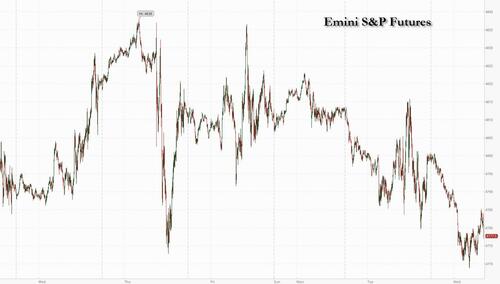

US equity futures and global markets extended their decline on Wednesday after central bankers continued their push-back against market bets for interest rate cuts, deepening a global selloff across stocks and bonds. At 8:00am ET, S&P futures fall 0.4% and Nasdaq contracts ease about 0.5% suggesting another weak day ahead for US equities after ECB President Christine Lagarde and Governing Council member Klaas Knot warned on Wednesday that aggressive bets on interest-rate cuts aren’t helping policymakers in the battle against lingering price pressures, echoing hawkish comments from the Fed's Waller on Tuesday who urged caution on the pace of easing. The VIX rose to 14.60, the highest leve since mid-November. The Bloomberg Dollar Spot Index extended its rally to a fourth day while the 2Y Treasury yields climbed six basis points to 4.29% and 10-year yields rose 2bps to 4.08%. Oil dropped again with Brent sliding to $77 as gold also eases to near $2,025.

Meanwhile, fresh concerns about China’s economy added another headwind for equities. US-listed Chinese stocks fell in premarket trading as disappointing economic data and a lack of major stimulus deter investors, with the exchange-traded KraneShares CSI China Internet Fund, which holds over 30 US- and Hong Kong-listed Chinese tech firms, trading more than 3% lower. Here are some other notable premarket movers:

- Allakos drops 10% and appears set to extend Tuesday’s 60% plunge after the drug developer was downgraded to hold at Jefferies following two mid-stage trials that failed to meet their main goals.

- Donald Trump-tied stocks fall and appear set to give back some of Tuesday’s double-digit gains after the former president scored a big win at the Iowa caucuses. Digital World (DWAC) -8%, Phunware (PHUN) -60%

- Fisker (FSR) drops 3% after TD Cowen downgrades to market perform, saying the electric-vehicle maker’s growing pains are continuing to accumulate.

- Interactive Brokers (IBKR) falls 4% after the firm reported fourth-quarter total net interest income that missed estimates.

- Mattel (MAT) falls 3% after Morgan Stanley downgrades the toymaker to equal-weight, citing a tougher category outlook in 2024 and limited growth drivers.

- Morgan Stanley (MS) slips 1% after being downgraded to neutral at JPMorgan, which said the bank is now fairly valued, with limited near-term catalysts to propel shares higher.

- Plexus (PLXS) falls 1.7% after the company reported preliminary first-quarter revenue that missed the average analyst estimate.

- Polaris (PII) gains 1% as Morgan Stanley upgrades its rating to overweight, saying the risk/reward for shares in the maker of off-road vehicles is “too attractive to ignore.”

- Spirit Airlines (SAVE) declines 15% after a federal judge blocked JetBlue’s $3.8 billion acquisition of the budget airline.

Following the recent hawkish comments from central bankers, swaps market pricing for a Fed rate cut in March has dropped to around 65% from 80% on Friday, while money markets pushed back bets on the timing of the ECB’s first quarter-point cut to June, from April.

“Inflation was never going to be a straight line down, as we have seen in the US and Europe,” said Luke Hickmore, investment director at abrdn. “Rates will fall this year but market expectations around when and how much are going to be very volatile.”

Still more evidence that the battle against inflation isn’t over came from the UK, where price increases accelerated unexpectedly for the first time in 10-months, prompting traders to scale back their expectations for rate cuts from the Bank of England this year. Gilts tumbled and the pound gained as traders aggressively trimmed expectations for monetary-policy easing this year.

Basic resources and luxury-goods stocks were among the biggest decliners in Europe amid worries about slackening demand in China, a key market. The Stoxx Europe 600 index slumped more than 1%. All industry sectors were in the red, with real estate and retailers among the hardest hit. German two-year yields rose five basis points to 2.65%. Here are the biggest European movers Wednesday:

- IMI rises as much as 3.9% and is the top gainer in the Stoxx Europe 600 index in early trade after being upgraded to buy from neutral by Goldman Sachs, which sees scope for the engineering firm’s shares to outperform over the next year

- Telecom Italia shares rise as much as 3% in Milan trading, the most in two weeks, as the Italian government cleared the sale of the company’s landline network to KKR & Co. after a review process for an asset deemed to be of strategic interest to the state

- IAG was raised to buy from neutral at Goldman Sachs, with analysts expecting the British Airways parent to see earnings growth this year and sustain higher margins. Shares rise as much as 0.9%

- Basic-Fit shares rises as much as 3.5% after the health and fitness club operator received a double upgrade to buy from underperform from Jefferies, which says its valuation has fallen too low

- BP shares fall as much as 1.5%, , to its lowest intraday level since Oct. after the oil giant said interim Chief Executive Officer Murray Auchincloss will take up the role permanently

- Antofagasta declined as much as 4.9%, the most since July, after costs increased in the fourth quarter. Peers with copper exposure also edged lower

- Pearson shares fall as much as 2.5%, retreating further from recent 13-month highs, after the education publishing firm said adjusted operating profit for 2023 will slightly undershoot forecasts due to pound-dollar exchange-rate fluctuations

- 888 drops as much as 15%, the most since September, after the online gambling group reported lower 4Q revenue. Though analysts across the board cut their Ebitda forecasts for 2023 and 2024

- Meyer Burger shares slump as much as 46%, the most ever, after the Swiss solar panel maker announced it could shift focus to the US, shut one of its European production sites, and possibly raise more equity

Earlier in the session, Asian equities suffered broad losses for a second day with Hong Kong leading the selloff after Chinese economic data failed to moderate bearish momentum. Hang Seng Tech index slumped almost 4% and H shares plunged 3%. Shanghai Composite drops 0.6%, ChiNext dropped 1.2%, and the CSI 300 mainland Chinese benchmark also fell 2.2%. The losses came after official figures showed while China reached its 2023 economic goal, the country’s housing slump has worsened and domestic demand remained listless. South Korean stocks are also sharply lower, while Japanese shares extend 2024 outperformance by staying narrowly in the green thanks to the renewed implosion of the yen.

The Bloomberg Dollar Spot Index steadied around a one-month high while the yen extended its recent tumble, sending the USDJPY hovering around 147.6. Traders awaited the release of the central bank’s beige book and US retail sales, after the Fed’s Waller warned rates are unlikely to come down as quickly as they have done in the past

- GBP/USD rose as much as 0.5% to 1.2694 leading G-10 gains against the dollar; UK inflation unexpectedly picked up in December as CPI rose 4% from a year earlier

- EUR/USD pared losses to trade around 1.0880 after dropping 0.2% to 1.0856, the lowest level since Dec. 13; ECB President Christine Lagarde told Bloomberg it’s likely interest rates will be cut in the summer in a push back to current market pricing

- AUD/USD fell 0.7% to 0.6535 as the Australian dollar led G-10 losses on disappointing Chinese economic data; China’s 4Q GDP rose 5.2% from a year ago, compared with a 5.3% estimate, home prices fell the most in almost nine years

- The loonie is set to drop for a fifth day as growing fears of inflation following UK data undermines investor sentiment, sending bonds and stocks lower.

