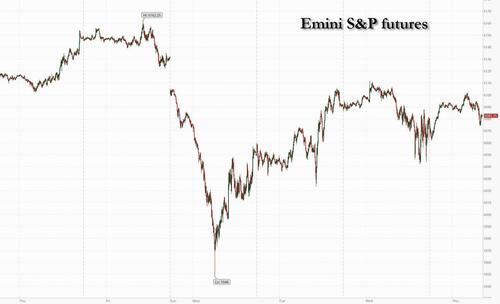

US equity futures and European markets are broadly higher led by Tech/Small-Caps following a dovish Powell press conference (which reversed the hawkish FOMC statement) and solid, if hardly stellar (see MSFT), earnings. As of 8:00am ET, S&P futures are up 0.25%, off session highs; Nasdaq futures rise 0.3% with Mag 7 names mixed (GOOGL +0.7%, AMZN flat, AAPL -0.4%, MSFT -4%, META +1%, NVDA -0.8% and TSLA +2%). European markets are solid in the green ahead of what is widely expected to be the 5th consecutive ECB rate cut later Thursday to revive the sluggish eurozone economy. Bond yields are lower as the curve flattens and USD weakens on the back of continued strength in the JPY which will continue until Japan's exports crater. Commodities are mixed with strength in both base and precious metals while oil has reversed earlier losses. Today’s macro data focus is on jobless claims and Q4 GDP data ahead of tomorrow’s Dec PCE print, after the close we get AAPL earnings.

In premarket trading, IBM gains 8% after fourth-quarter results beat expectations on key metrics, thanks to strong growth in its software business. Microsoft fell 4% after saying said its cloud-computing business will continue to grow slowly in the current quarter as the company struggles to build enough data centers to handle demand for its artificial intelligence products. Meta Platforms (META) rises 1% after the Facebook parent reported fourth-quarter results that beat expectations. CEO Mark Zuckerberg predicted that 2025 will be a “really big year” in AI. AI infrastructure stocks extend their advance, including Broadcom (AVGO) +4%, Marvell Technology (MRVL) +3%. Mag 7 names are mixed (GOOGL +0.7%, AMZN flat, AAPL -0.4%, MSFT -4%, META +1%, NVDA -0.8% and TSLA +2%). American Airlines (AAL) declines 2% after a regional jet flown for the carrier collided with a military helicopter near Ronald Reagan Washington National Airport. Here are some other notable premarket movers:

- Arista Networks (ANET) rises 3% following positive AI-investment commentary from Meta and Microsoft.

- Cargo Therapeutics (CRGX) sinks 74% after the biotech said it decided to stop a Phase 2 clinical study of Firi-cel and slashed its workforce.

- Celestica’s (CLS) US-traded shares climb 12% after the Canadian-based maker of electronics components boosted its 2025 profit and revenue forecast, citing strengthening demand in its connectivity & cloud division.

- Cigna (CI) falls 9% after the health insurer gave adjusted profit and medical cost guidance for the year 2025 that was worse than Wall Street’s estimates.

- Coursera (COUR) rises 2% after the online education company said that Jeff Maggioncalda would retire as CEO and be replaced by Greg Hart, a former Amazon and Compass executive.

- Lam Research (LRCX) advances 5% after the semiconductor equipment company gave a forecast that beat the average analyst estimate.

- Las Vegas Sands (LVS) rises 6% after the casino operator reported net revenue for the fourth quarter that beat the average analyst estimate.

- Levi Strauss (LEVI) drops 7% after the retailer’s forecasts for revenue and profit trailed Wall Street expectations.

- ServiceNow (NOW) falls 9% after the software company forecast full-year subscription revenue that’s weaker than expected.

- Tesla (TSLA) rises 2% after the electric-vehicle maker unveiled plans to start robotaxi operations and forecast a sales recovery this year.

- Tractor Supply (TSCO) declines 5% after the retailer reported comparable sales for the fourth quarter that missed the average analyst estimate.

- United Parcel Service (UPS) slides 10% after the courier tempered expectations for a long-awaited rebound this year in demand for its parcel shipping services, projecting annual revenue well below expectations.

Attention now turns to the world's biggest company Apple (after NVDA lost that spot on Monday) which is expected to post record results when the company delivers quarterly earnings later today. Tech stocks continued to power ahead in premarket trading, with IBM jumping 8% and Meta Platforms Inc. rising on hopes for future artificial intelligence gains. Tesla Inc. climbed as much as 4.1% amid investor optimism about the company’s robotaxi business and AI prospects.

The technological arms race has defined global markets this week, with Chinese startup DeepSeek claiming to have made significant progress on its AI model at a fraction of the price. That put a question mark over the spending and investment plans of Silicon Valley firms in the runup to the earnings announcements, sparking a market slump on Monday. Microsoft shares bucked the upbeat mood, falling 3.9% in early trading, as the firm struggles to build enough data centers to handle AI demand.

Attention also turns to the ECB which is expected to cut rates by a quarter-point later Thursday to revive the sluggish eurozone economy. European government bonds gained after gross domestic product figures came in weaker than expected for Germany and France.

“The divergence trade is alive and well with a widening gap between European and US growth expectations that has translated into a much more dovish outlook for the ECB relative to the Fed,” said Daniel Murray, Zurich-based chief executive officer of EFG Asset Management.

And speaking of Europe, on the continent stocks advanced to another record high; real estate, industrials and tech outpperform while telecoms and banks are the only sectors to fall. The Stoxx 600 rises 0.5% to 536.77 with 457 members up, 141 down and 2 unchanged. Here are some of the biggest movers on Thursday:

- ABB shares gain as much as 3.7% as the Swiss industrial company benefits from demand in its electrification business spurred by spending around data centers.

- Fevertree Drinks shares rise as much as 23%, the steepest gain since July 2017, after the UK tonic and drinks maker announced a strategic partnership with Molson Coors that will see the US firm take an 8.5% stake.

- St James’s Place rises as much as 8.4% as the UK wealth management firm reports net inflows for the full year that beat the average analyst estimate.

- Nokia shares rise as much as 4.6% after the telecom equipment maker reported 4Q sales and profits beating estimates, helped by a strong network infrastructure business and a string of licensing deals.

- STMicro shares fall as much as 9.3% after the chipmaker guided 1Q sales below estimates, while breaking the norm to skip a revenue outlook for the full year.

- Deutsche Bank shares declined as much as 6.3 after the German lender’s fourth-quarter pretax profit missed estimates amid higher costs, with the firm also raising its guidance for expenses as a share of income.

- Wizz Air shares sink as much as 16%, the biggest drop in six months. The budget airline cut its income guidance for the full year due to adverse currency effects in the third quarter, though analysts note that the downgrade was widely expected.

- Swatch shares slump as much as 7.5%, hitting their lowest level in four months, after the Swiss watchmaker’s results fell short of estimates.

- H&M shares drop as much as 5.9% after the clothing retailer reported fourth-quarter sales that missed consensus estimates.

