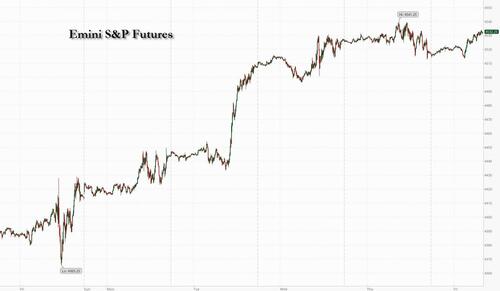

Futures and global markets are higher ahead of the NFP today at 8:30am ET (full preview here). At 7:40am ET, S&P futures rose 0.3% to 4,531 with Nasdaq futures up 0.2%. Major global markets are also higher, led by the UK (UKX +0.5%, SX5E +0.4%, SXXP +0.4%, DAX +0.1%), with the final Eurozone Mfg PMI is revised lower to 43.5 from 43.7, further boosting odds the ECB is done. On September ECB, Greg Fuzesi thinks that the July minutes and Isabel Schnabel’s comments yesterday (“growth had “moderated visibly”) both consistent with a pause in September ECB. He expects the final hike to happen in October after a pause in September. China reduced banks’ reserve requirement of foreign currency deposits, boosting the yuan, while China's Caixin Mfg PMIsurprised to the upside: 51.0 vs. 49.0 survey vs. 49.2 prior. Bond yields are lower and the Bloomberg dollar index is flat. Commodities are mostly stronger led by oil. Key macro focus will be the labor data release today (NFP, Unemployment Rate, Avg. Hourly Earnings, Labor Force Participation) at 8.30am ET and the Mfg ISM at 10am ET.

In premarket trading, Broadcom dropped as much as 4.6% after its revenue forecast disappointed, signaling that demand for electronic components remains sluggish. Dell Technologies jumped 10% after it reported better-than-expected second-quarter revenue, driven by personal computers and data center hardware sales. US-listed Chinese stocks advanced in premarket trading after Beijing and Shanghai both eased housing rules, a sign of further government support toward the economy. Here are some other notable premarket movers:

- 23andMe jumps 19% after it received FDA 510(k) clearance to report an additional 41 genetic variants in the BRCA1 and BRCA2 genes that increase risk for breast, ovarian, prostate and pancreatic cancer.

- Elastic rises 17% after its first-quarter results beat expectations and full-year forecast was raised.

- Eos Energy Enterprises soars 50% after announcing that the Department of Energy’s Loan Programs Office has issued an up to $398.6 million conditional commitment to the battery startup.

- Lululemon gains 3% as analysts lift their price targets on the the athleisure firm that boosted its net revenue guidance after the close on Thursday.

- MongoDB rallies 6.4% after a 55% boost to full-year EPS guidance at mid-point of the outlook range, prompting analysts to raise price targets.

- Nutanix jumps 18% as guidance beat expectations. Analysts noted a strong performance in renewals and a share buyback worth $350 million.

- SentinelOne gains 2% after estimate-beating results and raised guidance eased investor fears over competition.

- Shares in marijuana companies advanced as the Drug Enforcement Agency said Wednesday it would review its classification of cannabis. Canopy Growth gains 12%, Tilray Brands (TLRY) rises 3%, Aurora Cannabis (ACB) is up 2.5%.

- Tingo Group falls 14% as short seller Hindenburg Research posted a message about the agri-fintech firm on X.

Friday’s payrolls report (previewed here) should provide further evidence of cooling in the still-tight US labor market. The question is whether that will be enough to stall the Federal Reserve’s tightening cycle or even lead to early rate cuts. Meanwhile, a rapidly weakening economy is likely to tilt the European Central Bank in favor of a pause this month, with no further hikes beyond the current rate of 3.75%, according to Morgan Stanley economists.

Consensus expects a 170K NFP print with unemployment unchanged at 3.5%, and average hourly earnings dropping to 4.3% YoY from 4.4%. Here is a breakdown of payrolls forecasts by bank:

- 215,000 - Societe Generale

- 200,000 - Barclays

- 200,000 - UBS

- 175,000 - HSBC

- 170,000 - Credit Suisse

- 160,000 - Wells Fargo

- 155,000 - Morgan Stanley

- 150,000 - Deutsche Bank

- 149,000 - Goldman Sachs

- 130,000 - Citigroup

- 125,000 - JP Morgan Chase

“I’m personally more inclined toward the soft landing scenario given the resilience of the labor market and inflation slowing down, so I’m not expecting any catastrophic numbers this afternoon,” said Harry Wolhandler, head of equities at Meeschaert Asset Management in Paris. “In any event, should there be bad surprises, the Fed now has room for maneuver to lower rates.”

The Stoxx Europe 600 index rose 0.3%, trimming a bigger gain earlier in the session, with energy majors outperforming as crude oil headed for the biggest weekly advance since April. Miners jumped as China’s latest stimulus measures boosted prices of some industrial metals. Car makers declined, with Renault SA and Volkswagen AG falling more than 3% each after being downgraded to sell by UBS Group AG on increasing competition from Asia. Aurubis AG slumped as much as 18% after Europe’s top copper producer said it faces large losses due to a massive metal theft. Here are the other notable European movers:

- Johnson Matthey jumps as much as 14% after Standard Investments, the investment arm of US company Standard Industries, doubles its stake in the British chemicals maker

- Vestas gains as much as 3.8% after the wind-turbine manufacturer announced it is close to landing a large order to deliver turbines for a US wind park, a potential respite for the beleaguered industry

- European energy stocks outperform after the sector is double-upgraded to overweight at Morgan Stanley, predicting an extended period of strong free cash flow, buybacks and dividend growth

- WH Smith gains as much as 4.3% after Goodbody upgraded its recommendation on the UK newsagent and bookstore chain to buy, citing “encouraging momentum” going into the new fiscal year

- Boohoo shares rise as much as 10% on Friday, on track for their biggest weekly advance since Nov. 11, after Frasers increases its stake in the online fast fashion retailer

- Fielmann Group rises as much as 6.3% after the eyewear company raised its full-year guidance after its recent acquisition of SVS Vision amid what AlsterResearch sees as an attractive market.

