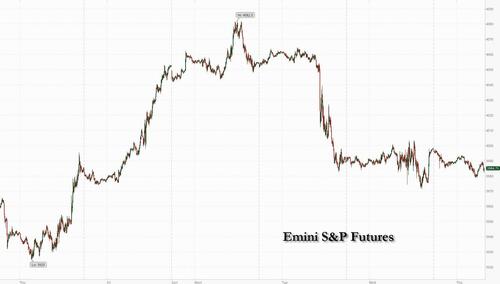

US futures dropped on Thursday, led by tech companies, as yesterday's late, 3:30pm surge which brought stocks back to unchanged levels is being tested ahead of tomorrow's payroll reports. S&P 500 contracts dropped 0.3% as of 7:30 a.m. ET while Nasdaq futures retreated 0.6%. Bonds yields were flat alongside a weaker Bloomberg Dollar Spot Index which is set for its first one-day drop this week, commodities are mixed with copper outperforming +1.7%.

In premarket trading, mega cap tech names are mostly lower. Silvergate Capital slumped 44% in premarket trading after announcing plans to wind down operations and voluntarily liquidate the crypto-friendly bank. Tesla extended this week’s losses and fell as much as 2.6% in premarket trading on Thursday, an investigation by US regulators over complaints the steering wheel can fall off certain new Model Y vehicles. MongoDB fell 12% in premarket trading after the infrastructure software company gave a full-year revenue forecast that missed expectations. Analysts said the weaker forecast overshadows its strong 4Q beat. By contrast, Asana surged 21% after CEO and co-founder Dustin Moskovitz said he plans to enter into a trading plan to purchase up to 30 million shares. Here are some other notable premarket movers:

- Uber shares gain in US premarket trading, after the ride hailing company was said to be considering spinning off its freight logistics business, a move that analysts said would be positive for the company, with Piper Sandler saying it could eventually increase the stock’s chances of being included in the S&P 500 Index.

- Etsy shares drop 5.4% in US premarket trading after the online marketplace operator was double- downgraded at Jefferies to underperform from buy, with the broker citing the stock’s premium valuation and “troubling” buyer trends that could put pressure on growth.

- SVB Financial falls as much as 32% in premarket trading after offering $1.25 billion of common stock. The holding company for Silicon Valley Bank also announced the sale of $21 billion of securities, which will result in an after-tax loss of about $1.8 billion in the first quarter.

There is a light macro calendar today; we see Biden’s budget proposal reveal later today, as well as Challenger Job cuts and Jobless Claims data to further assess the labor market. In addition, there is a Treasury 30yr bond auction.

Investors are digesting Jerome Powell’s signaling after the Federal Reserve chief told lawmakers no decision had been made on the pace of the next move. He reiterated however, that an acceleration in tightening was still on the table, and rates may go higher than anticipated should economic data warrant. Still, markets tilt solidly toward a half-point hike in March rather than the quarter-point expected earlier as Powell's comments coincided with another round of US jobs figures that came in on the hot side, bolstering bets that policymakers will remain hawkish.

“The Fed will pause only when they start to see weakness in the labor market and inflation starting to come down. After that they will want to leave interest rates high to squeeze out inflation expectations from the market,” said Charles Diebel, head of fixed income at Mediolanum International Funds. “So rates will remain restrictive even when the economy is slowing or in recession, that turns the screw even further for markets,” he said.

“This would shatter the market’s comfortable illusion at the start of the year that rates were about to pivot and a soft landing for the US economy could be engineered,” said Russ Mould, investment director at AJ Bell.

Meanwhile, JPM strategists - desperate to find anything bearish now that Marko Kolanovic has staked his reputation on stocks hitting new cycle lows - said that while the US earnings season was not as bad as expected, it confirmed emerging cracks within corporate fundamentals, adding that the rising cost of capital is a key concern for corporates. Which, of course, has been obvious for the past year and has been priced in long ago.

Euro Stoxx 50 falls 0.5%. In Europe, real estate, miners and travel underperform. Here are some of the most notable European movers:

- Hugo Boss shares fell as much as 4.5% as its 2023 Ebit guidance came in below some analysts’ estimates and brokers flagged the German fashion brand’s inventory build

- Credit Suisse shares drop as much as 4.9% after the Swiss lender delayed the publication of its annual report and compensation details for 2022

- Entain shares slip as much as 4.4% after the UK-based gambling company reported full-year results that analysts said were broadly in line with estimates

- DS Smith shares fall as much as 4.3% after “downbeat” commentary from the packaging maker that appears to mostly echo reporting from its peers

- National Express falls as much as 7.4%, among the biggest decliners in the UK on Thursday, after getting its only sell rating

- IQE shares drop as much as 33%, the most since June 2019, after a trading update, with Peel Hunt flagging the chipmaker is suffering from the impact of a deepening inventory correction

- Aviva gains as much as 3.8% after posting a results beat for the full year and launching a £300m share buyback that met expectations

- M&G shares gained as much as 4.4%, reversing a slump in early trading, as analysts welcomed the fund manager’s strong operating profit and management’s focus on reducing debt

- De’ Longhi gains as much as 6.7%, the most intraday since November, after Equita upgraded the Italian appliance maker to buy from hold

- Dassault Aviation shares jump as much as 11% to a record high after the French maker of the Rafale fighter plane reported 2022 sales and net income that were ahead of analyst expectations

Asian stocks were mixed as the latest Chinese inflation data underscored a mediocre recovery in the economy, offsetting the boost from a softer tone by the Federal Reserve’s chief on interest rate increases. The MSCI Asia Pacific Index rose as much as 0.3% on Thursday before giving up the increase. About three stocks declined for every two that advanced in the gauge. Japan led gains in the region ahead of the Bank of Japan meeting this week, where expectations are for ultra-easy policies to continue. Chinese stocks fell after the nation’s costs of food and consumer goods eased following the end of the Lunar New Year holiday, suggesting that an economic rebound driven by reopening may take longer than expected. South Korean shares also declined.

