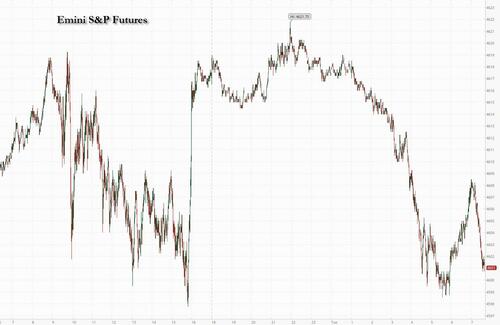

S&P futures are are weaker to start the new month with bond yields flat and Bloomberg Dollar Spot Index climbed to session highs, dragging down all Group-of-10 currencies, as the rally that sent the S&P 500 to a 16-month high in July lost momentum after a flurry of companies reported disappointing earnings. Commodities are mixed as China's Caixin PMI-Mfg prints 49.2, down from 50.5 and missing the est. 50.1.

As of 7:40am, S&P futures traded down 0.3% to 4,600 as the bizarre last minute spike in the S&P yesterday melted away, while Nasdaq 100 futures traded down 0.4%. Europe's Estoxx 50 drops almost 1% with Asian stocks also lower. The US Dollar was boosted by weak Chinese data as well as the surprise RBA decision to leave rates unchanged. Treasury yields were little changed, while UK and Europe bond markets are similarly listless. Gold and oil fell, while Bitcoin slid nearly 1% and headed for a third straight day of losses. WTI futures fall less than 0.5%. A quick look at seasonals: August/Sept are typically the weakest 2 months of the year, so we may see increasing calls for a pullback, before resuming the squeeze higher. Keep an eye on oil, bond yields, and vol as we await macro data, Jackson Hole, and the Sept Fed meeting. Today’s macro data focus includes ISM-Mfg, JOLTS, Construction Spending, and Regional Fed data.

In premarket trading, major technology and internet stocks are edging lower in premarket trading with Advanced Micro Devices, Electronic Arts and Pinterest all set to report after the close. Arista Networks shares rose as much as 18%, after the communications equipment company reported second-quarter results that beat expectations and gave a revenue forecast that is above the consensus analyst estimate. Analysts note that the company’s earnings are boosted by its diversified revenue streams. CVS Health rose as much as 1.5% after the Wall Street Journal reported that the pharmacy chain operator said it would cut about 5,000 jobs to help reduce costs. Here are some other notable premarket movers:

- Emergent BioSolutions shares soared as much as 12% after the maker of medical countermeasures was awarded a 10-year US government contract valued at up to $704 million.

- Rambus shares slide 8.2% as Jefferies notes that the semiconductor device company expects headwinds for DDR4 buffer chipset inventory to continue for the rest of the year.

- ZoomInfo Technologies shares fall as much as 20%, after the infrastructure software company cut its full-year revenue forecast. Analysts note continued weakness in software spending, though they remain optimistic about the company’s long-term prospects. Deutsche Bank downgraded its rating on the stock saying there’s a “persistent lack of visibility.”

While futures suggest a weaker open on Wall Street later, the buoyant mood of the past months has prompted a retreat among bears as market returns and economic data continue to challenge expectations. The S&P 500 on Tuesday received its most bullish outlook from Oppenheimer Asset Management, which raised its year-end S&P price target to 4,900 and predicts further strength in stocks as the Federal Reserve nears a pivot and the US economy stays resilient.

As BBG notes, with the S&P 500 now less than 5% away from an all-time high, there are signs that investors are taking a pause before a Bank of England interest rates decision on Thursday and US employment figures Friday. The line-up of blockbuster earnings still to come this week includes tech heavyweights Apple and Amazon.com Inc.

“When we look forward from here, we feel that the drivers for the rally may become a little bit more mixed,” said Karim Chedid, head of EMEA iShares investment strategy at BlackRock International. “We still don’t feel that the trough in earnings has come yet. Whilst the macro picture has been stronger than expected, there is no doubt that the tightening from central bank policy is starting to come through.”

Meanwhile, China's economic weakness reminded markets it isn't going away any time soon: Chinese new home sales plunged by the most in a year last month, underscoring why policymakers need to address faltering demand and a liquidity crunch in the sector. Caixin PMI figures showed factory activity contracted in July, missing economists’ estimates for a small expansion.

In Europe, the Stoxx 600 is down 0.5% with auto shares leading declines as BMW dropped more than 6% after warning about higher costs for developing electric cars, while logistics giant DHL Group gave a profit guidance that missed analyst estimates. The results highlight growing concern about the durability of corporate earnings and questions about whether stocks can keep rallying after notching big gains in July. In other individual stock moves, HSBC Holdings Plc provided one of the bright spots in Tuesday’s company results, rising after the bank announced a new share repurchase program and earnings that outpaced estimates. Energy names outperform as BP rallies after raising its dividend despite disappointing profit. Here are the most notable European movers:

- HSBC gains as much as 3% in London after the banking giant delivered a strong beat on revenue in the second quarter and a buyback near the high end of analyst expectations

- BP shares rise as much as 2.5%, reversing initial losses, after the energy company’s dividend hike and buyback announcement eclipsed what analysts said was a drab set of results

- Diageo rises as much as 3.3% as the UK alcoholic beverages group offered reassurance over its key US market, offsetting lackluster yearly sales and operating profits

- Weir Group gains as much as 6.6%, the steepest advance since March 1, after first-half results beat estimates on most metrics

- Redcare Pharmacy jumps as much as 13%, the most since January, after the German online pharmacy formerly known as Shop Apotheke presented strong 1H earnings that confirmed the company’s solid market-share gains, analysts say

- Galapagos NV rises as much as 4.6% after being raised to accumulate at KBC, which says it has conviction in the biotechnology company’s experienced management and point-of-care model for CAR-T cell therapy

- BMW shares slide as much as 5.9% after the carmaker gave cautious comments on a potential second-half headwind, while also raising guidance for 2023

- DHL Group shares fall as much as 4.8% in Frankfurt after the logistics firm’s improved FY23 earnings guidance came short of market expectations, even as the company posted a 2Q beat, Citi writes

- Daimler Truck falls as much as 3.4% after reporting second-quarter earnings. Morgan Stanley notes a measure of free cash flow missed consensus

- Nexi shares fall as much as 5.9% after the payment firm reported slowing consumption volume growth across key markets amid concerns that a recession could weigh on consumer spending

- Man Group shares drop as much as 7.9%, the most in more than 10 months, after the world’s largest publicly traded hedge fund firm reported 2Q results which reflected a lower-margin long-only focus from clients

- Greggs shares fell as much as 7.9% after the sandwich- and-bakery products retailer kept its 2023 outlook unchanged and posted 1H results that weren’t strong enough to push the rally higher

Earlier in the session, Asian stock benchmarks were steady in the first day of August trading, as investors snapped up some bigger tech shares but Chinese equities took a breather after recent gains. The MSCI Asia Pacific Index was little changed after six-straight days of gains. Samsung, Alibaba and TSMC were among the biggest boosts. Korea’s Kospi rose, poised to reach a fresh year-to-date high, and Australian stocks gained ahead of the central bank’s policy decision due later Tuesday. Benchmarks in Indonesia, Malaysia and Singapore fell. Key gauges in Hong Kong and mainland China failed to extend Monday’s gains after their best week in months. Investors await further stimulus measures after the latest Politburo meeting as the world’s second-largest economy continues to struggle.

