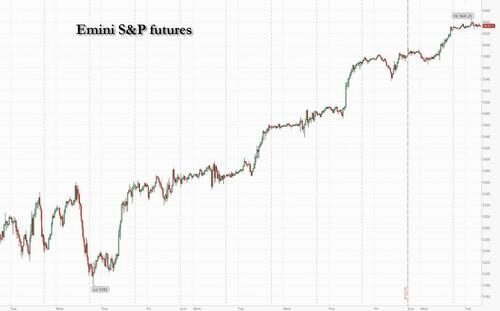

US equity futures are flat after another narrow overnight range, following another euphoric session on Wall Street amid bets the Fed chair Powell will signal it’s ready to start cutting interest rates as soon as this Friday's Jackson Hole symposium. As of 7:30am ET, S&P futures were up 0.1% to 5,634 while Nasdaq futures also gained 0.1%. MSCI’s all-country stock index headed for a ninth day of increases, its longest winning streak since December. Oil halted its latest rout, treasury 10-year yields held steady around 3.87%, the Bloomberg dollar index was unchanged after sliding to the lowest since March, while gold exploded to a new record high, trading at $2525. It is a quiet session with just the Philly Fed non-mfg activity index on deck.

In premarket trading, home improvement retailer Lowe's cut its sales and earnings forecast, blaming a frozen housing market. Hawaiian Holdings rose 10% after the US Justice Department decided against challenging its proposed tie-up with Alaska Air. Meanwhile, the European Union said it plans to introduce a 9% tariff on Teslas imported from China. Here are other notable premarket movers:

- Fabrinet shares rise 8.8% after first-quarter forecasts for adjusted earnings per share and revenue topped the average analyst estimates. Analysts note AI momentum as company issues strong outlook for the current quarter.

- FuboTV shares increase 0%, putting the online TV provider on track for its sixth consecutive session of gains. The stock got a boost this week after Fox, Warner Bros. Discovery and Walt Disney were blocked by a judge from launching their streaming sports service rival one week before its rollout

- Kymera shares slide 3.8% after the biopharmaceutical company’s offering priced at $40.75-per-share via Morgan Stanley, JPMorgan, Stifel.

- Vornado Realty Trust shares rise 1.7% after Evercore ISI upgraded the real estate investment trust to outperform from underperform.

On the corporate front, Alimentation Couche-Tard Inc.’s preliminary proposal to buy 7-Eleven owner Seven & i Holdings Co. could be worth more than ¥5.63 trillion ($38.4 billion), based on the Japanese company’s market value after news of the potential deal was disclosed. Edgar Bronfman Jr. submitted a $4.3 billion bid to take control of Paramount Global and quash an existing offer from Skydance Media, Bloomberg reported.

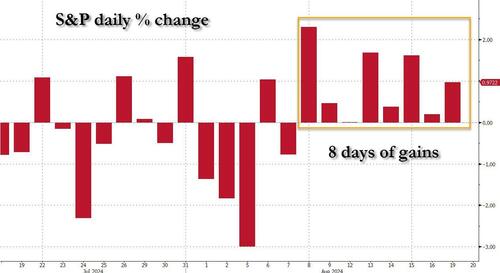

Traders are taking a break after Monday’s session in the US lifted the S&P 500 for an eighth straight day. Stock volumes have been trending lower with investors reluctant to place big bets before central bankers gather for the Fed’s Jackson Hole economic symposium this week.

“What we’ve seen happen is a swath of recent data, which has eased fears about slowing US growth without stoking fears of re-accelerating inflation,” said Kyle Rodda, a senior market analyst at Capital.Com Inc.

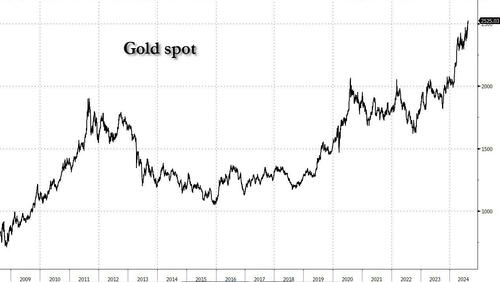

With stocks relatively flat, attention has turned now to gold where the precious metal has broken out from its range and is hitting new record highs on an almost daily basis ahead of the coming dollar debasement about to be unleash by the Kam-unist regime of Kamala Harris who plans on "fighting" food inflation with price control. Gold has gained more than 20% this year, in part driven by the view that the Fed’s pivot toward cutting rates was nearing. Banks including UBS and ANZ say that there’s scope for further gains too, not just on the Fed’s policy but on central bank buying and demand for portfolio hedges.

