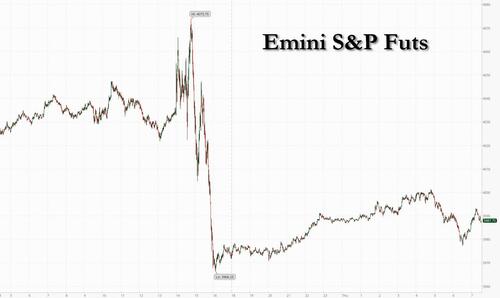

After 76 year old treasury secretary Janet Yellen blew up the market yesterday with her post-FOMC comments that regulators aren’t looking to provide “blanket” deposit insurance to stabilize the US banking system, stock futures have rebounded modestly on Thursday, while paring some earlier gains. S&P 500 futures were up 0.5% at 3990 at 7:45 a.m. ET while Nasdaq 100 futures rose 0.9%. Both underlying indexes fell the most in two weeks yesterday. The tech-heavy Nasdaq index flirted with a bull market yesterday after briefly rising 20% from its December low. US government bond yields have edged up after falling sharply on Wednesday when the Fed raised rates 25bps but also opened the door to a pause, while WTI crude futures are down 0.6% in early US session. The Stoxx Europe 600 Index slid 0.8%, falling for the first time this week before a rates decision from the Bank of England.

In premarket trading, banking stocks were again the biggest laggards, following weakness in their US peers and as Citigroup Inc. slashed its outlook for the sector. Coinbase slumped after the largest US crypto exchange said it received a notice from the SEC formally declaring the securities regulator’s plans to bring an enforcement action against it. Analysts say the notice might be a precursor to the agency ultimately suing the company. Here are some other notable premarket movers:

- First Republic Bank shares rose on Thursday along with banking peers, set for a tentative rebound from yesterday’s losses following disappointment over comments from Treasury Secretary Janet Yellen over bank deposits.

- Cryptocurrency-exposed stocks rise as Bitcoin rebounds after snapping a six-session gaining streak on Wednesday. US equity futures also climbed, signaling a recovery following a tumultuous day of losses on Wall Street. Marathon Digital (MARA US) +5.1%, Riot Platforms (RIOT US) +4.7%.

- Chewy falls as much as 6.6% in US premarket trade after the online pet supplies retailer issued softer-than-expected FY23 guidance, with plans for international expansion likely to pressure margins. The company’s 4Q results also showed declining customer numbers, which Barclays says raises questions given that headwinds should have been abating.

- Phreesia Inc. shares dropped 3.3% in postmarket trading, after the application software company reported fourth-quarter results that beat expectations but gave a revenue outlook that KeyBanc sees as light.

Caution reigned in markets on Thursday following the Fed’s decision to proceed with a quarter-point rate hike, combined with Treasury Secretary Janet Yellen’s remarks on the health of the banking sector. While Fed Chair Jerome Powell assured that regulators’ actions demonstrated “all depositors’ savings are safe” as he raised rates by an expected quarter point, Yellen effectively contradicted him and sent stocks whipsawing, when she said regulators aren’t looking to provide “blanket” deposit insurance.

“Yellen’s comments were clearly the more important factor yesterday,” said Manish Kabra, US equity strategist at Société Générale. “Not securing all deposits risks more deposit runs, which means large banks’ outperformance versus regional banks is likely to continue. Overall, the US banks rally will continue to fade, at least until the yield curve is firmly positive.”

“It is well possible that the post-FOMC equity selloff quickly reverses, as falling yields are supportive of equity valuations — if financial stress is contained and economic data is not too bad,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

UBS strategists led by Mark Haefele believe that any rally would be unlikely to endure just yet however, noting that turning points usually rely on investors anticipating interest-rate cuts alongside a trough in economic activity and corporate earnings. “The Fed’s actions and analysis of the economy suggest these conditions are not yet fully in place,” they said in a note.

Separately, Goldman Sachs Group Inc. strategists say they expect US households to be net sellers of $750 billion worth of stocks in 2023 amid rising bond yields and declining personal savings. The team led by Cormac Conners says higher 10-year yields and lower savings rates tend to be associated with decreased net equity demand from households.

As a result of the ongoing bank crisis, the swap market shows investors are split on the chances that Fed officials will add another 25 basis points to their benchmark in May. Despite Powell’s guidance, expectations for cuts have deepened, with the market suggesting that the effective fed funds rate will drop to around 4.1% in December. “I would not expect the market to take these rate cuts out in the near term and could very well price in more cuts if the data deteriorates from here,” Matthew Hornbach, global head of macro strategy at Morgan Stanley, told Bloomberg Television. Powell himself, though, said in response to questioning that officials “just don’t” see cuts this year and that they will raise higher than expected if that is needed. “Rate cuts are not in our base case,” he said. He also didn't see the bank crisis as recently as three weeks ago when he swore to Congress he would hike rates 50bps only to trigger the worst banking crisis since Lehman.

European stocks are on course to snap a three-day winning streak as banks underperform after US Treasury Secretary Janet Yellen warned they aren’t considering widespread insurance for bank deposits. The Stoxx 600 is down 1.0% while the Stoxx 600 Banks Index falls 2.5%. Here are some of the biggest European movers:

- HSBC shares drop as much as 3.3%, ING slides as much as 2.5% and ABN Amro tumbles as much as 3.7% after US peers fell on remarks that US lawmakers aren’t planning on widespread insurance for bank deposits

- Jeronimo Martins falls as much as 4.1%, curbing the stock’s rally since the start of the month, after 4Q earnings showed a further drop in the Portuguese retailer’s margins

- Rallye SA slumps as much as 10% after the company said the latest earnings from its French supermarket business make it difficult to finish debt restructuring

- Gym Group drops as much as 5.1% after Barclays downgrades the fitness operator to equal-weight from overweight, citing a “bleak” profit outlook

- Sanofi gains as much as 5.3%, the most since December, after releasing positive data from a phase 3 trial for its key drug Dupixent

- Scout24 climbs as much as 4.4%, reaching highest since mid-November, after the online classified advertising company announced a buyback

- Inwit rises as much as 4.8% to a record after Reuters reported that private equity firm Ardian is in the early stage of exploring a bid for the Italian tower operator

- Domino’s Pizza Group jumps as much as 4.3% after Barclays upgrades the pizza delivery chain to overweight from equal-weight, highlighting the increase in app usage

- Meyer Burger gains as much as 15% after the Swiss solar equipment manufacturer’s Ebitda and profitability beat expectations

- Nemetschek shares rise as much as 13% to their highest level since September. The German firm’s outlook for 2024 and 2025 was seen as solid

The BOE is likely to continue the quickest series of interest-rate increases in three decades, with its focus on combating inflation outweighing calls for a pause given recent turmoil in the banking system. The Swiss and Norwegian central banks both raised rates Thursday, as forecast, and flagged more hikes to come in their campaigns to tame rising consumer prices.

For the BOE, February UK CPI data have “removed any flexibility they may have thought they had and now markets are pricing in a higher terminal rate of around 4.5% as a result,” said Craig Erlam, a senior market analyst at Oanda Ltd. “This makes the language that accompanies the decision key,” he said, expecting policymakers to highlight an uncertain outlook and the need to be data-dependent.

Earlier in the session, Asian stocks rose as the region’s currencies strengthened against the dollar despite the Federal Reserve’s decision to raise US interest rates on Wednesday. The MSCI Asia Pacific Index climbed as much as 1.5%, rising for a third day, as most Asian currencies, including South Korea’s won and Thailand’s baht, gained. Hong Kong’s equity benchmarks were among the top performers, boosted by gains in Tencent after the firm reported better-than-expected revenue. Stock gauges in Japan and India underperformed. “Dollar reaction to the Fed hike looks to be muted, which can ease pressure on Asian currencies and fund flows,” said Marvin Chen, an analyst at Bloomberg Intelligence. “Focus should be on the dollar impact as peak Fed rates near.” The dollar slid as market expectations for rate cuts by the Fed deepened despite the central bank hiking its benchmark rate by a quarter-point and signaling that it expects more tightening after that.