China investors “are still waiting to see some meaningful comeback in high frequency indicators,” Alec Jin, investment director of Asian equities at abrdn, wrote in a note. “We would expect targeted measures that can boost consumer income and demand in sectors like autos, electronics and household products,” as well as more support for the property sector, he added. The MSCI Asia gauge is coming off its best month since January, flirting with its highest close since April 2022. It rose 4.6% in July amid improved sentiment on China, an AI-driven rally in chip stocks and expectations of a soft landing in the US.

Japan's Nikkei 225 was underpinned by a weaker currency and with headlines in Japan dominated by earnings releases, while a recent poll by Bloomberg also showed that BoJ watchers don’t expect a further policy shift from the central bank this year with April 2024 now seen as the likely timing for a policy change. Australia's ASX 200 traded positive amid strength in tech and the commodity-related sectors with further upside after the RBA kept rates unchanged.

In FX, the Bloomberg dollar index climbed by about 0.3% to a three-week high before the release of US economic data including ISM manufacturing and JOLTS job openings. The Aussie is the weakest of the G-10 currencies after the RBA left rates on hold for a second straight meeting, falling 1.2% versus the greenback. Relief rallies in the Aussie were limited as leveraged funds maintained short positions in expectation of further selling following the RBA decision, traders said. The rate-sensitive three-year government bond yield slumped as investors speculated the central bank may be close to wrapping up its tightening campaign. The yen traded weaker against the dollar, adding to Monday’s decline, amid sluggish demand at a 10-year bond auction. While investors had earlier anticipated that the Bank of Japan is moving toward letting yields rise after a tweak to its yield-curve control policy, it bought bonds on Monday to anchor rates.

In rates, treasuries were slightly cheaper from the belly to long end of the curve, unwinding gains seen in Asia session after the RBA left policy rates steady while keeping the door ajar to future hikes. US 10-year yield sit around 3.98%, cheaper on the day; yields across the curve are within one basis point of Monday’s close. 10-year gilts lag Treasuries by around 1bp while bunds trade broadly in line. Bunds and gilts are both in the red with German and UK 10-year yields rising by 1bps and 2bps respectively. Traders’ focus during the US session will be on activity data including PMI and ISM manufacturing gauges, as well as JOLTS job openings.

In commodities, crude futures decline with WTI falling 0.5%. Spot gold drops 0.4%

Looking to the day ahead, we have a data heavy day. From the US, we have the July ISM index, the Dallas Fed services activity and the June JOLTS report, as well as total vehicle sales and construction spending. In Europe, we have the Eurozone unemployment rate for June, as well as the Italian July PMI, the new car registrations, budget balance and June unemployment rate. From Germany, we have the July unemployment rate, and finally the Canadian PMI for July. We also have several key earnings releases, including Pfizer, AMD, Caterpillar, Starbucks, Uber, Altria, Marriott, Pioneer Natural Resources, Electronic Arts, Devon Energy and Pinterest.

Market Snapshot

- S&P 500 futures down 0.3% to 4,602.00

- MXAP down 0.2% to 170.47

- MXAPJ down 0.3% to 539.82

- Nikkei up 0.9% to 33,476.58

- Topix up 0.6% to 2,337.36

- Hang Seng Index down 0.3% to 20,011.12

- Shanghai Composite little changed at 3,290.95

- Sensex little changed at 66,477.12

- Australia S&P/ASX 200 up 0.5% to 7,450.71

- Kospi up 1.3% to 2,667.07

- STOXX Europe 600 down 0.5% to 469.13

- German 10Y yield little changed at 2.51%

- Euro down 0.2% to $1.0974

- Brent Futures down 0.5% to $85.04/bbl

- Gold spot down 0.5% to $1,955.71

- U.S. Dollar Index up 0.30% to 102.17

Top Overnight News

- Australia’s RBA leaves rates unchanged, signaling further that it is done hiking (markets were mostly looking for unchanged, although economists were more split, with some calling for a 25bp hike). RTRS

- China’s Caixin manufacturing PMI for Jul came in at 49.2, missing the Street’s 50.1 forecast and falling from 50.5 in June. RTRS

- Foreign investors are returning to China's stock market en masse, signaling a bullish shift in sentiment after months of skepticism. Overseas funds added a net 49 billion yuan ($6.9 billion) worth of mainland stocks via trading links with Hong Kong in the past five sessions, encouraged by the new pro-growth policies. The buying spree has taken the year-to-date net purchase to a new high of 230 billion yuan. BBG

- The eurozone unemployment rate has fallen to a record low, indicating that the single currency bloc’s labor market remains healthy despite concerns about weak growth. Eurostat, the EU’s statistical agency, said on Tuesday the June unemployment rate was 6.4 per cent — an all-time low in the eurozone — as it also revised down the rate in the previous two months from 6.5 percent to 6.4 percent. FT

- Trump’s lead within the GOP primary seems increasingly insurmountable. Trump and Biden are tied at 43% in a new poll looking at a 2024 rematch. NYT

- Top active fund managers say they are struggling to attract money from large investors who are holding back in the face of volatile markets and cash accounts offering the best yields in years. Institutional investors such as pension funds, endowments, and foundations control billions in capital and are responsible for the majority of allocations to the biggest asset managers. Cash sitting in US institutional money market accounts now totals almost $3.5tn, according to the Investment Company Institute, a sum that has climbed steadily this year even as stock markets gather strength. FT

- BMW shares slide in Europe despite boosting guidance for 2023 as Q2 auto EBIT margins missed and investors focus on this line from the release (“expects higher expenses for suppliers due to inflation and the supply chain to continue to be a headwind in the second half of the year”). RTRS