In Europe, technology and travel shares outperformed, keeping the Stoxx 600 within a whisker of recouping August’s losses as investors bet that interest rates in the US will ultimately come down. Technology is the strongest performing sector, with energy the biggest laggard as oil stocks fall on easing supply risks from a potential Gaza cease-fire. Here are some of the biggest European movers on Tuesday:

- Huber+Suhner shares rise as much as 12%, the most in almost 13 years, after the Swiss electrical products manufacturer’s first-half results beat estimates and it confirmed its full-year guidance. Analysts see continued recovery in the second half of the year and Baader says the order flow was particularly impressive.

- Antofagasta gains as much as 0.9% after the copper mine operator reported first-half Ebitda that beat analyst estimates. Citi notes that higher copper prices offset the impact from lower production and higher unit costs.

- European oil stocks are down on Tuesday as oil extended the biggest drop in two weeks after the US said Israel accepted a cease-fire proposal in Gaza, potentially easing supply risks as concerns about the global demand outlook mount. Biggest laggards in terms of index points are Shell (-1.7%), BP (-1.7%), TotalEnergies (-1.2%), Equinor (-1.7%), Aker BP (-2.7%) and Eni (-0.4%)

- BT shares slide as much as 6% amid competition worries, after Sky struck a deal to launch its broadband services on CityFibre’s network from next year.

- Coloplast falls as much as 3.5%, the most since May, after the Danish ostomy and wound care company reported 3Q margins that fell short of estimates. The miss was a key negative in an otherwise overall in-line report where it also reiterated guidance, analysts say.

- DocMorris shares plunge as much as 17% after the pharmaceutical products retailer warned it is expecting to book a bigger annual adjusted Ebitda loss than previously anticipated as it reported interim results. Analysts at Jefferies say the weaker bottom-line target was expected, but the reduced revenue growth goal is the main disappointment.

- Wood Group shares swing between gains and losses after the Scottish engineering firm published mixed first-half results. Analysts weighed goodwill impairments and the net loss against some signs of recovery and stabilization, especially as the company held its guidance steady for the year, after Sidara ended takeover interest in Wood Group this month.

The recent turmoil in financial markets has left strategists unfazed about the outlook for European stocks. The benchmark gauge is seen ending the year at 535 points — about 4.6% above Friday’s close, according to the median estimate in a Bloomberg survey of 16 strategists. Still, increasing risks to the region’s growth outlook have reinforced the case for a policy adjustment when the European Central Bank meets next month, Governing Council member Olli Rehn said. Markets are pricing in at least two more rate reductions this year.

Asian stocks gained for a third day, helped by advances in Japan and South Korea amid optimism over Fed rate cuts. The MSCI Asia Pacific Index rose as much as 0.7%, with SK Hynix, Keyence and Samsung Electronics the biggest contributors to the advance. Key gauges in Japan climbed as the yen’s rally against the dollar stalled, supporting exporters such as tech companies and automakers. South Korean and Thai equities also gained.

In FX, the Bloomberg Dollar Spot Index is also little changed, trading near a 6 month low. The kiwi dollar tops the G-10 FX leader board, rising 0.4% against the greenback. The Swedish krona rises 0.3% even after the Riksbank cut interest rates and sketched out more easing than its previous guidance.

In rates, treasuries are steady, with US 10-year yields at 3.87%. The curve is steeper, unwinding much of Monday’s flattening move in 2s10s and 5s30s spreads. Corporate new-issue calendar may dominate the session, with Kroger expected to bring one of this year’s largest deals.

In commodities, WTI fell 0.6% to $73.95 after the US said Israel accepted a cease-fire proposal in Gaza, which however has zero chance of being accepted by Hamas. Copper steadied after a recent rebound and gold jumped by $18 to a record $2,525 an ounce on expectations that the Fed is poised to cut interest rates. Bitcoin gained 2%.

It's a quiet day: on the US economic calendar we only get the August Philadelphia Fed non-manufacturing activity at 8:30am. Fed speaker slate includes Bostic (1:35pm) and Barr (2:45pm)

Market Snapshot

- S&P 500 futures little changed at 5,631.50

- STOXX Europe 600 little changed at 514.79

- MXAP up 0.6% to 184.89

- MXAPJ up 0.4% to 576.07

- Nikkei up 1.8% to 38,062.92

- Topix up 1.1% to 2,670.54

- Hang Seng Index down 0.3% to 17,511.08

- Shanghai Composite down 0.9% to 2,866.66

- Sensex up 0.6% to 80,873.27

- Australia S&P/ASX 200 up 0.2% to 7,997.73

- Kospi up 0.8% to 2,696.63

- German 10Y yield little changed at 2.24%

- Euro little changed at $1.1084

- Brent Futures down 1.2% to $76.71/bbl

- Gold spot up 0.5% to $2,517.95

- US Dollar Index little changed at 101.79

Top Overnight News

- Former US President Trump said he would consider ending the USD 7,500 electric vehicle tax credit and if elected, he would tap Elon Musk for a cabinet or advisory role if Musk would do it, according to an interview. Trump later stated that VP Harris informed that she will not do the Fox News debate on September 4th and he will conduct a tele-town hall, according to a post on Truth Social.