A weaker greenback tends to be beneficial for Asian shares if it signals higher risk appetite and is seen as a positive for growth in the region’s emerging economies, many of which rely on imports priced in dollars. An index of Asian financial stocks headed for a three-day gain as a key technical indicator suggested the sector’s loss of more than 3% this month may have been excessive. US shares slumped Wednesday after comments from Treasury Secretary Janet Yellen rattled US bank shares and Fed Chairman Jerome Powell dashed hopes on rate cuts this year. Given expected slower US growth and the stresses in its banking system, it makes more sense to lean into the stronger growth recovery in China as well as Hong Kong and Thailand, said Sunil Koul, Asia Pacific equity strategist at Goldman Sachs, in a Bloomberg TV interview

Japanese equities fell, following US peers lower, after comments from Treasury Secretary Janet Yellen rattled US bank shares and Federal Reserve chief Jerome Powell said he was prepared to keep raising rates. The Topix Index fell 0.3% to 1,957.32 as of market close Tokyo time, while the Nikkei declined 0.2% to 27,419.61. Sony Group Corp. contributed the most to the Topix Index decline, decreasing 1.3%. Out of 2,159 stocks in the index, 1,256 rose and 781 fell, while 122 were unchanged. Yellen told US lawmakers that the government wasn’t considering “blanket” deposit insurance to stabilize the banking system while Powell said he was ready to keep raising rates until inflation shows signs of cooling. Japanese shares are falling after the comments, said Rina Oshimo, a senior strategist at Okasan Securities.

Australian stocks joined the selloff: the S&P/ASX 200 index fell 0.7% to close at 6,968.60, in a broad decline weighed by losses in mining shares and banks. The drop followed a slump on Wall Street as the Federal Reserve pushed back against bets for interest rate cuts this year. In New Zealand, the S&P/NZX 50 index was little changed at 11,594.94

Lastly, stocks in India were among the worst performers in Asia amid a mixed trend seen across global markets as investors remained concerned over the future course of central banks’ policy actions. The S&P BSE Sensex fell 0.5% to 57,925.28 in Mumbai, while the NSE Nifty 50 Index declined 0.4%. The gauge is now little changed this week after dropping for two out of the last four sessions. The benchmarks have slipped more than 4.5% each for the year. The underperformance in local equities compared with Asian and emerging market peers is a result of surging interest rates in the US - the Fed raised its main lending rate by another 25 bps on Wednesday to 5% - impacting flows from overseas investors. Index-heavy software exporters and banks came under pressure on increasing worries over global economic growth. Foreign investors have sold $2.8b of local shares this year through March 20 following inflows of about $11b over the preceding two quarters. Domestic investors have however remained buyers to the tune of $9b in 2023. Reliance Industries contributed the most to the Sensex’s decline, decreasing 1.3%. Out of 30 shares in the Sensex index, 13 rose, while 17 fell.

In FX, weakness in the dollar extended to a sixth day, with a gauge of the greenback falling to the lowest in more than a month as traders boosted bets for US interest-rate cuts, even after the Fed said more tightening may be needed. It has since rebounded fractionally from session lows.

- The Norwegian krone gained 1% versus the dollar after a hawkish 25bps hike from the Norges Bank. While there were expectations that Norges Bank would stand pat after hiking today, the central bank explicitly signaled another increase in May

- The pound and euro advanced, with the former climbing on leveraged demand amid expectations for the Bank of England to deliver a hawkish quarter-point rate increase on Thursday, according to a trader “With the banking sector concerns still fresh, the Fed was more dovish than just a while ago and that is dragging down bond yields and the dollar,” said Daisuke Uno, chief strategist at Sumitomo Mitsui Banking Corp. “I still think the Fed will raise the rate to tame inflation, which seems to remain stubborn”

- The Swiss franc struggled to hold gains after the SNB opted for a 50bps increase. The Dollar Index is little changed.

In rates, treasuries were cheaper across the curve, although futures remain near top of Wednesday’s range, a bull-steepening rally following Fed’s rate decision. US two-year yields are up ~2bps while UK two-year borrowing costs fall 9bps ahead of the Bank of England rate decision later today. Thursday’s losses are belly-led, cheapening 2s5s30s fly by ~3bp on the day. Bank of England rate decision at 8am New York time is expected to be a quarter-point rate increase. US yields cheaper by 3bp-5bp across the curve with 10-year around 3.48%, near low end of Wednesday’s 3.427%-3.642% range; on the curve, 2s10s spread is wider by ~1.5bp on the day, near Wednesday’s steepest levels, while 5s30s spread tightens ~1.5bp. Fed-dated OIS contracts price in around 13bp of rate hike premium for the May policy decision and then ~75bp of cuts by year-end.

Crude futures decline with WTI falling 1.2% to trade near $70.05. Spot gold adds 0.5% to around $1,980. Bitcoin rises 1.2%.

Looking to the day ahead now, monetary policy decisions will include the Bank of England, the Swiss National Bank and the Norges Bank. Data releases include the US weekly initial jobless claims, February’s new home sales, the Kansas City Fed manufacturing activity for March, and the Q4 current account balance. Finally, EU leaders will gather in Brussels for a summit.

Market Snapshot

- S&P 500 futures up 0.5% to 3,989.00

- MXAP up 1.3% to 160.31

- MXAPJ up 1.5% to 517.51

- Nikkei down 0.2% to 27,419.61

- Topix down 0.3% to 1,957.32

- Hang Seng Index up 2.3% to 20,049.64

- Shanghai Composite up 0.6% to 3,286.65

- Sensex little changed at 58,181.18

- Australia S&P/ASX 200 down 0.7% to 6,968.61

- Kospi up 0.3% to 2,424.48

- STOXX Europe 600 down 0.4% to 445.25

- German 10Y yield little changed at 2.28%

- Euro up 0.4% to $1.0897

- Brent Futures down 0.2% to $76.52/bbl

- Gold spot up 0.4% to $1,977.01

- U.S. Dollar Index down 0.18% to 102.16

Top Overnight News from Bloomberg

- Hong Kong’s CPI for Feb falls short of expectations, coming in at +1.7% (down from +2.4% in Jan and below the St’s +2.4% forecast). Singapore’s inflation also comes in a bit below plan at +6.3% headline for Feb (down from +6.6% in Jan and below the St’s +6.4% forecast). BBG

- Blinken’s planned trip to China may be in the process of getting back on track after being derailed by the Chinese balloon incident. Blinken said China will be capable of invading Taiwan by 2027. SCMP

- The ECB will probably need to raise borrowing costs more, though the bulk of tightening is already done, according to Governing Council member Madis Muller. BBG

- Ukrainian troops, on the defensive for four months, will launch a long-awaited counterassault "very soon" now that Russia's huge winter offensive is losing steam without taking Bakhmut, Ukraine's top ground forces commander said on Thursday. RTRS

- Swiss financial regulator Finma has defended its decision to wipe out a huge swath of risky subordinated bonds as part of the CS rescue deal. In its first statement on the deal since the weekend, Finma said that all the contractual and legal obligations had been met for it to act unilaterally given the urgency of the situation. “On Sunday, a solution was found to protect clients, the financial centr and the markets,” said Finma’s chief executive Urban Angehrn. “In this context, it is important that Credit Suisse’s banking business continues to function smoothly and without interruption.” FT