The focus will now be on the US jobs report due Friday and inflation data next week. Sentiment in Asia has been weak recently, dragged by concerns over the Fed’s policy path and a lack of major catalysts from the National People’s Congress in China. The MSCI regional benchmark has fallen 6% from a January peak. “The upside potential of Asia equities remains constrained by monetary policy in the US, where real rates, the crudest measure of financial conditions remain in negative territory,” Societe Generale strategists including Frank Benzimra wrote in a note.

Japanese stocks rose for a fifth day after Federal Reserve Chair Jerome Powell softened his tone slightly during a congressional testimony and investors awaited a Bank of Japan policy decision on Friday. The Topix index advanced 1% to 2,071.09 as of the 3 p.m. close in Tokyo, while the Nikkei 225 climbed 0.6% to 28,623.15. Seven & i Holdings Co. contributed the most to the Topix’s gain, increasing 4.1% after the Nikkei reported the company will reduce the number of Ito-Yokado stores by about 20%. Out of 2,160 stocks in the index, 1,642 rose and 413 fell, while 105 were unchanged

Australian stocks were flat: the S&P/ASX 200 index was little changed to close at 7,311.10, with gains in banks offset by losses in the mining sector. Some of the largest miners, including BHP and Rio Tinto, traded ex-dividend. In New Zealand, the S&P/NZX 50 index fell 0.2% to 11,826.15.

In FX, the Bloomberg Dollar Spot Index fell as the greenback weakened agajinst all of its Group-of-10 peers apart from the Norwegian krone. The euro climbed above $1.0550.

- The yen rose against all G-10 peers in the wake of Jerome Powell’s comments that further rate hikes would be data- dependent. Traders are also positioning ahead of the BOJ’s policy decision on Friday, with investors high alert for a surprise parting shot from Haruhiko Kuroda in his final meeting.

- The Australian and New Zealand dollars rose but stayed within recent ranges amid broad greenback weakness. Bonds hold opening gains. Australian bonds climbed to extend recent outperformance

In rates, treasuries higher across belly and front-end of the curve, reversing recent flattening trend with the long-end underperforming. Gains accumulated during Asia session as Australian bonds climbed, extending recent outperformance. Long-end Treasuries lag ahead of 30-year bond auction at 1pm New York time. Yields richer by 3bp-4bp across front-end of the curve in early US session with 20- and 30-year bonds slightly cheaper vs Wednesday’s close; 10-year yields around 3.98%, around 1bp richer on the day. The bund yield curve bear steepened, paring the past two days of gains as well as trimming outperformance over Treasuries. The pound advanced and the UK sovereign yield curve bear-flattened. WI 30-year at 3.90% is above auction stops since November and ~21bp cheaper than February’s result. IG dollar issuance slate empty so far; two issuers priced $8b Wednesday, with four or five issuers electing to stand down, which could lead to an active session Thursday.

In commodities, WTI trades within Wednesday’s range at ~$76.69. Spot gold rises roughly $4 to trade near $1,818/oz

To the day ahead now, and data releases include the weekly initial jobless claims from the US. Otherwise, central bank speakers include the Fed’s Barr and the ECB’s Vujcic.

Market Snapshot

- S&P 500 futures down 0.3% to 3,982.50

- STOXX Europe 600 down 0.6% to 458.34

- MXAP little changed at 160.28

- MXAPJ down 0.6% to 513.07

- Nikkei up 0.6% to 28,623.15

- Topix up 1.0% to 2,071.09

- Hang Seng Index down 0.6% to 19,925.74

- Shanghai Composite down 0.2% to 3,276.09

- Sensex down 0.8% to 59,851.99

- Australia S&P/ASX 200 little changed at 7,311.12

- Kospi down 0.5% to 2,419.09

- German 10Y yield little changed at 2.69%

- Euro up 0.2% to $1.0566

- Brent Futures down 0.3% to $82.40/bbl

- Gold spot up 0.2% to $1,817.23

- U.S. Dollar Index down 0.27% to 105.38

Top Overnight News from Bloomberg

- Northwestern University Professor Janice Eberly is the frontrunner in the White House search for a successor to Lael Brainard as vice chair of the Federal Reserve, people familiar with the matter said

- Bank of France Governor Francois Villeroy de Galhau said French inflation should peak between now and June and the ECB will do what’s needed to bring it back to its 2% goal

- Swedish inflation is far too high and the Riksbank will do whatever it takes to slow price increases, Deputy Governor Aino Bunge said in her first public speech since joining the central bank’s executive board

- Indicator data for Sweden’s GDP showed an increase of 2% from a month earlier, adjusted for seasonal variations, the fastest increase in four months, according to data published by Statistics Sweden on Thursday. That compares with a median estimate for a 0.1% decline in a Bloomberg survey of economists

- Turkey borrowed $2.25 billion in its first international bond offering following last month’s devastating earthquakes. The Treasury and Finance Ministry said it sold dollar-denominated bonds maturing March 14, 2029 at a yield of 9.5%

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mostly rangebound after the choppy performance in the US where Fed Chair Powell reaffirmed his hawkish view but clarified that the Fed has not yet made a decision, while the region also digested weak data including softer-than-expected Chinese inflation. ASX 200 was kept afloat amid outperformance in tech and energy albeit with upside limited by weakness in the mining and materials industries, while sentiment is also clouded following confirmation of a substantial drop in building approvals. Nikkei 225 rose to its highest level since August after downward revisions to Q4 GDP added to the case for a slower exit from the BoJ’s ultra-easy policy and as the central bank kick-started the final 2-day policy meeting before the end of the Kuroda era. Hang Seng and Shanghai Comp. were indecisive as participants reflected on the soft inflation data from China which showed consumer price growth was at its slowest pace in a year.