- AmRest Holdings rise as much as 3.5% after the Polish restaurant operator reported better-than-expected 2Q earnings and gave positive outlook on current trading

- Aurubis slumps as much as 18% after Europe’s top copper producer releases an update identifying a large metal theft. Salzgitter, which has a 30% stake in Aurubis, drops 7.3% as it suspends guidance

- Renault and Volkswagen decline after both carmakers were cut to sell and given Street-low price targets by UBS, which cites the impact from factors including the rise of Chinese automakers

- BioMerieux falls as much as 7.7% after the French diagnostics firm’s second-quarter Ebit slightly missed estimates due to negative currency and M&A effects, overshadowing a beat on overall sales

Earlier in the session, Asian stocks advanced and headed for their second weekly gain, as Chinese equities climbed following more stimulus measures from Beijing. Japan’s benchmark also rose, eyeing an historic milestone. The MSCI Asia Pacific Index rose as much as 0.5%, led higher by Samsung and several Japanese firms.

China shares traded higher and metals looked set to extend this week’s advances after China's government allowed the nation’s largest cities to cut down payments for home buyers and encouraged lenders to lower rates on existing mortgages as well as on deposits. Meanwhile, Shanghai and Beijing eased home-buying mortgage rules for residents. Hong Kong’s market was shut as the city braced for what may be the strongest storm to hit in at least five years.

The yuan also strengthened after China’s central bank reduced the foreign exchange reserve requirement ratio for financial institutions in a bid to support the currency. The currency has since pared its gains. Sentiment was further buoyed by an unexpected rise in manufacturing data that advanced to 51 in August, the highest reading since February, according to a Caixin survey.

Japan’s Topix benchmark gained nearly 1%, boosted by Sony, putting it on course for its highest close since 1990. The index posted its eighth consecutive month of increase in August — the longest winning streak since 2013 — and the gauge was now set for the best weekly advance since October. Data earlier showed companies’ profits rose 11.6% on an annual basis in the second quarter.

Australia's ASX 200 declined further under 7,300 and was weighted by its metals names as Fortescue Metals slumped after its CFO left three days after the CEO's departure. Korea's KOSPI was underpinned by the South Korean trade data which printed better than feared.

Indian stocks posted their biggest advance in two months on Friday as metals and utilities led the rally across sectors after strong economic data boosted investor sentiment. The S&P BSE Sensex Index rose 0.9% to 65,387.16 in Mumbai, while the NSE Nifty 50 Index advanced by a similar measure as both gauges surged the most since June 30. The sharp move pushed the benchmarks by at least 0.7% higher for the week, snapping their retreat for preceding five weeks. Stocks in India have been receiving a chunk of foreign flows coming to emerging markets. For August, foreigners bought $1.6 billion of local shares while selling Taiwan, South Korea and Indonesia, and extending a selloff in China.

In FX, the Bloomberg Dollar Spot Index was little changed on Friday but down 0.2% this week, set to halt six straight weeks of gains after data showed the Federal Reserve’s preferred measure of underlying inflation posted the smallest back-to-back increases since late 2020. Focus now is on US payrolls data later on Friday, which is expected to show the US labor market likely cooled in August

Further dollar declines could be limited. “The path to more pronounced dollar depreciation — further moderation in the US economic data, including nonfarm payrolls report, combined with less negativity abroad — has been narrowing lately,” wrote Goldman Sachs strategist Karen Fishman, and since Goldman's sellside desk is always wrong, it means the dollar is about to crater.

- EUR/USD recouped some lost ground ahead of the key US data. The common currency fell yesterday after bearish comments from European Central Bank officials fueled concern the euro region may be heading for stagflation.

- USD/JPY little changed at 145.49. The pair recovered from an intraday low of 145.24 after Japanese Finance Minister Shunichi Suzuki said sudden moves in the foreign currency market aren’t desirable, and he will closely watch movements

- A 0.3% rise in the Aussie dollar on China’s FX RRR cut was reversed in part by leveraged selling shortly after by weak domestic home loan data. Move extended under weight of early London names selling to partially fill in option and exporter related bids under 0.6450 strikes, according to traders

In rates, treasuries were mixed in early US trading ahead of the August employment report, with the curve steeper. With Fed swaps pricing in about 50% odds of another rate hike this year, report is anticipated to show 170k nonfarm payrolls increase, smallest in more than two years; crowd-sourced whisper number is 155k. Yields remain within 2bp of Thursday’s closing levels; Thursday’s ranges included weekly lows for 10-year to 30-year tenors. 2s10s and 5s30s spreads are wider by 2bp-3bp, paced by curve-steepening in most euro-zone bond markets. The economic calendar also includes August final S&P Global US Manufacturing PMI at 9:45am, July construction spending and August ISM manufacturing at 10am and August vehicle sales throughout the day.

In commodities, oil is set for a weekly gain after Russia signaled that it would extend export curbs and US inventories dropped further. Gold headed for the second weekly advance.

Looking to the day ahead now, and the main highlight will be the US jobs report for August. Otherwise, we’ll get the global manufacturing PMIs for August and the ISM manufacturing reading from the US. From central banks, we’ll hear from the Fed’s Bostic and Mester.

Market Snapshot

- S&P 500 futures up 0.2% to 4,526.00

- MXAP up 0.4% to 162.78

- MXAPJ up 0.3% to 508.53

- Nikkei up 0.3% to 32,710.62

- Topix up 0.8% to 2,349.75

- Hang Seng Index down 0.5% to 18,382.06

- Shanghai Composite up 0.4% to 3,133.25

- Sensex up 0.8% to 65,348.50

- Australia S&P/ASX 200 down 0.4% to 7,278.30

- Kospi up 0.3% to 2,563.71

- STOXX Europe 600 up 0.2% to 459.33

- German 10Y yield little changed at 2.49%

- Euro little changed at $1.0852

- Brent Futures up 0.3% to $87.13/bbl

- Gold spot up 0.1% to $1,942.47

- US Dollar Index little changed at 103.57

Top Overnight News from Bloomberg

- Markets settled into a holding pattern ahead of Friday’s key US jobs data, with European stocks and American equity-index futures edging higher, Treasury yields flat and a gauge of the dollar steady.

- China intensified efforts to stimulate the economy and support its currency, as investor concerns over the growth outlook persist. The central bank will trim the amount of foreign currency deposits banks are required to hold as reserves for the first time this year, the People’s Bank of China said Friday.

- Dollar General Corp., already on track for its first annual share decline, fell again after cutting its profit forecast for the second straight quarter amid rising labor costs and “softer sales trends.”