- Following the Fed, the BOE will probably continue its quickest series of rate increases in three decades with a 25-bp hike to 4.25%. The SNB raised rates by 50 bps and signaled more to come as it resumed its inflation fight just days after the downfall of Credit Suisse. Norges Bank raised by 25 bps to 3%, as expected, and said it will tighten further in May. BBG

- Freight companies are dialing back expectations that demand will recover strongly in the second half of the year amid growing economic uncertainty and signs retailers are growing more guarded about placing big orders in 2023. WSJ

- OPEC+ is unlikely to take action on production despite the recent slump in prices as they attribute most of the volatility to financial speculation, not fundamentals. RTRS

- The SEC has told Coinbase that it plans to take enforcement action against the company, escalating its crackdown on digital-currency firms by targeting the biggest U.S. crypto exchange, Coinbase said Wednesday. WSJ

- The Swiss National Bank raised its interest rate by 50 basis points and signaled more to come as it resumed its inflation fight just days after the downfall of the country’s second- biggest bank became the epicenter of global financial turmoil: BBG

- Norway’s central bank raised its key interest rate to the highest level since 2009 and signaled further tightening after higher price pressure from a weaker-than-forecast krone outweighed concerns about global banking turbulence: BBG

- Wall Street banks and European rivals are undoing de facto hiring freezes after Credit Suisse’s emergency rescue by UBS, unable to resist the lure of top talent available at a discount: BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed with price action choppy as markets digested the FOMC where the Fed delivered a widely expected 25bps rate hike and maintained its terminal rate view but dropped its reference regarding expectations that ‘ongoing’ rate hikes will be appropriate. ASX 200 declined amid the uninspired mood across most industries with underperformance in tech and mining. Nikkei 225 was contained by weakness in financials and after Japan maintained the overall assessment of the economy but cut the assessment on corporate profits and production for the first time since April 2020. Hang Seng and Shanghai Comp. swung between gains and losses with optimism in Hong Kong following earnings releases from Orient Overseas International and Tencent whereby the advances in the latter inspired its tech peers, although participants also digested a rate hike by the HKMA which moved in lockstep with the Fed.

Top Asian News

- HKMA raised its base rate by 25bps to 5.25%, as expected, which is in lockstep with the Fed.

- RBNZ Chief Economist Conway said inflation is high and widespread because strong demand outstripped supply, while he added that they are incredibly determined to get inflation and inflation expectations back to the target. Furthermore, Conway expects monetary policy tightening to cause the New Zealand economy to enter a mild recession later this year as demand slows, as well as noted that the OCR is now comfortably above neutral and having the desired contractionary effect, according to Reuters.

European bourses began the session mixed/flat, but have since dipped more convincingly into negative territory with newsflow focused on hawkish Central Bank action post-Fed thus far. Once again, the FTSE 100 is lagging its peers as focus remains firmly on the upcoming BoE announcement, FTSE 100 -1.0%. Stateside, futures are firmer though remain shy of Wednesday's best levels and have most recently eased off the sessions peak given the above action, ES +0.4%. Citi cuts their Stoxx 600 end-2023 forecast to 445 (prev. 475); FTSE 100 cut to 7600 (prev. 8000); downgrades Banks to Neutral (prev. Overweight).

Top European News

- ECB's Muller says inflation is a bigger problem than the increase in borrowing costs. Lions share of hikes are behind us; ECB is likely to increase rates by a little.

- ECB's Stournaras says should not commit to any rates in advance.

- Italy is reportedly preparing a new package of measures worth some EUR 5bln to aid firms and families cope with energy bills, and could be unveiled next week, according to Reuters sources.

Central bank decisions

- SNB hikes by 50bps to 1.50% vs exp. 1.50% (prev. 1.00%); does not rule out further hikes; reiterates language around price stability and FX intervention. Further increased its inflation forecasts, with CPI now not seen dropping back into the 0-2% target band until Q2-2023 (prev. Q4-2023). Click here for full details, reaction & analysis.

- Norges Bank hikes by 25bps to 3.00% vs exp. 3.00% (prev. 2.75%); the policy rate will be raised further in May; decision unanimous. Rate path now implies an end-2023 rate of 3.60% (prev. 3.08%). Click here for full details, reaction & analysis.

- Brazilian Central Bank maintained the Selic rate at 13.75%, as expected, while it will remain vigilant and will assess if the strategy of maintaining the Selic rate for a sufficiently long period of time will be enough to ensure the convergence of inflation. BCB added that inflation expectations have shown additional deterioration, especially at longer horizons and they will not hesitate to resume the tightening cycle if the disinflationary process does not proceed as expected.

FX

- The USD remains on the back-foot after Wednesday's FOMC, though the DXY is back towards a 102.44 high after briefly printing a fresh March low of 101.91.

- Action which supports peers across the board and features antipodeans outperforming after recent pressure, NZD leading and cognisant of RBNZ's Conway emphasising that inflation remains high and widespread; NZD/USD and AUD/USD testing 0.63 and 0.6750 respectively.

- GBP is next best ahead of the BoE, Cable at a fresh March peak of 1.2343 with 25bp fully priced and a peak of around 4.45% (current 4.00%) implied.

- The single currency, EUR, is underpinned by the USD but with EUR/GBP pressure preventing any further appreciation; EUR/USD holding sub-1.09 while EUR/GBP near the 0.8832 low.

- Finally, CHF benefitted from the SNB's hawkish-hike while the NOK is back to pre-release levels as expectations for a 50bp hike unwind while the hawkish repo path adjustments are factored in.

Fixed Income

- EGBs are underpinned with yields softer across the curve post-Fed while Gilts are closer to the unchanged mark pre-BoE, though the morning's hawkish action has sparked a pullback from best levels.

- Bunds hold around 136.00 and the 10yr yield now back above 2.25% after dipping to a 2.22% low; modest upside was seen in Bunds following Germany leaving its Q2 issuance calendar unrevised vs the prelim. FY release.

- Stateside, USTs continue to derive support from Wednesday's announcements; though, the yield curve has lifted marginally from the mid-week trough, but does remain lower overall with action most pronounced in the belly.

- German Q2 issuance calendar sees no changes vs the prelim. annual release.

Commodities

- Commodities are mixed, with the crude benchmarks attempting to pare back some of their overnight losses while metals glean support from the USD's downside.

- Specifically, WTI and Brent are towards the lower-end of USD 69.91-70.79/bbl and USD 75.76-76.66/bbl parameters, though the benchmarks are holding above USD 70 and USD 76 respectively.

- Both precious and base metals are benefitting from the softer dollar; spot gold towards the upper-end of USD 1964-1983/oz parameters, just shy of Wednesday's USD 1985/oz best with base metals supported but off best given the broader risk tone.

- Iran's Finance Minister said Iran achieved its highest level of oil exports for at least two years last month, according to FT.

- Goldman Sachs said gold remains the best safe-haven asset for financial risks and raised its gold target to USD 2050/oz from 1950/oz, while it added that Chinese demand continues to surge across the commodity complex with oil demand topping 16mln bpd and it remains very positive on commodity prices with 12-month forecasted returns of 27.9% for S&P GSCI.

Geopolitics

- China's military said it monitored and drove away a US destroyer which entered the South China Sea Paracel Islands, although the US Navy later said that the Chinese military's statement is false regarding a US destroyer being expelled from the South China Sea.

- Taiwan's Foreign Minister said President Tsai's meeting with the US House Speaker is still being arranged, according to Reuters.

- Saudi Arabia and Iran's Foreign Ministers agreed to meet soon to pave the way for the reopening of embassies, according to the Saudi state news agency.

- Russian Foreign Ministry Lavrov is to hold discussions with Iran's top diplomat on March 29th in Moscow, according to Tass.

- US mulls opening Pacific defense pact with Britain and Australia to more countries, according to Semafor.

