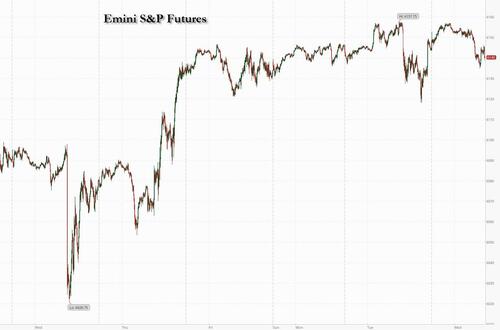

US equity futures are lower ahead of today's FOMC minutes, with global markets also sinking and bonds extended their slide after President Trump’s latest tariff threats stoked concern about a widening trade war; hawkish UK inflation prints which sent bond yields higher did not help. As of 8:00am S&P futures are -0.3% lower after the index topped its January record on Tuesday, while Nasdaq futures traded steady after Trump raised the specter of 25% tariffs on Autos and Pharma, both coming after April 1. The Trump Admin will also keep Biden-era rules on M&A. A slew of earnings reports also dented sentiment, with Arista Networks, Occidental Petroleum, Celanese and Bumble all dropping in premarket trading after results. Super Micro Computer rallied, however, after issuing an aggressive long-term revenue outlook. Pre-mkt, Mag7 names are mixed with Semis seeing some profit-taking. The yield curve is twisting steeper as the USD appreciates. Commodities are stronger despite the USD move; Brent trades above $76 while gold is at an all time high around $2940. Today’s macro data focus will be on Housing data and the Fed Minutes.

In premarket trading, Nvidia is leading gains among the Magnificent Seven (GOOGL +0.3%, AMZN -0.1%, AAPL -0.1%, MSFT -0.02%, META -0.09%, NVDA +0.4% and TSLA -0.1%). Bumble plunged 17% after the online dating company gave a first-quarter forecast that was weaker than expected on key metrics. Etsy tumbled 7% after reporting gross merchandise sales for the fourth quarter that missed the average analyst estimate. Here are some other notable premarket movers:

- Analog Devices (ADI) gains 5% after posting adjusted earnings per share for the first quarter that beat the average analyst estimate.

- Arista Networks (ANET) falls 4% after the computer networking company posted 4Q results.

- Cadence Design Systems (CDNS) slips 3% after the electronic design automation software company gave an outlook that was seen as disappointing.

- Celanese (CE) drops 13% after the chemical firm said it sees “persistently weak global demand” in end markets including paint and coatings.

- Fiverr (FVRR) rises 4% after forecasting 1Q revenue that beat the average analyst estimate.

- Howard Hughes Holdings (HHH) falls 3% after confirming it received an revised unsolicited proposal from Pershing Square and will evaluate the offer.

- International Flavors (IFF) falls 2% after forecasting disappointing sales for 2025.

- RB Global Inc. (RBA) rises 3% after reporting quarterly revenue that beat the average analyst estimate.

- Shift4 Payments (FOUR) declines 10% after the payments processing firm gave a weaker-than-expected outlook for adjusted Ebitda.

- Global Blue (GB) jumps 18% after Shift4 agreed to acquire the shopping technology company for $7.50 per share in cash.

- Star Bulk (SBLK) slips 5% as Jefferies notes that 4Q results were weak due to lower dry bulk spot rates, which have continued into the current quarter.

- Supernus Pharmaceuticals (SUPN) drops 21% after the drugmaker said a mid-stage study of its experimental therapy for treatment-resistant depression failed to meet its primary endpoint.

- Toll Brothers (TOL) falls 5% after the luxury homebuilder reported first-quarter revenue and total home sales that fell short of consensus estimates.

- Wix.com (WIX) rises 2% after the company’s forecast for 1Q revenue disappointed.

Traders’ attention will focus turn to the latest FOMC Minutes which could offer clues on the monetary policy outlook. While inflation has been slowing, many fear the effect of Trump’s tariff push on prices. Several officials, including Governor Christopher Waller and San Francisco Fed chief Mary Daly, have signaled rates will stay on hold until inflation slows significantly.

Separately, on Wednesday, the European Central Bank’s Isabel Schnabel said the bank will have to discuss pausing or ending its rate-cut campaign. Her comments pushed the euro 0.2% lower against the dollar, while bond yields rose across Europe, with 10-year German bund yields up about five basis points. Meanwhile, British 10-year gilt yields rose about six basis points after data showed inflation at a 10-month high.

Investors are also pricing increased government spending on defense should the war in Ukraine draw to an end. “When you think about the outcome of any peace treaty between Ukraine and Russia, that will involve a huge uplift in defense spending from European countries,” said Lilian Chovin, head of asset allocation at Coutts & Co.

Europe’s Stoxx 600 Index dropped 0.5% after another record close on Tuesday. Mining, travel, retail and construction stocks underperform. Sentiment was hurt after Trump warned he is weighing tariffs of around 25% on automobile, semiconductor and pharmaceutical imports. His comments added to the a fragile market picture as hopes for an end to the war in Ukraine were tempered by the exclusion of Ukrainian and European officials from US-Russia talks held on Tuesday. Major markets are all lower ex-Italy as bond yields increase following the UK inflation print. Aero/Def, Energy, Semis among the strongest baskets. Here are some of the biggest movers on Wednesday:

- HSBC shares in London rise 1.1% following a recent strong rally that took the stock to trade at highest since 2001, after the lender reported pretax profit that beat estimates and detailed a $2 billion share buyback.

- Societe BIC shares rise as much as 5.9% to hit their highest level in more than eight months after the French consumer-goods firm posted annual earnings ahead of expectations.

- Glencore shares drop as much as 7.2% to their lowest level in over three years, with analysts pointing to the miner’s disappointing copper production guidance as well as its shareholder returns, which were weighed down by its debt.

- Jet2 shares sink as much as 11%, their biggest drop since July 2023, after the package holiday company’s guidance fell short of analysts’ expectations.

- Philips shares drop 11%, the most since Oct. 28, after the Dutch medical equipment maker said it expects lower demand in China to continue to stymie growth this year.

- Delivery Hero shares fall 5%, the most in a month, after Citigroup downgraded the stock to sell from neutral, citing risk to margins due to mounting competitive pressures in the Middle East.

- Straumann shares fall as much as 4.4% after the Swiss maker of dental equipment posted results with weaker profitability levels.

- Tate & Lyle shares fall as much as 3.5% after Berenberg cut its recommendation on the stock to hold from buy, citing the ingredient maker’s weak FY2026 outlook, and a lack of signs of improvement in pricing conditions.

- BAE Systems shares fall as much as 3.3% after the UK defense firm’s FY25 cash-flow guidance disappointed analysts, who also noted concerns around US and UK budgets and reviews.

- Temenos shares fall as much as 4%, the most since November, as the Swiss banking software company’s guidance was seen dampened by the recently announced sale of Multifonds at a valuation that is deemed too low.

Some investors are also concerned about Germany’s national election on Sunday. While Friedrich Merz of the center-right opposition is expected to become chancellor, polls suggest the far-right Alternative for Germany will become the second-biggest party in parliament.

“I have been selling quite a lot over the last two days as Europe is now pricing the best possible scenario for the next catalysts, which is the Ukraine ceasefire and German elections,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “The situation might get bumpy as both events are going to be more complicated than what the market thinks.”

In FX, the Bloomberg Dollar index rises 0.1%. The kiwi sits atop the G-10 FX leader board, rising 0.3% against the greenback after the RBNZ signaled it would slow the pace of interest-rate cuts after a third straight reduction of 50 bps. The yen rises 0.2%, taking USDJPY down to ~151.80 after BOJ Board Member Takata said it’s important for authorities to continue considering gradual hikes.

In rates, treasuries edged lower, pushing US 10-year yields up 2 basis points to 4.57%; long-end yields are less than 3bp cheaper on the day with 2s10s, 5s30s spreads wider by 2bp-3bp. Gilts led a selloff in European government bonds as traders trim their Bank of England interest-rate cut bets after UK inflation climbed to the highest since March 2024. UK 10-year yields rise 5 bps to 4.61%, although the pound still falls 0.1% to around $1.26. The German 10-year is ~5bp higher as expectations for ECB rate cuts decline; money markets see 72bps of easing by year-end vs about 76bps before Schnabel’s comments. Treasury coupon auctions resume with $16b 20-year sale at 1pm New York time and continue Thursday with $9b 30-year TIPS new issue. WI 20-year yield at around 4.835% is 6.5bp richer than January’s auction, which drew strong demand and stopped through by 1.1bp

In commodities, oil prices advance, with WTI rising 1% to $72.50 a barrel. European natural gas futures are flat having topped €50 a megawatt-hour at one stage. Spot gold rises $8 to around $2,944/oz.

