US stock futures fell for the second day amid deepening geopolitical tensions, and as investors awaited data this week that may show stickier core inflation, prompting expectations for more rate hikes by the Federal Reserve. Futures contracts on the S&P 500 dropped 0.7%, while those on the Nasdaq 100 were down 0.9% as of 7:45 a.m. in New York, after the cash market was closed on Monday for a public holiday. Treasury yields jumped, with the 10Y rising as high as 3.89%, while the Bloomberg Dollar Spot Index retreated from the day’s highs, and the pound led gains among Group-of-10 currencies after UK companies reported surprise growth in output.

In premarket trading, Manchester United shares rose as bid interest in the English Premier League club intensified over the weekend. Sigma Lithium jumped after Bloomberg News reported that Tesla has been weighing a takeover of the battery-metals miner. Walmart tumbled after the retailing giant's profit forecast for this year fell short of analyst estimates, signaling a cautious outlook for the world’s largest retailer after a 2022 performance that was marred by an inventory surge. Bank stocks are lower in premarket trading Tuesday as the US market is set to reopen following a holiday. Here are some other notable premarket movers:

- JD.com leads a decline in Chinese internet stocks in US premarket trading, after a South China Morning Post report that the e-commerce firm is launching a subsidy campaign to compete with PDD Holdings in a low-price product offering.

- Sigma Lithium (SGML US) rises as much as 27% after Bloomberg News reported that Tesla (TSLA US) has been weighing a takeover of the battery-metals miner. Tesla declines 0.9%.

- Manchester United (MANU US) shares jump 8.2% before paring gains as bid interest in the English Premier League club intensified over the weekend, with British billionaire Jim Ratcliffe submitting a bid, while Elliott Investment Management offered a proposal to provide financing.

- MarineMax (HZO US) shares rise 1.9% after B. Riley upgrades the boat retailer to buy from neutral, with the broker highlighting the company’s diversification push and opportunities arising from its real estate portfolio.

- Keep an eye on Generac Holdings (GNRC US) stock as its rating was cut to hold from buy at Truist Securities, which says high interest rates and product prices will pose a “meaningful risk” to the generator maker’s 2023 financials.

- Watch Caleres (CAL US) stock as it was raised to overweight from neutral at Piper Sandler after the footwear company’s preliminary 2022 results indicated structural earnings gains.

- BioMarin Pharmaceutical (BMRN US) is started with a neutral recommendation at Citi, which in a note says that recent developments and expected progress for 2023 are already priced into the stock.

After the underlying S&P benchmark fell last week, US stocks are likely to remain under pressure amid concerns that the Fed could keep rates higher for longer. Investors will be closely watching the US purchasing managers index, due on Tuesday, and Friday’s personal consumption expenditures data for an indication of the likely path of monetary policy.

A start-of-the-year rally in global stocks has fizzled, and the dollar resumed gains, after central bankers reaffirmed their will to combat inflation. That, and a stubborn trend in prices, have pushed traders to factor in another 75 basis points of rate hikes by the Federal Reserve by July. They also pruned their bets for the first US rate cut: swaps now expect a 20 basis-point reduction by year-end, compared with a 50 basis-point move seen earlier this month.

"The tone after the long weekend is more biased to the downside as investors adjust to a more hawkish path from central banks that’s coming into play,” said Karim Chedid, head of investment strategy for iShares EMEA at BlackRock Inc. “In the past week we started to see equity sentiment respond to that, and we expect that to continue this week.”

Expensive US equities are flashing a warning sign that could see the S&P 500 sliding as much as 26% in the first half of this year, according to the latest weekly doom and gloom sermon by Morgan Stanley's Mike Wilson. The year-to-date rally in equities is “pure FOMO” — fear of missing out — at best, and the excitement is misplaced, they said.

“The Fed are not signaling they will do anything different from what they have always said — but earlier, markets did not believe them,” said Fahad Kamal, chief investors officer at SG Kleinwort Hambros Bank. “The market was far too complacent at start of the year thinking there’ll be a pivot. Now the data has come in stronger, and the Fed hasn’t changed what they said. So we got a big rally earlier and then a bit of reversal.”

European stocks drifted lower as Bank of America to JPMorgan predicted an end to their 2023 rally. European stocks were in the red although off their worst levels with the Stoxx 600 down 0.3% in wake of the morning's strong EZ PMI metrics which potentially give the ECB cover to tighten more aggressively.

- Euro Area Composite PMI (Feb, Flash): 52.3, consensus 50.7, last 50.3.

- Euro Area Manufacturing PMI (Feb, Flash): 48.5, consensus 49.3, last 48.8.

- Euro Area Services PMI (Feb, Flash): 53.0, consensus 51.0, last 50.8.

- France Composite PMI (Feb, Flash): 51.6, consensus 49.8, last 49.1.

- Germany Composite PMI (Feb, Flash): 51.1, consensus 50.3, last 49.9.

- UK Composite PMI (Feb, Flash): 53.0, consensus 49.0, last 48.5.

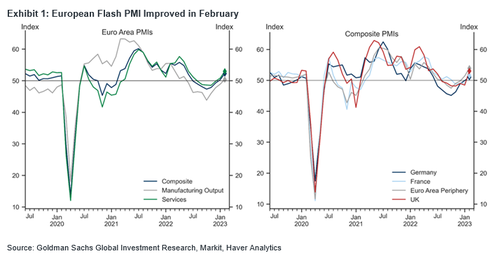

And some Goldman commentary on the PMIs:

The Euro area composite flash PMI increased by 2.0pt to 52.3 in February, well above consensus expectations. The increase in the composite index was broad-based across sectors, with manufacturing output surpassing the 50 threshold for the first time since May last year. Across countries, the improvement was led by France and the periphery, followed by Germany. In the UK, the composite flash PMI improved by 4.6pt to 53.0, also well above consensus expectations. We see three main takeaways from today’s data. First, even though the composite manufacturing index weakened, this decline was driven by an improvement in supply constraints as suppliers’ delivery times—which are included in the composite calculation with an inverse sign—recorded the largest monthly improvement outside the pandemic period and inventory stocks declined. Resilient demand in the services sector and easing supply constraints point to positive growth momentum in both the services and manufacturing sector, consistent with our above-consensus view on the Euro area growth outlook. Second, price pressures are moderating but services inflation remains sticky. Third, today’s notable upside surprise in the UK points to upside risk to our Q1 growth forecast but increases the likelihood of another 25bp hike at the upcoming MPC meeting, as we continue to expect.

Tech, autos and miners are the worst performing sectors. Credit Suisse shares tumbled as much as 6.4% after Reuters reported that Switzerland’s financial regulator is reviewing comments from Chairman Axel Lehmann on outlows from the company having stabilized. Here are some of the notable European movers:

- SIG Group shares fall as much as 5%, the most since November, as Kepler Cheuvreux cuts the packaging firm to hold from buy, saying the stock now looks fairly valued

- ALSO shares fall as much as 6%, the most since August 2022, as analysts said the Swiss computer hardware and software wholesaler’s 2023 guidance is cautious and below expectations

- GB Group plunges as much as 13% after after projecting full-year profit that misses estimates with the fraud prevention company seeing longer sales cycles and challenging conditions

- InterContinental Hotels shares drop as much as 2.9% in London after the hotel operator’s full-year results, with Citi seeing the performance as slightly negative overall

- Worldline shares slip as much as 4.5%, erasing earlier gains, as Citi notes that the payment firm’s FY23 profitability was slightly weaker than consensus forecasts

- Straumann falls as much as 3.3%, erasing earlier gains, after its latest earnings slightly beat estimates, with analysts calling 2023 guidance from the dental implants-maker encouraging

- HSBC shares erase early losses, rising as much as 2.6%, after fourth-quarter results that showed profit that beat expectations but higher-than-expected costs

- ElringKlinger gains as much as 3.3% after the German car- parts maker posted what Warburg calls strong preliminary results

- Rovi gains as much as 7.4%, the most since Sept. 2021, after the specialty pharmaceuticals company released results which beat on strong contract manufacturing organization revenue

The Stoxx 600 will end the year 2% lower than Friday’s close, according to the average target in a Bloomberg survey of forecasters. Bank of America strategist Milla Savova said a temporary boost to the region’s economy will fade as the full impact of monetary tightening materializes, while earnings forecasts will get downgraded.

