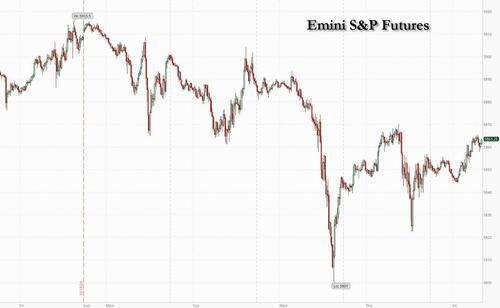

US equity futures are higher for the second day in a row, trimming their weekly drop to less than 1.0%, and led by small caps as investors looked past a jump in borrowing costs that cooled market sentiment earlier in the week. As of 8:00am ET, S&P futures are up 0.3% with Nasdaq futures up 0.2%. Megacap tech are mostly mixed: META +1.0% and AMZN +0.7%, while TSLA -1.7% after its second biggest one day gain in history following blowout earnings, and AAPL is down 1% after China Q3 smartphone sales decline. Treasury yields drop for a second day, down 1-2bps, and leaving the rate on the 10-year note up about one tenth of a percentage point in the week at 4.18%; the USD is flat. Commodities are mixed with oil higher, base metals mixed, and precious metals lower. Today, the macro focus will be Durable/Cap Goods Orders, as well as the final revision to Mich. Sentiment.

In premarket trading, Capri crashed 46%, the most ever, after a federal judge blocked a planned takeover by Tapestry due to handbag-market competition concerns. New York Community Bancorp fell 6% after reporting a provision for credit losses for the 3Q that missed the average analyst estimate. Western Digital gains 11% after the computer hardware firm posted 1Q profit that beat, with some analysts noting that the NAND flash memory segment is holding up better than feared. Here are some other notable premarket movers:

- Boston Beer (SAM) falls 4% on light trading after the company cut its profit forecast for the full year.

- Centene (CNC) gains 11% after the health insurer boosted its revenue guidance for the full year.

- Coursera (COUR) plummets 20% after the online-education company cut its year revenue guidance. Management plans to cut about 10% of the company’s global workforce.

- Deckers Outdoor (DECK) jumps 14% after the maker of Hoka running shoes and UGG boots boosted its sales forecast for the full year.

- Denny’s (DENN) rises 5% as Citi turned bullish on the company, citing greater cost discipline and accelerated store closures.

- Newell Brands (NWL) climbs 11% after management increased its year forecast.

- Olin Corp. (OLN) slips 8% after the company posted a 3Q loss as Hurricane Beryl hurt results worse than the company initially anticipated.

- Skechers U.S.A. (SKX) climbs 7.5% after the footwear company reported third-quarter sales and profit that topped Wall Street expectations and boosted its projections for the full year.

Traders’ attention is turning to US economic data next week, including a monthly payrolls report, for fresh clues on the scope for Federal Reserve interest-rate cuts. With the Nov. 5 presidential vote approaching, some analysts are predicting a stock market boost should Donald Trump win, while others warn it may reignite inflation and slow the pace of Fed easing.

“The markets at least are sniffing out a Republican sweep, and perhaps an electoral/Senate landslide,” Stephen Auth, chief investment officer for equities at Federated Hermes, wrote in a note. “Should this occur, and we think it very well might, we’d expect the modest rally we’ve experienced since July to pick up steam. A Trump win would likely favor the old economy financial, industrial, energy and small cap stocks.”

BofA strategist Michael Hartnett highlighted other pre-election trades. Investors are continuing to load up on gold as a hedge against inflation and populism, while other popular themes — like selling bonds and buying artificial intelligence stocks, are holding up. More in a follow up article later. Gold hit a record high on Wednesday and gold funds recorded their biggest weekly inflow since July 2020, according to the BofA strategists. The yield on US 10-year government bonds briefly breached 4.2% this week, the highest level since July, while shares of US chip company Nvidia Corp. touched an all-time high.

Meanwhile, Europe’s Stoxx 600 index retreated on Friday after lackluster results from companies including French Cognac maker Remy Cointreau SA and Mercedes-Benz Group AG. Gains in banks and energy shares offset losses in travel and personal care. The regional stocks measure is headed for a more than 1% drop in the week. Here are the biggest European movers:

- Sanofi shares climb as much as 2.9%, best performer in the Stoxx 600 Health Care Index, after the drugmaker reported better-than-expected sales and earnings for the third quarter.

- NatWest shares rise as much as 4.7% on Friday, their biggest intraday gain in three months, after earnings beat estimates and the British lender raised its outlook for the year.

- Schibsted shares soar as much as 9.4% to the highest since May as the Norwegian classifieds company reported quarterly profits that blew past analyst estimates.

- Holcim shares rise as much as 2% as the Swiss cement giant posts another quarter of margin expansion while sales slightly missed in North America.

- Eni shares gain as much as 1.4% after the Italian oil company posts “decent” 3Q results, according to RBC, which adds that the share buyback is marginally ahead of market expectations.

- Yara shares jump as much as 7.6%, the most since February, after the Norwegian agricultural chemicals firm’s third-quarter results showed what analysts called a strong Ebitda beat.

- Remy Cointreau shares drop as much as 3.7% to a nine-year low after the French cognac maker cut its guidance amid weak demand in the US and China.

- Mercedes shares fall as much as 3.9%, the most in just more than a month, after the German carmaker reported what RBC called “severely depressed” third-quarter results due to China weakness.

- Electrolux shares slide as much as 15% after the Swedish home appliances firm reported a disappointing set of 3Q numbers, driven by underperformance in North America.

- Valeo shares drop as much as 13%, the most since Feb. 2022, after trimming its revenue forecast for 2024 to reflect challenges across the auto industry, and withdrawing guidance for 2025.

- Hexatronic shares fall as much as 17% after the Swedish fiber-optics firm missed expectations on most earnings metrics, including a 13% shortfall on net income.

- Better Collective shares slump as much as 37%, the most on record, after the digital sports media marketing company reported what Nordea says is its first ever profit warning.

“It’s been volatile,” said Vidya Anant, senior portfolio manager and head of sustainable equity funds Europe at DWS Asset Management. “We’re seeing a little bit of a risk-off behaviour, nobody’s willing to take the move into equities at this point especially just before the elections.”