The US event calendar includes January housing starts and building permits and February New York Fed services business activity (8:30am). Fed speaker slate includes Jefferson at 5pm; minutes of January FOMC meeting to be released at 2pm

Market Snapshot

- S&P 500 futures little changed at 6,152.00

- STOXX Europe 600 little changed at 557.19

- MXAP down 0.1% to 189.67

- MXAPJ little changed at 598.35

- Nikkei down 0.3% to 39,164.61

- Topix down 0.3% to 2,767.25

- Hang Seng Index down 0.1% to 22,944.24

- Shanghai Composite up 0.8% to 3,351.54

- Sensex little changed at 75,952.51

- Australia S&P/ASX 200 down 0.7% to 8,419.19

- Kospi up 1.7% to 2,671.52

- German 10Y yield little changed at 2.53%

- Euro little changed at $1.0441

- Brent Futures up 0.8% to $76.41/bbl

- Gold spot up 0.3% to $2,943.81

- US Dollar Index little changed at 107.03

Top Overnight News

- President Donald Trump said he would likely impose tariffs on automobile, semiconductor and pharmaceutical imports of around 25%, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the president’s trade war. BBG

- Trump said the media seeks to sow division between them when asked about the media description of Elon Musk as an 'unelected president', while Trump said having someone as smart as Elon Musk to work with him in running the country's affairs is very important. Furthermore, he thinks Musk's team will discover a trillion dollars in wasted money: Fox

- Trump posted on Truth that the Department of Justice has been politicised like never before over the past four years and he therefore instructed the termination of all the remaining “Biden Era” US attorneys.

- Intelligence from the United States and close allies shows that Russian President Vladimir Putin still wants to control all of Ukraine. While Putin is sending representatives to Saudi Arabia for negotiations with the US that are aimed at ending the war, officials said that current intelligence shows Putin still believes he can wait out Ukraine and Europe to eventually control all of Ukraine. NBC

- Trump said that Republicans would not touch Medicaid, also repeating his assertion that Medicare and Social security would not be touched: Punchbowl.

- Pharma leaders are to meet with US President Trump in a push to tweak drug policies: BBG

- China’s decline in new-home prices eased for a fifth month in January, offering hope for an end to the slump. Still, Fitch said a solid rebound in sales is needed to put a floor under prices. BBG

- China’s holdings of Treasuries have fallen to their lowest level since 2009, as Beijing holds more of its US government bonds through lower-profile accounts and diversifies into alternative assets such as gold. Analysts add that part of the change is also Beijing seeking to disguise the true extent of its Treasury holdings to accounts not captured in the data. FT

- Japan’s export growth accelerated to 7.2% year on year in January, driven by shipments to the US. Core machine orders unexpectedly fell in December. BBG

- New Zealand’s central bank slashed its policy rate by 50bp to 3.75%, a move that was expected by investors. WSJ

- UK CPI for Jan overshoots the Street on headline at +3% (vs. the Street +2.8% and up from +2.5% in Dec), although core was inline at +3.7% (vs. +3.2% in Dec) and services fell a tiny bit short at +5% (vs. the Street +5.1% and up from +4.4% in Dec). RTRS

- Traders trimmed bets on further rate cuts from the BOE this year in the wake of a surprise jump in UK inflation, and now see fewer than two more reductions through December. CPI accelerated to 3% in January, the highest level in 10 months. Two-year gilt yields gained. BBG

- Iranian oil flows to China jumped to 1.74 million barrels a day this month, the highest since October, according to Kpler, as traders work around tighter US curbs. BBG

- The DeepSeek-led selloff in AI stocks last month provided the first test this year for whether the low correlation environment would persist. Ultimately, the market reaction was discerning rather than indiscriminate, as stocks moved according to their individual exposure to the new information rather than in unison. On Monday, January 27th, as investors digested the DeepSeek news, the tech-heavy Nasdaq 100 fell by 3% while the equal-weight S&P 500 was flat and the broader S&P 500 fell by just 1% (Furthermore, among the mega-cap tech stocks the market discerned winners and losers, with AAPL gaining 3% and NVDA falling by 17%. Goldman

Tariffs

- US President Trump said he will be announcing large companies that are coming back to the US related to chips and cars, while he added car plants are going to be built in the US and the auto tariff rate will be around 25%. Trump said pharmaceutical tariffs will probably be 25% or higher and will see announcements over the next couple of weeks. Trump also stated he was contacted by companies because of tariffs and that the EU has been very unfair to the US.

- China’s ambassador to WTO said US tariffs create tariff shocks that heighten economic uncertainty, disrupt global trade and risk global recession, while the ambassador added that US unilateralism.

A more detailed look at global markets courtesy of Newsuqawk

APAC stocks traded mixed following the somewhat choppy performance stateside as attention centred on US-Russia talks on Ukraine, while US President Trump reiterated threats of tariffs on autos, chips and pharmaceuticals. ASX 200 was dragged lower by underperformance in energy and the top-weighted financial sector after a double-digit percentage drop in Santos's underlying profit and Big 4 bank NAB also reported a decline in earnings. Nikkei 225 briefly tested the 39,000 level to the downside following disappointing machinery orders and export data. Hang Seng and Shanghai Comp were mixed with sentiment in Hong Kong subdued and the mainland kept afloat in a reversal of recent fortunes, while the US tariff threat lingered and Chinese House Prices continued to contract Y/Y albeit at a less severe pace.

Top Asian News

- RBNZ cut the OCR by 50bps to 3.75%, as expected, while it said rates were reduced further as inflation abates and if economic conditions continue to evolve, there is scope to lower the OCR further in 2025. RBNZ said the committee has the confidence to continue lowering rates and economic activity remains subdued although the economy is expected to recover over 2025. RBNZ lowered its official cash rate forecast to 3.45% for June 2025 (previously 3.83%) and to 3.1% in March 2026 (previously 3.43%), while it sees the OCR at 3.1% in June 2026 (previously 3.32%) and at 3.1% in March 2028.

- RBNZ Governor Orr said the OCR path projects 50bps by mid-year at around July and suggested two 25bp cuts with April and May 'about right', while he added the economy has significant spare capacity and 3.75% is the high end of the range of neutral rates. Furthermore, he said it would be a beautiful world if they could get rates to neutral and keep them there and they are seeing a turnaround in the economy.

- BoJ's Takata said it is necessary for the BoJ to shift gears as appropriate and BoJ's flexibility has increased, while he added Japan's real interest rates remain deeply negative, with no change to the accommodative monetary environment. Takata said they must adjust the degree of monetary support further if the economy moves in line with the BoJ's forecasts and must gradually shift policy, even after January's rate hike, to avoid upside price risks from materialising. However, he also stated the BoJ needs to take a cautious approach in shifting policy due to uncertainty over the US economic outlook and difficulty in gauging the neutral rate level.

- China issues plan to stabilise foreign investment: Will better utilise foreign investment to strengthen supply chain in the manufacturing sector, promote orderly opening up in the BioPharma field. To encourage financial institutions to provide financing services to foreign-funded enterprises. Foreign invested firms will be allowed to use domestic loans to carry out equity investment. Encourages FDI in livestock breeding, feeding equipment production, feed and veterinary drug production. Will facilitate foreign investors with M&A investment in China.

European bourses (STOXX 600 -0.4%) began the session on either side of the unchanged mark, continuing the indecisive mood seen in APAC trade overnight. As the morning progressed, stocks dipped lower, with a more pronounced sell-off seen in recent trade; indices generally at lows. The dip in sentiment does come amid commentary via Ukrainian President Zelensky who noted that the US demanding return of USD 500bln in minerals is "not a serious conversation". Seemingly pushing down optimism regarding a near-term Ukraine-Russia peace deal. European sectors are mixed vs initially opening with a slight negative bias; the breadth of the market is fairly narrow. Energy is towards the top of the pile, with upside facilitated by gains in BP, alongside broadly firmer oil prices; BP benefits on reports that it is mulling selling its lubricants unit, worth around USD 10bln. Basic Resources is the slight underperformer today, with the sectors hampered by losses in Glencore after its FY results disappointed (details in the FTSE 100 section below).