Earlier in the session, Asian stocks also fell as investors awaited earnings from China’s major tech companies and minutes from the US Federal Reserve later this week. The MSCI Asia Pacific Index slid as much as 0.9%, with China’s tech shares among the biggest laggards. JD.com led declines following a report that the e-commerce firm is planning a subsidy campaign as it ratchets up a price war against rivals. While China’s benchmark recovered from intraday losses, the Hang Seng Index continued its slide toward a technical correction, down more than 9% since peaking late last month. Investors are looking ahead to reports from tech behemoths Alibaba and Baidu later this week. MSCI’s Asia index has broken below its 50-day moving average for the first time since August amid concerns the Federal Reserve will keep raising rates to quell inflation. Fed minutes are scheduled to be released Wednesday.

“If we’re seeing higher implied volatility in interest rates – as options trader’s price higher degrees of movement -then that should spill over into higher volatility in the USD and equity markets too,” Chris Weston, head of research at Pepperstone Group, wrote in a note. “This is the biggest risk to the markets we’re facing now.”

Japanese stocks ended lower as investors await for clues on the next moves by the Bank of Japan and Federal Reserve. The Topix Index fell 0.1% to 1,997.46 as of market close Tokyo time, while the Nikkei declined 0.2% to 27,473.10. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix Index decline, decreasing 1.5%. Out of 2,163 stocks in the index, 1,185 rose and 867 fell, while 111 were unchanged. “It’s difficult for domestic investors to move, ahead of the hearing of Mr. Ueda, who was nominated as the BOJ governor,” said Ryuta Otsuka, a strategist at Toyo Securities.

Australian stocks also declined: the S&P/ASX 200 index fell 0.2% to close at 7,336.30, dragged by losses in banks and real estate names. Stocks around Asia declined as investors mulled the prospect of central banks tightening policy more than previously expected to tame inflation. In New Zealand, the S&P/NZX 50 index fell 0.8% to 11,801.49

In FX, the Bloomberg Dollar Spot Index rose as much as 0.4% before paring, though it remained within recent days’ ranges. The greenback traded higher against all of its Group-of-10 peers apart from the pound and the Swedish krona. The pound rallied after data showed UK private-sector business activity expanded in February, defying forecasts for another month of contraction. Here are some notable moves:

- The euro fell a second day to a low of 1.0643, before paring. The currency shrugged off German ZEW expectations, which rose to 28.1 in February, versus estimate 23.0. Other data showed euro-area business activity rose at the fastest rate in nine months in February. The euro’s volatility term structure versus the dollar has been inverted since January 2022 and hedge funds are betting that normalization is due for a return

- The pound flipped to gains against the dollar and gilt yields surged as markets added to pricing of future BOE hikes after British companies unexpectedly reported the first growth in seven months in PMI data. Earlier, public finance figures showed borrowing since the fiscal year that began in April is running £22 billion below the level forecast by the Office for Budget Responsibility

- The Swedish krona rose versus the euro and the dollar, outperforming Group-of-10 peers, after Riksbank Deputy Governor Martin Floden described underlying inflation in January as worrying. Separately, Swedish long-term inflation expectations fell in the latest Prospera survey, signaling that money market participants are strengthening in their belief that the Riksbank will succeed in bringing soaring price increases down closer to its target

- Japan’s benchmark yield briefly rose above the central bank’s ceiling for the first time since its January meeting as traders continued to bet on further policy tweaks.

- The Australian dollar gave up an advance and sovereign bonds pared declines. Bonds earlier fell after the Reserve Bank’s meeting minutes showed that the central bank also considered a 50 basis-point hike to the 25 basis-point one it delivered

In rates, Treasuries slid across the curve and were under pressure as US trading resumes after long weekend, trailing steeper declines for gilts sparked by stronger-than-forecast UK PMI gauges for February. Treasury yields are higher by 4bp-7bp across the curve, still inside Friday’s ranges which included YTD highs for all tenors except 20Y. Treasury auction cycle begins with $42b 2-year note sale at 1pm that’s poised to draw the highest yield since 2007. WI 2-year yield 4.64%; current issue traded as high as 4.713% Friday, within 9bp of last year’s multiyear high, as traders fully priced in a Fed rate hike in May to follow expected increase in March

In commodities, oil futures witnessed a choppy session as investors weighed the possibility of further monetary tightening against signs of improving demand from China. A gain in West Texas Intermediate futures reflected catch-up trades as there had been no settlement on Monday. WTI rose 0.9% to trade near $77.10 while Brent drops 0.3% to trade around $83.80. Spot gold falls roughly 0.4% to $1,833.

In crypto, bitcoin held around the $25k handle within fairly narrow parameters awaiting the re-entry of US participants after Monday's market holiday.

Looking to the day ahead, we have a number of data releases today, but the main highlight will be the global flash PMIs for February. In other data releases, we will have the US February Philadelphia Fed non-manufacturing activity release, January existing house sales, UK January public finances, the Germany and Eurozone February ZEW survey, France January retail sales, EU27 January new car registrations and in Canada, the January CPI and December retail sales. Finally, earnings releases include Walmart, Home Depot, Medtronic and Palo Alto Networks.

Market Snapshot

- S&P 500 futures down 0.7% to 4,058.50

- STOXX Europe 600 down 0.3% to 463.44

- MXAP down 0.8% to 162.43

- MXAPJ down 0.9% to 528.89

- Nikkei down 0.2% to 27,473.10

- Topix down 0.1% to 1,997.46

- Hang Seng Index down 1.7% to 20,529.49

- Shanghai Composite up 0.5% to 3,306.52

- Sensex little changed at 60,678.01

- Australia S&P/ASX 200 down 0.2% to 7,336.30

- Kospi up 0.2% to 2,458.96

- German 10Y yield little changed at 2.47%

- Euro down 0.2% to $1.0664

- Brent Futures down 1.2% to $83.02/bbl

- Gold spot down 0.4% to $1,834.74

- U.S. Dollar Index up 0.15% to 104.02

Top Overnight News

- President Vladimir Putin issued a defiant message on his war in Ukraine, vowing to continue the faltering invasion until Russia has achieved its goals: BBG

- “Frustrating,” “very annoying” and “left in the dark.” These and similar expressions have been used to describe the near month-long blackout on key global investor positioning reports that cover bets on everything from Treasuries to soybean futures — the casualty of a ransomware attack on financial firm ION Trading UK: BBG

- China tech leaders from firms such as Tencent, NetEast, Bidu, Didi, and others, met with senior officials from China’s Ministry of Industry and Information Technology (MIIT) to discuss ways to advance the interests of the tech industry. SCMP

- China is no longer viable as the world’s factory according to the head of Kyocera, a critical Japanese tech firm, due to Western restrictions on Beijing’s access to advanced technology (“the business model of producing in China and exporting abroad is no longer viable”). FT

- China is increasingly concerned that Russia, which it considers a key partner in Beijing’s quest to contain and counter the US, is being permanently weakened by Putin’s misguided war in Ukraine, and so is pushing for a ceasefire in the conflict. WSJ

- Europe’s flash PMIs for February were net positive, with encouraging growth details (especially in services) and an inflation slowdown (inflation notably cooled in manufacturing); UK flash PMIs for Feb were bullish, with solid upside on growth (the composite reading came in at 52, up from 48.5 in Jan and above the St’s 49 consensus) and cooling inflation (“Feb data pointed to the slowest overall increase in average cost burdens since April 2021”). S&P

