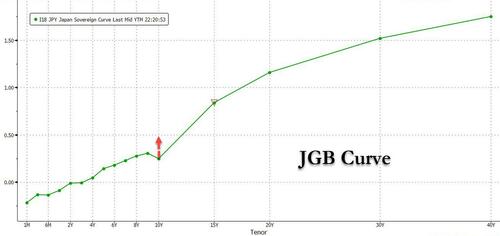

After last week's CPI and FOMC decision, it was supposed to be smooth sailing into the illiquid, year-end waters as trading desks closed down for the year, and where among those few traders left some expected a Santa rally while others kept pressing their shorts. The BOJ - which was badly been lagging all of its central bank peers in tightening financial conditions - however had other plans, and on Tuesday morning Japan's central bank shocked the world when it announced it would widen the Yield Control Curve band on the 10Y Treasury from 0.25% to 0.50% on either side, a move which had been viewed as a “when not if" - as markets knew the BoJ would eventually have to realign the "kinked" 10Y point with the rest of JGB curve and fundamentals…

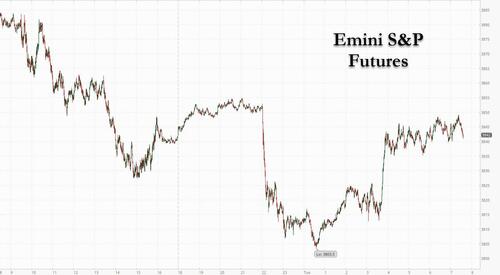

... and begin a gradual policy alignment with rest of world’s already robust tightening, as they had instead continued to ease throughout ‘22 - but this was not seen as today's business and virtually everyone expected this move to come after the Kuroda term ended in April ‘23, with most expecting a “phase-in” executed in smaller increments over time. So the news that the yield on Japan's 10Y would be allowed to double from 0.25% to 0.50% came as a shock and sparked cross-asset contagion across the world, sending futures tumbling and bond yields soaring at least initially and briefly halted Japans' treasury futures.

"Tighter BoJ policy would remove one of the last global anchors that’s helped to keep borrowing costs at low levels more broadly," Deutsche Bank analysts told clients, noting the BOJ move had come as markets were “already reeling” from the ECB and Fed’s hawkishness last week.

BOJ governor Haruhiko Kuroda later reiterated at a press briefing that the widening of the yield band was aimed at improving market functioning and smoothing out a distorted yield curve. Still, the abrupt decision risks eroding confidence in the central bank’s messaging after the governor and other board members had repeatedly said a widening of the range would be tantamount to raising interest rates.

As attention turned away from the surge in yields -to the plunge in the dollar, US stock-index futures managed to recover most of their earlier losses, and as of 730am ET, contracts on the S&P 500 were flat while Nasdaq 100 futures slightly underperformed, falling 0.2% as the yield on 10-year Treasuries extended gains.

Contracts on the S&P 500 had slumped as much as 1.1% earlier after the BOJ’s move triggered concerns among investors already worried about the growing chorus of hawkish central banks: “There are some investors that are doing cross assets, and so if the yen moves — if the foreign exchange moves a lot — they automatically readjust” their equity futures positions, said Michael Makdad, an analyst at Morningstar Inc. in Tokyo.

But the move in stocks was actually relatively modest: the move in JGBs was more powerful, as the yield on 10Y bonds surged to the highest level since 2015...

... and dragged US TSYs along with it amid fears Japanese would be less willing to buy US paper (spoiler alert: the opposite will happen as local pensions start factoring in capital losses amid future YCC expansions) while the biggest fireworks took place in the world of FX, however, where the dollar tumbled as the yen rose: at one point the USDJPY plunged all the way down to 132.0 a 500+ pip move from where the pair was pre-BOJ, and the second biggest move in the past year, lagging only behind the shock US CPI miss repricing in November.

Among US premarket moves, Lucid Group advanced after the company said it has completed its stock sale program and successfully raised about $1.5 billion. Here are some of the biggest US movers today:

- Verona Pharma (VRNA US) shares surge as much as 162% in US premarket trading after the drug developer achieved positive results in the Phase 3 ENHANCE-1 trial evaluating nebulized ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease.

- Cryptocurrency-exposed stocks rise as Bitcoin rebounds after falling to the lowest level this month as worries over the path of central bank policy damped moves across risky assets. Riot Blockchain (RIOT US) advances 1.6%, Marathon Digital (MARA US) +0.8%, Silvergate (SI US) +1.9%

- MKS Instruments (MKSI US) stock rises 1.1% on low volumes after it was upgraded to overweight from sector weight at KeyBanc, with the broker saying the company’s strong competitive position should drive growth in semiconductor and advanced packaging.

- Heico (HEI US) shares could be in focus as the aerospace parts manufacturer reported earnings per share for the fourth quarter that matched the average analyst estimate, but did not provide guidance for 2023.

- Keep an eye on Conagra Brands (CAG US) stock as Morgan Stanley upgraded it to overweight, expecting the packaged-food sector to maintain its relative outperformance through 2023 and also raising J M Smucker (SJM US) to equal-weight.

- Beam Therapeutics (BEAM US) is upgraded to outperform from market perform at BMO, which said that the risk/reward on the stock now seems skewed to the upside.

- The insurance lead generation sector is JPMorgan’s favorite across small and mid-cap internet stocks for 2023, with analysts upgrading MediaAlpha (MAX US) to overweight from neutral, and EverQuote (EVER US) to overweight from underweight, while downgrading some advertising-exposed stocks.

Even before the BOJ, US stocks dropped for a fourth session on Monday as traders recoiled at the growing possibility that the Fed will push the US economy into a painful recession after central bank officials vowed to keep raising rates until they’re confident inflation is coming down meaningfully. The S&P 500 closed at its lowest level in more than a month, dragged by declines in big-tech firms including Apple, Microsoft and Amazon.com. As Bloomberg points out, US tech stocks are facing a big technical trial this week, with the Nasdaq 100 Index testing a long-term uptrend in place since 2008, based on a logarithmic scale and weekly data.

“The Fed now knows that the forward-looking indicators are starting to move in their favor,” Hugh Gimber, global market strategist at JPMorgan Asset Management, told Bloomberg Television. “They just want to see that coming through in hard data now and hence they want another few months just to get a clearer sense of the picture, but the direction of travel is much more positive.” Gimber expects a half-point hike when the Federal Open Market Committee meets in February, followed by a raise of 25 basis points in March.