In rates, the treasuries curve was aggressively flatter on the day, with front-end underperforming following a wider bear flattening move in gilts after data showed UK inflation picked up unexpectedly for the first time in 10 months. The 10Y TSY yield rose to session highs of 4.08%, reversing earlier losses; long-end Treasury yields were slightly richer on the day while front-end of the curve is cheaper by around 6bp vs Tuesday close; curve subsequently shifts flatter, following move in gilts with US 2s10s, 5s30s spreads tighter by 6bp and 4.5bp, remains near lows into early US session. On outright basis, UK 2-year yields remain cheaper by around 14bp on the day into early US session, which includes retail sales and a 20-year bond auction. US economic data includes January NY services business activity, December retail sales, import/export prices (8:30am), industrial production (9:15am), November business inventories and January NAHB housing market index (10am). Federal Reserve members scheduled to speak include Barr, Bowman (9am) and Williams (3pm); Fed release Beige book at 2pm

In commodities, oil fell again as a broad risk-off tone across markets coupled with a stronger US dollar offset concerns over Middle East tensions, including continued attacks on ships in the Red Sea by Iran-backed Houthi rebels. WTI crude futures paused around $71.80 while Brent traded down to $77. In other news, BP Plc appointed Murray Auchincloss as its permanent chief executive officer, four months after the shock resignation of his predecessor.

Elsewhere, gold was steady after a Tuesday decline of more than 1% to trade around $2,028 per ounce and Bitcoin dropped below $43,000 while Ether is also lower, sliding 2%. A new rule requiring US businesses to report cryptocurrency transactions over USD 10k has been postponed until the IRS issues new regulations on digital asset reporting, according to Cointelegraph.

Looking the day ahead now, and data releases include UK CPI for December, US retail sales, industrial production and capacity utilisation for December, along with the NAHB’s housing market index for January. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Cipollone, Vasle, Simkus, Villeroy, Vujcic, Knot and Nagel, as well as the Fed’s Barr, Bowman and Williams. The Fed will also be releasing their Beige Book.

Market Snapshot

- S&P 500 futures down 0.5% to 4,776.25

- STOXX Europe 600 down 1.2% to 467.23

- MXAP down 1.7% to 162.13

- MXAPJ down 2.2% to 491.66

- Nikkei down 0.4% to 35,477.75

- Topix down 0.3% to 2,496.38

- Hang Seng Index down 3.7% to 15,276.90

- Shanghai Composite down 2.1% to 2,833.62

- Sensex down 2.2% to 71,506.16

- Australia S&P/ASX 200 down 0.3% to 7,393.08

- Kospi down 2.5% to 2,435.90

- German 10Y yield little changed at 2.28%

- Euro little changed at $1.0869

- Brent Futures down 1.9% to $76.84/bbl

- Gold spot down 0.4% to $2,021.15

- U.S. Dollar Index little changed at 103.44

Top Overnight News

- China’s Q4 GDP numbers were largely inline with expectations (which isn’t a surprise since Premier Li preannounced GDP at Davos Tues morning) and industrial production for Dec was a bit better than anticipated (+6.8% vs. the Street +6.6%), but the GDP deflator shows the country still grappling with deflation while retail sales fell short in Dec (+7.4% vs. the Street +8%), the population decline accelerated, and property investment stayed weak. FT

- Aramco’s CEO said global oil markets can cope with Red Sea disruptions in the short-term, but prolonged attacks could create a problem. RTRS

- The ECB is “likely” to cut rates by or in the summer, Christine Lagarde said in response to a question on whether there’s majority support among officials for such a move. Policy makers are “on the right path” in curbing inflation, she said, adding that overoptimistic rate-cut bets in the market don’t help. BBG

- UK CPI runs hotter than anticipated, with headline +4% in Dec (up from +3.9% in Nov and firmer than the Street’s +3.8% forecast) and core +5.1% (flat vs. Nov and firmer than the Street’s +4.9% forecast). FT

- Qatar brokered a deal to permit medications to reach Israeli hostages in exchange for additional aid and medicine for Palestinian civilians. NYT

- The US is stepping up efforts to broker a diplomatic solution to the intensifying hostilities between Israel and Lebanon’s Hizbollah, as fears grow in Washington that the window is narrowing to avert a full-blown war erupting on the shared border. FT

- Biden has invited Congressional leaders to the White House for a meeting on Wed to discuss Ukraine aid and other fiscal matters (this will be the first face-to-face discussion between Biden and the congressional leadership in months). NYT

- Iran isn’t yet restocking Houthi rebels with weapons by sea after US and UK air strikes last week, Western officials said, signaling cautious optimism that the military action was successful in disrupting arms supplies. BBG

- JPMorgan plans to add to its headcount this year, President Daniel Pinto said. The bank sees opportunities in investment banking, international retail and US wealth management. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly pressured after the recent upside in yields and tapering of Fed rate cut expectations, while participants also digested mixed Chinese economic releases including GDP and activity data. ASX 200 declined as losses in the commodity-related sectors overshadowed the gains in defensives and tech. Nikkei 225 was initially boosted at the open on the back of a weaker currency and briefly climbed back above 36,000 but then pulled back from fresh three-decade highs and wiped out all of its gains as it succumbed to the risk-off mood. Hang Seng and Shanghai Comp retreated amid the mixed data releases from China and with Hong Kong significantly underperforming amid hefty losses in tech and property, with the latter pressured by the decline in Chinese home prices.

Top Asian News

- China's stats bureau head said the economy faces a complex external environment and insufficient demand in 2024, as well as noted that low consumer prices reflect insufficient effective demand and expects a modest consumer price rise in 2024. NBS head stated China's economy is at a crucial stage of recovery and its property market is showing some positive changes, while he added there is still relatively big room for China's property sector to develop and there is still room to unveil more policy steps to support growth.

- China has drafted guideline on formatting standards for AI sector; details light

- China's BYD (1211 HK) to stop making pouch-type batteries for its hybrid EVs on concerns they may leak; plans to completely stop using pouch cells by 2025, via Reuters citing sources.

- Former BoJ official Maeda says that the BoJ could end NIRP in April, but will likely move slowly in any additional normalisation steps, via Reuters.

European bourses are lower, with over 90% of the Stoxx600 (-1.1%) in the red, amid a negative risk tone following mixed Chinese data overnight, initial hawkish-tone and hotter-than-expected UK CPI; the FTSE 100 (-1.7%) lags, dragged down by miners. European sectors are entirely in the red; Real Estate suffers from the higher yield environment, Basic Resources and Energy are dragged lower by broader weakness in the commodity markets. US equity futures are trading on the backfoot, in tandem with losses seen in the European session. The RTY (-1.3%) significantly underperforms, continuing to extend on yesterday’s hefty losses. ES/NQ (-0.4%), into Retail Sales, Fed speak and a handful of earnings. Headline US Specifics: JPM will increase headcount this year; IBKR down after results; TSLA reduces Model Y prices in Germany.