Top Asian News

- Australia will end COVID testing for travellers from China, while Australia's Trade Minister separately noted that progress is being made on almost all instances of trade blockages with China.

- Japan's lower house approved the appointment of Kazuo Ueda as the next BoJ Governor, while it approved the appointment of Shinichi Uchida and Ryozo Himino as the next Deputy Governors, which was as expected and with the upper house set to vote on the nominations tomorrow.

- South Korean President Yoon is to visit Japan on March 16-17th, according to Yonhap.

European bourses are under pressure, Euro Stoxx 50 -0.5%, with sentiment gradually deteriorating amid numerous geopolitical updates ahead of Friday's NFP report. Beforehand, we do have Fed's voter Barr and IJC scheduled before a 30yr auction, going into this US futures are lower across the board with the NQ -0.6% lagging as yields pickup. Bank of America (BAC) CEO sees a slight US recession in Q3; says what the Federal Reserve intended to do is happening. Says consumer spending growth is accelerating, consumer account balances are still growing, BofA had to stop hiring last Autumn.

Top European News

- US President Biden and European Commission President von der Leyen are expected to agree on Friday to work towards a trade deal that would give the EU free-trade agreement-like status, according to Reuters sources. It was separately reported that the US and the EU are to start trade negotiations on minerals, according to WSJ.

- German Economy Ministry says they will be setting up a system of social subsidies so low/medium-income households can afford the energy transition; double-digit billion EUR sum is planned to help the industry cope with the climate transition.

- Riksbank's Bunge says it is important for inflation to fall significantly this year. Inflation is far too high, prices are rising broadly. Underlying inflation has not shown clear signs of falling, will take time for mon pol to have full impact. Adds, the economy is still faring relatively well; still sees a 25bp or 50bp hike in April.

FX

- The DXY is underpressure and has moved below yesterday's 105.35 trough to 105.28 at worst with the 100-DMA in proximity ahead of US IJC, Fed speak and more pertinently Friday's NFP.

- Amidst this, the JPY is the standout outperformer with USD/JPY within 10 pips of 136.00 at best vs 137.37 initial high ahead of Kuroda's final BoJ where the straddle premium indicates 230 pip breakeven across the BoJ and NFP events.

- Antipodeans and the CHF are taking advantage of the USD's pullback, firmly below 0.94 and above 0.66 and 0.61 for CHF, AUD & NZD vs USD.

- Next-best are the EUR and GBP, with fresh drivers limited as we enter the ECB's quiet period, though with action very much at the whim of broader risk sentiment before next week's UK/EZ specific events; Cable testing 1.19 and EUR/USD holding above 1.0550.

- SEK shrugged off conflicting macro data though gleaned incremental upside from Riksbank's Bunge's hawkish remarks and a fresh call from SEB, who now look for a 25bp in June after April's 50bp.

- PBoC set USD/CNY mid-point at 6.9666 vs exp. 6.9668 (prev. 6.9525)

Fixed Income

- Bonds back within tighter ranges as dust settles on Fed Chair Powell's testimonies and attention turns to Friday's US jobs data with BoJ prequel.

- Bunds meander between 131.77-07, Gilts roam from 100.50 to 100.06 and T-note sits just shy of parity within 110-31+/23+ band.

- Next on the agenda Challenger layoffs, jobless claims and last long bond refunding leg.

Commodities

- Commodities, generally speaking, reside within fairly contained ranges with price action choppy thus far amid a lack of scheduled catalysts aside from geopolitical developments.

- WTI and Brent currently reside around USD 76.50/bbl mark (USD 76.16-76.85 range) and USD 82.50/bbl (USD 82.17-82.89/bbl range) respectively.

- EU Energy Commissioner says we will propose to extend EU gas price cap to other gas hubs, to propose EU extends the voluntary target to cut gas demand by 15%.

- Russian Foreign Minister Lavrov says it is important to continue the Russian-Saudi coordination on all levels, according to Sky News Arabia. Alongside this, the Saudi Foreign Minister stresses close coordination between themselves and Russia within the energy market and the commitment to OPEC+.

- Russian Foreign Minister Lavrov says Russia and Saudi "discussed exporting Ukraine's grain across the Black Sea and removing restrictions on our exports of grain and fertilizers", via Al Jazeera.

- Spot gold remains above USD 1800/oz and by extension within Wednesday parameters and technically between the 10- & 100-DMAs at USD 1827/oz and USD 1808/oz.

Geopolitics

- Twitter sources noted a major Russian air attack was underway in Ukraine, while regional officials said strikes hit many Ukrainian regions including Kharkiv and Odesa with power cuts in some places, while explosions were also heard in Kyiv and Dnipro.

- Russian missiles struck 10 regions across Ukraine, according to Russian President Zelensky cited by AFP.

- US Justice Department said the US obtained a warrant for the seizure of an aeroplane owned by a Russian oil company valued at more than USD 25mln, according to Reuters.

- North Korea fired short-ranged ballistic missile towards the Yellow Sea, according to Yonhap.

US Event Calendar

- 07:30: Feb. Challenger Job Cuts YoY, prior 440.0%

- 08:30: March Initial Jobless Claims, est. 195,000, prior 190,000

- 08:30: Feb. Continuing Claims, est. 1.66m, prior 1.66m

- 12:00: 4Q US Household Change in Net Wor, prior -$392b

DB's Jim Reid concludes the overnight wrap

After the sizeable losses on Tuesday, markets showed signs of stabilising over the last 24 hours as Fed Chair Powell put forward a slightly softer message on the pace of future rate hikes. He was appearing before the House Financial Services Committee, where he delivered almost exactly the same testimony as he had to the Senate Banking Committee the previous day. However, there was one important caveat added, since when referring to his comments that “we would be prepared to increase the pace of rate hikes”, he said “I stress that no decision has been made on this”. So a clear message that faster rate hikes were not a done deal just yet.