- Electrolux declines as much as 8.4% as the Swedish home appliance manufacturer’s outlook disappoints, with DNB analysts expecting double-digit cuts to 2025 earnings estimates.

- Sage Group shares fall as much as 3.4%, their biggest one-day drop since September, after a trading statement from the accounting software provider reiterated full-year guidance but flagged macroeconomic uncertainty.

Earlier in the session, Asian equities rose slightly, as Australian stocks gained for a second day amid hopes for easier monetary policy. Most major Asian markets including China, South Korea, Taiwan and Hong Kong remained closed for the Lunar New Year. The MSCI Asia Pacific Index rose as much as 0.2%, touching its highest level since Dec. 18, with Hitachi and BHP among top contributors. Positive results from global tech majors including Meta and Tesla provided a lift, as did news that SoftBank Group is in discussions to invest as much as $25 billion in OpenAI. The regional benchmark is poised for its first monthly rise since September, amid hopes for a softer stance on trade tariffs by US President Donald Trump. That’s helped counter the recent hit to Nvidia and others from the surprise news of China’s AI advancement with DeepSeek.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The yen tops the G-10 FX leader board, rising as much as 0.6% against the dollar as fast money traders lined up bets on the currency, according to an Asia-based FX trader.

In rates, the yield on 10-year US Treasuries was down two basis points at 4.50% after the Federal Reserve left interest rates unchanged yesterday, adopting a “wait and see” approach with inflation still above the 2% target. German bonds lead a rally in government debt after data showed the euro area unexpectedly stagnated at the end of last year. German 10-year yields fall 6 bps to 2.52% as traders add to their ECB interest-rate cut bets for the year ahead of the policy decision later Thursday. The euro falls 0.1% to ~1.0410.

US economic data calendar includes 4Q advance GDP and jobless claims (8:30am) and December pending home sales (10am). Fed speaker schedule resumes Friday with Bowman speaking on the economy and banks at 8:30am

Market Snapshot

- S&P 500 futures up 0.4% to 6,093.75

- STOXX Europe 600 up 0.5% to 536.75

- MXAP up 0.2% to 183.87

- MXAPJ little changed at 575.69

- Nikkei up 0.3% to 39,513.97

- Topix up 0.2% to 2,781.93

- Hang Seng Index up 0.1% to 20,225.11

- Shanghai Composite little changed at 3,250.60

- Sensex up 0.2% to 76,679.06

- Australia S&P/ASX 200 up 0.6% to 8,493.70

- Kospi up 0.8% to 2,536.80

- German 10Y yield little changed at 2.53%

- Euro little changed at $1.0411

- Brent Futures down 0.5% to $76.22/bbl

- Gold spot up 0.5% to $2,773.57

- US Dollar Index little changed at 107.93

Top Overnight News

- Ronald Reagan Washington National Airport announced all take-offs and landings were halted and emergency personnel were responding to an aircraft incident. Furthermore, the FAA announced that a PSA Airlines Bombardier regional jet collided in mid-air with a Sikorsky H-60 helicopter as it was approaching the runway at Reagan Washington National Airport, while PSA Airlines was operating Flight 5342 for American Airlines (AAL) which took off from Kansas.

- US President Trump said because the Fed and Chair Powell failed to stop problem they created with inflation, he will do it by unleashing American energy production slashing regulation, rebalancing international trade, and reigniting American manufacturing, while he will make the US financially, and otherwise, powerful again.

- BoC Governor Macklem said the Bank of Canada can ease tariff pain but can’t fix the damage and a big increase in tariffs is a big disruption to the Canadian economy, while he added that if a trade battle comes to pass, it would mean the economy will work less efficiently. Macklem also commented that inflation has come down, inflation is low, and it is thought to stay around the target.

- Softbank is in talks to invest $15 billion to $25 billion in OpenAI, potentially deepening the relationship between the two companies that are already planning a significant artificial-intelligence infrastructure initiative. WSJ

- BOJ Deputy Governor Ryozo Himino signaled there’s more room to hike given that real rates remain in negative territory. BBG

- Japan’s government expects its annual debt-servicing costs to rise by 25% to almost $230 billion over the next four years as the BOJ’s rate hikes drive up financing costs. BBG

- Eurozone officials are considering making an offer to Russia to resume gas purchases as an inducement to end the Ukraine war. FT

- The euro zone unexpectedly stagnated in the fourth quarter, defying estimates for a little growth. Germany’s GDP fell by a bigger-than-expected 0.2% compared with the previous three months. France’s economy unexpectedly contracted 0.1%. BBG

- STMicro (STM ADR -7.8% premkt) stock plunged to the lowest level since 2020 after the chipmaker forecast first-quarter revenue that missed expectations. BBG

- US annualized GDP probably slowed slightly to 2.6% in the fourth quarter. There’s a chance animal spirits may prop up investment and growth this year, Bloomberg Economics said, but it may be choppy given uncertainties. BBG

- Sen. John Fetterman (D-Pa.), who was thought to be open to voting for Robert F. Kennedy Jr.’s nomination to head the Department of Health and Human Services, now says the nominee is in serious trouble after his rocky confirmation hearing. The Hill

- House Democrats launched a multilateral effort Wednesday to combat the flood of executive actions from President Trump, vowing to punch back through legislation, lawsuits and a blitz of counter-messaging. The Hill

- FX options show diverging views about the risks to Canada and Mexico from potential US tariffs. Implied volatility in the loonie has spiked since the US election, while peso traders seem more relaxed. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed amid the ongoing mass closures in the region and after the choppy performance stateside in reaction to the FOMC, while the first earnings results from the magnificent 7 stocks were also varied. ASX 200 climbed to a fresh record high amid broad strength across sectors and further calls for a February RBA rate cut with NAB joining the rest of Australia's big 4 banks in forecasting a cut next month. Nikkei 225 swung between gains and losses amid earnings releases and as the index largely shrugged off a firmer currency.

Top Asian News

- HKMA said interest rates in Hong Kong might still remain at relatively high levels for some time and that the extent and pace of future US interest rate cuts are subject to considerable uncertainty, in response to the Fed keeping rates unchanged.

European bourses (Stoxx 600 +0.5%) are generally modestly firmer across the board, as sentiment improves from a mostly mixed APAC session; the AEX/IBEX 35 are the European outperformers. European sectors hold a strong positive bias; aside from the top performer, the breadth of the market is fairly narrow. Real Estate leads, whilst Telecoms is pressured by BT (-3.5%) post-earnings. For Banking names, BBVA (+3.5%) gains after it beat estimates and announced a near EUR 1bln share buyback. Caixabank (-1%) slips a little lower after lending income came under pressure. Deutsche Bank (-4.5%) sinks after its results (details below).

Top European News

- UK Government is mulling proposals to relax rules on pension protection fund, reducing the levy it collects from pension scheme.