Earlier in the session, a key gauge of Asian equities was little changed, set to cap a fourth-straight week of losses, as selling in Japan was countered by gains in China and Taiwan. The MSCI Asia Pacific Index swung in a narrow range, heading for a weekly loss of 2.4%. Japanese stocks were the biggest drags on the Asian gauge, slumping amid speculation the nation’s ruling coalition may lose its majority in the election this weekend. Stocks rose in mainland China and Hong Kong in early trading, as traders look for further stimulus to help restart a recently stalled market rally. Benchmarks also advanced in Taiwan and South Korea.A lack of details or a smaller-than-expected fiscal package could slow the positive momentum in Chinese stocks, May Yan, an analyst at UBS Global Asset Management, told Bloomberg Television. But “as we get more details on the policy side, the rally can continue into next year,” she said. Asian stocks more broadly have tailed off this month as well on concerns over Beijing’s measures will be enough to rescue the property sector and boost consumer spending. China’s central bank kept its one-year policy rate unchanged, after slashing funding costs by the most on record a month ago, suggesting authorities are cautiously pacing monetary stimulus to support the economy.

In FX, the Bloomberg Dollar Spot Index steadied, while Treasury yields ticked 1-2bp lower across the curve. The New Zealand dollar and Swedish krona led Group-of-10 losses against the greenback, while the Canadian dollar and British pound led gains. EUR/USD steadied at 1.0825, after data showed Germany’s business outlook improved in October. The yen was stuck in a range against the dollar, trading unchanged around 151.90 ahead of the weekend election that may see Japan’s ruling coalition lose its majority in the lower house of parliament for the first time since 2009. Such an outcome would weaken the yen and Japanese stocks, according to strategists.

Treasuries are marginally richer with gains led by the front-end, re-steepening curve spreads following Thursday’s sharp flattening move. US front-end yields are richer by 1bp-2bp with curve spreads slightly steeper. 10-year is 2bps lower on the day near 4.19% and 3bp richer vs bunds in the sector. German government bonds fall on a combination of better-than-expected data and slightly hawkish ECB speak. The expectations gauge of the German IFO survey rose to the highest since June while the business climate and current assessment readings topped even the highest estimates. Soon after, ECB’s Simkus said he couldn’t justify a 50-bp interest-rate cut at present. Shorter-dated bonds have bore the brunt of the selling with German two-year yields rising 3 bps to 2.10%.

In commodities, oil resumed its advance after a two-day drop, with traders keeping their focus on geopolitical developments in the Middle East and the supply outlook.WTI rose 0.5% to $70.50. Spot gold falls $17 to around $2,719/oz.

Today's US economic data calendar includes September preliminary durable goods orders (8:30am), October final University of Michigan sentiment (10am) and October Kansas City Fed services activity (11am). Fed speaker slate includes Collins at 11am

Market Snapshot

- S&P 500 futures up 0.1% to 5,857.75

- STOXX Europe 600 down 0.1% to 518.26

- MXAP down 0.2% to 186.43

- MXAPJ little changed at 599.02

- Nikkei down 0.6% to 37,913.92

- Topix down 0.7% to 2,618.32

- Hang Seng Index up 0.5% to 20,590.15

- Shanghai Composite up 0.6% to 3,299.70

- Sensex down 1.0% to 79,240.57

- Australia S&P/ASX 200 little changed at 8,211.29

- Kospi little changed at 2,583.27

- German 10Y yield up 1 bp at 2.28%

- Euro little changed at $1.0829

- Brent Futures little changed at $74.36/bbl

- Gold spot down 0.5% to $2,721.23

- US Dollar Index little changed at 104.04

Top Overnight News

- Japan’s Tokyo CPI for Oct came in at +1.8% headline (inline w/the Street and down from +2.1%, sliding below the 2% BOJ target for the first time in 5 months) but core ran a bit hot at +1.8% (up from +1.6% in Sept and ahead of the Street’s +1.6% forecast). RTRS

- Apple's iPhone sales in China slipped 0.3% while rival Huawei (HWT.UL) posted a 42% surge in the third quarter of 2024, as competition intensifies in the world's largest smartphone market. RTRS

- China’s top legislature will meet Nov 4-8 and investors expect additional fiscal stimulus developments at this event. SCMP

- Eurozone inflation expectations tumble to +2.4% over 12 months (down from +2.7%) and +2.1% over 36 months (down from +2.3%). Eurozone M3 money supply for Sept came in at +3.2% Y/Y (vs. the Street +2.9% and up from +2.9% in Aug). BBG

- Mercedes shares slide in European trading after the company reported weak Q3 results (sales -7% and adjusted EBIT -48%) w/mgmt. calling out challenging market conditions and “fierce competition” (especially in China). RTRS

- Elon Musk, the world’s richest man and a linchpin of U.S. space efforts, has been in regular contact with Russian President Vladimir Putin since late 2022. The discussions, confirmed by several current and former U.S., European and Russian officials, touch on personal topics, business and geopolitical tensions. WSJ

- The U.S. Justice Department's Antitrust Division and the Transportation Department said on Thursday they are launching a broad public inquiry into the state of competition in air travel. RTRS

- Kamala Harris and Donald J. Trump are locked in a dead heat for the popular vote, 48 percent to 48 percent, the final national poll by The New York Times and Siena College has found, as Ms. Harris struggles for an edge over Mr. Trump with an electorate that seems impossibly and immovably divided. NYT

- The White House said it was encouraging Boeing and the union representing about 33,000 striking machinists to continue working to reach a deal, a day after workers rejected the planemaker's latest contract offer. President Biden "directed his team … to encourage parties to continue working to achieve an agreement that works, certainly for all parties," White House press secretary Karine Jean-Pierre told reporters. "We're going to continue to monitor those negotiations and continue to make sure that we encourage that." RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following a similar handover from Wall St albeit with upside capped in a somewhat cautious session amid ongoing geopolitical concerns and heading into next month's key events. ASX 200 marginally gained and was led by notable strength in tech after WiseTech's CEO and founder stepped down due to a secret affairs and payments scandal, although the upside in the index was limited by weakness in consumer stocks. Nikkei 225 underperformed following recent yen strength and amid uncertainty ahead of Sunday's election. Hang Seng and Shanghai Comp rebounded from yesterday's selling with the help of strength in tech and automakers, while the PBoC conducted an MLF operation and kept the 1-year MLF rate unchanged at 2.00%, as expected.

Top Asian News

- China's NPC standing committee meeting to start from Nov 4th running until Nov 8th

- PBoC conducted a CNY 700bln (CNY 789bln maturing) 1-year MLF operation with the rate kept at 2.00%.