Whilst Powell was trying to steer us away from a specific outcome, ultimately the decision was always going to depend significantly on tomorrow’s jobs report, as well as the CPI release on Tuesday. And in the meantime, markets continued to price in a growing chance that the Fed would go for a 50bps move at the next meeting, whatever Powell might have said. In fact, futures ended the day pricing in a 42.8bps hike for March, which is up from 40.7bps the previous day.

With a 50bp hike being increasingly priced in, shorter-dated yields continued to move higher, and the 2yr Treasury yield was up +6.2bps to another post-2007 high of 5.07%. 10yr yields rose by a smaller +2.8bps to 3.99% where they remain overnight, after being down shortly after Powell’s testimony before selling off during the day. That meant we had a fresh round of curve inversions, with the 2s10s falling all the way to -109bps by the close, which is something we haven’t seen since 1981.

Otherwise yesterday, there was plenty of evidence for the hawks and doves to look over. On the hawkish side, we had a couple of releases suggesting that the labour market remained in a robust position. First, the ADP’s report of private payrolls came in at +242k in February (vs. +200k expected), and there was a modest upward revision of +13k to the prior month’s release. Then we had the JOLTS data for January, which is a bit more backward-looking, but showed that job openings fell by less than expected to 10.824m (vs. 10.546m expected). That means that there are still 1.90 vacancies per unemployed worker, which isn’t far beneath the 2.01 peak last March when the Fed started tightening, and it remains well above its pre-Covid average.

That offered evidence for the hawks, but on the dovish side, there were also a couple of indications from the JOLTS release that the labour market tightness was continuing to ease off at the start of 2023. In particular, the quits rate of those voluntarily leaving their jobs (which is strongly correlated with wage growth) fell to its lowest level in almost two years, at 2.5%. If that’s coming down, then that suggests that the labour market might be coming into better balance between supply and demand, which is what the Fed wants to see.

There’s much anticipation for the Fed’s next decision, but before that we’ve got the ECB decision in just a week’s time, and the latest speakers suggested some divisions on policy within the Governing Council. Specifically, Italy’s Visco (one of the more dovish members) said that “uncertainty is so high that the Governing Council of the ECB has agreed to decide ‘meeting by meeting’, without ‘forward guidance’”. He added that “I therefore don’t appreciate statements by my colleagues about future and prolonged interest rate hikes.” That comes on the back of comments from Austria’s Holzmann earlier in the week, who said that they should hike by 50bps at the next four meetings, and markets are now pricing that the deposit rate will move to at least 4% by the end of the year.

With that in mind, sovereign bonds in Europe followed a similar pattern to the US yesterday, with curve inversions becoming even deeper. For instance, the 2yr German yield (+2.5bps) hit a post-2007 high of 3.31%, whereas the 10yr yield was down -4.6bps to 2.64%, thus leaving the German 2s10s curve at its most inverted since 1992. Likewise in France, the 2yr yield (+2.0bps) was higher, and the 10yr yield (-4.7bps) fell back.

Against this backdrop, equities were pretty steady on both sides of the Atlantic, with the S&P 500 (+0.14%) seeing a modest gain after its bigger losses from the previous day. Bond proxies such as Real Estate (+1.3%) and Utilities (+0.8%) were among the best performers along with tech sectors like Semiconductors (+2.6%) and Tech Hardware (+0.8%). This was tempered by energy (-1.0%) and some other more cyclical sectors such as Autos (-2.2%) and Banks (-0.9%). Meanwhile in Europe, the STOXX 600 (+0.08%) only just closed higher on the day.

Following all that, Asian equity markets have been mostly subdued this morning. That comes on the back of weaker-than-expected data on Chinese inflation, with consumer prices up by +1.0% in the year to February (vs. +1.9% expected), which is its slowest pace in a year. Furthermore producer prices were down -1.4% (vs. -1.3% expected), marking the lowest reading since November 2020. In the meantime, we also had some weaker-than-expected data out of Japan, with annualised GDP only up by +0.1% in Q4, rather than +0.6% as initially estimated.

Amidst all that, the major indices in Asia have struggled to gain much traction, with the CSI 300 (-0.16%), the Shanghai Comp (-0.13%) and the KOSPI (-0.32%) all trading in negative territory. However, the Hang Seng is up +0.33%, and Japanese equities are outperforming with the Nikkei up +0.50%. Looking forward, the picture remains downbeat, with US equity futures are pointing to modest losses today, including for the S&P 500 (-0.09%) and the NASDAQ 100 (-0.15%).

Elsewhere yesterday, the Bank of Canada left rates unchanged, following a run of 8 successive hikes over the previous year. The move was in line with expectations, since the BoC had already announced a pause at their previous meeting. However, the Canadian Dollar (-0.4%) fell to its weakest level since October against the US Dollar, after the statement removed a previous reference that the economy was experiencing excess demand. Looking forward, the statement said they were “prepared to increase the policy rate further” if required to get inflation back to target, and investors still expect the next move to be up rather than down, with another 25bp hike fully priced in by the September meeting.

Staying on central banks, Bloomberg reported that Janice Eberly is the frontrunner to be the next Vice Chair of the Federal Reserve, according to “people familiar with the matter”. Eberly is a professor at Northwestern University, but previously served as Assistant Secretary of the Treasury for Economic Policy under President Obama. Bloomberg’s article said that Eberly had met for an interview with senior officials, including Treasury Secretary Janet Yellen, NEC Director and former Fed Vice Chair Lael Brainard, as well as Biden’s chief of staff Jeff Zients.

Looking at yesterday’s other releases, we found out that the Euro Area economy didn’t grow at all in Q4 of last year, contrary to previous estimates that there’d been a +0.1% expansion. Otherwise, German industrial production grew by +3.5% in January (vs. +1.4% expected), and although retail sales unexpectedly fell -0.3% (vs. +2.3% expected), there were sharp upward revisions to the previous month.