Earnings Recap

- IBM (IBM) +8% pre-market: Q4 earnings and revenue exceeded expectations. Software revenue grew 10%, driven by AI and Red Hat, while consulting revenue fell 2%, and it sees +5% annual growth in FY25

- Meta (META) +2.4% pre-market: Q4 sales up 21% and net income rising 49%; its AI's userbase reached 700mln monthly users. CEO Zuckerberg said it will be a "really big year" for AI, expects Meta AI to be the leading AI assistant.

- Microsoft (MSFT) -3.5% pre-market: Reported disappointing Azure growth forecasts, higher-than-expected capex, and concerns over competition from cheaper Chinese AI models, raising investor fears of a price war and delayed returns on substantial AI investments.

- Tesla (TSLA) +1.7% pre-market: Q4 earnings and revenue missed expectations, and its vehicle sales profit margin narrowed; while shares initially slipped on the release, they rebounded as investors focussed on the automaker's plans to launch cheaper EVs in early 2025 and test autonomous vehicles in June, as well as cost-cutting measures and future self-driving prospects.

FX

- DXY is trivially higher as the dust settles on yesterday's FOMC policy announcement. Price action yesterday saw the USD spike higher as the FOMC removed language over progress on inflation before fading the move as Powell downplayed the change in language. For today's docket, focus is on the advance release of Q4 GDP and PCE data with the former expected to print at 2.6% vs. prev. 3.1%. Greater attention will likely fall on tomorrow's monthly PCE metrics. DXY is currently steady within yesterday's 107.74-108.29 range.

- EUR is marginally softer vs. the USD. This morning has seen disappointing GDP outturns for France and Germany which culminated in the EZ-wide figure printing at 0.0% Q/Q vs. Exp. 0.1%; EUR was unreactive. Looking forward, focus is very much on today's ECB policy announcement. A 25bps cut is nailed on and the policy statement will likely reiterate the bank's meeting-by-meeting and data dependent approach. Clues will be on any negative emphasis on the growth outlook which some could see as a signal to price the terminal Deposit Rate closer to 1.5/1.75% vs. the current 2% level. EUR/USD is currently tucked within yesterday's 1.0381-1.0443 range and below its 50DMA at 1.0426.

- JPY is firmer vs. the USD with not much in the way of fresh macro drivers out of Japan. USD/JPY is ultimately lower on the week on account of the risk-aversion triggered on Monday by the sell-off in US large cap tech stocks. USD/JPY is back below its 50DMA at 154.86.

- GBP is steady vs. the USD and EUR with fresh drivers for the UK lacking as yesterday's speech by Chancellor Reeves failed to have any follow-through into the GBP. Cable currently sits towards the top end of yesterday's 1.2393-1.2463 range.

- Antipodeans are both lacking firm conviction and failed to sustain overnight gains in the absence of pertinent drivers and tier-1 data releases. AUD/USD is steady after three consecutive sessions of losses which dragged the pair to a 0.6209 low yesterday.

Fixed Income

- USTs are bid and eclipsed Wednesday’s 109-09 pre-FOMC peak by half a tick. In brief, the FOMC statement sparked a hawkish move given the removal of the line around inflation progress, causing USTs to hit a 108-22 session low; thereafter, the move pared as Powell clarified this was just a tightening of the statements language, not a signal. As such, if we surpass the 109-09 top more convincingly then we look to 109-12 from Monday after which there is a bit of a gap until 110-00. Ahead, a slew of earnings and then US GDP/PCE (Q4) prints.

- Bunds are firmer, in-fitting with USTs directionally and have just eclipsed Wednesday’s best to a 131.85 peak. As it stands, action is seemingly a continuation of the post-Powell bullish move from Wednesday. For the bloc, specifics this morning include Flash GDP data which came in softer-than-expected but spurred no real reaction, following weaker than forecast German and Italian numbers; the German metrics were weighed on by export activity, which printed “significantly lower” Q/Q in the GDP series. Ahead, the ECB; a 25bps is widely expected so more focus will lie on President Lagarde's press conference on any clue on where the terminal rate could be.

- Gilts are bid in tandem with peers. Chancellor Reeves continues to do the media rounds taking up her growth plan from Wednesday’s session. The most pertinent line being she expects the economy to feel the benefit within the current Parliament, while this is a positive for Gilts and her fiscal position, it remains to be seen if it is realised. Gilts find themselves at a 92.50 peak. Stopping just shy of Wednesday’s 92.54 best.

- UK sells GBP 1.5bln 0.125% 2026 Gilt via Tender: average yield 3.88% (prev. 3.97%).

- Italy sells EUR 6.25bln vs exp. EUR 5.0-6.25bln 3.00% 2029, 3.85% 2035, 3.35% 2035 BTP & EUR 2.75bln vs Exp. 2.25-2.75bln 2.105% 2033 CCTeu.

Commodities

- Subdued trade across crude oil following a rangebound overnight session after yesterday's slide in prices. Recent losses have been attributed to tariff fears after US President Trump's recent rhetoric and ahead of the looming Mexico, Canada, and China tariffs on February 1st. On the EZ growth front, this morning's metrics showed that the German economy shrank more than expected in Q4 (-0.2% vs. Exp. -0.1% (Prev. 0.1%), not boding well on demand. Brent Apr in a USD 74.98-75.81/bbl parameter.

- Precious metals trade higher across the board with upside seen ahead of the European open despite a lack of macro drivers at the time. That being said, it's worth noting that Chinese markets are away and thus potential European flows could've helped. Spot gold resides in a USD 2,758.39-2,776.64/oz range with the next upside level the 24th Jan peak (USD 2,786.06/oz).

- Base metals are firmer in what is seemingly broad-based metals upside following an uneventful APAC session with Chinese markets also away on holiday. 3M LME copper trades in a USD 9,042.10-9,119.15/t after briefly dipping under USD 9,000/t yesterday.

Geopolitics: Middle East

- Israeli army says it has recently intercepted a reconnaissance drone launched by Lebanon's Hezbollah.

- Israeli tank fire was reported in the western area of Rafah in the Tel Al-Sultan neighbourhood, according to Al Arabiya.

- Palestinian Authority PM Mustafa said he has every reason to believe the Trump administration will help them all do a right and balanced deal that could hopefully end the conflict in the region, while he added the goal for Gaza is no Hamas or Israel and that the PA rejects the Trump idea of relocating Gazans

Geopolitics: Ukraine

- European officials are reportedly considering whether Russian gas pipeline sales to the EU should recommence as part of any potential settlement to end the war against Ukraine, via FT citing sources.

Geopolitics: LatAm

- Brazilian Central Bank hiked rates 100bps to 13.25%, as expected in a unanimous decision, while it expects a further adjustment of the same magnitude in the next meeting if the scenario evolves as expected. BCB said that beyond the next meeting, the committee reinforces that the total magnitude of the tightening cycle will be determined by the firm commitment to reaching the inflation target and it stated the current scenario requires an even more contractionary monetary policy.

