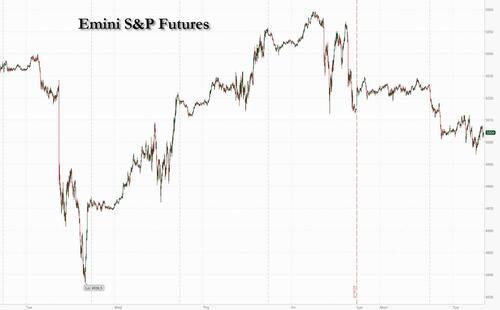

After a flat Monday when US cash market were closed for President's Day, equity futures are pointing to a lower open on Tuesday as the latest earnings reports and corporate news failed to shake concerns about higher-for-longer interest rates and the faltering Chinese economy, while markets braced for the main event: tomorrow's NVDA earnings after the close. As of 8:00am contracts on the S&P 500 fall 0.3% but rebounded from session lows and were trading just above 5,000; Nasdaq 100 futures lost 0.5%. European stocks were mixed while Asian stocks pulled back from their highest level since April 2022 amid a lack of positive momentum, with a reduction in China’s mortgage reference rate failing to lift sentiment. 10Y yields dropped 1 basis point from Friday's close (cash Treasuries were closed on Monday), while gold rose, the dollar dipped and bitcoin traded back over $52,000 erasing overnight losses. The only notable macro event today is the Leading Index (exp.-0.3, last -0.1).

In premarktet trading, AI bellwether Nvidia declined ahead of its widely anticipated earnings report due Wednesday. Credit card company Discover Financial surged after Capital One agreed to buy the credit card issuer; Capital One dropped. Here are some other notable premarket movers:

- GlobalFoundries (GFS) gains 7% as the US plans to award $1.5 billion to the largest domestic maker of made-to-order semiconductors under the so-called Chips Act grant.

- Home Depot (HD) slips 2% after reporting a fourth consecutive quarterly revenue decline.

- Intel (INTC) rises 3% after Bloomberg reported that the Biden administration is in talks to give more than $10 billion in subsidies to the chipmaker.

- Iovance Biotherapeutics (IOVA) rallies 21% as analysts boost their price targets on optimism for the drug developer’s newly approved treatment for patients with advanced melanoma.

- Medtronic (MDT) rises 3% after the medical-device maker boosted its sales and adjusted earnings per share forecasts for the full year.

- SSR Mining (SSRM) drops 10% as Turkey canceled the environmental licenses of a gold mine operated by a unit of the company following a landslide.

Among companies reporting earnings, Walmart rose a2% fter an beat, even though it delivered softer guidance. Medtronic Plc climbed after the medial device maker boosted sales. Home Depot Inc. declined after reporting a fifth consecutive drop in quarterly revenue.

Stocks closed lower last week, breaking a streak of 15 higher weeks in the past 16, as traders moved Fed rate-cut expectations out to June, from March, as a barrage of Fed officials warned against over-exuberant expectations of policy easing, and economic data continued to surprise to the upside. Former US Treasury Secretary Lawrence Summers said on Friday “there’s a meaningful chance” the next move is up.

Investors will thus be wary ahead of the Fed January meeting minutes to be released Wednesday, but most of the focus will be on Nvidia. The chip giant has surpassed the market value of Amazon.com Inc on the expectation it will be a big winner from artificial intelligence developments. The two companies together with Meta and Microsoft have collectively contributed almost 60% of the S&P 500’s year-to-date rally.

“Nvidia results on Wednesday could be a turning point for the markets,” Charles-Henry Monchau, chief investment officer for Banque Syz, said on Bloomberg Television. “The market relies on very few large-cap growth stocks and if they disappoint for any reason there is a risk of a pullback.”

European stocks look set to fall for the first time in four days albeit slightly, after a four-day rising streak that took it to within two points of its January 2022 record high on Monday. Mining shares are among the worst performers as iron ore prices fall to a three-month low: Miners Anglo American Plc and Rio Tinto Plc led basic-resources stocks lower after a slump in iron ore prices, with Bloomberg’s index of industrial metals down 0.7%. The chemicals sub-sector outperformed, with Air Liquide SA jumping more than 4% after the French gas producer beat analysts’ expectations for margin expansion. Barclays Plc soared as much as 6% after announcing plans for capital returns. Here are the biggest movers Tuesday:

- Barclays rises the most in more than three years after the UK bank said it will return £10b to shareholders over the next three years and announced plans to reduce costs by £2b

- Air Liquide rises as much as 6.4%, reaching a record high, after reporting 2023 earnings. The French industrial gas manufacturer pleased analysts by doubling its mid-term margin target

- InterContinental Hotels rises as much as 3.6%, reversing initial losses and climbing to fresh record highs after outlining a new $800 million share buyback alongside in-line FY results

- Evolution shares rise as much as 4.9% to their highest intraday level since July after the New Jersey Division of Gaming Enforcement (NJDGE) closed an investigation into the company

- Plus500 rises as much as 4.9% after the online trading company delivered results for 2023 that were in line with guidance, while announcing new distributions of $175m to shareholders

- Argenx rises as much as 2.3% after KBC upgraded the biotech company to buy on account of a more bullish view for its key drug Vyvgart after it receved a priority review with the US FDA

- Grifols falls as much as 7.3% in Madrid after short seller Gotham City Research poses new questions to the pharmaceutical company in a document published on its website

- Mobico shares plummet as much as 21%, the most since October, after the bus and rail operator delayed publication of its full-year results to the end of March

- Sandoz slips as much as 7.1% as Morgan Stanley cuts to equal-weight, saying the stock’s valuation gap has closed and there is now some debate over its upcoming 2023 results and outlook

- Also Holding shares fall as much as 12%, the most since 2020, after the Swiss IT distributor reported Ebitda missing analyst estimates, citing a “challenging environment”

Earlier in the session, Asian stocks pulled back from their highest level since April 2022 amid a lack of positive momentum, with a reduction in China’s mortgage reference rate failing to lift sentiment. The MSCI Asia Pacific Index dropped as much as 0.4%, with consumer discretionary and materials declining by the most. China’s benchmark CSI 300 slipped, suggesting investors remain skeptical that a record cut in the five-year loan prime rate will be sufficient to boost property demand.

- Hang Seng and Shanghai Comp. were lacklustre as tech weakness in Hong Kong clouded over the gains in the energy sector, while the mainland was rangebound as participants digested the announcement of the PBoC's latest benchmark rates in which the 1-year LPR was surprisingly maintained at 3.45% (exp. 5bps cut), but the 5-year LPR was cut by 25bps (exp. 10bps cut).

- ASX 200 was dragged lower by miners after BHP reported flat underlying profits and cut its dividend by 20%.

- Nikkei 225 reversed its earlier advances as momentum stalled and the 1989 record high remained elusive.

- Indian stocks advanced for a sixth consecutive day, their longest run since early December, as lenders rose.

- The S&P BSE Sensex Index neared its all-time high, rising 0.5% to 73,057.40 in Mumbai, while the NSE Nifty 50 Index extended its record run. The Sensex is now less than 0.5% short of its peak seen in early January.