European stocks also erased earlier losses, with the Stoxx 600 trading down -0.20% after tumbling more than 1% earlier. European real estate stocks underperformed; the Stoxx 600 Real Estate subindex drops 3.6% at 9:36 a.m. CET. Biggest laggards include Aroundtown -9.1%, Wihlborgs -4.5%, Balder -4.4%, LEG Immobilien -4.2%, Vonovia -4%, SBB -3.8%. Other notable European movers include:

- Elior shares rise as much as 8.8% after the French caterer said it would buy Derichebourg Multiservices division by issuing new stock. The analysts noted that the equity-financed deal would add scale, boost margins and accelerate the company’s deleveraging.

- Hugo Boss shares rise as much as 6% after Deutsche Bank analyst Michael Kuhn raised the recommendation to buy from hold.

- Engie shares slumped as much as 6.9% after the French utility said it may take a hit of up to €5.7 billion ($6.1 billion) through next year from windfall taxes on soaring power sales and Belgium’s requirements for nuclear plant dismantling.

- Credit Suisse shares decline as much as 3.9% as both Citi and RBC say the troubled lender needs to give greater visibility on its planned strategic overhaul for the stock to recover.

- Petrofac shares drop as much as 10% to fresh record low as the energy infrastructure supplier predicts a full-year Ebit loss.

- European real estate stocks underperformed on Tuesday after a hawkish move from the Bank of Japan, which adjusted its yield curve control program. Aroundtown is the sector’s biggest decliner, falling as much as 11%, after being downgraded to hold from buy at Berenberg.

- Rheinmetall shares fall as much as 5.5% in Frankfurt, extending Monday’s losses, after German Defense Minister Christine Lambrecht set a deadline for the industry to fix defective infantry vehicles.

- Kinepolis shares drop as much as 6.6%, the most in more than a month, after Berenberg lowers its price target and adopts a “more cautious” stance over its FY23/24 estimates.

Earlier in the session, Asian stocks fell as Japanese shares tumbled following a surprise policy tweak by the central bank, while China’s Covid disruptions also hurt sentiment. The MSCI Asia Pacific Index dropped as much as 1.1% before mostly trimming losses. The Nikkei 225 Index slumped 2.5% as the Bank of Japan raised the upper band limit of its yield curve control program, giving the yen a boost. Financial shares in the nation surged while tech and auto stocks slumped in Tokyo. “Usually the weak yen is good for the stock market earnings, and now if you have a stronger yen, it’s going to be a concern for the companies that were doing so well, mainly the exporters and maybe tourism,” said Peter Tasker, co-founder and strategist at Arcus Investment

“The whole Asian region is dragged down by BOJ’s new policy, which is triggering the short covering of yen,” said Steven Leung, executive director at UOB Kay Hian (Hong Kong) Ltd. “Those who borrow yen and invest in other securities” need to unwind positions, he added. Stocks in China and Hong Kong fell for the second day as the reopening rally continued to cool. China reported a pickup in Covid deaths, with analysts expecting the actual toll to be much worse than the official tally. Despite the dismantling of heavy Covid restrictions, activity in key cities has slowed as infections spike, diminishing the economic boost from a reopening. Investors are contending with slowdown risks in the region in 2023, with China’s path to reopening facing headwinds and doubts about the Fed’s ability to tackle inflation without pushing the US economy into a recession

In FX, the Bloomberg Dollar Spot Index was set a second day of losses as the greenback weakened against all of its Group-of-10 peers apart from the Australian and New Zealand dollars.

- The yen rose by as much as 3.7%, to a four-month high of 132.06 per dollar, while the benchmark 10-year yield surged to 0.444%, the highest since 2015. The BOJ said it will now allow Japan’s 10-year bond yields to rise to around 0.5%, up from the previous limit of 0.25%; details here

- Cross sales into yen hit the Aussie and kiwi with the latter already weakened after data showed business confidence in the nation slumped to a record low. Both Australia’s and New Zealand’s bonds also fell

- The yuan flipped to a gain as the dollar weakened following the Bank of Japan’s hawkish shift. China’s loan prime rates were kept on hold, as expected.

In rates, Treasuries, bunds and gilts yields are off highs reached after BOJ’s yield pivot, though still up about 8 basis points each at the 10-year mark. Treasury futures off worst levels of the day, recouping a portion of losses into early US session after an aggressive cheapening move sparked by Bank of Japan widens the trading band on 10-year bond yields. Into peak selloff 10-year yields topped through 3.70% and onto cheapest levels since Nov. 30, before settling around 3.65% into the US session; the 2s10s spread remains wider by 5bp on the day after reaching steepest since Nov. 16. On outright basis Treasury yields remain cheaper by 1bp to 8.5bp across the curve in a bear steepening move, following wider selloff across JGBs where 10- year yields closed at 0.399% and 2s10s curve steepened 13bp on the day

In commodities, WTI trades within Monday’s range, adding 1.1% to near $75.98. Most base metals trade in the green. Spot gold rises roughly $19 to trade near $1,806/oz.

In crypto, Bitcoin is firmer to the tune of 1.0%, though once again remains within relatively narrow ranges.

To the day ahead now, and data releases include German PPI for November, US housing starts and building permits for November, and the European Commission’s advance December reading on consumer confidence for the Euro Area. Central bank speakers include the ECB’s Kazimir and Muller. Finally, earnings releases include Nike.

Market Snapshot

- S&P 500 futures little changed at 3,842.50

- STOXX Europe 600 down 0.4% to 424.16

- MXAP little changed at 155.50

- MXAPJ down 1.0% to 502.25

- Nikkei down 2.5% to 26,568.03

- Topix down 1.5% to 1,905.59

- Hang Seng Index down 1.3% to 19,094.80

- Shanghai Composite down 1.1% to 3,073.77

- Sensex down 0.2% to 61,653.10

- Australia S&P/ASX 200 down 1.5% to 7,024.27

- Kospi down 0.8% to 2,333.29

- German 10Y yield little changed at 2.27%

- Euro up 0.2% to $1.0632

- Brent Futures up 0.6% to $80.29/bbl

- Gold spot up 0.9% to $1,804.50

- U.S. Dollar Index down 0.73% to 103.96

Top Overnight News from Bloomberg

- The BOJ’s surprise policy shift is sending shock waves through global markets that may just be getting started, as the developed world’s last holdout for rock-bottom interest rates inches toward policy normalization

- The BOJ’s latest policy shock is cementing the central bank’s reputation for using the element of surprise to achieve its strategic goals

- At least three funds stand to benefit from Japan’s policy move: UBS Asset Management, Schroders Plc and BlueBay Asset Management

- ECB Governing Council member Francois Villeroy de Galhau said the euro-zone economy is unlikely to experience a deep slump as interest rates are lifted to tackle soaring inflation

- The ECB remains “a long way” from achieving its goal of inflation of 2% over the medium term, according to Governing Council Member and Bundesbank President Joachim Nagel

- South African President Cyril Ramaphosa emerged from a ruling party electoral conference with a stronger mandate, yet still has to overcome a series of political hurdles to tackle a daunting economic to-do list

- Hong Kong will further ease social distancing measures, including rules on banquets, ahead of a trip by the city’s leader to Beijing

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded lower across the board with the broader risk profile hit by the BoJ's unexpected tweak to its Yield Curve Control. Nikkei 225 fell over 2.5% as it reacted to the BoJ's move, with the index briefly dipping under 26,500, although bank stocks soared. ASX 200 was dragged lower by its Tech and IT sectors whilst Banks and Utilities were the better performers. Hang Seng and Shanghai Comp conformed to the downbeat tone across the equity market, with the former seeing its housing stocks slip after the PBoC opted to maintain its 5yr LPR unchanged vs some expectations for a cut.

