After several days of rollercoaster volatility and uniform pain across global equity markets for bulls, US equity futures are flat as the global sell-off stabilizes into the most important macro data releases. As of 8:00am ET S&P futures are up 0.1% and Nasdaq futs are flat, with NVDA +40bps premarket, TSLA rising 2.3% while the balance of Mag7 is weaker and Semis under pressure, too. Europe’s Stoxx 600 index dropped 0.3%, with China-facing luxury stocks such as LVMH again among the biggest losers. Asian equities erased most gains after declines in Hong Kong and Japan. Bond yields are 1bps higher, but the USD is weaker as the yen gained overnight following unexpectedly strong - if transitory - Japanese wage data. Commodities are stronger led by Energy and precious metals while iron ore slumped to its lowest level since 2022 and traded near $90 a ton as China’s main steel industry group advised mills to be cautious in boosting output too quickly to avoid snuffing out a post-summer recovery. Looking at the coming FOMC decision, 50bps bets are increasing, rising as high as 50% after yesterday's dismal JOLTS report, as the growth component of the Goldilocks narrative is challenged. ISM-Services today and NFP tomorrow are key facets of the narrative and we should leave for the weekend with a stronger sense of 25bps or 50bps.

In premarket trading, Frontier Communications fell 9.9% after agreeing to be purchased in a take under by Verizon Communications. Tesla gained 3% on plans to launch the advanced driver assistance system that it calls Full Self Driving technology in China and Europe in the first quarter of next year, pending regulatory approvals. Meanwhile, the company with the luckiest ticker,C3.ai (better known for its AI ticker) was not so lucky, and tumbled 19% to a new 2024 low after the software company reported 1Q subscription revenue that’s weaker than expected. Here are some other premarket movers:

- ChargePoint (CHPT) falls 7.7% as the operator of the largest electric vehicle charging network in the US plans to cut 15% of its workforce after missing revenue forecasts.

- Copart (CPRT) slips 5.7% after posting 4Q operating income that missed estimates.

- Frontier Communications (FYBR) falls 9.9% after agreeing to be purchased by Verizon Communications.

- Fortive (FTV) rises 4% after confirming plans to pursue a spinoff of its Precision Technologies segment.

- JetBlue (JBLU) rises 5% after boosting its revenue forecast for the third quarter.

- PagSeguro (PAGS) and StoneCo (STNE) fall after Morgan Stanley downgraded the Brazilian digital payments companies, saying the market has likely reached saturation. PagSeguro declines 8.5% and StoneCo drops 8.3%.

- Hewlett Packard Enterprise (HPE) slips 3% after the computer hardware and storage company reported weaker-than-expected margins.

- NIO ADRs (NIO) gain 3.5% after the automaker reported 2Q gross margin that came ahead of estimates.

- Verint (VRNT) tumbles 11% after the customer-service software firm reported second-quarter profit and revenue that fell short of estimates.

After yesterday's catastrophic JOLTS report, traders will look to weekly jobless claims data due later today and Friday’s nonfarm payrolls reports to assess whether the US economy is heading for a soft-landing as the Fed prepares to start easing policy. Global stocks suffered their worst losses earlier this week since the Aug. 5 meltdown, with VIX remaining elevated at 20. Swap traders have ramped up bets on the pace of rate cuts after a Wednesday reading on US job openings trailed estimates and the Fed’s Beige Book survey showed flat or declining economic activity. Rates pricing foresees at least 100 basis points of easing this year, including one jumbo cut of 50 basis points.

“We think that the US soft landing scenario is intact but acknowledge that the next two-three months could be a tricky period,” Eddy Loh, chief investment officer at Maybank Group Wealth Management, said on Bloomberg Television. “If the Fed were to cut 50 basis points, the market could perceive it as a negative because that means the Fed is seeing something in the economy.”

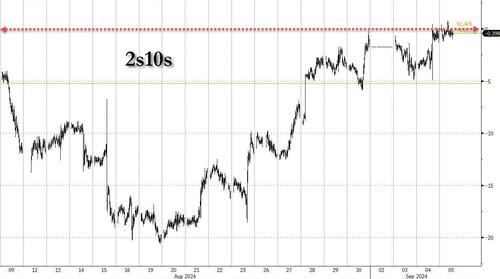

The yield on 2-year Treasuries rose 2bps after tumbling Wednesday on the data showing a slowdown in the US labor market and leading to the first 2s10s yield curve disinversion in 27 months. This morning the 2s10s flirted with the unchanged level, and was last 0.4bps.

US interest rates will settle in a range of between 3% and 4%, according to Oaktree Capital Management LP’s Howard Marks.

“The Fed will back off from the emergency rate of five and a quarter, five and a half and get down into the threes,” Marks, the co-chairman and co-founder of Oaktree said at a conference in Melbourne Thursday. “But my point to you, my belief is that we’re going to stay there in the threes and we’re not going back to zero or a half or one.”

European stocks fell to their lowest in around two weeks as global growth concerns continue to dampen investor sentiment ahead of the US jobs report on Friday. The Stoxx 600 was down 0.2%, led by losses in luxury stocks such as LVMH; consumer product, industrial and technology names also slumped. Here are the biggest movers Thursday:

- Asos shares jump as much as 19%, the most intraday since January 2023, after agreeing to sell control of its Topshop and Topman brands to a company controlled by Denmark’s Holch Povlsen family. The online fashion retailer also announced refinancing moves

- BioMerieux gains as much as 5.5% after the French medical technology firm slightly boosted its guidance

- Lanxess shares rise as much as 4.4% as the German specialty chemicals firm was double-upgraded by Morgan Stanley, which cited investment de-gearing and lower gas prices

- Ashmore rises as much as 4.6%, reversing an earlier decline, as analysts note a more positive outlook for the emerging-markets specialist fund house

- Vistry Group shares rise as much as 7.1%, the most since March 14, after the UK housebuilder reported 1H revenue and profit growth following a shift in strategy

- Jet2 shares rise as much as 2.1%, reversing losses in earlier trading, as analysts are positive about the trajectory of bookings of the package holiday provider

- European luxury stocks slide after Bloomberg reported that LVMH’s Tiffany brand is planning to downsize a flagship store in Shanghai, fueling broader conserns about a slowdown in luxury demand in China. LVMH, Hermes and Kering fell

- Grifols Class B shares slumped after a report that Brookfield will seek to pay less for that series of stock in its planned takeover offer for the Spanish blood-plasma company

- AB Foods drops as much as 5.8%, the most since April 2023, after the company warned sales growth at Primark was negatively impacted by poor weather conditions

- Tomra falls as much as 10%, the most since October 2023, after the Norwegian recycling technology firm published new financial targets

- Genus drops as much as 5.1% after the livestock breeding specialist releases its full-year results, with the company only cautiously guiding for improving markets

Earlier in the session, Asian equities erased most gains after declines in Hong Kong and Japan even as key chipmaker shares rebounded from a Wednesday selloff sparked by concerns the artificial intelligence rally is overheating. The MSCI Asia Pacific Index rose 0.1%, with Nvidia suppliers TSMC and SK Hynix among the biggest boosts. It had added as much as 0.8% earlier in the session before erasing the advance. Taiwan’s Taiex index added 0.5% while Japanese stocks slumped as the yen strengthened. Asian stocks are “seeing flows out of Japan into other markets as hot wage data increases the likelihood of further tightening by the Bank of Japan,” said Matthew Haupt, a portfolio manager at Wilson Asset Management. A bigger divergence between the Fed and BOJ may spark “some more volatility,” he added.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Norwegian krone tops the G-10 FX leader board, rising 0.3%. The Japanese yen is not far behind, with a 0.2% gain.