Top European News

- Tesla Cuts Model Y Prices in Europe: Investor’s Business Daily

- Bank of Italy’s Panetta Sees Growth Under 1% in 2024: Radiocor

- Oil in Retreat as Risk-Off Mood Swamps Impact of Mideast Crisis

- Basic-Fit Climbs on Double Upgrade To Buy From Jefferies

- Frankfurt Airport Cancels Flights Amid Icy Winter Weather

FX

- USD continues to gain as Waller tempers the pace of rate cut expectations. DXY has advanced to a high of 103.58 with not much resistance until 104.

- EUR is one of the better performers vs. the USD today amid hawkish ECB speak. That said, EUR/USD saw a hefty decline from yesterday's 1.0951 high. Further downside could bring its 200DMA at 1.0845 into play.

- The Pound is the only G10 currency firmer vs. USD amid hawkish inflation metrics; Cable hit a high just shy of the 1.27 mark but remains some way off yesterday's best of 1.2729.

- Antipodeans both remain battered by risk environment with AUD lagging on account of Chinese sell-off overnight; AUD/USD next target is a Dec 7th low at 0.6525 with NZD/USD selling putting a test of 0.61 on the cards.

- PBoC set USD/CNY mid-point at 7.1168 vs exp. 7.1986 (prev. 7.1134).

Fixed Income

- USTs are contained, but with a modest bearish-bias given a hotter than expected UK CPI print and additional hawkish commentary from ECB speakers. Yields continue to bear-flatten a touch as participants digest Waller before Retail Sales and thereafter Bowman, Barr & Williams

- Bunds started the session on the backfoot and felt additional pressure on UK CPI which saw the 134.37 trough print (matches 8/12 low); since, benchmarks have found some reprieve though still remain in negative territory.

- Gilts are the clear laggard after an unexpected rise in UK CPI for December, which led benchmarks to fall to a 98.82 trough; levels to the downside include 98.29, Dec 12th low.

Commodities

- Crude is at lows, Brent (-2.1%), amid a concoction of bearish factors including the firmer Dollar, soured risk tone, hotter-than-expected UK CPI data, and the mixed Chinese GDP data overnight; Brent Mar is back under USD 77.00/bbl and markets await OPEC MOMR at 12:45GMT/07:45EST.

- Gold is subdued amid the firmer Dollar, but losses in the yellow metal are cushioned, potentially amid haven flows coupled with technical support; XAU resides around USD 2,025/oz.

- Base metals are softer across the board, in-fitting with the broader market mood, and in the aftermath of the mixed Chinese GDP data overnight.

- China is to cut gasoline price by CNY 50/t starting Jan 18th, according to the NDRC

- Saudi Aramco CEO says Red Sea attacks are manageable in the short-term, may create tanker shortage and weigh on market if it lasts longer

- Pemex reports that it is carrying out work activity which could result in flaring at the Deer Park, Texas facility (340k BPD)

- Exxon's (XOM) 250k BPD Joliet Illinois refinery reports flaring, according to Reuters

- Antofagasta (ANTO LN) reports FY23 copper production at 661kt (vs guided 640-670kt)

ECB Speak

- ECB President Lagarde (Neutral) says inflation is not where the ECB wants it to be; confident the ECB will get inflation to the 2% target; Will stay restrictive for as long as necessary. Too optimistic markets do not help the ECB in its inflation fight. Cannot should victory until inflation is sustainably at 2%. Watching wages, profit margins, energy and supply chains. Second-round effects would be a cause for concern. ECB has reached peak rates, short of a major shock.

- ECB President Lagarde (Neutral) says it is likely that the ECB will cut rates by the summer, according to Bloomberg.

- ECB’s Knot (Hawk) says markets are getting ahead of themselves on rate cuts; a lot must go well to hit the 2% inflation in 2025; rate path priced by markets can be self-defeating, via CNBC; "rate hike in the first half is rather unlikely".

- ECB's Vasle (Neutral) says his rate expectations are significantly different to the market; says it is absolutely premature to expect rate cuts at the start of Q2.

- ECB's Panetta (Dove) says disinflation is happening, and is strong and will continue; says risks are emerging for raw material costs; adds that monetary conditions should adjust; awaiting data first to confirm the disinflation outlook.

- ECB's Villeroy (Neutral) says the job of monetary policy is not finished yet; premature to say when the ECB will reduce rates this year

Geopolitics

- Maersk CEO sees Red Sea disruptions "lasting a few months at least"

- US President Biden's administration is expected to announce plans to designate Yemen's Houthi rebel group as a global terrorist organisation, according to an official cited by CBS News.

- US National Security Council spokesperson said the US welcomed the announcement by Qatar that an agreement was reached to have medicine delivered to hostages in Gaza, according to Reuters.

- Iran’s Defense Minister said the country is engaged in talks with Russia over concluding an MoU on respect for national sovereignty, territorial integrity and regional interests, according to journalist Aslani.

- China's Taiwan Affairs Office said Taiwan's election result cannot stop the trend towards reunification and China is willing to create the widest space for peaceful reunification, while it added that Taiwan has never been a country and China will never leave any space for Taiwan independence, according to Reuters.

US Event Calendar

- 07:00: Jan. MBA Mortgage Applications 10.4%, prior 9.9%

- 08:30: Jan. New York Fed Services Business, prior -14.6

- 08:30: Dec. Import Price Index MoM, est. -0.5%, prior -0.4%

- 08:30: Dec. Import Price Index YoY, est. -2.0%, prior -1.4%

- 08:30: Dec. Export Price Index YoY, est. -0.7%, prior -5.2%

- 08:30: Dec. Export Price Index MoM, est. -0.6%, prior -0.9%

- 08:30: Dec. Retail Sales Advance MoM, est. 0.4%, prior 0.3%

- 08:30: Dec. Retail Sales Ex Auto MoM, est. 0.2%, prior 0.2%

- 08:30: Dec. Retail Sales Control Group, est. 0.2%, prior 0.4%

- 08:30: Dec. Retail Sales Ex Auto and Gas, est. 0.3%, prior 0.6%

- 09:15: Dec. Industrial Production MoM, est. -0.1%, prior 0.2%

- 09:15: Dec. Capacity Utilization, est. 78.7%, prior 78.8%

- 10:00: Nov. Business Inventories, est. -0.1%, prior -0.1%

- 10:00: Jan. NAHB Housing Market Index, est. 39, prior 37

- 14:00: Federal Reserve Releases Beige Book

Central Bank Speakers

- 09:00: Fed’s Barr Speaks at Conference on Cyber Risk

- 09:00: Fed’s Bowman Speaks About Future of Bank Capital Reform

- 14:00: Federal Reserve Releases Beige Book

- 15:00: Fed’s Williams Speaks at NY Fed Event

DB's Jim Reid concludes the overnight wrap

After all the comparisons with the 1970s over the last few years, Henry pointed out yesterday that actually the late-1960s are becoming an increasingly good parallel. That was another period of low unemployment, rising deficits, and growing geopolitical risks. But it also saw inflation rebound, as the Fed cut rates just as fiscal spending rose because of the Vietnam War. Although markets are encouraging and hoping for significant rate cuts this year, today’s policymakers are cautious about a repeat. Interestingly since the ECB's Lane spoke over the weekend, the central bank speak has certainly turned a little more cautious about endorsing the amount of cuts currently priced in by markets. Our view is that the pricing is very aggressive versus history absent a recession so for it to be correct you have to believe in the immaculate soft landing scenario or a recession. We will see. Back to Henry's note and overall the late 1960s shows that with tight labour markets, fiscal stimulus and geopolitical shocks, that’s the sort of environment where inflation can return if policy errors are made. See the report here.