European bourses, Stoxx 600 (-0.2%) began the session very modestly in negative territory, but have clambered off worst levels in recent trade and now generally reside near session highs. European sectors hold a strong negative bias, with only a handful of sectors managing to hold afloat; Banks is lifted by post-earning strength in NatWest (+4.7%). Travel & Leisure is at the foot of the pile, hampered by losses in Accor. Autos are not quiet underperforming, but remain subdued after Mercedes-Benz (-2.6%) cut guidance. US Equity Futures (ES +0.2%, NQ +0.3%, RTY +0.5%) are entirely, albeit modestly so, in the green; continuing the upside seen in the prior session.

Top European News

- UK PM Starmer said Britons who receive additional income from stock holdings don’t count as ‘working people,’ which suggests he is willing to raise taxes on investors, according to Bloomberg.

- The EU Commission says the EU and China have agreed to further technical negotiations on EVs

- ECB's Kazaks says "I don't see case for rates to fall below neutral: it would require a weaker baseline substantial undershooting of target".

- ECB's Simkus doesn't see case for 50bps cut, says "the destination for rates is more important". "We are on a disinflationary path". "Need to reduce still-restrictive rates". "Economy quite sluggish but not doing that badly".

- ECB's Vujcic says he is open on the December rate decision, via Bloomberg.

FX

- USD is net flat vs. peers. Fresh macro drivers for the US have been on the lighter side this week with yesterday's PMI and IJC metrics doing little to sway Fed pricing. Attention going forward is on next week's NFP and upcoming US Presidential election.

- EUR is steady vs. the USD and relatively resilient given soft PMI data yesterday, ECB speak which has increased the odds of a 50bps December rate and looming US election risk in the event of a Trump victory. EUR/USD currently sitting around 1.0825.

- GBP is flat vs. the USD at the end of what was a week that was expected to see BoE speak help guide expectations over future easing. However, interjections by MPC officials have proved relatively non-incremental. Cable is currently trading towards the top end of last Friday's 1.2908-87.

- JPY is steady vs. the USD in the run-up to two crucial Japanese risk events; Japan's general election on Sunday and then the BoJ. USD/JPY is currently holding below the 152 mark but above its 200DMA at 151.41.

- Antipodeans are both softer vs. the USD as attempted recoveries vs. the USD continue to falter amid looming US election risk. AUD/USD is currently lingering around its 200DMA at 0.6628. NZD/USD has continued its drift lower and slipped onto a 0.59 handle.

- Barclays month-end rebalancing model: weak USD buying against most majors, neutral against EUR and weak USD selling against JPY.

Fixed Income

- USTs are flat with specifics light so far and while USTs have been dragged to a 111-06 low by EGBs they are yet to convincingly slip into the red. Docket ahead has durables in addition to potential remarks from Fed’s Collins.

- Bunds are in the red, initial action was somewhat contained with a slight positive bias following JGBs after Tokyo CPI. However, another set of relatively strong German metrics placed pressure on EGBs, sending Bunds to a 133.14 trough in the 20-minutes after the data, where they currently reside.

- Gilts opened lower by just two ticks, specifics have been light since yesterday’s Reeves-induced downside. Gilts have followed EGBs lower though only by a few ticks. To a 96.18 base which remains some way clear of Thursday’s 95.68 trough.

- Italy sells EUR 2.5bln vs exp. EUR 2-2.5bln 2026 BTP Short term and EUR 2.5bln vs. exp. EUR 2-2.5bln 1.80% 2036 and 0.40% 2030 I/L BTP

Commodities

- WTI and Brent are contained, having attempted to recoup some of the prior day's losses but ultimately failing to materially break out of overnight ranges. Brent'Dec currently sits at around USD 74.70/bbl.

- Precious metals are under modest pressure, though XAU remains comfortably above the USD 2700/oz mark.

- Base metals are pressured, in-fitting with the European risk tone this morning and soft performance in auto names which is weighing on the demand-side for the complex.

Geopolitics: Middle East

- Iran's Supreme Leader Khamenei ordered plans to respond to a possible Israeli attack but stressed that Iran will not act if the Israeli attack is limited, according to The New York Times. Iranian officials said Khamenei ordered the military to devise multiple military plans for responding to an Israeli attack in which the scope of any Iranian retaliation will largely depend on the severity of Israel’s attacks with Iran to retaliate if Israeli strikes inflict widespread damage and high casualties, but if Israel limits its attack to a few military bases and warehouses storing missiles and drones, Iran may do nothing. Furthermore, Khamenei directed that a response would be certain if Israel strikes oil and energy infrastructure or nuclear facilities, or if it assassinates senior officials.. "The officials, including two members of the Islamic Revolutionary Guard Corps, said that if Israel inflicted major harm, the responses under consideration included a barrage of up to 1,000 ballistic missiles; escalated attacks by Iranian proxy militant groups in the region; and disrupting the flow of global energy supplies and shipping moving through the Persian Gulf and the Strait of Hormuz."

- Israel conducted raids on the area of Choueifat Amrousiya, Haret Hreik and the Hadath area in the southern suburbs of Beirut, according to Sky News Arabia. Israel also conducted a raid on the Masnaa border crossing between Lebanon and Syria, as well as on the residence of press teams in the southern town of Hasbaya, Lebanon.

- Israel said its spy chief will attend Gaza ceasefire talks, while Hamas vows to stop fighting if a truce is reached, as long-stalled efforts to end the war appeared to gain momentum, according to Arab News via X.

- Egyptian media reported that an Egyptian security and military delegation met with the head of the Mossad and a delegation from the Shin Bet. It was separately reported that a Hamas delegation went to Cairo to listen to proposed ceasefire deal ideas but there is no change in the group's position, according to a Hamas senior official.

- Secretary General of the Gulf Cooperation Council said their recent meetings with Iran focused on the future of relations and ensuring calm, while their main goal is to end military operations in the Gaza Strip and Lebanon.

Geopolitics: Other

- Russian President Putin said the cross-border payments issue is important and will develop cooperation within BRICS, while he added that BRICS does not pursue a separate common payment system and if the US is open to normal relations with Russia, they will do the same. Putin earlier said they will discuss peaceful settlements of conflict in the Middle East and that Ukraine is being used to create strategic threats to Russia.