- Iran – UN nuclear inspectors have detected uranium in Iran enriched to near weapons-grade (84% purity vs. the 90% required for weapons), a potential major escalatory step in the country’s nuclear program. WSJ

- Credit Suisse shares slump in Europe on reports that Swiss financial regulators are looking into reassuring remarks made by chairman Axel Lehmann about outflows at the company stabilizing. RTRS

- US fiscal stimulus to fade further – one of the last fiscal stimulus programs related to COVID, enhanced food stamps, is about to come to an end, creating headwinds for Walmart, Kroger, Dollar General, Dollar Tree, etc. (and the expiration of this program could have a dampening effect on food inflation too). WSJ

- Google's $168 billion online ad business will be in focus when arguments are heard today on whether internet companies are liable for the content their algos recommend to users. The Supreme Court case may affect automated ads that hand Facebook and Google the bulk of their revenue. BBG

- Home Depot's US comp sales fell less than expected but overall like-for-likes missed. It forecast profit will fall in the mid-single digits as it spends $1 billion to increase wages for sales staff. Shares slipped. Coming up, Walmart's same-store sales growth may exceed its 3% guidance after a strong holiday season and a rise in cost-conscious shopping. Inventory-clearing markdowns and higher input costs may weigh on margin recovery. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were subdued with trade mostly kept rangebound in the absence of a lead from Wall Street. ASX 200 traded lower amid a deluge of earnings releases including a decline in BHP's profits. Nikkei 225 was contained after mixed PMI data in which Manufacturing PMI declined by the fastest pace in two and a half years although Services PMI showed a firmer expansion. Hang Seng and Shanghai Comp. were mixed with Hong Kong dragged lower by tech losses, while the mainland was just kept afloat amid strength in developers after China launched an investment pilot for the property sector.

Top Asian News

- UK Foreign Secretary Cleverly said he spoke with Chinese Foreign Minister Qin Gang and raised human rights abuses in Xinjiang and the need for peace in the Taiwan Strait during the call, according to Reuters.

- RBA Minutes from the February meeting noted that the board considered a hike of 25bps or 50bps and that a pause was not an option. RBA said there were arguments in favour of both options but it concluded that the case to increase the Cash Rate by 25bps was the stronger one and the Board also agreed further increases would be needed over the months ahead. Furthermore, the RBA noted that monthly meetings allowed for frequent adjustments and that rates have already risen substantially, while it stated the Board will do what is needed to return inflation to the target and that data suggested more breadth and persistence in inflation than expected.

- China's Politburo discussed reforms to party and state organisations, according to state media.

- Iron Ore Piles Up at South African Mines on Rail Bottlenecks

- Gold Declines as Traders Await Fed Minutes for Rate Clues

- China Leaders Pledge Stronger Growth as Recovery Takes Hold

European bourses, Euro Stoxx 50 -0.7%, & US futures, ES -0.7%, remain negative but have lifted from the sessions' trough that printed in wake of the morning's EZ PMI metrics which potentially give the ECB cover to tighten more aggressively. The FTSE 100 was dragged lower in tandem though remained somewhat resilient to the strong UK PMIs, which sparked a hawkish re-pricing for 25bp in March from the BoE, with a yield-induced turnaround in HSBC (+2.0%) now proving supportive after initial post-guidance pressure.

Stateside, futures are lower with the above drivers factoring after Monday's holiday and ahead of the week's key events via FOMC Minutes and PCE; modest further pressure seen post-HD earnings, though futures remain off earlier lows. Home Depot Inc (HD) Q4 2022 (USD): EPS 3.21 (exp. 3.28), Revenue 35.719bln (exp. 35.97bln); boosts dividend 10%. -2.8% in pre-market trade

Top European News

- BoE Deputy Governor Woods said he will consult on changes to UK insurance capital rules in June and September, while he added that insurers will have a very good sense of what the changes to capital rules will be by year-end, according to Reuters.

- UK PM Sunak was warned not to undermine Northern Ireland and that an N.I. deal could trigger resignations, according to The Times.

- Germany's tax revenues rose 0.8% Y/Y, which was driven by higher sales taxes and wages taxes, according to the Finance Ministry.

- Hungary's EU funds negotiator said access to the grants and cheap loans could be delayed until the summer (vs prior April guidance) to resolve remaining issues with Brussels over democratic reforms.

- Enagas Sees 2023 Net Income EU310M to EU320M

- UK Companies Unexpectedly Show First Output Growth in Six Months; UK Feb. Flash Services PMI 53.3; Est 49.2

- Iron Ore Piles Up at South African Mines on Rail Bottlenecks

- Manchester United Shares Advance as Bid Interest Intensifies

- Putin Defiant as Struggling Ukraine Invasion Nears Second Year

FX

- DXY has derived support from upside in US yields, risk aversion and a loss of momentum in some FX peers, with the index holding around 104.00 despite being pressured to a 103.86 trough post UK PMI data.

- A release which sent GBP/USD to a 1.2113 peak from circa. 1.2000 before hand in a marked hawkish move which also allowed peers, ex-EUR, to trim some downside vs the USD, though this dynamic has since eased.

- For the EUR, despite hitting a 1.0688 peak following the French PMIs the single currency has failed to hold onto this upside with EUR/GBP action weighing.

- JPY is the incremental laggard given unfavourable yield dynamics for JGBs vs USTs/EGBS while antipodeans have faded amid domestic data for the NZD and despite hawkish RBA minutes for the AUD; currently, around 134.65, 0.623 & 0.688 respectively.

- SEK continues to lift amid further hawkish rhetoric and continuing emphasis on the currency from officials, with EUR/SEK briefly moving below 11.00.

- PBoC set USD/CNY mid-point at 6.8557 vs exp. 6.8550 (prev. 6.8643)

Fixed Income

- Core benchmarks are ultimately pressured despite initial gyrations around geopolitics and PMIs; Bunds at 134.60 within 134,32-134.97 boundaries.

- Gilts are the stand-out laggard following UK Flash PMIs which saw a hawkish re-pricing of market expectations for a 25bp BoE hike in March increase to over 95% from the low-80s before hand; UK supply due.

- Stateside, USTs are softer in tandem with the above narrative with yields elevated and the move fairly broad-based across the curve ahead of Biden and supply.

Commodities

- WTI and Brent April futures have experienced a choppy Tuesday session thus far and are currently modestly firmer as broader sentiment eases and Putin concludes his speech, despite being initially pressured below USD 76.00/bbl and USD 83/bbl respectively.

- Iran set March Iranian light crude price to Asia at Oman/Dubai +USD 2.00/bbl, according to a Reuters source.

- Russian Deputy PM Novak says oil output reductions in March will be from January levels, according to Interfax; Oil output reduction decision was only made for March. Expects discount on Urals to decrease. Novak has previously said that Russian crude production for January was between 9.8-9.9mln BPD.

- Caspian pipeline consortium is reportedly to suspend crude shipments due to poor weather, via Reuters citing sources.

- Iraq's oil minister says new licensing deals will produce 250k BPD of crude, according to the State News Agency.

- NatGas benchmarks are softer on both sides of the pond, though the magnitude of downside is fairly modest, with broader sentiment dictating price action.

- Spot gold is weighed on by the USD, though the downside is minimal in nature given its traditional haven allure while base metals are mixed overall.

Geopolitics

- Russian President Putin says we will decide on the tasks of the special military operation step-by-step, the West is seeking to change local conflict into a global one. The next steps to strengthen the army and navy should take into account the experience of the special military operation. Expects to enhance cooperation with India, Iran and Pakistan. Adds, if the US conducts nuclear tests then Russia will do the same.