- US and other Group of Seven nations increasingly see evidence of deep-seated structural problems in China that ultimately will strengthen the West’s hand against a weakening geopolitical competitor. The view emerging from officials in Washington, Rome, Tokyo and other capitals, who spoke with Bloomberg News mostly on condition of anonymity in recent days, is that the dominant economic narrative that has guided the flows of capital around the globe for decades is flipping fast.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following a similar lead from Wall Street, whilst Hong Kong markets were closed due to Typhoon Saola. ASX 200 declined further under 7,300 and was weighted by its metals names as Fortescue Metals slumped after its CFO left three days after the CEO's departure. Nikkei 225 opened in the red but quickly trimmed losses with the rebound spearheaded by the energy sector. KOSPI was underpinned by the South Korean trade data which printed better than feared. Shanghai Comp opened firmer after large Chinese banks cut their deposit rates, while the PBoC also lowered down payment for first and second-time home buyers and announced a cut to the FX RRR. Modest upticks were seen after the Caixin PMI Finals were surprisingly revised into expansion territory.

Top Asian News

- PBoC is to cut FX RRR by 2ppts to 4% (prev. 6%) from September 15th, according to the central bank. China's Global Times, on the PBoC FX RRR cut, said "This move aims to enhance the ability of financial institutions to utilize foreign exchange capital."

- Several major Chinese banks lowered their deposit rates, including ICBC, China Construction Bank, Bank of Communications, and Bank of China.

- China's Shenzhen City will suspend work, businesses, transportation, and markets from Friday afternoon amid Typhoon Saola, according to the Shenzhen Government.

- PBoC sold CNY 101bln via 7-day reverse repos with the rate at 1.80% for a CNY 120bln net injection.

- China to take additional action to revive the property sector, via Reuters citing sources; incl. relaxing home purchase curbs and removing caps on new homes.

- Softbank's (9984 JT) Arm Holdings is expected to set a price range for its IPO next week, with plans to price its shares on September 13th and trading to start the following day, according to Reuters sources.

- Japanese Finance Minister Suzuki said FX moves should be set by the market and should reflect fundamentals; sudden FX moves are undesirable, according to Reuters.

European bourses are in the green, Euro Stoxx 50 +0.3%, as modest upside creeps in following a tentative/slightly subdued open with fundamentals light ahead of key US data. Sectors are primarily positive, Energy the clear outperformer after an MS upgrade and broader benchmark action while Autos lag following a negative Volkswagen broker move and as Tesla cuts prices in China for some models. Stateside, futures are in-fitting with Europe and are slightly firmer, ES +0.2%. with the tone equally as tentative before NFP & ISM Manufacturing.

Top European News

- ECB's de Guindos said the latest data from July and August point towards economic deceleration in Q3 and probably in Q4, and the ECB needs to keep working to bring inflation back to the 2% target. He said the latest data from inflation in August has been very similar to July, and the rate decision in September is still up for debate. He said data in the next few days is key to the September ECB decision, according to Reuters.

- ECB's Villeroy says after overall inflation peaked and underlying inflation has also peaked since April and appears to have begun its decline. This encouraging sign is still far from sufficient. Options are open at the next and upcoming meetings. Very close to a peak in rates, far from the point where we could consider cuts. Keeping rates high for long enough matters more than the level. Will slightly revise up France's 2023 GDP forecast.

- ECB's Vujcic says inflation data in August was in-line with expectations, economic activity is slowing faster than forecast. Will not know in September, October or November where the terminal is. Inflation will ease in the coming months but there is a risk that disinflation will stall above the target.

- BoE's Pill says BoE needs to be particularly wary about letting an inflation persistence dynamic to set in; we have not yet seen a downturn in core inflation which would reassure us.

FX

- Buck bounces from overnight lows, but is contained overall ahead of US payrolls, DXY sits within 103.480-770 range.

- Franc a tad firmer in line with Swiss YY CPI vs consensus, USD/CHF towards base of 0.8813-46 parameters.

- Euro, Pound, Yen and Loonie all rangy pre-NFP and Canadian GDP, EUR/USD around 1.0850 and surrounded by hefty expiries, Cable hovering below 1.2700, USD/JPY pivoting 145.00 and USD/CAD straddling 1.3500.

- Yuan underpinned by multiple factors including 200 bp RRR cut and surprise upgrade to Caixin Chinese manufacturing PMI to growth from contraction, USD/CNY close to 7.2450 and USD/CNH sub-7.2400 at one stage.

- PBoC set USD/CNY mid-point at 7.1788 vs exp. 7.2967 (prev. 7.1811)

Fixed Income

- Debt succumbs to some consolidation as the turn of the month comes with key US macro releases via NFP and the manufacturing ISM.

- Bunds, Gilts and T-note all in negative territory after Thursday's rallies and within 133.13-132.76, 95.49-14 and 110-31+/27 respective ranges.

Commodities

- Crude benchmarks are in the green but only modestly so and taking impetus from the USD rather than any specific crude driver with the overall tone tentative pre-NFP.

- Dutch TTF has pared back to near the unchanged mark after initial gains as Chevron workers rejected the first mediation package ahead of potential strikes on September 7th.

- Spot gold is at the top-end of parameters but as above this is relatively modest with specifics light while base metals have returned firmly to the green as China unveils further stimulus.

- Crude futures were on a slightly firmer footing and extended on the prior session’s gains, with Brent testing 87/bbl to the upside as it takes aim at the August high of USD 87.37/bbl.

- Spot gold saw an uptick as the DXY pulled back but price action remains within yesterday’s range and under USD 1,950/oz ahead of NFPs.

- Copper futures were lifted on the aforementioned China announcement, with 3M LME copper briefly topping USD 8,500/t to the upside.

- Chevron's (CVX) Australia LNG workers reject the Co's bargaining offer, according to unions; less than 1% of the Wheatstone and Gorgon downstream workforce voted in support of the offer, according to Reuters. Subsequently, sources report that CVX and unions will meet for talks next week.

- Russia introduced a 7% export duty on a number of fertilisers from September 1st, according to Interfax.

Geopolitics

- Japan imposed additional sanctions against North Korea, according to Reuters.

US Event Calendar

- 08:30: Aug. Change in Nonfarm Payrolls, est. 170,000, prior 187,000

- Change in Private Payrolls, est. 148,000, prior 172,000

- Change in Manufact. Payrolls, est. zero, prior -2,000

- 08:30: Aug. Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- Average Hourly Earnings YoY, est. 4.3%, prior 4.4%

- Average Weekly Hours All Emplo, est. 34.3, prior 34.3

- 08:30: Aug. Unemployment Rate, est. 3.5%, prior 3.5%

- Underemployment Rate, prior 6.7%

- Labor Force Participation Rate, est. 62.6%, prior 62.6%

- 09:45: Aug. S&P Global US Manufacturing PM, est. 47.0, prior 47.0

- 10:00: July Construction Spending MoM, est. 0.5%, prior 0.5%

- 10:00: Aug. ISM Manufacturing, est. 47.0, prior 46.4

Central Bank Speakers

- 06:00: FEd’s Bostic Speaks on US Monetary Policy

- 09:45: Fed’s Mester Speaks on Inflation

DB's Jim Reid concludes the overnight wrap

Welcome to September and to an early month payrolls Friday. Spare a thought for me this weekend as I’ll be refereeing 40 plus over excited 6 year olds playing Laser Quest as our twins have their birthday party on Sunday. My advice to all the graduates just joining the industry and reading this is to have your kids young while you have lots of energy. Then when you get to my age you can have easy paced relaxing weekends rather than the ones I have. I'm going to be especially exhausted by Monday.