To the day ahead now, and data releases include the weekly initial jobless claims from the US. Otherwise, central bank speakers include the Fed’s Barr and the ECB’s Vujcic.

US futures dropped on Thursday, led by tech companies, as yesterday’s late, 3:30pm surge which brought stocks back to unchanged levels is being tested ahead of tomorrow’s payroll reports. S&P 500 contracts dropped 0.3% as of 7:30 a.m. ET while Nasdaq futures retreated 0.6%. Bonds yields were flat alongside a weaker Bloomberg Dollar Spot Index which is set for its first one-day drop this week, commodities are mixed with copper outperforming +1.7%.

In premarket trading, mega cap tech names are mostly lower. Silvergate Capital slumped 44% in premarket trading after announcing plans to wind down operations and voluntarily liquidate the crypto-friendly bank. Tesla extended this week’s losses and fell as much as 2.6% in premarket trading on Thursday, an investigation by US regulators over complaints the steering wheel can fall off certain new Model Y vehicles. MongoDB fell 12% in premarket trading after the infrastructure software company gave a full-year revenue forecast that missed expectations. Analysts said the weaker forecast overshadows its strong 4Q beat. By contrast, Asana surged 21% after CEO and co-founder Dustin Moskovitz said he plans to enter into a trading plan to purchase up to 30 million shares. Here are some other notable premarket movers:

- Uber shares gain in US premarket trading, after the ride hailing company was said to be considering spinning off its freight logistics business, a move that analysts said would be positive for the company, with Piper Sandler saying it could eventually increase the stock’s chances of being included in the S&P 500 Index.

- Etsy shares drop 5.4% in US premarket trading after the online marketplace operator was double- downgraded at Jefferies to underperform from buy, with the broker citing the stock’s premium valuation and “troubling” buyer trends that could put pressure on growth.

- SVB Financial falls as much as 32% in premarket trading after offering $1.25 billion of common stock. The holding company for Silicon Valley Bank also announced the sale of $21 billion of securities, which will result in an after-tax loss of about $1.8 billion in the first quarter.

There is a light macro calendar today; we see Biden’s budget proposal reveal later today, as well as Challenger Job cuts and Jobless Claims data to further assess the labor market. In addition, there is a Treasury 30yr bond auction.

Investors are digesting Jerome Powell’s signaling after the Federal Reserve chief told lawmakers no decision had been made on the pace of the next move. He reiterated however, that an acceleration in tightening was still on the table, and rates may go higher than anticipated should economic data warrant. Still, markets tilt solidly toward a half-point hike in March rather than the quarter-point expected earlier as Powell’s comments coincided with another round of US jobs figures that came in on the hot side, bolstering bets that policymakers will remain hawkish.

“The Fed will pause only when they start to see weakness in the labor market and inflation starting to come down. After that they will want to leave interest rates high to squeeze out inflation expectations from the market,” said Charles Diebel, head of fixed income at Mediolanum International Funds. “So rates will remain restrictive even when the economy is slowing or in recession, that turns the screw even further for markets,” he said.

“This would shatter the market’s comfortable illusion at the start of the year that rates were about to pivot and a soft landing for the US economy could be engineered,” said Russ Mould, investment director at AJ Bell.

Meanwhile, JPM strategists – desperate to find anything bearish now that Marko Kolanovic has staked his reputation on stocks hitting new cycle lows – said that while the US earnings season was not as bad as expected, it confirmed emerging cracks within corporate fundamentals, adding that the rising cost of capital is a key concern for corporates. Which, of course, has been obvious for the past year and has been priced in long ago.

Euro Stoxx 50 falls 0.5%. In Europe, real estate, miners and travel underperform. Here are some of the most notable European movers:

- Hugo Boss shares fell as much as 4.5% as its 2023 Ebit guidance came in below some analysts’ estimates and brokers flagged the German fashion brand’s inventory build

- Credit Suisse shares drop as much as 4.9% after the Swiss lender delayed the publication of its annual report and compensation details for 2022

- Entain shares slip as much as 4.4% after the UK-based gambling company reported full-year results that analysts said were broadly in line with estimates

- DS Smith shares fall as much as 4.3% after “downbeat” commentary from the packaging maker that appears to mostly echo reporting from its peers

- National Express falls as much as 7.4%, among the biggest decliners in the UK on Thursday, after getting its only sell rating

- IQE shares drop as much as 33%, the most since June 2019, after a trading update, with Peel Hunt flagging the chipmaker is suffering from the impact of a deepening inventory correction

- Aviva gains as much as 3.8% after posting a results beat for the full year and launching a £300m share buyback that met expectations

- M&G shares gained as much as 4.4%, reversing a slump in early trading, as analysts welcomed the fund manager’s strong operating profit and management’s focus on reducing debt

- De’ Longhi gains as much as 6.7%, the most intraday since November, after Equita upgraded the Italian appliance maker to buy from hold

- Dassault Aviation shares jump as much as 11% to a record high after the French maker of the Rafale fighter plane reported 2022 sales and net income that were ahead of analyst expectations

Asian stocks were mixed as the latest Chinese inflation data underscored a mediocre recovery in the economy, offsetting the boost from a softer tone by the Federal Reserve’s chief on interest rate increases. The MSCI Asia Pacific Index rose as much as 0.3% on Thursday before giving up the increase. About three stocks declined for every two that advanced in the gauge. Japan led gains in the region ahead of the Bank of Japan meeting this week, where expectations are for ultra-easy policies to continue. Chinese stocks fell after the nation’s costs of food and consumer goods eased following the end of the Lunar New Year holiday, suggesting that an economic rebound driven by reopening may take longer than expected. South Korean shares also declined.

