Global stocks, already hammered by several days of relentless selling in mega-cap tech shares, struggled on Friday as an unprecedented, worldwide computer systems outage hit travel, trading and support services, threatening to exacerbate a pullback in technology stocks. As of 7:00am ET, S&P futures were flat, paring earlier losses, while Nasdaq futures dropped -0.1%. Global markets are also mostly in the red: FTSE -45bps, CAC -55bps, DAX -65bps, Nikkei -16bps, Hang Seng -2.03%, Shanghai +17bps. Cybersecurity firm Crowdstrike plunged as much as 21% in US premarket trading after warning its software was causing computer systems to crash. Its chief executive later said the issue was being fixed. Microsoft shares dropped 2%, though it said it had resolved the cloud-services outage that was blamed for disrupting flights and banks globally. Even the Russell is red this morning as the rotation takes a break. US Treasury yields were unchanged, with the 10Y trading at ~4.21% while the Bloomberg dollar index modestly higher as the yen reverses shallow overnight gains. There is nothing on today's economic calendar so attention will focus on the fallout from the global IT outage and Trump's RNC speech.

In premarket trading, IT outages across the globe weighed on several sectors on Friday, including airlines, insurers and stock exchange operators. Shares in Crowdstrike sank 14% after a widely used cybersecurity program crashed, while Microsoft fell 2.0% after separately reporting problems with its cloud services. Here are some other notable movers:

- Bank of America shares slip 0.3% after the lender was cut to neutral from accumulate at Phillip Securities in the wake of its recent earnings and share-price rally, with the broker flagging a number of headwinds.

- Intuitive Surgical shares jump 6.6% after the company’s second-quarter adjusted earnings per share came ahead of consensus estimates. Piper Sandler said this was an “all-around positive” update.

- Netflix shares fell 0.95% after the streaming-video giant’s third-quarter revenue forecast was slightly weaker than expected. However, analysts were largely positive on the print, which showed strong subscriber additions. Netflix shares were up 32% this year going into the report.

- SunPower shares slide 17% as the solar company extends declines after telling dealers it would no longer support new installations and was halting shipments.

Today's tech disruptions come toward the end of a week that’s seen the Nasdaq shed more than 3%, as investors pulled out of high-flying megacap names and rotated into smaller companies. The Russell 2000 index has risen 2.3% this week. That said, market losses triggered by the outages are unlikely to last, said Rajeev De Mello, chief investment officer at Gama Asset Management, adding investors could “take advantage of such selloffs, especially in lower liquidity summer trading, and on Friday, to buy risk.”

“However, the equity sector rotation has been brutal and could continue somewhat longer,” he added.

The recent moves into smaller, lower-valuation sectors were precipitated by signs the Federal Reserve will cut interest rates in September, a view cemented by Thursday’s data showing the biggest jobless claims increase since early May, as well as the likelihood of more protectionism under a potential Donald Trump presidency.

“From a big-picture perspective, both the Fed moving towards a rate cut and Trump odds increasing should be risk positive,” said Mohit Kumar, a strategist at Jefferies International Ltd. “But it also meant that investors reconsider their asset and sector allocation as we head into the summer months. Sectors with heavier positioning suffered in the adjustment.”

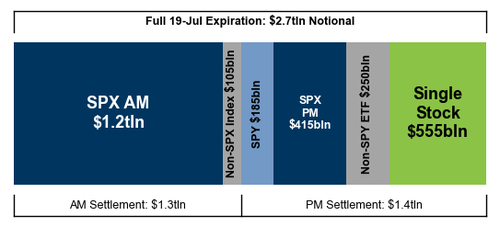

Aside for the global IT outage, it has been light news flow heading into the final day of the week. OPEX today will be the largest July expiry on record - GS estimates $2.7tn of exposure including $555bn of single stock options. This means gamma is about to tumble as the market unclenches.

In Europe, the Stoxx 600 index was down 0.6%, falling for a fifth day. Shares in Air France-KLM, Ryanair Holdings Plc and other airlines fell heavily as flights were either grounded or delayed. LSE Group Plc, which operates the London stock exchange, recouped some of its share-price losses triggered after it said technical issues were preventing news from being published. Sartorius AG plunged 13% after the German electronics maker lowered full-year guidance. Computer-games maker Ubisoft Entertainment SA slid more than 8% after mixed full-year targets, while gaming firm Evolution AB also tumbled after its earnings missed estimates. Here are some of the biggest movers on Friday:

- Danske Bank shares jumped as much as 8% after Denmark’s largest lender unveiled a spate of dividend payouts and net income in the 2Q climbed 17% from a year ago.

- Electrolux gains as much as 11%, the most since April 2023, after the Swedish maker of home appliances reported a better-than-feared second-quarter report, where raw material costs have turned to tailwinds from headwinds, boosting the result.

- Mips shares rise as much as 8.6% as Jefferies upgrades the Swedish helmet component manufacturer to buy from hold, saying it delivered strong results in the second quarter and this positive momentum should continue through the second half of the year.

- Billerud surges as much as 9.6% after the Swedish packaging firm’s earnings beat estimates, with analysts anticipating some upgrades to estimates while highlighting investor concern around higher wood prices.