Since it’s the start of the month, we’ll shortly be releasing our monthly performance review for August, which has been a pretty challenging one for financial markets albeit one where markets had a much better last week or so. In the month we had a further softening in the economic data, particularly in Europe and China, which has led to growing concern about the near-term outlook. At the same time, there’s been rising speculation that interest rates are set to remain higher for longer, and earlier in the month we even saw the 10yr Treasury yield hit a post-GFC high after both a US government debt downgrade and a much higher Treasury issuance profile announced than expected. So a lot going on in a holiday heavy month. See the full report in your inboxes shortly.

August might not have been a great month overall, but since Jackson Hole last week, we’ve actually had a decent market rally though one that lost a little momentum in the last 24 hours. Yesterday saw the S&P 500 (-0.16%) end a four-day winning streak after a sell off late in the US session, whilst the 10yr Treasury yield (-0.7bps) retreated for a 5th day running. Fresh China stimulus overnight (more below) has restored a little momentum as we start September.

For much of the final day of the month yesterday, markets were supported by the data alongside several central bank speakers who sounded cautious about further rate hikes. For instance in the US, the weekly initial jobless claims fell back to 228k over the week ending August 26 (vs. 235k expected), which is their third consecutive decline. Furthermore, the PCE inflation numbers for July were also in decent shape, and that’s the number the Fed officially targets. The important takeaway was that the year-on-year number for core PCE only rose a tenth to 4.2%, which is beneath the 4.3% estimate that Chair Powell cited in his speech last week. So things are running a bit better than the Fed was expecting even a week ago. Slightly concerningly, the supercore services measure often referred to by the Fed was up a strong +0.45% on the month. But more encouragingly, our US economists noted that the 1-month annualised rate of trimmed mean PCE was only +2.4%, its lowest since spring 2021. So take your pick.

In conjunction with the inflation data, we had several remarks from central bank officials that added to hopes they might be done with their rate hikes. That included Atlanta Fed President Bostic, who said that “I feel policy is appropriately restrictive”, and that “we should be cautious and patient and let the restrictive policy continue to influence the economy, lest we risk tightening too much and inflicting unnecessary economic pain.” Meanwhile at the ECB, Isabel Schnabel of the Executive Board said that recent developments “point to growth prospects being weaker than foreseen in the baseline scenario” in the June projections. She also said that whilst further rate hikes could be warranted, there was also an acknowledgement that “should our assessment of the transmission of monetary policy suggest that the pace of disinflation is proceeding as desired, we may afford to wait until our next meeting”. We also got the accounts of the ECB’s July meeting, which showed a moderation of the ECB’s hawkish bias. See our European economists’ reaction note here.

When it comes to the ECB’s decision in a couple of weeks, yesterday brought another piece of the jigsaw with the flash CPI print for August. That showed headline inflation remaining at +5.3%, whilst core inflation fell back two-tenths to +5.3%. While the core print was in line with consensus, our economists note that the underlying momentum was more encouraging, with services inflation easing slightly despite upside in volatile package holidays. The global trend, the inflation data, and the Schnabel remarks helped dial back the chances of a rate hike in September, with market pricing moving from a 55% chance at the previous close, down to 40% immediately prior to the CPI print (after Schnabel’s comments) and to 24% by the close. That’s the lowest chance the market has given a September hike since May, so as it stands we’re getting to the point where it would actively be a surprise if the ECB didn’t pause. In turn, those expectations of a pause led to a significant rally among European sovereign bonds, with yields on 10yr bunds (-8.1bps), OATs (-8.3bps) and BTPs (-7.7bps) seeing big declines.

Looking forward, we’ve got a couple of important releases today that might give us extra clues on the hard vs soft landing debate. The most important will be the US jobs report for August, which is out at 13:30 London time. Our US economists expect nonfarm payrolls growth to slow to +150k (consensus at +170k). That would be the slowest print since December 2020, and they see that causing the unemployment rate to move up a tenth to 3.6%. The other release of note will be the ISM manufacturing, which has now been in contractionary territory for 9 months in a row.

With another round of data to look forward to, US equities were in something of a holding pattern. Having started the day up by nearly +0.4% in the morning, the S&P 500 ended up closing -0.16% down after a late sell-off. Healthcare services (-2.65%) and banks (-0.73%) were among the underperformers. Meanwhile, tech stocks outperformed, with the NASDAQ (+0.11%) hitting a 4-week high as it eked out a fifth consecutive gain. Over in Europe, equities saw a subdued performance, with the STOXX 600 down -0.20%.

Asian equity markets are trading higher this morning as China ramped up its efforts to support the economy after the People’s Bank of China (PBOC) reduced the amount of foreign exchange that financial institutions must hold as reserves for the first time this year. Starting from September 15, the central bank will lower the forex reserve ratio to 4% from the current level of 6%, a move aimed at reining in yuan weakness. The offshore yuan did spike +0.5% on the news but has settled only +0.1% higher as we type. Additionally, China’s Caixin manufacturing PMI rose to 51.0 in August, the highest reading since February compared to a level of 49.2 in July.

In terms of equity market moves, the Nikkei (+0.53%) is leading gains overnight, while the CSI (+0.51%), the Shanghai Composite (+0.25%), and the KOSPI (+0.17%) are also trading in positive territory. Elsewhere, trading in Hong Kong has been suspended for today as the city is bracing itself for super Typhoon Saola. S&P 500 (+0.10%) and NASDAQ 100 (+0.07%) futures are trading slightly higher.

Looking back at yesterday’s other data, there was a decent +0.8% jump in US personal spending in July (vs. +0.7% expected) supporting the evidence of strong start to the quarter. However, the savings rate fell back to an 8-month low of 3.5% and incomes were a tenth below expectations at +0.2%. Otherwise, the MNI Chicago PMI for August rose to a one-year high of 48.7 (vs. 44.2 expected) and 42.8 last month. Earlier in the day, German retail sales for July disappointed (-0.8% vs +0.3% expected) in a latest sign of growth struggles for Europe’s largest economy.