- US reportedly plans to send aging A-10 attack planes to the Middle East while shifting newer jets to Asia and Europe, according to US officials cited by WSJ.

US Event Calendar

- 08:30: March Initial Jobless Claims, est. 197,000, prior 192,000

- March Continuing Claims, est. 1.69m, prior 1.68m

- 08:30: Feb. Chicago Fed Nat Activity Index, est. 0.10, prior 0.23

- 08:30: 4Q Current Account Balance, est. -$213.7b, prior -$217.1b

- 10:00: Feb. New Home Sales, est. 650,000, prior 670,000

- Feb. New Home Sales MoM, est. -3.1%, prior 7.2%

- 11:00: March Kansas City Fed Manf. Activity, est. -2, prior 0

DB's Jim Ried concludes the overnight wrap

In an FOMC meeting that went to script but perhaps leaned dovish, Mr Powell’s press conference was overshadowed by his predecessor’s (Yellen) simultaneous comments that a blanket guarantee of deposits had not been discussed or considered. It seems highly unlikely the US would let depositors take losses but maybe such a move won't be done pre-emptively and would require future stress first. The reaction to her comments also highlighted the nervousness and fragility underpinning a big 2-day rally. The remarks led to a late slump in equities (S&P 500 -1.65% - all post Yellen) and big rally in bonds (2yr -23bps - more than half after Yellen) and distracted from a relative uneventful FOMC, even if there were nuances worth discussing.

Let’s look at the Fed first. They hiked interest rates a further 25bps to put the policy rate in a target range of 4.75-5.00%, while saying in the statement that “additional policy firming may be appropriate”. This replaced "ongoing increases in the target rate will be appropriate". So a softening in language.

The pace and asset makeup of QT was unchanged as expected. The median dot plot projection showed fed funds ending 2023 at 5.1%, unchanged from December, and up by roughly one hike to 4.3% at the end of 2024. Despite the median remaining unchanged, there was some upward migration in the dot plot for 2023. In terms of economic projections, the Fed had Core PCE inflation up modestly both this year (3.6% from 3.5% in Jan) and next (2.6% from 2.5% in Jan), but saw risks as “broadly balanced” rather than “weighted to the upside” as we had seen last meeting. On the banking stress, the Fed’s statement noted that it is “likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation.”

At the press conference, Chair Powell opened with a statement on the banking sector first by saying that the US banking system is sound and that the Fed programs are “effectively meeting” liquidity needs while policymakers are closely monitoring the situation. He also noted that the events of the past week are likely to weigh on lending standards and slow the economy, which may in fact necessitate fewer rate hikes than thought before. Chair Powell noted that some officials considered a pause in the days leading up to the meeting, however in the end it was a unanimous vote to hike rates. The "pause" word sparked a front-end rally.

Our US economists have maintained their terminal rate view of 5.1% following another 25bp rate hike in May. They note there is elevated uncertainty around this modal outcome. Financial and credit conditions along with inflation data will be important to watch in the weeks ahead. See their FOMC review note here for more.

The S&P 500 went into the FOMC announcement about flat on the day (-0.04%), having traded in a 0.60% range through much of the US trading session. The initial statement saw a pop in sentiment, before stocks whipsawed through the Chair’s opening statement and peaked up around +0.9% on the day as he noted “disinflation is intact.” However, comments on credit conditions tightening further and rate cuts in 2023 not being the FOMC’s “baseline expectation” saw risk sentiment fall.

Roughly an hour prior to the close Chair Powell also acknowledged that the Fed was still open to further rate hikes if the data proves them necessary. At the same time, his predecessor, Treasury Secretary Yellen said to a Senate subcommittee hearing that, “I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits.” She also noted that it was not yet the time to discuss changing the FDIC insurance cap.

Risk sold off harder after this with the S&P falling over -1.5% over the last hour of trading to finish at the lows of the day at -1.65%. 493 of the index’s constituents were lower yesterday with Banks leading the late move lower. The KBW index closed down -4.70% on the back of significant regional bank losses once again led by First Republic (-15.5%), while the majors held up relatively better with JPM (-2.6%), C (-3.0%), and BAC (-3.3%) outperforming.

Fixed income markets saw more one way traffic with 10yr US Treasury yields -17.53bps lower on the day to 3.43% after being roughly unchanged around the European close and rallying though the FOMC statement and the risk-off move that followed. US 2yr yields were actually higher in the US morning before being unchanged just prior to the meeting and then rallying through the US afternoon to finish the day -23.0bps lower at 3.937% - just off the lows of the day. Following the meeting, fed futures are pricing in a 46% chance of a hike at the next meeting in May, and then roughly 70bps of cut by year-end despite the comments from Chair Powell. This morning in Asia, we are seeing a further steepening in the curve with 2yrs -6bps but 10yrs +1bps. 2s10s is now -44bps after being in the low -60s before the FOMC statement. See our rates strategists' call and rationale for steepeners here for more on the forces around this trade.

So the mood completely changed in the last hour or so. Ahead of the Fed, European markets had actually continued to normalise following last week’s volatility. For instance, equities put in another steady performance, with the STOXX 600 (+0.15%) posting a third consecutive advance. Sovereign bond yields also moved higher, with those on 10yr bunds (+3.6bps) at a one-week high of 2.328% as investors priced out the chances of an imminent pause in rate hikes from the ECB. In part, that was supported by a Bloomberg article later in the session, which reported that ECB officials were growing in confidence that they had withstood the current turmoil, whilst concern remained that inflation still needed tackling. When it came to banks however, the rally at the start of the week showed signs of petering out, with the STOXX Banks index coming down -0.69%, and UBS falling -3.71%.

Looking forward, central banks will remain in the spotlight today, with the Bank of England’s decision coming up at midday London time. Up until yesterday, market pricing had been more in the balance on whether they’d keep hiking or pause. But just after we went to press yesterday, there was a big upside surprise in the February CPI print. That showed an unexpected increase in the year-on-year measure to +10.4% (vs. +9.9% expected), and core CPI also rose to +6.2% (vs. +5.7% expected). Furthermore, that was faster than the BoE’s own staff projections too, with last month’s Monetary Policy Report predicting a +9.9% reading like the consensus.

On the back of that print, investors ratcheted up the probability of a 25bp hike today, with overnight index swaps currently placing a 91% probability on such a move. That echoes the view of our UK economist, who is also expecting a 25bp increase in the Bank Rate that would take it up to a post-2008 high of 4.25%. In his preview (link here), he sees a 6-3 vote split in favour of the 25bp hike, but the big question now will be what they indicate in the forward guidance, and whether they echo the Bank of Canada’s move in making a “conditional pause” more explicit.

Asian equity markets are mixed this morning despite an overnight slump on Wall Street. US stock futures being notably higher is helping, with contracts tied to the S&P 500 (+0.43%) and NASDAQ 100 (+0.45%) seeing mild gains. As I type, the Nikkei (-0.30%) as well as the KOSPI (-0.11%) are edging lower but the Hang Seng (+0.78%) is trading in the green after technology heavyweight Tencent yesterday reported better than expected quarterly revenues. Meanwhile, the CSI (+0.36%) is trading higher with the Shanghai Composite (-0.01%) swinging between gains and losses. In FX, the US dollar (as measured by the DXY index) remains under pressure, trading near a seven-week low of 102.105 on the prospect of less Fed tightening ahead.

In other news yesterday, UK MPs voted overwhelmingly in favour of the Windsor Framework, which is the recently agreed adjustment to the Brexit deal’s arrangements for Northern Ireland. In the end the vote was 515-29 in favour, although the opponents included former PMs Boris Johnson and Liz Truss.