- Central bankers gathering this week for one of the world’s most prominent annual economic forums are set to find themselves more divided than perhaps any time since before the pandemic.

- Increasing risks to Europe’s growth outlook have reinforced the case for a policy adjustment when the European Central Bank meets next month, according to Governing Council member Olli Rehn.

- US Secretary of State Antony Blinken said Israeli Prime Minister Benjamin Netanyahu has accepted a cease-fire proposal to halt the war in Gaza and the next step is for “Hamas to say yes,” putting the onus on the group to end the 10-month conflict even as violence continued.

- A price war is spreading across China’s new-home market, as local governments dial back on intervention and developers race to recoup cash.

- Sweden’s Riksbank lowered borrowing costs and outlined more easing than previously expected as inflation has fallen below its target and the largest Nordic economy is sputtering.

- Oil extended the biggest drop in two weeks as the US said Israel accepted a cease-fire proposal in Gaza, potentially easing supply risks as concerns about the global demand outlook mount.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed and only partially took impetus from the tech-led gains stateside amid a lack of major macro drivers. ASX 200 edged mild gains with stock news in Australia dominated by earnings releases, while the RBA Minutes noted it is possible the cash rate would have to stay steady for an extended period and members agreed a rate cut in the short term was unlikely. Nikkei 225 outperformed and reclaimed the 38,000 level despite the absence of notable catalysts. Hang Seng and Shanghai Comp. declined amid lingering economic concerns, while China also maintained its Loan Prime Rates which was widely expected after last month's bout of cuts to key funding rates.

Top Asian news

- Chinese Loan Prime Rate 1Y (Aug) 3.35% vs. Exp. 3.35% (Prev. 3.35%); 5Y 3.85% vs. Exp. 3.85% (Prev. 3.85%)

- China is unleashing billions of dollars of lending to technology start-ups and other small companies using their intellectual property as collateral as Beijing seeks to revive demand for loans and stimulate a lagging economy, according to FT.

- RBA Minutes from the August 5th-6th meeting stated the board considered the case to raise rates but decided a steady outcome better balanced the risks and it is possible the cash rate would have to stay steady for an extended period. Members agreed it is unlikely rates would be cut in the short term and they need to be vigilant to upside risks to inflation, while policy would need to remain restrictive and it was noted that an immediate hike in rates could be justified if risks to inflation had increased materially. Furthermore, members also observed that holding the cash rate target steady at its current level for a longer period than currently implied by market pricing may be sufficient to return inflation to target in a reasonable timeframe, but the Board will need to reassess this possibility at future meetings.

- China is said to be mulling allowing local governments to issue bonds for home purchases, according to Bloomberg sources.

European bourses, Stoxx 600 (+0.1%) are mostly, but modestly firmer (ex-FTSE 100), continuing the strength seen on Wall St in the prior session. FTSE 100 (-0.6%) is the worst performing index in Europe, weighed on by losses in Energy names amid the broader weakness in underlying oil prices; Shell (-1.8%), BP (-1.6%). European sectors are mixed; Tech takes the top spot, continuing the strength seen in the US on Monday. Travel & Leisure is also one of the better performers, benefiting from the recent drop in oil prices – as such, Energy is found at the foot of the pile. US Equity Futures (ES U/C, NQ U/C, RTY U/C) are flat, taking a breather following the significant strength seen in the prior session.

Top European news

- ECB's Rehn said there are no clear signs of a pick-up in the manufacturing sector, while he added the recent increase in negative growth risks in the euro area has reinforced the case for a rate cut at the next ECB monetary policy meeting in September.

- Riksbank cuts its Rate by 25bps as expected to 3.50% (prev. 3.75%); Policy rate can be cut two or three more times this year - somewhat faster than the Board expected in June.

- Riksbank's Governor Thedeen says moving gradually with rates is part of central bank strategy. There are good reasons to keep SEK on the Riksbank's radar. Inflation is not under target, it is currently in line with target.

FX

- DXY is flat with the dollar showing mixed performance vs. peers. DXY remains stuck below the 102.00 mark in catalyst light trade as investors eye key risk events later in the week, including Jackson Hole and FOMC Minutes.