Top European News

- ECB's Schnabel says "we are getting closer to the point where we may have to pause or halt our rate cuts", according to FT. Does not think R-star can be a reliable guide for monetary policy in real-time. "Restriction has come down significantly, up to a point where we can no longer say with confidence that our monetary policy is still restrictive". "I’m not saying our monetary policy is no longer restrictive. What I'm saying is I’m no longer sure whether it is still restrictive. But we should not overstate a difference of 25 basis points". When questioned on "should the ECB drop the reference to restrictiveness in March?", replied "that is a discussion we should have in the next meeting". "I firmly believe in the meeting-by-meeting approach". "...for me, the direction of travel is not so clear anymore". "Both services inflation and wage growth are still at an uncomfortably high level". Should start to see services inflation come down in February. Should stop fine-tuning and responding to single data points.

- ECB's Panetta says signs of weakness in the EZ economy "are more present than we were anticipating". Expected a recovery driven by consumer spending which didn't materialise. A weak economy poses a downward risk for inflation, upward risk is primarily from energy prices. Divergence in regulatory approach between US and Europe poses an issue. Need to avoid starting a de-regulation race. Banking regulation could be simplified.

- UK ONS says average private rents rose by 8.7% in the 12 months to January 2025.

FX

- DXY is steady with the USD showing a mixed performance vs. peers after yesterday's session of gains which some have attributed to a recent pick-up in US yields. Overnight, President Trump stated he will impose 25% tariffs on autos, pharmaceuticals and chips. However, this is a reiteration of recent threats and markets are broadly anticipating a period of "relative calm" ahead of the April 1st deadline. DXY sits towards the top end of yesterday's 106.80-107.22 range, ahead of the FOMC Minutes. Sentiment has been hit in recent trade amid commentary via Ukrainian President Zelensky who noted that the US demanding return of USD 500bln in minerals is "not a serious conversation".

- EUR is softer vs. the USD with macro newsflow for the Eurozone on the light side. As such, geopolitics remains in focus with attention on the fallout from US-Russia discussions on the Ukraine war and what that could mean for the region, mainly via the lens of likely increased issuance for Defence spending. ECB dove Panetta stated that signs of weakness in the EZ economy "are more present than we were anticipating". EUR/USD recently breached the lower end of Tuesday's 1.0435-86 range.

- USD/JPY has traded on both sides of the 152.00 level (151.56-152.31 range) after disappointing Japanese Machinery Orders and Exports, as well as mixed comments from BoJ's Takata who stated the BoJ must gradually shift policy even after January's rate hike to avoid upside price risks from materialising but added that they need to take a cautious approach in shifting policy due to uncertainty.

- GBP is steady vs. the USD following a mixed UK inflation report; CPI Y/Y 3.0% vs. Exp. 2.8% (Prev. 2.5%), Core Y/Y 3.7% vs. Exp. 3.7% (Prev. 3.2%), Services Y/Y 5.0% vs. Market & BoE Exp. 5.20% (Prev. 4.40%). Markets don't fully price the next 25bps rate cut until June with a total of 52bps of cuts seen by year-end. Cable hit a fresh YTD peak at 1.2640 late yesterday but has since faded gains.

- Antipodeans are both firmer vs. the USD with outperformance in the NZD post-RBNZ. NZD was initially pressured after the RBNZ delivered a third consecutive 50bps rate cut and signalled further cuts ahead, although the currency later rebounded off lows after the dust settled and RBNZ Orr suggested at the press conference for a shift to 25bps cuts in April and May.

- PBoC set USD/CNY mid-point at 7.1705 vs exp. 7.2807 (prev. 7.1697).

- Westpac week ahead orders: Buy AUD/CAD at 0.8990, targeting 0.9180, with a trailing stop initially set at 0.8955; Sell CAD/JPY at 107.80, targeting 105.00, with a trailing stop initially set at 108.50.

Fixed Income

- USTs are marginally in the red but essentially flat when compared to EGBs and in particular Gilts. Docket ahead features 20yr supply, FOMC Minutes and remarks from Jefferson (voter) but with the latest building permit/housing start data first. Thus far, specifics for USTs are a little light and as such the benchmark is steady in a slim five tick overnight band between 108-22+ and 108-27. However, it is worth highlighting that long-end benchmarks, particularly the 20yr, trade a little heavy pre-supply.

- A softer morning for EGBs though not to quite the same magnitude as Gilts. Specifics for the bloc light with the focus still firmly on Ukraine and potential defense-related joint issuance. A well-received Bund auction had little impact on German paper.

- Thereafter, remarks via ECB hawk Schnabel, has sparked some additional downside in Bunds, taking them down to fresh lows at 131.58; her comments held a hawkish tilt. She said that “we can no longer say with confidence that our monetary policy is still restrictive", adding that the "we are getting closer to the point where we may have to pause or halt our rate cuts”.

- Gilts are underperforming after a noisy set of inflation data from the UK. Metrics which saw the headline come in hotter than expected though much of this was due to potential one-off factors around Transport and Energy. The all-important Services figure printed cooler than both the BoE and market expected. While there are caveats and positives to the release, this does not however change the overall picture from it of increasing price pressures. The 2028 outing sparked some modest pressure in Gilts, taking UK paper to the a fresh session low of 92.08.

- Amid commentary via Ukrainian President Zelensky who noted that the US demanding return of USD 500bln in minerals is "not a serious conversation", risk-off sentiment crept in. The downside in the complex has subsided and currently traverse worse levels.

- Orders for the new 8yr "BTP Plus" reach EUR 10lbn since start of offer, according to bourse data.

- UK sells GBP 4.25bln 4.375% 2028 Gilt: b/c 3.09x (prev. 3.2x), average yield 4.294% (prev. 4.384%) & tail 0.5bps (prev. 0.2bps)

- Germany sells EUR 3.47bln vs exp. EUR 4.5bln 2.50% 2035 Bund: b/c 2.8x (prev. 2.8x), average yield 2.52% (prev. 2.54%) & retention 22.8% (prev. 23.58%)

Commodities

- Firmer trade across the crude complex amid ongoing geopolitics and with the European Commission this morning targeting Russian aluminium, shadow fleet and tech. Brent Apr resides in a USD 75.80-76.48/bbl parameter. Some modest pressure has been seen in the complex in recent trade amid commentary via Ukrainian President Zelensky, who seemed to pour cold water on the prospects of a near-term solution to the Ukrainian conflict.

- Modest gains were seen across spot gold and silver with the Dollar steady but as spot gold prints fresh record highs, buoyed by the broader geopolitical landscape, with the US-Russia meeting not received well by Ukraine. Spot gold currently resides in a USD 2,942.21-2,947.08/oz range.

- Base metals are mostly firmer following a mostly lower APAC session, with aluminium prices shooting higher after the European Commission unveiled its 16th Russian sanctions package this morning, targeting Russian aluminium, shadow fleet and tech. 3M LME copper resides in a USD 9,407.85-9,494.00/t range.

- US President Trump said he is looking at Venezuela very seriously and may not let Venezuela export oil via Chevron.

- EU envoys have agreed on the 16th sanctions package against Russia, includes primary aluminium import ban and listing of 73 new shadow fleet vessels. European Commission's 16th sanctions package against Russia expected to be formally imposed on Monday, according to WSJ's Norman.

- Glencore (GLEN LN) believes initiatives to remove some regulation will be positive for commodity markets; demand for commodities looks good in China, which is seen growing 5% in 2025.

- Exxon (XOM) reports that flare gas recovery equipment froze up resulting in release of sulphur dioxide at the 275k BPD Joliet Illinois refinery.

- Turkish Energy Minister says have not received any information from Iraq on resuming oil flows from Iraq-Turkey pipeline.

- China's NDRC will cut retail gasoline and diesel prices by CNH 170/ton and CNH 160/ton respectively, starting February 19.

Geopolitics: Ukraine

- Ukrainian President Zelensky says US President Trump is trapped in a disinformation bubble; US demanding return of USD 500bln in minerals is "not a serious conversation"; "I can't sell our country". Nobody in Ukraine trusts [Russian President] Putin.

- Russia's Kremlin says Russian President Putin/US President Trump meeting will take time to prepare, via Tass. Will first need reanimation of Russia-US relations, then restoration, via Tass. Talks in Riyadh is an important step towards Ukraine crisis settlement. Russian and US mainly discussed their own relations yesterday.

- Ukrainian President Zelensky says "he wants to end war with Russia this year", according to Sky News Arabia

- Kremlin says Russian President Putin and US President Trump meeting may occur before the end of February, according to Interfax. Russia will appoint Ukraine negotiator depending on who the US representative is.

- Russian Foreign Minister Lavrov says he assumes that the US intends to remove obstacles that are in the path of promising projects. Have begun to move away from the edge of the abyss where the Biden admin led the US-Russia relationship.

- European Commission President says "We are committed to keep up the pressure on the Kremlin".