On this theme, markets have struggled over the last 24 hours, with bonds and equities selling off after Fed Governor Waller pushed back on market expectations for rapid rate cuts. His November 28th speech was a big part of the rates and risk repricing towards the end of the year but this time his comments were more balanced but perhaps that was as much due to how far markets have come in terms of Fed pricing. What was dovish back then may look more hawkish now.

Yesterday's speech had several important lines, but when it came to the market reaction, the key point was that he saw “no reason to move as quickly or cut as rapidly as in the past”. So that was an explicit pushback on market pricing, which had been expecting 165bps of rate cuts in 2024 before the speech, and it meant that 10yr Treasury yields (+11.8bps) saw their largest daily increase in over two months (albeit with some catch-up needed after the holiday), ending the day at 4.06%. Other assets also saw significant moves, with the Dollar Index (+0.93%) seeing its biggest daily increase since last March, whilst the S&P 500 shed -0.37%. China risk is slumping overnight as we'll see below. Today's highlights are US retail sales, UK CPI as we go to print, and lots of ECB speakers.

In terms of the rest of Waller’s speech, it did look towards rate cuts in 2024, saying that if “inflation doesn’t rebound and stay elevated, I believe the FOMC will be able to lower the target range for the federal funds rate this year.” But his view was that cuts should proceed “methodically and carefully”, and that he’d also be focusing on the CPI revisions scheduled for February 9. Readers may recall that last year, the revisions showed that inflation was declining slower than previously thought, so that’ll be a crucial update affecting the timing of any potential rate cuts.

However, even with Waller’s speech, it was striking that investors remained pretty confident that the Fed will be cutting rates by March, and fairly rapidly over 2024 as a whole. This echoes what we saw after the CPI last week, when the upside surprise didn’t seem to affect investor conviction much about future rate cuts. In fact by the close, the pricing for a cut by March was only down slightly to 69%, having been at 74% the previous day. Likewise for 2024 as a whole, the amount of cuts priced in by the December meeting came down from 165bps intraday just before the speech, to 157bps by the end, so still a rapid pace by historical standards. That means there’s still a tension between what Fed officials are saying and market pricing, since Waller was openly discussing a pace of cuts that were slower than previous cycles. Moreover, officials only have until Friday before the blackout period starts ahead of the next meeting, so after that the next scheduled remarks won’t be until Chair Powell’s press conference on January 31.

As noted at the top, this hawkish backdrop meant that US Treasuries struggled, with the 2yr yield up +7.7bps to 4.22%, whilst the 10yr yield was up +11.8bps to 4.06%. And in Canada, there was an even larger move for the 10yr yield (+13.8bps) after their latest inflation print for December showed that core CPI was proving stickier than anticipated. Looking at the measures followed by the Bank of Canada, the trim core rate was up to +3.7% (vs. +3.4% expected), and the median core rate remained at +3.6% (vs. +3.3% expected). And in turn, that saw investors push back the timing of future rate cuts, and the likelihood of a cut by March came down from 35% to 23%.

Over in Europe, we had several pieces of ECB commentary, with pushback against near-term pricing of cuts again evident. Among the hawks, Germany’s Nagel repeated his comments that market discussion of rate cuts had come too soon, while Lithuania’s Simkus said he was “far less optimistic” than markets on rate cuts. France’s Villeroy suggested it was premature to speak of when in 2024 rate cuts are likely to come. Pricing of a March cut inched lower again from 29% to 25% yesterday (it was 43% on Friday). In bonds, the 2yr bund yield (+0.2bps) was little changed after the sizeable sell-off on Monday, but the 10yr yield rose by +2.5bps to 2.26%, its highest since December 11. We have another busy day of ECB speakers ahead today so watch out for them in what has been a more hawkish week to date.

For equities, it was also a fairly negative session, with the S&P 500 (-0.37%) declining as US markets returned after Monday’s holiday. In addition, the decline was broader than the headline loss suggested, as the index was dragged up by the outperformance of the Magnificent 7, which were flat on the day. The latter was supported by a +3.06% gain for chipmaker Nvidia. Within the S&P 500, energy (-2.40%) and materials (-1.19%) stocks led the declines. Otherwise, the small-cap Russell 2000 (-1.21%) fell for a 3rd consecutive session, reaching its lowest level in over a month. And there were also declines in Europe, where the STOXX 600 (-0.24%) lost ground for a second day running.

In Asia the Hang Seng (-2.81%) is sharply lower led by real estate and consumer non-cyclical stocks. The KOSPI (-2.43%) is not far behind. Mainland Chinese stocks are also trading in the red with the CSI (-0.73%) and the Shanghai Composite (-0.64%) down. S&P 500 (-0.19%) and NASDAQ 100 (-0.27%) futures are also slipping.

Coming back to China, the economy expanded by +5.2% in 2023, hitting the government’s official target after the previous year's miss but the outlook for 2024 remains uncertain as the world’s second-biggest economy is still contending with the ongoing property crisis, deflationary pressures and sluggish consumer and business confidence. On a quarterly basis, the economy grew +1.0% (+1.1% expected) in Q4, slowing from a revised +1.5% pace in the previous quarter. The fact that the deflator fell -1.5% in the quarter is also gaining a lot of attention as deflation continues.

Retail sales advanced +7.4% y/y in December (v/s +8.0% expected), slowing from a +10.1% increase in November. At the same time, production rose by +6.8% y/y in December, slightly higher than the previous month’s +6.6%, and meeting market forecasts. Housing data was also soft overnight.

Elsewhere yesterday, UK gilts outperformed (with the 10yr yield flat at 3.80%) after data showed wage growth was running slower than expected. For instance, averageweekly earnings were up by +6.5% over the three months to November compared with the previous year, beneath the +6.8% reading expected. We also found out that the number of payrolled employees was down by -24k in December (vs. -13k expected). Shortly after we go to press this morning, we’ll get the CPI release for December as well, so keep an eye out for that in terms of the timing of any potential rate cut.

Lastly, there were also a few other data releases out yesterday. In the US, the Empire State manufacturing survey fell to -43.7 in January (vs. -5.0 expected), which is the lowest since the first Covid wave in spring 2020, and otherwise the lowest since the start of the series in 2001. We also had the ECB’s latest Consumer Expectations Survey for November, which showed 1yr inflation expectations were down to 3.2%, and 3yr expectations were down to 2.2%. In both cases, that was the lowest reading since February 2022. That said, our European economists’ own dbDIG survey, which is one month ahead (for December), suggests that inflation expectations may be stabilising at still slightly elevated levels.