- EUR is flat vs. the USD in quiet newsflow. EUR on Monday was able to extend its advance on a 1.10 handle and has today printed a fresh YTD high at 1.1088.

- Cable has managed to poke its head above the 1.30 mark for the first time since July 18th, despite the lack of clear UK-specific catalysts.

- JPY is flat with USD/JPY well within yesterday's 145.19-148.05 range with newsflow out of Japan and the US on the light side in the run up to the Jackson Hole event later in the week and BoJ Governor Ueda's appearance before Parliament on the 23rd August.

- AUD is steady vs. the USD after a recent run of gains which has seen the pair gain a firm footing on a 0.67 handle and top out today at 0.6738.

- CAD is broadly steady vs. the USD in the run up to Canadian inflation metrics which are expected to see a pullback in the Y/Y rate and an increase in the M/M print.

- SEK was fairly unreactive to the Riksbank decision to cut rates by 25bps to 3.50%. The guidance for "two or three more times this year" in terms of policy cuts is a dovish shift vs the guidance seen at the last gathering for "two or three times in H2", as it opens the door to a cut per meeting in H2.

- PBoC set USD/CNY mid-point at 7.1325 vs exp. 7.1317 (prev. 7.1415).

Fixed Income

- USTs are contained within a thin six-tick range with the benchmark yet to lastingly deviate from the unchanged mark. Data docket remains light, but Fed speak sees Barr and Bostic later today.

- A firmer start with EGBs finding a grinding bid early doors, but a slight dip to the 134.09 low was seen on German Producer Price metrics which ticked up from the prior Y/Y.

- Bunds then edged higher throughout the morning, to a 134.41 peak, approaching Monday's 134.62 best; but some modest pressure was seen following Bloomberg reports that China is said to be considering allowing local gov'ts to issue bonds for home buying. Bunds were unreactive to the Green Bund auction.

- Gilts are modestly firmer in a narrow 99.74-99.88 band, which is entirely within the parameters of both Monday and Friday.

- Germany sells EUR 0.734bln vs exp. EUR 0.75bln 2.30% 2033 Green Bund & EUR 0.727bln vs exp. EUR 0.75bln 0.00% 2050 Green Bund. Sells EUR 0.734bln 2.30% 2033: b/c 3.3x (prev. 3.4x), average yield 2.16% (prev. 2.51%) & retention 2.13% (prev. 15.4%). Sells EUR 0.727bln 0.00% 2050: b/c 1.6x (prev. 2.2x), average yield 2.42% (prev. 2.41%) & retention 3.07% (prev. 20.2%)

Commodities

- Crude is softer intraday and continuing the price action seen on Monday, with focus on continued Gaza ceasefire talks and a weak Chinese economy. Brent October sits towards the lower end of a USD 76.55-77.77/bbl parameter.

- Precious metals are firmer across the board with broad-based modest gains against the backdrop of a subdued Dollar and with geopolitical risks looming. Spot gold printed a fresh all-time-high at USD 2,521.30/oz (vs low USD 2,497.51/oz).

- Base metals are mostly firmer across the board but to varying degrees, with copper prices somewhat flat intraday with some suggesting a short-covering rally ended amid China growth woes.

- LME Stocks: Copper +11975 (prev. -975).

- Equinor (EQNR NO) has commenced work to resume oil and gas output from Norway's Gullfaks C platform.

Geopolitics - Middle East

- US President Biden says Hamas is 'backing down' from Gaza deal, according to AFP cited by Sky News Arabia.

- "[Israel-Hamas ceasefire] Negotiations scheduled in Cairo are expected to be postponed until the end of the week due to lack of progress in contacts", according to Sky News Arabia citing Israeli official and diplomats via Israeli Broadcasting Corp

- Israeli PM Netanyahu accepted the updated proposal that includes some of his new demands because he knew that Hamas would reject it, according to Al Jazeera citing Axios quoting Israeli officials.

- US Secretary of State Blinken made it clear to Israeli PM Netanyahu that the US expects negotiations to continue until an agreement is reached, according to Al Jazeera citing Axios sources.

- Hamas senior official Hamdan said they confirmed to mediators that they don't need new Gaza negotiations and what they need is to agree on an implementation mechanism. Hamdan added that US Secretary of State Blinken's statement that Netanyahu accepted an updated proposal 'raises many ambiguities' since it is not what was presented to them and not what was agreed on, according to Reuters.

- Iran's Foreign Ministry said they affirm the right to respond to the attack on their sovereignty and will do so at the appropriate time.

- Iran's mission to the UN said they have no intention to interfere in US elections and demanded evidence from Washington after Tehran was accused of targeting the Trump campaign electronically.