In FX, the dollar slipped versus major peers amid a thin data calendar; the Bloomberg Dollar Spot Index erased a 0.1% advance to trade 0.1% lower on the day. The pound rises 0.1% as BOE Governor Bailey testifies to the Treasury Committee. “There doesn’t seem to be much appetite to embrace fresh USD longs here, but we think DXY can retain the bulk of its gains,” Richard Franulovich, FX strategist at Westpac Banking Corp., wrote in a note. The greenback might find support from Federal Reserve commentary, he added, “with officials likely to reinforce a patient and careful message, keeping first half Fed rate cut bets at bay.”

In rates, treasuries were mixed with the curve steeper as front-end yields drop around 2.5bps vs Friday close while long-end trades slightly cheaper on the day. Treasuries 2s10s, 5s30s spreads are steeper by ~2bp on the day with 10-year yield around 4.27%, down 1 bp vs Friday close. Core European rates outperform, led by front-end of UK curve after Bank of England Governor Andrew Bailey said inflation doesn’t need to fall to target before policymakers start lowering interest rates. UK yields richer by 4bp to 6bp across the curve with front-end and belly outperforming as more premium for BOE cuts is added following Bailey comments. Bunds also rose as ECB data showed euro-zone wage growth slowed at the end of 2023. According to Bloomberg calcs, credit issuance slate has begun to build, with syndicate desks anticipating a weekly total of about $45b, following $37b last week. Treasury auctions this week include $16b 20-year bond sale Wednesday.

Bitcoin holds just shy of USD 52k, whilst Ethereum (-1.9%) gives back some of the recent advances.

In commodities, oil prices declined, with Brent falling 0.7% to trade near $83. Spot gold rises 0.5%.

Looking to the day ahead now, and data releases include Canada’s CPI for January, and the February Philadelphia Fed non-manufacturing activity (8:30am) and the Conference Board’s January Leading index (10am). From central banks, we’ll hear from BoE Governor Bailey. Finally, earnings releases include Walmart and Home Depot.

Market Snapshot

- S&P 500 futures down 0.3% to 5,003.75

- STOXX Europe 600 down 0.2% to 491.50

- MXAP little changed at 171.14

- MXAPJ up 0.2% to 522.96

- Nikkei down 0.3% to 38,363.61

- Topix down 0.3% to 2,632.30

- Hang Seng Index up 0.6% to 16,247.51

- Shanghai Composite up 0.4% to 2,922.73

- Sensex up 0.3% to 72,945.96

- Australia S&P/ASX 200 little changed at 7,659.05

- Kospi down 0.8% to 2,657.79

- German 10Y yield little changed at 2.38%

- Euro little changed at $1.0789

- Brent Futures down 0.6% to $83.07/bbl

- Brent Futures down 0.6% to $83.06/bbl

- Gold spot up 0.3% to $2,023.75

- U.S. Dollar Index little changed at 104.22

Top Overnight News

- Capital One said it will buy Discover Financial Services for more than $35 billion, a deal that will marry two of the largest credit-card companies in the U.S. Under the terms of the all-stock deal, Discover shareholders are set to receive 1.0192 Capital One shares for each Discover share, representing a premium of about 27% based on Discover’s closing price Friday. After the deal closes, Capital One shareholders will hold roughly 60% of the combined company, with Discover shareholders owning the rest. WSJ

- China cut its 5-year Loan Prime Rate, on which mortgage loans are priced, by a record 25bp to 3.95% from 4.2% (the Street was anticipating only a 10bp cut to 4.1%). FT

- Foreign businesses’ direct investment into China last year increased by the lowest amount since the early 1990s, underscoring challenges for the nation as Beijing seeks more overseas funds to help its economy. China’s direct investment liabilities in its balance of payments stood at $33 billion last year, according to data from the State Administration of Foreign Exchange released Sunday. BBG

- The FBI is “laser focused” on Chinese efforts to insert malicious software code into computer networks in ways that could disrupt critical US infrastructure, according to the agency’s director Christopher Wray. FT

- Brussels is to impose its first ever fine on tech giant Apple for allegedly breaking EU law over access to its music streaming services, according to five people with direct knowledge of the long-running investigation. The fine, which is in the region of €500mn and is expected to be announced early next month, is the culmination of a European Commission antitrust probe into whether Apple has used its own platform to favour its services over those of competitors. FT

- Barclays jumped after C.S. Venkatakrishnan announced plans to return £10 billion of capital to shareholders between 2024 and 2026, and to reduce costs by £2 billion. The firm also aims to boost returns above 12% and lift revenue to £30 billion — a high bar, said Bloomberg Intelligence. Corporate and investment bank revenue missed estimates. It plans to reorganize into five divisions, and named Adeel Khan as sole head of Global Markets. Banker bonuses fell 43% last year. Top execs also shared some of the pain, with Venkat’s bonus falling 27%. BBG

- Iran is urging its various proxy partners in the Middle East to temper their attacks against US forces in the region as Tehran seeks to avoid a direct conflict with Washington (the words may be bearing fruit as attacks have dropped over the last couple of weeks). WaPo

- US economy receives a major boost from all the aid money flowing to Ukraine – of the ~$61B earmarked for Ukraine in the $95B supplemental bill, about 65% would flow right back to the American defense industrial base. WSJ

- US oil production may be at a peak – output has surged over the last few years, but the pace of increase in 2024 is expected to plummet due to falling prices and sector M&A. US natural gas prices have plunged to a near-three-decade low as what is set to be the country’s warmest winter on record slashes demand for the heating fuel just as production surges to record levels. Winter months, when heating demand is highest, are on track this year to be the mildest since reliable records began in 1950, analysts said, leaving gas usage much lower than expected. WSJ / FT

- GIR raises our S&P 500 year-end 2024 index target to 5200 (from 5100), reflecting 4% upside from the current level. In December, we lifted our target from 4700 to 5100 to reflect an outlook for more dovish policy, lower real interest rates, and higher valuations than we had originally expected. Our target upgrade today reflects an improved earnings outlook. We continue to expect the S&P 500 forward P/E multiple will end the year at roughly 19.5x, a slight contraction from today’s 20x multiple.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with mild losses with price action contained following the US holiday lull. ASX 200 was dragged lower by miners after BHP reported flat underlying profits and cut its dividend by 20%. Nikkei 225 reversed its earlier advances as momentum stalled and the 1989 record high remained elusive. Hang Seng and Shanghai Comp. were lacklustre as tech weakness in Hong Kong clouded over the gains in the energy sector, while the mainland was rangebound as participants digested the announcement of the PBoC's latest benchmark rates in which the 1-year LPR was surprisingly maintained at 3.45% (exp. 5bps cut), but the 5-year LPR was cut by 25bps (exp. 10bps cut).PBOC LPR REVIEW: 1yr maintained but the 5yr cut, likely designed to support the property sector. Click here for more details.

Top Asian News

- PBoC 1-Year Loan Prime Rate (Feb) 3.45% vs Exp. 3.40% (Prev. 3.45%); PBoC 5-Year Loan Prime Rate (Feb) 3.95% vs Exp. 4.10% (Prev. 4.20%)

- Chinese Foreign Minister Wang told his Spanish counterpart that China is ready to maintain high-level exchanges with Spain and strengthen the synergy of development strategies, as well as deepen mutually beneficial cooperation. Wang said China regards the EU as an important force in the multipolar pattern and supports European integration, the development and growth of the EU, and realising strategic autonomy. Furthermore, he said as long as China and the EU strengthen solidarity and cooperation, bloc confrontation will not arise and they are ready to work with the EU to uphold the free trade system, practice multilateralism, promote an equal and orderly multipolar world and inclusive economic globalisation.