- Yara shares rise as much as 4.9% after the Norwegian agricultural chemical firm’s second-quarter earnings beat estimates as analysts noted the firm’s cost-cutting initiatives.

- Sartorius shares tumble as much as 15% after the German lab-quipment maker cut its outlook for the year.

- Ubisoft falls as much as 10%, the most in more than two months, after delivering an update that Citi describes as “characteristically messy.”

- Boliden declines as much as 9.3% after the miner reported revenue for the second quarter that missed the average analyst estimate.

- Evolution falls as much as 9.5% after the Swedish online live casino reported a weak set of second-quarter figures which were weighed down by a large customer payout and slower growth across all regions.

- Sopra Steria slides as much as 11% after the French software company issued a warning based on a weaker trajectory for the second half of the year.

- European airlines are losing ground on Friday as several companies from the travel industry deal with widespread technological issues that have delayed operations.

- Kone shares fall as much as 3.2% after the elevator installation company cut full-year guidance and released second-quarter results. Analysts at Jefferies also pointed to the impact of a slowdown in China.

Earlier, Asian stocks declined, with a key regional benchmark on course for its biggest weekly fall since mid-April, amid concerns over geopolitics and China’s economy. The MSCI Asia Pacific Index fell 1.3% Friday, with technology stocks TSMC, Samsung and Tencent among the biggest drags. Hong Kong was the region’s worst performer, with the Hang Seng Index down more than 2%. Equities also declined in South Korea, Australia, Japan and India. The MSCI Asian gauge was headed for a weekly loss of 2.4%.

China’s Third Plenum gave little reason for investors to buy, with few new measures to address weak domestic demand and the ailing property sector. That added to negative sentiment from prospects for tighter US restrictions on tech exports to Asia’s largest nation, as well as heightening tensions with the US as the presidential election looms. The region’s tech stocks have been the biggest losers after strong gains this year. Markets were not excited at the conclusion of China’s policy meeting, with the communique “giving little details on specific reforms, and no mention of any stimulus measures for the economy,” according to a DBS note. “On the positive side, there was agreement to leverage the role of the market, and to lift restrictions while ensuring effective regulation,” the note said.

In FX, the Bloomberg dollar spot index is near flat. JPY and CHF are the strongest performers in G-10 FX, SEK and NOK underperform.

In commodities, WTI drifts 0.1% lower to trade near $82.70. Brent flat at $85.08. Most base metals trade in the red; LME tin falls 2.7%, underperforming peers. Spot gold falls roughly $28 to trade near $2,417/oz. Spot silver loses 1.9% near $29.

In rates, treasuries were little changed amid modest losses in most European bond markets. Treasury 10-year yield is near flat on the day 4.20% with bunds and gilts lagging by 1bp and 3bp in the sector. Curve spreads also remain within a basis point of Thursday’s closing levels. The Bund curve bull-steepens with 2s10s widening 1.5bps. Treasury bull-flattens. Gilt bear-steepens. Peripheral spreads tighten to Germany. Australian 10-year yield rises 6bps, most in two weeks.

Looking at today's calendar, there is no econ data on deck; Fed members scheduled to speak include Williams (10:40am) and Bostic (1pm)

Market Snapshot

- S&P 500 futures up 0.1% at 5,600

- Europe 600 down 0.6% to 511.05

- MXAP down 1.3% to 183.45

- MXAPJ down 1.6% to 569.18

- Nikkei down 0.2% to 40,063.79

- Topix down 0.3% to 2,860.83

- Hang Seng Index down 2.0% to 17,417.68

- Shanghai Composite up 0.2% to 2,982.31

- Sensex down 0.6% to 80,891.22

- Australia S&P/ASX 200 down 0.8% to 7,971.59

- Kospi down 1.0% to 2,795.46

- German 10Y yield little changed at 2.43%

- Euro down 0.1% to $1.0883

- Brent Futures little changed at $85.09/bbl

- Gold spot down 1.0% to $2,421.17

- US Dollar Index up 0.12% to 104.30

Top Overnight News

- Businesses across the world, from airlines to financial services and media groups, were hit by a global IT outage on Friday, causing massive disruption to a wide range of services and operations. According to multiple posts on social media, the outage has been blamed on an update to security software from US group CrowdStrike, which caused a problem with Microsoft’s Windows. A statement shared on social media that was also posted on a site for CrowdStrike’s business customers said: “CrowdStrike is aware of reports of crashes on Windows.” A status update on Friday morning said the company had “determined the underlying cause” — which did not appear to be a cyber attack but a technical problem — and that “the majority of services are now recovered”. However, wider outages remained, with some users on Friday unable to access various of Microsoft’s 365 suite of apps and services. (FT)

- Psident Biden is 'soul searching' amid calls to exit the 2024 race and some Democratic officials said they see a Biden exit from the race as a matter of time: Reuters sources.

- Several people close to President Biden said they believe he has begun to accept the idea that he may not be able to win in November and may have to drop out of the race, The New York Times reported. However, the Biden-Harris campaign co-chair later said that the New York Times report on President Biden is wrong and that Biden can win.