Top Asian News

- RBA Minutes (Dec): Board considered several options for the cash rate decision at the December meeting: a 50bps increase; a 25bps increase; or no change in the cash; members also noted the importance of acting consistently. The Board did not rule out returning to larger increases if the situation warranted. Click here for the detailed headline

- PBoC maintained the 1yr and 5yr Loan Prime Rates (LPRs) at 3.65% and 4.30% respectively, as expected, according to Bloomberg.

- BoK Governor said the board believes it is premature to cut rates. BoK said consumer inflation is to gradually slow after hovering around 5% for some time; uncertainty is high over how swiftly consumer inflation will slow, according to Reuters. BoK Governor said the risk of USD/KRW rate surging at an unusual pace has decreased.

- China reports five COVID-related deaths in the mainland on Dec 19 vs two a day earlier, according to Reuters.

- Hong Kong Chief Executive Lee said Hong Kong will further ease social distancing measures, according to Bloomberg; subsequently, Hong Kong Health Authorities are to drop the rapid antigen COVID test requirement to enter bars/nightclubs from Thursday, no capacity limit on such venues.

- Japan is reportedly mulling issuing JPY 500bln of green transformation economic transition bonds (GX bonds) in FY23, according to Japanese press Yomiuri.

- Japanese government reportedly looking to issue around JPY 35.5tln of new JGBs for FY23/24, according to Reuters sources.

- PBoC injected CNY 5bln via 7-day reverse repos with the rate maintained at 2.00%; injects CNY 141bln via 14-day reverse repos with the rate maintained at 2.15%; daily net injection CNY 144bln.

European bourses are under modest pressure, Euro Stoxx 50 -0.3%, as the complex lifts off post-BoJ lows in limited newsflow. US futures are moving in tandem with the above, ES -0.1%, ahead of a handful of stateside data prints. JPMorgan lowers its Apple (AAPL) iPhone volume forecasts for the December quarter to around 70mln (prev. forecast ~74mln).

Top European News

- ECB’s Kazimir Says Stable Pace of Tightening Should Continue

- Spain Court Foils Sánchez Bid to Name Judges in Power Clash

- Engie Drops as Taxes, Nuclear Rules Take Multibillion Euro Bite

- Swedish Property Stocks End Brutal 2022 With Tough Reset Ahead

- Germany Cuts Russian Share in Gas Use by More Than Half in 2022

FX

- JPY is the standout outperformer after the BoJ widened the 10yr yield band, sending USD/JPY to a test of 132.00 vs 137.00+ initial levels.

- Amidst this, the DXY has been pushed below 104.00 to the modest benefit of G10 peers across the board.

- Though, the read across from the USD's downside to peers is being hampered somewhat by the pronounced action in JPY-crosses.

- Elsewhere, antipodeans are the incremental laggards following the ANZ survey and post-RBA minutes, which has a dovish tilt.

- PBoC sets USD/CNY mid-point at 6.9861 vs exp. 6.9862 (prev. 6.9746)

Fixed Income

- Benchmarks have bounced from BoJ induced worst levels with modest assistance from German PPI and UK supply.

- However, core debt is lower by around 100 ticks for Bunds and Gilts, with the German 10yr approaching 2.3% at best.

- Stateside, USTs are directionally in-fitting though magnitudes are slightly more contained ahead of the US session, yields bid across the curve and bear-steepening.

Geopolitics

- North Korea said Japan's counterattack capabilities are effectively pre-emptive strike capabilities; said Japan's new security strategy is bringing security crisis in the region. North Korea said it has the right to take "decisive" military measures to protect its rights in response to the changing security environment, via KCNA.

BOJ

STATEMENT

- BoJ unexpectedly tweaked its Yield Curve Control (YCC) in which it widened the 10yr yield band to +/-0.5% (prev. +/-0.25%) and unexpectedly announced it is to increase bond purchases to JPY 9tln/m (prev. JPY 7.3tln/m) in Q1. The BoJ kept its rate unchanged at -0.10% and maintained 10yr JGB yield target of around 0% as expected. The decision on the YCC was unanimous. The adjustment is intended to “improve market functioning and encourage a smoother formation of the entire yield curve while maintaining accommodative financial conditions,” the central bank said. BoJ said it is to make nimble responses for each maturity by increasing the amount of purchases even more and conducting fixed-rate purchases operations when deemed necessary. BoJ maintained its rate guidance. Click here for the detailed headline

GOVERNOR KURODA

YCC:

- Market functionality was decreasing. Domestic market has been hit by volatility abroad. Decision was made today as deteriorating market functions could threaten corporate financing.

- Decision is not an exit of YCC or a change in policy, appropriate to continue easing policy.

- There is no need to further expanding the allowance band, not likely that the market calls for another increase of the yield cap maximum limit.

Broader Policy:

- It is too early to debate the exit to current monetary policy; today's decision is not a rate hike.

- Won't hesitate to ease monetary policy further if necessary.

- No intention to hike rates or tighten policy. Not thinking about revising the 2013 gov't-BoJ joint statement.

OTHER

- BoJ announced an unscheduled bond operation: BoJ offered to buy JPY 100bln in up to 1-3yr JGBs, JPY 100bln in 3-5yr JGBs, JPY 300bln in 5-10yr JGBs and JPY 100bln in 10-25yr, according to Reuters. BoJ to conduct unlimited bond buying in the 1-5yr tenors, according to Bloomberg.

- Japanese Finance Minister Suzuki said it is not true that the government and the BoJ have decided on a policy to revise its joint statement, according to Reuters.

- Japanese Economy, Trade, and Industry Ministry Nishimura said it is important to continue carrying out economic revitalisation based on the joint statement with the BoJ, according to Reuters.

- Japan Securities Clearing Corporation has issued an emergency margin call re. JGB futures.

Commodities

- Crude benchmarks slipping in tandem with broader sentiment initially and in the hours since have pared this pressure and are now posting upside just shy of USD 1.0/bbl.

- Currently, Dutch TTF Jan’23 remains under modest pressure, but is yet to slip below the EUR 100/MWh mark.