To the day ahead now, and the main highlight will be the US jobs report for August. Otherwise, we’ll get the global manufacturing PMIs for August and the ISM manufacturing reading from the US. From central banks, we’ll hear from the Fed’s Bostic and Mester.

Futures and global markets are higher ahead of the NFP today at 8:30am ET (full preview here). At 7:40am ET, S&P futures rose 0.3% to 4,531 with Nasdaq futures up 0.2%. Major global markets are also higher, led by the UK (UKX +0.5%, SX5E +0.4%, SXXP +0.4%, DAX +0.1%), with the final Eurozone Mfg PMI is revised lower to 43.5 from 43.7, further boosting odds the ECB is done. On September ECB, Greg Fuzesi thinks that the July minutes and Isabel Schnabel’s comments yesterday (“growth had “moderated visibly”) both consistent with a pause in September ECB. He expects the final hike to happen in October after a pause in September. China reduced banks’ reserve requirement of foreign currency deposits, boosting the yuan, while China’s Caixin Mfg PMIsurprised to the upside: 51.0 vs. 49.0 survey vs. 49.2 prior. Bond yields are lower and the Bloomberg dollar index is flat. Commodities are mostly stronger led by oil. Key macro focus will be the labor data release today (NFP, Unemployment Rate, Avg. Hourly Earnings, Labor Force Participation) at 8.30am ET and the Mfg ISM at 10am ET.

In premarket trading, Broadcom dropped as much as 4.6% after its revenue forecast disappointed, signaling that demand for electronic components remains sluggish. Dell Technologies jumped 10% after it reported better-than-expected second-quarter revenue, driven by personal computers and data center hardware sales. US-listed Chinese stocks advanced in premarket trading after Beijing and Shanghai both eased housing rules, a sign of further government support toward the economy. Here are some other notable premarket movers:

- 23andMe jumps 19% after it received FDA 510(k) clearance to report an additional 41 genetic variants in the BRCA1 and BRCA2 genes that increase risk for breast, ovarian, prostate and pancreatic cancer.

- Elastic rises 17% after its first-quarter results beat expectations and full-year forecast was raised.

- Eos Energy Enterprises soars 50% after announcing that the Department of Energy’s Loan Programs Office has issued an up to $398.6 million conditional commitment to the battery startup.

- Lululemon gains 3% as analysts lift their price targets on the the athleisure firm that boosted its net revenue guidance after the close on Thursday.

- MongoDB rallies 6.4% after a 55% boost to full-year EPS guidance at mid-point of the outlook range, prompting analysts to raise price targets.

- Nutanix jumps 18% as guidance beat expectations. Analysts noted a strong performance in renewals and a share buyback worth $350 million.

- SentinelOne gains 2% after estimate-beating results and raised guidance eased investor fears over competition.

- Shares in marijuana companies advanced as the Drug Enforcement Agency said Wednesday it would review its classification of cannabis. Canopy Growth gains 12%, Tilray Brands (TLRY) rises 3%, Aurora Cannabis (ACB) is up 2.5%.

- Tingo Group falls 14% as short seller Hindenburg Research posted a message about the agri-fintech firm on X.

Friday’s payrolls report (previewed here) should provide further evidence of cooling in the still-tight US labor market. The question is whether that will be enough to stall the Federal Reserve’s tightening cycle or even lead to early rate cuts. Meanwhile, a rapidly weakening economy is likely to tilt the European Central Bank in favor of a pause this month, with no further hikes beyond the current rate of 3.75%, according to Morgan Stanley economists.

Consensus expects a 170K NFP print with unemployment unchanged at 3.5%, and average hourly earnings dropping to 4.3% YoY from 4.4%. Here is a breakdown of payrolls forecasts by bank:

- 215,000 – Societe Generale

- 200,000 – Barclays

- 200,000 – UBS

- 175,000 – HSBC

- 170,000 – Credit Suisse

- 160,000 – Wells Fargo

- 155,000 – Morgan Stanley

- 150,000 – Deutsche Bank

- 149,000 – Goldman Sachs

- 130,000 – Citigroup

- 125,000 – JP Morgan Chase

“I’m personally more inclined toward the soft landing scenario given the resilience of the labor market and inflation slowing down, so I’m not expecting any catastrophic numbers this afternoon,” said Harry Wolhandler, head of equities at Meeschaert Asset Management in Paris. “In any event, should there be bad surprises, the Fed now has room for maneuver to lower rates.”

The Stoxx Europe 600 index rose 0.3%, trimming a bigger gain earlier in the session, with energy majors outperforming as crude oil headed for the biggest weekly advance since April. Miners jumped as China’s latest stimulus measures boosted prices of some industrial metals. Car makers declined, with Renault SA and Volkswagen AG falling more than 3% each after being downgraded to sell by UBS Group AG on increasing competition from Asia. Aurubis AG slumped as much as 18% after Europe’s top copper producer said it faces large losses due to a massive metal theft. Here are the other notable European movers:

- Johnson Matthey jumps as much as 14% after Standard Investments, the investment arm of US company Standard Industries, doubles its stake in the British chemicals maker

- Vestas gains as much as 3.8% after the wind-turbine manufacturer announced it is close to landing a large order to deliver turbines for a US wind park, a potential respite for the beleaguered industry

- European energy stocks outperform after the sector is double-upgraded to overweight at Morgan Stanley, predicting an extended period of strong free cash flow, buybacks and dividend growth

- WH Smith gains as much as 4.3% after Goodbody upgraded its recommendation on the UK newsagent and bookstore chain to buy, citing “encouraging momentum” going into the new fiscal year

- Boohoo shares rise as much as 10% on Friday, on track for their biggest weekly advance since Nov. 11, after Frasers increases its stake in the online fast fashion retailer

- Fielmann Group rises as much as 6.3% after the eyewear company raised its full-year guidance after its recent acquisition of SVS Vision amid what AlsterResearch sees as an attractive market.

- AmRest Holdings rise as much as 3.5% after the Polish restaurant operator reported better-than-expected 2Q earnings and gave positive outlook on current trading

- Aurubis slumps as much as 18% after Europe’s top copper producer releases an update identifying a large metal theft. Salzgitter, which has a 30% stake in Aurubis, drops 7.3% as it suspends guidance

- Renault and Volkswagen decline after both carmakers were cut to sell and given Street-low price targets by UBS, which cites the impact from factors including the rise of Chinese automakers

- BioMerieux falls as much as 7.7% after the French diagnostics firm’s second-quarter Ebit slightly missed estimates due to negative currency and M&A effects, overshadowing a beat on overall sales

Earlier in the session, Asian stocks advanced and headed for their second weekly gain, as Chinese equities climbed following more stimulus measures from Beijing. Japan’s benchmark also rose, eyeing an historic milestone. The MSCI Asia Pacific Index rose as much as 0.5%, led higher by Samsung and several Japanese firms.