- Elon Musk has reportedly been in regular contact with Russian President Putin since late 2022 and at one point, Putin asked him to avoid activating his Starlink internet service over Taiwan as a favour to Chinese President Xi, according to WSJ.

US Event Calendar

- 08:30: Sept. Durable Goods Orders, est. -1.0%, prior 0%

- Sept. -Less Transportation, est. -0.1%, prior 0.5%

- Sept. Cap Goods Ship Nondef Ex Air, est. 0%, prior -0.1%

- Sept. Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0.3%

- 10:00: Oct. U. of Mich. Sentiment, est. 69.1, prior 68.9

- U. of Mich. Current Conditions, prior 62.7

- U. of Mich. Expectations, prior 72.9

- U. of Mich. 1 Yr Inflation, est. 2.9%, prior 2.9%

- Oct. U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

- 11:00: Oct. Kansas City Fed Services Activ, prior -2

DB's Jim Reid concludes the overnight wrap

Risk assets began to stabilise over the last 24 hours, with the S&P 500 up +0.21% after 3 consecutive declines. Multiple factors helped to lift sentiment, including some decent earnings reports, upside US data surprises, as well as mounting speculation about faster rate cuts. But even with the modest gain, investors are still very cautious as we approach a pivotal couple of weeks, which will include a raft of earnings reports, the US jobs report next Friday, and then the US election in just 11 days’ time. So there’s been a reluctance to push the rally much further before we get some clarity on those, all of which will play a crucial role in shaping the outlook as we move into next year.

Several stories were driving markets yesterday, but one of the biggest moves was a significant bond rally across the Euro Area. That followed some weak data in the latest flash PMIs for October, which showed that business activity was still subdued at the start of Q4. The Euro Area composite PMI was little changed at 49.7 (vs. 49.6 previous), so still beneath the 50 mark that separates expansion from contraction. And the details leant on the dovish side with Euro Area composite output prices down to their lowest since early 2021, while Germany’s composite employment PMI fell further into contractionary territory at 45.8 (vs 46.3 prev.).

All that meant investors continued to speculate that the ECB might speed up their rate cuts, not least as both the Fed and the Bank of Canada have now done so. Indeed, a larger 50bp cut at the ECB’s next meeting in December was priced in as a 42% probability by last night’s close. Moreover, comments from several officials seemed to leave that open as an option, with Latvia’s Kazaks saying that “everything should be on the table”. From the dovish side of the Governing Council, Portugal’s Centeno said that “we need to consider the possibility of moving in bigger steps”, while from the hawkish side the Austria’s Holzmann said that a 50bp cut is “unlikely though not impossible”. In turn, that led yields to fall across all maturities, including those on 10yr bunds (-3.8bps), OATs (-4.3bps) and BTPs (-4.7bps).

In the meantime, investors have remained closely focused on the US election, which is continuing to influence markets. There weren’t a great deal of new political headlines over the last 24 hours, but the polls in the battleground states have remained very tight and within the margin of error. For instance, an Emerson poll of several swing states yesterday had Trump very marginally ahead, including a 1pt lead in Pennsylvania and Wisconsin, and a 2pt lead in North Carolina. But given the margin of error is just over three points for those polls, this remains a very tight race, as reflected in various prediction markets and forecast models. For instance, the RealClearPolitics average of betting markets gives Trump a 59.5% chance of victory this morning, whilst FiveThirtyEight’s model sees Trump as a 51% chance to win.

Ahead of that, US Treasuries rallied yesterday alongside their European counterparts, which unwound a notable move higher for yields over recent sessions. In fact by the close, the 10yr yield was down -3.4bps on the day to 4.21%, and overnight they’ve seen a further -2.4bps decline to 4.19%. Lower yields also received support from the latest decline in oil prices, with Brent crude down –0.59% on the day to $74.52/bbl.

Here in the UK however, gilts underperformed yesterday, with the 10yr yield up +3.6bps on the day to 4.24%. It also meant that the UK-German 10yr yield spread widened to 197bps, which is the widest it’s been since August 2023. The moves come ahead of the new government’s first Budget next week, with Chancellor Rachel Reeves confirming yesterday that the government would change the way it measures debt, in order to fund extra investment.

For equities, it was a fairly subdued day on both sides of the Atlantic, but the major indices did manage to post modest gains for the most part. That included the S&P 500 (+0.21%), which came back from a run of three consecutive declines, with Tesla (+21.92%) seeing the biggest gain in the entire index following its earnings results after the previous day’s close. This marked Tesla’s largest daily rise since 2013, back when the company was worth only around 2% of its current $836bn market cap. So the move left the Magnificent 7 group up +3.26%, closing at its highest level since mid-July, and less than -4% beneath its all-time closing high. Nevertheless, some areas posted a weaker performance, with around half of the S&P 500’s constituents lower on the day as materials (-1.42%) and industrials (-0.71%) sectors led on the downside. Meanwhile in Europe, the main indices only just managed to eke out some gains, with the STOXX 600 up +0.03%.

One factor supporting US equities was upbeat economic data, which continued a run of positive data surprises out of the US. For instance, the weekly initial jobless claims fell back to 227k (vs. 242k expected) over the week ending October 19, moving back down to their levels before the recent hurricanes impacted the figures. In addition, the flash PMIs from the US were also decent, with the services PMI at 55.3 (vs. 55.0 expected), while the manufacturing PMI was also on the upside of expectations at 47.8 (vs. 47.5 expected). Also supporting a soft landing narrative, the composite PMI output price series fell to its lowest since 2020. Finally, the new home sales data for September came in at an annualised rate of 738k (vs. 720k expected), the highest in over a year.

Overnight in Asia, there’s been a divergent performance across the region this morning. In Japan, the Nikkei is down -0.98%, which comes ahead of the country’s general election on Sunday. Moreover, the Tokyo CPI data for October overnight was marginally stronger than expected, with core-core CPI picking up to +1.8% (vs. +1.6% expected). But elsewhere there’ve been stronger gains, and the Hang Seng (+1.13%), CSI 300 (+1.06%), Shanghai Comp (+0.82%) and the KOSPI (+0.33%) have all risen this morning. Otherwise, US equity futures are struggling to gain traction, with those on the S&P 500 (-0.04%) and the NASDAQ 100 (-0.03%) both pointing very slightly lower.