In rates, treasuries dip, paring some of Wednesday’s post-JOLTS rally with US 10-year yields rising 1 basis point to 3.76%; the US lags little-changed bunds and gilts during European morning. Yields are higher by 1bp-2bp across the curve with front-end and belly underperforming slightly, leaving 2s10s spread around -0.5bp after disinverting Wednesday for only the second time since 2022. Focal points of US session include weekly jobless claims, August ADP employment change and August ISM services gauge.

In commodities, brent crude futures were heading for the first day of gains in five, with OPEC+ getting closer to an agreement on delaying an increase in oil production. WTI rose 1% to $69.90 while Brent was trading just above $73. Iron ore slumped to its lowest level since 2022 and traded near $90 a ton as China’s main steel industry group advised mills to be cautious in boosting output too quickly to avoid snuffing out a post-summer recovery. Spot gold rises $20 to around $2,516/oz.

Looking at the calendar, US economic data calendar includes August Challenger job cuts (7:30am), ADP employment change (8:15am), 2Q final nonfarm productivity and weekly jobless claims (8:30am), August final S&P Global US services PMI (9:45am) and ISM services index (10am). No Fed speakers are scheduled; Williams and Waller are slated to speak Friday

Market Snapshot

- S&P 500 futures little changed at 5,534.75

- STOXX Europe 600 down 0.1% to 514.22

- MXAP up 0.1% to 181.97

- MXAPJ up 0.4% to 563.99

- Nikkei down 1.1% to 36,657.09

- Topix down 0.5% to 2,620.76

- Hang Seng Index little changed at 17,444.30

- Shanghai Composite up 0.1% to 2,788.31

- Sensex down 0.1% to 82,245.54

- Australia S&P/ASX 200 up 0.4% to 7,982.38

- Kospi down 0.2% to 2,575.50

- German 10Y yield unchanged at 2.22%

- Euro up 0.1% to $1.1094

- Brent Futures up 0.7% to $73.23/bbl

- Brent Futures up 0.7% to $73.21/bbl

- Gold spot up 0.7% to $2,513.92

- US Dollar Index down 0.16% to 101.20

Top Overnight News

- President in absentia Joe Biden is due to speak on economic policy on Thursday 5th September at 16:00 ET

- Japan-US business council says they are very alarmed by any attempts to politicise the committee on foreign investments in the US review process, regarding US Steel and Nippon

Verizon to acquire Frontier Communications; deal valued at USD 20bln, all-cash - Japan’s wage numbers for July cool vs. June, but come in ahead of expectations (the real wage figure came in at +0.4% for Jul, down from +1.1% in June but above the Street’s -0.6% forecast). RTRS

- BOJ official says the central bank must be mindful of avoiding undue market volatility as it proceeds with its tightening agenda. RTRS

- China still sees some room to lower the amount of cash banks must hold as reserves, a central bank official said on Thursday, adding that the lender will continue to implement policies to support the economic recovery. RTRS

- AstraZeneca staff were detained in China over potential illegal activities involving data collection and drug imports. BBG

- Russia has been forced to start storing gas from Vladimir Putin’s flagship Arctic project, in a sign that western sanctions are deterring buyers. According to ship-tracking data and satellite images, three vessels have shipped liquefied natural gas from the Arctic LNG 2, which is under US sanctions, since it started loading operations last month. FT

- Hostage killings and irreconcilable demands complicate Gaza cease-fire talks. Frustrated mediators are now putting together what they have described as a “final offer,” but significant concessions on both sides are needed for agreement, said a U.S. official. WaPo

- US crude stockpiles slumped by 7.4 million barrels last week, API data is said to show, pushing oil prices higher. That would bring holdings to the lowest in 11 months, if confirmed by the EIA. Crude may benefit further if OPEC+ delays its plan to to boost output. BBG

- Rate options traders stepped up wagers that the Fed will start its easing cycle with a 50-bp cut. Oaktree’s Howard Marks said rates will settle in a 3-4% range, but won’t go lower. Rate reductions are needed to keep the labor market healthy, according to the Fed’s Mary Daly. BBG

- Auto sales in the US cooled in Aug vs. Jul due to difficult comparisons (Jul was boosted from a recovery from an industry-wide cyberattack) and elevated interest rates. Marketwatch

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed following the earlier mild regional gains, with the overall market tone tentative ahead of a slew of US data ahead of NFP on Friday. ASX 200 was kept afloat by its Tech and Real Estate sectors whilst Energy resided at the bottom. Nikkei 225 was choppy on either side of 37k as it saw initial pressure amid the stronger JPY, with the index later entirely trimming losses, only to falter once again. Hang Seng and Shanghai Comp were mixed for most of the session, Hang Seng initially saw modest gains with Banks and Real Estate initially supported following reports China mulls cutting mortgage rates in two steps to shield banks, via Bloomberg sources. That being said, the mood later waned despite a lack of catalysts, although pre-market reports suggested JPMorgan cut China stocks to Neutral from Overweight.

Top Asian news

- PBoC official says there is still some room for cutting the RRR. Face some constraints in further cutting deposit/lending rates. Will reasonably set the strength and pace of policy adjustments based on the economic recovery.

- JPMorgan cut China stocks to Neutral from Overweight.

- PBoC injected CNY 63.3bln via 7-day Reverse Repo at maintained rate of 1.70%

- BoJ Board Member Takata said Japan's economy is recovering moderately, though some weak signs are evident; notes significant volatility in stock and FX markets but maintains that achieving the inflation target remains within reach, and BoJ must be vigilant to the chance of renewed wave of price hikes, while taking into account impact of yen rise in early August, according to Reuters. He noted it is hard to debate at this stage to what degree BoJ can shrink its balance sheet, and hard to pin down the precise level of Japan's natural rate of interest. He said Japan's current real interest rate is below the estimated natural rate of interest, which means monetary conditions remain accommodative and the fallout from market turbulence in early August remains, "so we must scrutinize the impact for the time being". He noted the BoJ must adjust monetary conditions by 'another gear' if we can confirm that firms will continue to increase capex, wages and prices, and won't hike policy rates with a pre-set level of neutral interest rate in mind. BoJ's decision to reduce bond buying won't hugely affect the impact of monetary easing, but marks a big turning point from when the central bank had YCC in place, and markets stabilizing after some turbulence, but must watch market developments with a very strong sense of urgency.