To the day ahead now, and monetary policy decisions will include the Bank of England, the Swiss National Bank and the Norges Bank. Data releases include the US weekly initial jobless claims, February’s new home sales, the Kansas City Fed manufacturing activity for March, and the Q4 current account balance. In the Euro Area, we’ll also get the preliminary consumer confidence reading for March. Finally, EU leaders will gather in Brussels for a summit.

After 76 year old treasury secretary Janet Yellen blew up the market yesterday with her post-FOMC comments that regulators aren’t looking to provide “blanket” deposit insurance to stabilize the US banking system, stock futures have rebounded modestly on Thursday, while paring some earlier gains. S&P 500 futures were up 0.5% at 3990 at 7:45 a.m. ET while Nasdaq 100 futures rose 0.9%. Both underlying indexes fell the most in two weeks yesterday. The tech-heavy Nasdaq index flirted with a bull market yesterday after briefly rising 20% from its December low. US government bond yields have edged up after falling sharply on Wednesday when the Fed raised rates 25bps but also opened the door to a pause, while WTI crude futures are down 0.6% in early US session. The Stoxx Europe 600 Index slid 0.8%, falling for the first time this week before a rates decision from the Bank of England.

In premarket trading, banking stocks were again the biggest laggards, following weakness in their US peers and as Citigroup Inc. slashed its outlook for the sector. Coinbase slumped after the largest US crypto exchange said it received a notice from the SEC formally declaring the securities regulator’s plans to bring an enforcement action against it. Analysts say the notice might be a precursor to the agency ultimately suing the company. Here are some other notable premarket movers:

- First Republic Bank shares rose on Thursday along with banking peers, set for a tentative rebound from yesterday’s losses following disappointment over comments from Treasury Secretary Janet Yellen over bank deposits.

- Cryptocurrency-exposed stocks rise as Bitcoin rebounds after snapping a six-session gaining streak on Wednesday. US equity futures also climbed, signaling a recovery following a tumultuous day of losses on Wall Street. Marathon Digital (MARA US) +5.1%, Riot Platforms (RIOT US) +4.7%.

- Chewy falls as much as 6.6% in US premarket trade after the online pet supplies retailer issued softer-than-expected FY23 guidance, with plans for international expansion likely to pressure margins. The company’s 4Q results also showed declining customer numbers, which Barclays says raises questions given that headwinds should have been abating.

- Phreesia Inc. shares dropped 3.3% in postmarket trading, after the application software company reported fourth-quarter results that beat expectations but gave a revenue outlook that KeyBanc sees as light.

Caution reigned in markets on Thursday following the Fed’s decision to proceed with a quarter-point rate hike, combined with Treasury Secretary Janet Yellen’s remarks on the health of the banking sector. While Fed Chair Jerome Powell assured that regulators’ actions demonstrated “all depositors’ savings are safe” as he raised rates by an expected quarter point, Yellen effectively contradicted him and sent stocks whipsawing, when she said regulators aren’t looking to provide “blanket” deposit insurance.

“Yellen’s comments were clearly the more important factor yesterday,” said Manish Kabra, US equity strategist at Société Générale. “Not securing all deposits risks more deposit runs, which means large banks’ outperformance versus regional banks is likely to continue. Overall, the US banks rally will continue to fade, at least until the yield curve is firmly positive.”

“It is well possible that the post-FOMC equity selloff quickly reverses, as falling yields are supportive of equity valuations — if financial stress is contained and economic data is not too bad,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

UBS strategists led by Mark Haefele believe that any rally would be unlikely to endure just yet however, noting that turning points usually rely on investors anticipating interest-rate cuts alongside a trough in economic activity and corporate earnings. “The Fed’s actions and analysis of the economy suggest these conditions are not yet fully in place,” they said in a note.

Separately, Goldman Sachs Group Inc. strategists say they expect US households to be net sellers of $750 billion worth of stocks in 2023 amid rising bond yields and declining personal savings. The team led by Cormac Conners says higher 10-year yields and lower savings rates tend to be associated with decreased net equity demand from households.

As a result of the ongoing bank crisis, the swap market shows investors are split on the chances that Fed officials will add another 25 basis points to their benchmark in May. Despite Powell’s guidance, expectations for cuts have deepened, with the market suggesting that the effective fed funds rate will drop to around 4.1% in December. “I would not expect the market to take these rate cuts out in the near term and could very well price in more cuts if the data deteriorates from here,” Matthew Hornbach, global head of macro strategy at Morgan Stanley, told Bloomberg Television. Powell himself, though, said in response to questioning that officials “just don’t” see cuts this year and that they will raise higher than expected if that is needed. “Rate cuts are not in our base case,” he said. He also didn’t see the bank crisis as recently as three weeks ago when he swore to Congress he would hike rates 50bps only to trigger the worst banking crisis since Lehman.

European stocks are on course to snap a three-day winning streak as banks underperform after US Treasury Secretary Janet Yellen warned they aren’t considering widespread insurance for bank deposits. The Stoxx 600 is down 1.0% while the Stoxx 600 Banks Index falls 2.5%. Here are some of the biggest European movers:

- HSBC shares drop as much as 3.3%, ING slides as much as 2.5% and ABN Amro tumbles as much as 3.7% after US peers fell on remarks that US lawmakers aren’t planning on widespread insurance for bank deposits

- Jeronimo Martins falls as much as 4.1%, curbing the stock’s rally since the start of the month, after 4Q earnings showed a further drop in the Portuguese retailer’s margins

- Rallye SA slumps as much as 10% after the company said the latest earnings from its French supermarket business make it difficult to finish debt restructuring

- Gym Group drops as much as 5.1% after Barclays downgrades the fitness operator to equal-weight from overweight, citing a “bleak” profit outlook

- Sanofi gains as much as 5.3%, the most since December, after releasing positive data from a phase 3 trial for its key drug Dupixent

- Scout24 climbs as much as 4.4%, reaching highest since mid-November, after the online classified advertising company announced a buyback

- Inwit rises as much as 4.8% to a record after Reuters reported that private equity firm Ardian is in the early stage of exploring a bid for the Italian tower operator

- Domino’s Pizza Group jumps as much as 4.3% after Barclays upgrades the pizza delivery chain to overweight from equal-weight, highlighting the increase in app usage

- Meyer Burger gains as much as 15% after the Swiss solar equipment manufacturer’s Ebitda and profitability beat expectations

- Nemetschek shares rise as much as 13% to their highest level since September. The German firm’s outlook for 2024 and 2025 was seen as solid

The BOE is likely to continue the quickest series of interest-rate increases in three decades, with its focus on combating inflation outweighing calls for a pause given recent turmoil in the banking system. The Swiss and Norwegian central banks both raised rates Thursday, as forecast, and flagged more hikes to come in their campaigns to tame rising consumer prices.

For the BOE, February UK CPI data have “removed any flexibility they may have thought they had and now markets are pricing in a higher terminal rate of around 4.5% as a result,” said Craig Erlam, a senior market analyst at Oanda Ltd. “This makes the language that accompanies the decision key,” he said, expecting policymakers to highlight an uncertain outlook and the need to be data-dependent.

Earlier in the session, Asian stocks rose as the region’s currencies strengthened against the dollar despite the Federal Reserve’s decision to raise US interest rates on Wednesday. The MSCI Asia Pacific Index climbed as much as 1.5%, rising for a third day, as most Asian currencies, including South Korea’s won and Thailand’s baht, gained. Hong Kong’s equity benchmarks were among the top performers, boosted by gains in Tencent after the firm reported better-than-expected revenue. Stock gauges in Japan and India underperformed. “Dollar reaction to the Fed hike looks to be muted, which can ease pressure on Asian currencies and fund flows,” said Marvin Chen, an analyst at Bloomberg Intelligence. “Focus should be on the dollar impact as peak Fed rates near.” The dollar slid as market expectations for rate cuts by the Fed deepened despite the central bank hiking its benchmark rate by a quarter-point and signaling that it expects more tightening after that.