- Ukrainian President Zelensky said he sees resolve from the US and President Biden to end Russian aggression this year and also stated that a world order based on rules, humanity and predictability depends on what happens now in Ukraine, according to Reuters.

- EU's Borrell said he is confident EU members will approve the next Russian sanctions package within the next hours or days and said the sanctions agreement should be reached before the end of the week.

- US Deputy Treasury Secretary Adeyemo says the US and allies are planning new sanctions this week to continue to isolate Russia over the war in Ukraine; additionally, 12 EU nations say Russia is transitioning into a full-on military economy, with a view to sustaining its war efforts, via Reuters citing a document.

- Belarus sees direct threats to its military security, according to Tass citing the Defence Ministry; adds, a significant grouping of the Ukrainian army is massed near its border. Will take adequate measures to respond to military provocations, intends to hold over 150 joint exercises with Russia in 2023.

- Ukrainian Presidential Aide says Ukrainian forces have the situation along the northern border under "special control".

- Japanese PM Kishida said they plan to pledge another USD 5.5bln in aid to Ukraine and announced that they will host a G7 summit meeting this Friday in which Ukrainian President Zelensky will be invited to join. Japanese Finance Minister Suzuki separately announced to hold the G7 financial leaders meeting on February 23rd and will reaffirm a stern stance against Russia at the G7 meeting, while he added they will continue to closely coordinate with other countries on sanctions to achieve the ultimate goal of Russia's withdrawal from Ukraine, as well as noted that measures against Russia and support for Ukraine will be the main topics on the G7 agenda.

- China seeks to broker Russia-Ukraine peace and urged the world to stop saying Taiwan is next after Ukraine, according to Bloomberg.

- Senior aides of Israeli PM Netanyahu and Palestinian President Abbas have been conducting secret talks for almost two months in an effort to de-escalate rising tensions in the occupied West Bank, according to Axios sources.

US Event Calendar

- 08:30: Feb. Philadelphia Fed Non-Manufactu, prior -6.5

- 09:45: Feb. S&P Global US Manufacturing PM, est. 47.4, prior 46.9

- 09:45: Feb. S&P Global US Services PMI, est. 47.3, prior 46.8

- 09:45: Feb. S&P Global US Composite PMI, est. 47.5, prior 46.8

- 10:00: Jan. Existing Home Sales MoM, est. 2.0%, prior -1.5%

Central Bank Speakers

- Nothing on the calendar

DB's Jim Reid concludes the overnight wrap

If you interacted with me yesterday please disregard it (unless the advice proves correct) as I was a total zombie all day having been up all night the previous one with a sick dog (Brontë). My wife was up the previous night. Thankfully Brontë seems better and I slept from 830pm-445am last night. So I feel as fresh as a daisy this morning... albeit one that managed to dodge the lawn mower all summer and has just felt the first frost of the year at the end of September.

Thankfully for me, markets had a quiet start to the week yesterday, with US markets closed, whilst in Europe, markets fluctuated between gains and losses over the day, with the STOXX 600 (-0.04%) modestly retreating, and 10yr bund yields (+1.9bps) advancing at the close after being lower most of the day. The quiet start to the week will break with the Eurozone, UK, Germany, France and US publishing their flash February PMIs over the course of today. The data momentum has been positive of late but it’s going to be hard for the next few months to assess where we should be at this stage of the cycle. There has no doubt been big improvements from gas price falls and loosening of financial conditions but we’re yet to see anything close to the full lag of monetary policy filter through to the US and Europe. If the war in Ukraine hadn’t happened and if financial conditions hadn’t collapsed for the first 9 months of last year due to the rates shock, then growth may still be quite strong at this point before the lag of a huge and rapid hiking cycle could kick in. So we have to be careful not to over interpret an improvement back to where we might normally be at this stage of a cycle and not confuse it with a sustainable soft landing.

Japan has kicked off the PMI round with mixed readings. The nation’s manufacturing activity shrank for the fourth consecutive month, falling to a level of 47.4 from last month’s 48.9 – its largest decline since August 2020. On the otherside, the au Jibun Bank flash services PMI rose to an eight-month-high of 53.6 from 52.3 last month.

Asian equity markets are mostly trading lower this morning as the prospect of the US Fed staying hawkish over policy tightening continues to weight on sentiment. As I type, the Hang Seng (-0.99%) is leading losses, dragged lower mostly by tech stocks with the Nikkei (-0.12%) also losing ground while the Chinese stocks are mixed with the CSI (-0.02%) trading just below flat and the Shanghai Composite (+0.10%) eking out minor gains in early trade. Meanwhile, the KOSPI (+0.22%) is bucking the trend.

Outside of Asia, US stock futures are indicating a negative start with contracts tied to the S&P 500 (-0.44%) and NASDAQ 100 (-0.37%) edging lower. Meanwhile, yields on 10yr USTs (+3.5bps) have moved higher, trading at 3.85% after resuming trading following the President’s Day holiday. Meanwhile, the terminal rate (July) and Dec 23 are being priced at around 5.30% and 5.09%, as we go to print, just a little higher than Friday's close.

Elsewhere, minutes from the RBA’s latest meeting indicated that additional rate hikes are likely needed over the months ahead to bring down inflation from overheated levels. The minutes further highlighted that currently a pause in its hikes - as was the case in December is not an option mainly because of “incoming prices and wages data exceeding expectations”

Yesterday, with US markets closed, the main news story was President Biden’s unannounced visit to Kyiv to meet with President Zelensky. Bloomberg reported that the US intends to support the Ukraine with new military aid package worth $500 million, the full details of which are to be clarified today. Biden also announced that the package will include ammunition for HIMARS rocket launchers, a weapon previously proven highly effective against Russian forces.

In Europe, markets struggled for direction after fluctuating between gains and losses before finishing in the red. Yesterday, we heard from ECB’s Rehn in an interview with Börsen-Zeitung. Although historically dovish, Rehn instead added to the hawkish drumbeat coming from the central bank stating that rates must be raised further after the March meeting and that they should stay restrictive as long as core inflation is still rising. Rehn also highlighted that the ECB will likely arrive at its terminal rate over the course of the coming summer. Off the back of this, Eurozone overnight index swaps moved to price in 121bps of rate hikes by the September meeting, up +1.2bps yesterday.

Against this backdrop, the STOXX 600 was mildly positive during intraday trading, before posting a small loss at the close, down -0.04%. A strong outperforming was the materials sector which gained +1.27%, with utilities (+0.19%) and health care (+0.13%) also posting modest gains. On the other end, information technology relatively underperformed, down -0.65%. In fixed income markets, 10yr bund yields posted a modest rise, up +1.9bps to 2.45%, while the interest-rate sensitive 2yr bund yield closed up +2.5bps to 2.88%. 10yr gilts outperformed yesterday, with yields falling back -4.2bps to 3.47%.

In other news, we had a material upside surprise in Swedish CPI yesterday. Core was significantly higher than expected by both the market and the Riksbank, up +0.4% month-on-month (vs -0.2%), bringing core inflation to 8.7% year-on-year (vs 8.2% expected). The minutes from the meeting were released soon after the print and demonstrated a strong hawkish consensus that speaks to further rate hikes before the summer. Following the print, Swedish 10yr government yields hit their highest level since September 2013, closing up +12.8bps.

Finally, ahead of today’s PMI releases, we had the Eurozone’s February consumer confidence index, which printed at -19.0 as expected, an improvement from -20.9 in January. We also had the print for Eurozone construction output for December, with the month-on-month printing at -2.5%, and the year-on-year down to -1.3%.

To the day ahead, we have a number of data releases today, but the main highlight will be the global flash PMIs for February. In other data releases, we will have the US February Philadelphia Fed non-manufacturing activity release, January existing house sales, UK January public finances, the Germany and Eurozone February ZEW survey, France January retail sales, EU27 January new car registrations and in Canada, the January CPI and December retail sales. Finally, earnings releases include Walmart, Home Depot, Medtronic and Palo Alto Networks.