- US President Trump said talks with Russia were very good and he is more confident, while he added that he does not think they would have to remove all troops from Europe and it is fine if Europeans want peacekeeping troops in Ukraine. Trump criticised Ukraine who he said wants a seat at the table but noted that Ukraine has had a seat and this could have been settled easily, as well as falsely accused Ukraine of starting the war and suggested Ukraine should hold an election. Furthermore, Trump said it was the Ukrainian leadership that allowed the war to continue so far and he is disappointed after Ukraine denounced its exclusion from US-Russia talks, while he also stated that he will probably meet with Russian President Putin before the end of the month.

- German Defence Minister said Russian threat will remain even with the possibility of peace in Ukraine and their experts estimate that in 4 to 7 years Putin will be able to launch an attack on NATO territory, according to Al Jazeera.

Geopolitics: Other

- China’s Foreign Minister Wang Yi met with Bolivia’s Foreign Minister at the UN and said China is willing to work with Bolivia to elevate their strategic partnership, while he added that Latin America belongs to its people and is not any country’s "backyard", as well as stated that China will always be a trustworthy friend and partner of Latin America.

- N12 reports that the Israeli gov't has begun working on an initiative to allow Gaza Strip residents to voluntarily leave to receptive third nations, article adds that such countries "have not yet been identified".

US Event Calendar

- 07:00: Feb. MBA Mortgage Applications -6.6%, prior 2.3%

- 08:30: Jan. Housing Starts, est. 1.39m, prior 1.5m

- Jan. Housing Starts MoM, est. -7.3%, prior 15.8%

- Jan. Building Permits, est. 1.46m, prior 1.48m

- Jan. Building Permits MoM, est. -1.5%, prior -0.7%

- 08:30: Feb. New York Fed Services Business, prior -5.6

- 14:00: Jan. FOMC Meeting Minutes

DB's Jim Reid concludes the overnight wrap

Markets put in a strong performance yesterday, with both the S&P 500 (+0.24%) and the STOXX 600 (+0.32%) hitting all-time highs. For the S&P 500 that marked a second all-time high of the year. Remarkably, it had already registered 11 all-time highs by this time last year and 57 in 2024 as a whole. Talks over Ukraine were an important catalyst for yesterday’s advance, as hopes for an end to the conflict helped to power the European advance, where equities have seen a clear outperformance against their global counterparts so far this year. Indeed, the STOXX 600 hasn’t seen a weekly decline at all this year, with the index currently on track for a 9th consecutive weekly gain.

US equity futures are edging higher again overnight but Asian equities are more mixed after last night Trump signalled major tariffs on autos, chips and pharmaceuticals. When asked on auto tariffs, he said “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25%”, adding similar comments on the other two sectors. In a report earlier this month (link here), Peter Sidorov highlighted how electronics, autos and pharma are three groups in which the US runs the largest trade deficit so it’s not a surprise to see these being targeted. It remains to be seen which of the floated tariffs will be implemented but there are now many tariff spinning plates in play, with reciprocal tariff investigations also due by early April, steel and aluminium tariffs due on March 12, and the one-month delay to tariffs on Canada and Mexico ending on March 4.

Turning to the latest on Ukraine, yesterday saw the US and Russia commence talks in Saudi Arabia, with US Secretary of State Marco Rubio speaking with Russian Foreign Minister Sergei Lavrov. In a readout from the US State Department, it said they agreed to appoint “high-level teams to begin working on a path to ending the conflict in Ukraine as soon as possible in a way that is enduring, sustainable, and acceptable to all sides.” However, there was no sign yet of a date for a meeting between Presidents Trump and Putin. In the meantime, we had a report from Fox News that the US and Russia were proposing a 3-stage peace plan, according to diplomatic sources close to the talks. That would involve a ceasefire, Ukrainian elections, and signing a final agreement, though Fox reporting later clarified that officials were only “floating” the elections idea at this stage. Trump also referred to the “long time” since Ukraine had an election in his comments later on.

There have been concerns that Europe and Ukraine are being left on the sidelines and yesterday Zelenskiy postponed his own visit to Saudi Arabia, saying “we want no one to decide anything behind our back”. That said, last night Rubio did have a call with major European foreign ministers to brief them on the meeting. And while the direction of travel may be very uncomfortable for Europe politically, markets have been more focused on the prospect of any agreement to end the war rather than the type of agreement. As such European risk assets continued to outperform. In fact, all of the major equity indices posted a fresh advance, which included new records for the STOXX 600 (+0.32%) and the DAX (+0.20%). There was also some positive news from the ZEW survey in Germany, as the expectations component rose to a 7-month high of 26.0 (vs. 20.0 expected). Perhaps the upcoming election is also bringing renewed hope. And even though tech stocks dragged on the main indices, other cyclicals helped to overpower that, with the STOXX Banks Index (+1.96%) up to a 13-year high as well. As a European banker that wasn't the worst news I've had this year.

Elsewhere in Europe, sovereign bonds stabilised after their Monday losses, with yields on 10yr bunds (+0.5bps), OATs (-0.7bps) and OATs (-0.1bps) seeing little movement in either direction. Nevertheless, the broader risk-on tone meant that sovereign bond spreads tightened further, with the Italian-German 10yr spread down to a 3-year low of 105bps. And it was the same story for credit as well, with both Euro IG and HY spreads closing at their tightest in over 3 years, around the time that energy prices began to spike higher and inflation rose meaningfully.

Over in the US, financial markets caught up with the rest of the world as they reopened after Monday’s holiday. The S&P 500 (+0.24%) was little changed for much of the day, but a late rally helped it reach a new all-time high, surpassing its previous record from January 23. The gains were fairly broad with more than 70% of the S&P 500 higher on the day and the Russell 2000 up +0.45%. But the advance was held back by the Magnificent 7 (-0.71%), with Meta (-2.76%) leading on the downside after a remarkable run on 20 consecutive gains that had seen its shares rise +20.5% in the past month. Meanwhile, Intel (+16.06%) was the second-best performer in the S&P 500 following weekend reporting by WSJ and Bloomberg that it could be broken up in a deal involving TSMC and Broadcom.

US Treasuries also struggled by comparison with their European counterparts, with the 10yr yield up +7.4bps on the day to 4.55%. That was in part a catch down to Monday's sell-off and also followed remarks from Fed officials on Monday, who reiterated the message that they were in no hurry to adjust policy. Yesterday’s sizable $30bn slate of IG corporate bond issuance may have also added upward pressure on yields. And in Canada, the 10yr yield surged by +8.4bps on the day, which came after their latest core CPI print surprised on the upside. For instance, both the core inflation measures preferred by the Bank of Canada moved up to +2.7% (+2.6% expected), which led investors to dial back the likelihood of another rate cut at their next meeting.

Here in the UK, gilts underperformed their European counterparts after the latest labour market data surprised on the upside. That included a rise in average weekly earnings to +6.0% (vs. +5.9% expected), whilst the unemployment rate remained at 4.4% (vs. 4.5% expected). So as with the Canadian inflation numbers, that also saw investors dial back the probability of a rate cut from the Bank of England at their next meeting. Yields on 10yr gilts themselves were up +3.0bps on the day, whilst the 2yr yield was up +3.7bs. Watch out for UK CPI just after we go to press.

Coming back to Asia, the Nikkei (-0.31%), the Hang Seng (-0.51%) and the S&P/ASX 200 (-0.73%) are all losing ground. The KOSPI (+1.72%) is the best performer rallying to a 5-month high buoyed by hopes of improving political conditions in the country. Additionally, mainland Chinese stocks are also advancing with the Shanghai Composite (+0.54%) moving higher after the central government vowed to support private industries.

In monetary policy action, the Reserve Bank of New Zealand (RBNZ) lowered the official cash rate by 50bps to 3.75% as expected in its policy meeting, marking its fourth straight cut, as easing inflation offers the central bank room to boost the economy. Additionally, the central bank indicated that it will likely follow with 25bps cut at its April and May policy meetings.

Early morning data showed that Japanese exports rose +7.2% y/y in January (vs +2.8% in December, +7.7% market consensus). Meanwhile, imports rose a bigger-than-expected +16.7% (vs +1.7% in December, +9.3% market consensus), thus leading to a trade deficit of -2.76 trillion yen in January (v/s -2.10 trillion yen expected) and compared with a revised surplus of +0.133 trillion yen in the previous month as worries continue to grow about looming tariffs from the Trump administration.

Looking at yesterday’s other data, the US Empire State manufacturing survey came in at 5.7 in February (vs. 0.0 expected). But there was more negative news from the NAHB’s housing market index, which fell to a five-month low of 42 in February (vs. 46 expected).