- BP hiked its dividend by 10%, well above guidance, and announced another $1.5 billion buyback. The surprise payout eclipsed a big profit miss and weakness in oil trading. CEO Bernard Looney sees a strong outlook for oil prices and demand growth on top of "huge demand" for green electricity. BBG

- AMZN aims to double its same-day delivery facilities in the “coming years” as it works to extend its e-commerce advantage, although investors question all this spending amid paltry margins in the retail business. Fortune

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly higher following the positive lead from Wall St where the S&P 500 notched its 5th consecutive monthly gain, while participants also digested disappointing Chinese Caixin Manufacturing PMI data and the RBA rate decision. ASX 200 traded positive amid strength in tech and the commodity-related sectors with further upside after the RBA kept rates unchanged. Nikkei 225 was underpinned by a weaker currency and with headlines in Japan dominated by earnings releases, while a recent poll by Bloomberg also showed that BoJ watchers don’t expect a further policy shift from the central bank this year with April 2024 now seen as the likely timing for a policy change. Hang Seng and Shanghai Comp managed to shrug off the disappointing Chinese Caixin Manufacturing PMI data which slipped into contraction territory for the first time in 3 months with Hong Kong boosted by tech strength and the mainland kept afloat by further support efforts from China.

Top Asian News

- China's NDRC issued a notice to promote private economy development in China and said it will extend loan support tools for small and micro firms until the end of 2024.

- RBA maintained its Cash Rate Target unchanged at 4.10% (vs split views between 25bps hike and unchanged) and noted that some further tightening of monetary policy may be required. RBA reiterated that the Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that, while it also reaffirmed a priority to return inflation to target within a reasonable timeframe and expects inflation will be back at 2-3% target range in late 2025.

European bourses are in the red, Euro Stoxx 50 -1.0%; as sentiment has deteriorated gradually since the European cash open and was impacted further by the morning's Final PMIs. Sectors are similarly negative, with Autos lagging amid marked losses in BMW despite a guidance update as associated H2 commentary flagged headwinds. Basic Resource names are similarly dented post-Fresnillo. To the upside, Energy is the only sector in the green bolstered by Q2 earnings from BP who announced a buyback and increased their dividend while Banks derive support from HSBC. Stateside, futures are modestly softer and have been drifting in-line with European peers throughout the morning but with magnitudes more contained ahead of key data points; ES -0.3%.

Top European News

- Germany's VDMA says German engineering orders in June -15% Y/Y (domestic -18%; Foreign -14%).

- German Economy Ministry says the European Commission has made important progress on subsidies for hydrogen power plant talks, but no approval yet.

FX

- A session of firm gains thus far for the Dollar amid the broader risk aversion across the market coupled with continued weakness in the JPY against major peers.

- Antipodeans remain the marked laggards amid a combination of subdued risk and RBA opting to pause.

- Traditional havens are also on the back foot against the Dollar but to a lesser extent vs the non-US dollar counterparts. JPY continues to feel headwinds following the BoJ policy decision and subsequent off-schedule bond purchases conducted yesterday.

- EUR and GBP are subdued against the Dollar with little initial reaction seen to the final release of the S&P Manufacturing PMIs, which underscored increasing risks of recession, although prices have been moving favourably amid sharply deteriorating demand.

- PBoC set USD/CNY mid-point at 7.1283 vs exp. 7.1495 (prev. 7.1305)

Fixed Income

- EGBs slip while USTs are mixed/tentative with drivers limited overall ahead of a busy PM agenda; EGBs are under bearish pressure despite deteriorating risk sentiment and welcome EZ PMI commentary re. inflation.

- Bunds at the lower-end of 132.64-133.06 parameters with attention still on Friday's 131.81 low, specific catalysts remain light aside from the referenced PMI commentary.

- USTs are more mixed with the short-end bid and the long-end soft though magnitudes are relatively minimal and from a yield perspective it is only resulting in very modest curve flattening

Commodities

- WTI and Brent front-month futures are modestly softer intraday as the Dollar remains firm and risk sentiment tilts lower.

- Spot gold is pressured by the firmer Dollar awaiting the US ISM and JOLTS data, with the yellow metal sandwiched between its 100 and 21 DMAs at USD 1,968.25/oz and USD 1,950.60/oz respectively.

- Base metals are on the back foot amid the broader risk aversion, stronger Greenback, and the surprise contraction in the Caixin Manufacturing PMI.

Geopolitics

- White House's Kirby said the US is not encouraging attacks inside Russia and that the decision is for Ukraine to make, according to a CNN interview.

- A drone hit a high-rise building in Moscow and a second drone was downed in Moscow's suburbs, according to agencies quoting emergency services.

- China's Defence Ministry said it lodged solemn representations to the US side regarding US military arms sales to Taiwan and urges the US to stop all forms of military collusion with Taiwan, according to Reuters.

US Event Calendar

- July Wards Total Vehicle Sales, est. 15.7m, prior 15.7m

- 09:45: July S&P Global US Manufacturing PM, est. 49.0, prior 49.0

- 10:00: June JOLTs Job Openings, est. 9.6m, prior 9.82m

- 10:00: July ISM Manufacturing, est. 46.9, prior 46.0

- 10:00: June Construction Spending MoM, est. 0.6%, prior 0.9%

- 10:30: July Dallas Fed Services Activity, prior -8.2

DB's Jim Reid concludes the overnight wrap

Welcome to August, the last month of an increasingly wet summer here in the UK. A bright spot yesterday was a tremendous climax to the Ashes where England levelled a barn-storming series 2-2 after 6 weeks of high drama, a diplomatic incident, interventions from both prime ministers, and a series where but for the weather England could have won 3-2 after being 2-0 down. This will mean nothing to 99% of global readers but it was nothing short of a sensational series.

Unlike with the Ashes, July ended quietly for markets but the month overall was largely positive for assets across the board. Commodities, and oil, stole the show, as supply cuts spurred upward pressure on prices, but the AI excitement saw both S&P 500 and the NASDAQ extend their rally, securing their fifth and fourth consecutive month of positive returns, respectively. However, fixed income took a hit in July, as central banks continued their hiking cycle and near-term cuts continue to be priced out. All-in-all, we had the strongest month in performance terms since January, with 32 of the 38 non-currency assets in our sample ending July in positive territory. In YTD terms, 36 out of 38 non-currency assets are now in the green. See the full review in your inboxes shortly.