- Germany's BDEW (energy industry association) says it is concerned about the EU gas price cap, it needs monitoring and adjusting if results in too little gas reaching Europe.

- The yellow metal is a handful of ounces above the USD 1800/oz handle while base metals are firmer in action that is for the most part in-fitting with the above risk tone/dynamics.

US Event Calendar

- 08:30: Nov. Building Permits MoM, est. -2.1%, prior -2.4%, revised -3.3%

- 08:30: Nov. Building Permits, est. 1.48m, prior 1.53m, revised 1.51m

- 08:30: Nov. Housing Starts MoM, est. -1.8%, prior -4.2%

- 08:30: Nov. Housing Starts, est. 1.4m, prior 1.43m

DB's Jim Reid concludes the overnight wrap

We go to press this morning amidst big moves in global markets overnight, since the Bank of Japan have decided to adjust their yield-curve-control policy, which is widely seen as the beginning of a potential end to their ultra-loose monetary policy. That policy has made them a big outlier compared to other central banks this year, having maintained rates at the zero lower bound whilst others embarked on their biggest tightening cycle in a generation. Indeed, it’s important not to underestimate the impact this could have, because tighter BoJ policy would remove one of the last global anchors that’s helped to keep borrowing costs at low levels more broadly.

In terms of the policy shift, the BoJ announced in a surprise move that Japan’s 10yr yield would now be able to rise to around 0.5%, having been limited to 0.25% previously. In turn, that led to a massive slump in Japanese equities, with the Nikkei down by -2.88% this morning, and those moves lower have been echoed more broadly. Indeed, not only are other indices in Asia pointing lower, including the CSI 300 (-1.64%), the Shanghai Comp (-1.03%), the Hang Seng (-2.19%) and the Kospi (-1.10%), but futures on the S&P 500 are currently down -1.07%, even after a run of 4 consecutive declines for the index already. The one big exception to this pattern of equity losses were bank stocks, with those in the Nikkei surging +4.96% this morning given the potential move away from ultra-low borrowing costs.

Unsurprisingly, Japanese government bond yields have surged on the back of the announcement, with the 10yr yield up +15.5bps this morning to 0.41% after trading around 0.25% for months. But the impact hasn’t been confined there either, with Australian 10yr yields up +19.5bps this morning, and those on US 10yr Treasuries up +8.1bps to 3.666%. In the meantime, the yen has strengthened massively, gaining +2.75% against the US Dollar this morning to 133.22 per dollar.

Even before the BoJ’s overnight announcement, markets had already got the week off to a rough start yesterday, with the bond selloff showing no sign of letting up whilst the S&P 500 (-0.90%) lost ground for a fourth day running. The moves were very similar to last week’s in many respects, with investors continuing to grapple with the prospect that central banks will keep hiking rates into 2023, not least after the hawkish tone from their recent meetings. That theme is only going to be bolstered by the BoJ’s move, which came as a big surprise to markets that were already reeling from the ECB and Fed’s hawkishness last week.

Whilst many investors are still expecting we could get a dovish pivot later in 2023, markets aren’t banking on that for now, with sovereign bonds seeing fresh losses on both sides of the Atlantic yesterday. In terms of the daily moves, yields did come off their highs by the end of the session in Europe, but those on 10yr bunds (+5.1bps), OATs (+4.4bps) and BTPs (+8.5bps) were still noticeably higher by the close. We also saw another round of milestones at the front-end of the curve as well, since yields on 2yr German and French debt both hit their highest levels since 2008. That followed further hawkish rhetoric from ECB speakers over the last 24 hours, with a nod to rate hikes continuing at a 50bps pace. For instance, Vice President de Guindos said that they had “to take additional measures to increase interest rates at a speed similar to that of this last 50 basis-point increase”. In the meantime, Lithuania’s Simkus said he had “no doubt” there’d be another 50bp move in February, and Slovakia’s Kazimir said that “we need to increase the base interest rate significantly higher than today.”

Whilst the continued bond selloff very much echoed last week, one key difference yesterday was that Eurozone bonds were no longer underperforming their international counterparts. For instance, yields on 10yr Treasuries saw a much larger increase on the day of +10.2bps to 3.585%, before their latest moves to 3.666% overnight. Higher real yields led that move yesterday, with the 10yr real yield up +7.2bps to 1.42%, followed by a further move to 1.45% this morning meaning that it’s now risen by over +40bps since its recent closing low earlier this month. And over in the UK, yields saw an even larger increase yesterday, with 10yr gilt yields up +17.3bps on the day to 3.50%. Those moves came as investors moved to price in a slightly more hawkish path for central bank policy rates, with pricing for the Fed’s rate by end-2023 up +5.5bps on the day to 4.413%.

This backdrop of growing concern about the rates outlook proved further bad news for equities, and the S&P 500 (-0.90%) fell to its lowest level in nearly 6 weeks. That’s its 4th consecutive decline, and means that in less than a week since the S&P briefly surged after the downside CPI surprise, the index has now lost -6.91% since its intraday peak. In terms of the drivers, tech stocks were a major contributor, with the NASDAQ (-1.49%) and the FANG+ index (-2.02%) seeing sizeable declines, although the Dow Jones didn’t fare so badly with a -0.49% decline. Europe was also a relative outperformer, with the STOXX 600 seeing a modest +0.27% gain after its -3.28% decline last week.

Elsewhere yesterday, we heard that EU member states had reached a deal to cap gas prices at €180 per megawatt-hour. It’ll apply for a year starting February 15, and follows lengthy negotiations on where the cap should be, with an earlier proposal from the Commission suggesting a €275/MWh level. The cap will also only apply if the difference with global liquefied natural gas prices is bigger than €35/MWh. Against this backdrop, European natural gas futures were down -5.98% yesterday to €109 per megawatt-hour.

On the data side yesterday, we got further evidence that the European economy was outperforming expectations this winter, with the Ifo’s business climate indicator from Germany rising to 88.6 (vs. 87.5 expected), marking its highest level in 4 months. However in the US, the NAHB’s latest housing market index showed that the housing market was continuing to struggle, with a decline in December to 31 (vs. 34 expected). With the exception of April 2020, that’s the index’s lowest reading in over a decade, and means that it’s fallen in every single month over 2022.

Finally, the US Congress are focusing on concluding their 2023 fiscal year omnibus budget package, ahead of the government funding deadline at the end of the week. Senate Minority Leader McConnell said that he expects to review the full text soon and signalled that there would be ample GOP support, indicating there would not be a period of protracted debate with the White House. The provisions are expected to total close to $1.7tr, and include funding for border security, state aid for natural disasters, a realigning of pandemic-era programs, and aid to Ukraine amongst a host of other initiatives and programs. Notably, it does not appear that there will be an increase to the debt ceiling in this agreement, so that’s another event that looks as though it could get some attention in 2023, particularly given the Republicans will control the House of Representatives next year.