- RBA Minutes from the February 6th Meeting stated that the board considered the case to hike by 25bps or hold steady, while the case to hold steady was the stronger one and appropriate given balanced risks to the outlook. The minutes also stated the data gave the board more confidence inflation would return to target in a reasonable timeframe although it would "take some time" before the board could be confident enough about inflation. Furthermore, the board agreed it was appropriate not to rule out another rise in rates and noted that hiking rates would not prevent it from cutting should the economy weaken.

European bourses, Stoxx600 (-0.1%), began the session on a weaker footing and trade throughout the morning has been choppy/mixed. The CAC 40 (+0.2%) outperforms, lifted by post-earning strength in Air Liquide (+5.9%). European sectors hold a negative tilt; Chemicals outperform, with the sector lifted by Air Liquide. Basic Resources is hampered by poor BHP results, peers Anglo American and Rio Tinto lag. US Equity Futures (ES -0.3%, NQ -0.4%, RTY -0.9%) are trading modestly weaker, with clear underperformance in the RTY, as it continues the prior session’s weakness; focus ahead on key retail earnings including Walmart (WMT) In terms of stock specifics, Capital One (-4.5%) is to acquire Discover Financial Services (+14.6%) in an all-stock transaction valued at USD 35.3bln. Click here and here for the sessions European pre-market equity newsflow, including earnings from Air Liquide, Antofagasta, Barclays, IHG, Fresenius Medical Care and more.

Top European News

- EU New car registrations: +12.1% in January 2024; battery electric 10.9% (prev. 9.5%) market share; Volkswagen (VOW3 GY) +11.5% Y/Y; Stellantis (STLAM IM/STLAP FP) +15% Y/Y; Renault (RNO FP) -2.9% Y/Y; BMW (BMW GY) +28.2% Y/Y; Mercedes-Benz (MBG GY) -7.5% Y/Y; Volvo Cars (VOLCARB SS) +34.9%

- Goldman Sachs expects the BoE to begin cutting rates in June (prev. May)

Earnings

- Air Liquide (AI FP) - FY23 (EUR): Net 3.08bln (exp. 3.40bln), Op. 5.07bln (exp. 5.05bln), Revenue 27.6bln (exp. 27.7bln). Confirms its advanced financial objectives. Payment of EUR 3.20/shr will be proposed to shareholders for 2023, +8.5% Y/Y. Shares +5.9% in European trade

- Antofagasta (ANTO LN) – FY (USUD): Revenue 6.3bln (exp. 6.3bln), EBITDA 3.08bln (exp. 3.08bln), PBT 1.97bln (1.73bln). Outlook for the Co. and shareholders is positive. Recommenced a 0.243/shr dividend. (Newswires) Shares +4.1% in European trade

- Barclays (BARC LN) - Q4 (GBP): CIB revenue 2.39bln (exp. 2.55bln). NII 3.14bln (exp. 3bln). FICC 724mln (exp. 830.8mln). Sees 2024 rote above +10% (exp. +9.2%). Sees 2024 CET1 ratio 13-14% (exp. 14.2%). Plans to return at least GBP 10bln between 2024-2026. (Newswires)

- IHG (IHG LN) – FY23 (USD): Adj. EPS 3.76 (exp. 3.76), Revenue 2.16bln (exp. 2.16bln, prev. 1.84bln Y/Y), Op. 1.02bln (prev. 828mln Y/Y), RevPAR +16.1% Y/Y, +10.9% vs 2019. To commence 800mln share buyback. (Newswires)Shares +5.9% in European trade

- Mining names - BHP (BHP AT) - H1 (USD) profit after tax attributable 927mln (prev. 6.5bln Y/Y), underlying profit 6.6bln (prev. 6.6bln Y/Y), underlying EBITDA USD 13.9bln (prev. 13.2bln Y/Y), rev. 27.2bln (prev. 25.7bln Y/Y), lowers the H1 dividend by 20% to USD 0.72/shr. Says: The external operating environment in calendar year 2023 was relatively volatile. (Newswires) Shares fell 1.1% in Australian trade.

- Fresenius Medical Care (FME GY) - Q4 (EUR): EPS 0.88 (exp. 0.33), EBIT 428mln (exp. 382mln), Revenue 4.99bln (exp. 4.94bln). Guides initial FY24 Revenue "grow low to mid-single-digit % Y/Y", Op "grow mid to high teen % Y/Y". Affirms FY25 Op. margin 10-14% (prev. guided 10-14%). (Newswires) Shares +4.6% in European trade

FX

- Tight parameters (104.06-41) for the DXY with catalysts lacking. In recent trade, the Dollar has been making its way lower towards the round 104.00 mark, pressured by mild upside in G10 peers.

- EUR is edging mild gains vs. USD but focus remains on whether the incremental move above 1.08 sticks or not, with EUR/USD having now surpassed the 21DMA at 1.0796. The ECB EZ wage metrics provided little impetus for the EUR.

- JPY back on a 150.00 handle with the pair having chopped and changed around this in recent sessions. Focus remains on the 150.88 YTD peak.

- CNH is around flat vs. the USD despite PBoC easing measures overnight. ING suggests this and the muted reaction to Lunar NY spending shows "expectations of a recovery in China’s growth sentiment will be gradual at best".

- Antipodeans are both a touch firmer vs. the USD with AUD supported by Chinese stimulus efforts and considerations of an RBA high in the latest minutes.

- PBoC set USD/CNY mid-point at 7.1068 vs exp. 7.2018 (prev. 7.1032).

Fixed Income

- USTs are a touch firmer after the President's Day holiday. Newsflow has been limited thus far but the larger than expected PBoC LPR cut to the 5yr is perhaps having some influence given the US markets sensitivity to property/CRE-related updates; currently holds near highs at 109-30.

- Bunds are bid as action picks up after Monday's US holiday-induced lull. There was no reaction to the ECB negotiated wage metrics, which only incrementally lessened from the prior, therefore having little impact on market pricing for the April/June ECB decisions; Bund peak for today at 133.27 thus far.

- Gilt price action is in-fitting with EGBs directionally and in terms of magnitude; firmer by around 50 ticks at 97.98 high, surpassing Friday's 97.76 peak but stalling on approach to the figure

- UK sells GBP 1.75bln 4.00% 2063: b/c 2.92x, average yield 4.518%, tail 0.6bps. No pronounced reaction

- Germany sells EUR 4.138bln vs exp. EUR 5bln 2.50% 2026: b/c 1.91 (prev. 1.8x), average yield 2.79% (prev. 2.44%), retention 17.24% (prev. 17.40%). No pronounced reaction

Commodities

- Crude is subdued as China woes are reflected across commodities with one eye on geopolitics, with the situation in the Middle East expected to escalate in the coming month; Brent Apr currently holds below USD 83/bbl.

- Precious metals see a mild upward bias in tandem with price action in the Dollar and awaiting the next catalyst ahead of tomorrow's FOMC Minutes; XAU tests Monday's high (2,023.07/oz) ahead of the 50 DMA (2,030.32/oz).