The focus will now be on the US jobs report due Friday and inflation data next week. Sentiment in Asia has been weak recently, dragged by concerns over the Fed’s policy path and a lack of major catalysts from the National People’s Congress in China. The MSCI regional benchmark has fallen 6% from a January peak. “The upside potential of Asia equities remains constrained by monetary policy in the US, where real rates, the crudest measure of financial conditions remain in negative territory,” Societe Generale strategists including Frank Benzimra wrote in a note.

Japanese stocks rose for a fifth day after Federal Reserve Chair Jerome Powell softened his tone slightly during a congressional testimony and investors awaited a Bank of Japan policy decision on Friday. The Topix index advanced 1% to 2,071.09 as of the 3 p.m. close in Tokyo, while the Nikkei 225 climbed 0.6% to 28,623.15. Seven & i Holdings Co. contributed the most to the Topix’s gain, increasing 4.1% after the Nikkei reported the company will reduce the number of Ito-Yokado stores by about 20%. Out of 2,160 stocks in the index, 1,642 rose and 413 fell, while 105 were unchanged

Australian stocks were flat: the S&P/ASX 200 index was little changed to close at 7,311.10, with gains in banks offset by losses in the mining sector. Some of the largest miners, including BHP and Rio Tinto, traded ex-dividend. In New Zealand, the S&P/NZX 50 index fell 0.2% to 11,826.15.

In FX, the Bloomberg Dollar Spot Index fell as the greenback weakened agajinst all of its Group-of-10 peers apart from the Norwegian krone. The euro climbed above $1.0550.

- The yen rose against all G-10 peers in the wake of Jerome Powell’s comments that further rate hikes would be data- dependent. Traders are also positioning ahead of the BOJ’s policy decision on Friday, with investors high alert for a surprise parting shot from Haruhiko Kuroda in his final meeting.

- The Australian and New Zealand dollars rose but stayed within recent ranges amid broad greenback weakness. Bonds hold opening gains. Australian bonds climbed to extend recent outperformance

In rates, treasuries higher across belly and front-end of the curve, reversing recent flattening trend with the long-end underperforming. Gains accumulated during Asia session as Australian bonds climbed, extending recent outperformance. Long-end Treasuries lag ahead of 30-year bond auction at 1pm New York time. Yields richer by 3bp-4bp across front-end of the curve in early US session with 20- and 30-year bonds slightly cheaper vs Wednesday’s close; 10-year yields around 3.98%, around 1bp richer on the day. The bund yield curve bear steepened, paring the past two days of gains as well as trimming outperformance over Treasuries. The pound advanced and the UK sovereign yield curve bear-flattened. WI 30-year at 3.90% is above auction stops since November and ~21bp cheaper than February’s result. IG dollar issuance slate empty so far; two issuers priced $8b Wednesday, with four or five issuers electing to stand down, which could lead to an active session Thursday.

In commodities, WTI trades within Wednesday’s range at ~$76.69. Spot gold rises roughly $4 to trade near $1,818/oz

To the day ahead now, and data releases include the weekly initial jobless claims from the US. Otherwise, central bank speakers include the Fed’s Barr and the ECB’s Vujcic.

Market Snapshot

- S&P 500 futures down 0.3% to 3,982.50

- STOXX Europe 600 down 0.6% to 458.34

- MXAP little changed at 160.28

- MXAPJ down 0.6% to 513.07

- Nikkei up 0.6% to 28,623.15

- Topix up 1.0% to 2,071.09

- Hang Seng Index down 0.6% to 19,925.74

- Shanghai Composite down 0.2% to 3,276.09

- Sensex down 0.8% to 59,851.99

- Australia S&P/ASX 200 little changed at 7,311.12

- Kospi down 0.5% to 2,419.09

- German 10Y yield little changed at 2.69%

- Euro up 0.2% to $1.0566

- Brent Futures down 0.3% to $82.40/bbl

- Gold spot up 0.2% to $1,817.23

- U.S. Dollar Index down 0.27% to 105.38

Top Overnight News from Bloomberg

- Northwestern University Professor Janice Eberly is the frontrunner in the White House search for a successor to Lael Brainard as vice chair of the Federal Reserve, people familiar with the matter said

- Bank of France Governor Francois Villeroy de Galhau said French inflation should peak between now and June and the ECB will do what’s needed to bring it back to its 2% goal

- Swedish inflation is far too high and the Riksbank will do whatever it takes to slow price increases, Deputy Governor Aino Bunge said in her first public speech since joining the central bank’s executive board

- Indicator data for Sweden’s GDP showed an increase of 2% from a month earlier, adjusted for seasonal variations, the fastest increase in four months, according to data published by Statistics Sweden on Thursday. That compares with a median estimate for a 0.1% decline in a Bloomberg survey of economists

- Turkey borrowed $2.25 billion in its first international bond offering following last month’s devastating earthquakes. The Treasury and Finance Ministry said it sold dollar-denominated bonds maturing March 14, 2029 at a yield of 9.5%

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mostly rangebound after the choppy performance in the US where Fed Chair Powell reaffirmed his hawkish view but clarified that the Fed has not yet made a decision, while the region also digested weak data including softer-than-expected Chinese inflation. ASX 200 was kept afloat amid outperformance in tech and energy albeit with upside limited by weakness in the mining and materials industries, while sentiment is also clouded following confirmation of a substantial drop in building approvals. Nikkei 225 rose to its highest level since August after downward revisions to Q4 GDP added to the case for a slower exit from the BoJ’s ultra-easy policy and as the central bank kick-started the final 2-day policy meeting before the end of the Kuroda era. Hang Seng and Shanghai Comp. were indecisive as participants reflected on the soft inflation data from China which showed consumer price growth was at its slowest pace in a year.

Top Asian News

- Australia will end COVID testing for travellers from China, while Australia’s Trade Minister separately noted that progress is being made on almost all instances of trade blockages with China.