To the day ahead now, and data releases from the US include preliminary durable goods orders for September, along with the University of Michigan’s final consumer sentiment index for October. Elsewhere, we’ll get the ECB’s Consumer Expectations Survey for September, and in Germany there’s also the Ifo’s business climate indicator for October. Central bank speakers include the Fed’s Collins and the ECB’s Villeroy.

US equity futures are higher for the second day in a row, trimming their weekly drop to less than 1.0%, and led by small caps as investors looked past a jump in borrowing costs that cooled market sentiment earlier in the week. As of 8:00am ET, S&P futures are up 0.3% with Nasdaq futures up 0.2%. Megacap tech are mostly mixed: META +1.0% and AMZN +0.7%, while TSLA -1.7% after its second biggest one day gain in history following blowout earnings, and AAPL is down 1% after China Q3 smartphone sales decline. Treasury yields drop for a second day, down 1-2bps, and leaving the rate on the 10-year note up about one tenth of a percentage point in the week at 4.18%; the USD is flat. Commodities are mixed with oil higher, base metals mixed, and precious metals lower. Today, the macro focus will be Durable/Cap Goods Orders, as well as the final revision to Mich. Sentiment.

In premarket trading, Capri crashed 46%, the most ever, after a federal judge blocked a planned takeover by Tapestry due to handbag-market competition concerns. New York Community Bancorp fell 6% after reporting a provision for credit losses for the 3Q that missed the average analyst estimate. Western Digital gains 11% after the computer hardware firm posted 1Q profit that beat, with some analysts noting that the NAND flash memory segment is holding up better than feared. Here are some other notable premarket movers:

- Boston Beer (SAM) falls 4% on light trading after the company cut its profit forecast for the full year.

- Centene (CNC) gains 11% after the health insurer boosted its revenue guidance for the full year.

- Coursera (COUR) plummets 20% after the online-education company cut its year revenue guidance. Management plans to cut about 10% of the company’s global workforce.

- Deckers Outdoor (DECK) jumps 14% after the maker of Hoka running shoes and UGG boots boosted its sales forecast for the full year.

- Denny’s (DENN) rises 5% as Citi turned bullish on the company, citing greater cost discipline and accelerated store closures.

- Newell Brands (NWL) climbs 11% after management increased its year forecast.

- Olin Corp. (OLN) slips 8% after the company posted a 3Q loss as Hurricane Beryl hurt results worse than the company initially anticipated.

- Skechers U.S.A. (SKX) climbs 7.5% after the footwear company reported third-quarter sales and profit that topped Wall Street expectations and boosted its projections for the full year.

Traders’ attention is turning to US economic data next week, including a monthly payrolls report, for fresh clues on the scope for Federal Reserve interest-rate cuts. With the Nov. 5 presidential vote approaching, some analysts are predicting a stock market boost should Donald Trump win, while others warn it may reignite inflation and slow the pace of Fed easing.

“The markets at least are sniffing out a Republican sweep, and perhaps an electoral/Senate landslide,” Stephen Auth, chief investment officer for equities at Federated Hermes, wrote in a note. “Should this occur, and we think it very well might, we’d expect the modest rally we’ve experienced since July to pick up steam. A Trump win would likely favor the old economy financial, industrial, energy and small cap stocks.”

BofA strategist Michael Hartnett highlighted other pre-election trades. Investors are continuing to load up on gold as a hedge against inflation and populism, while other popular themes — like selling bonds and buying artificial intelligence stocks, are holding up. More in a follow up article later. Gold hit a record high on Wednesday and gold funds recorded their biggest weekly inflow since July 2020, according to the BofA strategists. The yield on US 10-year government bonds briefly breached 4.2% this week, the highest level since July, while shares of US chip company Nvidia Corp. touched an all-time high.

Meanwhile, Europe’s Stoxx 600 index retreated on Friday after lackluster results from companies including French Cognac maker Remy Cointreau SA and Mercedes-Benz Group AG. Gains in banks and energy shares offset losses in travel and personal care. The regional stocks measure is headed for a more than 1% drop in the week. Here are the biggest European movers:

- Sanofi shares climb as much as 2.9%, best performer in the Stoxx 600 Health Care Index, after the drugmaker reported better-than-expected sales and earnings for the third quarter.

- NatWest shares rise as much as 4.7% on Friday, their biggest intraday gain in three months, after earnings beat estimates and the British lender raised its outlook for the year.

- Schibsted shares soar as much as 9.4% to the highest since May as the Norwegian classifieds company reported quarterly profits that blew past analyst estimates.

- Holcim shares rise as much as 2% as the Swiss cement giant posts another quarter of margin expansion while sales slightly missed in North America.

- Eni shares gain as much as 1.4% after the Italian oil company posts “decent” 3Q results, according to RBC, which adds that the share buyback is marginally ahead of market expectations.

- Yara shares jump as much as 7.6%, the most since February, after the Norwegian agricultural chemicals firm’s third-quarter results showed what analysts called a strong Ebitda beat.

- Remy Cointreau shares drop as much as 3.7% to a nine-year low after the French cognac maker cut its guidance amid weak demand in the US and China.

- Mercedes shares fall as much as 3.9%, the most in just more than a month, after the German carmaker reported what RBC called “severely depressed” third-quarter results due to China weakness.

- Electrolux shares slide as much as 15% after the Swedish home appliances firm reported a disappointing set of 3Q numbers, driven by underperformance in North America.

- Valeo shares drop as much as 13%, the most since Feb. 2022, after trimming its revenue forecast for 2024 to reflect challenges across the auto industry, and withdrawing guidance for 2025.

- Hexatronic shares fall as much as 17% after the Swedish fiber-optics firm missed expectations on most earnings metrics, including a 13% shortfall on net income.

- Better Collective shares slump as much as 37%, the most on record, after the digital sports media marketing company reported what Nordea says is its first ever profit warning.

“It’s been volatile,” said Vidya Anant, senior portfolio manager and head of sustainable equity funds Europe at DWS Asset Management. “We’re seeing a little bit of a risk-off behaviour, nobody’s willing to take the move into equities at this point especially just before the elections.”