- BoJ to hold meeting on market operations on October 16th from 17:30 local time, according to Reuters.

- RBA Governor Bullock repeated that it is premature to be thinking about rate cuts; as of now, the board does not expect to be in a position to cut rates in the near term. She noted the RBA's highest priority has been and remains to bring inflation down, and the Board remains vigilant to upside risks to inflation, whilst the RBA's full employment goal is not served by letting inflation stay above target indefinitely. She noted substantial uncertainty around the central outlook, with risks on both sides and if circumstances change, the board will respond accordingly. Bullock said the labour market remains relatively tight, expected to ease gradually, and labour cost growth is strong reflecting wage increases, and weak productivity. She warned key drivers of elevated inflation are housing costs, market services, and CPI rents inflation is likely to be high for some time. Bullock said need to see results on inflation before lowering rates; board is not going to focus on one inflation number, and slightly elevated AUD is positive for inflation fight.

European bourses, Stoxx 600 (U/C) began the session entirely in the red, but sentiment improved soon after the cash open, with indices now displaying more of a mixed picture. European sectors are mixed, having opened with a negative bias. Utilities takes the top spot, alongside Real Estate whilst Consumer Products lags. US Equity Futures (ES U/C, NQ -0.1%, RTY -0.1%) are mixed, but with sentiment seemingly stabilising after this week's glum price action. Today’s docket is packed with key US data; jobs (Challenger Layoffs, ADP, IJC), activity (PMIs, ISM Services).

Top European news

- ASML (ASML NA) CEO repeated 2024 and 2025 guidance and said the chip market recovery is uneven.

- BoE Monthly Decision Maker Panel data August 2024; inflation expectations 1-yr 2.7% (prev. 2.7%); 3-yr 2.7% (prev. 2.7%)

FX

- DXY is slightly lower and trading within a narrow 101.14-35 range and towards the bottom end of the prior day’s confines. A busy US data slate ahead; US Challenger Layoffs kicks things off, ahead of ADP Employment, IJC, PMI (F) and the key ISM Services data

- EUR is incrementally firmer and trading towards the upper end of today’s 1.1076-1.11 range. Today’s much stronger-than-expected Industrials Orders sparked modest strength in the Single-Currency, whilst EZ Construction PMIs passed through without having an impact.

- GBP is trading on a slightly firmer footing and near today’s high at 1.3172; UK-specific newsflow light.

- JPY is slightly firmer, having pared most of its early morning strength, largely a factor of a more improved risk-tone vs the prior 2 sessions. Overnight strength was also a factor of a higher-than-expected Labour Cash Earnings print.

- Antipodeans are flat/firmer, in what has been a lacklustre session for the pair thus far.

- PBoC set USD/CNY mid-point at 7.0989 vs exp. 7.1010 (prev. 7.1148); strongest level since Apr 15th

- Reuters Poll, FX: bullish bets have increased for most Asian FX.

Fixed Income

- USTs are flat ahead of a packed and potentially pivotal afternoon agenda. From which, the labour market data points will take centre stage and be scrutinised in the context of Friday’s Payrolls. USTs are just off Wednesday’s JOLTS-driven highs at 114-18.

- Bunds ultimately trade lower, but with price action choppy. Modest two-way action was seen on the latest German Industrial Orders, which came in significantly above forecasts. Bunds are yet to make much headway above the 134.00 mark, current high at 134.26.

- Gilts are slightly firmer, but ultimately rangebound ahead of the busy data docket. A strong UK auction had little impact on the benchmark. Gilts are holding just above Wednesday’s 99.53 high.

- OATs were weighed on by a hefty supply docket from both France and Spain; both passed without any real reaction.

- Spain sells EUR 6bln vs exp. EUR 5-6bln 2.50% 2027, 3.50% 2029, 3.45% 2034 Bono & EUR vs exp. EUR 0.25-0.75bln 1.00% 2030 I/L:

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.29x (prev. 2.87x), average yield 3.811% (prev. 3.854%) & tail 0.9bps (prev. 0.9bps)

- France sells EUR 11.99bln vs exp. 10-12bln 3.0% 2034, 1.25% 2036, 0.5% 2040 and 3.25% 2055 OATs:

Commodities

- Crude is firmer, having found a bit of a floor from the marked declines WTD. A slight recovery was assisted by the private inventory report last night. Brent'Nov as high as USD 73.46/bbl.

- Spot gold is back above USD 2500/oz, benefitting from pressure in the USD and the relatively contained yield environment/risk tone in western markets; notable, further support stemming from China where yields are pressured by RRR talk from the PBoC.

- Base metals are benefitting from the steady risk tone and softer USD. Though, as with precious peers, it remains to be seen what the macro backdrop will be following the afternoon’s US data deluge.

- US Private Inventory (bbls): Crude -7.4mln (exp. -1.0mln), Distillate -0.4mln (exp. +0.5mln), Gasoline -0.3mln (exp. -0.7mln), Cushing -0.8mln (prev. -0.49mln).

- Russian President Putin on expiration of deal on Russian gas to Europe via Ukraine after Dec 31 2024, "we do reject this transit, seek to maintain gas supply contracts, if Ukraine ditches this transit we cannot force it to keep it"

- UAE's ADNOC sets the October Murban OSP at USD 77.94/bbl.

Geopolitics

- White House reportedly scrambling to put forward a new Israel-Hamas proposal; draft accord could come next week or sooner; there is a strong perception that a ceasefire is slipping away, according to Reuters sources.

US Event Calendar

- 07:30: Aug. Challenger Job Cuts YoY 1.0%, prior 9.2%

- 08:15: Aug. ADP Employment Change, est. 145,000, prior 122,000

- 08:30: 2Q Unit Labor Costs, est. 0.8%, prior 0.9%

- 2Q Nonfarm Productivity, est. 2.5%, prior 2.3%

- 08:30: Aug. Initial Jobless Claims, est. 230,000, prior 231,000

- Aug. Continuing Claims, est. 1.87m, prior 1.87m

- 09:45: Aug. S&P Global US Services PMI, est. 55.1, prior 55.2

- 09:45: Aug. S&P Global US Composite PMI, est. 54.0, prior 54.1

- 10:00: Aug. ISM Services New Orders, est. 51.9, prior 52.4

DB's Jim Reid concludes the overnight wrap

A cloud has lifted over our house as the kids were all back to school yesterday after a long and feral summer. To be fair Maisie is a wonderful girl and the twins are good boys individually. However together at home the twins are never more than 20 minutes away from a fight, bruises, scratches, and manic tears. 2 minutes later it's high pitched laughter and co-scheming. Repeat to fade. It is draining. At school they all behave impeccably so I’m lobbying for it to become a boarding school asap.