To the day ahead now, and data releases include the UK CPI for January, US housing starts and building permits for January. Otherwise from central banks, we’ll get the minutes of the FOMC’s January meeting, and also hear from Fed Vice Chair Jefferson.

US equity futures are lower ahead of today’s FOMC minutes, with global markets also sinking and bonds extended their slide after President Trump’s latest tariff threats stoked concern about a widening trade war; hawkish UK inflation prints which sent bond yields higher did not help. As of 8:00am S&P futures are -0.3% lower after the index topped its January record on Tuesday, while Nasdaq futures traded steady after Trump raised the specter of 25% tariffs on Autos and Pharma, both coming after April 1. The Trump Admin will also keep Biden-era rules on M&A. A slew of earnings reports also dented sentiment, with Arista Networks, Occidental Petroleum, Celanese and Bumble all dropping in premarket trading after results. Super Micro Computer rallied, however, after issuing an aggressive long-term revenue outlook. Pre-mkt, Mag7 names are mixed with Semis seeing some profit-taking. The yield curve is twisting steeper as the USD appreciates. Commodities are stronger despite the USD move; Brent trades above $76 while gold is at an all time high around $2940. Today’s macro data focus will be on Housing data and the Fed Minutes.

In premarket trading, Nvidia is leading gains among the Magnificent Seven (GOOGL +0.3%, AMZN -0.1%, AAPL -0.1%, MSFT -0.02%, META -0.09%, NVDA +0.4% and TSLA -0.1%). Bumble plunged 17% after the online dating company gave a first-quarter forecast that was weaker than expected on key metrics. Etsy tumbled 7% after reporting gross merchandise sales for the fourth quarter that missed the average analyst estimate. Here are some other notable premarket movers:

- Analog Devices (ADI) gains 5% after posting adjusted earnings per share for the first quarter that beat the average analyst estimate.

- Arista Networks (ANET) falls 4% after the computer networking company posted 4Q results.

- Cadence Design Systems (CDNS) slips 3% after the electronic design automation software company gave an outlook that was seen as disappointing.

- Celanese (CE) drops 13% after the chemical firm said it sees “persistently weak global demand” in end markets including paint and coatings.

- Fiverr (FVRR) rises 4% after forecasting 1Q revenue that beat the average analyst estimate.

- Howard Hughes Holdings (HHH) falls 3% after confirming it received an revised unsolicited proposal from Pershing Square and will evaluate the offer.

- International Flavors (IFF) falls 2% after forecasting disappointing sales for 2025.

- RB Global Inc. (RBA) rises 3% after reporting quarterly revenue that beat the average analyst estimate.

- Shift4 Payments (FOUR) declines 10% after the payments processing firm gave a weaker-than-expected outlook for adjusted Ebitda.

- Global Blue (GB) jumps 18% after Shift4 agreed to acquire the shopping technology company for $7.50 per share in cash.

- Star Bulk (SBLK) slips 5% as Jefferies notes that 4Q results were weak due to lower dry bulk spot rates, which have continued into the current quarter.

- Supernus Pharmaceuticals (SUPN) drops 21% after the drugmaker said a mid-stage study of its experimental therapy for treatment-resistant depression failed to meet its primary endpoint.

- Toll Brothers (TOL) falls 5% after the luxury homebuilder reported first-quarter revenue and total home sales that fell short of consensus estimates.

- Wix.com (WIX) rises 2% after the company’s forecast for 1Q revenue disappointed.

Traders’ attention will focus turn to the latest FOMC Minutes which could offer clues on the monetary policy outlook. While inflation has been slowing, many fear the effect of Trump’s tariff push on prices. Several officials, including Governor Christopher Waller and San Francisco Fed chief Mary Daly, have signaled rates will stay on hold until inflation slows significantly.

Separately, on Wednesday, the European Central Bank’s Isabel Schnabel said the bank will have to discuss pausing or ending its rate-cut campaign. Her comments pushed the euro 0.2% lower against the dollar, while bond yields rose across Europe, with 10-year German bund yields up about five basis points. Meanwhile, British 10-year gilt yields rose about six basis points after data showed inflation at a 10-month high.

Investors are also pricing increased government spending on defense should the war in Ukraine draw to an end. “When you think about the outcome of any peace treaty between Ukraine and Russia, that will involve a huge uplift in defense spending from European countries,” said Lilian Chovin, head of asset allocation at Coutts & Co.

Europe’s Stoxx 600 Index dropped 0.5% after another record close on Tuesday. Mining, travel, retail and construction stocks underperform. Sentiment was hurt after Trump warned he is weighing tariffs of around 25% on automobile, semiconductor and pharmaceutical imports. His comments added to the a fragile market picture as hopes for an end to the war in Ukraine were tempered by the exclusion of Ukrainian and European officials from US-Russia talks held on Tuesday. Major markets are all lower ex-Italy as bond yields increase following the UK inflation print. Aero/Def, Energy, Semis among the strongest baskets. Here are some of the biggest movers on Wednesday:

- HSBC shares in London rise 1.1% following a recent strong rally that took the stock to trade at highest since 2001, after the lender reported pretax profit that beat estimates and detailed a $2 billion share buyback.

- Societe BIC shares rise as much as 5.9% to hit their highest level in more than eight months after the French consumer-goods firm posted annual earnings ahead of expectations.

- Glencore shares drop as much as 7.2% to their lowest level in over three years, with analysts pointing to the miner’s disappointing copper production guidance as well as its shareholder returns, which were weighed down by its debt.

- Jet2 shares sink as much as 11%, their biggest drop since July 2023, after the package holiday company’s guidance fell short of analysts’ expectations.

- Philips shares drop 11%, the most since Oct. 28, after the Dutch medical equipment maker said it expects lower demand in China to continue to stymie growth this year.

- Delivery Hero shares fall 5%, the most in a month, after Citigroup downgraded the stock to sell from neutral, citing risk to margins due to mounting competitive pressures in the Middle East.

- Straumann shares fall as much as 4.4% after the Swiss maker of dental equipment posted results with weaker profitability levels.

- Tate & Lyle shares fall as much as 3.5% after Berenberg cut its recommendation on the stock to hold from buy, citing the ingredient maker’s weak FY2026 outlook, and a lack of signs of improvement in pricing conditions.

- BAE Systems shares fall as much as 3.3% after the UK defense firm’s FY25 cash-flow guidance disappointed analysts, who also noted concerns around US and UK budgets and reviews.

- Temenos shares fall as much as 4%, the most since November, as the Swiss banking software company’s guidance was seen dampened by the recently announced sale of Multifonds at a valuation that is deemed too low.

Some investors are also concerned about Germany’s national election on Sunday. While Friedrich Merz of the center-right opposition is expected to become chancellor, polls suggest the far-right Alternative for Germany will become the second-biggest party in parliament.

“I have been selling quite a lot over the last two days as Europe is now pricing the best possible scenario for the next catalysts, which is the Ukraine ceasefire and German elections,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “The situation might get bumpy as both events are going to be more complicated than what the market thinks.”

In FX, the Bloomberg Dollar index rises 0.1%. The kiwi sits atop the G-10 FX leader board, rising 0.3% against the greenback after the RBNZ signaled it would slow the pace of interest-rate cuts after a third straight reduction of 50 bps. The yen rises 0.2%, taking USDJPY down to ~151.80 after BOJ Board Member Takata said it’s important for authorities to continue considering gradual hikes.

In rates, treasuries edged lower, pushing US 10-year yields up 2 basis points to 4.57%; long-end yields are less than 3bp cheaper on the day with 2s10s, 5s30s spreads wider by 2bp-3bp. Gilts led a selloff in European government bonds as traders trim their Bank of England interest-rate cut bets after UK inflation climbed to the highest since March 2024. UK 10-year yields rise 5 bps to 4.61%, although the pound still falls 0.1% to around $1.26. The German 10-year is ~5bp higher as expectations for ECB rate cuts decline; money markets see 72bps of easing by year-end vs about 76bps before Schnabel’s comments. Treasury coupon auctions resume with $16b 20-year sale at 1pm New York time and continue Thursday with $9b 30-year TIPS new issue. WI 20-year yield at around 4.835% is 6.5bp richer than January’s auction, which drew strong demand and stopped through by 1.1bp

In commodities, oil prices advance, with WTI rising 1% to $72.50 a barrel. European natural gas futures are flat having topped €50 a megawatt-hour at one stage. Spot gold rises $8 to around $2,944/oz.