Turning to yesterday, it was a relatively quiet day in markets with the main event the Federal Reserve’s senior loan officers' opinion survey (SLOOS) late in the US session. This continues to be one of the few data points to argue against a soft-landing narrative. The share of banks reporting tighter credit standards for commercial & industrial loans increased (from +46 to +51). The four times since the start of the SLOOS in 1990 (as we know it today) that have seen such tightening have all been associated with recessions. The decline in demand for C&I loans eased a touch (from -56 to -52) but remains very negative. Commercial real estate (CRE) remained a focal point of the tightening in credit conditions, as “banks reported tighter standards and weaker demand for all CRE loan categories”. There were some more encouraging details on the residential side, as the slowdown in demand for mortgages was the least severe since H1 2022. But in all, while activity and inflation data have been more encouraging of late, it would take an unusual decoupling of the US economy from the bank credit cycle to avoid a recession. Clearly the market is expecting such a "this time is different" narrative. Standby for the June US JOLTS data and ISM today for the next data instalment.

In markets, the SLOOS survey hardly moved the needle and the positive mood from Friday continued, albeit in a subdued session. The S&P 500 gained a modest +0.15% and 10yr US Treasury yields inched up by +0.9bps despite dovish commentary from the Chicago Fed’s Goolsbee. A known dove, Goolsbee emphasised that the most recent inflation prints were “fabulous news” and that the US was now on what he called the “golden path”. However, he was careful to note that the Fed still needed to “play by ear” and did not commit to a view on the September meeting, with the potential for cuts only arising when inflation recedes.

There was little change to market expectations following Goolsbee’s interview, with the probability of a Fed hike in September unchanged at 19%. An 18% chance of a further 25bps hike is priced in for November. Overall, the market is anticipating just over a third of another hike this Fed hiking cycle, and 115bps of rate cuts in total by December 2024.

Across the Atlantic, following the German and French CPI prints on Friday, eyes were on the release of the Euro area flash CPI data for July, with headline HICP as expected at 5.3%, easing from 5.5% in June. However, core inflation surprised to the upside at 5.5% (vs 5.4% expected) rising above the headline result for the first time since the start of 2021. Will it be enough to justify a pause on September 14th? There is still a fair amount of data before then but only one inflation print.

Within the same data package was the euro area economic growth for Q2, which overshot expectations to hit +0.3% quarter-on-quarter (vs +0.2% expected). However, markets did not lend much credence to the beat. When digging into the details, it’s apparent Ireland (+3.3% quarter-on-quarter) created a sizeable upward distortion, while French numbers (+0.5% quarter-on-quarter, expectations were for +0.1%) were also distorted, by the delivery of a cruise ship. In contrast, Germany recorded no growth (0% quarter-on-quarter), and Italy a contraction (-0.3% quarter-on-quarter)

With markets taking on board these prints, European overnight index swaps are now pricing 61% chance of an additional 25bps hike by the end of 2024, down from nearly 90% prior to last Thursday’s ECB meeting. Off the back of this, German fixed income fluctuated over the day, with the 10yr struggling for direction before eventually closing down -0.2bps, while the 2yr was down -1.3bp.

US equities continued their rally on Monday, albeit at a slower pace, with the S&P up +0.15% after a late rally, securing its fifth consecutive month of advances (+3.11% in price terms in July), the longest streak since August 2021. At the sectoral level, the energy sector outperformed on the day, up +2.00%, as WTI and Brent Crude rounded up their third consecutive day of gains, climbing +1.51% and +0.67%, respectively. On the oil side, the market will be watching whether Saudi Arabia announces an extension of its output cut in the coming days. Real estate (+0.70%) and financials (+0.44%) equity sectors followed energy’s lead. The NASDAQ also traded modestly up by +0.21%, whilst the FANG+ index of megacap stocks outperformed with a +0.43% gain. Price action in European equities also saw the same modest risk-on sentiment, as the STOXX 600 climbed +0.12%. The consumer staples sector particularly struggled on Monday after beverage firm Heineken (-7.97%) pared back its full-year guidance, whilst energy outperformed, climbing +1.32%.

As we go to print, the Reserve Bank of Australia (RBA) has just kept the official interest rate unchanged at 4.1% (the highest level since 2012), thus extending its pause for the second consecutive month to assess if further rate hikes are needed to tame inflation. Most economists expected a hike but it was a close call. 2yr yields are around -8bps lower after the decision.

Asian equity markets are mostly trading higher this morning. Across the region, The KOSPI (+1.22%) is leading gains with the Nikkei (+0.74%) and the Hang Seng (+0.23%) also trading in the green. However, mainland Chinese stocks are mixed with the CSI (-0.12%) losing ground and the Shanghai Composite (+0.10%) eking out minor gains. Meanwhile, S&P 500 (+0.08%) and NASDAQ 100 (+0.09%) futures are seeing marginal gains.

Early morning data showed that China’s private factory activity returned to contraction for the first time since April as the Caixin manufacturing PMI came in at 49.2 in July (v/s 50.5 in June) in contrast to market expectations of 50.1. The data comes a day after the official factory activity remained in negative territory for the fourth straight month. Elsewhere, Japan’s jobless rate unexpectedly dropped to 2.5% in June from 2.6% a month earlier amid the ongoing COVID-19 recovery. Meanwhile, the job availability ratio, fell 0.01 point from May to 1.30 (v/s 1.32 expected).

In FX, the Japanese yen fell to a fresh low of 142.80 against the dollar after the Bank of Japan (BOJ) yesterday conducted an unscheduled buying operation of JGBs to cap the surge in government bond yields after the central bank tweaked its YCC policy on Friday. A 10yr auction this morning was soft but yields are fairly stable overnight.

We had an update in the geopolitics arena on Monday, with Bloomberg reporting that Ukrainian President Zelensky is likely to head to the UN General Assembly in New York come September. It is anticipated that he intends to make the case for Ukraine’s “peace formula”, a blueprint for ending the conflict. Ukraine’s peace plan may also get discussed at a gathering in Saudi Arabia next weekend, with the planned meeting first reported by the Wall Street Journal on Saturday. While Russia’s withdrawal from the Black Sea grain deal, and accompanying escalation, gathered attention in July, diplomatic efforts could become an increasing topic in the coming weeks.

Finally on the data side, the MNI Chicago PMI for July slipped below expectations at 42.8 (vs 43.5 expected). This was an increase from June (41.5), but still speaks to continued contraction in factory sector activity. The Dallas Fed Manufacturing Activity surprised modestly to the upside at -20.0 (vs -22.5 expected), and the six month ahead new orders index ticked slightly higher.

Now to the day ahead, we have a data heavy day. From the US, we have the July ISM index, the Dallas Fed services activity and the June JOLTS report, as well as total vehicle sales and construction spending. In Europe, we have the Eurozone unemployment rate for June, as well as the Italian July PMI, the new car registrations, budget balance and June unemployment rate. From Germany, we have the July unemployment rate, and finally the Canadian PMI for July. We also have several key earnings releases, including Pfizer, AMD, Caterpillar, Starbucks, Uber, Altria, Marriott, Pioneer Natural Resources, Electronic Arts, Devon Energy and Pinterest.