A weaker greenback tends to be beneficial for Asian shares if it signals higher risk appetite and is seen as a positive for growth in the region’s emerging economies, many of which rely on imports priced in dollars. An index of Asian financial stocks headed for a three-day gain as a key technical indicator suggested the sector’s loss of more than 3% this month may have been excessive. US shares slumped Wednesday after comments from Treasury Secretary Janet Yellen rattled US bank shares and Fed Chairman Jerome Powell dashed hopes on rate cuts this year. Given expected slower US growth and the stresses in its banking system, it makes more sense to lean into the stronger growth recovery in China as well as Hong Kong and Thailand, said Sunil Koul, Asia Pacific equity strategist at Goldman Sachs, in a Bloomberg TV interview

Japanese equities fell, following US peers lower, after comments from Treasury Secretary Janet Yellen rattled US bank shares and Federal Reserve chief Jerome Powell said he was prepared to keep raising rates. The Topix Index fell 0.3% to 1,957.32 as of market close Tokyo time, while the Nikkei declined 0.2% to 27,419.61. Sony Group Corp. contributed the most to the Topix Index decline, decreasing 1.3%. Out of 2,159 stocks in the index, 1,256 rose and 781 fell, while 122 were unchanged. Yellen told US lawmakers that the government wasn’t considering “blanket” deposit insurance to stabilize the banking system while Powell said he was ready to keep raising rates until inflation shows signs of cooling. Japanese shares are falling after the comments, said Rina Oshimo, a senior strategist at Okasan Securities.

Australian stocks joined the selloff: the S&P/ASX 200 index fell 0.7% to close at 6,968.60, in a broad decline weighed by losses in mining shares and banks. The drop followed a slump on Wall Street as the Federal Reserve pushed back against bets for interest rate cuts this year. In New Zealand, the S&P/NZX 50 index was little changed at 11,594.94

Lastly, stocks in India were among the worst performers in Asia amid a mixed trend seen across global markets as investors remained concerned over the future course of central banks’ policy actions. The S&P BSE Sensex fell 0.5% to 57,925.28 in Mumbai, while the NSE Nifty 50 Index declined 0.4%. The gauge is now little changed this week after dropping for two out of the last four sessions. The benchmarks have slipped more than 4.5% each for the year. The underperformance in local equities compared with Asian and emerging market peers is a result of surging interest rates in the US – the Fed raised its main lending rate by another 25 bps on Wednesday to 5% – impacting flows from overseas investors. Index-heavy software exporters and banks came under pressure on increasing worries over global economic growth. Foreign investors have sold $2.8b of local shares this year through March 20 following inflows of about $11b over the preceding two quarters. Domestic investors have however remained buyers to the tune of $9b in 2023. Reliance Industries contributed the most to the Sensex’s decline, decreasing 1.3%. Out of 30 shares in the Sensex index, 13 rose, while 17 fell.

In FX, weakness in the dollar extended to a sixth day, with a gauge of the greenback falling to the lowest in more than a month as traders boosted bets for US interest-rate cuts, even after the Fed said more tightening may be needed. It has since rebounded fractionally from session lows.

- The Norwegian krone gained 1% versus the dollar after a hawkish 25bps hike from the Norges Bank. While there were expectations that Norges Bank would stand pat after hiking today, the central bank explicitly signaled another increase in May

- The pound and euro advanced, with the former climbing on leveraged demand amid expectations for the Bank of England to deliver a hawkish quarter-point rate increase on Thursday, according to a trader “With the banking sector concerns still fresh, the Fed was more dovish than just a while ago and that is dragging down bond yields and the dollar,” said Daisuke Uno, chief strategist at Sumitomo Mitsui Banking Corp. “I still think the Fed will raise the rate to tame inflation, which seems to remain stubborn”

- The Swiss franc struggled to hold gains after the SNB opted for a 50bps increase. The Dollar Index is little changed.

In rates, treasuries were cheaper across the curve, although futures remain near top of Wednesday’s range, a bull-steepening rally following Fed’s rate decision. US two-year yields are up ~2bps while UK two-year borrowing costs fall 9bps ahead of the Bank of England rate decision later today. Thursday’s losses are belly-led, cheapening 2s5s30s fly by ~3bp on the day. Bank of England rate decision at 8am New York time is expected to be a quarter-point rate increase. US yields cheaper by 3bp-5bp across the curve with 10-year around 3.48%, near low end of Wednesday’s 3.427%-3.642% range; on the curve, 2s10s spread is wider by ~1.5bp on the day, near Wednesday’s steepest levels, while 5s30s spread tightens ~1.5bp. Fed-dated OIS contracts price in around 13bp of rate hike premium for the May policy decision and then ~75bp of cuts by year-end.

Crude futures decline with WTI falling 1.2% to trade near $70.05. Spot gold adds 0.5% to around $1,980. Bitcoin rises 1.2%.

Looking to the day ahead now, monetary policy decisions will include the Bank of England, the Swiss National Bank and the Norges Bank. Data releases include the US weekly initial jobless claims, February’s new home sales, the Kansas City Fed manufacturing activity for March, and the Q4 current account balance. Finally, EU leaders will gather in Brussels for a summit.

Market Snapshot

- S&P 500 futures up 0.5% to 3,989.00

- MXAP up 1.3% to 160.31

- MXAPJ up 1.5% to 517.51

- Nikkei down 0.2% to 27,419.61

- Topix down 0.3% to 1,957.32

- Hang Seng Index up 2.3% to 20,049.64

- Shanghai Composite up 0.6% to 3,286.65

- Sensex little changed at 58,181.18

- Australia S&P/ASX 200 down 0.7% to 6,968.61

- Kospi up 0.3% to 2,424.48

- STOXX Europe 600 down 0.4% to 445.25

- German 10Y yield little changed at 2.28%

- Euro up 0.4% to $1.0897

- Brent Futures down 0.2% to $76.52/bbl

- Gold spot up 0.4% to $1,977.01

- U.S. Dollar Index down 0.18% to 102.16

Top Overnight News from Bloomberg

- Hong Kong’s CPI for Feb falls short of expectations, coming in at +1.7% (down from +2.4% in Jan and below the St’s +2.4% forecast). Singapore’s inflation also comes in a bit below plan at +6.3% headline for Feb (down from +6.6% in Jan and below the St’s +6.4% forecast). BBG

- Blinken’s planned trip to China may be in the process of getting back on track after being derailed by the Chinese balloon incident. Blinken said China will be capable of invading Taiwan by 2027. SCMP

- The ECB will probably need to raise borrowing costs more, though the bulk of tightening is already done, according to Governing Council member Madis Muller. BBG

- Ukrainian troops, on the defensive for four months, will launch a long-awaited counterassault “very soon” now that Russia’s huge winter offensive is losing steam without taking Bakhmut, Ukraine’s top ground forces commander said on Thursday. RTRS

- Swiss financial regulator Finma has defended its decision to wipe out a huge swath of risky subordinated bonds as part of the CS rescue deal. In its first statement on the deal since the weekend, Finma said that all the contractual and legal obligations had been met for it to act unilaterally given the urgency of the situation. “On Sunday, a solution was found to protect clients, the financial centr and the markets,” said Finma’s chief executive Urban Angehrn. “In this context, it is important that Credit Suisse’s banking business continues to function smoothly and without interruption.” FT

- Following the Fed, the BOE will probably continue its quickest series of rate increases in three decades with a 25-bp hike to 4.25%. The SNB raised rates by 50 bps and signaled more to come as it resumed its inflation fight just days after the downfall of Credit Suisse. Norges Bank raised by 25 bps to 3%, as expected, and said it will tighten further in May. BBG