Earlier in the session, a key gauge of Asian equities was little changed, set to cap a fourth-straight week of losses, as selling in Japan was countered by gains in China and Taiwan. The MSCI Asia Pacific Index swung in a narrow range, heading for a weekly loss of 2.4%. Japanese stocks were the biggest drags on the Asian gauge, slumping amid speculation the nation’s ruling coalition may lose its majority in the election this weekend. Stocks rose in mainland China and Hong Kong in early trading, as traders look for further stimulus to help restart a recently stalled market rally. Benchmarks also advanced in Taiwan and South Korea.A lack of details or a smaller-than-expected fiscal package could slow the positive momentum in Chinese stocks, May Yan, an analyst at UBS Global Asset Management, told Bloomberg Television. But “as we get more details on the policy side, the rally can continue into next year,” she said. Asian stocks more broadly have tailed off this month as well on concerns over Beijing’s measures will be enough to rescue the property sector and boost consumer spending. China’s central bank kept its one-year policy rate unchanged, after slashing funding costs by the most on record a month ago, suggesting authorities are cautiously pacing monetary stimulus to support the economy.

In FX, the Bloomberg Dollar Spot Index steadied, while Treasury yields ticked 1-2bp lower across the curve. The New Zealand dollar and Swedish krona led Group-of-10 losses against the greenback, while the Canadian dollar and British pound led gains. EUR/USD steadied at 1.0825, after data showed Germany’s business outlook improved in October. The yen was stuck in a range against the dollar, trading unchanged around 151.90 ahead of the weekend election that may see Japan’s ruling coalition lose its majority in the lower house of parliament for the first time since 2009. Such an outcome would weaken the yen and Japanese stocks, according to strategists.

Treasuries are marginally richer with gains led by the front-end, re-steepening curve spreads following Thursday’s sharp flattening move. US front-end yields are richer by 1bp-2bp with curve spreads slightly steeper. 10-year is 2bps lower on the day near 4.19% and 3bp richer vs bunds in the sector. German government bonds fall on a combination of better-than-expected data and slightly hawkish ECB speak. The expectations gauge of the German IFO survey rose to the highest since June while the business climate and current assessment readings topped even the highest estimates. Soon after, ECB’s Simkus said he couldn’t justify a 50-bp interest-rate cut at present. Shorter-dated bonds have bore the brunt of the selling with German two-year yields rising 3 bps to 2.10%.

In commodities, oil resumed its advance after a two-day drop, with traders keeping their focus on geopolitical developments in the Middle East and the supply outlook.WTI rose 0.5% to $70.50. Spot gold falls $17 to around $2,719/oz.

Today’s US economic data calendar includes September preliminary durable goods orders (8:30am), October final University of Michigan sentiment (10am) and October Kansas City Fed services activity (11am). Fed speaker slate includes Collins at 11am

Market Snapshot

- S&P 500 futures up 0.1% to 5,857.75

- STOXX Europe 600 down 0.1% to 518.26

- MXAP down 0.2% to 186.43

- MXAPJ little changed at 599.02

- Nikkei down 0.6% to 37,913.92

- Topix down 0.7% to 2,618.32

- Hang Seng Index up 0.5% to 20,590.15

- Shanghai Composite up 0.6% to 3,299.70

- Sensex down 1.0% to 79,240.57

- Australia S&P/ASX 200 little changed at 8,211.29

- Kospi little changed at 2,583.27

- German 10Y yield up 1 bp at 2.28%

- Euro little changed at $1.0829

- Brent Futures little changed at $74.36/bbl

- Gold spot down 0.5% to $2,721.23

- US Dollar Index little changed at 104.04

Top Overnight News

- Japan’s Tokyo CPI for Oct came in at +1.8% headline (inline w/the Street and down from +2.1%, sliding below the 2% BOJ target for the first time in 5 months) but core ran a bit hot at +1.8% (up from +1.6% in Sept and ahead of the Street’s +1.6% forecast). RTRS

- Apple’s iPhone sales in China slipped 0.3% while rival Huawei (HWT.UL) posted a 42% surge in the third quarter of 2024, as competition intensifies in the world’s largest smartphone market. RTRS

- China’s top legislature will meet Nov 4-8 and investors expect additional fiscal stimulus developments at this event. SCMP

- Eurozone inflation expectations tumble to +2.4% over 12 months (down from +2.7%) and +2.1% over 36 months (down from +2.3%). Eurozone M3 money supply for Sept came in at +3.2% Y/Y (vs. the Street +2.9% and up from +2.9% in Aug). BBG

- Mercedes shares slide in European trading after the company reported weak Q3 results (sales -7% and adjusted EBIT -48%) w/mgmt. calling out challenging market conditions and “fierce competition” (especially in China). RTRS

- Elon Musk, the world’s richest man and a linchpin of U.S. space efforts, has been in regular contact with Russian President Vladimir Putin since late 2022. The discussions, confirmed by several current and former U.S., European and Russian officials, touch on personal topics, business and geopolitical tensions. WSJ

- The U.S. Justice Department’s Antitrust Division and the Transportation Department said on Thursday they are launching a broad public inquiry into the state of competition in air travel. RTRS

- Kamala Harris and Donald J. Trump are locked in a dead heat for the popular vote, 48 percent to 48 percent, the final national poll by The New York Times and Siena College has found, as Ms. Harris struggles for an edge over Mr. Trump with an electorate that seems impossibly and immovably divided. NYT

- The White House said it was encouraging Boeing and the union representing about 33,000 striking machinists to continue working to reach a deal, a day after workers rejected the planemaker’s latest contract offer. President Biden “directed his team … to encourage parties to continue working to achieve an agreement that works, certainly for all parties,” White House press secretary Karine Jean-Pierre told reporters. “We’re going to continue to monitor those negotiations and continue to make sure that we encourage that.” RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following a similar handover from Wall St albeit with upside capped in a somewhat cautious session amid ongoing geopolitical concerns and heading into next month’s key events. ASX 200 marginally gained and was led by notable strength in tech after WiseTech’s CEO and founder stepped down due to a secret affairs and payments scandal, although the upside in the index was limited by weakness in consumer stocks. Nikkei 225 underperformed following recent yen strength and amid uncertainty ahead of Sunday’s election. Hang Seng and Shanghai Comp rebounded from yesterday’s selling with the help of strength in tech and automakers, while the PBoC conducted an MLF operation and kept the 1-year MLF rate unchanged at 2.00%, as expected.

Top Asian News

- China’s NPC standing committee meeting to start from Nov 4th running until Nov 8th

- PBoC conducted a CNY 700bln (CNY 789bln maturing) 1-year MLF operation with the rate kept at 2.00%.