S&P futures are are weaker to start the new month with bond yields flat and Bloomberg Dollar Spot Index climbed to session highs, dragging down all Group-of-10 currencies, as the rally that sent the S&P 500 to a 16-month high in July lost momentum after a flurry of companies reported disappointing earnings. Commodities are mixed as China’s Caixin PMI-Mfg prints 49.2, down from 50.5 and missing the est. 50.1.

As of 7:40am, S&P futures traded down 0.3% to 4,600 as the bizarre last minute spike in the S&P yesterday melted away, while Nasdaq 100 futures traded down 0.4%. Europe’s Estoxx 50 drops almost 1% with Asian stocks also lower. The US Dollar was boosted by weak Chinese data as well as the surprise RBA decision to leave rates unchanged. Treasury yields were little changed, while UK and Europe bond markets are similarly listless. Gold and oil fell, while Bitcoin slid nearly 1% and headed for a third straight day of losses. WTI futures fall less than 0.5%. A quick look at seasonals: August/Sept are typically the weakest 2 months of the year, so we may see increasing calls for a pullback, before resuming the squeeze higher. Keep an eye on oil, bond yields, and vol as we await macro data, Jackson Hole, and the Sept Fed meeting. Today’s macro data focus includes ISM-Mfg, JOLTS, Construction Spending, and Regional Fed data.

In premarket trading, major technology and internet stocks are edging lower in premarket trading with Advanced Micro Devices, Electronic Arts and Pinterest all set to report after the close. Arista Networks shares rose as much as 18%, after the communications equipment company reported second-quarter results that beat expectations and gave a revenue forecast that is above the consensus analyst estimate. Analysts note that the company’s earnings are boosted by its diversified revenue streams. CVS Health rose as much as 1.5% after the Wall Street Journal reported that the pharmacy chain operator said it would cut about 5,000 jobs to help reduce costs. Here are some other notable premarket movers:

- Emergent BioSolutions shares soared as much as 12% after the maker of medical countermeasures was awarded a 10-year US government contract valued at up to $704 million.

- Rambus shares slide 8.2% as Jefferies notes that the semiconductor device company expects headwinds for DDR4 buffer chipset inventory to continue for the rest of the year.

- ZoomInfo Technologies shares fall as much as 20%, after the infrastructure software company cut its full-year revenue forecast. Analysts note continued weakness in software spending, though they remain optimistic about the company’s long-term prospects. Deutsche Bank downgraded its rating on the stock saying there’s a “persistent lack of visibility.”

While futures suggest a weaker open on Wall Street later, the buoyant mood of the past months has prompted a retreat among bears as market returns and economic data continue to challenge expectations. The S&P 500 on Tuesday received its most bullish outlook from Oppenheimer Asset Management, which raised its year-end S&P price target to 4,900 and predicts further strength in stocks as the Federal Reserve nears a pivot and the US economy stays resilient.

As BBG notes, with the S&P 500 now less than 5% away from an all-time high, there are signs that investors are taking a pause before a Bank of England interest rates decision on Thursday and US employment figures Friday. The line-up of blockbuster earnings still to come this week includes tech heavyweights Apple and Amazon.com Inc.

“When we look forward from here, we feel that the drivers for the rally may become a little bit more mixed,” said Karim Chedid, head of EMEA iShares investment strategy at BlackRock International. “We still don’t feel that the trough in earnings has come yet. Whilst the macro picture has been stronger than expected, there is no doubt that the tightening from central bank policy is starting to come through.”

Meanwhile, China’s economic weakness reminded markets it isn’t going away any time soon: Chinese new home sales plunged by the most in a year last month, underscoring why policymakers need to address faltering demand and a liquidity crunch in the sector. Caixin PMI figures showed factory activity contracted in July, missing economists’ estimates for a small expansion.

In Europe, the Stoxx 600 is down 0.5% with auto shares leading declines as BMW dropped more than 6% after warning about higher costs for developing electric cars, while logistics giant DHL Group gave a profit guidance that missed analyst estimates. The results highlight growing concern about the durability of corporate earnings and questions about whether stocks can keep rallying after notching big gains in July. In other individual stock moves, HSBC Holdings Plc provided one of the bright spots in Tuesday’s company results, rising after the bank announced a new share repurchase program and earnings that outpaced estimates. Energy names outperform as BP rallies after raising its dividend despite disappointing profit. Here are the most notable European movers:

- HSBC gains as much as 3% in London after the banking giant delivered a strong beat on revenue in the second quarter and a buyback near the high end of analyst expectations

- BP shares rise as much as 2.5%, reversing initial losses, after the energy company’s dividend hike and buyback announcement eclipsed what analysts said was a drab set of results

- Diageo rises as much as 3.3% as the UK alcoholic beverages group offered reassurance over its key US market, offsetting lackluster yearly sales and operating profits

- Weir Group gains as much as 6.6%, the steepest advance since March 1, after first-half results beat estimates on most metrics

- Redcare Pharmacy jumps as much as 13%, the most since January, after the German online pharmacy formerly known as Shop Apotheke presented strong 1H earnings that confirmed the company’s solid market-share gains, analysts say

- Galapagos NV rises as much as 4.6% after being raised to accumulate at KBC, which says it has conviction in the biotechnology company’s experienced management and point-of-care model for CAR-T cell therapy

- BMW shares slide as much as 5.9% after the carmaker gave cautious comments on a potential second-half headwind, while also raising guidance for 2023

- DHL Group shares fall as much as 4.8% in Frankfurt after the logistics firm’s improved FY23 earnings guidance came short of market expectations, even as the company posted a 2Q beat, Citi writes

- Daimler Truck falls as much as 3.4% after reporting second-quarter earnings. Morgan Stanley notes a measure of free cash flow missed consensus

- Nexi shares fall as much as 5.9% after the payment firm reported slowing consumption volume growth across key markets amid concerns that a recession could weigh on consumer spending

- Man Group shares drop as much as 7.9%, the most in more than 10 months, after the world’s largest publicly traded hedge fund firm reported 2Q results which reflected a lower-margin long-only focus from clients

- Greggs shares fell as much as 7.9% after the sandwich- and-bakery products retailer kept its 2023 outlook unchanged and posted 1H results that weren’t strong enough to push the rally higher

Earlier in the session, Asian stock benchmarks were steady in the first day of August trading, as investors snapped up some bigger tech shares but Chinese equities took a breather after recent gains. The MSCI Asia Pacific Index was little changed after six-straight days of gains. Samsung, Alibaba and TSMC were among the biggest boosts. Korea’s Kospi rose, poised to reach a fresh year-to-date high, and Australian stocks gained ahead of the central bank’s policy decision due later Tuesday. Benchmarks in Indonesia, Malaysia and Singapore fell. Key gauges in Hong Kong and mainland China failed to extend Monday’s gains after their best week in months. Investors await further stimulus measures after the latest Politburo meeting as the world’s second-largest economy continues to struggle.