Clouds continue over markets though with global bond yields continuing to tumble yesterday, as another batch of weak US data fuelled expectations that the Fed might cut rates by 50bps in just under two weeks. That led to some very significant market moves, with the 2s10s curve ending the day around the zero level for the first time in the last 2 years. We briefly traded in positive territory yesterday but haven't closed above zero since July 2022. This is the longest ever inversion for the 2s10s curve in available data stretching back well over 60 years. Given that inversions have historically been a leading indicator of recessions, the re-steepening has previously led to suggestions that removing such an environment means a recession would now be less likely to happen. But sadly, the historic precedent isn’t particularly favourable on this front, as in previous cycles the final stage before the recession was actually a re-steepening of the curve back into positive territory. So we have to be cautious in being too optimistic about waving bye to an inversion. Henry wrote about this pattern last year, with a few charts on how this played out in previous cycles (link here).

The trigger for yesterday's moves was the latest US JOLTS report of job openings, which showed that the labour market was weakening faster than previously thought. For instance, the number of job openings fell to a three-and-a-half year low of 7.673m in July (vs. 8.1m expected). And if you look at the ratio of job openings per unemployed individuals, that also fell back to 1.07, which is now beneath its pre-Covid levels in 2019. So there’s growing evidence that the labour market is still weakening, backing up Chair Powell’s point at Jackson Hole that “labor market conditions are now less tight than just before the pandemic in 2019”.

To be fair, it wasn’t all bad news from the report. The hires rate ticked back up to 3.5% in July, and the quits rate of those voluntarily leaving their jobs also rose to 2.1%. Moreover, we should bear in mind that this is still covering July, the same month as with the underwhelming jobs report a month ago, rather than a new period since then. So all eyes will remain on tomorrow’s jobs report for August to see if that deterioration continues, or whether the weaker July numbers look like more of a blip. Ahead of that today's services ISM will take on added significance given the nerves around at the moment.

After the JOLTS report, investors dialled up the chance that the Fed would cut by 50bps in September, and futures were giving that a 44% chance by the close (up +7pps). That’s the highest probability on 50bps since August 13 and is now back close to a 50-50 call. Investors also moved to price in a more dovish rates path over the months ahead as well. For example, there are now 111bps of cuts priced in by the December meeting, up from 102bps the previous day.

With more rapid cuts being priced in, US Treasury yields fell across the curve, and the 2yr yield (-10.9bps) fell to 3.76%, which is its lowest closing level since September 2022. The 10yr yield (-7.6ps) also fell to 3.76% also, which is its lowest close since July 2023 and marks the first time since July 2022 that the 2s10s slope has uninverted. Breakevens led the decline in yields with the 10yr (-5.2bps) ending the day at 2.06%, less than 1bp above its early August lows and otherwise its lowest level since January 2021. Over in Europe it was much the same story as well, with yields on 10yr bunds (-5.3bps), OATs (-6.7bps) and BTPs (-8.8bps) all falling back.

Alongside the JOLTS report, a few other factors supported that move to price in faster rate cuts. The first was the continued fall in oil prices, which is taking away one source of inflationary pressure. Indeed, yesterday saw Brent crude oil prices (-1.42%) fall for the fourth day in a row to $72.70/bbl, which is their lowest level since June 2023. This decline came even as Reuters reported that OPEC+ was close to agreeing a delay to the increase in oil production planned for October. The second came from the Bank of Canada, who cut rates by 25bps for a third consecutive meeting, in line with expectations. Significantly, Governor Macklem also said that “if we need to take a bigger step, we will take a bigger step.” So there was an explicit acknowledgement that such an outcome was possible. Last but not least, the Fed’s Beige Book review of regional economic conditions added to the dovish mood, as 9 of the 12 regional Fed districts “reported flat or declining activity”.

Against this backdrop, US equities held up relatively well, with the S&P 500 posting a modest -0.16% decline. In part, that was driven by the hope that the Fed would now deliver a larger 50bp cut. But unlike the original jobs report, the news from the JOLTS report didn’t lead to a sudden reassessment on how the economy was doing, given it was covering July anyway, where we’ve already got plenty of data for. Indeed, with the other data releases yesterday, the Atlanta Fed’s GDPNow estimate actually ticked up slightly to an annualised +2.1% rate for Q3. So with those various releases in hand, US equities held broadly steady. Energy (-1.42%) and information technology (-0.48%) stocks led the decline for the S&P 500, but its downside was limited by gains for defensive and rate sensitive sectors, notably utilities (+0.85%) and consumer staples (+0.52%). The Magnificent 7 were flat on the day (-0.00%), even as Nvidia (-1.66%) again declined after seeing the largest market cap fall of any global stock in history the previous day.

Over in Europe, the picture was quite a bit more negative, but that mostly reflected a catchup to the slump later in the US session the previous day. That was evident by the STOXX 600 immediately falling lower after the open, but basically staying around that range for the rest of the day, closing -0.97% lower. Even so, that’s still a third consecutive decline for the STOXX 600, so that’s another index where September is living up to its reputation as a poor one for equities. Sentiment wasn’t exactly helped by the final August PMIs either, as the final composite PMI for the Euro Area was revised down two-tenths from the flash reading to 51.0.

Asian equity markets are maintaining the risk-off start to the month with the Nikkei (-1.22%), Hang Seng (-0.45%) and KOSPI (-0.36%) also lower. Elsewhere, mainland Chinese stocks have held on to their minor gains with the CSI (+0.10%) and the Shanghai Composite (+0.04%) both trading in the green. S&P (-0.16%) and NASDAQ 100 (-0.28%) futures are both slipping.

Early morning data showed that Japan's real wages in July unexpectedly rose +0.4% y/y (v/s -0.6% expected), advancing for the second consecutive month, boosted by pay hikes and summer bonuses. It followed a +1.1% gain in June, the first gain in 27 months. Nominal wages grew by +3.6% y/y in July, a deceleration from June's +4.5% but surpassing market expectations of +2.9% gain. This strong performance is adding to speculation that the BOJ may look to hike again before the end of 2024 and perhaps helps explain the weak performance of Japanese equities overnight.