China shares traded higher and metals looked set to extend this week’s advances after China’s government allowed the nation’s largest cities to cut down payments for home buyers and encouraged lenders to lower rates on existing mortgages as well as on deposits. Meanwhile, Shanghai and Beijing eased home-buying mortgage rules for residents. Hong Kong’s market was shut as the city braced for what may be the strongest storm to hit in at least five years.

The yuan also strengthened after China’s central bank reduced the foreign exchange reserve requirement ratio for financial institutions in a bid to support the currency. The currency has since pared its gains. Sentiment was further buoyed by an unexpected rise in manufacturing data that advanced to 51 in August, the highest reading since February, according to a Caixin survey.

Japan’s Topix benchmark gained nearly 1%, boosted by Sony, putting it on course for its highest close since 1990. The index posted its eighth consecutive month of increase in August — the longest winning streak since 2013 — and the gauge was now set for the best weekly advance since October. Data earlier showed companies’ profits rose 11.6% on an annual basis in the second quarter.

Australia’s ASX 200 declined further under 7,300 and was weighted by its metals names as Fortescue Metals slumped after its CFO left three days after the CEO’s departure. Korea’s KOSPI was underpinned by the South Korean trade data which printed better than feared.

Indian stocks posted their biggest advance in two months on Friday as metals and utilities led the rally across sectors after strong economic data boosted investor sentiment. The S&P BSE Sensex Index rose 0.9% to 65,387.16 in Mumbai, while the NSE Nifty 50 Index advanced by a similar measure as both gauges surged the most since June 30. The sharp move pushed the benchmarks by at least 0.7% higher for the week, snapping their retreat for preceding five weeks. Stocks in India have been receiving a chunk of foreign flows coming to emerging markets. For August, foreigners bought $1.6 billion of local shares while selling Taiwan, South Korea and Indonesia, and extending a selloff in China.

In FX, the Bloomberg Dollar Spot Index was little changed on Friday but down 0.2% this week, set to halt six straight weeks of gains after data showed the Federal Reserve’s preferred measure of underlying inflation posted the smallest back-to-back increases since late 2020. Focus now is on US payrolls data later on Friday, which is expected to show the US labor market likely cooled in August

Further dollar declines could be limited. “The path to more pronounced dollar depreciation — further moderation in the US economic data, including nonfarm payrolls report, combined with less negativity abroad — has been narrowing lately,” wrote Goldman Sachs strategist Karen Fishman, and since Goldman’s sellside desk is always wrong, it means the dollar is about to crater.

- EUR/USD recouped some lost ground ahead of the key US data. The common currency fell yesterday after bearish comments from European Central Bank officials fueled concern the euro region may be heading for stagflation.

- USD/JPY little changed at 145.49. The pair recovered from an intraday low of 145.24 after Japanese Finance Minister Shunichi Suzuki said sudden moves in the foreign currency market aren’t desirable, and he will closely watch movements

- A 0.3% rise in the Aussie dollar on China’s FX RRR cut was reversed in part by leveraged selling shortly after by weak domestic home loan data. Move extended under weight of early London names selling to partially fill in option and exporter related bids under 0.6450 strikes, according to traders

In rates, treasuries were mixed in early US trading ahead of the August employment report, with the curve steeper. With Fed swaps pricing in about 50% odds of another rate hike this year, report is anticipated to show 170k nonfarm payrolls increase, smallest in more than two years; crowd-sourced whisper number is 155k. Yields remain within 2bp of Thursday’s closing levels; Thursday’s ranges included weekly lows for 10-year to 30-year tenors. 2s10s and 5s30s spreads are wider by 2bp-3bp, paced by curve-steepening in most euro-zone bond markets. The economic calendar also includes August final S&P Global US Manufacturing PMI at 9:45am, July construction spending and August ISM manufacturing at 10am and August vehicle sales throughout the day.

In commodities, oil is set for a weekly gain after Russia signaled that it would extend export curbs and US inventories dropped further. Gold headed for the second weekly advance.

Looking to the day ahead now, and the main highlight will be the US jobs report for August. Otherwise, we’ll get the global manufacturing PMIs for August and the ISM manufacturing reading from the US. From central banks, we’ll hear from the Fed’s Bostic and Mester.

Market Snapshot

- S&P 500 futures up 0.2% to 4,526.00

- MXAP up 0.4% to 162.78

- MXAPJ up 0.3% to 508.53

- Nikkei up 0.3% to 32,710.62

- Topix up 0.8% to 2,349.75

- Hang Seng Index down 0.5% to 18,382.06

- Shanghai Composite up 0.4% to 3,133.25

- Sensex up 0.8% to 65,348.50

- Australia S&P/ASX 200 down 0.4% to 7,278.30

- Kospi up 0.3% to 2,563.71

- STOXX Europe 600 up 0.2% to 459.33

- German 10Y yield little changed at 2.49%

- Euro little changed at $1.0852

- Brent Futures up 0.3% to $87.13/bbl

- Gold spot up 0.1% to $1,942.47

- US Dollar Index little changed at 103.57

Top Overnight News from Bloomberg

- Markets settled into a holding pattern ahead of Friday’s key US jobs data, with European stocks and American equity-index futures edging higher, Treasury yields flat and a gauge of the dollar steady.

- China intensified efforts to stimulate the economy and support its currency, as investor concerns over the growth outlook persist. The central bank will trim the amount of foreign currency deposits banks are required to hold as reserves for the first time this year, the People’s Bank of China said Friday.

- Dollar General Corp., already on track for its first annual share decline, fell again after cutting its profit forecast for the second straight quarter amid rising labor costs and “softer sales trends.”

- US and other Group of Seven nations increasingly see evidence of deep-seated structural problems in China that ultimately will strengthen the West’s hand against a weakening geopolitical competitor. The view emerging from officials in Washington, Rome, Tokyo and other capitals, who spoke with Bloomberg News mostly on condition of anonymity in recent days, is that the dominant economic narrative that has guided the flows of capital around the globe for decades is flipping fast.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following a similar lead from Wall Street, whilst Hong Kong markets were closed due to Typhoon Saola. ASX 200 declined further under 7,300 and was weighted by its metals names as Fortescue Metals slumped after its CFO left three days after the CEO’s departure. Nikkei 225 opened in the red but quickly trimmed losses with the rebound spearheaded by the energy sector. KOSPI was underpinned by the South Korean trade data which printed better than feared. Shanghai Comp opened firmer after large Chinese banks cut their deposit rates, while the PBoC also lowered down payment for first and second-time home buyers and announced a cut to the FX RRR. Modest upticks were seen after the Caixin PMI Finals were surprisingly revised into expansion territory.