China investors “are still waiting to see some meaningful comeback in high frequency indicators,” Alec Jin, investment director of Asian equities at abrdn, wrote in a note. “We would expect targeted measures that can boost consumer income and demand in sectors like autos, electronics and household products,” as well as more support for the property sector, he added. The MSCI Asia gauge is coming off its best month since January, flirting with its highest close since April 2022. It rose 4.6% in July amid improved sentiment on China, an AI-driven rally in chip stocks and expectations of a soft landing in the US.

Japan’s Nikkei 225 was underpinned by a weaker currency and with headlines in Japan dominated by earnings releases, while a recent poll by Bloomberg also showed that BoJ watchers don’t expect a further policy shift from the central bank this year with April 2024 now seen as the likely timing for a policy change. Australia’s ASX 200 traded positive amid strength in tech and the commodity-related sectors with further upside after the RBA kept rates unchanged.

In FX, the Bloomberg dollar index climbed by about 0.3% to a three-week high before the release of US economic data including ISM manufacturing and JOLTS job openings. The Aussie is the weakest of the G-10 currencies after the RBA left rates on hold for a second straight meeting, falling 1.2% versus the greenback. Relief rallies in the Aussie were limited as leveraged funds maintained short positions in expectation of further selling following the RBA decision, traders said. The rate-sensitive three-year government bond yield slumped as investors speculated the central bank may be close to wrapping up its tightening campaign. The yen traded weaker against the dollar, adding to Monday’s decline, amid sluggish demand at a 10-year bond auction. While investors had earlier anticipated that the Bank of Japan is moving toward letting yields rise after a tweak to its yield-curve control policy, it bought bonds on Monday to anchor rates.

In rates, treasuries were slightly cheaper from the belly to long end of the curve, unwinding gains seen in Asia session after the RBA left policy rates steady while keeping the door ajar to future hikes. US 10-year yield sit around 3.98%, cheaper on the day; yields across the curve are within one basis point of Monday’s close. 10-year gilts lag Treasuries by around 1bp while bunds trade broadly in line. Bunds and gilts are both in the red with German and UK 10-year yields rising by 1bps and 2bps respectively. Traders’ focus during the US session will be on activity data including PMI and ISM manufacturing gauges, as well as JOLTS job openings.

In commodities, crude futures decline with WTI falling 0.5%. Spot gold drops 0.4%

Looking to the day ahead, we have a data heavy day. From the US, we have the July ISM index, the Dallas Fed services activity and the June JOLTS report, as well as total vehicle sales and construction spending. In Europe, we have the Eurozone unemployment rate for June, as well as the Italian July PMI, the new car registrations, budget balance and June unemployment rate. From Germany, we have the July unemployment rate, and finally the Canadian PMI for July. We also have several key earnings releases, including Pfizer, AMD, Caterpillar, Starbucks, Uber, Altria, Marriott, Pioneer Natural Resources, Electronic Arts, Devon Energy and Pinterest.

Market Snapshot

- S&P 500 futures down 0.3% to 4,602.00

- MXAP down 0.2% to 170.47

- MXAPJ down 0.3% to 539.82

- Nikkei up 0.9% to 33,476.58

- Topix up 0.6% to 2,337.36

- Hang Seng Index down 0.3% to 20,011.12

- Shanghai Composite little changed at 3,290.95

- Sensex little changed at 66,477.12

- Australia S&P/ASX 200 up 0.5% to 7,450.71

- Kospi up 1.3% to 2,667.07

- STOXX Europe 600 down 0.5% to 469.13

- German 10Y yield little changed at 2.51%

- Euro down 0.2% to $1.0974

- Brent Futures down 0.5% to $85.04/bbl

- Gold spot down 0.5% to $1,955.71

- U.S. Dollar Index up 0.30% to 102.17

Top Overnight News

- Australia’s RBA leaves rates unchanged, signaling further that it is done hiking (markets were mostly looking for unchanged, although economists were more split, with some calling for a 25bp hike). RTRS

- China’s Caixin manufacturing PMI for Jul came in at 49.2, missing the Street’s 50.1 forecast and falling from 50.5 in June. RTRS

- Foreign investors are returning to China’s stock market en masse, signaling a bullish shift in sentiment after months of skepticism. Overseas funds added a net 49 billion yuan ($6.9 billion) worth of mainland stocks via trading links with Hong Kong in the past five sessions, encouraged by the new pro-growth policies. The buying spree has taken the year-to-date net purchase to a new high of 230 billion yuan. BBG

- The eurozone unemployment rate has fallen to a record low, indicating that the single currency bloc’s labor market remains healthy despite concerns about weak growth. Eurostat, the EU’s statistical agency, said on Tuesday the June unemployment rate was 6.4 per cent — an all-time low in the eurozone — as it also revised down the rate in the previous two months from 6.5 percent to 6.4 percent. FT

- Trump’s lead within the GOP primary seems increasingly insurmountable. Trump and Biden are tied at 43% in a new poll looking at a 2024 rematch. NYT

- Top active fund managers say they are struggling to attract money from large investors who are holding back in the face of volatile markets and cash accounts offering the best yields in years. Institutional investors such as pension funds, endowments, and foundations control billions in capital and are responsible for the majority of allocations to the biggest asset managers. Cash sitting in US institutional money market accounts now totals almost $3.5tn, according to the Investment Company Institute, a sum that has climbed steadily this year even as stock markets gather strength. FT

- BMW shares slide in Europe despite boosting guidance for 2023 as Q2 auto EBIT margins missed and investors focus on this line from the release (“expects higher expenses for suppliers due to inflation and the supply chain to continue to be a headwind in the second half of the year”). RTRS

- BP hiked its dividend by 10%, well above guidance, and announced another $1.5 billion buyback. The surprise payout eclipsed a big profit miss and weakness in oil trading. CEO Bernard Looney sees a strong outlook for oil prices and demand growth on top of “huge demand” for green electricity. BBG

- AMZN aims to double its same-day delivery facilities in the “coming years” as it works to extend its e-commerce advantage, although investors question all this spending amid paltry margins in the retail business. Fortune

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly higher following the positive lead from Wall St where the S&P 500 notched its 5th consecutive monthly gain, while participants also digested disappointing Chinese Caixin Manufacturing PMI data and the RBA rate decision. ASX 200 traded positive amid strength in tech and the commodity-related sectors with further upside after the RBA kept rates unchanged. Nikkei 225 was underpinned by a weaker currency and with headlines in Japan dominated by earnings releases, while a recent poll by Bloomberg also showed that BoJ watchers don’t expect a further policy shift from the central bank this year with April 2024 now seen as the likely timing for a policy change. Hang Seng and Shanghai Comp managed to shrug off the disappointing Chinese Caixin Manufacturing PMI data which slipped into contraction territory for the first time in 3 months with Hong Kong boosted by tech strength and the mainland kept afloat by further support efforts from China.