Geopolitics - Ukraine

- Ukrainian military said its forces experienced repeated attacks in the Toretsk zone, Donetsk region and that its forces were under heavy Russian attack around Pokrovsk, eastern Ukraine. Ukrainian military later announced that air defence units were engaged in repelling a Russian air attack on Kyiv.

- Russia on Monday ruled out any peace talks with Ukraine despite Kyiv raising pressure on the Kremlin by claiming fresh advances in its offensive into Russian territory, according to AFP.

- US and South Korea are holding joint air drills to counter North Korean threat, according to Reuters.

US Event Calendar

- 08:30: Aug. Philadelphia Fed Non-mfg, prior -19.1

Central Bank Speakers

- 13:35: Fed’s Bostic on Innovating for Inclusion

- 14:45: Fed’s Barr Speaks on Cybersecurity

US equity futures are flat after another narrow overnight range, following another euphoric session on Wall Street amid bets the Fed chair Powell will signal it’s ready to start cutting interest rates as soon as this Friday’s Jackson Hole symposium. As of 7:30am ET, S&P futures were up 0.1% to 5,634 while Nasdaq futures also gained 0.1%. MSCI’s all-country stock index headed for a ninth day of increases, its longest winning streak since December. Oil halted its latest rout, treasury 10-year yields held steady around 3.87%, the Bloomberg dollar index was unchanged after sliding to the lowest since March, while gold exploded to a new record high, trading at $2525. It is a quiet session with just the Philly Fed non-mfg activity index on deck.

In premarket trading, home improvement retailer Lowe’s cut its sales and earnings forecast, blaming a frozen housing market. Hawaiian Holdings rose 10% after the US Justice Department decided against challenging its proposed tie-up with Alaska Air. Meanwhile, the European Union said it plans to introduce a 9% tariff on Teslas imported from China. Here are other notable premarket movers:

- Fabrinet shares rise 8.8% after first-quarter forecasts for adjusted earnings per share and revenue topped the average analyst estimates. Analysts note AI momentum as company issues strong outlook for the current quarter.

- FuboTV shares increase 0%, putting the online TV provider on track for its sixth consecutive session of gains. The stock got a boost this week after Fox, Warner Bros. Discovery and Walt Disney were blocked by a judge from launching their streaming sports service rival one week before its rollout

- Kymera shares slide 3.8% after the biopharmaceutical company’s offering priced at $40.75-per-share via Morgan Stanley, JPMorgan, Stifel.

- Vornado Realty Trust shares rise 1.7% after Evercore ISI upgraded the real estate investment trust to outperform from underperform.

On the corporate front, Alimentation Couche-Tard Inc.’s preliminary proposal to buy 7-Eleven owner Seven & i Holdings Co. could be worth more than ¥5.63 trillion ($38.4 billion), based on the Japanese company’s market value after news of the potential deal was disclosed. Edgar Bronfman Jr. submitted a $4.3 billion bid to take control of Paramount Global and quash an existing offer from Skydance Media, Bloomberg reported.

Traders are taking a break after Monday’s session in the US lifted the S&P 500 for an eighth straight day. Stock volumes have been trending lower with investors reluctant to place big bets before central bankers gather for the Fed’s Jackson Hole economic symposium this week.

“What we’ve seen happen is a swath of recent data, which has eased fears about slowing US growth without stoking fears of re-accelerating inflation,” said Kyle Rodda, a senior market analyst at Capital.Com Inc.

With stocks relatively flat, attention has turned now to gold where the precious metal has broken out from its range and is hitting new record highs on an almost daily basis ahead of the coming dollar debasement about to be unleash by the Kam-unist regime of Kamala Harris who plans on “fighting” food inflation with price control. Gold has gained more than 20% this year, in part driven by the view that the Fed’s pivot toward cutting rates was nearing. Banks including UBS and ANZ say that there’s scope for further gains too, not just on the Fed’s policy but on central bank buying and demand for portfolio hedges.

In Europe, technology and travel shares outperformed, keeping the Stoxx 600 within a whisker of recouping August’s losses as investors bet that interest rates in the US will ultimately come down. Technology is the strongest performing sector, with energy the biggest laggard as oil stocks fall on easing supply risks from a potential Gaza cease-fire. Here are some of the biggest European movers on Tuesday:

- Huber+Suhner shares rise as much as 12%, the most in almost 13 years, after the Swiss electrical products manufacturer’s first-half results beat estimates and it confirmed its full-year guidance. Analysts see continued recovery in the second half of the year and Baader says the order flow was particularly impressive.

- Antofagasta gains as much as 0.9% after the copper mine operator reported first-half Ebitda that beat analyst estimates. Citi notes that higher copper prices offset the impact from lower production and higher unit costs.