- Base metals are mostly subdued, particularly for iron ore with traders citing ongoing woes surrounding China's economy, whilst the PBoC's 5yr LPR cut failed to provide relief.

- Three tankers with Russian Sokol oil onboard started to move to ports in China and India after being stored for three months, while two of the tankers are under US sanctions and are heading towards China.

Geopolitics - Middle East

- EU Foreign Policy Chief Borrell said 26 EU countries called for an immediate humanitarian pause that would lead to a sustainable ceasefire in Gaza.

- US proposed a rival draft UN Security Council resolution that would underscore 'support for a temporary ceasefire in Gaza as soon as practicable' and would determine that a major ground offensive into Rafah would further harm civilians and potentially displace them into neighbouring countries. Furthermore, it stated that a major ground offensive into Rafah should not proceed under current circumstances, while a senior administration official later said there was no rush to vote on the UN Security Council resolution on Gaza and the US intends to allow some time for negotiations, according to Reuters.

- US President Biden's top Middle East adviser Brett McGurt will visit Israel and Egypt, according to Axios.

- Yemen’s Houthis said they attacked two US ships in the Gulf of Aden, while they also confirmed that they attacked a UK ship over the weekend which resulted in its sinking. In relevant news, UKMTO reported an incident with a vessel 90NM west of Jizan, Saudi Arabia and British maritime security firm Ambrey said a Marshall Island-flagged ship was physically damaged by an unmanned aerial vehicle in an attack 60NM north of Djibouti.

- IAEA Chief said Iran continues to enrich uranium just short of weapons-grade level, according to Reuters.

Geopolitics - Other

- Ukrainian President Zelensky said the front-line situation is extremely difficult where Russian troops are concentrated and that Russia is exploiting delays in aid, while it was also reported that Ukrainian PM Shmyhal said Ukrainian forces are hampered by a lack of artillery and long-range munitions, according to Reuters.

- China’s military said it organised front-line naval and air forces to closely monitor the Philippines' 'joint air patrol' with foreign countries in the South China Sea on Monday, while it added the Philippine side 'brought together extraterritorial countries to stir up trouble in the South China Sea' and publicly hyped up the air patrol.

- Taiwanese minister expressed regret at China's coastguard boarding a Taiwanese tourist boat and said the incident harmed Taiwanese people's feelings and triggered panic, according to Reuters.

US Event Calendar

- 08:30: Feb. Philadelphia Fed Non-Manufactu, prior -3.7

- 10:00: Jan. Leading Index, est. -0.3%, prior -0.1%

DB's Jim Reid concludes the overnight wrap

Global markets have been subdued over the last 24 hours given the US holiday. In very quiet markets, the STOXX 600 (+0.16%) built on its run of four consecutive weekly gains to close at a fresh two-year high. And that strength was clear in other asset classes, since Euro IG and HY spreads both closed at their tightest level in over two years, whilst WTI oil futures closed at a 3-month high of $79.49/bbl.

However Asian equity markets are slipping this morning even after the PBOC cut the benchmark five-year loan prime rate (LPR), the peg for most mortgages, by 25bps to 3.95%, marking its first cut since June, and more than expected. Our Chinese economists have just published a piece here looking at the implications of the cut. They kept the one-year LPR, the peg for most household and corporate loans, unchanged at 3.45%.

Across the region, the KOSPI (-1.14%) is the biggest underperformer while the Nikkei (-0.28%), the Hang Seng (-0.27%), the CSI (-0.18%) and the S&P/ASX 200 (-0.17%) are also trading lower. S&P 500 (-0.29%) and NASDAQ 100 (-0.36%) futures are also down. US Treasuries have resumed trading following the holiday with yields on the 10yr up +1.8bps to 4.297% as we go to print.

Elsewhere, the minutes of the Reserve Bank of Australia’s recent meeting indicated that the central bank still remains inclined towards hiking interest rates further as it is not sufficiently confident that inflation is on track to return to its target range within the next couple of years.

On a similar theme, one interesting data point yesterday was the Swedish CPI print for January, which showed a larger-than-expected increase to +5.4% (vs. +5.0% expected). That led to growing doubts about how soon the Riksbank would be cutting rates, and added to fears that the global inflation path would still be bumpy this year, not least after the US CPI and PPI prints last week. Watch out for Canadian inflation today to see if there are any continued signs that inflation is edging up globally versus expectations. Swedish government bonds underperformed after the print, with the 10yr yield up +2.1bps. And there was a series of smaller rises across Europe, with 10yr bund yields (+0.9bps) closing at 2.41%, which is their highest level since November, whilst 10yr OATs (+0.8bps) and BTPs (+1.9bps) also saw a rise in yields. Meanwhile in the US, although Treasuries weren’t trading, it was clear from Fed funds futures that investors were also pricing out the chances of a near-term rate cut. Indeed, the chance of a cut at the March meeting was down to just 10.6%, the joint-lowest in over three months.

Nevertheless, that news on the rates side shouldn’t detract from a strong performance for risk assets, which saw the STOXX 600 (+0.16%) post a 4th consecutive daily advance. In fact, that leaves the index less than 0.5% away from its all-time high in January 2022, so it’s plausible we could get another record shortly. However, there was a divergent performance between sectors and regions, with Spain’s IBEX 35 (+0.59%) leading the advance, in contrast to Germany’s DAX (-0.15%) and France’s CAC 40 (unch). Looking ahead, the focus is likely to be on corporate earnings announcements today, with Walmart releasing at 12pm London time, before Nvidia then report tomorrow after the close. That Nvidia release will be critical, since the Magnificent 7 have continued to power this year’s equity gains so far, with a +10.65% YTD performanc e, and Nvidia has seen the strongest gain in the whole S&P 500 with a +46.63% rise

Over in the commodities space there was a very mixed performance yesterday. On the one hand, WTI oil prices (+0.38%) closed at a 3-month high of $79.49/bbl, so that’s one that’ll have a mechanical impact on inflation if it’s sustained, with US gasoline prices having already risen since the start of the year. By contrast however, European natural gas futures continued to decline, and yesterday saw a -4.50% decline to their lowest since June, at €23.70/MWh.

In the political sphere, we heard yesterday that European Commission President Ursula von der Leyen will be seeking a second five-year term in office, which comes ahead of the European Parliamentary elections in June. But unlike the US Presidency for example, where voters cast their ballot for a candidate, there’s no direct election for the Commission President. Instead, von der Leyen would need to be nominated as the lead candidate of her party, the centre-right European People’s Party, who are choosing their candidate next month. After the parliamentary election, the European Council (the group of EU leaders) then propose a candidate for Commission President to the Parliament, who is usually taken from the largest group in the Parliament. But even so, there’s no requirement for the leaders to select the lead candidate from the biggest grouping, as we saw last time when von der Leyen was selected over Manfred Weber, who was originally the lead EPP candidate. Once EU leaders have selected someone, the nominated candidate then requires an absolute majority of the European Parliament to get the job, and last time von der Leyen only won 383 votes, which was just above the 374 necessary. So if the political groupings are more fragmented after the election, then it could be even harder to achieve a majority this time round. Our economists have written about what a VdL 2.0 term might look like in their election monitor here.