- US President Biden's campaign reportedly called an all-staff meeting on Friday, according to AP. It was separately reported that top Democrats are preparing for a campaign without Biden, according to WSJ.

- Former House Speaker Pelosi told some House Democrats she believes President Biden can be convinced fairly soon to exit the race and told California Democrats Biden is getting close to deciding to abandon his presidential bid: Washington Post.

- Donald Trump said at the RNC that he is running to be president for all of America, not half of America, because there is no victory in winning for half of America, while he said they will achieve a great victory and a new phase towards prosperity will be launched. Trump also stated they will end the devastating inflation crisis immediately and bring down interest rates, as well as noted that they will not allow auto manufacturing plants to be built in Mexico and China. Furthermore, Trump referred to coronavirus as the 'China virus' and said they will not allow other countries to plunder the US.

- Japan’s national CPI for June didn’t deviate too far from expectations, coming in at +2.8% on the headline (flat vs. May and below the Street’s +2.9% forecast) and +2.2% core (up from +2.1% in May and inline w/the Street). RTRS

- Chinese leader Xi Jinping and several hundred other top Communist Party officials huddled in Beijing this week to plot a path forward for their country’s sagging economy. The outline they released after four days of meetings suggests a future that looks more or less like the present. That fidelity to China’s current course signals that Xi remains committed to his vision of state-led development, even as unease festers—among ordinary Chinese and foreign investors—over his stewardship of the world’s second-largest economy. WSJ

- Eurozone wages set to cool according to an ECB survey of businesses (a survey of large companies finds that firms anticipate wages coming in at +4.3% this year and +3.5% in ’25 vs. +5.4% in ’23). WSJ

- Netflix fell as its slightly weaker-than-expected third-quarter revenue forecast overshadowed a big beat on subscribers. RTRS

- Some of Joe Biden’s cabinet discussed whether he should end his reelection bid, people familiar said. Nancy Pelosi told some House Democrats she believes he can be convinced to exit, the WaPo reported. Biden’s campaign team called an all-staff meeting today, the AP said. BBG

- San Francisco Fed chief Mary Daly said some recent inflation data has been good but “we’re not there yet.” She flagged the need for policymakers to focus on both their mandates. BBG

- Hawaiian Electric is said to be among companies tentatively agreeing to pay more than $4 billion to resolve lawsuits from the Maui wildfires. BBG

IT Outage

- Major global IT outages have grounded planes and led to major service disruptions, for the likes of Microsoft (-2.2%) and Nvidia (-1%). A full list of headlines below.

- "Issue at cybersecurity firm CrowdStrike (CRWD) causing major IT problems around the world", according to BNO News.

- London Stock Exchange Group (LSEG LN) is investigating technical issue with RNS announcements; said other services across the group, including London Stock Exchange, continue as normal.

- Microsoft (MSFT) some 365 apps remain in "degraded state", via Bloomberg.

- AWS (AMZN) is investigating reports of connectivity issues related to update to CrowdStrike (CRWD) agent.

- American Airlines (AAL), Delta (DAL) and United Airlines (UAL) grounding all flights due to IT problem, according to ABC.

- Several major oil/gas trading desks in London and Singapore struggle to execute trades amid cyber outage, according to six sources cited by Reuters.

- CrowdStrike (CRWD) said outage resulted from an issue with the latest update, according to CNBC.

- NVIDIA (NVDA) said GeForce is currently experiencing a global outage for linking Xbox accounts with GFN.

- Microsoft (MSFT) said multiple services are "continuing to see improvements"

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly followed suit to the losses on Wall St where sentiment was dampened and the Trump trade was seen in play as President Biden's re-election chances dwindled further after top Democrats suggested he could be persuaded to drop out as soon as this weekend. ASX 200 fell below the 8,000 level with mining stocks leading the broad downturn seen across sectors. Nikkei 225 briefly retreated beneath 40,000 but then pared most of the initial losses to reclaim the key psychological level. Hang Seng and Shanghai Comp. conformed to the downbeat mood with the former pressured by weakness in the real estate industry, while losses in the mainland were stemmed after the PBoC liquidity efforts amounted to a net CNY 1.17tln for its largest weekly cash injection since January, while a CPC official noted the economic recovery is not strong enough and they need to implement macro policies more effectively.

Top Asian News

- Chinese senior party official for policy research said promoting Chinese-style modernisation faces many complex contradictions and problems, but it is necessary and they will improve the modern market system and promote market-oriented reform of factors of production. China will also deepen the reform of state-owned enterprises and will encourage the development and expansion of the private economy.

- Chinese senior party official for economic affairs said China's economic recovery is not strong enough and needs to implement macro policies more effectively, while they should speed up the issuance and use of special bonds and noted that monetary policy should be flexible, moderate, accurate, and effective. Furthermore, China will maintain reasonable and abundant liquidity, while they should increase policy support so that enterprises and consumers tangibly benefit.

- Japanese PM Kishida said need to be cautious about the effects of rising prices due to a weak yen, while he noted the government must be vigilant about the impact of rising prices, driven in part by a weak yen, and on the economy to achieve a domestic demand-driven recovery.