US Event calendar

- 08:30: 4Q GDP Annualized QoQ, est. 2.6%, prior 3.1%

- 4Q Personal Consumption, est. 3.2%, prior 3.7%

- 4Q Core PCE Price Index QoQ, est. 2.5%, prior 2.2%

- 4Q GDP Price Index, est. 2.5%, prior 1.9%

- 08:30: Jan. Initial Jobless Claims, est. 225,000, prior 223,000

- Jan. Continuing Claims, est. 1.9m, prior 1.9m

- 10:00: Dec. Pending Home Sales (MoM), est. 0%, prior 2.2%

- Dec. Pending Home Sales YoY, est. 4.2%, prior 5.6%

DB's Jim Reid concludes the overnight wrap

Morning from Milan where the DB 2025 Outlook tour rolls on and where I'm hopeful I'll see double digit celsius temperatures for the first time in a while. Tech and AI, and their influence on macro, continue to dominate the conversations and last night we had the first three Mag-7 companies report after the bell. It was a bit of a mixed bag but US futures are higher this morning.

Firstly Microsoft’s shares fell by nearly 5% in post-market trading despite a headline beat, as cloud revenue growth missed estimates amid capacity constraints in the company’s data centre business. Meta delivered a solid earnings beat, but its Q1 sales guidance of $39.5bn to $41.8bn came towards the lower end of expectations ($41.7bn midpoint). Still, Meta shares gained about +2.5% after-hours as Zuckerberg predicted that 2025 would be a "really big year" for Meta's plans in AI. Tesla initially slipped after missing Q4 revenue estimates, but was more than +4% higher by the end of after-hours trading after reassuring investors that it expects to return to positive sales growth this year with Musk claiming “epic” growth ahead. This mixed bag hasn't hurt US equities with Nasdaq (+0.59%) and S&P 500 (+0.33%) futures higher.

Prior to those results, the Mag-7 fell by -0.92% in the regular session, underperforming a -0.47% decline for the S&P 500. This was mostly driven by Nvidia (-4.10%), which reversed a good chunk of Tuesday’s rebound, in part after Bloomberg reported that the Trump administration officials were considering expanding restrictions on exports of Nvidia chips to China. Microsoft (-1.09%) and Tesla (-2.26%) also lost ground ahead of their earnings releases.

Turning to the Fed decision, as widely expected the FOMC kept the fed funds rate unchanged in the 4.25-4.50% range after delivering 100bps of cuts over the previous three meetings. The on hold decision was accompanied by some potentially hawkish tweaks in the press release, notably removing wording that “inflation has made progress toward the 2% objective”. However, Powell later downplayed this change, also referring to the policy stance and the economy as in a “good place”. He said that the Fed needs to see “further progress” on inflation or a labour market weakening to ease policy further, but added that the Fed did not need to see inflation “all the way back to 2%” to cut rates. In terms of the immediate signal, Powell appeared to downplay the likelihood of a rate cut in March, saying that “we don't need to be in a hurry to adjust the policy stance”, though he noted that the policy stance was still “meaningfully restrictive”.

The Fed chair largely avoided getting drawn on the potential implications of the new Trump administration, pointing to uncertainty around tariffs, immigration, fiscal and regulatory policies and saying that the Fed will have to “wait and see”. Following the meeting, our US economists continue to think that the fed funds rate is likely to remain above 4% this year, with a base case of no additional cuts.

Post the FOMC, money markets further reduced the pricing of a rate cut in March, with its likelihood down to 19% by the close from 30% prior to the decision. But further out the curve an initial move higher in rates reversed as Powell downplayed the potentially hawkish policy statement signal. The amount of rate cuts priced by the December meeting fell -2.6bps on the day to 47bps, but this move had come prior the Fed. And long-dated Treasury yields ended the day a couple of basis points below their pre-FOMC levels, with the 10yr yield inching -0.3bps lower to a new 2025 low of 4.53%, despite almost touching 4.59% as Powell spoke. Equities also mostly shrugged off an initial negative reaction, with the S&P 500 (-0.47%) closing largely in line with its pre-FOMC level, having traded as much as -0.9% down during the press conference. As discussed at the top, the tech mega caps underperformed but the decline was fairly broad based with the equal-weighted S&P 500 down -0.34%.

Ahead of the Fed’s decision and all the evening news, the European session was a pretty resilient one, with equities advancing across most of the continent. That included a fresh record high for both the STOXX 600 (+0.50%) and the DAX (+0.97%), whilst the FTSE 100 (+0.28%) closed just shy of its peak last Thursday. However, the CAC 40 (-0.32%) lost ground, which came following underwhelming results from luxury giant LVMH (-4.98%) and amidst a wider underperformance in French assets as concern mounted about whether the Socialists would continue to support the government. That also led to a widening in the Franco-German 10yr spread, which moved up +0.7bps to 73.9bps.

The other main story in Europe was a pickup in natural gas prices, with futures up +6.17% yesterday to their highest level since October 2023, at €51.45/MWh. That was partly the result of supply issues in Norway, along with cooler weather that’s forecast for the days ahead. So that led to a bit more concern about inflationary pressures, with yields on 10yr bunds paring back their initial decline to close up +2.1bps.

Inflation and central banks will stay in the spotlight again today, as we’ve got the ECB’s decision coming up this afternoon. In terms of the decision, it’s widely expected they’ll deliver another 25bp cut, taking their deposit rate down to 2.75%. So the bigger question will be how long they’ll continue to cut rates, particularly with core inflation still lingering above 2%. For today, our European economists share that view expecting another 25bp cut, and think the description of the policy stance will be unchanged relative to the last meeting in December. However, the main risk for them is that the ECB will tweak the description of recent data in a hawkish-leaning direction.

In other central bank news, the Bank of Canada delivered their own 25bp rate cut yesterday, taking their policy rate down to 3%. The statement explicitly acknowledged the risk of US tariffs, saying that “a protracted trade conflict would most likely lead to weaker GDP and higher prices in Canada”, and that “if broad-based and significant tariffs were imposed, the resilience of Canada’s economy would be tested.” Alongside the rate cut, they also announced their plan to end QT, which would see asset purchases restart in early March.

Finally, there was some important US data on the merchandise trade deficit, which widened by an unexpectedly large amount to a record $122.1bn in December (vs $105.5bn expected), perhaps reflecting front-running of imports ahead of possible tariffs. That’s significant as that’s led to a notable drop in GDP trackers for Q4, with the Atlanta Fed’s GDPNow estimate dropping from an annualised +3.2% pace on Tuesday to +2.3% yesterday.

Overnight in Asia, the Nikkei 225 in Japan is trimming its gains this morning and is up just +0.07%. The Yen is around half a percent stronger after continued QT chatter after the phasing out of a loan program in last week's BoJ meeting. Markets in China, Hong Kong and South Korea remain closed for holidays. Meanwhile, the US 10yr yield is modestly down by -0.4bps and the front end (2yr) is unchanged.