To the day ahead now, and data releases from the US include the ISM services index for August, the ADP’s report of private payrolls for August, and the weekly initial jobless claims. Meanwhile in Europe, there’s German factory orders for July, Euro Area retail sales for July, and the August construction PMIs from Germany and the UK. From central banks, we’ll hear from the ECB’s Holzmann.

After several days of rollercoaster volatility and uniform pain across global equity markets for bulls, US equity futures are flat as the global sell-off stabilizes into the most important macro data releases. As of 8:00am ET S&P futures are up 0.1% and Nasdaq futs are flat, with NVDA +40bps premarket, TSLA rising 2.3% while the balance of Mag7 is weaker and Semis under pressure, too. Europe’s Stoxx 600 index dropped 0.3%, with China-facing luxury stocks such as LVMH again among the biggest losers. Asian equities erased most gains after declines in Hong Kong and Japan. Bond yields are 1bps higher, but the USD is weaker as the yen gained overnight following unexpectedly strong – if transitory – Japanese wage data. Commodities are stronger led by Energy and precious metals while iron ore slumped to its lowest level since 2022 and traded near $90 a ton as China’s main steel industry group advised mills to be cautious in boosting output too quickly to avoid snuffing out a post-summer recovery. Looking at the coming FOMC decision, 50bps bets are increasing, rising as high as 50% after yesterday’s dismal JOLTS report, as the growth component of the Goldilocks narrative is challenged. ISM-Services today and NFP tomorrow are key facets of the narrative and we should leave for the weekend with a stronger sense of 25bps or 50bps.

In premarket trading, Frontier Communications fell 9.9% after agreeing to be purchased in a take under by Verizon Communications. Tesla gained 3% on plans to launch the advanced driver assistance system that it calls Full Self Driving technology in China and Europe in the first quarter of next year, pending regulatory approvals. Meanwhile, the company with the luckiest ticker,C3.ai (better known for its AI ticker) was not so lucky, and tumbled 19% to a new 2024 low after the software company reported 1Q subscription revenue that’s weaker than expected. Here are some other premarket movers:

- ChargePoint (CHPT) falls 7.7% as the operator of the largest electric vehicle charging network in the US plans to cut 15% of its workforce after missing revenue forecasts.

- Copart (CPRT) slips 5.7% after posting 4Q operating income that missed estimates.

- Frontier Communications (FYBR) falls 9.9% after agreeing to be purchased by Verizon Communications.

- Fortive (FTV) rises 4% after confirming plans to pursue a spinoff of its Precision Technologies segment.

- JetBlue (JBLU) rises 5% after boosting its revenue forecast for the third quarter.

- PagSeguro (PAGS) and StoneCo (STNE) fall after Morgan Stanley downgraded the Brazilian digital payments companies, saying the market has likely reached saturation. PagSeguro declines 8.5% and StoneCo drops 8.3%.

- Hewlett Packard Enterprise (HPE) slips 3% after the computer hardware and storage company reported weaker-than-expected margins.

- NIO ADRs (NIO) gain 3.5% after the automaker reported 2Q gross margin that came ahead of estimates.

- Verint (VRNT) tumbles 11% after the customer-service software firm reported second-quarter profit and revenue that fell short of estimates.

After yesterday’s catastrophic JOLTS report, traders will look to weekly jobless claims data due later today and Friday’s nonfarm payrolls reports to assess whether the US economy is heading for a soft-landing as the Fed prepares to start easing policy. Global stocks suffered their worst losses earlier this week since the Aug. 5 meltdown, with VIX remaining elevated at 20. Swap traders have ramped up bets on the pace of rate cuts after a Wednesday reading on US job openings trailed estimates and the Fed’s Beige Book survey showed flat or declining economic activity. Rates pricing foresees at least 100 basis points of easing this year, including one jumbo cut of 50 basis points.

“We think that the US soft landing scenario is intact but acknowledge that the next two-three months could be a tricky period,” Eddy Loh, chief investment officer at Maybank Group Wealth Management, said on Bloomberg Television. “If the Fed were to cut 50 basis points, the market could perceive it as a negative because that means the Fed is seeing something in the economy.”

The yield on 2-year Treasuries rose 2bps after tumbling Wednesday on the data showing a slowdown in the US labor market and leading to the first 2s10s yield curve disinversion in 27 months. This morning the 2s10s flirted with the unchanged level, and was last 0.4bps.

US interest rates will settle in a range of between 3% and 4%, according to Oaktree Capital Management LP’s Howard Marks.

“The Fed will back off from the emergency rate of five and a quarter, five and a half and get down into the threes,” Marks, the co-chairman and co-founder of Oaktree said at a conference in Melbourne Thursday. “But my point to you, my belief is that we’re going to stay there in the threes and we’re not going back to zero or a half or one.”

European stocks fell to their lowest in around two weeks as global growth concerns continue to dampen investor sentiment ahead of the US jobs report on Friday. The Stoxx 600 was down 0.2%, led by losses in luxury stocks such as LVMH; consumer product, industrial and technology names also slumped. Here are the biggest movers Thursday:

- Asos shares jump as much as 19%, the most intraday since January 2023, after agreeing to sell control of its Topshop and Topman brands to a company controlled by Denmark’s Holch Povlsen family. The online fashion retailer also announced refinancing moves

- BioMerieux gains as much as 5.5% after the French medical technology firm slightly boosted its guidance

- Lanxess shares rise as much as 4.4% as the German specialty chemicals firm was double-upgraded by Morgan Stanley, which cited investment de-gearing and lower gas prices

- Ashmore rises as much as 4.6%, reversing an earlier decline, as analysts note a more positive outlook for the emerging-markets specialist fund house

- Vistry Group shares rise as much as 7.1%, the most since March 14, after the UK housebuilder reported 1H revenue and profit growth following a shift in strategy

- Jet2 shares rise as much as 2.1%, reversing losses in earlier trading, as analysts are positive about the trajectory of bookings of the package holiday provider

- European luxury stocks slide after Bloomberg reported that LVMH’s Tiffany brand is planning to downsize a flagship store in Shanghai, fueling broader conserns about a slowdown in luxury demand in China. LVMH, Hermes and Kering fell

- Grifols Class B shares slumped after a report that Brookfield will seek to pay less for that series of stock in its planned takeover offer for the Spanish blood-plasma company

- AB Foods drops as much as 5.8%, the most since April 2023, after the company warned sales growth at Primark was negatively impacted by poor weather conditions

- Tomra falls as much as 10%, the most since October 2023, after the Norwegian recycling technology firm published new financial targets

- Genus drops as much as 5.1% after the livestock breeding specialist releases its full-year results, with the company only cautiously guiding for improving markets

Earlier in the session, Asian equities erased most gains after declines in Hong Kong and Japan even as key chipmaker shares rebounded from a Wednesday selloff sparked by concerns the artificial intelligence rally is overheating. The MSCI Asia Pacific Index rose 0.1%, with Nvidia suppliers TSMC and SK Hynix among the biggest boosts. It had added as much as 0.8% earlier in the session before erasing the advance. Taiwan’s Taiex index added 0.5% while Japanese stocks slumped as the yen strengthened. Asian stocks are “seeing flows out of Japan into other markets as hot wage data increases the likelihood of further tightening by the Bank of Japan,” said Matthew Haupt, a portfolio manager at Wilson Asset Management. A bigger divergence between the Fed and BOJ may spark “some more volatility,” he added.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Norwegian krone tops the G-10 FX leader board, rising 0.3%. The Japanese yen is not far behind, with a 0.2% gain.