- European oil stocks are down on Tuesday as oil extended the biggest drop in two weeks after the US said Israel accepted a cease-fire proposal in Gaza, potentially easing supply risks as concerns about the global demand outlook mount. Biggest laggards in terms of index points are Shell (-1.7%), BP (-1.7%), TotalEnergies (-1.2%), Equinor (-1.7%), Aker BP (-2.7%) and Eni (-0.4%)

- BT shares slide as much as 6% amid competition worries, after Sky struck a deal to launch its broadband services on CityFibre’s network from next year.

- Coloplast falls as much as 3.5%, the most since May, after the Danish ostomy and wound care company reported 3Q margins that fell short of estimates. The miss was a key negative in an otherwise overall in-line report where it also reiterated guidance, analysts say.

- DocMorris shares plunge as much as 17% after the pharmaceutical products retailer warned it is expecting to book a bigger annual adjusted Ebitda loss than previously anticipated as it reported interim results. Analysts at Jefferies say the weaker bottom-line target was expected, but the reduced revenue growth goal is the main disappointment.

- Wood Group shares swing between gains and losses after the Scottish engineering firm published mixed first-half results. Analysts weighed goodwill impairments and the net loss against some signs of recovery and stabilization, especially as the company held its guidance steady for the year, after Sidara ended takeover interest in Wood Group this month.

The recent turmoil in financial markets has left strategists unfazed about the outlook for European stocks. The benchmark gauge is seen ending the year at 535 points — about 4.6% above Friday’s close, according to the median estimate in a Bloomberg survey of 16 strategists. Still, increasing risks to the region’s growth outlook have reinforced the case for a policy adjustment when the European Central Bank meets next month, Governing Council member Olli Rehn said. Markets are pricing in at least two more rate reductions this year.

Asian stocks gained for a third day, helped by advances in Japan and South Korea amid optimism over Fed rate cuts. The MSCI Asia Pacific Index rose as much as 0.7%, with SK Hynix, Keyence and Samsung Electronics the biggest contributors to the advance. Key gauges in Japan climbed as the yen’s rally against the dollar stalled, supporting exporters such as tech companies and automakers. South Korean and Thai equities also gained.

In FX, the Bloomberg Dollar Spot Index is also little changed, trading near a 6 month low. The kiwi dollar tops the G-10 FX leader board, rising 0.4% against the greenback. The Swedish krona rises 0.3% even after the Riksbank cut interest rates and sketched out more easing than its previous guidance.

In rates, treasuries are steady, with US 10-year yields at 3.87%. The curve is steeper, unwinding much of Monday’s flattening move in 2s10s and 5s30s spreads. Corporate new-issue calendar may dominate the session, with Kroger expected to bring one of this year’s largest deals.

In commodities, WTI fell 0.6% to $73.95 after the US said Israel accepted a cease-fire proposal in Gaza, which however has zero chance of being accepted by Hamas. Copper steadied after a recent rebound and gold jumped by $18 to a record $2,525 an ounce on expectations that the Fed is poised to cut interest rates. Bitcoin gained 2%.

It’s a quiet day: on the US economic calendar we only get the August Philadelphia Fed non-manufacturing activity at 8:30am. Fed speaker slate includes Bostic (1:35pm) and Barr (2:45pm)

Market Snapshot

- S&P 500 futures little changed at 5,631.50

- STOXX Europe 600 little changed at 514.79

- MXAP up 0.6% to 184.89

- MXAPJ up 0.4% to 576.07

- Nikkei up 1.8% to 38,062.92

- Topix up 1.1% to 2,670.54

- Hang Seng Index down 0.3% to 17,511.08

- Shanghai Composite down 0.9% to 2,866.66

- Sensex up 0.6% to 80,873.27

- Australia S&P/ASX 200 up 0.2% to 7,997.73

- Kospi up 0.8% to 2,696.63

- German 10Y yield little changed at 2.24%

- Euro little changed at $1.1084

- Brent Futures down 1.2% to $76.71/bbl

- Gold spot up 0.5% to $2,517.95

- US Dollar Index little changed at 101.79

Top Overnight News

- Former US President Trump said he would consider ending the USD 7,500 electric vehicle tax credit and if elected, he would tap Elon Musk for a cabinet or advisory role if Musk would do it, according to an interview. Trump later stated that VP Harris informed that she will not do the Fox News debate on September 4th and he will conduct a tele-town hall, according to a post on Truth Social.

- Central bankers gathering this week for one of the world’s most prominent annual economic forums are set to find themselves more divided than perhaps any time since before the pandemic.

- Increasing risks to Europe’s growth outlook have reinforced the case for a policy adjustment when the European Central Bank meets next month, according to Governing Council member Olli Rehn.