US stock futures fell for the second day amid deepening geopolitical tensions, and as investors awaited data this week that may show stickier core inflation, prompting expectations for more rate hikes by the Federal Reserve. Futures contracts on the S&P 500 dropped 0.7%, while those on the Nasdaq 100 were down 0.9% as of 7:45 a.m. in New York, after the cash market was closed on Monday for a public holiday. Treasury yields jumped, with the 10Y rising as high as 3.89%, while the Bloomberg Dollar Spot Index retreated from the day’s highs, and the pound led gains among Group-of-10 currencies after UK companies reported surprise growth in output.

In premarket trading, Manchester United shares rose as bid interest in the English Premier League club intensified over the weekend. Sigma Lithium jumped after Bloomberg News reported that Tesla has been weighing a takeover of the battery-metals miner. Walmart tumbled after the retailing giant’s profit forecast for this year fell short of analyst estimates, signaling a cautious outlook for the world’s largest retailer after a 2022 performance that was marred by an inventory surge. Bank stocks are lower in premarket trading Tuesday as the US market is set to reopen following a holiday. Here are some other notable premarket movers:

- JD.com leads a decline in Chinese internet stocks in US premarket trading, after a South China Morning Post report that the e-commerce firm is launching a subsidy campaign to compete with PDD Holdings in a low-price product offering.

- Sigma Lithium (SGML US) rises as much as 27% after Bloomberg News reported that Tesla (TSLA US) has been weighing a takeover of the battery-metals miner. Tesla declines 0.9%.

- Manchester United (MANU US) shares jump 8.2% before paring gains as bid interest in the English Premier League club intensified over the weekend, with British billionaire Jim Ratcliffe submitting a bid, while Elliott Investment Management offered a proposal to provide financing.

- MarineMax (HZO US) shares rise 1.9% after B. Riley upgrades the boat retailer to buy from neutral, with the broker highlighting the company’s diversification push and opportunities arising from its real estate portfolio.

- Keep an eye on Generac Holdings (GNRC US) stock as its rating was cut to hold from buy at Truist Securities, which says high interest rates and product prices will pose a “meaningful risk” to the generator maker’s 2023 financials.

- Watch Caleres (CAL US) stock as it was raised to overweight from neutral at Piper Sandler after the footwear company’s preliminary 2022 results indicated structural earnings gains.

- BioMarin Pharmaceutical (BMRN US) is started with a neutral recommendation at Citi, which in a note says that recent developments and expected progress for 2023 are already priced into the stock.

After the underlying S&P benchmark fell last week, US stocks are likely to remain under pressure amid concerns that the Fed could keep rates higher for longer. Investors will be closely watching the US purchasing managers index, due on Tuesday, and Friday’s personal consumption expenditures data for an indication of the likely path of monetary policy.

A start-of-the-year rally in global stocks has fizzled, and the dollar resumed gains, after central bankers reaffirmed their will to combat inflation. That, and a stubborn trend in prices, have pushed traders to factor in another 75 basis points of rate hikes by the Federal Reserve by July. They also pruned their bets for the first US rate cut: swaps now expect a 20 basis-point reduction by year-end, compared with a 50 basis-point move seen earlier this month.

“The tone after the long weekend is more biased to the downside as investors adjust to a more hawkish path from central banks that’s coming into play,” said Karim Chedid, head of investment strategy for iShares EMEA at BlackRock Inc. “In the past week we started to see equity sentiment respond to that, and we expect that to continue this week.”

Expensive US equities are flashing a warning sign that could see the S&P 500 sliding as much as 26% in the first half of this year, according to the latest weekly doom and gloom sermon by Morgan Stanley’s Mike Wilson. The year-to-date rally in equities is “pure FOMO” — fear of missing out — at best, and the excitement is misplaced, they said.

“The Fed are not signaling they will do anything different from what they have always said — but earlier, markets did not believe them,” said Fahad Kamal, chief investors officer at SG Kleinwort Hambros Bank. “The market was far too complacent at start of the year thinking there’ll be a pivot. Now the data has come in stronger, and the Fed hasn’t changed what they said. So we got a big rally earlier and then a bit of reversal.”

European stocks drifted lower as Bank of America to JPMorgan predicted an end to their 2023 rally. European stocks were in the red although off their worst levels with the Stoxx 600 down 0.3% in wake of the morning’s strong EZ PMI metrics which potentially give the ECB cover to tighten more aggressively.

- Euro Area Composite PMI (Feb, Flash): 52.3, consensus 50.7, last 50.3.

- Euro Area Manufacturing PMI (Feb, Flash): 48.5, consensus 49.3, last 48.8.

- Euro Area Services PMI (Feb, Flash): 53.0, consensus 51.0, last 50.8.

- France Composite PMI (Feb, Flash): 51.6, consensus 49.8, last 49.1.

- Germany Composite PMI (Feb, Flash): 51.1, consensus 50.3, last 49.9.

- UK Composite PMI (Feb, Flash): 53.0, consensus 49.0, last 48.5.

And some Goldman commentary on the PMIs:

The Euro area composite flash PMI increased by 2.0pt to 52.3 in February, well above consensus expectations. The increase in the composite index was broad-based across sectors, with manufacturing output surpassing the 50 threshold for the first time since May last year. Across countries, the improvement was led by France and the periphery, followed by Germany. In the UK, the composite flash PMI improved by 4.6pt to 53.0, also well above consensus expectations. We see three main takeaways from today’s data. First, even though the composite manufacturing index weakened, this decline was driven by an improvement in supply constraints as suppliers’ delivery times—which are included in the composite calculation with an inverse sign—recorded the largest monthly improvement outside the pandemic period and inventory stocks declined. Resilient demand in the services sector and easing supply constraints point to positive growth momentum in both the services and manufacturing sector, consistent with our above-consensus view on the Euro area growth outlook. Second, price pressures are moderating but services inflation remains sticky. Third, today’s notable upside surprise in the UK points to upside risk to our Q1 growth forecast but increases the likelihood of another 25bp hike at the upcoming MPC meeting, as we continue to expect.

Tech, autos and miners are the worst performing sectors. Credit Suisse shares tumbled as much as 6.4% after Reuters reported that Switzerland’s financial regulator is reviewing comments from Chairman Axel Lehmann on outlows from the company having stabilized. Here are some of the notable European movers:

- SIG Group shares fall as much as 5%, the most since November, as Kepler Cheuvreux cuts the packaging firm to hold from buy, saying the stock now looks fairly valued

- ALSO shares fall as much as 6%, the most since August 2022, as analysts said the Swiss computer hardware and software wholesaler’s 2023 guidance is cautious and below expectations

- GB Group plunges as much as 13% after after projecting full-year profit that misses estimates with the fraud prevention company seeing longer sales cycles and challenging conditions

- InterContinental Hotels shares drop as much as 2.9% in London after the hotel operator’s full-year results, with Citi seeing the performance as slightly negative overall

- Worldline shares slip as much as 4.5%, erasing earlier gains, as Citi notes that the payment firm’s FY23 profitability was slightly weaker than consensus forecasts

- Straumann falls as much as 3.3%, erasing earlier gains, after its latest earnings slightly beat estimates, with analysts calling 2023 guidance from the dental implants-maker encouraging

- HSBC shares erase early losses, rising as much as 2.6%, after fourth-quarter results that showed profit that beat expectations but higher-than-expected costs

- ElringKlinger gains as much as 3.3% after the German car- parts maker posted what Warburg calls strong preliminary results

- Rovi gains as much as 7.4%, the most since Sept. 2021, after the specialty pharmaceuticals company released results which beat on strong contract manufacturing organization revenue

The Stoxx 600 will end the year 2% lower than Friday’s close, according to the average target in a Bloomberg survey of forecasters. Bank of America strategist Milla Savova said a temporary boost to the region’s economy will fade as the full impact of monetary tightening materializes, while earnings forecasts will get downgraded.