In rates, treasuries dip, paring some of Wednesday’s post-JOLTS rally with US 10-year yields rising 1 basis point to 3.76%; the US lags little-changed bunds and gilts during European morning. Yields are higher by 1bp-2bp across the curve with front-end and belly underperforming slightly, leaving 2s10s spread around -0.5bp after disinverting Wednesday for only the second time since 2022. Focal points of US session include weekly jobless claims, August ADP employment change and August ISM services gauge.

In commodities, brent crude futures were heading for the first day of gains in five, with OPEC+ getting closer to an agreement on delaying an increase in oil production. WTI rose 1% to $69.90 while Brent was trading just above $73. Iron ore slumped to its lowest level since 2022 and traded near $90 a ton as China’s main steel industry group advised mills to be cautious in boosting output too quickly to avoid snuffing out a post-summer recovery. Spot gold rises $20 to around $2,516/oz.

Looking at the calendar, US economic data calendar includes August Challenger job cuts (7:30am), ADP employment change (8:15am), 2Q final nonfarm productivity and weekly jobless claims (8:30am), August final S&P Global US services PMI (9:45am) and ISM services index (10am). No Fed speakers are scheduled; Williams and Waller are slated to speak Friday

Market Snapshot

- S&P 500 futures little changed at 5,534.75

- STOXX Europe 600 down 0.1% to 514.22

- MXAP up 0.1% to 181.97

- MXAPJ up 0.4% to 563.99

- Nikkei down 1.1% to 36,657.09

- Topix down 0.5% to 2,620.76

- Hang Seng Index little changed at 17,444.30

- Shanghai Composite up 0.1% to 2,788.31

- Sensex down 0.1% to 82,245.54

- Australia S&P/ASX 200 up 0.4% to 7,982.38

- Kospi down 0.2% to 2,575.50

- German 10Y yield unchanged at 2.22%

- Euro up 0.1% to $1.1094

- Brent Futures up 0.7% to $73.23/bbl

- Brent Futures up 0.7% to $73.21/bbl

- Gold spot up 0.7% to $2,513.92

- US Dollar Index down 0.16% to 101.20

Top Overnight News

- President in absentia Joe Biden is due to speak on economic policy on Thursday 5th September at 16:00 ET

- Japan-US business council says they are very alarmed by any attempts to politicise the committee on foreign investments in the US review process, regarding US Steel and Nippon

Verizon to acquire Frontier Communications; deal valued at USD 20bln, all-cash - Japan’s wage numbers for July cool vs. June, but come in ahead of expectations (the real wage figure came in at +0.4% for Jul, down from +1.1% in June but above the Street’s -0.6% forecast). RTRS

- BOJ official says the central bank must be mindful of avoiding undue market volatility as it proceeds with its tightening agenda. RTRS

- China still sees some room to lower the amount of cash banks must hold as reserves, a central bank official said on Thursday, adding that the lender will continue to implement policies to support the economic recovery. RTRS

- AstraZeneca staff were detained in China over potential illegal activities involving data collection and drug imports. BBG

- Russia has been forced to start storing gas from Vladimir Putin’s flagship Arctic project, in a sign that western sanctions are deterring buyers. According to ship-tracking data and satellite images, three vessels have shipped liquefied natural gas from the Arctic LNG 2, which is under US sanctions, since it started loading operations last month. FT

- Hostage killings and irreconcilable demands complicate Gaza cease-fire talks. Frustrated mediators are now putting together what they have described as a “final offer,” but significant concessions on both sides are needed for agreement, said a U.S. official. WaPo

- US crude stockpiles slumped by 7.4 million barrels last week, API data is said to show, pushing oil prices higher. That would bring holdings to the lowest in 11 months, if confirmed by the EIA. Crude may benefit further if OPEC+ delays its plan to to boost output. BBG

- Rate options traders stepped up wagers that the Fed will start its easing cycle with a 50-bp cut. Oaktree’s Howard Marks said rates will settle in a 3-4% range, but won’t go lower. Rate reductions are needed to keep the labor market healthy, according to the Fed’s Mary Daly. BBG

- Auto sales in the US cooled in Aug vs. Jul due to difficult comparisons (Jul was boosted from a recovery from an industry-wide cyberattack) and elevated interest rates. Marketwatch

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed following the earlier mild regional gains, with the overall market tone tentative ahead of a slew of US data ahead of NFP on Friday. ASX 200 was kept afloat by its Tech and Real Estate sectors whilst Energy resided at the bottom. Nikkei 225 was choppy on either side of 37k as it saw initial pressure amid the stronger JPY, with the index later entirely trimming losses, only to falter once again. Hang Seng and Shanghai Comp were mixed for most of the session, Hang Seng initially saw modest gains with Banks and Real Estate initially supported following reports China mulls cutting mortgage rates in two steps to shield banks, via Bloomberg sources. That being said, the mood later waned despite a lack of catalysts, although pre-market reports suggested JPMorgan cut China stocks to Neutral from Overweight.

Top Asian news

- PBoC official says there is still some room for cutting the RRR. Face some constraints in further cutting deposit/lending rates. Will reasonably set the strength and pace of policy adjustments based on the economic recovery.

- JPMorgan cut China stocks to Neutral from Overweight.

- PBoC injected CNY 63.3bln via 7-day Reverse Repo at maintained rate of 1.70%

- BoJ Board Member Takata said Japan’s economy is recovering moderately, though some weak signs are evident; notes significant volatility in stock and FX markets but maintains that achieving the inflation target remains within reach, and BoJ must be vigilant to the chance of renewed wave of price hikes, while taking into account impact of yen rise in early August, according to Reuters. He noted it is hard to debate at this stage to what degree BoJ can shrink its balance sheet, and hard to pin down the precise level of Japan’s natural rate of interest. He said Japan’s current real interest rate is below the estimated natural rate of interest, which means monetary conditions remain accommodative and the fallout from market turbulence in early August remains, “so we must scrutinize the impact for the time being”. He noted the BoJ must adjust monetary conditions by ‘another gear’ if we can confirm that firms will continue to increase capex, wages and prices, and won’t hike policy rates with a pre-set level of neutral interest rate in mind. BoJ’s decision to reduce bond buying won’t hugely affect the impact of monetary easing, but marks a big turning point from when the central bank had YCC in place, and markets stabilizing after some turbulence, but must watch market developments with a very strong sense of urgency.