The US event calendar includes January housing starts and building permits and February New York Fed services business activity (8:30am). Fed speaker slate includes Jefferson at 5pm; minutes of January FOMC meeting to be released at 2pm

Market Snapshot

- S&P 500 futures little changed at 6,152.00

- STOXX Europe 600 little changed at 557.19

- MXAP down 0.1% to 189.67

- MXAPJ little changed at 598.35

- Nikkei down 0.3% to 39,164.61

- Topix down 0.3% to 2,767.25

- Hang Seng Index down 0.1% to 22,944.24

- Shanghai Composite up 0.8% to 3,351.54

- Sensex little changed at 75,952.51

- Australia S&P/ASX 200 down 0.7% to 8,419.19

- Kospi up 1.7% to 2,671.52

- German 10Y yield little changed at 2.53%

- Euro little changed at $1.0441

- Brent Futures up 0.8% to $76.41/bbl

- Gold spot up 0.3% to $2,943.81

- US Dollar Index little changed at 107.03

Top Overnight News

- President Donald Trump said he would likely impose tariffs on automobile, semiconductor and pharmaceutical imports of around 25%, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the president’s trade war. BBG

- Trump said the media seeks to sow division between them when asked about the media description of Elon Musk as an ‘unelected president’, while Trump said having someone as smart as Elon Musk to work with him in running the country’s affairs is very important. Furthermore, he thinks Musk’s team will discover a trillion dollars in wasted money: Fox

- Trump posted on Truth that the Department of Justice has been politicised like never before over the past four years and he therefore instructed the termination of all the remaining “Biden Era” US attorneys.

- Intelligence from the United States and close allies shows that Russian President Vladimir Putin still wants to control all of Ukraine. While Putin is sending representatives to Saudi Arabia for negotiations with the US that are aimed at ending the war, officials said that current intelligence shows Putin still believes he can wait out Ukraine and Europe to eventually control all of Ukraine. NBC

- Trump said that Republicans would not touch Medicaid, also repeating his assertion that Medicare and Social security would not be touched: Punchbowl.

- Pharma leaders are to meet with US President Trump in a push to tweak drug policies: BBG

- China’s decline in new-home prices eased for a fifth month in January, offering hope for an end to the slump. Still, Fitch said a solid rebound in sales is needed to put a floor under prices. BBG

- China’s holdings of Treasuries have fallen to their lowest level since 2009, as Beijing holds more of its US government bonds through lower-profile accounts and diversifies into alternative assets such as gold. Analysts add that part of the change is also Beijing seeking to disguise the true extent of its Treasury holdings to accounts not captured in the data. FT

- Japan’s export growth accelerated to 7.2% year on year in January, driven by shipments to the US. Core machine orders unexpectedly fell in December. BBG

- New Zealand’s central bank slashed its policy rate by 50bp to 3.75%, a move that was expected by investors. WSJ

- UK CPI for Jan overshoots the Street on headline at +3% (vs. the Street +2.8% and up from +2.5% in Dec), although core was inline at +3.7% (vs. +3.2% in Dec) and services fell a tiny bit short at +5% (vs. the Street +5.1% and up from +4.4% in Dec). RTRS

- Traders trimmed bets on further rate cuts from the BOE this year in the wake of a surprise jump in UK inflation, and now see fewer than two more reductions through December. CPI accelerated to 3% in January, the highest level in 10 months. Two-year gilt yields gained. BBG

- Iranian oil flows to China jumped to 1.74 million barrels a day this month, the highest since October, according to Kpler, as traders work around tighter US curbs. BBG

- The DeepSeek-led selloff in AI stocks last month provided the first test this year for whether the low correlation environment would persist. Ultimately, the market reaction was discerning rather than indiscriminate, as stocks moved according to their individual exposure to the new information rather than in unison. On Monday, January 27th, as investors digested the DeepSeek news, the tech-heavy Nasdaq 100 fell by 3% while the equal-weight S&P 500 was flat and the broader S&P 500 fell by just 1% (Furthermore, among the mega-cap tech stocks the market discerned winners and losers, with AAPL gaining 3% and NVDA falling by 17%. Goldman

Tariffs

- US President Trump said he will be announcing large companies that are coming back to the US related to chips and cars, while he added car plants are going to be built in the US and the auto tariff rate will be around 25%. Trump said pharmaceutical tariffs will probably be 25% or higher and will see announcements over the next couple of weeks. Trump also stated he was contacted by companies because of tariffs and that the EU has been very unfair to the US.

- China’s ambassador to WTO said US tariffs create tariff shocks that heighten economic uncertainty, disrupt global trade and risk global recession, while the ambassador added that US unilateralism.

A more detailed look at global markets courtesy of Newsuqawk

APAC stocks traded mixed following the somewhat choppy performance stateside as attention centred on US-Russia talks on Ukraine, while US President Trump reiterated threats of tariffs on autos, chips and pharmaceuticals. ASX 200 was dragged lower by underperformance in energy and the top-weighted financial sector after a double-digit percentage drop in Santos’s underlying profit and Big 4 bank NAB also reported a decline in earnings. Nikkei 225 briefly tested the 39,000 level to the downside following disappointing machinery orders and export data. Hang Seng and Shanghai Comp were mixed with sentiment in Hong Kong subdued and the mainland kept afloat in a reversal of recent fortunes, while the US tariff threat lingered and Chinese House Prices continued to contract Y/Y albeit at a less severe pace.

Top Asian News

- RBNZ cut the OCR by 50bps to 3.75%, as expected, while it said rates were reduced further as inflation abates and if economic conditions continue to evolve, there is scope to lower the OCR further in 2025. RBNZ said the committee has the confidence to continue lowering rates and economic activity remains subdued although the economy is expected to recover over 2025. RBNZ lowered its official cash rate forecast to 3.45% for June 2025 (previously 3.83%) and to 3.1% in March 2026 (previously 3.43%), while it sees the OCR at 3.1% in June 2026 (previously 3.32%) and at 3.1% in March 2028.

- RBNZ Governor Orr said the OCR path projects 50bps by mid-year at around July and suggested two 25bp cuts with April and May ‘about right’, while he added the economy has significant spare capacity and 3.75% is the high end of the range of neutral rates. Furthermore, he said it would be a beautiful world if they could get rates to neutral and keep them there and they are seeing a turnaround in the economy.

- BoJ’s Takata said it is necessary for the BoJ to shift gears as appropriate and BoJ’s flexibility has increased, while he added Japan’s real interest rates remain deeply negative, with no change to the accommodative monetary environment. Takata said they must adjust the degree of monetary support further if the economy moves in line with the BoJ’s forecasts and must gradually shift policy, even after January’s rate hike, to avoid upside price risks from materialising. However, he also stated the BoJ needs to take a cautious approach in shifting policy due to uncertainty over the US economic outlook and difficulty in gauging the neutral rate level.

- China issues plan to stabilise foreign investment: Will better utilise foreign investment to strengthen supply chain in the manufacturing sector, promote orderly opening up in the BioPharma field. To encourage financial institutions to provide financing services to foreign-funded enterprises. Foreign invested firms will be allowed to use domestic loans to carry out equity investment. Encourages FDI in livestock breeding, feeding equipment production, feed and veterinary drug production. Will facilitate foreign investors with M&A investment in China.

European bourses (STOXX 600 -0.4%) began the session on either side of the unchanged mark, continuing the indecisive mood seen in APAC trade overnight. As the morning progressed, stocks dipped lower, with a more pronounced sell-off seen in recent trade; indices generally at lows. The dip in sentiment does come amid commentary via Ukrainian President Zelensky who noted that the US demanding return of USD 500bln in minerals is “not a serious conversation”. Seemingly pushing down optimism regarding a near-term Ukraine-Russia peace deal. European sectors are mixed vs initially opening with a slight negative bias; the breadth of the market is fairly narrow. Energy is towards the top of the pile, with upside facilitated by gains in BP, alongside broadly firmer oil prices; BP benefits on reports that it is mulling selling its lubricants unit, worth around USD 10bln. Basic Resources is the slight underperformer today, with the sectors hampered by losses in Glencore after its FY results disappointed (details in the FTSE 100 section below).

Top European News

- ECB’s Schnabel says “we are getting closer to the point where we may have to pause or halt our rate cuts”, according to FT. Does not think R-star can be a reliable guide for monetary policy in real-time. “Restriction has come down significantly, up to a point where we can no longer say with confidence that our monetary policy is still restrictive”. “I’m not saying our monetary policy is no longer restrictive. What I’m saying is I’m no longer sure whether it is still restrictive. But we should not overstate a difference of 25 basis points”. When questioned on “should the ECB drop the reference to restrictiveness in March?”, replied “that is a discussion we should have in the next meeting”. “I firmly believe in the meeting-by-meeting approach”. “…for me, the direction of travel is not so clear anymore”. “Both services inflation and wage growth are still at an uncomfortably high level”. Should start to see services inflation come down in February. Should stop fine-tuning and responding to single data points.

