. See his report here. The hawkish lean left the probability of a cut in May at 64% down from 72% at the prior close. 10yr Gilts slightly underperformed, climbing +1.0bps with 2yr yields +3.5bps in contrast with German and French 2yr yields which were -2.3bps and -2.5bps lower, respectively.

Elsewhere in Europe, the SNB cut rates by 25bps as expected to 0.25%, their lowest since September 2022, but signalled that it doesn’t anticipate further easing as things stand. And in Sweden, the Riksbank kept rates on hold at 2.25% and also reiterated that it expects stable rates ahead. In other central bank news, Bank of Canada Governor Macklem said that the hotter inflation print the previous day “got our attention”.

Sticking with Canada, the Globe and Mail reported that new Prime Minister Mark Carney is expected this weekend to call a snap election for late April. An election is due by October at the latest. The former Bank of England and Bank of Canada governor took over from Trudeau as the head of the Liberal party earlier this month, and while the Liberals had been more than 20pts behind the opposition Conservatives in opinion polls at the turn of the year, the latest polls now show them in a slight lead in a dramatic turnaround since Trudeau’s decision to step down and amid increased tensions with the US.

Turkish markets remained in the headlines yesterday as Türkiye’s central bank raised its overnight lending rate by 2pp to 46% in a surprise meeting. The Turkish lira saw modest rebound (+0.25%) and has been trading in a narrow range close to 38 on the dollar, hinting at a concerted effort to stabilise the currency after its initially sharp sell-off on Wednesday.

In commodities, Brent crude oil prices (+2.13%) rose to their highest level since the end of February at $72.29/bbl after the US for the first time sanctioned a Chinese refinery for allegedly buying Iranian oil, raising the prospect of stricter US sanctions enforcement against Iran. Meanwhile, copper (+0.03%) hovered within 1% of its record high from last May, after extending its YTD gains to +26% YTD on risks of US duties and stronger China data.

Asian equity markets are sharply lower in China but generally slightly higher elsewhere. The Hang Seng (-2.14%) is leading losses in the region followed by the CSI (-1.30%) and the Shanghai Composite (-1.06%). Elsewhere, the Nikkei (+0.17%) is trading slightly higher with the KOSPI (+0.06%) and the S&P/ASX 200 (+0.16%) also hanging on to gains. US stock futures are a fraction lower and 10yr US yields around a basis point higher.

Coming back to Japan, Japan’s core inflation came in at 3.0% y/y in February (v/s +2.9% expected) but lower than January’s figure of 3.2%. At the same time, headline inflation rose +3.7% y/y in February (v/s +3.5% expected) easing from a two-year high of+ 4.0% seen last month, thus staying above the BOJ’s 2% target for 35 straight months. The “core-core” inflation rate climbed to +2.6% y/y from +2.5% in the month before and maybe a touch above expectations especially as the print nearly rounded up to 2.7%. Following the data release, yields on the 10yr JGBs are +1.3bps higher trading at 1.52%. See our economist’s take on the inflation release here.

Now to the day ahead, the Bundesrat is voting today on the huge fiscal package ahead of the new Bundestag session starting next Tuesday. Data releases include the UK GfK consumer confidence for March whilst in France there’s the manufacturing confidence for March and retail sales for February. Additionally, Eurozone consumer confidence for March and Italy’s current account balance for January will also be published. Outside of the Eurozone, we have Canada retail sales for January. Otherwise from central banks, we’ll hear from the Fed’s Williams and the ECB’s Escriva.

Loading…