Top Asian News

- China’s NDRC issued a notice to promote private economy development in China and said it will extend loan support tools for small and micro firms until the end of 2024.

- RBA maintained its Cash Rate Target unchanged at 4.10% (vs split views between 25bps hike and unchanged) and noted that some further tightening of monetary policy may be required. RBA reiterated that the Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that, while it also reaffirmed a priority to return inflation to target within a reasonable timeframe and expects inflation will be back at 2-3% target range in late 2025.

European bourses are in the red, Euro Stoxx 50 -1.0%; as sentiment has deteriorated gradually since the European cash open and was impacted further by the morning’s Final PMIs. Sectors are similarly negative, with Autos lagging amid marked losses in BMW despite a guidance update as associated H2 commentary flagged headwinds. Basic Resource names are similarly dented post-Fresnillo. To the upside, Energy is the only sector in the green bolstered by Q2 earnings from BP who announced a buyback and increased their dividend while Banks derive support from HSBC. Stateside, futures are modestly softer and have been drifting in-line with European peers throughout the morning but with magnitudes more contained ahead of key data points; ES -0.3%.

Top European News

- Germany’s VDMA says German engineering orders in June -15% Y/Y (domestic -18%; Foreign -14%).

- German Economy Ministry says the European Commission has made important progress on subsidies for hydrogen power plant talks, but no approval yet.

FX

- A session of firm gains thus far for the Dollar amid the broader risk aversion across the market coupled with continued weakness in the JPY against major peers.

- Antipodeans remain the marked laggards amid a combination of subdued risk and RBA opting to pause.

- Traditional havens are also on the back foot against the Dollar but to a lesser extent vs the non-US dollar counterparts. JPY continues to feel headwinds following the BoJ policy decision and subsequent off-schedule bond purchases conducted yesterday.

- EUR and GBP are subdued against the Dollar with little initial reaction seen to the final release of the S&P Manufacturing PMIs, which underscored increasing risks of recession, although prices have been moving favourably amid sharply deteriorating demand.

- PBoC set USD/CNY mid-point at 7.1283 vs exp. 7.1495 (prev. 7.1305)

Fixed Income

- EGBs slip while USTs are mixed/tentative with drivers limited overall ahead of a busy PM agenda; EGBs are under bearish pressure despite deteriorating risk sentiment and welcome EZ PMI commentary re. inflation.

- Bunds at the lower-end of 132.64-133.06 parameters with attention still on Friday’s 131.81 low, specific catalysts remain light aside from the referenced PMI commentary.

- USTs are more mixed with the short-end bid and the long-end soft though magnitudes are relatively minimal and from a yield perspective it is only resulting in very modest curve flattening

Commodities

- WTI and Brent front-month futures are modestly softer intraday as the Dollar remains firm and risk sentiment tilts lower.

- Spot gold is pressured by the firmer Dollar awaiting the US ISM and JOLTS data, with the yellow metal sandwiched between its 100 and 21 DMAs at USD 1,968.25/oz and USD 1,950.60/oz respectively.

- Base metals are on the back foot amid the broader risk aversion, stronger Greenback, and the surprise contraction in the Caixin Manufacturing PMI.

Geopolitics

- White House’s Kirby said the US is not encouraging attacks inside Russia and that the decision is for Ukraine to make, according to a CNN interview.

- A drone hit a high-rise building in Moscow and a second drone was downed in Moscow’s suburbs, according to agencies quoting emergency services.

- China’s Defence Ministry said it lodged solemn representations to the US side regarding US military arms sales to Taiwan and urges the US to stop all forms of military collusion with Taiwan, according to Reuters.

US Event Calendar

- July Wards Total Vehicle Sales, est. 15.7m, prior 15.7m

- 09:45: July S&P Global US Manufacturing PM, est. 49.0, prior 49.0

- 10:00: June JOLTs Job Openings, est. 9.6m, prior 9.82m

- 10:00: July ISM Manufacturing, est. 46.9, prior 46.0

- 10:00: June Construction Spending MoM, est. 0.6%, prior 0.9%

- 10:30: July Dallas Fed Services Activity, prior -8.2

DB’s Jim Reid concludes the overnight wrap

Welcome to August, the last month of an increasingly wet summer here in the UK. A bright spot yesterday was a tremendous climax to the Ashes where England levelled a barn-storming series 2-2 after 6 weeks of high drama, a diplomatic incident, interventions from both prime ministers, and a series where but for the weather England could have won 3-2 after being 2-0 down. This will mean nothing to 99% of global readers but it was nothing short of a sensational series.

Unlike with the Ashes, July ended quietly for markets but the month overall was largely positive for assets across the board. Commodities, and oil, stole the show, as supply cuts spurred upward pressure on prices, but the AI excitement saw both S&P 500 and the NASDAQ extend their rally, securing their fifth and fourth consecutive month of positive returns, respectively. However, fixed income took a hit in July, as central banks continued their hiking cycle and near-term cuts continue to be priced out. All-in-all, we had the strongest month in performance terms since January, with 32 of the 38 non-currency assets in our sample ending July in positive territory. In YTD terms, 36 out of 38 non-currency assets are now in the green. See the full review in your inboxes shortly.

Turning to yesterday, it was a relatively quiet day in markets with the main event the Federal Reserve’s senior loan officers’ opinion survey (SLOOS) late in the US session. This continues to be one of the few data points to argue against a soft-landing narrative. The share of banks reporting tighter credit standards for commercial & industrial loans increased (from +46 to +51). The four times since the start of the SLOOS in 1990 (as we know it today) that have seen such tightening have all been associated with recessions. The decline in demand for C&I loans eased a touch (from -56 to -52) but remains very negative. Commercial real estate (CRE) remained a focal point of the tightening in credit conditions, as “banks reported tighter standards and weaker demand for all CRE loan categories”. There were some more encouraging details on the residential side, as the slowdown in demand for mortgages was the least severe since H1 2022. But in all, while activity and inflation data have been more encouraging of late, it would take an unusual decoupling of the US economy from the bank credit cycle to avoid a recession. Clearly the market is expecting such a “this time is different” narrative. Standby for the June US JOLTS data and ISM today for the next data instalment.