To the day ahead now, and data releases include Canada’s CPI for January, and the US Conference Board’s leading index for January. From central banks, we’ll hear from BoE Governor Bailey. Finally, earnings releases include Walmart and Home Depot.

After a flat Monday when US cash market were closed for President’s Day, equity futures are pointing to a lower open on Tuesday as the latest earnings reports and corporate news failed to shake concerns about higher-for-longer interest rates and the faltering Chinese economy, while markets braced for the main event: tomorrow’s NVDA earnings after the close. As of 8:00am contracts on the S&P 500 fall 0.3% but rebounded from session lows and were trading just above 5,000; Nasdaq 100 futures lost 0.5%. European stocks were mixed while Asian stocks pulled back from their highest level since April 2022 amid a lack of positive momentum, with a reduction in China’s mortgage reference rate failing to lift sentiment. 10Y yields dropped 1 basis point from Friday’s close (cash Treasuries were closed on Monday), while gold rose, the dollar dipped and bitcoin traded back over $52,000 erasing overnight losses. The only notable macro event today is the Leading Index (exp.-0.3, last -0.1).

In premarktet trading, AI bellwether Nvidia declined ahead of its widely anticipated earnings report due Wednesday. Credit card company Discover Financial surged after Capital One agreed to buy the credit card issuer; Capital One dropped. Here are some other notable premarket movers:

- GlobalFoundries (GFS) gains 7% as the US plans to award $1.5 billion to the largest domestic maker of made-to-order semiconductors under the so-called Chips Act grant.

- Home Depot (HD) slips 2% after reporting a fourth consecutive quarterly revenue decline.

- Intel (INTC) rises 3% after Bloomberg reported that the Biden administration is in talks to give more than $10 billion in subsidies to the chipmaker.

- Iovance Biotherapeutics (IOVA) rallies 21% as analysts boost their price targets on optimism for the drug developer’s newly approved treatment for patients with advanced melanoma.

- Medtronic (MDT) rises 3% after the medical-device maker boosted its sales and adjusted earnings per share forecasts for the full year.

- SSR Mining (SSRM) drops 10% as Turkey canceled the environmental licenses of a gold mine operated by a unit of the company following a landslide.

Among companies reporting earnings, Walmart rose a2% fter an beat, even though it delivered softer guidance. Medtronic Plc climbed after the medial device maker boosted sales. Home Depot Inc. declined after reporting a fifth consecutive drop in quarterly revenue.

Stocks closed lower last week, breaking a streak of 15 higher weeks in the past 16, as traders moved Fed rate-cut expectations out to June, from March, as a barrage of Fed officials warned against over-exuberant expectations of policy easing, and economic data continued to surprise to the upside. Former US Treasury Secretary Lawrence Summers said on Friday “there’s a meaningful chance” the next move is up.

Investors will thus be wary ahead of the Fed January meeting minutes to be released Wednesday, but most of the focus will be on Nvidia. The chip giant has surpassed the market value of Amazon.com Inc on the expectation it will be a big winner from artificial intelligence developments. The two companies together with Meta and Microsoft have collectively contributed almost 60% of the S&P 500’s year-to-date rally.

“Nvidia results on Wednesday could be a turning point for the markets,” Charles-Henry Monchau, chief investment officer for Banque Syz, said on Bloomberg Television. “The market relies on very few large-cap growth stocks and if they disappoint for any reason there is a risk of a pullback.”

European stocks look set to fall for the first time in four days albeit slightly, after a four-day rising streak that took it to within two points of its January 2022 record high on Monday. Mining shares are among the worst performers as iron ore prices fall to a three-month low: Miners Anglo American Plc and Rio Tinto Plc led basic-resources stocks lower after a slump in iron ore prices, with Bloomberg’s index of industrial metals down 0.7%. The chemicals sub-sector outperformed, with Air Liquide SA jumping more than 4% after the French gas producer beat analysts’ expectations for margin expansion. Barclays Plc soared as much as 6% after announcing plans for capital returns. Here are the biggest movers Tuesday:

- Barclays rises the most in more than three years after the UK bank said it will return £10b to shareholders over the next three years and announced plans to reduce costs by £2b

- Air Liquide rises as much as 6.4%, reaching a record high, after reporting 2023 earnings. The French industrial gas manufacturer pleased analysts by doubling its mid-term margin target

- InterContinental Hotels rises as much as 3.6%, reversing initial losses and climbing to fresh record highs after outlining a new $800 million share buyback alongside in-line FY results

- Evolution shares rise as much as 4.9% to their highest intraday level since July after the New Jersey Division of Gaming Enforcement (NJDGE) closed an investigation into the company

- Plus500 rises as much as 4.9% after the online trading company delivered results for 2023 that were in line with guidance, while announcing new distributions of $175m to shareholders

- Argenx rises as much as 2.3% after KBC upgraded the biotech company to buy on account of a more bullish view for its key drug Vyvgart after it receved a priority review with the US FDA

- Grifols falls as much as 7.3% in Madrid after short seller Gotham City Research poses new questions to the pharmaceutical company in a document published on its website

- Mobico shares plummet as much as 21%, the most since October, after the bus and rail operator delayed publication of its full-year results to the end of March

- Sandoz slips as much as 7.1% as Morgan Stanley cuts to equal-weight, saying the stock’s valuation gap has closed and there is now some debate over its upcoming 2023 results and outlook

- Also Holding shares fall as much as 12%, the most since 2020, after the Swiss IT distributor reported Ebitda missing analyst estimates, citing a “challenging environment”

Earlier in the session, Asian stocks pulled back from their highest level since April 2022 amid a lack of positive momentum, with a reduction in China’s mortgage reference rate failing to lift sentiment. The MSCI Asia Pacific Index dropped as much as 0.4%, with consumer discretionary and materials declining by the most. China’s benchmark CSI 300 slipped, suggesting investors remain skeptical that a record cut in the five-year loan prime rate will be sufficient to boost property demand.

- Hang Seng and Shanghai Comp. were lacklustre as tech weakness in Hong Kong clouded over the gains in the energy sector, while the mainland was rangebound as participants digested the announcement of the PBoC’s latest benchmark rates in which the 1-year LPR was surprisingly maintained at 3.45% (exp. 5bps cut), but the 5-year LPR was cut by 25bps (exp. 10bps cut).

- ASX 200 was dragged lower by miners after BHP reported flat underlying profits and cut its dividend by 20%.

- Nikkei 225 reversed its earlier advances as momentum stalled and the 1989 record high remained elusive.

- Indian stocks advanced for a sixth consecutive day, their longest run since early December, as lenders rose.

- The S&P BSE Sensex Index neared its all-time high, rising 0.5% to 73,057.40 in Mumbai, while the NSE Nifty 50 Index extended its record run. The Sensex is now less than 0.5% short of its peak seen in early January.

In FX, the dollar slipped versus major peers amid a thin data calendar; the Bloomberg Dollar Spot Index erased a 0.1% advance to trade 0.1% lower on the day. The pound rises 0.1% as BOE Governor Bailey testifies to the Treasury Committee. “There doesn’t seem to be much appetite to embrace fresh USD longs here, but we think DXY can retain the bulk of its gains,” Richard Franulovich, FX strategist at Westpac Banking Corp., wrote in a note. The greenback might find support from Federal Reserve commentary, he added, “with officials likely to reinforce a patient and careful message, keeping first half Fed rate cut bets at bay.”