- BoJ to hold meeting on market operations on October 16th from 17:30 local time, according to Reuters.

- RBA Governor Bullock repeated that it is premature to be thinking about rate cuts; as of now, the board does not expect to be in a position to cut rates in the near term. She noted the RBA’s highest priority has been and remains to bring inflation down, and the Board remains vigilant to upside risks to inflation, whilst the RBA’s full employment goal is not served by letting inflation stay above target indefinitely. She noted substantial uncertainty around the central outlook, with risks on both sides and if circumstances change, the board will respond accordingly. Bullock said the labour market remains relatively tight, expected to ease gradually, and labour cost growth is strong reflecting wage increases, and weak productivity. She warned key drivers of elevated inflation are housing costs, market services, and CPI rents inflation is likely to be high for some time. Bullock said need to see results on inflation before lowering rates; board is not going to focus on one inflation number, and slightly elevated AUD is positive for inflation fight.

European bourses, Stoxx 600 (U/C) began the session entirely in the red, but sentiment improved soon after the cash open, with indices now displaying more of a mixed picture. European sectors are mixed, having opened with a negative bias. Utilities takes the top spot, alongside Real Estate whilst Consumer Products lags. US Equity Futures (ES U/C, NQ -0.1%, RTY -0.1%) are mixed, but with sentiment seemingly stabilising after this week’s glum price action. Today’s docket is packed with key US data; jobs (Challenger Layoffs, ADP, IJC), activity (PMIs, ISM Services).

Top European news

- ASML (ASML NA) CEO repeated 2024 and 2025 guidance and said the chip market recovery is uneven.

- BoE Monthly Decision Maker Panel data August 2024; inflation expectations 1-yr 2.7% (prev. 2.7%); 3-yr 2.7% (prev. 2.7%)

FX

- DXY is slightly lower and trading within a narrow 101.14-35 range and towards the bottom end of the prior day’s confines. A busy US data slate ahead; US Challenger Layoffs kicks things off, ahead of ADP Employment, IJC, PMI (F) and the key ISM Services data

- EUR is incrementally firmer and trading towards the upper end of today’s 1.1076-1.11 range. Today’s much stronger-than-expected Industrials Orders sparked modest strength in the Single-Currency, whilst EZ Construction PMIs passed through without having an impact.

- GBP is trading on a slightly firmer footing and near today’s high at 1.3172; UK-specific newsflow light.

- JPY is slightly firmer, having pared most of its early morning strength, largely a factor of a more improved risk-tone vs the prior 2 sessions. Overnight strength was also a factor of a higher-than-expected Labour Cash Earnings print.

- Antipodeans are flat/firmer, in what has been a lacklustre session for the pair thus far.

- PBoC set USD/CNY mid-point at 7.0989 vs exp. 7.1010 (prev. 7.1148); strongest level since Apr 15th

- Reuters Poll, FX: bullish bets have increased for most Asian FX.

Fixed Income

- USTs are flat ahead of a packed and potentially pivotal afternoon agenda. From which, the labour market data points will take centre stage and be scrutinised in the context of Friday’s Payrolls. USTs are just off Wednesday’s JOLTS-driven highs at 114-18.

- Bunds ultimately trade lower, but with price action choppy. Modest two-way action was seen on the latest German Industrial Orders, which came in significantly above forecasts. Bunds are yet to make much headway above the 134.00 mark, current high at 134.26.

- Gilts are slightly firmer, but ultimately rangebound ahead of the busy data docket. A strong UK auction had little impact on the benchmark. Gilts are holding just above Wednesday’s 99.53 high.

- OATs were weighed on by a hefty supply docket from both France and Spain; both passed without any real reaction.

- Spain sells EUR 6bln vs exp. EUR 5-6bln 2.50% 2027, 3.50% 2029, 3.45% 2034 Bono & EUR vs exp. EUR 0.25-0.75bln 1.00% 2030 I/L:

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.29x (prev. 2.87x), average yield 3.811% (prev. 3.854%) & tail 0.9bps (prev. 0.9bps)

- France sells EUR 11.99bln vs exp. 10-12bln 3.0% 2034, 1.25% 2036, 0.5% 2040 and 3.25% 2055 OATs:

Commodities

- Crude is firmer, having found a bit of a floor from the marked declines WTD. A slight recovery was assisted by the private inventory report last night. Brent’Nov as high as USD 73.46/bbl.

- Spot gold is back above USD 2500/oz, benefitting from pressure in the USD and the relatively contained yield environment/risk tone in western markets; notable, further support stemming from China where yields are pressured by RRR talk from the PBoC.

- Base metals are benefitting from the steady risk tone and softer USD. Though, as with precious peers, it remains to be seen what the macro backdrop will be following the afternoon’s US data deluge.

- US Private Inventory (bbls): Crude -7.4mln (exp. -1.0mln), Distillate -0.4mln (exp. +0.5mln), Gasoline -0.3mln (exp. -0.7mln), Cushing -0.8mln (prev. -0.49mln).

- Russian President Putin on expiration of deal on Russian gas to Europe via Ukraine after Dec 31 2024, “we do reject this transit, seek to maintain gas supply contracts, if Ukraine ditches this transit we cannot force it to keep it”

- UAE’s ADNOC sets the October Murban OSP at USD 77.94/bbl.

Geopolitics

- White House reportedly scrambling to put forward a new Israel-Hamas proposal; draft accord could come next week or sooner; there is a strong perception that a ceasefire is slipping away, according to Reuters sources.

US Event Calendar

- 07:30: Aug. Challenger Job Cuts YoY 1.0%, prior 9.2%

- 08:15: Aug. ADP Employment Change, est. 145,000, prior 122,000

- 08:30: 2Q Unit Labor Costs, est. 0.8%, prior 0.9%

- 2Q Nonfarm Productivity, est. 2.5%, prior 2.3%

- 08:30: Aug. Initial Jobless Claims, est. 230,000, prior 231,000

- Aug. Continuing Claims, est. 1.87m, prior 1.87m

- 09:45: Aug. S&P Global US Services PMI, est. 55.1, prior 55.2

- 09:45: Aug. S&P Global US Composite PMI, est. 54.0, prior 54.1

- 10:00: Aug. ISM Services New Orders, est. 51.9, prior 52.4

DB’s Jim Reid concludes the overnight wrap

A cloud has lifted over our house as the kids were all back to school yesterday after a long and feral summer. To be fair Maisie is a wonderful girl and the twins are good boys individually. However together at home the twins are never more than 20 minutes away from a fight, bruises, scratches, and manic tears. 2 minutes later it’s high pitched laughter and co-scheming. Repeat to fade. It is draining. At school they all behave impeccably so I’m lobbying for it to become a boarding school asap.