- ECB’s Panetta says signs of weakness in the EZ economy “are more present than we were anticipating”. Expected a recovery driven by consumer spending which didn’t materialise. A weak economy poses a downward risk for inflation, upward risk is primarily from energy prices. Divergence in regulatory approach between US and Europe poses an issue. Need to avoid starting a de-regulation race. Banking regulation could be simplified.

- UK ONS says average private rents rose by 8.7% in the 12 months to January 2025.

FX

- DXY is steady with the USD showing a mixed performance vs. peers after yesterday’s session of gains which some have attributed to a recent pick-up in US yields. Overnight, President Trump stated he will impose 25% tariffs on autos, pharmaceuticals and chips. However, this is a reiteration of recent threats and markets are broadly anticipating a period of “relative calm” ahead of the April 1st deadline. DXY sits towards the top end of yesterday’s 106.80-107.22 range, ahead of the FOMC Minutes. Sentiment has been hit in recent trade amid commentary via Ukrainian President Zelensky who noted that the US demanding return of USD 500bln in minerals is “not a serious conversation”.

- EUR is softer vs. the USD with macro newsflow for the Eurozone on the light side. As such, geopolitics remains in focus with attention on the fallout from US-Russia discussions on the Ukraine war and what that could mean for the region, mainly via the lens of likely increased issuance for Defence spending. ECB dove Panetta stated that signs of weakness in the EZ economy “are more present than we were anticipating”. EUR/USD recently breached the lower end of Tuesday’s 1.0435-86 range.

- USD/JPY has traded on both sides of the 152.00 level (151.56-152.31 range) after disappointing Japanese Machinery Orders and Exports, as well as mixed comments from BoJ’s Takata who stated the BoJ must gradually shift policy even after January’s rate hike to avoid upside price risks from materialising but added that they need to take a cautious approach in shifting policy due to uncertainty.

- GBP is steady vs. the USD following a mixed UK inflation report; CPI Y/Y 3.0% vs. Exp. 2.8% (Prev. 2.5%), Core Y/Y 3.7% vs. Exp. 3.7% (Prev. 3.2%), Services Y/Y 5.0% vs. Market & BoE Exp. 5.20% (Prev. 4.40%). Markets don’t fully price the next 25bps rate cut until June with a total of 52bps of cuts seen by year-end. Cable hit a fresh YTD peak at 1.2640 late yesterday but has since faded gains.

- Antipodeans are both firmer vs. the USD with outperformance in the NZD post-RBNZ. NZD was initially pressured after the RBNZ delivered a third consecutive 50bps rate cut and signalled further cuts ahead, although the currency later rebounded off lows after the dust settled and RBNZ Orr suggested at the press conference for a shift to 25bps cuts in April and May.

- PBoC set USD/CNY mid-point at 7.1705 vs exp. 7.2807 (prev. 7.1697).

- Westpac week ahead orders: Buy AUD/CAD at 0.8990, targeting 0.9180, with a trailing stop initially set at 0.8955; Sell CAD/JPY at 107.80, targeting 105.00, with a trailing stop initially set at 108.50.

Fixed Income

- USTs are marginally in the red but essentially flat when compared to EGBs and in particular Gilts. Docket ahead features 20yr supply, FOMC Minutes and remarks from Jefferson (voter) but with the latest building permit/housing start data first. Thus far, specifics for USTs are a little light and as such the benchmark is steady in a slim five tick overnight band between 108-22+ and 108-27. However, it is worth highlighting that long-end benchmarks, particularly the 20yr, trade a little heavy pre-supply.

- A softer morning for EGBs though not to quite the same magnitude as Gilts. Specifics for the bloc light with the focus still firmly on Ukraine and potential defense-related joint issuance. A well-received Bund auction had little impact on German paper.

- Thereafter, remarks via ECB hawk Schnabel, has sparked some additional downside in Bunds, taking them down to fresh lows at 131.58; her comments held a hawkish tilt. She said that “we can no longer say with confidence that our monetary policy is still restrictive”, adding that the “we are getting closer to the point where we may have to pause or halt our rate cuts”.

- Gilts are underperforming after a noisy set of inflation data from the UK. Metrics which saw the headline come in hotter than expected though much of this was due to potential one-off factors around Transport and Energy. The all-important Services figure printed cooler than both the BoE and market expected. While there are caveats and positives to the release, this does not however change the overall picture from it of increasing price pressures. The 2028 outing sparked some modest pressure in Gilts, taking UK paper to the a fresh session low of 92.08.

- Amid commentary via Ukrainian President Zelensky who noted that the US demanding return of USD 500bln in minerals is “not a serious conversation”, risk-off sentiment crept in. The downside in the complex has subsided and currently traverse worse levels.

- Orders for the new 8yr “BTP Plus” reach EUR 10lbn since start of offer, according to bourse data.

- UK sells GBP 4.25bln 4.375% 2028 Gilt: b/c 3.09x (prev. 3.2x), average yield 4.294% (prev. 4.384%) & tail 0.5bps (prev. 0.2bps)

- Germany sells EUR 3.47bln vs exp. EUR 4.5bln 2.50% 2035 Bund: b/c 2.8x (prev. 2.8x), average yield 2.52% (prev. 2.54%) & retention 22.8% (prev. 23.58%)

Commodities

- Firmer trade across the crude complex amid ongoing geopolitics and with the European Commission this morning targeting Russian aluminium, shadow fleet and tech. Brent Apr resides in a USD 75.80-76.48/bbl parameter. Some modest pressure has been seen in the complex in recent trade amid commentary via Ukrainian President Zelensky, who seemed to pour cold water on the prospects of a near-term solution to the Ukrainian conflict.

- Modest gains were seen across spot gold and silver with the Dollar steady but as spot gold prints fresh record highs, buoyed by the broader geopolitical landscape, with the US-Russia meeting not received well by Ukraine. Spot gold currently resides in a USD 2,942.21-2,947.08/oz range.

- Base metals are mostly firmer following a mostly lower APAC session, with aluminium prices shooting higher after the European Commission unveiled its 16th Russian sanctions package this morning, targeting Russian aluminium, shadow fleet and tech. 3M LME copper resides in a USD 9,407.85-9,494.00/t range.

- US President Trump said he is looking at Venezuela very seriously and may not let Venezuela export oil via Chevron.

- EU envoys have agreed on the 16th sanctions package against Russia, includes primary aluminium import ban and listing of 73 new shadow fleet vessels. European Commission’s 16th sanctions package against Russia expected to be formally imposed on Monday, according to WSJ’s Norman.

- Glencore (GLEN LN) believes initiatives to remove some regulation will be positive for commodity markets; demand for commodities looks good in China, which is seen growing 5% in 2025.

- Exxon (XOM) reports that flare gas recovery equipment froze up resulting in release of sulphur dioxide at the 275k BPD Joliet Illinois refinery.

- Turkish Energy Minister says have not received any information from Iraq on resuming oil flows from Iraq-Turkey pipeline.

- China’s NDRC will cut retail gasoline and diesel prices by CNH 170/ton and CNH 160/ton respectively, starting February 19.

Geopolitics: Ukraine

- Ukrainian President Zelensky says US President Trump is trapped in a disinformation bubble; US demanding return of USD 500bln in minerals is “not a serious conversation”; “I can’t sell our country”. Nobody in Ukraine trusts [Russian President] Putin.

- Russia’s Kremlin says Russian President Putin/US President Trump meeting will take time to prepare, via Tass. Will first need reanimation of Russia-US relations, then restoration, via Tass. Talks in Riyadh is an important step towards Ukraine crisis settlement. Russian and US mainly discussed their own relations yesterday.

- Ukrainian President Zelensky says “he wants to end war with Russia this year”, according to Sky News Arabia

- Kremlin says Russian President Putin and US President Trump meeting may occur before the end of February, according to Interfax. Russia will appoint Ukraine negotiator depending on who the US representative is.

- Russian Foreign Minister Lavrov says he assumes that the US intends to remove obstacles that are in the path of promising projects. Have begun to move away from the edge of the abyss where the Biden admin led the US-Russia relationship.

- European Commission President says “We are committed to keep up the pressure on the Kremlin”.