In rates, treasuries were mixed with the curve steeper as front-end yields drop around 2.5bps vs Friday close while long-end trades slightly cheaper on the day. Treasuries 2s10s, 5s30s spreads are steeper by ~2bp on the day with 10-year yield around 4.27%, down 1 bp vs Friday close. Core European rates outperform, led by front-end of UK curve after Bank of England Governor Andrew Bailey said inflation doesn’t need to fall to target before policymakers start lowering interest rates. UK yields richer by 4bp to 6bp across the curve with front-end and belly outperforming as more premium for BOE cuts is added following Bailey comments. Bunds also rose as ECB data showed euro-zone wage growth slowed at the end of 2023. According to Bloomberg calcs, credit issuance slate has begun to build, with syndicate desks anticipating a weekly total of about $45b, following $37b last week. Treasury auctions this week include $16b 20-year bond sale Wednesday.

Bitcoin holds just shy of USD 52k, whilst Ethereum (-1.9%) gives back some of the recent advances.

In commodities, oil prices declined, with Brent falling 0.7% to trade near $83. Spot gold rises 0.5%.

Looking to the day ahead now, and data releases include Canada’s CPI for January, and the February Philadelphia Fed non-manufacturing activity (8:30am) and the Conference Board’s January Leading index (10am). From central banks, we’ll hear from BoE Governor Bailey. Finally, earnings releases include Walmart and Home Depot.

Market Snapshot

- S&P 500 futures down 0.3% to 5,003.75

- STOXX Europe 600 down 0.2% to 491.50

- MXAP little changed at 171.14

- MXAPJ up 0.2% to 522.96

- Nikkei down 0.3% to 38,363.61

- Topix down 0.3% to 2,632.30

- Hang Seng Index up 0.6% to 16,247.51

- Shanghai Composite up 0.4% to 2,922.73

- Sensex up 0.3% to 72,945.96

- Australia S&P/ASX 200 little changed at 7,659.05

- Kospi down 0.8% to 2,657.79

- German 10Y yield little changed at 2.38%

- Euro little changed at $1.0789

- Brent Futures down 0.6% to $83.07/bbl

- Brent Futures down 0.6% to $83.06/bbl

- Gold spot up 0.3% to $2,023.75

- U.S. Dollar Index little changed at 104.22

Top Overnight News

- Capital One said it will buy Discover Financial Services for more than $35 billion, a deal that will marry two of the largest credit-card companies in the U.S. Under the terms of the all-stock deal, Discover shareholders are set to receive 1.0192 Capital One shares for each Discover share, representing a premium of about 27% based on Discover’s closing price Friday. After the deal closes, Capital One shareholders will hold roughly 60% of the combined company, with Discover shareholders owning the rest. WSJ

- China cut its 5-year Loan Prime Rate, on which mortgage loans are priced, by a record 25bp to 3.95% from 4.2% (the Street was anticipating only a 10bp cut to 4.1%). FT

- Foreign businesses’ direct investment into China last year increased by the lowest amount since the early 1990s, underscoring challenges for the nation as Beijing seeks more overseas funds to help its economy. China’s direct investment liabilities in its balance of payments stood at $33 billion last year, according to data from the State Administration of Foreign Exchange released Sunday. BBG

- The FBI is “laser focused” on Chinese efforts to insert malicious software code into computer networks in ways that could disrupt critical US infrastructure, according to the agency’s director Christopher Wray. FT

- Brussels is to impose its first ever fine on tech giant Apple for allegedly breaking EU law over access to its music streaming services, according to five people with direct knowledge of the long-running investigation. The fine, which is in the region of €500mn and is expected to be announced early next month, is the culmination of a European Commission antitrust probe into whether Apple has used its own platform to favour its services over those of competitors. FT

- Barclays jumped after C.S. Venkatakrishnan announced plans to return £10 billion of capital to shareholders between 2024 and 2026, and to reduce costs by £2 billion. The firm also aims to boost returns above 12% and lift revenue to £30 billion — a high bar, said Bloomberg Intelligence. Corporate and investment bank revenue missed estimates. It plans to reorganize into five divisions, and named Adeel Khan as sole head of Global Markets. Banker bonuses fell 43% last year. Top execs also shared some of the pain, with Venkat’s bonus falling 27%. BBG

- Iran is urging its various proxy partners in the Middle East to temper their attacks against US forces in the region as Tehran seeks to avoid a direct conflict with Washington (the words may be bearing fruit as attacks have dropped over the last couple of weeks). WaPo

- US economy receives a major boost from all the aid money flowing to Ukraine – of the ~$61B earmarked for Ukraine in the $95B supplemental bill, about 65% would flow right back to the American defense industrial base. WSJ

- US oil production may be at a peak – output has surged over the last few years, but the pace of increase in 2024 is expected to plummet due to falling prices and sector M&A. US natural gas prices have plunged to a near-three-decade low as what is set to be the country’s warmest winter on record slashes demand for the heating fuel just as production surges to record levels. Winter months, when heating demand is highest, are on track this year to be the mildest since reliable records began in 1950, analysts said, leaving gas usage much lower than expected. WSJ / FT

- GIR raises our S&P 500 year-end 2024 index target to 5200 (from 5100), reflecting 4% upside from the current level. In December, we lifted our target from 4700 to 5100 to reflect an outlook for more dovish policy, lower real interest rates, and higher valuations than we had originally expected. Our target upgrade today reflects an improved earnings outlook. We continue to expect the S&P 500 forward P/E multiple will end the year at roughly 19.5x, a slight contraction from today’s 20x multiple.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with mild losses with price action contained following the US holiday lull. ASX 200 was dragged lower by miners after BHP reported flat underlying profits and cut its dividend by 20%. Nikkei 225 reversed its earlier advances as momentum stalled and the 1989 record high remained elusive. Hang Seng and Shanghai Comp. were lacklustre as tech weakness in Hong Kong clouded over the gains in the energy sector, while the mainland was rangebound as participants digested the announcement of the PBoC’s latest benchmark rates in which the 1-year LPR was surprisingly maintained at 3.45% (exp. 5bps cut), but the 5-year LPR was cut by 25bps (exp. 10bps cut).PBOC LPR REVIEW: 1yr maintained but the 5yr cut, likely designed to support the property sector. Click here for more details.

Top Asian News

- PBoC 1-Year Loan Prime Rate (Feb) 3.45% vs Exp. 3.40% (Prev. 3.45%); PBoC 5-Year Loan Prime Rate (Feb) 3.95% vs Exp. 4.10% (Prev. 4.20%)

- Chinese Foreign Minister Wang told his Spanish counterpart that China is ready to maintain high-level exchanges with Spain and strengthen the synergy of development strategies, as well as deepen mutually beneficial cooperation. Wang said China regards the EU as an important force in the multipolar pattern and supports European integration, the development and growth of the EU, and realising strategic autonomy. Furthermore, he said as long as China and the EU strengthen solidarity and cooperation, bloc confrontation will not arise and they are ready to work with the EU to uphold the free trade system, practice multilateralism, promote an equal and orderly multipolar world and inclusive economic globalisation.