- Japan’s lower house approved the appointment of Kazuo Ueda as the next BoJ Governor, while it approved the appointment of Shinichi Uchida and Ryozo Himino as the next Deputy Governors, which was as expected and with the upper house set to vote on the nominations tomorrow.

- South Korean President Yoon is to visit Japan on March 16-17th, according to Yonhap.

European bourses are under pressure, Euro Stoxx 50 -0.5%, with sentiment gradually deteriorating amid numerous geopolitical updates ahead of Friday’s NFP report. Beforehand, we do have Fed’s voter Barr and IJC scheduled before a 30yr auction, going into this US futures are lower across the board with the NQ -0.6% lagging as yields pickup. Bank of America (BAC) CEO sees a slight US recession in Q3; says what the Federal Reserve intended to do is happening. Says consumer spending growth is accelerating, consumer account balances are still growing, BofA had to stop hiring last Autumn.

Top European News

- US President Biden and European Commission President von der Leyen are expected to agree on Friday to work towards a trade deal that would give the EU free-trade agreement-like status, according to Reuters sources. It was separately reported that the US and the EU are to start trade negotiations on minerals, according to WSJ.

- German Economy Ministry says they will be setting up a system of social subsidies so low/medium-income households can afford the energy transition; double-digit billion EUR sum is planned to help the industry cope with the climate transition.

- Riksbank’s Bunge says it is important for inflation to fall significantly this year. Inflation is far too high, prices are rising broadly. Underlying inflation has not shown clear signs of falling, will take time for mon pol to have full impact. Adds, the economy is still faring relatively well; still sees a 25bp or 50bp hike in April.

FX

- The DXY is underpressure and has moved below yesterday’s 105.35 trough to 105.28 at worst with the 100-DMA in proximity ahead of US IJC, Fed speak and more pertinently Friday’s NFP.

- Amidst this, the JPY is the standout outperformer with USD/JPY within 10 pips of 136.00 at best vs 137.37 initial high ahead of Kuroda’s final BoJ where the straddle premium indicates 230 pip breakeven across the BoJ and NFP events.

- Antipodeans and the CHF are taking advantage of the USD’s pullback, firmly below 0.94 and above 0.66 and 0.61 for CHF, AUD & NZD vs USD.

- Next-best are the EUR and GBP, with fresh drivers limited as we enter the ECB’s quiet period, though with action very much at the whim of broader risk sentiment before next week’s UK/EZ specific events; Cable testing 1.19 and EUR/USD holding above 1.0550.

- SEK shrugged off conflicting macro data though gleaned incremental upside from Riksbank’s Bunge’s hawkish remarks and a fresh call from SEB, who now look for a 25bp in June after April’s 50bp.

- PBoC set USD/CNY mid-point at 6.9666 vs exp. 6.9668 (prev. 6.9525)

Fixed Income

- Bonds back within tighter ranges as dust settles on Fed Chair Powell’s testimonies and attention turns to Friday’s US jobs data with BoJ prequel.

- Bunds meander between 131.77-07, Gilts roam from 100.50 to 100.06 and T-note sits just shy of parity within 110-31+/23+ band.

- Next on the agenda Challenger layoffs, jobless claims and last long bond refunding leg.

Commodities

- Commodities, generally speaking, reside within fairly contained ranges with price action choppy thus far amid a lack of scheduled catalysts aside from geopolitical developments.

- WTI and Brent currently reside around USD 76.50/bbl mark (USD 76.16-76.85 range) and USD 82.50/bbl (USD 82.17-82.89/bbl range) respectively.

- EU Energy Commissioner says we will propose to extend EU gas price cap to other gas hubs, to propose EU extends the voluntary target to cut gas demand by 15%.

- Russian Foreign Minister Lavrov says it is important to continue the Russian-Saudi coordination on all levels, according to Sky News Arabia. Alongside this, the Saudi Foreign Minister stresses close coordination between themselves and Russia within the energy market and the commitment to OPEC+.

- Russian Foreign Minister Lavrov says Russia and Saudi “discussed exporting Ukraine’s grain across the Black Sea and removing restrictions on our exports of grain and fertilizers”, via Al Jazeera.

- Spot gold remains above USD 1800/oz and by extension within Wednesday parameters and technically between the 10- & 100-DMAs at USD 1827/oz and USD 1808/oz.

Geopolitics

- Twitter sources noted a major Russian air attack was underway in Ukraine, while regional officials said strikes hit many Ukrainian regions including Kharkiv and Odesa with power cuts in some places, while explosions were also heard in Kyiv and Dnipro.

- Russian missiles struck 10 regions across Ukraine, according to Russian President Zelensky cited by AFP.

- US Justice Department said the US obtained a warrant for the seizure of an aeroplane owned by a Russian oil company valued at more than USD 25mln, according to Reuters.

- North Korea fired short-ranged ballistic missile towards the Yellow Sea, according to Yonhap.

US Event Calendar

- 07:30: Feb. Challenger Job Cuts YoY, prior 440.0%

- 08:30: March Initial Jobless Claims, est. 195,000, prior 190,000

- 08:30: Feb. Continuing Claims, est. 1.66m, prior 1.66m

- 12:00: 4Q US Household Change in Net Wor, prior -$392b

DB’s Jim Reid concludes the overnight wrap

After the sizeable losses on Tuesday, markets showed signs of stabilising over the last 24 hours as Fed Chair Powell put forward a slightly softer message on the pace of future rate hikes. He was appearing before the House Financial Services Committee, where he delivered almost exactly the same testimony as he had to the Senate Banking Committee the previous day. However, there was one important caveat added, since when referring to his comments that “we would be prepared to increase the pace of rate hikes”, he said “I stress that no decision has been made on this”. So a clear message that faster rate hikes were not a done deal just yet.

Whilst Powell was trying to steer us away from a specific outcome, ultimately the decision was always going to depend significantly on tomorrow’s jobs report, as well as the CPI release on Tuesday. And in the meantime, markets continued to price in a growing chance that the Fed would go for a 50bps move at the next meeting, whatever Powell might have said. In fact, futures ended the day pricing in a 42.8bps hike for March, which is up from 40.7bps the previous day.