European bourses, Stoxx 600 (-0.2%) began the session very modestly in negative territory, but have clambered off worst levels in recent trade and now generally reside near session highs. European sectors hold a strong negative bias, with only a handful of sectors managing to hold afloat; Banks is lifted by post-earning strength in NatWest (+4.7%). Travel & Leisure is at the foot of the pile, hampered by losses in Accor. Autos are not quiet underperforming, but remain subdued after Mercedes-Benz (-2.6%) cut guidance. US Equity Futures (ES +0.2%, NQ +0.3%, RTY +0.5%) are entirely, albeit modestly so, in the green; continuing the upside seen in the prior session.

Top European News

- UK PM Starmer said Britons who receive additional income from stock holdings don’t count as ‘working people,’ which suggests he is willing to raise taxes on investors, according to Bloomberg.

- The EU Commission says the EU and China have agreed to further technical negotiations on EVs

- ECB’s Kazaks says “I don’t see case for rates to fall below neutral: it would require a weaker baseline substantial undershooting of target”.

- ECB’s Simkus doesn’t see case for 50bps cut, says “the destination for rates is more important”. “We are on a disinflationary path”. “Need to reduce still-restrictive rates”. “Economy quite sluggish but not doing that badly”.

- ECB’s Vujcic says he is open on the December rate decision, via Bloomberg.

FX

- USD is net flat vs. peers. Fresh macro drivers for the US have been on the lighter side this week with yesterday’s PMI and IJC metrics doing little to sway Fed pricing. Attention going forward is on next week’s NFP and upcoming US Presidential election.

- EUR is steady vs. the USD and relatively resilient given soft PMI data yesterday, ECB speak which has increased the odds of a 50bps December rate and looming US election risk in the event of a Trump victory. EUR/USD currently sitting around 1.0825.

- GBP is flat vs. the USD at the end of what was a week that was expected to see BoE speak help guide expectations over future easing. However, interjections by MPC officials have proved relatively non-incremental. Cable is currently trading towards the top end of last Friday’s 1.2908-87.

- JPY is steady vs. the USD in the run-up to two crucial Japanese risk events; Japan’s general election on Sunday and then the BoJ. USD/JPY is currently holding below the 152 mark but above its 200DMA at 151.41.

- Antipodeans are both softer vs. the USD as attempted recoveries vs. the USD continue to falter amid looming US election risk. AUD/USD is currently lingering around its 200DMA at 0.6628. NZD/USD has continued its drift lower and slipped onto a 0.59 handle.

- Barclays month-end rebalancing model: weak USD buying against most majors, neutral against EUR and weak USD selling against JPY.

Fixed Income

- USTs are flat with specifics light so far and while USTs have been dragged to a 111-06 low by EGBs they are yet to convincingly slip into the red. Docket ahead has durables in addition to potential remarks from Fed’s Collins.

- Bunds are in the red, initial action was somewhat contained with a slight positive bias following JGBs after Tokyo CPI. However, another set of relatively strong German metrics placed pressure on EGBs, sending Bunds to a 133.14 trough in the 20-minutes after the data, where they currently reside.

- Gilts opened lower by just two ticks, specifics have been light since yesterday’s Reeves-induced downside. Gilts have followed EGBs lower though only by a few ticks. To a 96.18 base which remains some way clear of Thursday’s 95.68 trough.

- Italy sells EUR 2.5bln vs exp. EUR 2-2.5bln 2026 BTP Short term and EUR 2.5bln vs. exp. EUR 2-2.5bln 1.80% 2036 and 0.40% 2030 I/L BTP

Commodities

- WTI and Brent are contained, having attempted to recoup some of the prior day’s losses but ultimately failing to materially break out of overnight ranges. Brent’Dec currently sits at around USD 74.70/bbl.

- Precious metals are under modest pressure, though XAU remains comfortably above the USD 2700/oz mark.

- Base metals are pressured, in-fitting with the European risk tone this morning and soft performance in auto names which is weighing on the demand-side for the complex.

Geopolitics: Middle East

- Iran’s Supreme Leader Khamenei ordered plans to respond to a possible Israeli attack but stressed that Iran will not act if the Israeli attack is limited, according to The New York Times. Iranian officials said Khamenei ordered the military to devise multiple military plans for responding to an Israeli attack in which the scope of any Iranian retaliation will largely depend on the severity of Israel’s attacks with Iran to retaliate if Israeli strikes inflict widespread damage and high casualties, but if Israel limits its attack to a few military bases and warehouses storing missiles and drones, Iran may do nothing. Furthermore, Khamenei directed that a response would be certain if Israel strikes oil and energy infrastructure or nuclear facilities, or if it assassinates senior officials.. “The officials, including two members of the Islamic Revolutionary Guard Corps, said that if Israel inflicted major harm, the responses under consideration included a barrage of up to 1,000 ballistic missiles; escalated attacks by Iranian proxy militant groups in the region; and disrupting the flow of global energy supplies and shipping moving through the Persian Gulf and the Strait of Hormuz.”

- Israel conducted raids on the area of Choueifat Amrousiya, Haret Hreik and the Hadath area in the southern suburbs of Beirut, according to Sky News Arabia. Israel also conducted a raid on the Masnaa border crossing between Lebanon and Syria, as well as on the residence of press teams in the southern town of Hasbaya, Lebanon.

- Israel said its spy chief will attend Gaza ceasefire talks, while Hamas vows to stop fighting if a truce is reached, as long-stalled efforts to end the war appeared to gain momentum, according to Arab News via X.

- Egyptian media reported that an Egyptian security and military delegation met with the head of the Mossad and a delegation from the Shin Bet. It was separately reported that a Hamas delegation went to Cairo to listen to proposed ceasefire deal ideas but there is no change in the group’s position, according to a Hamas senior official.

- Secretary General of the Gulf Cooperation Council said their recent meetings with Iran focused on the future of relations and ensuring calm, while their main goal is to end military operations in the Gaza Strip and Lebanon.

Geopolitics: Other

- Russian President Putin said the cross-border payments issue is important and will develop cooperation within BRICS, while he added that BRICS does not pursue a separate common payment system and if the US is open to normal relations with Russia, they will do the same. Putin earlier said they will discuss peaceful settlements of conflict in the Middle East and that Ukraine is being used to create strategic threats to Russia.

- Elon Musk has reportedly been in regular contact with Russian President Putin since late 2022 and at one point, Putin asked him to avoid activating his Starlink internet service over Taiwan as a favour to Chinese President Xi, according to WSJ.