- US Secretary of State Antony Blinken said Israeli Prime Minister Benjamin Netanyahu has accepted a cease-fire proposal to halt the war in Gaza and the next step is for “Hamas to say yes,” putting the onus on the group to end the 10-month conflict even as violence continued.

- A price war is spreading across China’s new-home market, as local governments dial back on intervention and developers race to recoup cash.

- Sweden’s Riksbank lowered borrowing costs and outlined more easing than previously expected as inflation has fallen below its target and the largest Nordic economy is sputtering.

- Oil extended the biggest drop in two weeks as the US said Israel accepted a cease-fire proposal in Gaza, potentially easing supply risks as concerns about the global demand outlook mount.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed and only partially took impetus from the tech-led gains stateside amid a lack of major macro drivers. ASX 200 edged mild gains with stock news in Australia dominated by earnings releases, while the RBA Minutes noted it is possible the cash rate would have to stay steady for an extended period and members agreed a rate cut in the short term was unlikely. Nikkei 225 outperformed and reclaimed the 38,000 level despite the absence of notable catalysts. Hang Seng and Shanghai Comp. declined amid lingering economic concerns, while China also maintained its Loan Prime Rates which was widely expected after last month’s bout of cuts to key funding rates.

Top Asian news

- Chinese Loan Prime Rate 1Y (Aug) 3.35% vs. Exp. 3.35% (Prev. 3.35%); 5Y 3.85% vs. Exp. 3.85% (Prev. 3.85%)

- China is unleashing billions of dollars of lending to technology start-ups and other small companies using their intellectual property as collateral as Beijing seeks to revive demand for loans and stimulate a lagging economy, according to FT.

- RBA Minutes from the August 5th-6th meeting stated the board considered the case to raise rates but decided a steady outcome better balanced the risks and it is possible the cash rate would have to stay steady for an extended period. Members agreed it is unlikely rates would be cut in the short term and they need to be vigilant to upside risks to inflation, while policy would need to remain restrictive and it was noted that an immediate hike in rates could be justified if risks to inflation had increased materially. Furthermore, members also observed that holding the cash rate target steady at its current level for a longer period than currently implied by market pricing may be sufficient to return inflation to target in a reasonable timeframe, but the Board will need to reassess this possibility at future meetings.

- China is said to be mulling allowing local governments to issue bonds for home purchases, according to Bloomberg sources.

European bourses, Stoxx 600 (+0.1%) are mostly, but modestly firmer (ex-FTSE 100), continuing the strength seen on Wall St in the prior session. FTSE 100 (-0.6%) is the worst performing index in Europe, weighed on by losses in Energy names amid the broader weakness in underlying oil prices; Shell (-1.8%), BP (-1.6%). European sectors are mixed; Tech takes the top spot, continuing the strength seen in the US on Monday. Travel & Leisure is also one of the better performers, benefiting from the recent drop in oil prices – as such, Energy is found at the foot of the pile. US Equity Futures (ES U/C, NQ U/C, RTY U/C) are flat, taking a breather following the significant strength seen in the prior session.

Top European news

- ECB’s Rehn said there are no clear signs of a pick-up in the manufacturing sector, while he added the recent increase in negative growth risks in the euro area has reinforced the case for a rate cut at the next ECB monetary policy meeting in September.

- Riksbank cuts its Rate by 25bps as expected to 3.50% (prev. 3.75%); Policy rate can be cut two or three more times this year – somewhat faster than the Board expected in June.

- Riksbank’s Governor Thedeen says moving gradually with rates is part of central bank strategy. There are good reasons to keep SEK on the Riksbank’s radar. Inflation is not under target, it is currently in line with target.

FX

- DXY is flat with the dollar showing mixed performance vs. peers. DXY remains stuck below the 102.00 mark in catalyst light trade as investors eye key risk events later in the week, including Jackson Hole and FOMC Minutes.

- EUR is flat vs. the USD in quiet newsflow. EUR on Monday was able to extend its advance on a 1.10 handle and has today printed a fresh YTD high at 1.1088.

- Cable has managed to poke its head above the 1.30 mark for the first time since July 18th, despite the lack of clear UK-specific catalysts.

- JPY is flat with USD/JPY well within yesterday’s 145.19-148.05 range with newsflow out of Japan and the US on the light side in the run up to the Jackson Hole event later in the week and BoJ Governor Ueda’s appearance before Parliament on the 23rd August.

- AUD is steady vs. the USD after a recent run of gains which has seen the pair gain a firm footing on a 0.67 handle and top out today at 0.6738.

- CAD is broadly steady vs. the USD in the run up to Canadian inflation metrics which are expected to see a pullback in the Y/Y rate and an increase in the M/M print.