To the day ahead now, and data releases include German PPI for November, US housing starts and building permits for November, and the European Commission’s advance December reading on consumer confidence for the Euro Area. Central bank speakers include the ECB’s Kazimir and Muller. Finally, earnings releases include Nike.

After last week’s CPI and FOMC decision, it was supposed to be smooth sailing into the illiquid, year-end waters as trading desks closed down for the year, and where among those few traders left some expected a Santa rally while others kept pressing their shorts. The BOJ – which was badly been lagging all of its central bank peers in tightening financial conditions – however had other plans, and on Tuesday morning Japan’s central bank shocked the world when it announced it would widen the Yield Control Curve band on the 10Y Treasury from 0.25% to 0.50% on either side, a move which had been viewed as a “when not if” – as markets knew the BoJ would eventually have to realign the “kinked” 10Y point with the rest of JGB curve and fundamentals…

… and begin a gradual policy alignment with rest of world’s already robust tightening, as they had instead continued to ease throughout ‘22 – but this was not seen as today’s business and virtually everyone expected this move to come after the Kuroda term ended in April ‘23, with most expecting a “phase-in” executed in smaller increments over time. So the news that the yield on Japan’s 10Y would be allowed to double from 0.25% to 0.50% came as a shock and sparked cross-asset contagion across the world, sending futures tumbling and bond yields soaring at least initially and briefly halted Japans’ treasury futures.

“Tighter BoJ policy would remove one of the last global anchors that’s helped to keep borrowing costs at low levels more broadly,” Deutsche Bank analysts told clients, noting the BOJ move had come as markets were “already reeling” from the ECB and Fed’s hawkishness last week.

BOJ governor Haruhiko Kuroda later reiterated at a press briefing that the widening of the yield band was aimed at improving market functioning and smoothing out a distorted yield curve. Still, the abrupt decision risks eroding confidence in the central bank’s messaging after the governor and other board members had repeatedly said a widening of the range would be tantamount to raising interest rates.

As attention turned away from the surge in yields -to the plunge in the dollar, US stock-index futures managed to recover most of their earlier losses, and as of 730am ET, contracts on the S&P 500 were flat while Nasdaq 100 futures slightly underperformed, falling 0.2% as the yield on 10-year Treasuries extended gains.

Contracts on the S&P 500 had slumped as much as 1.1% earlier after the BOJ’s move triggered concerns among investors already worried about the growing chorus of hawkish central banks: “There are some investors that are doing cross assets, and so if the yen moves — if the foreign exchange moves a lot — they automatically readjust” their equity futures positions, said Michael Makdad, an analyst at Morningstar Inc. in Tokyo.

But the move in stocks was actually relatively modest: the move in JGBs was more powerful, as the yield on 10Y bonds surged to the highest level since 2015…

… and dragged US TSYs along with it amid fears Japanese would be less willing to buy US paper (spoiler alert: the opposite will happen as local pensions start factoring in capital losses amid future YCC expansions) while the biggest fireworks took place in the world of FX, however, where the dollar tumbled as the yen rose: at one point the USDJPY plunged all the way down to 132.0 a 500+ pip move from where the pair was pre-BOJ, and the second biggest move in the past year, lagging only behind the shock US CPI miss repricing in November.

Among US premarket moves, Lucid Group advanced after the company said it has completed its stock sale program and successfully raised about $1.5 billion. Here are some of the biggest US movers today:

- Verona Pharma (VRNA US) shares surge as much as 162% in US premarket trading after the drug developer achieved positive results in the Phase 3 ENHANCE-1 trial evaluating nebulized ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease.

- Cryptocurrency-exposed stocks rise as Bitcoin rebounds after falling to the lowest level this month as worries over the path of central bank policy damped moves across risky assets. Riot Blockchain (RIOT US) advances 1.6%, Marathon Digital (MARA US) +0.8%, Silvergate (SI US) +1.9%

- MKS Instruments (MKSI US) stock rises 1.1% on low volumes after it was upgraded to overweight from sector weight at KeyBanc, with the broker saying the company’s strong competitive position should drive growth in semiconductor and advanced packaging.

- Heico (HEI US) shares could be in focus as the aerospace parts manufacturer reported earnings per share for the fourth quarter that matched the average analyst estimate, but did not provide guidance for 2023.

- Keep an eye on Conagra Brands (CAG US) stock as Morgan Stanley upgraded it to overweight, expecting the packaged-food sector to maintain its relative outperformance through 2023 and also raising J M Smucker (SJM US) to equal-weight.

- Beam Therapeutics (BEAM US) is upgraded to outperform from market perform at BMO, which said that the risk/reward on the stock now seems skewed to the upside.

- The insurance lead generation sector is JPMorgan’s favorite across small and mid-cap internet stocks for 2023, with analysts upgrading MediaAlpha (MAX US) to overweight from neutral, and EverQuote (EVER US) to overweight from underweight, while downgrading some advertising-exposed stocks.

Even before the BOJ, US stocks dropped for a fourth session on Monday as traders recoiled at the growing possibility that the Fed will push the US economy into a painful recession after central bank officials vowed to keep raising rates until they’re confident inflation is coming down meaningfully. The S&P 500 closed at its lowest level in more than a month, dragged by declines in big-tech firms including Apple, Microsoft and Amazon.com. As Bloomberg points out, US tech stocks are facing a big technical trial this week, with the Nasdaq 100 Index testing a long-term uptrend in place since 2008, based on a logarithmic scale and weekly data.

“The Fed now knows that the forward-looking indicators are starting to move in their favor,” Hugh Gimber, global market strategist at JPMorgan Asset Management, told Bloomberg Television. “They just want to see that coming through in hard data now and hence they want another few months just to get a clearer sense of the picture, but the direction of travel is much more positive.” Gimber expects a half-point hike when the Federal Open Market Committee meets in February, followed by a raise of 25 basis points in March.

European stocks also erased earlier losses, with the Stoxx 600 trading down -0.20% after tumbling more than 1% earlier. European real estate stocks underperformed; the Stoxx 600 Real Estate subindex drops 3.6% at 9:36 a.m. CET. Biggest laggards include Aroundtown -9.1%, Wihlborgs -4.5%, Balder -4.4%, LEG Immobilien -4.2%, Vonovia -4%, SBB -3.8%. Other notable European movers include:

- Elior shares rise as much as 8.8% after the French caterer said it would buy Derichebourg Multiservices division by issuing new stock. The analysts noted that the equity-financed deal would add scale, boost margins and accelerate the company’s deleveraging.

- Hugo Boss shares rise as much as 6% after Deutsche Bank analyst Michael Kuhn raised the recommendation to buy from hold.