In markets, the SLOOS survey hardly moved the needle and the positive mood from Friday continued, albeit in a subdued session. The S&P 500 gained a modest +0.15% and 10yr US Treasury yields inched up by +0.9bps despite dovish commentary from the Chicago Fed’s Goolsbee. A known dove, Goolsbee emphasised that the most recent inflation prints were “fabulous news” and that the US was now on what he called the “golden path”. However, he was careful to note that the Fed still needed to “play by ear” and did not commit to a view on the September meeting, with the potential for cuts only arising when inflation recedes.

There was little change to market expectations following Goolsbee’s interview, with the probability of a Fed hike in September unchanged at 19%. An 18% chance of a further 25bps hike is priced in for November. Overall, the market is anticipating just over a third of another hike this Fed hiking cycle, and 115bps of rate cuts in total by December 2024.

Across the Atlantic, following the German and French CPI prints on Friday, eyes were on the release of the Euro area flash CPI data for July, with headline HICP as expected at 5.3%, easing from 5.5% in June. However, core inflation surprised to the upside at 5.5% (vs 5.4% expected) rising above the headline result for the first time since the start of 2021. Will it be enough to justify a pause on September 14th? There is still a fair amount of data before then but only one inflation print.

Within the same data package was the euro area economic growth for Q2, which overshot expectations to hit +0.3% quarter-on-quarter (vs +0.2% expected). However, markets did not lend much credence to the beat. When digging into the details, it’s apparent Ireland (+3.3% quarter-on-quarter) created a sizeable upward distortion, while French numbers (+0.5% quarter-on-quarter, expectations were for +0.1%) were also distorted, by the delivery of a cruise ship. In contrast, Germany recorded no growth (0% quarter-on-quarter), and Italy a contraction (-0.3% quarter-on-quarter)

With markets taking on board these prints, European overnight index swaps are now pricing 61% chance of an additional 25bps hike by the end of 2024, down from nearly 90% prior to last Thursday’s ECB meeting. Off the back of this, German fixed income fluctuated over the day, with the 10yr struggling for direction before eventually closing down -0.2bps, while the 2yr was down -1.3bp.

US equities continued their rally on Monday, albeit at a slower pace, with the S&P up +0.15% after a late rally, securing its fifth consecutive month of advances (+3.11% in price terms in July), the longest streak since August 2021. At the sectoral level, the energy sector outperformed on the day, up +2.00%, as WTI and Brent Crude rounded up their third consecutive day of gains, climbing +1.51% and +0.67%, respectively. On the oil side, the market will be watching whether Saudi Arabia announces an extension of its output cut in the coming days. Real estate (+0.70%) and financials (+0.44%) equity sectors followed energy’s lead. The NASDAQ also traded modestly up by +0.21%, whilst the FANG+ index of megacap stocks outperformed with a +0.43% gain. Price action in European equities also saw the same modest risk-on sentiment, as the STOXX 600 climbed +0.12%. The consumer staples sector particularly struggled on Monday after beverage firm Heineken (-7.97%) pared back its full-year guidance, whilst energy outperformed, climbing +1.32%.

As we go to print, the Reserve Bank of Australia (RBA) has just kept the official interest rate unchanged at 4.1% (the highest level since 2012), thus extending its pause for the second consecutive month to assess if further rate hikes are needed to tame inflation. Most economists expected a hike but it was a close call. 2yr yields are around -8bps lower after the decision.

Asian equity markets are mostly trading higher this morning. Across the region, The KOSPI (+1.22%) is leading gains with the Nikkei (+0.74%) and the Hang Seng (+0.23%) also trading in the green. However, mainland Chinese stocks are mixed with the CSI (-0.12%) losing ground and the Shanghai Composite (+0.10%) eking out minor gains. Meanwhile, S&P 500 (+0.08%) and NASDAQ 100 (+0.09%) futures are seeing marginal gains.

Early morning data showed that China’s private factory activity returned to contraction for the first time since April as the Caixin manufacturing PMI came in at 49.2 in July (v/s 50.5 in June) in contrast to market expectations of 50.1. The data comes a day after the official factory activity remained in negative territory for the fourth straight month. Elsewhere, Japan’s jobless rate unexpectedly dropped to 2.5% in June from 2.6% a month earlier amid the ongoing COVID-19 recovery. Meanwhile, the job availability ratio, fell 0.01 point from May to 1.30 (v/s 1.32 expected).

In FX, the Japanese yen fell to a fresh low of 142.80 against the dollar after the Bank of Japan (BOJ) yesterday conducted an unscheduled buying operation of JGBs to cap the surge in government bond yields after the central bank tweaked its YCC policy on Friday. A 10yr auction this morning was soft but yields are fairly stable overnight.

We had an update in the geopolitics arena on Monday, with Bloomberg reporting that Ukrainian President Zelensky is likely to head to the UN General Assembly in New York come September. It is anticipated that he intends to make the case for Ukraine’s “peace formula”, a blueprint for ending the conflict. Ukraine’s peace plan may also get discussed at a gathering in Saudi Arabia next weekend, with the planned meeting first reported by the Wall Street Journal on Saturday. While Russia’s withdrawal from the Black Sea grain deal, and accompanying escalation, gathered attention in July, diplomatic efforts could become an increasing topic in the coming weeks.

Finally on the data side, the MNI Chicago PMI for July slipped below expectations at 42.8 (vs 43.5 expected). This was an increase from June (41.5), but still speaks to continued contraction in factory sector activity. The Dallas Fed Manufacturing Activity surprised modestly to the upside at -20.0 (vs -22.5 expected), and the six month ahead new orders index ticked slightly higher.

Now to the day ahead, we have a data heavy day. From the US, we have the July ISM index, the Dallas Fed services activity and the June JOLTS report, as well as total vehicle sales and construction spending. In Europe, we have the Eurozone unemployment rate for June, as well as the Italian July PMI, the new car registrations, budget balance and June unemployment rate. From Germany, we have the July unemployment rate, and finally the Canadian PMI for July. We also have several key earnings releases, including Pfizer, AMD, Caterpillar, Starbucks, Uber, Altria, Marriott, Pioneer Natural Resources, Electronic Arts, Devon Energy and Pinterest.

Loading…