To the day ahead now, and data releases include UK CPI for December, US retail sales, industrial production and capacity utilisation for December, along with the NAHB’s housing market index for January. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Cipollone, Vasle, Simkus, Villeroy, Vujcic, Knot and Nagel, as well as the Fed’s Barr, Bowman and Williams. The Fed will also be releasing their Beige Book.

US equity futures and global markets extended their decline on Wednesday after central bankers continued their push-back against market bets for interest rate cuts, deepening a global selloff across stocks and bonds. At 8:00am ET, S&P futures fall 0.4% and Nasdaq contracts ease about 0.5% suggesting another weak day ahead for US equities after ECB President Christine Lagarde and Governing Council member Klaas Knot warned on Wednesday that aggressive bets on interest-rate cuts aren’t helping policymakers in the battle against lingering price pressures, echoing hawkish comments from the Fed’s Waller on Tuesday who urged caution on the pace of easing. The VIX rose to 14.60, the highest leve since mid-November. The Bloomberg Dollar Spot Index extended its rally to a fourth day while the 2Y Treasury yields climbed six basis points to 4.29% and 10-year yields rose 2bps to 4.08%. Oil dropped again with Brent sliding to $77 as gold also eases to near $2,025.

Meanwhile, fresh concerns about China’s economy added another headwind for equities. US-listed Chinese stocks fell in premarket trading as disappointing economic data and a lack of major stimulus deter investors, with the exchange-traded KraneShares CSI China Internet Fund, which holds over 30 US- and Hong Kong-listed Chinese tech firms, trading more than 3% lower. Here are some other notable premarket movers:

- Allakos drops 10% and appears set to extend Tuesday’s 60% plunge after the drug developer was downgraded to hold at Jefferies following two mid-stage trials that failed to meet their main goals.

- Donald Trump-tied stocks fall and appear set to give back some of Tuesday’s double-digit gains after the former president scored a big win at the Iowa caucuses. Digital World (DWAC) -8%, Phunware (PHUN) -60%

- Fisker (FSR) drops 3% after TD Cowen downgrades to market perform, saying the electric-vehicle maker’s growing pains are continuing to accumulate.

- Interactive Brokers (IBKR) falls 4% after the firm reported fourth-quarter total net interest income that missed estimates.

- Mattel (MAT) falls 3% after Morgan Stanley downgrades the toymaker to equal-weight, citing a tougher category outlook in 2024 and limited growth drivers.

- Morgan Stanley (MS) slips 1% after being downgraded to neutral at JPMorgan, which said the bank is now fairly valued, with limited near-term catalysts to propel shares higher.

- Plexus (PLXS) falls 1.7% after the company reported preliminary first-quarter revenue that missed the average analyst estimate.

- Polaris (PII) gains 1% as Morgan Stanley upgrades its rating to overweight, saying the risk/reward for shares in the maker of off-road vehicles is “too attractive to ignore.”

- Spirit Airlines (SAVE) declines 15% after a federal judge blocked JetBlue’s $3.8 billion acquisition of the budget airline.

Following the recent hawkish comments from central bankers, swaps market pricing for a Fed rate cut in March has dropped to around 65% from 80% on Friday, while money markets pushed back bets on the timing of the ECB’s first quarter-point cut to June, from April.

“Inflation was never going to be a straight line down, as we have seen in the US and Europe,” said Luke Hickmore, investment director at abrdn. “Rates will fall this year but market expectations around when and how much are going to be very volatile.”

Still more evidence that the battle against inflation isn’t over came from the UK, where price increases accelerated unexpectedly for the first time in 10-months, prompting traders to scale back their expectations for rate cuts from the Bank of England this year. Gilts tumbled and the pound gained as traders aggressively trimmed expectations for monetary-policy easing this year.

Basic resources and luxury-goods stocks were among the biggest decliners in Europe amid worries about slackening demand in China, a key market. The Stoxx Europe 600 index slumped more than 1%. All industry sectors were in the red, with real estate and retailers among the hardest hit. German two-year yields rose five basis points to 2.65%. Here are the biggest European movers Wednesday:

- IMI rises as much as 3.9% and is the top gainer in the Stoxx Europe 600 index in early trade after being upgraded to buy from neutral by Goldman Sachs, which sees scope for the engineering firm’s shares to outperform over the next year

- Telecom Italia shares rise as much as 3% in Milan trading, the most in two weeks, as the Italian government cleared the sale of the company’s landline network to KKR & Co. after a review process for an asset deemed to be of strategic interest to the state

- IAG was raised to buy from neutral at Goldman Sachs, with analysts expecting the British Airways parent to see earnings growth this year and sustain higher margins. Shares rise as much as 0.9%

- Basic-Fit shares rises as much as 3.5% after the health and fitness club operator received a double upgrade to buy from underperform from Jefferies, which says its valuation has fallen too low

- BP shares fall as much as 1.5%, , to its lowest intraday level since Oct. after the oil giant said interim Chief Executive Officer Murray Auchincloss will take up the role permanently

- Antofagasta declined as much as 4.9%, the most since July, after costs increased in the fourth quarter. Peers with copper exposure also edged lower

- Pearson shares fall as much as 2.5%, retreating further from recent 13-month highs, after the education publishing firm said adjusted operating profit for 2023 will slightly undershoot forecasts due to pound-dollar exchange-rate fluctuations

- 888 drops as much as 15%, the most since September, after the online gambling group reported lower 4Q revenue. Though analysts across the board cut their Ebitda forecasts for 2023 and 2024

- Meyer Burger shares slump as much as 46%, the most ever, after the Swiss solar panel maker announced it could shift focus to the US, shut one of its European production sites, and possibly raise more equity

Earlier in the session, Asian equities suffered broad losses for a second day with Hong Kong leading the selloff after Chinese economic data failed to moderate bearish momentum. Hang Seng Tech index slumped almost 4% and H shares plunged 3%. Shanghai Composite drops 0.6%, ChiNext dropped 1.2%, and the CSI 300 mainland Chinese benchmark also fell 2.2%. The losses came after official figures showed while China reached its 2023 economic goal, the country’s housing slump has worsened and domestic demand remained listless. South Korean stocks are also sharply lower, while Japanese shares extend 2024 outperformance by staying narrowly in the green thanks to the renewed implosion of the yen.

The Bloomberg Dollar Spot Index steadied around a one-month high while the yen extended its recent tumble, sending the USDJPY hovering around 147.6. Traders awaited the release of the central bank’s beige book and US retail sales, after the Fed’s Waller warned rates are unlikely to come down as quickly as they have done in the past

- GBP/USD rose as much as 0.5% to 1.2694 leading G-10 gains against the dollar; UK inflation unexpectedly picked up in December as CPI rose 4% from a year earlier

- EUR/USD pared losses to trade around 1.0880 after dropping 0.2% to 1.0856, the lowest level since Dec. 13; ECB President Christine Lagarde told Bloomberg it’s likely interest rates will be cut in the summer in a push back to current market pricing

- AUD/USD fell 0.7% to 0.6535 as the Australian dollar led G-10 losses on disappointing Chinese economic data; China’s 4Q GDP rose 5.2% from a year ago, compared with a 5.3% estimate, home prices fell the most in almost nine years

- The loonie is set to drop for a fifth day as growing fears of inflation following UK data undermines investor sentiment, sending bonds and stocks lower.