- Engie shares slumped as much as 6.9% after the French utility said it may take a hit of up to €5.7 billion ($6.1 billion) through next year from windfall taxes on soaring power sales and Belgium’s requirements for nuclear plant dismantling.

- Credit Suisse shares decline as much as 3.9% as both Citi and RBC say the troubled lender needs to give greater visibility on its planned strategic overhaul for the stock to recover.

- Petrofac shares drop as much as 10% to fresh record low as the energy infrastructure supplier predicts a full-year Ebit loss.

- European real estate stocks underperformed on Tuesday after a hawkish move from the Bank of Japan, which adjusted its yield curve control program. Aroundtown is the sector’s biggest decliner, falling as much as 11%, after being downgraded to hold from buy at Berenberg.

- Rheinmetall shares fall as much as 5.5% in Frankfurt, extending Monday’s losses, after German Defense Minister Christine Lambrecht set a deadline for the industry to fix defective infantry vehicles.

- Kinepolis shares drop as much as 6.6%, the most in more than a month, after Berenberg lowers its price target and adopts a “more cautious” stance over its FY23/24 estimates.

Earlier in the session, Asian stocks fell as Japanese shares tumbled following a surprise policy tweak by the central bank, while China’s Covid disruptions also hurt sentiment. The MSCI Asia Pacific Index dropped as much as 1.1% before mostly trimming losses. The Nikkei 225 Index slumped 2.5% as the Bank of Japan raised the upper band limit of its yield curve control program, giving the yen a boost. Financial shares in the nation surged while tech and auto stocks slumped in Tokyo. “Usually the weak yen is good for the stock market earnings, and now if you have a stronger yen, it’s going to be a concern for the companies that were doing so well, mainly the exporters and maybe tourism,” said Peter Tasker, co-founder and strategist at Arcus Investment

“The whole Asian region is dragged down by BOJ’s new policy, which is triggering the short covering of yen,” said Steven Leung, executive director at UOB Kay Hian (Hong Kong) Ltd. “Those who borrow yen and invest in other securities” need to unwind positions, he added. Stocks in China and Hong Kong fell for the second day as the reopening rally continued to cool. China reported a pickup in Covid deaths, with analysts expecting the actual toll to be much worse than the official tally. Despite the dismantling of heavy Covid restrictions, activity in key cities has slowed as infections spike, diminishing the economic boost from a reopening. Investors are contending with slowdown risks in the region in 2023, with China’s path to reopening facing headwinds and doubts about the Fed’s ability to tackle inflation without pushing the US economy into a recession

In FX, the Bloomberg Dollar Spot Index was set a second day of losses as the greenback weakened against all of its Group-of-10 peers apart from the Australian and New Zealand dollars.

- The yen rose by as much as 3.7%, to a four-month high of 132.06 per dollar, while the benchmark 10-year yield surged to 0.444%, the highest since 2015. The BOJ said it will now allow Japan’s 10-year bond yields to rise to around 0.5%, up from the previous limit of 0.25%; details here

- Cross sales into yen hit the Aussie and kiwi with the latter already weakened after data showed business confidence in the nation slumped to a record low. Both Australia’s and New Zealand’s bonds also fell

- The yuan flipped to a gain as the dollar weakened following the Bank of Japan’s hawkish shift. China’s loan prime rates were kept on hold, as expected.

In rates, Treasuries, bunds and gilts yields are off highs reached after BOJ’s yield pivot, though still up about 8 basis points each at the 10-year mark. Treasury futures off worst levels of the day, recouping a portion of losses into early US session after an aggressive cheapening move sparked by Bank of Japan widens the trading band on 10-year bond yields. Into peak selloff 10-year yields topped through 3.70% and onto cheapest levels since Nov. 30, before settling around 3.65% into the US session; the 2s10s spread remains wider by 5bp on the day after reaching steepest since Nov. 16. On outright basis Treasury yields remain cheaper by 1bp to 8.5bp across the curve in a bear steepening move, following wider selloff across JGBs where 10- year yields closed at 0.399% and 2s10s curve steepened 13bp on the day

In commodities, WTI trades within Monday’s range, adding 1.1% to near $75.98. Most base metals trade in the green. Spot gold rises roughly $19 to trade near $1,806/oz.

In crypto, Bitcoin is firmer to the tune of 1.0%, though once again remains within relatively narrow ranges.

To the day ahead now, and data releases include German PPI for November, US housing starts and building permits for November, and the European Commission’s advance December reading on consumer confidence for the Euro Area. Central bank speakers include the ECB’s Kazimir and Muller. Finally, earnings releases include Nike.

Market Snapshot

- S&P 500 futures little changed at 3,842.50

- STOXX Europe 600 down 0.4% to 424.16

- MXAP little changed at 155.50

- MXAPJ down 1.0% to 502.25

- Nikkei down 2.5% to 26,568.03

- Topix down 1.5% to 1,905.59

- Hang Seng Index down 1.3% to 19,094.80

- Shanghai Composite down 1.1% to 3,073.77

- Sensex down 0.2% to 61,653.10

- Australia S&P/ASX 200 down 1.5% to 7,024.27

- Kospi down 0.8% to 2,333.29

- German 10Y yield little changed at 2.27%

- Euro up 0.2% to $1.0632

- Brent Futures up 0.6% to $80.29/bbl

- Gold spot up 0.9% to $1,804.50

- U.S. Dollar Index down 0.73% to 103.96

Top Overnight News from Bloomberg

- The BOJ’s surprise policy shift is sending shock waves through global markets that may just be getting started, as the developed world’s last holdout for rock-bottom interest rates inches toward policy normalization

- The BOJ’s latest policy shock is cementing the central bank’s reputation for using the element of surprise to achieve its strategic goals

- At least three funds stand to benefit from Japan’s policy move: UBS Asset Management, Schroders Plc and BlueBay Asset Management

- ECB Governing Council member Francois Villeroy de Galhau said the euro-zone economy is unlikely to experience a deep slump as interest rates are lifted to tackle soaring inflation

- The ECB remains “a long way” from achieving its goal of inflation of 2% over the medium term, according to Governing Council Member and Bundesbank President Joachim Nagel

- South African President Cyril Ramaphosa emerged from a ruling party electoral conference with a stronger mandate, yet still has to overcome a series of political hurdles to tackle a daunting economic to-do list

- Hong Kong will further ease social distancing measures, including rules on banquets, ahead of a trip by the city’s leader to Beijing

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded lower across the board with the broader risk profile hit by the BoJ’s unexpected tweak to its Yield Curve Control. Nikkei 225 fell over 2.5% as it reacted to the BoJ’s move, with the index briefly dipping under 26,500, although bank stocks soared. ASX 200 was dragged lower by its Tech and IT sectors whilst Banks and Utilities were the better performers. Hang Seng and Shanghai Comp conformed to the downbeat tone across the equity market, with the former seeing its housing stocks slip after the PBoC opted to maintain its 5yr LPR unchanged vs some expectations for a cut.