European equities, Stoxx 600 (-0.5%) are entirely in the red, with sentiment hit amid ongoing worldwide IT outages, which have affected banking transactions and flights. European sectors hold a strong negative bias, with the typical defensive sectors performing better, given the glum risk tone. Basic Resources underperforms, amid broader weakness in the metals complex, with Travel & Leisure also hampered by the ongoing IT outages; Lufthansa (-1.9%). US equity futures (ES -0.2%, NQ -0.3%, RTY -0.4%) are entirely in the red, with sentiment hit amid global IT outages following updates at Crowdstrike (-14%), which has impacted the likes of Microsoft (-2.2%) and Nvidia (-1%).

Top European News

- ECB's Muller said rates are sufficiently high to curtail borrowing demand; to cut again need more confidence inflation is going to 2%; we know there is still fluctuation on inflation. Realistic that disinflation continues over next 12 months. "Hard for me to comment how many rate cuts this year." Important to not pre-commit on Sept.

- ECB's Villeroy said disinflation is happening as predicted; inflation will continue to decline a bit slower; there is more uncertainty on growth than a few months ago. Rate decisions will be data-dependent. Watching services inflation carefully. Market expectations on rates seem rather reasonable.

- ECB’s Vasle said decisions will continue to be data dependent, via Econostream.

- ECB's Simkus said no reason for cuts to exceed 25bps each; barring shocks, more easing is "undoubtedly" on the table; no doubt the topic of cut will be discussed in September; agrees with market view of two more cuts in 2024.

- ECB's Rehn said the bank is not pre-committing to any specific rate path

- ECB Survey of Professional Forecasters: inflation to average 2.4% in 2024, 2.0% in 2025; both unchanged from the prior survey

FX

- USD is firmer vs. most peers in a continuation of the price action yesterday which has seen DXY bounce from a 103.65 low to a current peak today at 104.34. Risk aversion is partly behind the price action as well as a general correction from recent losses.

- EUR is softer vs. the broadly firmer USD after the pair slipped onto a 1.08 handle despite the fallout from yesterday's ECB meeting being suggestive of a more cautious approach from policymakers. EUR/USD is now eyeing its weekly low set on Tuesday at 1.0871.

- GBP is a touch softer vs. USD with the pair's 1.3044 print on Wednesday very much in the rear-view mirror. UK retail sales came in softer-than-expected but didn't cause too much of a stir for the GBP.

- JPY relatively stable vs. the USD. For now, the base for the pair sits at 155.36 (printed yesterday) with the pair unable to launch a test of 155; around the European cash open, the JPY caught a slight bid, benefiting from the subdued risk tone, but has since stabilised.

- Antipodeans are both suffering at the hands of the current risk-aversion. AUD/USD has slipped onto a 0.66 handle, with the current session low at 0.6691.

Fixed Income

- USTs are very slightly lower, but faring better than their Transatlantic counterprarts as the Fed heads into its blackout period ahead of next week's meeting (no change expected). The US curve is currently a touch higher with no real flattening or steepening bias.

- Bunds are on the backfoot amid the fallout from yesterday's ECB meeting which was followed up by source reporting from Bloomberg which suggested that the Governing Council may only opt to lower rates one more time this year vs. the two broadly expected by the market.

- Gilts are lagging peers potentially in a bit of a catch-up play from yesterday's action in other global markets. From a fundamental perspective, today's UK Retail Sales came in soft but has had little follow-through into market pricing. Despite the recent downtrend, the UK 10yr yield is still managing to hold above the 4.0% mark

Commodities

- Crude is incrementally softer, but has clambered off lows in recent trade, and currently resides near session highs. Newsflow this morning has been dominated by the system outages caused by cybersecurity firm CrowdStrike, in which major oil/gas trading desks were also affected. In geopolitics, tensions mount as Israeli capital Tel Aviv saw an overnight attack.

- Precious metals are softer across the board amid the rising Dollar, with the deepest losses seen in spot silver, while spot gold pulls back further from record highs. Spot gold sits closer to the bottom of a current USD 2,413-2.445.34/oz parameter.

- Base metals are mostly lower amid the recent rebound of the Dollar coupled with ongoing woes over China's economic health, whilst China's Third Plenum presser only offered vague stimulus language.

Geopolitics

- Israeli officials mull EU and Palestinians running Rafah crossing and if enacted, it would foreshadow an end to the conflict between Israel and Hamas and enable more aid to get into Palestinian territory, according to Bloomberg.

- Israeli media reported smoke rising as a result of an explosion in Tel Aviv caused by an explosive device which was said to be a drone, while Yemen's Houthis said they will reveal details about a military operation that targeted Tel Aviv.

- Houthi's spokesperson said they targeted Tel Aviv "with a new drone bearing the name "Jaffa" capable of bypassing interceptor".

- Israeli military believes Iranian-made drone that hit Tel Aviv was launched from Yemen, according to a spokesperson.