To the day ahead now, and the main highlight will be the ECB’s policy decision and President Lagarde’s subsequent press conference. Data releases include the Q4 GDP readings from the US and the Euro Area, the US weekly initial jobless claims, and UK mortgage approvals for December. Finally, we’ll get earnings releases from Apple, Visa, Mastercard, Caterpillar and UPS.

US equity futures and European markets are broadly higher led by Tech/Small-Caps following a dovish Powell press conference (which reversed the hawkish FOMC statement) and solid, if hardly stellar (see MSFT), earnings. As of 8:00am ET, S&P futures are up 0.25%, off session highs; Nasdaq futures rise 0.3% with Mag 7 names mixed (GOOGL +0.7%, AMZN flat, AAPL -0.4%, MSFT -4%, META +1%, NVDA -0.8% and TSLA +2%). European markets are solid in the green ahead of what is widely expected to be the 5th consecutive ECB rate cut later Thursday to revive the sluggish eurozone economy. Bond yields are lower as the curve flattens and USD weakens on the back of continued strength in the JPY which will continue until Japan’s exports crater. Commodities are mixed with strength in both base and precious metals while oil has reversed earlier losses. Today’s macro data focus is on jobless claims and Q4 GDP data ahead of tomorrow’s Dec PCE print, after the close we get AAPL earnings.

In premarket trading, IBM gains 8% after fourth-quarter results beat expectations on key metrics, thanks to strong growth in its software business. Microsoft fell 4% after saying said its cloud-computing business will continue to grow slowly in the current quarter as the company struggles to build enough data centers to handle demand for its artificial intelligence products. Meta Platforms (META) rises 1% after the Facebook parent reported fourth-quarter results that beat expectations. CEO Mark Zuckerberg predicted that 2025 will be a “really big year” in AI. AI infrastructure stocks extend their advance, including Broadcom (AVGO) +4%, Marvell Technology (MRVL) +3%. Mag 7 names are mixed (GOOGL +0.7%, AMZN flat, AAPL -0.4%, MSFT -4%, META +1%, NVDA -0.8% and TSLA +2%). American Airlines (AAL) declines 2% after a regional jet flown for the carrier collided with a military helicopter near Ronald Reagan Washington National Airport. Here are some other notable premarket movers:

- Arista Networks (ANET) rises 3% following positive AI-investment commentary from Meta and Microsoft.

- Cargo Therapeutics (CRGX) sinks 74% after the biotech said it decided to stop a Phase 2 clinical study of Firi-cel and slashed its workforce.

- Celestica’s (CLS) US-traded shares climb 12% after the Canadian-based maker of electronics components boosted its 2025 profit and revenue forecast, citing strengthening demand in its connectivity & cloud division.

- Cigna (CI) falls 9% after the health insurer gave adjusted profit and medical cost guidance for the year 2025 that was worse than Wall Street’s estimates.

- Coursera (COUR) rises 2% after the online education company said that Jeff Maggioncalda would retire as CEO and be replaced by Greg Hart, a former Amazon and Compass executive.

- Lam Research (LRCX) advances 5% after the semiconductor equipment company gave a forecast that beat the average analyst estimate.

- Las Vegas Sands (LVS) rises 6% after the casino operator reported net revenue for the fourth quarter that beat the average analyst estimate.

- Levi Strauss (LEVI) drops 7% after the retailer’s forecasts for revenue and profit trailed Wall Street expectations.

- ServiceNow (NOW) falls 9% after the software company forecast full-year subscription revenue that’s weaker than expected.

- Tesla (TSLA) rises 2% after the electric-vehicle maker unveiled plans to start robotaxi operations and forecast a sales recovery this year.

- Tractor Supply (TSCO) declines 5% after the retailer reported comparable sales for the fourth quarter that missed the average analyst estimate.

- United Parcel Service (UPS) slides 10% after the courier tempered expectations for a long-awaited rebound this year in demand for its parcel shipping services, projecting annual revenue well below expectations.

Attention now turns to the world’s biggest company Apple (after NVDA lost that spot on Monday) which is expected to post record results when the company delivers quarterly earnings later today. Tech stocks continued to power ahead in premarket trading, with IBM jumping 8% and Meta Platforms Inc. rising on hopes for future artificial intelligence gains. Tesla Inc. climbed as much as 4.1% amid investor optimism about the company’s robotaxi business and AI prospects.

The technological arms race has defined global markets this week, with Chinese startup DeepSeek claiming to have made significant progress on its AI model at a fraction of the price. That put a question mark over the spending and investment plans of Silicon Valley firms in the runup to the earnings announcements, sparking a market slump on Monday. Microsoft shares bucked the upbeat mood, falling 3.9% in early trading, as the firm struggles to build enough data centers to handle AI demand.

Attention also turns to the ECB which is expected to cut rates by a quarter-point later Thursday to revive the sluggish eurozone economy. European government bonds gained after gross domestic product figures came in weaker than expected for Germany and France.

“The divergence trade is alive and well with a widening gap between European and US growth expectations that has translated into a much more dovish outlook for the ECB relative to the Fed,” said Daniel Murray, Zurich-based chief executive officer of EFG Asset Management.

And speaking of Europe, on the continent stocks advanced to another record high; real estate, industrials and tech outpperform while telecoms and banks are the only sectors to fall. The Stoxx 600 rises 0.5% to 536.77 with 457 members up, 141 down and 2 unchanged. Here are some of the biggest movers on Thursday:

- ABB shares gain as much as 3.7% as the Swiss industrial company benefits from demand in its electrification business spurred by spending around data centers.

- Fevertree Drinks shares rise as much as 23%, the steepest gain since July 2017, after the UK tonic and drinks maker announced a strategic partnership with Molson Coors that will see the US firm take an 8.5% stake.

- St James’s Place rises as much as 8.4% as the UK wealth management firm reports net inflows for the full year that beat the average analyst estimate.

- Nokia shares rise as much as 4.6% after the telecom equipment maker reported 4Q sales and profits beating estimates, helped by a strong network infrastructure business and a string of licensing deals.

- STMicro shares fall as much as 9.3% after the chipmaker guided 1Q sales below estimates, while breaking the norm to skip a revenue outlook for the full year.

- Deutsche Bank shares declined as much as 6.3 after the German lender’s fourth-quarter pretax profit missed estimates amid higher costs, with the firm also raising its guidance for expenses as a share of income.

- Wizz Air shares sink as much as 16%, the biggest drop in six months. The budget airline cut its income guidance for the full year due to adverse currency effects in the third quarter, though analysts note that the downgrade was widely expected.

- Swatch shares slump as much as 7.5%, hitting their lowest level in four months, after the Swiss watchmaker’s results fell short of estimates.

- H&M shares drop as much as 5.9% after the clothing retailer reported fourth-quarter sales that missed consensus estimates.

- Electrolux declines as much as 8.4% as the Swedish home appliance manufacturer’s outlook disappoints, with DNB analysts expecting double-digit cuts to 2025 earnings estimates.

- Sage Group shares fall as much as 3.4%, their biggest one-day drop since September, after a trading statement from the accounting software provider reiterated full-year guidance but flagged macroeconomic uncertainty.