- RBA Minutes from the February 6th Meeting stated that the board considered the case to hike by 25bps or hold steady, while the case to hold steady was the stronger one and appropriate given balanced risks to the outlook. The minutes also stated the data gave the board more confidence inflation would return to target in a reasonable timeframe although it would “take some time” before the board could be confident enough about inflation. Furthermore, the board agreed it was appropriate not to rule out another rise in rates and noted that hiking rates would not prevent it from cutting should the economy weaken.

European bourses, Stoxx600 (-0.1%), began the session on a weaker footing and trade throughout the morning has been choppy/mixed. The CAC 40 (+0.2%) outperforms, lifted by post-earning strength in Air Liquide (+5.9%). European sectors hold a negative tilt; Chemicals outperform, with the sector lifted by Air Liquide. Basic Resources is hampered by poor BHP results, peers Anglo American and Rio Tinto lag. US Equity Futures (ES -0.3%, NQ -0.4%, RTY -0.9%) are trading modestly weaker, with clear underperformance in the RTY, as it continues the prior session’s weakness; focus ahead on key retail earnings including Walmart (WMT) In terms of stock specifics, Capital One (-4.5%) is to acquire Discover Financial Services (+14.6%) in an all-stock transaction valued at USD 35.3bln. Click here and here for the sessions European pre-market equity newsflow, including earnings from Air Liquide, Antofagasta, Barclays, IHG, Fresenius Medical Care and more.

Top European News

- EU New car registrations: +12.1% in January 2024; battery electric 10.9% (prev. 9.5%) market share; Volkswagen (VOW3 GY) +11.5% Y/Y; Stellantis (STLAM IM/STLAP FP) +15% Y/Y; Renault (RNO FP) -2.9% Y/Y; BMW (BMW GY) +28.2% Y/Y; Mercedes-Benz (MBG GY) -7.5% Y/Y; Volvo Cars (VOLCARB SS) +34.9%

- Goldman Sachs expects the BoE to begin cutting rates in June (prev. May)

Earnings

- Air Liquide (AI FP) – FY23 (EUR): Net 3.08bln (exp. 3.40bln), Op. 5.07bln (exp. 5.05bln), Revenue 27.6bln (exp. 27.7bln). Confirms its advanced financial objectives. Payment of EUR 3.20/shr will be proposed to shareholders for 2023, +8.5% Y/Y. Shares +5.9% in European trade

- Antofagasta (ANTO LN) – FY (USUD): Revenue 6.3bln (exp. 6.3bln), EBITDA 3.08bln (exp. 3.08bln), PBT 1.97bln (1.73bln). Outlook for the Co. and shareholders is positive. Recommenced a 0.243/shr dividend. (Newswires) Shares +4.1% in European trade

- Barclays (BARC LN) – Q4 (GBP): CIB revenue 2.39bln (exp. 2.55bln). NII 3.14bln (exp. 3bln). FICC 724mln (exp. 830.8mln). Sees 2024 rote above +10% (exp. +9.2%). Sees 2024 CET1 ratio 13-14% (exp. 14.2%). Plans to return at least GBP 10bln between 2024-2026. (Newswires)

- IHG (IHG LN) – FY23 (USD): Adj. EPS 3.76 (exp. 3.76), Revenue 2.16bln (exp. 2.16bln, prev. 1.84bln Y/Y), Op. 1.02bln (prev. 828mln Y/Y), RevPAR +16.1% Y/Y, +10.9% vs 2019. To commence 800mln share buyback. (Newswires)Shares +5.9% in European trade

- Mining names – BHP (BHP AT) – H1 (USD) profit after tax attributable 927mln (prev. 6.5bln Y/Y), underlying profit 6.6bln (prev. 6.6bln Y/Y), underlying EBITDA USD 13.9bln (prev. 13.2bln Y/Y), rev. 27.2bln (prev. 25.7bln Y/Y), lowers the H1 dividend by 20% to USD 0.72/shr. Says: The external operating environment in calendar year 2023 was relatively volatile. (Newswires) Shares fell 1.1% in Australian trade.

- Fresenius Medical Care (FME GY) – Q4 (EUR): EPS 0.88 (exp. 0.33), EBIT 428mln (exp. 382mln), Revenue 4.99bln (exp. 4.94bln). Guides initial FY24 Revenue “grow low to mid-single-digit % Y/Y”, Op “grow mid to high teen % Y/Y”. Affirms FY25 Op. margin 10-14% (prev. guided 10-14%). (Newswires) Shares +4.6% in European trade

FX

- Tight parameters (104.06-41) for the DXY with catalysts lacking. In recent trade, the Dollar has been making its way lower towards the round 104.00 mark, pressured by mild upside in G10 peers.

- EUR is edging mild gains vs. USD but focus remains on whether the incremental move above 1.08 sticks or not, with EUR/USD having now surpassed the 21DMA at 1.0796. The ECB EZ wage metrics provided little impetus for the EUR.

- JPY back on a 150.00 handle with the pair having chopped and changed around this in recent sessions. Focus remains on the 150.88 YTD peak.

- CNH is around flat vs. the USD despite PBoC easing measures overnight. ING suggests this and the muted reaction to Lunar NY spending shows “expectations of a recovery in China’s growth sentiment will be gradual at best”.

- Antipodeans are both a touch firmer vs. the USD with AUD supported by Chinese stimulus efforts and considerations of an RBA high in the latest minutes.

- PBoC set USD/CNY mid-point at 7.1068 vs exp. 7.2018 (prev. 7.1032).

Fixed Income

- USTs are a touch firmer after the President’s Day holiday. Newsflow has been limited thus far but the larger than expected PBoC LPR cut to the 5yr is perhaps having some influence given the US markets sensitivity to property/CRE-related updates; currently holds near highs at 109-30.

- Bunds are bid as action picks up after Monday’s US holiday-induced lull. There was no reaction to the ECB negotiated wage metrics, which only incrementally lessened from the prior, therefore having little impact on market pricing for the April/June ECB decisions; Bund peak for today at 133.27 thus far.

- Gilt price action is in-fitting with EGBs directionally and in terms of magnitude; firmer by around 50 ticks at 97.98 high, surpassing Friday’s 97.76 peak but stalling on approach to the figure

- UK sells GBP 1.75bln 4.00% 2063: b/c 2.92x, average yield 4.518%, tail 0.6bps. No pronounced reaction

- Germany sells EUR 4.138bln vs exp. EUR 5bln 2.50% 2026: b/c 1.91 (prev. 1.8x), average yield 2.79% (prev. 2.44%), retention 17.24% (prev. 17.40%). No pronounced reaction

Commodities

- Crude is subdued as China woes are reflected across commodities with one eye on geopolitics, with the situation in the Middle East expected to escalate in the coming month; Brent Apr currently holds below USD 83/bbl.

- Precious metals see a mild upward bias in tandem with price action in the Dollar and awaiting the next catalyst ahead of tomorrow’s FOMC Minutes; XAU tests Monday’s high (2,023.07/oz) ahead of the 50 DMA (2,030.32/oz).

- Base metals are mostly subdued, particularly for iron ore with traders citing ongoing woes surrounding China’s economy, whilst the PBoC’s 5yr LPR cut failed to provide relief.