Top Asian News

- PBoC is to cut FX RRR by 2ppts to 4% (prev. 6%) from September 15th, according to the central bank. China’s Global Times, on the PBoC FX RRR cut, said “This move aims to enhance the ability of financial institutions to utilize foreign exchange capital.”

- Several major Chinese banks lowered their deposit rates, including ICBC, China Construction Bank, Bank of Communications, and Bank of China.

- China’s Shenzhen City will suspend work, businesses, transportation, and markets from Friday afternoon amid Typhoon Saola, according to the Shenzhen Government.

- PBoC sold CNY 101bln via 7-day reverse repos with the rate at 1.80% for a CNY 120bln net injection.

- China to take additional action to revive the property sector, via Reuters citing sources; incl. relaxing home purchase curbs and removing caps on new homes.

- Softbank’s (9984 JT) Arm Holdings is expected to set a price range for its IPO next week, with plans to price its shares on September 13th and trading to start the following day, according to Reuters sources.

- Japanese Finance Minister Suzuki said FX moves should be set by the market and should reflect fundamentals; sudden FX moves are undesirable, according to Reuters.

European bourses are in the green, Euro Stoxx 50 +0.3%, as modest upside creeps in following a tentative/slightly subdued open with fundamentals light ahead of key US data. Sectors are primarily positive, Energy the clear outperformer after an MS upgrade and broader benchmark action while Autos lag following a negative Volkswagen broker move and as Tesla cuts prices in China for some models. Stateside, futures are in-fitting with Europe and are slightly firmer, ES +0.2%. with the tone equally as tentative before NFP & ISM Manufacturing.

Top European News

- ECB’s de Guindos said the latest data from July and August point towards economic deceleration in Q3 and probably in Q4, and the ECB needs to keep working to bring inflation back to the 2% target. He said the latest data from inflation in August has been very similar to July, and the rate decision in September is still up for debate. He said data in the next few days is key to the September ECB decision, according to Reuters.

- ECB’s Villeroy says after overall inflation peaked and underlying inflation has also peaked since April and appears to have begun its decline. This encouraging sign is still far from sufficient. Options are open at the next and upcoming meetings. Very close to a peak in rates, far from the point where we could consider cuts. Keeping rates high for long enough matters more than the level. Will slightly revise up France’s 2023 GDP forecast.

- ECB’s Vujcic says inflation data in August was in-line with expectations, economic activity is slowing faster than forecast. Will not know in September, October or November where the terminal is. Inflation will ease in the coming months but there is a risk that disinflation will stall above the target.

- BoE’s Pill says BoE needs to be particularly wary about letting an inflation persistence dynamic to set in; we have not yet seen a downturn in core inflation which would reassure us.

FX

- Buck bounces from overnight lows, but is contained overall ahead of US payrolls, DXY sits within 103.480-770 range.

- Franc a tad firmer in line with Swiss YY CPI vs consensus, USD/CHF towards base of 0.8813-46 parameters.

- Euro, Pound, Yen and Loonie all rangy pre-NFP and Canadian GDP, EUR/USD around 1.0850 and surrounded by hefty expiries, Cable hovering below 1.2700, USD/JPY pivoting 145.00 and USD/CAD straddling 1.3500.

- Yuan underpinned by multiple factors including 200 bp RRR cut and surprise upgrade to Caixin Chinese manufacturing PMI to growth from contraction, USD/CNY close to 7.2450 and USD/CNH sub-7.2400 at one stage.

- PBoC set USD/CNY mid-point at 7.1788 vs exp. 7.2967 (prev. 7.1811)

Fixed Income

- Debt succumbs to some consolidation as the turn of the month comes with key US macro releases via NFP and the manufacturing ISM.

- Bunds, Gilts and T-note all in negative territory after Thursday’s rallies and within 133.13-132.76, 95.49-14 and 110-31+/27 respective ranges.

Commodities

- Crude benchmarks are in the green but only modestly so and taking impetus from the USD rather than any specific crude driver with the overall tone tentative pre-NFP.

- Dutch TTF has pared back to near the unchanged mark after initial gains as Chevron workers rejected the first mediation package ahead of potential strikes on September 7th.

- Spot gold is at the top-end of parameters but as above this is relatively modest with specifics light while base metals have returned firmly to the green as China unveils further stimulus.

- Crude futures were on a slightly firmer footing and extended on the prior session’s gains, with Brent testing 87/bbl to the upside as it takes aim at the August high of USD 87.37/bbl.

- Spot gold saw an uptick as the DXY pulled back but price action remains within yesterday’s range and under USD 1,950/oz ahead of NFPs.

- Copper futures were lifted on the aforementioned China announcement, with 3M LME copper briefly topping USD 8,500/t to the upside.

- Chevron’s (CVX) Australia LNG workers reject the Co’s bargaining offer, according to unions; less than 1% of the Wheatstone and Gorgon downstream workforce voted in support of the offer, according to Reuters. Subsequently, sources report that CVX and unions will meet for talks next week.

- Russia introduced a 7% export duty on a number of fertilisers from September 1st, according to Interfax.

Geopolitics

- Japan imposed additional sanctions against North Korea, according to Reuters.

US Event Calendar

- 08:30: Aug. Change in Nonfarm Payrolls, est. 170,000, prior 187,000

- Change in Private Payrolls, est. 148,000, prior 172,000

- Change in Manufact. Payrolls, est. zero, prior -2,000

- 08:30: Aug. Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- Average Hourly Earnings YoY, est. 4.3%, prior 4.4%

- Average Weekly Hours All Emplo, est. 34.3, prior 34.3

- 08:30: Aug. Unemployment Rate, est. 3.5%, prior 3.5%

- Underemployment Rate, prior 6.7%

- Labor Force Participation Rate, est. 62.6%, prior 62.6%

- 09:45: Aug. S&P Global US Manufacturing PM, est. 47.0, prior 47.0

- 10:00: July Construction Spending MoM, est. 0.5%, prior 0.5%

- 10:00: Aug. ISM Manufacturing, est. 47.0, prior 46.4

Central Bank Speakers

- 06:00: FEd’s Bostic Speaks on US Monetary Policy

- 09:45: Fed’s Mester Speaks on Inflation

DB’s Jim Reid concludes the overnight wrap

Welcome to September and to an early month payrolls Friday. Spare a thought for me this weekend as I’ll be refereeing 40 plus over excited 6 year olds playing Laser Quest as our twins have their birthday party on Sunday. My advice to all the graduates just joining the industry and reading this is to have your kids young while you have lots of energy. Then when you get to my age you can have easy paced relaxing weekends rather than the ones I have. I’m going to be especially exhausted by Monday.