Earlier in the session, Asian stocks also fell as investors awaited earnings from China’s major tech companies and minutes from the US Federal Reserve later this week. The MSCI Asia Pacific Index slid as much as 0.9%, with China’s tech shares among the biggest laggards. JD.com led declines following a report that the e-commerce firm is planning a subsidy campaign as it ratchets up a price war against rivals. While China’s benchmark recovered from intraday losses, the Hang Seng Index continued its slide toward a technical correction, down more than 9% since peaking late last month. Investors are looking ahead to reports from tech behemoths Alibaba and Baidu later this week. MSCI’s Asia index has broken below its 50-day moving average for the first time since August amid concerns the Federal Reserve will keep raising rates to quell inflation. Fed minutes are scheduled to be released Wednesday.

“If we’re seeing higher implied volatility in interest rates – as options trader’s price higher degrees of movement -then that should spill over into higher volatility in the USD and equity markets too,” Chris Weston, head of research at Pepperstone Group, wrote in a note. “This is the biggest risk to the markets we’re facing now.”

Japanese stocks ended lower as investors await for clues on the next moves by the Bank of Japan and Federal Reserve. The Topix Index fell 0.1% to 1,997.46 as of market close Tokyo time, while the Nikkei declined 0.2% to 27,473.10. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix Index decline, decreasing 1.5%. Out of 2,163 stocks in the index, 1,185 rose and 867 fell, while 111 were unchanged. “It’s difficult for domestic investors to move, ahead of the hearing of Mr. Ueda, who was nominated as the BOJ governor,” said Ryuta Otsuka, a strategist at Toyo Securities.

Australian stocks also declined: the S&P/ASX 200 index fell 0.2% to close at 7,336.30, dragged by losses in banks and real estate names. Stocks around Asia declined as investors mulled the prospect of central banks tightening policy more than previously expected to tame inflation. In New Zealand, the S&P/NZX 50 index fell 0.8% to 11,801.49

In FX, the Bloomberg Dollar Spot Index rose as much as 0.4% before paring, though it remained within recent days’ ranges. The greenback traded higher against all of its Group-of-10 peers apart from the pound and the Swedish krona. The pound rallied after data showed UK private-sector business activity expanded in February, defying forecasts for another month of contraction. Here are some notable moves:

- The euro fell a second day to a low of 1.0643, before paring. The currency shrugged off German ZEW expectations, which rose to 28.1 in February, versus estimate 23.0. Other data showed euro-area business activity rose at the fastest rate in nine months in February. The euro’s volatility term structure versus the dollar has been inverted since January 2022 and hedge funds are betting that normalization is due for a return

- The pound flipped to gains against the dollar and gilt yields surged as markets added to pricing of future BOE hikes after British companies unexpectedly reported the first growth in seven months in PMI data. Earlier, public finance figures showed borrowing since the fiscal year that began in April is running £22 billion below the level forecast by the Office for Budget Responsibility

- The Swedish krona rose versus the euro and the dollar, outperforming Group-of-10 peers, after Riksbank Deputy Governor Martin Floden described underlying inflation in January as worrying. Separately, Swedish long-term inflation expectations fell in the latest Prospera survey, signaling that money market participants are strengthening in their belief that the Riksbank will succeed in bringing soaring price increases down closer to its target

- Japan’s benchmark yield briefly rose above the central bank’s ceiling for the first time since its January meeting as traders continued to bet on further policy tweaks.

- The Australian dollar gave up an advance and sovereign bonds pared declines. Bonds earlier fell after the Reserve Bank’s meeting minutes showed that the central bank also considered a 50 basis-point hike to the 25 basis-point one it delivered

In rates, Treasuries slid across the curve and were under pressure as US trading resumes after long weekend, trailing steeper declines for gilts sparked by stronger-than-forecast UK PMI gauges for February. Treasury yields are higher by 4bp-7bp across the curve, still inside Friday’s ranges which included YTD highs for all tenors except 20Y. Treasury auction cycle begins with $42b 2-year note sale at 1pm that’s poised to draw the highest yield since 2007. WI 2-year yield 4.64%; current issue traded as high as 4.713% Friday, within 9bp of last year’s multiyear high, as traders fully priced in a Fed rate hike in May to follow expected increase in March

In commodities, oil futures witnessed a choppy session as investors weighed the possibility of further monetary tightening against signs of improving demand from China. A gain in West Texas Intermediate futures reflected catch-up trades as there had been no settlement on Monday. WTI rose 0.9% to trade near $77.10 while Brent drops 0.3% to trade around $83.80. Spot gold falls roughly 0.4% to $1,833.

In crypto, bitcoin held around the $25k handle within fairly narrow parameters awaiting the re-entry of US participants after Monday’s market holiday.

Looking to the day ahead, we have a number of data releases today, but the main highlight will be the global flash PMIs for February. In other data releases, we will have the US February Philadelphia Fed non-manufacturing activity release, January existing house sales, UK January public finances, the Germany and Eurozone February ZEW survey, France January retail sales, EU27 January new car registrations and in Canada, the January CPI and December retail sales. Finally, earnings releases include Walmart, Home Depot, Medtronic and Palo Alto Networks.

Market Snapshot

- S&P 500 futures down 0.7% to 4,058.50

- STOXX Europe 600 down 0.3% to 463.44

- MXAP down 0.8% to 162.43

- MXAPJ down 0.9% to 528.89

- Nikkei down 0.2% to 27,473.10

- Topix down 0.1% to 1,997.46

- Hang Seng Index down 1.7% to 20,529.49

- Shanghai Composite up 0.5% to 3,306.52

- Sensex little changed at 60,678.01

- Australia S&P/ASX 200 down 0.2% to 7,336.30

- Kospi up 0.2% to 2,458.96

- German 10Y yield little changed at 2.47%

- Euro down 0.2% to $1.0664

- Brent Futures down 1.2% to $83.02/bbl

- Gold spot down 0.4% to $1,834.74

- U.S. Dollar Index up 0.15% to 104.02

Top Overnight News

- President Vladimir Putin issued a defiant message on his war in Ukraine, vowing to continue the faltering invasion until Russia has achieved its goals: BBG

- “Frustrating,” “very annoying” and “left in the dark.” These and similar expressions have been used to describe the near month-long blackout on key global investor positioning reports that cover bets on everything from Treasuries to soybean futures — the casualty of a ransomware attack on financial firm ION Trading UK: BBG

- China tech leaders from firms such as Tencent, NetEast, Bidu, Didi, and others, met with senior officials from China’s Ministry of Industry and Information Technology (MIIT) to discuss ways to advance the interests of the tech industry. SCMP

- China is no longer viable as the world’s factory according to the head of Kyocera, a critical Japanese tech firm, due to Western restrictions on Beijing’s access to advanced technology (“the business model of producing in China and exporting abroad is no longer viable”). FT

- China is increasingly concerned that Russia, which it considers a key partner in Beijing’s quest to contain and counter the US, is being permanently weakened by Putin’s misguided war in Ukraine, and so is pushing for a ceasefire in the conflict. WSJ

- Europe’s flash PMIs for February were net positive, with encouraging growth details (especially in services) and an inflation slowdown (inflation notably cooled in manufacturing); UK flash PMIs for Feb were bullish, with solid upside on growth (the composite reading came in at 52, up from 48.5 in Jan and above the St’s 49 consensus) and cooling inflation (“Feb data pointed to the slowest overall increase in average cost burdens since April 2021”). S&P