Earlier in the session, Asian equities rose slightly, as Australian stocks gained for a second day amid hopes for easier monetary policy. Most major Asian markets including China, South Korea, Taiwan and Hong Kong remained closed for the Lunar New Year. The MSCI Asia Pacific Index rose as much as 0.2%, touching its highest level since Dec. 18, with Hitachi and BHP among top contributors. Positive results from global tech majors including Meta and Tesla provided a lift, as did news that SoftBank Group is in discussions to invest as much as $25 billion in OpenAI. The regional benchmark is poised for its first monthly rise since September, amid hopes for a softer stance on trade tariffs by US President Donald Trump. That’s helped counter the recent hit to Nvidia and others from the surprise news of China’s AI advancement with DeepSeek.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The yen tops the G-10 FX leader board, rising as much as 0.6% against the dollar as fast money traders lined up bets on the currency, according to an Asia-based FX trader.

In rates, the yield on 10-year US Treasuries was down two basis points at 4.50% after the Federal Reserve left interest rates unchanged yesterday, adopting a “wait and see” approach with inflation still above the 2% target. German bonds lead a rally in government debt after data showed the euro area unexpectedly stagnated at the end of last year. German 10-year yields fall 6 bps to 2.52% as traders add to their ECB interest-rate cut bets for the year ahead of the policy decision later Thursday. The euro falls 0.1% to ~1.0410.

US economic data calendar includes 4Q advance GDP and jobless claims (8:30am) and December pending home sales (10am). Fed speaker schedule resumes Friday with Bowman speaking on the economy and banks at 8:30am

Market Snapshot

- S&P 500 futures up 0.4% to 6,093.75

- STOXX Europe 600 up 0.5% to 536.75

- MXAP up 0.2% to 183.87

- MXAPJ little changed at 575.69

- Nikkei up 0.3% to 39,513.97

- Topix up 0.2% to 2,781.93

- Hang Seng Index up 0.1% to 20,225.11

- Shanghai Composite little changed at 3,250.60

- Sensex up 0.2% to 76,679.06

- Australia S&P/ASX 200 up 0.6% to 8,493.70

- Kospi up 0.8% to 2,536.80

- German 10Y yield little changed at 2.53%

- Euro little changed at $1.0411

- Brent Futures down 0.5% to $76.22/bbl

- Gold spot up 0.5% to $2,773.57

- US Dollar Index little changed at 107.93

Top Overnight News

- Ronald Reagan Washington National Airport announced all take-offs and landings were halted and emergency personnel were responding to an aircraft incident. Furthermore, the FAA announced that a PSA Airlines Bombardier regional jet collided in mid-air with a Sikorsky H-60 helicopter as it was approaching the runway at Reagan Washington National Airport, while PSA Airlines was operating Flight 5342 for American Airlines (AAL) which took off from Kansas.

- US President Trump said because the Fed and Chair Powell failed to stop problem they created with inflation, he will do it by unleashing American energy production slashing regulation, rebalancing international trade, and reigniting American manufacturing, while he will make the US financially, and otherwise, powerful again.

- BoC Governor Macklem said the Bank of Canada can ease tariff pain but can’t fix the damage and a big increase in tariffs is a big disruption to the Canadian economy, while he added that if a trade battle comes to pass, it would mean the economy will work less efficiently. Macklem also commented that inflation has come down, inflation is low, and it is thought to stay around the target.

- Softbank is in talks to invest $15 billion to $25 billion in OpenAI, potentially deepening the relationship between the two companies that are already planning a significant artificial-intelligence infrastructure initiative. WSJ

- BOJ Deputy Governor Ryozo Himino signaled there’s more room to hike given that real rates remain in negative territory. BBG

- Japan’s government expects its annual debt-servicing costs to rise by 25% to almost $230 billion over the next four years as the BOJ’s rate hikes drive up financing costs. BBG

- Eurozone officials are considering making an offer to Russia to resume gas purchases as an inducement to end the Ukraine war. FT

- The euro zone unexpectedly stagnated in the fourth quarter, defying estimates for a little growth. Germany’s GDP fell by a bigger-than-expected 0.2% compared with the previous three months. France’s economy unexpectedly contracted 0.1%. BBG

- STMicro (STM ADR -7.8% premkt) stock plunged to the lowest level since 2020 after the chipmaker forecast first-quarter revenue that missed expectations. BBG

- US annualized GDP probably slowed slightly to 2.6% in the fourth quarter. There’s a chance animal spirits may prop up investment and growth this year, Bloomberg Economics said, but it may be choppy given uncertainties. BBG

- Sen. John Fetterman (D-Pa.), who was thought to be open to voting for Robert F. Kennedy Jr.’s nomination to head the Department of Health and Human Services, now says the nominee is in serious trouble after his rocky confirmation hearing. The Hill

- House Democrats launched a multilateral effort Wednesday to combat the flood of executive actions from President Trump, vowing to punch back through legislation, lawsuits and a blitz of counter-messaging. The Hill

- FX options show diverging views about the risks to Canada and Mexico from potential US tariffs. Implied volatility in the loonie has spiked since the US election, while peso traders seem more relaxed. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed amid the ongoing mass closures in the region and after the choppy performance stateside in reaction to the FOMC, while the first earnings results from the magnificent 7 stocks were also varied. ASX 200 climbed to a fresh record high amid broad strength across sectors and further calls for a February RBA rate cut with NAB joining the rest of Australia’s big 4 banks in forecasting a cut next month. Nikkei 225 swung between gains and losses amid earnings releases and as the index largely shrugged off a firmer currency.

Top Asian News

- HKMA said interest rates in Hong Kong might still remain at relatively high levels for some time and that the extent and pace of future US interest rate cuts are subject to considerable uncertainty, in response to the Fed keeping rates unchanged.

European bourses (Stoxx 600 +0.5%) are generally modestly firmer across the board, as sentiment improves from a mostly mixed APAC session; the AEX/IBEX 35 are the European outperformers. European sectors hold a strong positive bias; aside from the top performer, the breadth of the market is fairly narrow. Real Estate leads, whilst Telecoms is pressured by BT (-3.5%) post-earnings. For Banking names, BBVA (+3.5%) gains after it beat estimates and announced a near EUR 1bln share buyback. Caixabank (-1%) slips a little lower after lending income came under pressure. Deutsche Bank (-4.5%) sinks after its results (details below).

Top European News

- UK Government is mulling proposals to relax rules on pension protection fund, reducing the levy it collects from pension scheme.

Earnings Recap

- IBM (IBM) +8% pre-market: Q4 earnings and revenue exceeded expectations. Software revenue grew 10%, driven by AI and Red Hat, while consulting revenue fell 2%, and it sees +5% annual growth in FY25

- Meta (META) +2.4% pre-market: Q4 sales up 21% and net income rising 49%; its AI’s userbase reached 700mln monthly users. CEO Zuckerberg said it will be a “really big year” for AI, expects Meta AI to be the leading AI assistant.