Since it’s the start of the month, we’ll shortly be releasing our monthly performance review for August, which has been a pretty challenging one for financial markets albeit one where markets had a much better last week or so. In the month we had a further softening in the economic data, particularly in Europe and China, which has led to growing concern about the near-term outlook. At the same time, there’s been rising speculation that interest rates are set to remain higher for longer, and earlier in the month we even saw the 10yr Treasury yield hit a post-GFC high after both a US government debt downgrade and a much higher Treasury issuance profile announced than expected. So a lot going on in a holiday heavy month. See the full report in your inboxes shortly.

August might not have been a great month overall, but since Jackson Hole last week, we’ve actually had a decent market rally though one that lost a little momentum in the last 24 hours. Yesterday saw the S&P 500 (-0.16%) end a four-day winning streak after a sell off late in the US session, whilst the 10yr Treasury yield (-0.7bps) retreated for a 5th day running. Fresh China stimulus overnight (more below) has restored a little momentum as we start September.

For much of the final day of the month yesterday, markets were supported by the data alongside several central bank speakers who sounded cautious about further rate hikes. For instance in the US, the weekly initial jobless claims fell back to 228k over the week ending August 26 (vs. 235k expected), which is their third consecutive decline. Furthermore, the PCE inflation numbers for July were also in decent shape, and that’s the number the Fed officially targets. The important takeaway was that the year-on-year number for core PCE only rose a tenth to 4.2%, which is beneath the 4.3% estimate that Chair Powell cited in his speech last week. So things are running a bit better than the Fed was expecting even a week ago. Slightly concerningly, the supercore services measure often referred to by the Fed was up a strong +0.45% on the month. But more encouragingly, our US economists noted that the 1-month annualised rate of trimmed mean PCE was only +2.4%, its lowest since spring 2021. So take your pick.

In conjunction with the inflation data, we had several remarks from central bank officials that added to hopes they might be done with their rate hikes. That included Atlanta Fed President Bostic, who said that “I feel policy is appropriately restrictive”, and that “we should be cautious and patient and let the restrictive policy continue to influence the economy, lest we risk tightening too much and inflicting unnecessary economic pain.” Meanwhile at the ECB, Isabel Schnabel of the Executive Board said that recent developments “point to growth prospects being weaker than foreseen in the baseline scenario” in the June projections. She also said that whilst further rate hikes could be warranted, there was also an acknowledgement that “should our assessment of the transmission of monetary policy suggest that the pace of disinflation is proceeding as desired, we may afford to wait until our next meeting”. We also got the accounts of the ECB’s July meeting, which showed a moderation of the ECB’s hawkish bias. See our European economists’ reaction note here.

When it comes to the ECB’s decision in a couple of weeks, yesterday brought another piece of the jigsaw with the flash CPI print for August. That showed headline inflation remaining at +5.3%, whilst core inflation fell back two-tenths to +5.3%. While the core print was in line with consensus, our economists note that the underlying momentum was more encouraging, with services inflation easing slightly despite upside in volatile package holidays. The global trend, the inflation data, and the Schnabel remarks helped dial back the chances of a rate hike in September, with market pricing moving from a 55% chance at the previous close, down to 40% immediately prior to the CPI print (after Schnabel’s comments) and to 24% by the close. That’s the lowest chance the market has given a September hike since May, so as it stands we’re getting to the point where it would actively be a surprise if the ECB didn’t pause. In turn, those expectations of a pause led to a significant rally among European sovereign bonds, with yields on 10yr bunds (-8.1bps), OATs (-8.3bps) and BTPs (-7.7bps) seeing big declines.

Looking forward, we’ve got a couple of important releases today that might give us extra clues on the hard vs soft landing debate. The most important will be the US jobs report for August, which is out at 13:30 London time. Our US economists expect nonfarm payrolls growth to slow to +150k (consensus at +170k). That would be the slowest print since December 2020, and they see that causing the unemployment rate to move up a tenth to 3.6%. The other release of note will be the ISM manufacturing, which has now been in contractionary territory for 9 months in a row.

With another round of data to look forward to, US equities were in something of a holding pattern. Having started the day up by nearly +0.4% in the morning, the S&P 500 ended up closing -0.16% down after a late sell-off. Healthcare services (-2.65%) and banks (-0.73%) were among the underperformers. Meanwhile, tech stocks outperformed, with the NASDAQ (+0.11%) hitting a 4-week high as it eked out a fifth consecutive gain. Over in Europe, equities saw a subdued performance, with the STOXX 600 down -0.20%.

Asian equity markets are trading higher this morning as China ramped up its efforts to support the economy after the People’s Bank of China (PBOC) reduced the amount of foreign exchange that financial institutions must hold as reserves for the first time this year. Starting from September 15, the central bank will lower the forex reserve ratio to 4% from the current level of 6%, a move aimed at reining in yuan weakness. The offshore yuan did spike +0.5% on the news but has settled only +0.1% higher as we type. Additionally, China’s Caixin manufacturing PMI rose to 51.0 in August, the highest reading since February compared to a level of 49.2 in July.

In terms of equity market moves, the Nikkei (+0.53%) is leading gains overnight, while the CSI (+0.51%), the Shanghai Composite (+0.25%), and the KOSPI (+0.17%) are also trading in positive territory. Elsewhere, trading in Hong Kong has been suspended for today as the city is bracing itself for super Typhoon Saola. S&P 500 (+0.10%) and NASDAQ 100 (+0.07%) futures are trading slightly higher.

Looking back at yesterday’s other data, there was a decent +0.8% jump in US personal spending in July (vs. +0.7% expected) supporting the evidence of strong start to the quarter. However, the savings rate fell back to an 8-month low of 3.5% and incomes were a tenth below expectations at +0.2%. Otherwise, the MNI Chicago PMI for August rose to a one-year high of 48.7 (vs. 44.2 expected) and 42.8 last month. Earlier in the day, German retail sales for July disappointed (-0.8% vs +0.3% expected) in a latest sign of growth struggles for Europe’s largest economy.

To the day ahead now, and the main highlight will be the US jobs report for August. Otherwise, we’ll get the global manufacturing PMIs for August and the ISM manufacturing reading from the US. From central banks, we’ll hear from the Fed’s Bostic and Mester.

Loading…