- "IDF: In the coming days, we will discuss options for offensive responses to those who threaten Israel's security", according to Sky News Arabia

US Event Calendar

- Nothing major scheduled

Central Bank Speakers

- 10:40: Fed’s Williams Speaks on Panel on Monetary Policy

- 13:00: Fed’s Bostic Gives Closing Remarks

Global stocks, already hammered by several days of relentless selling in mega-cap tech shares, struggled on Friday as an unprecedented, worldwide computer systems outage hit travel, trading and support services, threatening to exacerbate a pullback in technology stocks. As of 7:00am ET, S&P futures were flat, paring earlier losses, while Nasdaq futures dropped -0.1%. Global markets are also mostly in the red: FTSE -45bps, CAC -55bps, DAX -65bps, Nikkei -16bps, Hang Seng -2.03%, Shanghai +17bps. Cybersecurity firm Crowdstrike plunged as much as 21% in US premarket trading after warning its software was causing computer systems to crash. Its chief executive later said the issue was being fixed. Microsoft shares dropped 2%, though it said it had resolved the cloud-services outage that was blamed for disrupting flights and banks globally. Even the Russell is red this morning as the rotation takes a break. US Treasury yields were unchanged, with the 10Y trading at ~4.21% while the Bloomberg dollar index modestly higher as the yen reverses shallow overnight gains. There is nothing on today’s economic calendar so attention will focus on the fallout from the global IT outage and Trump’s RNC speech.

In premarket trading, IT outages across the globe weighed on several sectors on Friday, including airlines, insurers and stock exchange operators. Shares in Crowdstrike sank 14% after a widely used cybersecurity program crashed, while Microsoft fell 2.0% after separately reporting problems with its cloud services. Here are some other notable movers:

- Bank of America shares slip 0.3% after the lender was cut to neutral from accumulate at Phillip Securities in the wake of its recent earnings and share-price rally, with the broker flagging a number of headwinds.

- Intuitive Surgical shares jump 6.6% after the company’s second-quarter adjusted earnings per share came ahead of consensus estimates. Piper Sandler said this was an “all-around positive” update.

- Netflix shares fell 0.95% after the streaming-video giant’s third-quarter revenue forecast was slightly weaker than expected. However, analysts were largely positive on the print, which showed strong subscriber additions. Netflix shares were up 32% this year going into the report.

- SunPower shares slide 17% as the solar company extends declines after telling dealers it would no longer support new installations and was halting shipments.

Today’s tech disruptions come toward the end of a week that’s seen the Nasdaq shed more than 3%, as investors pulled out of high-flying megacap names and rotated into smaller companies. The Russell 2000 index has risen 2.3% this week. That said, market losses triggered by the outages are unlikely to last, said Rajeev De Mello, chief investment officer at Gama Asset Management, adding investors could “take advantage of such selloffs, especially in lower liquidity summer trading, and on Friday, to buy risk.”

“However, the equity sector rotation has been brutal and could continue somewhat longer,” he added.

The recent moves into smaller, lower-valuation sectors were precipitated by signs the Federal Reserve will cut interest rates in September, a view cemented by Thursday’s data showing the biggest jobless claims increase since early May, as well as the likelihood of more protectionism under a potential Donald Trump presidency.

“From a big-picture perspective, both the Fed moving towards a rate cut and Trump odds increasing should be risk positive,” said Mohit Kumar, a strategist at Jefferies International Ltd. “But it also meant that investors reconsider their asset and sector allocation as we head into the summer months. Sectors with heavier positioning suffered in the adjustment.”

Aside for the global IT outage, it has been light news flow heading into the final day of the week. OPEX today will be the largest July expiry on record – GS estimates $2.7tn of exposure including $555bn of single stock options. This means gamma is about to tumble as the market unclenches.

In Europe, the Stoxx 600 index was down 0.6%, falling for a fifth day. Shares in Air France-KLM, Ryanair Holdings Plc and other airlines fell heavily as flights were either grounded or delayed. LSE Group Plc, which operates the London stock exchange, recouped some of its share-price losses triggered after it said technical issues were preventing news from being published. Sartorius AG plunged 13% after the German electronics maker lowered full-year guidance. Computer-games maker Ubisoft Entertainment SA slid more than 8% after mixed full-year targets, while gaming firm Evolution AB also tumbled after its earnings missed estimates. Here are some of the biggest movers on Friday:

- Danske Bank shares jumped as much as 8% after Denmark’s largest lender unveiled a spate of dividend payouts and net income in the 2Q climbed 17% from a year ago.

- Electrolux gains as much as 11%, the most since April 2023, after the Swedish maker of home appliances reported a better-than-feared second-quarter report, where raw material costs have turned to tailwinds from headwinds, boosting the result.

- Mips shares rise as much as 8.6% as Jefferies upgrades the Swedish helmet component manufacturer to buy from hold, saying it delivered strong results in the second quarter and this positive momentum should continue through the second half of the year.

- Billerud surges as much as 9.6% after the Swedish packaging firm’s earnings beat estimates, with analysts anticipating some upgrades to estimates while highlighting investor concern around higher wood prices.

- Yara shares rise as much as 4.9% after the Norwegian agricultural chemical firm’s second-quarter earnings beat estimates as analysts noted the firm’s cost-cutting initiatives.