US Event Calendar

- 08:30: Sept. Durable Goods Orders, est. -1.0%, prior 0%

- Sept. -Less Transportation, est. -0.1%, prior 0.5%

- Sept. Cap Goods Ship Nondef Ex Air, est. 0%, prior -0.1%

- Sept. Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0.3%

- 10:00: Oct. U. of Mich. Sentiment, est. 69.1, prior 68.9

- U. of Mich. Current Conditions, prior 62.7

- U. of Mich. Expectations, prior 72.9

- U. of Mich. 1 Yr Inflation, est. 2.9%, prior 2.9%

- Oct. U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

- 11:00: Oct. Kansas City Fed Services Activ, prior -2

DB’s Jim Reid concludes the overnight wrap

Risk assets began to stabilise over the last 24 hours, with the S&P 500 up +0.21% after 3 consecutive declines. Multiple factors helped to lift sentiment, including some decent earnings reports, upside US data surprises, as well as mounting speculation about faster rate cuts. But even with the modest gain, investors are still very cautious as we approach a pivotal couple of weeks, which will include a raft of earnings reports, the US jobs report next Friday, and then the US election in just 11 days’ time. So there’s been a reluctance to push the rally much further before we get some clarity on those, all of which will play a crucial role in shaping the outlook as we move into next year.

Several stories were driving markets yesterday, but one of the biggest moves was a significant bond rally across the Euro Area. That followed some weak data in the latest flash PMIs for October, which showed that business activity was still subdued at the start of Q4. The Euro Area composite PMI was little changed at 49.7 (vs. 49.6 previous), so still beneath the 50 mark that separates expansion from contraction. And the details leant on the dovish side with Euro Area composite output prices down to their lowest since early 2021, while Germany’s composite employment PMI fell further into contractionary territory at 45.8 (vs 46.3 prev.).

All that meant investors continued to speculate that the ECB might speed up their rate cuts, not least as both the Fed and the Bank of Canada have now done so. Indeed, a larger 50bp cut at the ECB’s next meeting in December was priced in as a 42% probability by last night’s close. Moreover, comments from several officials seemed to leave that open as an option, with Latvia’s Kazaks saying that “everything should be on the table”. From the dovish side of the Governing Council, Portugal’s Centeno said that “we need to consider the possibility of moving in bigger steps”, while from the hawkish side the Austria’s Holzmann said that a 50bp cut is “unlikely though not impossible”. In turn, that led yields to fall across all maturities, including those on 10yr bunds (-3.8bps), OATs (-4.3bps) and BTPs (-4.7bps).

In the meantime, investors have remained closely focused on the US election, which is continuing to influence markets. There weren’t a great deal of new political headlines over the last 24 hours, but the polls in the battleground states have remained very tight and within the margin of error. For instance, an Emerson poll of several swing states yesterday had Trump very marginally ahead, including a 1pt lead in Pennsylvania and Wisconsin, and a 2pt lead in North Carolina. But given the margin of error is just over three points for those polls, this remains a very tight race, as reflected in various prediction markets and forecast models. For instance, the RealClearPolitics average of betting markets gives Trump a 59.5% chance of victory this morning, whilst FiveThirtyEight’s model sees Trump as a 51% chance to win.

Ahead of that, US Treasuries rallied yesterday alongside their European counterparts, which unwound a notable move higher for yields over recent sessions. In fact by the close, the 10yr yield was down -3.4bps on the day to 4.21%, and overnight they’ve seen a further -2.4bps decline to 4.19%. Lower yields also received support from the latest decline in oil prices, with Brent crude down –0.59% on the day to $74.52/bbl.

Here in the UK however, gilts underperformed yesterday, with the 10yr yield up +3.6bps on the day to 4.24%. It also meant that the UK-German 10yr yield spread widened to 197bps, which is the widest it’s been since August 2023. The moves come ahead of the new government’s first Budget next week, with Chancellor Rachel Reeves confirming yesterday that the government would change the way it measures debt, in order to fund extra investment.

For equities, it was a fairly subdued day on both sides of the Atlantic, but the major indices did manage to post modest gains for the most part. That included the S&P 500 (+0.21%), which came back from a run of three consecutive declines, with Tesla (+21.92%) seeing the biggest gain in the entire index following its earnings results after the previous day’s close. This marked Tesla’s largest daily rise since 2013, back when the company was worth only around 2% of its current $836bn market cap. So the move left the Magnificent 7 group up +3.26%, closing at its highest level since mid-July, and less than -4% beneath its all-time closing high. Nevertheless, some areas posted a weaker performance, with around half of the S&P 500’s constituents lower on the day as materials (-1.42%) and industrials (-0.71%) sectors led on the downside. Meanwhile in Europe, the main indices only just managed to eke out some gains, with the STOXX 600 up +0.03%.

One factor supporting US equities was upbeat economic data, which continued a run of positive data surprises out of the US. For instance, the weekly initial jobless claims fell back to 227k (vs. 242k expected) over the week ending October 19, moving back down to their levels before the recent hurricanes impacted the figures. In addition, the flash PMIs from the US were also decent, with the services PMI at 55.3 (vs. 55.0 expected), while the manufacturing PMI was also on the upside of expectations at 47.8 (vs. 47.5 expected). Also supporting a soft landing narrative, the composite PMI output price series fell to its lowest since 2020. Finally, the new home sales data for September came in at an annualised rate of 738k (vs. 720k expected), the highest in over a year.

Overnight in Asia, there’s been a divergent performance across the region this morning. In Japan, the Nikkei is down -0.98%, which comes ahead of the country’s general election on Sunday. Moreover, the Tokyo CPI data for October overnight was marginally stronger than expected, with core-core CPI picking up to +1.8% (vs. +1.6% expected). But elsewhere there’ve been stronger gains, and the Hang Seng (+1.13%), CSI 300 (+1.06%), Shanghai Comp (+0.82%) and the KOSPI (+0.33%) have all risen this morning. Otherwise, US equity futures are struggling to gain traction, with those on the S&P 500 (-0.04%) and the NASDAQ 100 (-0.03%) both pointing very slightly lower.

To the day ahead now, and data releases from the US include preliminary durable goods orders for September, along with the University of Michigan’s final consumer sentiment index for October. Elsewhere, we’ll get the ECB’s Consumer Expectations Survey for September, and in Germany there’s also the Ifo’s business climate indicator for October. Central bank speakers include the Fed’s Collins and the ECB’s Villeroy.

Loading…