Top Asian News

- RBA Minutes (Dec): Board considered several options for the cash rate decision at the December meeting: a 50bps increase; a 25bps increase; or no change in the cash; members also noted the importance of acting consistently. The Board did not rule out returning to larger increases if the situation warranted. Click here for the detailed headline

- PBoC maintained the 1yr and 5yr Loan Prime Rates (LPRs) at 3.65% and 4.30% respectively, as expected, according to Bloomberg.

- BoK Governor said the board believes it is premature to cut rates. BoK said consumer inflation is to gradually slow after hovering around 5% for some time; uncertainty is high over how swiftly consumer inflation will slow, according to Reuters. BoK Governor said the risk of USD/KRW rate surging at an unusual pace has decreased.

- China reports five COVID-related deaths in the mainland on Dec 19 vs two a day earlier, according to Reuters.

- Hong Kong Chief Executive Lee said Hong Kong will further ease social distancing measures, according to Bloomberg; subsequently, Hong Kong Health Authorities are to drop the rapid antigen COVID test requirement to enter bars/nightclubs from Thursday, no capacity limit on such venues.

- Japan is reportedly mulling issuing JPY 500bln of green transformation economic transition bonds (GX bonds) in FY23, according to Japanese press Yomiuri.

- Japanese government reportedly looking to issue around JPY 35.5tln of new JGBs for FY23/24, according to Reuters sources.

- PBoC injected CNY 5bln via 7-day reverse repos with the rate maintained at 2.00%; injects CNY 141bln via 14-day reverse repos with the rate maintained at 2.15%; daily net injection CNY 144bln.

European bourses are under modest pressure, Euro Stoxx 50 -0.3%, as the complex lifts off post-BoJ lows in limited newsflow. US futures are moving in tandem with the above, ES -0.1%, ahead of a handful of stateside data prints. JPMorgan lowers its Apple (AAPL) iPhone volume forecasts for the December quarter to around 70mln (prev. forecast ~74mln).

Top European News

- ECB’s Kazimir Says Stable Pace of Tightening Should Continue

- Spain Court Foils Sánchez Bid to Name Judges in Power Clash

- Engie Drops as Taxes, Nuclear Rules Take Multibillion Euro Bite

- Swedish Property Stocks End Brutal 2022 With Tough Reset Ahead

- Germany Cuts Russian Share in Gas Use by More Than Half in 2022

FX

- JPY is the standout outperformer after the BoJ widened the 10yr yield band, sending USD/JPY to a test of 132.00 vs 137.00+ initial levels.

- Amidst this, the DXY has been pushed below 104.00 to the modest benefit of G10 peers across the board.

- Though, the read across from the USD’s downside to peers is being hampered somewhat by the pronounced action in JPY-crosses.

- Elsewhere, antipodeans are the incremental laggards following the ANZ survey and post-RBA minutes, which has a dovish tilt.

- PBoC sets USD/CNY mid-point at 6.9861 vs exp. 6.9862 (prev. 6.9746)

Fixed Income

- Benchmarks have bounced from BoJ induced worst levels with modest assistance from German PPI and UK supply.

- However, core debt is lower by around 100 ticks for Bunds and Gilts, with the German 10yr approaching 2.3% at best.

- Stateside, USTs are directionally in-fitting though magnitudes are slightly more contained ahead of the US session, yields bid across the curve and bear-steepening.

Geopolitics

- North Korea said Japan’s counterattack capabilities are effectively pre-emptive strike capabilities; said Japan’s new security strategy is bringing security crisis in the region. North Korea said it has the right to take “decisive” military measures to protect its rights in response to the changing security environment, via KCNA.

BOJ

STATEMENT

- BoJ unexpectedly tweaked its Yield Curve Control (YCC) in which it widened the 10yr yield band to +/-0.5% (prev. +/-0.25%) and unexpectedly announced it is to increase bond purchases to JPY 9tln/m (prev. JPY 7.3tln/m) in Q1. The BoJ kept its rate unchanged at -0.10% and maintained 10yr JGB yield target of around 0% as expected. The decision on the YCC was unanimous. The adjustment is intended to “improve market functioning and encourage a smoother formation of the entire yield curve while maintaining accommodative financial conditions,” the central bank said. BoJ said it is to make nimble responses for each maturity by increasing the amount of purchases even more and conducting fixed-rate purchases operations when deemed necessary. BoJ maintained its rate guidance. Click here for the detailed headline

GOVERNOR KURODA

YCC:

- Market functionality was decreasing. Domestic market has been hit by volatility abroad. Decision was made today as deteriorating market functions could threaten corporate financing.

- Decision is not an exit of YCC or a change in policy, appropriate to continue easing policy.

- There is no need to further expanding the allowance band, not likely that the market calls for another increase of the yield cap maximum limit.

Broader Policy:

- It is too early to debate the exit to current monetary policy; today’s decision is not a rate hike.

- Won’t hesitate to ease monetary policy further if necessary.

- No intention to hike rates or tighten policy. Not thinking about revising the 2013 gov’t-BoJ joint statement.

OTHER

- BoJ announced an unscheduled bond operation: BoJ offered to buy JPY 100bln in up to 1-3yr JGBs, JPY 100bln in 3-5yr JGBs, JPY 300bln in 5-10yr JGBs and JPY 100bln in 10-25yr, according to Reuters. BoJ to conduct unlimited bond buying in the 1-5yr tenors, according to Bloomberg.

- Japanese Finance Minister Suzuki said it is not true that the government and the BoJ have decided on a policy to revise its joint statement, according to Reuters.

- Japanese Economy, Trade, and Industry Ministry Nishimura said it is important to continue carrying out economic revitalisation based on the joint statement with the BoJ, according to Reuters.

- Japan Securities Clearing Corporation has issued an emergency margin call re. JGB futures.

Commodities

- Crude benchmarks slipping in tandem with broader sentiment initially and in the hours since have pared this pressure and are now posting upside just shy of USD 1.0/bbl.

- Currently, Dutch TTF Jan’23 remains under modest pressure, but is yet to slip below the EUR 100/MWh mark.

- Germany’s BDEW (energy industry association) says it is concerned about the EU gas price cap, it needs monitoring and adjusting if results in too little gas reaching Europe.

- The yellow metal is a handful of ounces above the USD 1800/oz handle while base metals are firmer in action that is for the most part in-fitting with the above risk tone/dynamics.