Clouds continue over markets though with global bond yields continuing to tumble yesterday, as another batch of weak US data fuelled expectations that the Fed might cut rates by 50bps in just under two weeks. That led to some very significant market moves, with the 2s10s curve ending the day around the zero level for the first time in the last 2 years. We briefly traded in positive territory yesterday but haven’t closed above zero since July 2022. This is the longest ever inversion for the 2s10s curve in available data stretching back well over 60 years. Given that inversions have historically been a leading indicator of recessions, the re-steepening has previously led to suggestions that removing such an environment means a recession would now be less likely to happen. But sadly, the historic precedent isn’t particularly favourable on this front, as in previous cycles the final stage before the recession was actually a re-steepening of the curve back into positive territory. So we have to be cautious in being too optimistic about waving bye to an inversion. Henry wrote about this pattern last year, with a few charts on how this played out in previous cycles (link here).

The trigger for yesterday’s moves was the latest US JOLTS report of job openings, which showed that the labour market was weakening faster than previously thought. For instance, the number of job openings fell to a three-and-a-half year low of 7.673m in July (vs. 8.1m expected). And if you look at the ratio of job openings per unemployed individuals, that also fell back to 1.07, which is now beneath its pre-Covid levels in 2019. So there’s growing evidence that the labour market is still weakening, backing up Chair Powell’s point at Jackson Hole that “labor market conditions are now less tight than just before the pandemic in 2019”.

To be fair, it wasn’t all bad news from the report. The hires rate ticked back up to 3.5% in July, and the quits rate of those voluntarily leaving their jobs also rose to 2.1%. Moreover, we should bear in mind that this is still covering July, the same month as with the underwhelming jobs report a month ago, rather than a new period since then. So all eyes will remain on tomorrow’s jobs report for August to see if that deterioration continues, or whether the weaker July numbers look like more of a blip. Ahead of that today’s services ISM will take on added significance given the nerves around at the moment.

After the JOLTS report, investors dialled up the chance that the Fed would cut by 50bps in September, and futures were giving that a 44% chance by the close (up +7pps). That’s the highest probability on 50bps since August 13 and is now back close to a 50-50 call. Investors also moved to price in a more dovish rates path over the months ahead as well. For example, there are now 111bps of cuts priced in by the December meeting, up from 102bps the previous day.

With more rapid cuts being priced in, US Treasury yields fell across the curve, and the 2yr yield (-10.9bps) fell to 3.76%, which is its lowest closing level since September 2022. The 10yr yield (-7.6ps) also fell to 3.76% also, which is its lowest close since July 2023 and marks the first time since July 2022 that the 2s10s slope has uninverted. Breakevens led the decline in yields with the 10yr (-5.2bps) ending the day at 2.06%, less than 1bp above its early August lows and otherwise its lowest level since January 2021. Over in Europe it was much the same story as well, with yields on 10yr bunds (-5.3bps), OATs (-6.7bps) and BTPs (-8.8bps) all falling back.

Alongside the JOLTS report, a few other factors supported that move to price in faster rate cuts. The first was the continued fall in oil prices, which is taking away one source of inflationary pressure. Indeed, yesterday saw Brent crude oil prices (-1.42%) fall for the fourth day in a row to $72.70/bbl, which is their lowest level since June 2023. This decline came even as Reuters reported that OPEC+ was close to agreeing a delay to the increase in oil production planned for October. The second came from the Bank of Canada, who cut rates by 25bps for a third consecutive meeting, in line with expectations. Significantly, Governor Macklem also said that “if we need to take a bigger step, we will take a bigger step.” So there was an explicit acknowledgement that such an outcome was possible. Last but not least, the Fed’s Beige Book review of regional economic conditions added to the dovish mood, as 9 of the 12 regional Fed districts “reported flat or declining activity”.

Against this backdrop, US equities held up relatively well, with the S&P 500 posting a modest -0.16% decline. In part, that was driven by the hope that the Fed would now deliver a larger 50bp cut. But unlike the original jobs report, the news from the JOLTS report didn’t lead to a sudden reassessment on how the economy was doing, given it was covering July anyway, where we’ve already got plenty of data for. Indeed, with the other data releases yesterday, the Atlanta Fed’s GDPNow estimate actually ticked up slightly to an annualised +2.1% rate for Q3. So with those various releases in hand, US equities held broadly steady. Energy (-1.42%) and information technology (-0.48%) stocks led the decline for the S&P 500, but its downside was limited by gains for defensive and rate sensitive sectors, notably utilities (+0.85%) and consumer staples (+0.52%). The Magnificent 7 were flat on the day (-0.00%), even as Nvidia (-1.66%) again declined after seeing the largest market cap fall of any global stock in history the previous day.

Over in Europe, the picture was quite a bit more negative, but that mostly reflected a catchup to the slump later in the US session the previous day. That was evident by the STOXX 600 immediately falling lower after the open, but basically staying around that range for the rest of the day, closing -0.97% lower. Even so, that’s still a third consecutive decline for the STOXX 600, so that’s another index where September is living up to its reputation as a poor one for equities. Sentiment wasn’t exactly helped by the final August PMIs either, as the final composite PMI for the Euro Area was revised down two-tenths from the flash reading to 51.0.

Asian equity markets are maintaining the risk-off start to the month with the Nikkei (-1.22%), Hang Seng (-0.45%) and KOSPI (-0.36%) also lower. Elsewhere, mainland Chinese stocks have held on to their minor gains with the CSI (+0.10%) and the Shanghai Composite (+0.04%) both trading in the green. S&P (-0.16%) and NASDAQ 100 (-0.28%) futures are both slipping.

Early morning data showed that Japan’s real wages in July unexpectedly rose +0.4% y/y (v/s -0.6% expected), advancing for the second consecutive month, boosted by pay hikes and summer bonuses. It followed a +1.1% gain in June, the first gain in 27 months. Nominal wages grew by +3.6% y/y in July, a deceleration from June’s +4.5% but surpassing market expectations of +2.9% gain. This strong performance is adding to speculation that the BOJ may look to hike again before the end of 2024 and perhaps helps explain the weak performance of Japanese equities overnight.

To the day ahead now, and data releases from the US include the ISM services index for August, the ADP’s report of private payrolls for August, and the weekly initial jobless claims. Meanwhile in Europe, there’s German factory orders for July, Euro Area retail sales for July, and the August construction PMIs from Germany and the UK. From central banks, we’ll hear from the ECB’s Holzmann.

Loading…