- Three tankers with Russian Sokol oil onboard started to move to ports in China and India after being stored for three months, while two of the tankers are under US sanctions and are heading towards China.

Geopolitics – Middle East

- EU Foreign Policy Chief Borrell said 26 EU countries called for an immediate humanitarian pause that would lead to a sustainable ceasefire in Gaza.

- US proposed a rival draft UN Security Council resolution that would underscore ‘support for a temporary ceasefire in Gaza as soon as practicable’ and would determine that a major ground offensive into Rafah would further harm civilians and potentially displace them into neighbouring countries. Furthermore, it stated that a major ground offensive into Rafah should not proceed under current circumstances, while a senior administration official later said there was no rush to vote on the UN Security Council resolution on Gaza and the US intends to allow some time for negotiations, according to Reuters.

- US President Biden’s top Middle East adviser Brett McGurt will visit Israel and Egypt, according to Axios.

- Yemen’s Houthis said they attacked two US ships in the Gulf of Aden, while they also confirmed that they attacked a UK ship over the weekend which resulted in its sinking. In relevant news, UKMTO reported an incident with a vessel 90NM west of Jizan, Saudi Arabia and British maritime security firm Ambrey said a Marshall Island-flagged ship was physically damaged by an unmanned aerial vehicle in an attack 60NM north of Djibouti.

- IAEA Chief said Iran continues to enrich uranium just short of weapons-grade level, according to Reuters.

Geopolitics – Other

- Ukrainian President Zelensky said the front-line situation is extremely difficult where Russian troops are concentrated and that Russia is exploiting delays in aid, while it was also reported that Ukrainian PM Shmyhal said Ukrainian forces are hampered by a lack of artillery and long-range munitions, according to Reuters.

- China’s military said it organised front-line naval and air forces to closely monitor the Philippines’ ‘joint air patrol’ with foreign countries in the South China Sea on Monday, while it added the Philippine side ‘brought together extraterritorial countries to stir up trouble in the South China Sea’ and publicly hyped up the air patrol.

- Taiwanese minister expressed regret at China’s coastguard boarding a Taiwanese tourist boat and said the incident harmed Taiwanese people’s feelings and triggered panic, according to Reuters.

US Event Calendar

- 08:30: Feb. Philadelphia Fed Non-Manufactu, prior -3.7

- 10:00: Jan. Leading Index, est. -0.3%, prior -0.1%

DB’s Jim Reid concludes the overnight wrap

Global markets have been subdued over the last 24 hours given the US holiday. In very quiet markets, the STOXX 600 (+0.16%) built on its run of four consecutive weekly gains to close at a fresh two-year high. And that strength was clear in other asset classes, since Euro IG and HY spreads both closed at their tightest level in over two years, whilst WTI oil futures closed at a 3-month high of $79.49/bbl.

However Asian equity markets are slipping this morning even after the PBOC cut the benchmark five-year loan prime rate (LPR), the peg for most mortgages, by 25bps to 3.95%, marking its first cut since June, and more than expected. Our Chinese economists have just published a piece here looking at the implications of the cut. They kept the one-year LPR, the peg for most household and corporate loans, unchanged at 3.45%.

Across the region, the KOSPI (-1.14%) is the biggest underperformer while the Nikkei (-0.28%), the Hang Seng (-0.27%), the CSI (-0.18%) and the S&P/ASX 200 (-0.17%) are also trading lower. S&P 500 (-0.29%) and NASDAQ 100 (-0.36%) futures are also down. US Treasuries have resumed trading following the holiday with yields on the 10yr up +1.8bps to 4.297% as we go to print.

Elsewhere, the minutes of the Reserve Bank of Australia’s recent meeting indicated that the central bank still remains inclined towards hiking interest rates further as it is not sufficiently confident that inflation is on track to return to its target range within the next couple of years.

On a similar theme, one interesting data point yesterday was the Swedish CPI print for January, which showed a larger-than-expected increase to +5.4% (vs. +5.0% expected). That led to growing doubts about how soon the Riksbank would be cutting rates, and added to fears that the global inflation path would still be bumpy this year, not least after the US CPI and PPI prints last week. Watch out for Canadian inflation today to see if there are any continued signs that inflation is edging up globally versus expectations. Swedish government bonds underperformed after the print, with the 10yr yield up +2.1bps. And there was a series of smaller rises across Europe, with 10yr bund yields (+0.9bps) closing at 2.41%, which is their highest level since November, whilst 10yr OATs (+0.8bps) and BTPs (+1.9bps) also saw a rise in yields. Meanwhile in the US, although Treasuries weren’t trading, it was clear from Fed funds futures that investors were also pricing out the chances of a near-term rate cut. Indeed, the chance of a cut at the March meeting was down to just 10.6%, the joint-lowest in over three months.

Nevertheless, that news on the rates side shouldn’t detract from a strong performance for risk assets, which saw the STOXX 600 (+0.16%) post a 4th consecutive daily advance. In fact, that leaves the index less than 0.5% away from its all-time high in January 2022, so it’s plausible we could get another record shortly. However, there was a divergent performance between sectors and regions, with Spain’s IBEX 35 (+0.59%) leading the advance, in contrast to Germany’s DAX (-0.15%) and France’s CAC 40 (unch). Looking ahead, the focus is likely to be on corporate earnings announcements today, with Walmart releasing at 12pm London time, before Nvidia then report tomorrow after the close. That Nvidia release will be critical, since the Magnificent 7 have continued to power this year’s equity gains so far, with a +10.65% YTD performanc e, and Nvidia has seen the strongest gain in the whole S&P 500 with a +46.63% rise

Over in the commodities space there was a very mixed performance yesterday. On the one hand, WTI oil prices (+0.38%) closed at a 3-month high of $79.49/bbl, so that’s one that’ll have a mechanical impact on inflation if it’s sustained, with US gasoline prices having already risen since the start of the year. By contrast however, European natural gas futures continued to decline, and yesterday saw a -4.50% decline to their lowest since June, at €23.70/MWh.

In the political sphere, we heard yesterday that European Commission President Ursula von der Leyen will be seeking a second five-year term in office, which comes ahead of the European Parliamentary elections in June. But unlike the US Presidency for example, where voters cast their ballot for a candidate, there’s no direct election for the Commission President. Instead, von der Leyen would need to be nominated as the lead candidate of her party, the centre-right European People’s Party, who are choosing their candidate next month. After the parliamentary election, the European Council (the group of EU leaders) then propose a candidate for Commission President to the Parliament, who is usually taken from the largest group in the Parliament. But even so, there’s no requirement for the leaders to select the lead candidate from the biggest grouping, as we saw last time when von der Leyen was selected over Manfred Weber, who was originally the lead EPP candidate. Once EU leaders have selected someone, the nominated candidate then requires an absolute majority of the European Parliament to get the job, and last time von der Leyen only won 383 votes, which was just above the 374 necessary. So if the political groupings are more fragmented after the election, then it could be even harder to achieve a majority this time round. Our economists have written about what a VdL 2.0 term might look like in their election monitor here.

To the day ahead now, and data releases include Canada’s CPI for January, and the US Conference Board’s leading index for January. From central banks, we’ll hear from BoE Governor Bailey. Finally, earnings releases include Walmart and Home Depot.

Loading…