- Sartorius shares tumble as much as 15% after the German lab-quipment maker cut its outlook for the year.

- Ubisoft falls as much as 10%, the most in more than two months, after delivering an update that Citi describes as “characteristically messy.”

- Boliden declines as much as 9.3% after the miner reported revenue for the second quarter that missed the average analyst estimate.

- Evolution falls as much as 9.5% after the Swedish online live casino reported a weak set of second-quarter figures which were weighed down by a large customer payout and slower growth across all regions.

- Sopra Steria slides as much as 11% after the French software company issued a warning based on a weaker trajectory for the second half of the year.

- European airlines are losing ground on Friday as several companies from the travel industry deal with widespread technological issues that have delayed operations.

- Kone shares fall as much as 3.2% after the elevator installation company cut full-year guidance and released second-quarter results. Analysts at Jefferies also pointed to the impact of a slowdown in China.

Earlier, Asian stocks declined, with a key regional benchmark on course for its biggest weekly fall since mid-April, amid concerns over geopolitics and China’s economy. The MSCI Asia Pacific Index fell 1.3% Friday, with technology stocks TSMC, Samsung and Tencent among the biggest drags. Hong Kong was the region’s worst performer, with the Hang Seng Index down more than 2%. Equities also declined in South Korea, Australia, Japan and India. The MSCI Asian gauge was headed for a weekly loss of 2.4%.

China’s Third Plenum gave little reason for investors to buy, with few new measures to address weak domestic demand and the ailing property sector. That added to negative sentiment from prospects for tighter US restrictions on tech exports to Asia’s largest nation, as well as heightening tensions with the US as the presidential election looms. The region’s tech stocks have been the biggest losers after strong gains this year. Markets were not excited at the conclusion of China’s policy meeting, with the communique “giving little details on specific reforms, and no mention of any stimulus measures for the economy,” according to a DBS note. “On the positive side, there was agreement to leverage the role of the market, and to lift restrictions while ensuring effective regulation,” the note said.

In FX, the Bloomberg dollar spot index is near flat. JPY and CHF are the strongest performers in G-10 FX, SEK and NOK underperform.

In commodities, WTI drifts 0.1% lower to trade near $82.70. Brent flat at $85.08. Most base metals trade in the red; LME tin falls 2.7%, underperforming peers. Spot gold falls roughly $28 to trade near $2,417/oz. Spot silver loses 1.9% near $29.

In rates, treasuries were little changed amid modest losses in most European bond markets. Treasury 10-year yield is near flat on the day 4.20% with bunds and gilts lagging by 1bp and 3bp in the sector. Curve spreads also remain within a basis point of Thursday’s closing levels. The Bund curve bull-steepens with 2s10s widening 1.5bps. Treasury bull-flattens. Gilt bear-steepens. Peripheral spreads tighten to Germany. Australian 10-year yield rises 6bps, most in two weeks.

Looking at today’s calendar, there is no econ data on deck; Fed members scheduled to speak include Williams (10:40am) and Bostic (1pm)

Market Snapshot

- S&P 500 futures up 0.1% at 5,600

- Europe 600 down 0.6% to 511.05

- MXAP down 1.3% to 183.45

- MXAPJ down 1.6% to 569.18

- Nikkei down 0.2% to 40,063.79

- Topix down 0.3% to 2,860.83

- Hang Seng Index down 2.0% to 17,417.68

- Shanghai Composite up 0.2% to 2,982.31

- Sensex down 0.6% to 80,891.22

- Australia S&P/ASX 200 down 0.8% to 7,971.59

- Kospi down 1.0% to 2,795.46

- German 10Y yield little changed at 2.43%

- Euro down 0.1% to $1.0883

- Brent Futures little changed at $85.09/bbl

- Gold spot down 1.0% to $2,421.17

- US Dollar Index up 0.12% to 104.30

Top Overnight News

- Businesses across the world, from airlines to financial services and media groups, were hit by a global IT outage on Friday, causing massive disruption to a wide range of services and operations. According to multiple posts on social media, the outage has been blamed on an update to security software from US group CrowdStrike, which caused a problem with Microsoft’s Windows. A statement shared on social media that was also posted on a site for CrowdStrike’s business customers said: “CrowdStrike is aware of reports of crashes on Windows.” A status update on Friday morning said the company had “determined the underlying cause” — which did not appear to be a cyber attack but a technical problem — and that “the majority of services are now recovered”. However, wider outages remained, with some users on Friday unable to access various of Microsoft’s 365 suite of apps and services. (FT)

- Psident Biden is ‘soul searching’ amid calls to exit the 2024 race and some Democratic officials said they see a Biden exit from the race as a matter of time: Reuters sources.

- Several people close to President Biden said they believe he has begun to accept the idea that he may not be able to win in November and may have to drop out of the race, The New York Times reported. However, the Biden-Harris campaign co-chair later said that the New York Times report on President Biden is wrong and that Biden can win.

- US President Biden’s campaign reportedly called an all-staff meeting on Friday, according to AP. It was separately reported that top Democrats are preparing for a campaign without Biden, according to WSJ.