- Iran – UN nuclear inspectors have detected uranium in Iran enriched to near weapons-grade (84% purity vs. the 90% required for weapons), a potential major escalatory step in the country’s nuclear program. WSJ

- Credit Suisse shares slump in Europe on reports that Swiss financial regulators are looking into reassuring remarks made by chairman Axel Lehmann about outflows at the company stabilizing. RTRS

- US fiscal stimulus to fade further – one of the last fiscal stimulus programs related to COVID, enhanced food stamps, is about to come to an end, creating headwinds for Walmart, Kroger, Dollar General, Dollar Tree, etc. (and the expiration of this program could have a dampening effect on food inflation too). WSJ

- Google’s $168 billion online ad business will be in focus when arguments are heard today on whether internet companies are liable for the content their algos recommend to users. The Supreme Court case may affect automated ads that hand Facebook and Google the bulk of their revenue. BBG

- Home Depot’s US comp sales fell less than expected but overall like-for-likes missed. It forecast profit will fall in the mid-single digits as it spends $1 billion to increase wages for sales staff. Shares slipped. Coming up, Walmart’s same-store sales growth may exceed its 3% guidance after a strong holiday season and a rise in cost-conscious shopping. Inventory-clearing markdowns and higher input costs may weigh on margin recovery. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were subdued with trade mostly kept rangebound in the absence of a lead from Wall Street. ASX 200 traded lower amid a deluge of earnings releases including a decline in BHP’s profits. Nikkei 225 was contained after mixed PMI data in which Manufacturing PMI declined by the fastest pace in two and a half years although Services PMI showed a firmer expansion. Hang Seng and Shanghai Comp. were mixed with Hong Kong dragged lower by tech losses, while the mainland was just kept afloat amid strength in developers after China launched an investment pilot for the property sector.

Top Asian News

- UK Foreign Secretary Cleverly said he spoke with Chinese Foreign Minister Qin Gang and raised human rights abuses in Xinjiang and the need for peace in the Taiwan Strait during the call, according to Reuters.

- RBA Minutes from the February meeting noted that the board considered a hike of 25bps or 50bps and that a pause was not an option. RBA said there were arguments in favour of both options but it concluded that the case to increase the Cash Rate by 25bps was the stronger one and the Board also agreed further increases would be needed over the months ahead. Furthermore, the RBA noted that monthly meetings allowed for frequent adjustments and that rates have already risen substantially, while it stated the Board will do what is needed to return inflation to the target and that data suggested more breadth and persistence in inflation than expected.

- China’s Politburo discussed reforms to party and state organisations, according to state media.

- Iron Ore Piles Up at South African Mines on Rail Bottlenecks

- Gold Declines as Traders Await Fed Minutes for Rate Clues

- China Leaders Pledge Stronger Growth as Recovery Takes Hold

European bourses, Euro Stoxx 50 -0.7%, & US futures, ES -0.7%, remain negative but have lifted from the sessions’ trough that printed in wake of the morning’s EZ PMI metrics which potentially give the ECB cover to tighten more aggressively. The FTSE 100 was dragged lower in tandem though remained somewhat resilient to the strong UK PMIs, which sparked a hawkish re-pricing for 25bp in March from the BoE, with a yield-induced turnaround in HSBC (+2.0%) now proving supportive after initial post-guidance pressure.

Stateside, futures are lower with the above drivers factoring after Monday’s holiday and ahead of the week’s key events via FOMC Minutes and PCE; modest further pressure seen post-HD earnings, though futures remain off earlier lows. Home Depot Inc (HD) Q4 2022 (USD): EPS 3.21 (exp. 3.28), Revenue 35.719bln (exp. 35.97bln); boosts dividend 10%. -2.8% in pre-market trade

Top European News

- BoE Deputy Governor Woods said he will consult on changes to UK insurance capital rules in June and September, while he added that insurers will have a very good sense of what the changes to capital rules will be by year-end, according to Reuters.

- UK PM Sunak was warned not to undermine Northern Ireland and that an N.I. deal could trigger resignations, according to The Times.

- Germany’s tax revenues rose 0.8% Y/Y, which was driven by higher sales taxes and wages taxes, according to the Finance Ministry.

- Hungary’s EU funds negotiator said access to the grants and cheap loans could be delayed until the summer (vs prior April guidance) to resolve remaining issues with Brussels over democratic reforms.

- Enagas Sees 2023 Net Income EU310M to EU320M

- UK Companies Unexpectedly Show First Output Growth in Six Months; UK Feb. Flash Services PMI 53.3; Est 49.2

- Iron Ore Piles Up at South African Mines on Rail Bottlenecks

- Manchester United Shares Advance as Bid Interest Intensifies

- Putin Defiant as Struggling Ukraine Invasion Nears Second Year

FX

- DXY has derived support from upside in US yields, risk aversion and a loss of momentum in some FX peers, with the index holding around 104.00 despite being pressured to a 103.86 trough post UK PMI data.

- A release which sent GBP/USD to a 1.2113 peak from circa. 1.2000 before hand in a marked hawkish move which also allowed peers, ex-EUR, to trim some downside vs the USD, though this dynamic has since eased.

- For the EUR, despite hitting a 1.0688 peak following the French PMIs the single currency has failed to hold onto this upside with EUR/GBP action weighing.

- JPY is the incremental laggard given unfavourable yield dynamics for JGBs vs USTs/EGBS while antipodeans have faded amid domestic data for the NZD and despite hawkish RBA minutes for the AUD; currently, around 134.65, 0.623 & 0.688 respectively.

- SEK continues to lift amid further hawkish rhetoric and continuing emphasis on the currency from officials, with EUR/SEK briefly moving below 11.00.

- PBoC set USD/CNY mid-point at 6.8557 vs exp. 6.8550 (prev. 6.8643)

Fixed Income

- Core benchmarks are ultimately pressured despite initial gyrations around geopolitics and PMIs; Bunds at 134.60 within 134,32-134.97 boundaries.

- Gilts are the stand-out laggard following UK Flash PMIs which saw a hawkish re-pricing of market expectations for a 25bp BoE hike in March increase to over 95% from the low-80s before hand; UK supply due.

- Stateside, USTs are softer in tandem with the above narrative with yields elevated and the move fairly broad-based across the curve ahead of Biden and supply.

Commodities

- WTI and Brent April futures have experienced a choppy Tuesday session thus far and are currently modestly firmer as broader sentiment eases and Putin concludes his speech, despite being initially pressured below USD 76.00/bbl and USD 83/bbl respectively.

- Iran set March Iranian light crude price to Asia at Oman/Dubai +USD 2.00/bbl, according to a Reuters source.

- Russian Deputy PM Novak says oil output reductions in March will be from January levels, according to Interfax; Oil output reduction decision was only made for March. Expects discount on Urals to decrease. Novak has previously said that Russian crude production for January was between 9.8-9.9mln BPD.

- Caspian pipeline consortium is reportedly to suspend crude shipments due to poor weather, via Reuters citing sources.

- Iraq’s oil minister says new licensing deals will produce 250k BPD of crude, according to the State News Agency.

- NatGas benchmarks are softer on both sides of the pond, though the magnitude of downside is fairly modest, with broader sentiment dictating price action.

- Spot gold is weighed on by the USD, though the downside is minimal in nature given its traditional haven allure while base metals are mixed overall.

Geopolitics

- Russian President Putin says we will decide on the tasks of the special military operation step-by-step, the West is seeking to change local conflict into a global one. The next steps to strengthen the army and navy should take into account the experience of the special military operation. Expects to enhance cooperation with India, Iran and Pakistan. Adds, if the US conducts nuclear tests then Russia will do the same.

- Ukrainian President Zelensky said he sees resolve from the US and President Biden to end Russian aggression this year and also stated that a world order based on rules, humanity and predictability depends on what happens now in Ukraine, according to Reuters.