- Microsoft (MSFT) -3.5% pre-market: Reported disappointing Azure growth forecasts, higher-than-expected capex, and concerns over competition from cheaper Chinese AI models, raising investor fears of a price war and delayed returns on substantial AI investments.

- Tesla (TSLA) +1.7% pre-market: Q4 earnings and revenue missed expectations, and its vehicle sales profit margin narrowed; while shares initially slipped on the release, they rebounded as investors focussed on the automaker’s plans to launch cheaper EVs in early 2025 and test autonomous vehicles in June, as well as cost-cutting measures and future self-driving prospects.

FX

- DXY is trivially higher as the dust settles on yesterday’s FOMC policy announcement. Price action yesterday saw the USD spike higher as the FOMC removed language over progress on inflation before fading the move as Powell downplayed the change in language. For today’s docket, focus is on the advance release of Q4 GDP and PCE data with the former expected to print at 2.6% vs. prev. 3.1%. Greater attention will likely fall on tomorrow’s monthly PCE metrics. DXY is currently steady within yesterday’s 107.74-108.29 range.

- EUR is marginally softer vs. the USD. This morning has seen disappointing GDP outturns for France and Germany which culminated in the EZ-wide figure printing at 0.0% Q/Q vs. Exp. 0.1%; EUR was unreactive. Looking forward, focus is very much on today’s ECB policy announcement. A 25bps cut is nailed on and the policy statement will likely reiterate the bank’s meeting-by-meeting and data dependent approach. Clues will be on any negative emphasis on the growth outlook which some could see as a signal to price the terminal Deposit Rate closer to 1.5/1.75% vs. the current 2% level. EUR/USD is currently tucked within yesterday’s 1.0381-1.0443 range and below its 50DMA at 1.0426.

- JPY is firmer vs. the USD with not much in the way of fresh macro drivers out of Japan. USD/JPY is ultimately lower on the week on account of the risk-aversion triggered on Monday by the sell-off in US large cap tech stocks. USD/JPY is back below its 50DMA at 154.86.

- GBP is steady vs. the USD and EUR with fresh drivers for the UK lacking as yesterday’s speech by Chancellor Reeves failed to have any follow-through into the GBP. Cable currently sits towards the top end of yesterday’s 1.2393-1.2463 range.

- Antipodeans are both lacking firm conviction and failed to sustain overnight gains in the absence of pertinent drivers and tier-1 data releases. AUD/USD is steady after three consecutive sessions of losses which dragged the pair to a 0.6209 low yesterday.

Fixed Income

- USTs are bid and eclipsed Wednesday’s 109-09 pre-FOMC peak by half a tick. In brief, the FOMC statement sparked a hawkish move given the removal of the line around inflation progress, causing USTs to hit a 108-22 session low; thereafter, the move pared as Powell clarified this was just a tightening of the statements language, not a signal. As such, if we surpass the 109-09 top more convincingly then we look to 109-12 from Monday after which there is a bit of a gap until 110-00. Ahead, a slew of earnings and then US GDP/PCE (Q4) prints.

- Bunds are firmer, in-fitting with USTs directionally and have just eclipsed Wednesday’s best to a 131.85 peak. As it stands, action is seemingly a continuation of the post-Powell bullish move from Wednesday. For the bloc, specifics this morning include Flash GDP data which came in softer-than-expected but spurred no real reaction, following weaker than forecast German and Italian numbers; the German metrics were weighed on by export activity, which printed “significantly lower” Q/Q in the GDP series. Ahead, the ECB; a 25bps is widely expected so more focus will lie on President Lagarde’s press conference on any clue on where the terminal rate could be.

- Gilts are bid in tandem with peers. Chancellor Reeves continues to do the media rounds taking up her growth plan from Wednesday’s session. The most pertinent line being she expects the economy to feel the benefit within the current Parliament, while this is a positive for Gilts and her fiscal position, it remains to be seen if it is realised. Gilts find themselves at a 92.50 peak. Stopping just shy of Wednesday’s 92.54 best.

- UK sells GBP 1.5bln 0.125% 2026 Gilt via Tender: average yield 3.88% (prev. 3.97%).

- Italy sells EUR 6.25bln vs exp. EUR 5.0-6.25bln 3.00% 2029, 3.85% 2035, 3.35% 2035 BTP & EUR 2.75bln vs Exp. 2.25-2.75bln 2.105% 2033 CCTeu.

Commodities

- Subdued trade across crude oil following a rangebound overnight session after yesterday’s slide in prices. Recent losses have been attributed to tariff fears after US President Trump’s recent rhetoric and ahead of the looming Mexico, Canada, and China tariffs on February 1st. On the EZ growth front, this morning’s metrics showed that the German economy shrank more than expected in Q4 (-0.2% vs. Exp. -0.1% (Prev. 0.1%), not boding well on demand. Brent Apr in a USD 74.98-75.81/bbl parameter.

- Precious metals trade higher across the board with upside seen ahead of the European open despite a lack of macro drivers at the time. That being said, it’s worth noting that Chinese markets are away and thus potential European flows could’ve helped. Spot gold resides in a USD 2,758.39-2,776.64/oz range with the next upside level the 24th Jan peak (USD 2,786.06/oz).

- Base metals are firmer in what is seemingly broad-based metals upside following an uneventful APAC session with Chinese markets also away on holiday. 3M LME copper trades in a USD 9,042.10-9,119.15/t after briefly dipping under USD 9,000/t yesterday.

Geopolitics: Middle East

- Israeli army says it has recently intercepted a reconnaissance drone launched by Lebanon’s Hezbollah.

- Israeli tank fire was reported in the western area of Rafah in the Tel Al-Sultan neighbourhood, according to Al Arabiya.

- Palestinian Authority PM Mustafa said he has every reason to believe the Trump administration will help them all do a right and balanced deal that could hopefully end the conflict in the region, while he added the goal for Gaza is no Hamas or Israel and that the PA rejects the Trump idea of relocating Gazans

Geopolitics: Ukraine

- European officials are reportedly considering whether Russian gas pipeline sales to the EU should recommence as part of any potential settlement to end the war against Ukraine, via FT citing sources.

Geopolitics: LatAm

- Brazilian Central Bank hiked rates 100bps to 13.25%, as expected in a unanimous decision, while it expects a further adjustment of the same magnitude in the next meeting if the scenario evolves as expected. BCB said that beyond the next meeting, the committee reinforces that the total magnitude of the tightening cycle will be determined by the firm commitment to reaching the inflation target and it stated the current scenario requires an even more contractionary monetary policy.