- Freight companies are dialing back expectations that demand will recover strongly in the second half of the year amid growing economic uncertainty and signs retailers are growing more guarded about placing big orders in 2023. WSJ

- OPEC+ is unlikely to take action on production despite the recent slump in prices as they attribute most of the volatility to financial speculation, not fundamentals. RTRS

- The SEC has told Coinbase that it plans to take enforcement action against the company, escalating its crackdown on digital-currency firms by targeting the biggest U.S. crypto exchange, Coinbase said Wednesday. WSJ

- The Swiss National Bank raised its interest rate by 50 basis points and signaled more to come as it resumed its inflation fight just days after the downfall of the country’s second- biggest bank became the epicenter of global financial turmoil: BBG

- Norway’s central bank raised its key interest rate to the highest level since 2009 and signaled further tightening after higher price pressure from a weaker-than-forecast krone outweighed concerns about global banking turbulence: BBG

- Wall Street banks and European rivals are undoing de facto hiring freezes after Credit Suisse’s emergency rescue by UBS, unable to resist the lure of top talent available at a discount: BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed with price action choppy as markets digested the FOMC where the Fed delivered a widely expected 25bps rate hike and maintained its terminal rate view but dropped its reference regarding expectations that ‘ongoing’ rate hikes will be appropriate. ASX 200 declined amid the uninspired mood across most industries with underperformance in tech and mining. Nikkei 225 was contained by weakness in financials and after Japan maintained the overall assessment of the economy but cut the assessment on corporate profits and production for the first time since April 2020. Hang Seng and Shanghai Comp. swung between gains and losses with optimism in Hong Kong following earnings releases from Orient Overseas International and Tencent whereby the advances in the latter inspired its tech peers, although participants also digested a rate hike by the HKMA which moved in lockstep with the Fed.

Top Asian News

- HKMA raised its base rate by 25bps to 5.25%, as expected, which is in lockstep with the Fed.

- RBNZ Chief Economist Conway said inflation is high and widespread because strong demand outstripped supply, while he added that they are incredibly determined to get inflation and inflation expectations back to the target. Furthermore, Conway expects monetary policy tightening to cause the New Zealand economy to enter a mild recession later this year as demand slows, as well as noted that the OCR is now comfortably above neutral and having the desired contractionary effect, according to Reuters.

European bourses began the session mixed/flat, but have since dipped more convincingly into negative territory with newsflow focused on hawkish Central Bank action post-Fed thus far. Once again, the FTSE 100 is lagging its peers as focus remains firmly on the upcoming BoE announcement, FTSE 100 -1.0%. Stateside, futures are firmer though remain shy of Wednesday’s best levels and have most recently eased off the sessions peak given the above action, ES +0.4%. Citi cuts their Stoxx 600 end-2023 forecast to 445 (prev. 475); FTSE 100 cut to 7600 (prev. 8000); downgrades Banks to Neutral (prev. Overweight).

Top European News

- ECB’s Muller says inflation is a bigger problem than the increase in borrowing costs. Lions share of hikes are behind us; ECB is likely to increase rates by a little.

- ECB’s Stournaras says should not commit to any rates in advance.

- Italy is reportedly preparing a new package of measures worth some EUR 5bln to aid firms and families cope with energy bills, and could be unveiled next week, according to Reuters sources.

Central bank decisions

- SNB hikes by 50bps to 1.50% vs exp. 1.50% (prev. 1.00%); does not rule out further hikes; reiterates language around price stability and FX intervention. Further increased its inflation forecasts, with CPI now not seen dropping back into the 0-2% target band until Q2-2023 (prev. Q4-2023). Click here for full details, reaction & analysis.

- Norges Bank hikes by 25bps to 3.00% vs exp. 3.00% (prev. 2.75%); the policy rate will be raised further in May; decision unanimous. Rate path now implies an end-2023 rate of 3.60% (prev. 3.08%). Click here for full details, reaction & analysis.

- Brazilian Central Bank maintained the Selic rate at 13.75%, as expected, while it will remain vigilant and will assess if the strategy of maintaining the Selic rate for a sufficiently long period of time will be enough to ensure the convergence of inflation. BCB added that inflation expectations have shown additional deterioration, especially at longer horizons and they will not hesitate to resume the tightening cycle if the disinflationary process does not proceed as expected.

FX

- The USD remains on the back-foot after Wednesday’s FOMC, though the DXY is back towards a 102.44 high after briefly printing a fresh March low of 101.91.

- Action which supports peers across the board and features antipodeans outperforming after recent pressure, NZD leading and cognisant of RBNZ’s Conway emphasising that inflation remains high and widespread; NZD/USD and AUD/USD testing 0.63 and 0.6750 respectively.

- GBP is next best ahead of the BoE, Cable at a fresh March peak of 1.2343 with 25bp fully priced and a peak of around 4.45% (current 4.00%) implied.

- The single currency, EUR, is underpinned by the USD but with EUR/GBP pressure preventing any further appreciation; EUR/USD holding sub-1.09 while EUR/GBP near the 0.8832 low.

- Finally, CHF benefitted from the SNB’s hawkish-hike while the NOK is back to pre-release levels as expectations for a 50bp hike unwind while the hawkish repo path adjustments are factored in.

Fixed Income

- EGBs are underpinned with yields softer across the curve post-Fed while Gilts are closer to the unchanged mark pre-BoE, though the morning’s hawkish action has sparked a pullback from best levels.

- Bunds hold around 136.00 and the 10yr yield now back above 2.25% after dipping to a 2.22% low; modest upside was seen in Bunds following Germany leaving its Q2 issuance calendar unrevised vs the prelim. FY release.

- Stateside, USTs continue to derive support from Wednesday’s announcements; though, the yield curve has lifted marginally from the mid-week trough, but does remain lower overall with action most pronounced in the belly.

- German Q2 issuance calendar sees no changes vs the prelim. annual release.

Commodities

- Commodities are mixed, with the crude benchmarks attempting to pare back some of their overnight losses while metals glean support from the USD’s downside.

- Specifically, WTI and Brent are towards the lower-end of USD 69.91-70.79/bbl and USD 75.76-76.66/bbl parameters, though the benchmarks are holding above USD 70 and USD 76 respectively.

- Both precious and base metals are benefitting from the softer dollar; spot gold towards the upper-end of USD 1964-1983/oz parameters, just shy of Wednesday’s USD 1985/oz best with base metals supported but off best given the broader risk tone.

- Iran’s Finance Minister said Iran achieved its highest level of oil exports for at least two years last month, according to FT.

- Goldman Sachs said gold remains the best safe-haven asset for financial risks and raised its gold target to USD 2050/oz from 1950/oz, while it added that Chinese demand continues to surge across the commodity complex with oil demand topping 16mln bpd and it remains very positive on commodity prices with 12-month forecasted returns of 27.9% for S&P GSCI.

Geopolitics

- China’s military said it monitored and drove away a US destroyer which entered the South China Sea Paracel Islands, although the US Navy later said that the Chinese military’s statement is false regarding a US destroyer being expelled from the South China Sea.

- Taiwan’s Foreign Minister said President Tsai’s meeting with the US House Speaker is still being arranged, according to Reuters.

- Saudi Arabia and Iran’s Foreign Ministers agreed to meet soon to pave the way for the reopening of embassies, according to the Saudi state news agency.

- Russian Foreign Ministry Lavrov is to hold discussions with Iran’s top diplomat on March 29th in Moscow, according to Tass.

- US mulls opening Pacific defense pact with Britain and Australia to more countries, according to Semafor.

- US reportedly plans to send aging A-10 attack planes to the Middle East while shifting newer jets to Asia and Europe, according to US officials cited by WSJ.