- EU’s Borrell said he is confident EU members will approve the next Russian sanctions package within the next hours or days and said the sanctions agreement should be reached before the end of the week.

- US Deputy Treasury Secretary Adeyemo says the US and allies are planning new sanctions this week to continue to isolate Russia over the war in Ukraine; additionally, 12 EU nations say Russia is transitioning into a full-on military economy, with a view to sustaining its war efforts, via Reuters citing a document.

- Belarus sees direct threats to its military security, according to Tass citing the Defence Ministry; adds, a significant grouping of the Ukrainian army is massed near its border. Will take adequate measures to respond to military provocations, intends to hold over 150 joint exercises with Russia in 2023.

- Ukrainian Presidential Aide says Ukrainian forces have the situation along the northern border under “special control”.

- Japanese PM Kishida said they plan to pledge another USD 5.5bln in aid to Ukraine and announced that they will host a G7 summit meeting this Friday in which Ukrainian President Zelensky will be invited to join. Japanese Finance Minister Suzuki separately announced to hold the G7 financial leaders meeting on February 23rd and will reaffirm a stern stance against Russia at the G7 meeting, while he added they will continue to closely coordinate with other countries on sanctions to achieve the ultimate goal of Russia’s withdrawal from Ukraine, as well as noted that measures against Russia and support for Ukraine will be the main topics on the G7 agenda.

- China seeks to broker Russia-Ukraine peace and urged the world to stop saying Taiwan is next after Ukraine, according to Bloomberg.

- Senior aides of Israeli PM Netanyahu and Palestinian President Abbas have been conducting secret talks for almost two months in an effort to de-escalate rising tensions in the occupied West Bank, according to Axios sources.

US Event Calendar

- 08:30: Feb. Philadelphia Fed Non-Manufactu, prior -6.5

- 09:45: Feb. S&P Global US Manufacturing PM, est. 47.4, prior 46.9

- 09:45: Feb. S&P Global US Services PMI, est. 47.3, prior 46.8

- 09:45: Feb. S&P Global US Composite PMI, est. 47.5, prior 46.8

- 10:00: Jan. Existing Home Sales MoM, est. 2.0%, prior -1.5%

Central Bank Speakers

- Nothing on the calendar

DB’s Jim Reid concludes the overnight wrap

If you interacted with me yesterday please disregard it (unless the advice proves correct) as I was a total zombie all day having been up all night the previous one with a sick dog (Brontë). My wife was up the previous night. Thankfully Brontë seems better and I slept from 830pm-445am last night. So I feel as fresh as a daisy this morning… albeit one that managed to dodge the lawn mower all summer and has just felt the first frost of the year at the end of September.

Thankfully for me, markets had a quiet start to the week yesterday, with US markets closed, whilst in Europe, markets fluctuated between gains and losses over the day, with the STOXX 600 (-0.04%) modestly retreating, and 10yr bund yields (+1.9bps) advancing at the close after being lower most of the day. The quiet start to the week will break with the Eurozone, UK, Germany, France and US publishing their flash February PMIs over the course of today. The data momentum has been positive of late but it’s going to be hard for the next few months to assess where we should be at this stage of the cycle. There has no doubt been big improvements from gas price falls and loosening of financial conditions but we’re yet to see anything close to the full lag of monetary policy filter through to the US and Europe. If the war in Ukraine hadn’t happened and if financial conditions hadn’t collapsed for the first 9 months of last year due to the rates shock, then growth may still be quite strong at this point before the lag of a huge and rapid hiking cycle could kick in. So we have to be careful not to over interpret an improvement back to where we might normally be at this stage of a cycle and not confuse it with a sustainable soft landing.

Japan has kicked off the PMI round with mixed readings. The nation’s manufacturing activity shrank for the fourth consecutive month, falling to a level of 47.4 from last month’s 48.9 – its largest decline since August 2020. On the otherside, the au Jibun Bank flash services PMI rose to an eight-month-high of 53.6 from 52.3 last month.

Asian equity markets are mostly trading lower this morning as the prospect of the US Fed staying hawkish over policy tightening continues to weight on sentiment. As I type, the Hang Seng (-0.99%) is leading losses, dragged lower mostly by tech stocks with the Nikkei (-0.12%) also losing ground while the Chinese stocks are mixed with the CSI (-0.02%) trading just below flat and the Shanghai Composite (+0.10%) eking out minor gains in early trade. Meanwhile, the KOSPI (+0.22%) is bucking the trend.

Outside of Asia, US stock futures are indicating a negative start with contracts tied to the S&P 500 (-0.44%) and NASDAQ 100 (-0.37%) edging lower. Meanwhile, yields on 10yr USTs (+3.5bps) have moved higher, trading at 3.85% after resuming trading following the President’s Day holiday. Meanwhile, the terminal rate (July) and Dec 23 are being priced at around 5.30% and 5.09%, as we go to print, just a little higher than Friday’s close.

Elsewhere, minutes from the RBA’s latest meeting indicated that additional rate hikes are likely needed over the months ahead to bring down inflation from overheated levels. The minutes further highlighted that currently a pause in its hikes – as was the case in December is not an option mainly because of “incoming prices and wages data exceeding expectations”

Yesterday, with US markets closed, the main news story was President Biden’s unannounced visit to Kyiv to meet with President Zelensky. Bloomberg reported that the US intends to support the Ukraine with new military aid package worth $500 million, the full details of which are to be clarified today. Biden also announced that the package will include ammunition for HIMARS rocket launchers, a weapon previously proven highly effective against Russian forces.

In Europe, markets struggled for direction after fluctuating between gains and losses before finishing in the red. Yesterday, we heard from ECB’s Rehn in an interview with Börsen-Zeitung. Although historically dovish, Rehn instead added to the hawkish drumbeat coming from the central bank stating that rates must be raised further after the March meeting and that they should stay restrictive as long as core inflation is still rising. Rehn also highlighted that the ECB will likely arrive at its terminal rate over the course of the coming summer. Off the back of this, Eurozone overnight index swaps moved to price in 121bps of rate hikes by the September meeting, up +1.2bps yesterday.

Against this backdrop, the STOXX 600 was mildly positive during intraday trading, before posting a small loss at the close, down -0.04%. A strong outperforming was the materials sector which gained +1.27%, with utilities (+0.19%) and health care (+0.13%) also posting modest gains. On the other end, information technology relatively underperformed, down -0.65%. In fixed income markets, 10yr bund yields posted a modest rise, up +1.9bps to 2.45%, while the interest-rate sensitive 2yr bund yield closed up +2.5bps to 2.88%. 10yr gilts outperformed yesterday, with yields falling back -4.2bps to 3.47%.

In other news, we had a material upside surprise in Swedish CPI yesterday. Core was significantly higher than expected by both the market and the Riksbank, up +0.4% month-on-month (vs -0.2%), bringing core inflation to 8.7% year-on-year (vs 8.2% expected). The minutes from the meeting were released soon after the print and demonstrated a strong hawkish consensus that speaks to further rate hikes before the summer. Following the print, Swedish 10yr government yields hit their highest level since September 2013, closing up +12.8bps.

Finally, ahead of today’s PMI releases, we had the Eurozone’s February consumer confidence index, which printed at -19.0 as expected, an improvement from -20.9 in January. We also had the print for Eurozone construction output for December, with the month-on-month printing at -2.5%, and the year-on-year down to -1.3%.

To the day ahead, we have a number of data releases today, but the main highlight will be the global flash PMIs for February. In other data releases, we will have the US February Philadelphia Fed non-manufacturing activity release, January existing house sales, UK January public finances, the Germany and Eurozone February ZEW survey, France January retail sales, EU27 January new car registrations and in Canada, the January CPI and December retail sales. Finally, earnings releases include Walmart, Home Depot, Medtronic and Palo Alto Networks.

Loading…