- Former House Speaker Pelosi told some House Democrats she believes President Biden can be convinced fairly soon to exit the race and told California Democrats Biden is getting close to deciding to abandon his presidential bid: Washington Post.

- Donald Trump said at the RNC that he is running to be president for all of America, not half of America, because there is no victory in winning for half of America, while he said they will achieve a great victory and a new phase towards prosperity will be launched. Trump also stated they will end the devastating inflation crisis immediately and bring down interest rates, as well as noted that they will not allow auto manufacturing plants to be built in Mexico and China. Furthermore, Trump referred to coronavirus as the ‘China virus’ and said they will not allow other countries to plunder the US.

- Japan’s national CPI for June didn’t deviate too far from expectations, coming in at +2.8% on the headline (flat vs. May and below the Street’s +2.9% forecast) and +2.2% core (up from +2.1% in May and inline w/the Street). RTRS

- Chinese leader Xi Jinping and several hundred other top Communist Party officials huddled in Beijing this week to plot a path forward for their country’s sagging economy. The outline they released after four days of meetings suggests a future that looks more or less like the present. That fidelity to China’s current course signals that Xi remains committed to his vision of state-led development, even as unease festers—among ordinary Chinese and foreign investors—over his stewardship of the world’s second-largest economy. WSJ

- Eurozone wages set to cool according to an ECB survey of businesses (a survey of large companies finds that firms anticipate wages coming in at +4.3% this year and +3.5% in ’25 vs. +5.4% in ’23). WSJ

- Netflix fell as its slightly weaker-than-expected third-quarter revenue forecast overshadowed a big beat on subscribers. RTRS

- Some of Joe Biden’s cabinet discussed whether he should end his reelection bid, people familiar said. Nancy Pelosi told some House Democrats she believes he can be convinced to exit, the WaPo reported. Biden’s campaign team called an all-staff meeting today, the AP said. BBG

- San Francisco Fed chief Mary Daly said some recent inflation data has been good but “we’re not there yet.” She flagged the need for policymakers to focus on both their mandates. BBG

- Hawaiian Electric is said to be among companies tentatively agreeing to pay more than $4 billion to resolve lawsuits from the Maui wildfires. BBG

IT Outage

- Major global IT outages have grounded planes and led to major service disruptions, for the likes of Microsoft (-2.2%) and Nvidia (-1%). A full list of headlines below.

- “Issue at cybersecurity firm CrowdStrike (CRWD) causing major IT problems around the world”, according to BNO News.

- London Stock Exchange Group (LSEG LN) is investigating technical issue with RNS announcements; said other services across the group, including London Stock Exchange, continue as normal.

- Microsoft (MSFT) some 365 apps remain in “degraded state”, via Bloomberg.

- AWS (AMZN) is investigating reports of connectivity issues related to update to CrowdStrike (CRWD) agent.

- American Airlines (AAL), Delta (DAL) and United Airlines (UAL) grounding all flights due to IT problem, according to ABC.

- Several major oil/gas trading desks in London and Singapore struggle to execute trades amid cyber outage, according to six sources cited by Reuters.

- CrowdStrike (CRWD) said outage resulted from an issue with the latest update, according to CNBC.

- NVIDIA (NVDA) said GeForce is currently experiencing a global outage for linking Xbox accounts with GFN.

- Microsoft (MSFT) said multiple services are “continuing to see improvements”

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly followed suit to the losses on Wall St where sentiment was dampened and the Trump trade was seen in play as President Biden’s re-election chances dwindled further after top Democrats suggested he could be persuaded to drop out as soon as this weekend. ASX 200 fell below the 8,000 level with mining stocks leading the broad downturn seen across sectors. Nikkei 225 briefly retreated beneath 40,000 but then pared most of the initial losses to reclaim the key psychological level. Hang Seng and Shanghai Comp. conformed to the downbeat mood with the former pressured by weakness in the real estate industry, while losses in the mainland were stemmed after the PBoC liquidity efforts amounted to a net CNY 1.17tln for its largest weekly cash injection since January, while a CPC official noted the economic recovery is not strong enough and they need to implement macro policies more effectively.

Top Asian News

- Chinese senior party official for policy research said promoting Chinese-style modernisation faces many complex contradictions and problems, but it is necessary and they will improve the modern market system and promote market-oriented reform of factors of production. China will also deepen the reform of state-owned enterprises and will encourage the development and expansion of the private economy.

- Chinese senior party official for economic affairs said China’s economic recovery is not strong enough and needs to implement macro policies more effectively, while they should speed up the issuance and use of special bonds and noted that monetary policy should be flexible, moderate, accurate, and effective. Furthermore, China will maintain reasonable and abundant liquidity, while they should increase policy support so that enterprises and consumers tangibly benefit.

- Japanese PM Kishida said need to be cautious about the effects of rising prices due to a weak yen, while he noted the government must be vigilant about the impact of rising prices, driven in part by a weak yen, and on the economy to achieve a domestic demand-driven recovery.