- US President Trump said talks with Russia were very good and he is more confident, while he added that he does not think they would have to remove all troops from Europe and it is fine if Europeans want peacekeeping troops in Ukraine. Trump criticised Ukraine who he said wants a seat at the table but noted that Ukraine has had a seat and this could have been settled easily, as well as falsely accused Ukraine of starting the war and suggested Ukraine should hold an election. Furthermore, Trump said it was the Ukrainian leadership that allowed the war to continue so far and he is disappointed after Ukraine denounced its exclusion from US-Russia talks, while he also stated that he will probably meet with Russian President Putin before the end of the month.

- German Defence Minister said Russian threat will remain even with the possibility of peace in Ukraine and their experts estimate that in 4 to 7 years Putin will be able to launch an attack on NATO territory, according to Al Jazeera.

Geopolitics: Other

- China’s Foreign Minister Wang Yi met with Bolivia’s Foreign Minister at the UN and said China is willing to work with Bolivia to elevate their strategic partnership, while he added that Latin America belongs to its people and is not any country’s “backyard”, as well as stated that China will always be a trustworthy friend and partner of Latin America.

- N12 reports that the Israeli gov’t has begun working on an initiative to allow Gaza Strip residents to voluntarily leave to receptive third nations, article adds that such countries “have not yet been identified”.

US Event Calendar

- 07:00: Feb. MBA Mortgage Applications -6.6%, prior 2.3%

- 08:30: Jan. Housing Starts, est. 1.39m, prior 1.5m

- Jan. Housing Starts MoM, est. -7.3%, prior 15.8%

- Jan. Building Permits, est. 1.46m, prior 1.48m

- Jan. Building Permits MoM, est. -1.5%, prior -0.7%

- 08:30: Feb. New York Fed Services Business, prior -5.6

- 14:00: Jan. FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

Markets put in a strong performance yesterday, with both the S&P 500 (+0.24%) and the STOXX 600 (+0.32%) hitting all-time highs. For the S&P 500 that marked a second all-time high of the year. Remarkably, it had already registered 11 all-time highs by this time last year and 57 in 2024 as a whole. Talks over Ukraine were an important catalyst for yesterday’s advance, as hopes for an end to the conflict helped to power the European advance, where equities have seen a clear outperformance against their global counterparts so far this year. Indeed, the STOXX 600 hasn’t seen a weekly decline at all this year, with the index currently on track for a 9th consecutive weekly gain.

US equity futures are edging higher again overnight but Asian equities are more mixed after last night Trump signalled major tariffs on autos, chips and pharmaceuticals. When asked on auto tariffs, he said “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25%”, adding similar comments on the other two sectors. In a report earlier this month (link here), Peter Sidorov highlighted how electronics, autos and pharma are three groups in which the US runs the largest trade deficit so it’s not a surprise to see these being targeted. It remains to be seen which of the floated tariffs will be implemented but there are now many tariff spinning plates in play, with reciprocal tariff investigations also due by early April, steel and aluminium tariffs due on March 12, and the one-month delay to tariffs on Canada and Mexico ending on March 4.

Turning to the latest on Ukraine, yesterday saw the US and Russia commence talks in Saudi Arabia, with US Secretary of State Marco Rubio speaking with Russian Foreign Minister Sergei Lavrov. In a readout from the US State Department, it said they agreed to appoint “high-level teams to begin working on a path to ending the conflict in Ukraine as soon as possible in a way that is enduring, sustainable, and acceptable to all sides.” However, there was no sign yet of a date for a meeting between Presidents Trump and Putin. In the meantime, we had a report from Fox News that the US and Russia were proposing a 3-stage peace plan, according to diplomatic sources close to the talks. That would involve a ceasefire, Ukrainian elections, and signing a final agreement, though Fox reporting later clarified that officials were only “floating” the elections idea at this stage. Trump also referred to the “long time” since Ukraine had an election in his comments later on.

There have been concerns that Europe and Ukraine are being left on the sidelines and yesterday Zelenskiy postponed his own visit to Saudi Arabia, saying “we want no one to decide anything behind our back”. That said, last night Rubio did have a call with major European foreign ministers to brief them on the meeting. And while the direction of travel may be very uncomfortable for Europe politically, markets have been more focused on the prospect of any agreement to end the war rather than the type of agreement. As such European risk assets continued to outperform. In fact, all of the major equity indices posted a fresh advance, which included new records for the STOXX 600 (+0.32%) and the DAX (+0.20%). There was also some positive news from the ZEW survey in Germany, as the expectations component rose to a 7-month high of 26.0 (vs. 20.0 expected). Perhaps the upcoming election is also bringing renewed hope. And even though tech stocks dragged on the main indices, other cyclicals helped to overpower that, with the STOXX Banks Index (+1.96%) up to a 13-year high as well. As a European banker that wasn’t the worst news I’ve had this year.

Elsewhere in Europe, sovereign bonds stabilised after their Monday losses, with yields on 10yr bunds (+0.5bps), OATs (-0.7bps) and OATs (-0.1bps) seeing little movement in either direction. Nevertheless, the broader risk-on tone meant that sovereign bond spreads tightened further, with the Italian-German 10yr spread down to a 3-year low of 105bps. And it was the same story for credit as well, with both Euro IG and HY spreads closing at their tightest in over 3 years, around the time that energy prices began to spike higher and inflation rose meaningfully.

Over in the US, financial markets caught up with the rest of the world as they reopened after Monday’s holiday. The S&P 500 (+0.24%) was little changed for much of the day, but a late rally helped it reach a new all-time high, surpassing its previous record from January 23. The gains were fairly broad with more than 70% of the S&P 500 higher on the day and the Russell 2000 up +0.45%. But the advance was held back by the Magnificent 7 (-0.71%), with Meta (-2.76%) leading on the downside after a remarkable run on 20 consecutive gains that had seen its shares rise +20.5% in the past month. Meanwhile, Intel (+16.06%) was the second-best performer in the S&P 500 following weekend reporting by WSJ and Bloomberg that it could be broken up in a deal involving TSMC and Broadcom.

US Treasuries also struggled by comparison with their European counterparts, with the 10yr yield up +7.4bps on the day to 4.55%. That was in part a catch down to Monday’s sell-off and also followed remarks from Fed officials on Monday, who reiterated the message that they were in no hurry to adjust policy. Yesterday’s sizable $30bn slate of IG corporate bond issuance may have also added upward pressure on yields. And in Canada, the 10yr yield surged by +8.4bps on the day, which came after their latest core CPI print surprised on the upside. For instance, both the core inflation measures preferred by the Bank of Canada moved up to +2.7% (+2.6% expected), which led investors to dial back the likelihood of another rate cut at their next meeting.

Here in the UK, gilts underperformed their European counterparts after the latest labour market data surprised on the upside. That included a rise in average weekly earnings to +6.0% (vs. +5.9% expected), whilst the unemployment rate remained at 4.4% (vs. 4.5% expected). So as with the Canadian inflation numbers, that also saw investors dial back the probability of a rate cut from the Bank of England at their next meeting. Yields on 10yr gilts themselves were up +3.0bps on the day, whilst the 2yr yield was up +3.7bs. Watch out for UK CPI just after we go to press.

Coming back to Asia, the Nikkei (-0.31%), the Hang Seng (-0.51%) and the S&P/ASX 200 (-0.73%) are all losing ground. The KOSPI (+1.72%) is the best performer rallying to a 5-month high buoyed by hopes of improving political conditions in the country. Additionally, mainland Chinese stocks are also advancing with the Shanghai Composite (+0.54%) moving higher after the central government vowed to support private industries.

In monetary policy action, the Reserve Bank of New Zealand (RBNZ) lowered the official cash rate by 50bps to 3.75% as expected in its policy meeting, marking its fourth straight cut, as easing inflation offers the central bank room to boost the economy. Additionally, the central bank indicated that it will likely follow with 25bps cut at its April and May policy meetings.

Early morning data showed that Japanese exports rose +7.2% y/y in January (vs +2.8% in December, +7.7% market consensus). Meanwhile, imports rose a bigger-than-expected +16.7% (vs +1.7% in December, +9.3% market consensus), thus leading to a trade deficit of -2.76 trillion yen in January (v/s -2.10 trillion yen expected) and compared with a revised surplus of +0.133 trillion yen in the previous month as worries continue to grow about looming tariffs from the Trump administration.

Looking at yesterday’s other data, the US Empire State manufacturing survey came in at 5.7 in February (vs. 0.0 expected). But there was more negative news from the NAHB’s housing market index, which fell to a five-month low of 42 in February (vs. 46 expected).

To the day ahead now, and data releases include the UK CPI for January, US housing starts and building permits for January. Otherwise from central banks, we’ll get the minutes of the FOMC’s January meeting, and also hear from Fed Vice Chair Jefferson.

Loading…