In rates, the treasuries curve was aggressively flatter on the day, with front-end underperforming following a wider bear flattening move in gilts after data showed UK inflation picked up unexpectedly for the first time in 10 months. The 10Y TSY yield rose to session highs of 4.08%, reversing earlier losses; long-end Treasury yields were slightly richer on the day while front-end of the curve is cheaper by around 6bp vs Tuesday close; curve subsequently shifts flatter, following move in gilts with US 2s10s, 5s30s spreads tighter by 6bp and 4.5bp, remains near lows into early US session. On outright basis, UK 2-year yields remain cheaper by around 14bp on the day into early US session, which includes retail sales and a 20-year bond auction. US economic data includes January NY services business activity, December retail sales, import/export prices (8:30am), industrial production (9:15am), November business inventories and January NAHB housing market index (10am). Federal Reserve members scheduled to speak include Barr, Bowman (9am) and Williams (3pm); Fed release Beige book at 2pm

In commodities, oil fell again as a broad risk-off tone across markets coupled with a stronger US dollar offset concerns over Middle East tensions, including continued attacks on ships in the Red Sea by Iran-backed Houthi rebels. WTI crude futures paused around $71.80 while Brent traded down to $77. In other news, BP Plc appointed Murray Auchincloss as its permanent chief executive officer, four months after the shock resignation of his predecessor.

Elsewhere, gold was steady after a Tuesday decline of more than 1% to trade around $2,028 per ounce and Bitcoin dropped below $43,000 while Ether is also lower, sliding 2%. A new rule requiring US businesses to report cryptocurrency transactions over USD 10k has been postponed until the IRS issues new regulations on digital asset reporting, according to Cointelegraph.

Looking the day ahead now, and data releases include UK CPI for December, US retail sales, industrial production and capacity utilisation for December, along with the NAHB’s housing market index for January. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Cipollone, Vasle, Simkus, Villeroy, Vujcic, Knot and Nagel, as well as the Fed’s Barr, Bowman and Williams. The Fed will also be releasing their Beige Book.

Market Snapshot

- S&P 500 futures down 0.5% to 4,776.25

- STOXX Europe 600 down 1.2% to 467.23

- MXAP down 1.7% to 162.13

- MXAPJ down 2.2% to 491.66

- Nikkei down 0.4% to 35,477.75

- Topix down 0.3% to 2,496.38

- Hang Seng Index down 3.7% to 15,276.90

- Shanghai Composite down 2.1% to 2,833.62

- Sensex down 2.2% to 71,506.16

- Australia S&P/ASX 200 down 0.3% to 7,393.08

- Kospi down 2.5% to 2,435.90

- German 10Y yield little changed at 2.28%

- Euro little changed at $1.0869

- Brent Futures down 1.9% to $76.84/bbl

- Gold spot down 0.4% to $2,021.15

- U.S. Dollar Index little changed at 103.44

Top Overnight News

- China’s Q4 GDP numbers were largely inline with expectations (which isn’t a surprise since Premier Li preannounced GDP at Davos Tues morning) and industrial production for Dec was a bit better than anticipated (+6.8% vs. the Street +6.6%), but the GDP deflator shows the country still grappling with deflation while retail sales fell short in Dec (+7.4% vs. the Street +8%), the population decline accelerated, and property investment stayed weak. FT

- Aramco’s CEO said global oil markets can cope with Red Sea disruptions in the short-term, but prolonged attacks could create a problem. RTRS

- The ECB is “likely” to cut rates by or in the summer, Christine Lagarde said in response to a question on whether there’s majority support among officials for such a move. Policy makers are “on the right path” in curbing inflation, she said, adding that overoptimistic rate-cut bets in the market don’t help. BBG

- UK CPI runs hotter than anticipated, with headline +4% in Dec (up from +3.9% in Nov and firmer than the Street’s +3.8% forecast) and core +5.1% (flat vs. Nov and firmer than the Street’s +4.9% forecast). FT

- Qatar brokered a deal to permit medications to reach Israeli hostages in exchange for additional aid and medicine for Palestinian civilians. NYT

- The US is stepping up efforts to broker a diplomatic solution to the intensifying hostilities between Israel and Lebanon’s Hizbollah, as fears grow in Washington that the window is narrowing to avert a full-blown war erupting on the shared border. FT

- Biden has invited Congressional leaders to the White House for a meeting on Wed to discuss Ukraine aid and other fiscal matters (this will be the first face-to-face discussion between Biden and the congressional leadership in months). NYT

- Iran isn’t yet restocking Houthi rebels with weapons by sea after US and UK air strikes last week, Western officials said, signaling cautious optimism that the military action was successful in disrupting arms supplies. BBG

- JPMorgan plans to add to its headcount this year, President Daniel Pinto said. The bank sees opportunities in investment banking, international retail and US wealth management. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly pressured after the recent upside in yields and tapering of Fed rate cut expectations, while participants also digested mixed Chinese economic releases including GDP and activity data. ASX 200 declined as losses in the commodity-related sectors overshadowed the gains in defensives and tech. Nikkei 225 was initially boosted at the open on the back of a weaker currency and briefly climbed back above 36,000 but then pulled back from fresh three-decade highs and wiped out all of its gains as it succumbed to the risk-off mood. Hang Seng and Shanghai Comp retreated amid the mixed data releases from China and with Hong Kong significantly underperforming amid hefty losses in tech and property, with the latter pressured by the decline in Chinese home prices.

Top Asian News

- China’s stats bureau head said the economy faces a complex external environment and insufficient demand in 2024, as well as noted that low consumer prices reflect insufficient effective demand and expects a modest consumer price rise in 2024. NBS head stated China’s economy is at a crucial stage of recovery and its property market is showing some positive changes, while he added there is still relatively big room for China’s property sector to develop and there is still room to unveil more policy steps to support growth.

- China has drafted guideline on formatting standards for AI sector; details light

- China’s BYD (1211 HK) to stop making pouch-type batteries for its hybrid EVs on concerns they may leak; plans to completely stop using pouch cells by 2025, via Reuters citing sources.

- Former BoJ official Maeda says that the BoJ could end NIRP in April, but will likely move slowly in any additional normalisation steps, via Reuters.

European bourses are lower, with over 90% of the Stoxx600 (-1.1%) in the red, amid a negative risk tone following mixed Chinese data overnight, initial hawkish-tone and hotter-than-expected UK CPI; the FTSE 100 (-1.7%) lags, dragged down by miners. European sectors are entirely in the red; Real Estate suffers from the higher yield environment, Basic Resources and Energy are dragged lower by broader weakness in the commodity markets. US equity futures are trading on the backfoot, in tandem with losses seen in the European session. The RTY (-1.3%) significantly underperforms, continuing to extend on yesterday’s hefty losses. ES/NQ (-0.4%), into Retail Sales, Fed speak and a handful of earnings. Headline US Specifics: JPM will increase headcount this year; IBKR down after results; TSLA reduces Model Y prices in Germany.