US Event Calendar

- 08:30: March Initial Jobless Claims, est. 197,000, prior 192,000

- March Continuing Claims, est. 1.69m, prior 1.68m

- 08:30: Feb. Chicago Fed Nat Activity Index, est. 0.10, prior 0.23

- 08:30: 4Q Current Account Balance, est. -$213.7b, prior -$217.1b

- 10:00: Feb. New Home Sales, est. 650,000, prior 670,000

- Feb. New Home Sales MoM, est. -3.1%, prior 7.2%

- 11:00: March Kansas City Fed Manf. Activity, est. -2, prior 0

DB’s Jim Ried concludes the overnight wrap

In an FOMC meeting that went to script but perhaps leaned dovish, Mr Powell’s press conference was overshadowed by his predecessor’s (Yellen) simultaneous comments that a blanket guarantee of deposits had not been discussed or considered. It seems highly unlikely the US would let depositors take losses but maybe such a move won’t be done pre-emptively and would require future stress first. The reaction to her comments also highlighted the nervousness and fragility underpinning a big 2-day rally. The remarks led to a late slump in equities (S&P 500 -1.65% – all post Yellen) and big rally in bonds (2yr -23bps – more than half after Yellen) and distracted from a relative uneventful FOMC, even if there were nuances worth discussing.

Let’s look at the Fed first. They hiked interest rates a further 25bps to put the policy rate in a target range of 4.75-5.00%, while saying in the statement that “additional policy firming may be appropriate”. This replaced “ongoing increases in the target rate will be appropriate”. So a softening in language.

The pace and asset makeup of QT was unchanged as expected. The median dot plot projection showed fed funds ending 2023 at 5.1%, unchanged from December, and up by roughly one hike to 4.3% at the end of 2024. Despite the median remaining unchanged, there was some upward migration in the dot plot for 2023. In terms of economic projections, the Fed had Core PCE inflation up modestly both this year (3.6% from 3.5% in Jan) and next (2.6% from 2.5% in Jan), but saw risks as “broadly balanced” rather than “weighted to the upside” as we had seen last meeting. On the banking stress, the Fed’s statement noted that it is “likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation.”

At the press conference, Chair Powell opened with a statement on the banking sector first by saying that the US banking system is sound and that the Fed programs are “effectively meeting” liquidity needs while policymakers are closely monitoring the situation. He also noted that the events of the past week are likely to weigh on lending standards and slow the economy, which may in fact necessitate fewer rate hikes than thought before. Chair Powell noted that some officials considered a pause in the days leading up to the meeting, however in the end it was a unanimous vote to hike rates. The “pause” word sparked a front-end rally.

Our US economists have maintained their terminal rate view of 5.1% following another 25bp rate hike in May. They note there is elevated uncertainty around this modal outcome. Financial and credit conditions along with inflation data will be important to watch in the weeks ahead. See their FOMC review note here for more.

The S&P 500 went into the FOMC announcement about flat on the day (-0.04%), having traded in a 0.60% range through much of the US trading session. The initial statement saw a pop in sentiment, before stocks whipsawed through the Chair’s opening statement and peaked up around +0.9% on the day as he noted “disinflation is intact.” However, comments on credit conditions tightening further and rate cuts in 2023 not being the FOMC’s “baseline expectation” saw risk sentiment fall.

Roughly an hour prior to the close Chair Powell also acknowledged that the Fed was still open to further rate hikes if the data proves them necessary. At the same time, his predecessor, Treasury Secretary Yellen said to a Senate subcommittee hearing that, “I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits.” She also noted that it was not yet the time to discuss changing the FDIC insurance cap.

Risk sold off harder after this with the S&P falling over -1.5% over the last hour of trading to finish at the lows of the day at -1.65%. 493 of the index’s constituents were lower yesterday with Banks leading the late move lower. The KBW index closed down -4.70% on the back of significant regional bank losses once again led by First Republic (-15.5%), while the majors held up relatively better with JPM (-2.6%), C (-3.0%), and BAC (-3.3%) outperforming.

Fixed income markets saw more one way traffic with 10yr US Treasury yields -17.53bps lower on the day to 3.43% after being roughly unchanged around the European close and rallying though the FOMC statement and the risk-off move that followed. US 2yr yields were actually higher in the US morning before being unchanged just prior to the meeting and then rallying through the US afternoon to finish the day -23.0bps lower at 3.937% – just off the lows of the day. Following the meeting, fed futures are pricing in a 46% chance of a hike at the next meeting in May, and then roughly 70bps of cut by year-end despite the comments from Chair Powell. This morning in Asia, we are seeing a further steepening in the curve with 2yrs -6bps but 10yrs +1bps. 2s10s is now -44bps after being in the low -60s before the FOMC statement. See our rates strategists’ call and rationale for steepeners here for more on the forces around this trade.

So the mood completely changed in the last hour or so. Ahead of the Fed, European markets had actually continued to normalise following last week’s volatility. For instance, equities put in another steady performance, with the STOXX 600 (+0.15%) posting a third consecutive advance. Sovereign bond yields also moved higher, with those on 10yr bunds (+3.6bps) at a one-week high of 2.328% as investors priced out the chances of an imminent pause in rate hikes from the ECB. In part, that was supported by a Bloomberg article later in the session, which reported that ECB officials were growing in confidence that they had withstood the current turmoil, whilst concern remained that inflation still needed tackling. When it came to banks however, the rally at the start of the week showed signs of petering out, with the STOXX Banks index coming down -0.69%, and UBS falling -3.71%.

Looking forward, central banks will remain in the spotlight today, with the Bank of England’s decision coming up at midday London time. Up until yesterday, market pricing had been more in the balance on whether they’d keep hiking or pause. But just after we went to press yesterday, there was a big upside surprise in the February CPI print. That showed an unexpected increase in the year-on-year measure to +10.4% (vs. +9.9% expected), and core CPI also rose to +6.2% (vs. +5.7% expected). Furthermore, that was faster than the BoE’s own staff projections too, with last month’s Monetary Policy Report predicting a +9.9% reading like the consensus.

On the back of that print, investors ratcheted up the probability of a 25bp hike today, with overnight index swaps currently placing a 91% probability on such a move. That echoes the view of our UK economist, who is also expecting a 25bp increase in the Bank Rate that would take it up to a post-2008 high of 4.25%. In his preview (link here), he sees a 6-3 vote split in favour of the 25bp hike, but the big question now will be what they indicate in the forward guidance, and whether they echo the Bank of Canada’s move in making a “conditional pause” more explicit.

Asian equity markets are mixed this morning despite an overnight slump on Wall Street. US stock futures being notably higher is helping, with contracts tied to the S&P 500 (+0.43%) and NASDAQ 100 (+0.45%) seeing mild gains. As I type, the Nikkei (-0.30%) as well as the KOSPI (-0.11%) are edging lower but the Hang Seng (+0.78%) is trading in the green after technology heavyweight Tencent yesterday reported better than expected quarterly revenues. Meanwhile, the CSI (+0.36%) is trading higher with the Shanghai Composite (-0.01%) swinging between gains and losses. In FX, the US dollar (as measured by the DXY index) remains under pressure, trading near a seven-week low of 102.105 on the prospect of less Fed tightening ahead.

In other news yesterday, UK MPs voted overwhelmingly in favour of the Windsor Framework, which is the recently agreed adjustment to the Brexit deal’s arrangements for Northern Ireland. In the end the vote was 515-29 in favour, although the opponents included former PMs Boris Johnson and Liz Truss.

To the day ahead now, and monetary policy decisions will include the Bank of England, the Swiss National Bank and the Norges Bank. Data releases include the US weekly initial jobless claims, February’s new home sales, the Kansas City Fed manufacturing activity for March, and the Q4 current account balance. In the Euro Area, we’ll also get the preliminary consumer confidence reading for March. Finally, EU leaders will gather in Brussels for a summit.

Loading…