European equities, Stoxx 600 (-0.5%) are entirely in the red, with sentiment hit amid ongoing worldwide IT outages, which have affected banking transactions and flights. European sectors hold a strong negative bias, with the typical defensive sectors performing better, given the glum risk tone. Basic Resources underperforms, amid broader weakness in the metals complex, with Travel & Leisure also hampered by the ongoing IT outages; Lufthansa (-1.9%). US equity futures (ES -0.2%, NQ -0.3%, RTY -0.4%) are entirely in the red, with sentiment hit amid global IT outages following updates at Crowdstrike (-14%), which has impacted the likes of Microsoft (-2.2%) and Nvidia (-1%).

Top European News

- ECB’s Muller said rates are sufficiently high to curtail borrowing demand; to cut again need more confidence inflation is going to 2%; we know there is still fluctuation on inflation. Realistic that disinflation continues over next 12 months. “Hard for me to comment how many rate cuts this year.” Important to not pre-commit on Sept.

- ECB’s Villeroy said disinflation is happening as predicted; inflation will continue to decline a bit slower; there is more uncertainty on growth than a few months ago. Rate decisions will be data-dependent. Watching services inflation carefully. Market expectations on rates seem rather reasonable.

- ECB’s Vasle said decisions will continue to be data dependent, via Econostream.

- ECB’s Simkus said no reason for cuts to exceed 25bps each; barring shocks, more easing is “undoubtedly” on the table; no doubt the topic of cut will be discussed in September; agrees with market view of two more cuts in 2024.

- ECB’s Rehn said the bank is not pre-committing to any specific rate path

- ECB Survey of Professional Forecasters: inflation to average 2.4% in 2024, 2.0% in 2025; both unchanged from the prior survey

FX

- USD is firmer vs. most peers in a continuation of the price action yesterday which has seen DXY bounce from a 103.65 low to a current peak today at 104.34. Risk aversion is partly behind the price action as well as a general correction from recent losses.

- EUR is softer vs. the broadly firmer USD after the pair slipped onto a 1.08 handle despite the fallout from yesterday’s ECB meeting being suggestive of a more cautious approach from policymakers. EUR/USD is now eyeing its weekly low set on Tuesday at 1.0871.

- GBP is a touch softer vs. USD with the pair’s 1.3044 print on Wednesday very much in the rear-view mirror. UK retail sales came in softer-than-expected but didn’t cause too much of a stir for the GBP.

- JPY relatively stable vs. the USD. For now, the base for the pair sits at 155.36 (printed yesterday) with the pair unable to launch a test of 155; around the European cash open, the JPY caught a slight bid, benefiting from the subdued risk tone, but has since stabilised.

- Antipodeans are both suffering at the hands of the current risk-aversion. AUD/USD has slipped onto a 0.66 handle, with the current session low at 0.6691.

Fixed Income

- USTs are very slightly lower, but faring better than their Transatlantic counterprarts as the Fed heads into its blackout period ahead of next week’s meeting (no change expected). The US curve is currently a touch higher with no real flattening or steepening bias.

- Bunds are on the backfoot amid the fallout from yesterday’s ECB meeting which was followed up by source reporting from Bloomberg which suggested that the Governing Council may only opt to lower rates one more time this year vs. the two broadly expected by the market.

- Gilts are lagging peers potentially in a bit of a catch-up play from yesterday’s action in other global markets. From a fundamental perspective, today’s UK Retail Sales came in soft but has had little follow-through into market pricing. Despite the recent downtrend, the UK 10yr yield is still managing to hold above the 4.0% mark

Commodities

- Crude is incrementally softer, but has clambered off lows in recent trade, and currently resides near session highs. Newsflow this morning has been dominated by the system outages caused by cybersecurity firm CrowdStrike, in which major oil/gas trading desks were also affected. In geopolitics, tensions mount as Israeli capital Tel Aviv saw an overnight attack.

- Precious metals are softer across the board amid the rising Dollar, with the deepest losses seen in spot silver, while spot gold pulls back further from record highs. Spot gold sits closer to the bottom of a current USD 2,413-2.445.34/oz parameter.

- Base metals are mostly lower amid the recent rebound of the Dollar coupled with ongoing woes over China’s economic health, whilst China’s Third Plenum presser only offered vague stimulus language.

Geopolitics

- Israeli officials mull EU and Palestinians running Rafah crossing and if enacted, it would foreshadow an end to the conflict between Israel and Hamas and enable more aid to get into Palestinian territory, according to Bloomberg.

- Israeli media reported smoke rising as a result of an explosion in Tel Aviv caused by an explosive device which was said to be a drone, while Yemen’s Houthis said they will reveal details about a military operation that targeted Tel Aviv.

- Houthi’s spokesperson said they targeted Tel Aviv “with a new drone bearing the name “Jaffa” capable of bypassing interceptor”.

- Israeli military believes Iranian-made drone that hit Tel Aviv was launched from Yemen, according to a spokesperson.

- “IDF: In the coming days, we will discuss options for offensive responses to those who threaten Israel’s security”, according to Sky News Arabia

US Event Calendar

- Nothing major scheduled

Central Bank Speakers

- 10:40: Fed’s Williams Speaks on Panel on Monetary Policy

- 13:00: Fed’s Bostic Gives Closing Remarks

Loading…