Top European News

- Tesla Cuts Model Y Prices in Europe: Investor’s Business Daily

- Bank of Italy’s Panetta Sees Growth Under 1% in 2024: Radiocor

- Oil in Retreat as Risk-Off Mood Swamps Impact of Mideast Crisis

- Basic-Fit Climbs on Double Upgrade To Buy From Jefferies

- Frankfurt Airport Cancels Flights Amid Icy Winter Weather

FX

- USD continues to gain as Waller tempers the pace of rate cut expectations. DXY has advanced to a high of 103.58 with not much resistance until 104.

- EUR is one of the better performers vs. the USD today amid hawkish ECB speak. That said, EUR/USD saw a hefty decline from yesterday’s 1.0951 high. Further downside could bring its 200DMA at 1.0845 into play.

- The Pound is the only G10 currency firmer vs. USD amid hawkish inflation metrics; Cable hit a high just shy of the 1.27 mark but remains some way off yesterday’s best of 1.2729.

- Antipodeans both remain battered by risk environment with AUD lagging on account of Chinese sell-off overnight; AUD/USD next target is a Dec 7th low at 0.6525 with NZD/USD selling putting a test of 0.61 on the cards.

- PBoC set USD/CNY mid-point at 7.1168 vs exp. 7.1986 (prev. 7.1134).

Fixed Income

- USTs are contained, but with a modest bearish-bias given a hotter than expected UK CPI print and additional hawkish commentary from ECB speakers. Yields continue to bear-flatten a touch as participants digest Waller before Retail Sales and thereafter Bowman, Barr & Williams

- Bunds started the session on the backfoot and felt additional pressure on UK CPI which saw the 134.37 trough print (matches 8/12 low); since, benchmarks have found some reprieve though still remain in negative territory.

- Gilts are the clear laggard after an unexpected rise in UK CPI for December, which led benchmarks to fall to a 98.82 trough; levels to the downside include 98.29, Dec 12th low.

Commodities

- Crude is at lows, Brent (-2.1%), amid a concoction of bearish factors including the firmer Dollar, soured risk tone, hotter-than-expected UK CPI data, and the mixed Chinese GDP data overnight; Brent Mar is back under USD 77.00/bbl and markets await OPEC MOMR at 12:45GMT/07:45EST.

- Gold is subdued amid the firmer Dollar, but losses in the yellow metal are cushioned, potentially amid haven flows coupled with technical support; XAU resides around USD 2,025/oz.

- Base metals are softer across the board, in-fitting with the broader market mood, and in the aftermath of the mixed Chinese GDP data overnight.

- China is to cut gasoline price by CNY 50/t starting Jan 18th, according to the NDRC

- Saudi Aramco CEO says Red Sea attacks are manageable in the short-term, may create tanker shortage and weigh on market if it lasts longer

- Pemex reports that it is carrying out work activity which could result in flaring at the Deer Park, Texas facility (340k BPD)

- Exxon’s (XOM) 250k BPD Joliet Illinois refinery reports flaring, according to Reuters

- Antofagasta (ANTO LN) reports FY23 copper production at 661kt (vs guided 640-670kt)

ECB Speak

- ECB President Lagarde (Neutral) says inflation is not where the ECB wants it to be; confident the ECB will get inflation to the 2% target; Will stay restrictive for as long as necessary. Too optimistic markets do not help the ECB in its inflation fight. Cannot should victory until inflation is sustainably at 2%. Watching wages, profit margins, energy and supply chains. Second-round effects would be a cause for concern. ECB has reached peak rates, short of a major shock.

- ECB President Lagarde (Neutral) says it is likely that the ECB will cut rates by the summer, according to Bloomberg.

- ECB’s Knot (Hawk) says markets are getting ahead of themselves on rate cuts; a lot must go well to hit the 2% inflation in 2025; rate path priced by markets can be self-defeating, via CNBC; “rate hike in the first half is rather unlikely”.

- ECB’s Vasle (Neutral) says his rate expectations are significantly different to the market; says it is absolutely premature to expect rate cuts at the start of Q2.

- ECB’s Panetta (Dove) says disinflation is happening, and is strong and will continue; says risks are emerging for raw material costs; adds that monetary conditions should adjust; awaiting data first to confirm the disinflation outlook.

- ECB’s Villeroy (Neutral) says the job of monetary policy is not finished yet; premature to say when the ECB will reduce rates this year

Geopolitics

- Maersk CEO sees Red Sea disruptions “lasting a few months at least”

- US President Biden’s administration is expected to announce plans to designate Yemen’s Houthi rebel group as a global terrorist organisation, according to an official cited by CBS News.

- US National Security Council spokesperson said the US welcomed the announcement by Qatar that an agreement was reached to have medicine delivered to hostages in Gaza, according to Reuters.

- Iran’s Defense Minister said the country is engaged in talks with Russia over concluding an MoU on respect for national sovereignty, territorial integrity and regional interests, according to journalist Aslani.

- China’s Taiwan Affairs Office said Taiwan’s election result cannot stop the trend towards reunification and China is willing to create the widest space for peaceful reunification, while it added that Taiwan has never been a country and China will never leave any space for Taiwan independence, according to Reuters.

US Event Calendar

- 07:00: Jan. MBA Mortgage Applications 10.4%, prior 9.9%

- 08:30: Jan. New York Fed Services Business, prior -14.6

- 08:30: Dec. Import Price Index MoM, est. -0.5%, prior -0.4%

- 08:30: Dec. Import Price Index YoY, est. -2.0%, prior -1.4%

- 08:30: Dec. Export Price Index YoY, est. -0.7%, prior -5.2%

- 08:30: Dec. Export Price Index MoM, est. -0.6%, prior -0.9%

- 08:30: Dec. Retail Sales Advance MoM, est. 0.4%, prior 0.3%

- 08:30: Dec. Retail Sales Ex Auto MoM, est. 0.2%, prior 0.2%

- 08:30: Dec. Retail Sales Control Group, est. 0.2%, prior 0.4%

- 08:30: Dec. Retail Sales Ex Auto and Gas, est. 0.3%, prior 0.6%

- 09:15: Dec. Industrial Production MoM, est. -0.1%, prior 0.2%

- 09:15: Dec. Capacity Utilization, est. 78.7%, prior 78.8%

- 10:00: Nov. Business Inventories, est. -0.1%, prior -0.1%

- 10:00: Jan. NAHB Housing Market Index, est. 39, prior 37

- 14:00: Federal Reserve Releases Beige Book

Central Bank Speakers

- 09:00: Fed’s Barr Speaks at Conference on Cyber Risk

- 09:00: Fed’s Bowman Speaks About Future of Bank Capital Reform

- 14:00: Federal Reserve Releases Beige Book

- 15:00: Fed’s Williams Speaks at NY Fed Event

DB’s Jim Reid concludes the overnight wrap

After all the comparisons with the 1970s over the last few years, Henry pointed out yesterday that actually the late-1960s are becoming an increasingly good parallel. That was another period of low unemployment, rising deficits, and growing geopolitical risks. But it also saw inflation rebound, as the Fed cut rates just as fiscal spending rose because of the Vietnam War. Although markets are encouraging and hoping for significant rate cuts this year, today’s policymakers are cautious about a repeat. Interestingly since the ECB’s Lane spoke over the weekend, the central bank speak has certainly turned a little more cautious about endorsing the amount of cuts currently priced in by markets. Our view is that the pricing is very aggressive versus history absent a recession so for it to be correct you have to believe in the immaculate soft landing scenario or a recession. We will see. Back to Henry’s note and overall the late 1960s shows that with tight labour markets, fiscal stimulus and geopolitical shocks, that’s the sort of environment where inflation can return if policy errors are made. See the report here.