With a 50bp hike being increasingly priced in, shorter-dated yields continued to move higher, and the 2yr Treasury yield was up +6.2bps to another post-2007 high of 5.07%. 10yr yields rose by a smaller +2.8bps to 3.99% where they remain overnight, after being down shortly after Powell’s testimony before selling off during the day. That meant we had a fresh round of curve inversions, with the 2s10s falling all the way to -109bps by the close, which is something we haven’t seen since 1981.

Otherwise yesterday, there was plenty of evidence for the hawks and doves to look over. On the hawkish side, we had a couple of releases suggesting that the labour market remained in a robust position. First, the ADP’s report of private payrolls came in at +242k in February (vs. +200k expected), and there was a modest upward revision of +13k to the prior month’s release. Then we had the JOLTS data for January, which is a bit more backward-looking, but showed that job openings fell by less than expected to 10.824m (vs. 10.546m expected). That means that there are still 1.90 vacancies per unemployed worker, which isn’t far beneath the 2.01 peak last March when the Fed started tightening, and it remains well above its pre-Covid average.

That offered evidence for the hawks, but on the dovish side, there were also a couple of indications from the JOLTS release that the labour market tightness was continuing to ease off at the start of 2023. In particular, the quits rate of those voluntarily leaving their jobs (which is strongly correlated with wage growth) fell to its lowest level in almost two years, at 2.5%. If that’s coming down, then that suggests that the labour market might be coming into better balance between supply and demand, which is what the Fed wants to see.

There’s much anticipation for the Fed’s next decision, but before that we’ve got the ECB decision in just a week’s time, and the latest speakers suggested some divisions on policy within the Governing Council. Specifically, Italy’s Visco (one of the more dovish members) said that “uncertainty is so high that the Governing Council of the ECB has agreed to decide ‘meeting by meeting’, without ‘forward guidance’”. He added that “I therefore don’t appreciate statements by my colleagues about future and prolonged interest rate hikes.” That comes on the back of comments from Austria’s Holzmann earlier in the week, who said that they should hike by 50bps at the next four meetings, and markets are now pricing that the deposit rate will move to at least 4% by the end of the year.

With that in mind, sovereign bonds in Europe followed a similar pattern to the US yesterday, with curve inversions becoming even deeper. For instance, the 2yr German yield (+2.5bps) hit a post-2007 high of 3.31%, whereas the 10yr yield was down -4.6bps to 2.64%, thus leaving the German 2s10s curve at its most inverted since 1992. Likewise in France, the 2yr yield (+2.0bps) was higher, and the 10yr yield (-4.7bps) fell back.

Against this backdrop, equities were pretty steady on both sides of the Atlantic, with the S&P 500 (+0.14%) seeing a modest gain after its bigger losses from the previous day. Bond proxies such as Real Estate (+1.3%) and Utilities (+0.8%) were among the best performers along with tech sectors like Semiconductors (+2.6%) and Tech Hardware (+0.8%). This was tempered by energy (-1.0%) and some other more cyclical sectors such as Autos (-2.2%) and Banks (-0.9%). Meanwhile in Europe, the STOXX 600 (+0.08%) only just closed higher on the day.

Following all that, Asian equity markets have been mostly subdued this morning. That comes on the back of weaker-than-expected data on Chinese inflation, with consumer prices up by +1.0% in the year to February (vs. +1.9% expected), which is its slowest pace in a year. Furthermore producer prices were down -1.4% (vs. -1.3% expected), marking the lowest reading since November 2020. In the meantime, we also had some weaker-than-expected data out of Japan, with annualised GDP only up by +0.1% in Q4, rather than +0.6% as initially estimated.

Amidst all that, the major indices in Asia have struggled to gain much traction, with the CSI 300 (-0.16%), the Shanghai Comp (-0.13%) and the KOSPI (-0.32%) all trading in negative territory. However, the Hang Seng is up +0.33%, and Japanese equities are outperforming with the Nikkei up +0.50%. Looking forward, the picture remains downbeat, with US equity futures are pointing to modest losses today, including for the S&P 500 (-0.09%) and the NASDAQ 100 (-0.15%).

Elsewhere yesterday, the Bank of Canada left rates unchanged, following a run of 8 successive hikes over the previous year. The move was in line with expectations, since the BoC had already announced a pause at their previous meeting. However, the Canadian Dollar (-0.4%) fell to its weakest level since October against the US Dollar, after the statement removed a previous reference that the economy was experiencing excess demand. Looking forward, the statement said they were “prepared to increase the policy rate further” if required to get inflation back to target, and investors still expect the next move to be up rather than down, with another 25bp hike fully priced in by the September meeting.

Staying on central banks, Bloomberg reported that Janice Eberly is the frontrunner to be the next Vice Chair of the Federal Reserve, according to “people familiar with the matter”. Eberly is a professor at Northwestern University, but previously served as Assistant Secretary of the Treasury for Economic Policy under President Obama. Bloomberg’s article said that Eberly had met for an interview with senior officials, including Treasury Secretary Janet Yellen, NEC Director and former Fed Vice Chair Lael Brainard, as well as Biden’s chief of staff Jeff Zients.

Looking at yesterday’s other releases, we found out that the Euro Area economy didn’t grow at all in Q4 of last year, contrary to previous estimates that there’d been a +0.1% expansion. Otherwise, German industrial production grew by +3.5% in January (vs. +1.4% expected), and although retail sales unexpectedly fell -0.3% (vs. +2.3% expected), there were sharp upward revisions to the previous month.

To the day ahead now, and data releases include the weekly initial jobless claims from the US. Otherwise, central bank speakers include the Fed’s Barr and the ECB’s Vujcic.

Loading…