US Event Calendar

- 08:30: Nov. Building Permits MoM, est. -2.1%, prior -2.4%, revised -3.3%

- 08:30: Nov. Building Permits, est. 1.48m, prior 1.53m, revised 1.51m

- 08:30: Nov. Housing Starts MoM, est. -1.8%, prior -4.2%

- 08:30: Nov. Housing Starts, est. 1.4m, prior 1.43m

DB’s Jim Reid concludes the overnight wrap

We go to press this morning amidst big moves in global markets overnight, since the Bank of Japan have decided to adjust their yield-curve-control policy, which is widely seen as the beginning of a potential end to their ultra-loose monetary policy. That policy has made them a big outlier compared to other central banks this year, having maintained rates at the zero lower bound whilst others embarked on their biggest tightening cycle in a generation. Indeed, it’s important not to underestimate the impact this could have, because tighter BoJ policy would remove one of the last global anchors that’s helped to keep borrowing costs at low levels more broadly.

In terms of the policy shift, the BoJ announced in a surprise move that Japan’s 10yr yield would now be able to rise to around 0.5%, having been limited to 0.25% previously. In turn, that led to a massive slump in Japanese equities, with the Nikkei down by -2.88% this morning, and those moves lower have been echoed more broadly. Indeed, not only are other indices in Asia pointing lower, including the CSI 300 (-1.64%), the Shanghai Comp (-1.03%), the Hang Seng (-2.19%) and the Kospi (-1.10%), but futures on the S&P 500 are currently down -1.07%, even after a run of 4 consecutive declines for the index already. The one big exception to this pattern of equity losses were bank stocks, with those in the Nikkei surging +4.96% this morning given the potential move away from ultra-low borrowing costs.

Unsurprisingly, Japanese government bond yields have surged on the back of the announcement, with the 10yr yield up +15.5bps this morning to 0.41% after trading around 0.25% for months. But the impact hasn’t been confined there either, with Australian 10yr yields up +19.5bps this morning, and those on US 10yr Treasuries up +8.1bps to 3.666%. In the meantime, the yen has strengthened massively, gaining +2.75% against the US Dollar this morning to 133.22 per dollar.

Even before the BoJ’s overnight announcement, markets had already got the week off to a rough start yesterday, with the bond selloff showing no sign of letting up whilst the S&P 500 (-0.90%) lost ground for a fourth day running. The moves were very similar to last week’s in many respects, with investors continuing to grapple with the prospect that central banks will keep hiking rates into 2023, not least after the hawkish tone from their recent meetings. That theme is only going to be bolstered by the BoJ’s move, which came as a big surprise to markets that were already reeling from the ECB and Fed’s hawkishness last week.

Whilst many investors are still expecting we could get a dovish pivot later in 2023, markets aren’t banking on that for now, with sovereign bonds seeing fresh losses on both sides of the Atlantic yesterday. In terms of the daily moves, yields did come off their highs by the end of the session in Europe, but those on 10yr bunds (+5.1bps), OATs (+4.4bps) and BTPs (+8.5bps) were still noticeably higher by the close. We also saw another round of milestones at the front-end of the curve as well, since yields on 2yr German and French debt both hit their highest levels since 2008. That followed further hawkish rhetoric from ECB speakers over the last 24 hours, with a nod to rate hikes continuing at a 50bps pace. For instance, Vice President de Guindos said that they had “to take additional measures to increase interest rates at a speed similar to that of this last 50 basis-point increase”. In the meantime, Lithuania’s Simkus said he had “no doubt” there’d be another 50bp move in February, and Slovakia’s Kazimir said that “we need to increase the base interest rate significantly higher than today.”

Whilst the continued bond selloff very much echoed last week, one key difference yesterday was that Eurozone bonds were no longer underperforming their international counterparts. For instance, yields on 10yr Treasuries saw a much larger increase on the day of +10.2bps to 3.585%, before their latest moves to 3.666% overnight. Higher real yields led that move yesterday, with the 10yr real yield up +7.2bps to 1.42%, followed by a further move to 1.45% this morning meaning that it’s now risen by over +40bps since its recent closing low earlier this month. And over in the UK, yields saw an even larger increase yesterday, with 10yr gilt yields up +17.3bps on the day to 3.50%. Those moves came as investors moved to price in a slightly more hawkish path for central bank policy rates, with pricing for the Fed’s rate by end-2023 up +5.5bps on the day to 4.413%.

This backdrop of growing concern about the rates outlook proved further bad news for equities, and the S&P 500 (-0.90%) fell to its lowest level in nearly 6 weeks. That’s its 4th consecutive decline, and means that in less than a week since the S&P briefly surged after the downside CPI surprise, the index has now lost -6.91% since its intraday peak. In terms of the drivers, tech stocks were a major contributor, with the NASDAQ (-1.49%) and the FANG+ index (-2.02%) seeing sizeable declines, although the Dow Jones didn’t fare so badly with a -0.49% decline. Europe was also a relative outperformer, with the STOXX 600 seeing a modest +0.27% gain after its -3.28% decline last week.

Elsewhere yesterday, we heard that EU member states had reached a deal to cap gas prices at €180 per megawatt-hour. It’ll apply for a year starting February 15, and follows lengthy negotiations on where the cap should be, with an earlier proposal from the Commission suggesting a €275/MWh level. The cap will also only apply if the difference with global liquefied natural gas prices is bigger than €35/MWh. Against this backdrop, European natural gas futures were down -5.98% yesterday to €109 per megawatt-hour.

On the data side yesterday, we got further evidence that the European economy was outperforming expectations this winter, with the Ifo’s business climate indicator from Germany rising to 88.6 (vs. 87.5 expected), marking its highest level in 4 months. However in the US, the NAHB’s latest housing market index showed that the housing market was continuing to struggle, with a decline in December to 31 (vs. 34 expected). With the exception of April 2020, that’s the index’s lowest reading in over a decade, and means that it’s fallen in every single month over 2022.

Finally, the US Congress are focusing on concluding their 2023 fiscal year omnibus budget package, ahead of the government funding deadline at the end of the week. Senate Minority Leader McConnell said that he expects to review the full text soon and signalled that there would be ample GOP support, indicating there would not be a period of protracted debate with the White House. The provisions are expected to total close to $1.7tr, and include funding for border security, state aid for natural disasters, a realigning of pandemic-era programs, and aid to Ukraine amongst a host of other initiatives and programs. Notably, it does not appear that there will be an increase to the debt ceiling in this agreement, so that’s another event that looks as though it could get some attention in 2023, particularly given the Republicans will control the House of Representatives next year.

To the day ahead now, and data releases include German PPI for November, US housing starts and building permits for November, and the European Commission’s advance December reading on consumer confidence for the Euro Area. Central bank speakers include the ECB’s Kazimir and Muller. Finally, earnings releases include Nike.

Loading…