- SEK was fairly unreactive to the Riksbank decision to cut rates by 25bps to 3.50%. The guidance for “two or three more times this year” in terms of policy cuts is a dovish shift vs the guidance seen at the last gathering for “two or three times in H2”, as it opens the door to a cut per meeting in H2.

- PBoC set USD/CNY mid-point at 7.1325 vs exp. 7.1317 (prev. 7.1415).

Fixed Income

- USTs are contained within a thin six-tick range with the benchmark yet to lastingly deviate from the unchanged mark. Data docket remains light, but Fed speak sees Barr and Bostic later today.

- A firmer start with EGBs finding a grinding bid early doors, but a slight dip to the 134.09 low was seen on German Producer Price metrics which ticked up from the prior Y/Y.

- Bunds then edged higher throughout the morning, to a 134.41 peak, approaching Monday’s 134.62 best; but some modest pressure was seen following Bloomberg reports that China is said to be considering allowing local gov’ts to issue bonds for home buying. Bunds were unreactive to the Green Bund auction.

- Gilts are modestly firmer in a narrow 99.74-99.88 band, which is entirely within the parameters of both Monday and Friday.

- Germany sells EUR 0.734bln vs exp. EUR 0.75bln 2.30% 2033 Green Bund & EUR 0.727bln vs exp. EUR 0.75bln 0.00% 2050 Green Bund. Sells EUR 0.734bln 2.30% 2033: b/c 3.3x (prev. 3.4x), average yield 2.16% (prev. 2.51%) & retention 2.13% (prev. 15.4%). Sells EUR 0.727bln 0.00% 2050: b/c 1.6x (prev. 2.2x), average yield 2.42% (prev. 2.41%) & retention 3.07% (prev. 20.2%)

Commodities

- Crude is softer intraday and continuing the price action seen on Monday, with focus on continued Gaza ceasefire talks and a weak Chinese economy. Brent October sits towards the lower end of a USD 76.55-77.77/bbl parameter.

- Precious metals are firmer across the board with broad-based modest gains against the backdrop of a subdued Dollar and with geopolitical risks looming. Spot gold printed a fresh all-time-high at USD 2,521.30/oz (vs low USD 2,497.51/oz).

- Base metals are mostly firmer across the board but to varying degrees, with copper prices somewhat flat intraday with some suggesting a short-covering rally ended amid China growth woes.

- LME Stocks: Copper +11975 (prev. -975).

- Equinor (EQNR NO) has commenced work to resume oil and gas output from Norway’s Gullfaks C platform.

Geopolitics – Middle East

- US President Biden says Hamas is ‘backing down’ from Gaza deal, according to AFP cited by Sky News Arabia.

- “[Israel-Hamas ceasefire] Negotiations scheduled in Cairo are expected to be postponed until the end of the week due to lack of progress in contacts”, according to Sky News Arabia citing Israeli official and diplomats via Israeli Broadcasting Corp

- Israeli PM Netanyahu accepted the updated proposal that includes some of his new demands because he knew that Hamas would reject it, according to Al Jazeera citing Axios quoting Israeli officials.

- US Secretary of State Blinken made it clear to Israeli PM Netanyahu that the US expects negotiations to continue until an agreement is reached, according to Al Jazeera citing Axios sources.

- Hamas senior official Hamdan said they confirmed to mediators that they don’t need new Gaza negotiations and what they need is to agree on an implementation mechanism. Hamdan added that US Secretary of State Blinken’s statement that Netanyahu accepted an updated proposal ‘raises many ambiguities’ since it is not what was presented to them and not what was agreed on, according to Reuters.

- Iran’s Foreign Ministry said they affirm the right to respond to the attack on their sovereignty and will do so at the appropriate time.

- Iran’s mission to the UN said they have no intention to interfere in US elections and demanded evidence from Washington after Tehran was accused of targeting the Trump campaign electronically.

Geopolitics – Ukraine

- Ukrainian military said its forces experienced repeated attacks in the Toretsk zone, Donetsk region and that its forces were under heavy Russian attack around Pokrovsk, eastern Ukraine. Ukrainian military later announced that air defence units were engaged in repelling a Russian air attack on Kyiv.

- Russia on Monday ruled out any peace talks with Ukraine despite Kyiv raising pressure on the Kremlin by claiming fresh advances in its offensive into Russian territory, according to AFP.

- US and South Korea are holding joint air drills to counter North Korean threat, according to Reuters.

US Event Calendar

- 08:30: Aug. Philadelphia Fed Non-mfg, prior -19.1

Central Bank Speakers

- 13:35: Fed’s Bostic on Innovating for Inclusion

- 14:45: Fed’s Barr Speaks on Cybersecurity

Loading…