On this theme, markets have struggled over the last 24 hours, with bonds and equities selling off after Fed Governor Waller pushed back on market expectations for rapid rate cuts. His November 28th speech was a big part of the rates and risk repricing towards the end of the year but this time his comments were more balanced but perhaps that was as much due to how far markets have come in terms of Fed pricing. What was dovish back then may look more hawkish now.

Yesterday’s speech had several important lines, but when it came to the market reaction, the key point was that he saw “no reason to move as quickly or cut as rapidly as in the past”. So that was an explicit pushback on market pricing, which had been expecting 165bps of rate cuts in 2024 before the speech, and it meant that 10yr Treasury yields (+11.8bps) saw their largest daily increase in over two months (albeit with some catch-up needed after the holiday), ending the day at 4.06%. Other assets also saw significant moves, with the Dollar Index (+0.93%) seeing its biggest daily increase since last March, whilst the S&P 500 shed -0.37%. China risk is slumping overnight as we’ll see below. Today’s highlights are US retail sales, UK CPI as we go to print, and lots of ECB speakers.

In terms of the rest of Waller’s speech, it did look towards rate cuts in 2024, saying that if “inflation doesn’t rebound and stay elevated, I believe the FOMC will be able to lower the target range for the federal funds rate this year.” But his view was that cuts should proceed “methodically and carefully”, and that he’d also be focusing on the CPI revisions scheduled for February 9. Readers may recall that last year, the revisions showed that inflation was declining slower than previously thought, so that’ll be a crucial update affecting the timing of any potential rate cuts.

However, even with Waller’s speech, it was striking that investors remained pretty confident that the Fed will be cutting rates by March, and fairly rapidly over 2024 as a whole. This echoes what we saw after the CPI last week, when the upside surprise didn’t seem to affect investor conviction much about future rate cuts. In fact by the close, the pricing for a cut by March was only down slightly to 69%, having been at 74% the previous day. Likewise for 2024 as a whole, the amount of cuts priced in by the December meeting came down from 165bps intraday just before the speech, to 157bps by the end, so still a rapid pace by historical standards. That means there’s still a tension between what Fed officials are saying and market pricing, since Waller was openly discussing a pace of cuts that were slower than previous cycles. Moreover, officials only have until Friday before the blackout period starts ahead of the next meeting, so after that the next scheduled remarks won’t be until Chair Powell’s press conference on January 31.

As noted at the top, this hawkish backdrop meant that US Treasuries struggled, with the 2yr yield up +7.7bps to 4.22%, whilst the 10yr yield was up +11.8bps to 4.06%. And in Canada, there was an even larger move for the 10yr yield (+13.8bps) after their latest inflation print for December showed that core CPI was proving stickier than anticipated. Looking at the measures followed by the Bank of Canada, the trim core rate was up to +3.7% (vs. +3.4% expected), and the median core rate remained at +3.6% (vs. +3.3% expected). And in turn, that saw investors push back the timing of future rate cuts, and the likelihood of a cut by March came down from 35% to 23%.

Over in Europe, we had several pieces of ECB commentary, with pushback against near-term pricing of cuts again evident. Among the hawks, Germany’s Nagel repeated his comments that market discussion of rate cuts had come too soon, while Lithuania’s Simkus said he was “far less optimistic” than markets on rate cuts. France’s Villeroy suggested it was premature to speak of when in 2024 rate cuts are likely to come. Pricing of a March cut inched lower again from 29% to 25% yesterday (it was 43% on Friday). In bonds, the 2yr bund yield (+0.2bps) was little changed after the sizeable sell-off on Monday, but the 10yr yield rose by +2.5bps to 2.26%, its highest since December 11. We have another busy day of ECB speakers ahead today so watch out for them in what has been a more hawkish week to date.

For equities, it was also a fairly negative session, with the S&P 500 (-0.37%) declining as US markets returned after Monday’s holiday. In addition, the decline was broader than the headline loss suggested, as the index was dragged up by the outperformance of the Magnificent 7, which were flat on the day. The latter was supported by a +3.06% gain for chipmaker Nvidia. Within the S&P 500, energy (-2.40%) and materials (-1.19%) stocks led the declines. Otherwise, the small-cap Russell 2000 (-1.21%) fell for a 3rd consecutive session, reaching its lowest level in over a month. And there were also declines in Europe, where the STOXX 600 (-0.24%) lost ground for a second day running.

In Asia the Hang Seng (-2.81%) is sharply lower led by real estate and consumer non-cyclical stocks. The KOSPI (-2.43%) is not far behind. Mainland Chinese stocks are also trading in the red with the CSI (-0.73%) and the Shanghai Composite (-0.64%) down. S&P 500 (-0.19%) and NASDAQ 100 (-0.27%) futures are also slipping.

Coming back to China, the economy expanded by +5.2% in 2023, hitting the government’s official target after the previous year’s miss but the outlook for 2024 remains uncertain as the world’s second-biggest economy is still contending with the ongoing property crisis, deflationary pressures and sluggish consumer and business confidence. On a quarterly basis, the economy grew +1.0% (+1.1% expected) in Q4, slowing from a revised +1.5% pace in the previous quarter. The fact that the deflator fell -1.5% in the quarter is also gaining a lot of attention as deflation continues.

Retail sales advanced +7.4% y/y in December (v/s +8.0% expected), slowing from a +10.1% increase in November. At the same time, production rose by +6.8% y/y in December, slightly higher than the previous month’s +6.6%, and meeting market forecasts. Housing data was also soft overnight.

Elsewhere yesterday, UK gilts outperformed (with the 10yr yield flat at 3.80%) after data showed wage growth was running slower than expected. For instance, averageweekly earnings were up by +6.5% over the three months to November compared with the previous year, beneath the +6.8% reading expected. We also found out that the number of payrolled employees was down by -24k in December (vs. -13k expected). Shortly after we go to press this morning, we’ll get the CPI release for December as well, so keep an eye out for that in terms of the timing of any potential rate cut.

Lastly, there were also a few other data releases out yesterday. In the US, the Empire State manufacturing survey fell to -43.7 in January (vs. -5.0 expected), which is the lowest since the first Covid wave in spring 2020, and otherwise the lowest since the start of the series in 2001. We also had the ECB’s latest Consumer Expectations Survey for November, which showed 1yr inflation expectations were down to 3.2%, and 3yr expectations were down to 2.2%. In both cases, that was the lowest reading since February 2022. That said, our European economists’ own dbDIG survey, which is one month ahead (for December), suggests that inflation expectations may be stabilising at still slightly elevated levels.

To the day ahead now, and data releases include UK CPI for December, US retail sales, industrial production and capacity utilisation for December, along with the NAHB’s housing market index for January. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Cipollone, Vasle, Simkus, Villeroy, Vujcic, Knot and Nagel, as well as the Fed’s Barr, Bowman and Williams. The Fed will also be releasing their Beige Book.

Loading…