US Event calendar

- 08:30: 4Q GDP Annualized QoQ, est. 2.6%, prior 3.1%

- 4Q Personal Consumption, est. 3.2%, prior 3.7%

- 4Q Core PCE Price Index QoQ, est. 2.5%, prior 2.2%

- 4Q GDP Price Index, est. 2.5%, prior 1.9%

- 08:30: Jan. Initial Jobless Claims, est. 225,000, prior 223,000

- Jan. Continuing Claims, est. 1.9m, prior 1.9m

- 10:00: Dec. Pending Home Sales (MoM), est. 0%, prior 2.2%

- Dec. Pending Home Sales YoY, est. 4.2%, prior 5.6%

DB’s Jim Reid concludes the overnight wrap

Morning from Milan where the DB 2025 Outlook tour rolls on and where I’m hopeful I’ll see double digit celsius temperatures for the first time in a while. Tech and AI, and their influence on macro, continue to dominate the conversations and last night we had the first three Mag-7 companies report after the bell. It was a bit of a mixed bag but US futures are higher this morning.

Firstly Microsoft’s shares fell by nearly 5% in post-market trading despite a headline beat, as cloud revenue growth missed estimates amid capacity constraints in the company’s data centre business. Meta delivered a solid earnings beat, but its Q1 sales guidance of $39.5bn to $41.8bn came towards the lower end of expectations ($41.7bn midpoint). Still, Meta shares gained about +2.5% after-hours as Zuckerberg predicted that 2025 would be a “really big year” for Meta’s plans in AI. Tesla initially slipped after missing Q4 revenue estimates, but was more than +4% higher by the end of after-hours trading after reassuring investors that it expects to return to positive sales growth this year with Musk claiming “epic” growth ahead. This mixed bag hasn’t hurt US equities with Nasdaq (+0.59%) and S&P 500 (+0.33%) futures higher.

Prior to those results, the Mag-7 fell by -0.92% in the regular session, underperforming a -0.47% decline for the S&P 500. This was mostly driven by Nvidia (-4.10%), which reversed a good chunk of Tuesday’s rebound, in part after Bloomberg reported that the Trump administration officials were considering expanding restrictions on exports of Nvidia chips to China. Microsoft (-1.09%) and Tesla (-2.26%) also lost ground ahead of their earnings releases.

Turning to the Fed decision, as widely expected the FOMC kept the fed funds rate unchanged in the 4.25-4.50% range after delivering 100bps of cuts over the previous three meetings. The on hold decision was accompanied by some potentially hawkish tweaks in the press release, notably removing wording that “inflation has made progress toward the 2% objective”. However, Powell later downplayed this change, also referring to the policy stance and the economy as in a “good place”. He said that the Fed needs to see “further progress” on inflation or a labour market weakening to ease policy further, but added that the Fed did not need to see inflation “all the way back to 2%” to cut rates. In terms of the immediate signal, Powell appeared to downplay the likelihood of a rate cut in March, saying that “we don’t need to be in a hurry to adjust the policy stance”, though he noted that the policy stance was still “meaningfully restrictive”.

The Fed chair largely avoided getting drawn on the potential implications of the new Trump administration, pointing to uncertainty around tariffs, immigration, fiscal and regulatory policies and saying that the Fed will have to “wait and see”. Following the meeting, our US economists continue to think that the fed funds rate is likely to remain above 4% this year, with a base case of no additional cuts.

Post the FOMC, money markets further reduced the pricing of a rate cut in March, with its likelihood down to 19% by the close from 30% prior to the decision. But further out the curve an initial move higher in rates reversed as Powell downplayed the potentially hawkish policy statement signal. The amount of rate cuts priced by the December meeting fell -2.6bps on the day to 47bps, but this move had come prior the Fed. And long-dated Treasury yields ended the day a couple of basis points below their pre-FOMC levels, with the 10yr yield inching -0.3bps lower to a new 2025 low of 4.53%, despite almost touching 4.59% as Powell spoke. Equities also mostly shrugged off an initial negative reaction, with the S&P 500 (-0.47%) closing largely in line with its pre-FOMC level, having traded as much as -0.9% down during the press conference. As discussed at the top, the tech mega caps underperformed but the decline was fairly broad based with the equal-weighted S&P 500 down -0.34%.

Ahead of the Fed’s decision and all the evening news, the European session was a pretty resilient one, with equities advancing across most of the continent. That included a fresh record high for both the STOXX 600 (+0.50%) and the DAX (+0.97%), whilst the FTSE 100 (+0.28%) closed just shy of its peak last Thursday. However, the CAC 40 (-0.32%) lost ground, which came following underwhelming results from luxury giant LVMH (-4.98%) and amidst a wider underperformance in French assets as concern mounted about whether the Socialists would continue to support the government. That also led to a widening in the Franco-German 10yr spread, which moved up +0.7bps to 73.9bps.

The other main story in Europe was a pickup in natural gas prices, with futures up +6.17% yesterday to their highest level since October 2023, at €51.45/MWh. That was partly the result of supply issues in Norway, along with cooler weather that’s forecast for the days ahead. So that led to a bit more concern about inflationary pressures, with yields on 10yr bunds paring back their initial decline to close up +2.1bps.

Inflation and central banks will stay in the spotlight again today, as we’ve got the ECB’s decision coming up this afternoon. In terms of the decision, it’s widely expected they’ll deliver another 25bp cut, taking their deposit rate down to 2.75%. So the bigger question will be how long they’ll continue to cut rates, particularly with core inflation still lingering above 2%. For today, our European economists share that view expecting another 25bp cut, and think the description of the policy stance will be unchanged relative to the last meeting in December. However, the main risk for them is that the ECB will tweak the description of recent data in a hawkish-leaning direction.

In other central bank news, the Bank of Canada delivered their own 25bp rate cut yesterday, taking their policy rate down to 3%. The statement explicitly acknowledged the risk of US tariffs, saying that “a protracted trade conflict would most likely lead to weaker GDP and higher prices in Canada”, and that “if broad-based and significant tariffs were imposed, the resilience of Canada’s economy would be tested.” Alongside the rate cut, they also announced their plan to end QT, which would see asset purchases restart in early March.

Finally, there was some important US data on the merchandise trade deficit, which widened by an unexpectedly large amount to a record $122.1bn in December (vs $105.5bn expected), perhaps reflecting front-running of imports ahead of possible tariffs. That’s significant as that’s led to a notable drop in GDP trackers for Q4, with the Atlanta Fed’s GDPNow estimate dropping from an annualised +3.2% pace on Tuesday to +2.3% yesterday.

Overnight in Asia, the Nikkei 225 in Japan is trimming its gains this morning and is up just +0.07%. The Yen is around half a percent stronger after continued QT chatter after the phasing out of a loan program in last week’s BoJ meeting. Markets in China, Hong Kong and South Korea remain closed for holidays. Meanwhile, the US 10yr yield is modestly down by -0.4bps and the front end (2yr) is unchanged.

To the day ahead now, and the main highlight will be the ECB’s policy decision and President Lagarde’s subsequent press conference. Data releases include the Q4 GDP readings from the US and the Euro Area, the US weekly initial jobless claims, and UK mortgage approvals for December. Finally, we’ll get earnings releases from Apple, Visa, Mastercard, Caterpillar and UPS.

Loading…