The yen crashed in early Asia trading, tumbling to match is exact lows from April 1990 in what is being blamed on a 'fat finger' trade or multiple barrier-option trades being triggered, by sources that have literally no idea.

The plunge extended Friday's big drop which followed BoJ Governor Ueda's apparent lack of interest in doing anything about the yen's decline, claiming it had 'no impact' on the currency's inflation picture.

“Currency rates is not a target of monetary policy to directly control,” he said.

“But currency volatility could be an important factor in impacting the economy and prices. If the impact on underlying inflation becomes too big to ignore, it may be a reason to adjust monetary policy.”

In fact, policymakers have repeatedly warned that depreciation won’t be tolerated if it goes too far too fast.

Finance Minister Shunichi Suzuki reiterated after the BoJ meeting that the government will respond appropriately to foreign exchange moves.

Potential triggers for interventions are public holidays in Japan on Monday and Friday next week, which bring the risk of volatility amid thin trading.

“Should the yen fall further from here, like after the BOJ decision in September 2022, the possibility of intervention will increase,” said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking Corp.

“It is not the level but it’s the speed that will trigger the action.”

Well currency volatility is what he has now...

Source: Bloomberg

The sudden drop pushed USDJPY perfectly to its April 1990 highs to the tick...

Source: Bloomberg

The currency pain was all focused in the Japanese market as EUR and GBP strengthened against the USD...

Source: Bloomberg

Perhaps even more notably, the yen puked relative to the Chinese yuan, hitting 22 for the first time since 1992 and putting further pressure on Beijing to potentially do something...

Source: Bloomberg

The question is, of course, what will Japan's MoF/BoJ do now - if anything as their recent excuses about 'velocity' or some such spin are now out of the window after a 6-handle standalone surge in their currency in a few short days (when the rest of the world's currencies are not).

“Authorities may say they don’t target levels per se, but they do pay close attention to the trend and the rate of change and current levels suggest they have to act soon or risk facing a credibility crisis,” said Chris Weston, head of research at Pepperstone Group Ltd.

“The FX market is almost taking them on like the bond vigilantes of old.”

Specifically as SocGen's FX strategist Kit Juckes noted on Friday, the yen's decline is becoming disorderly, which points to a final, potentially sharp, decline before it finds a floor.

However, as we detailed last week, the problem with intervention is that once the genie is out of the bottle… it’s hard to put it back in.

In other words, the onus should be on the BOJ to step in with a much more hawkish move than the market expects.

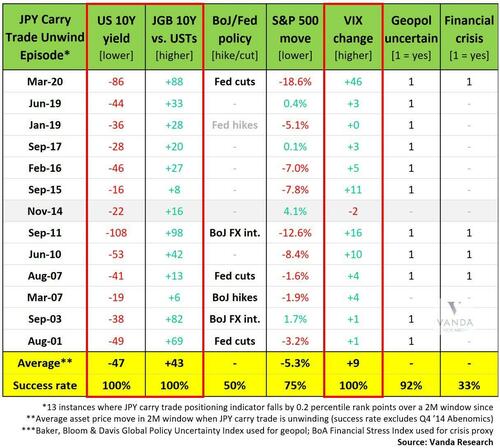

As Viraj Patel from Vanda Research goes on to note that "we’re at a stage where MoF/BoJ have no choice but to intervene. The best way would be for BoJ to hike 25bps this week. It’s not about the macro anymore (BoJ should’ve normalized policy faster last year)."

Instead, what is going on is that Japan's disastrous handling of its currency has evolved into a game between speculators and officials: Specs are short yen for good fundamental reasons (carry). At this stage, a “surprise” hike to send a signal to markets that they are concerned about ongoing FX weakness (and don’t test us) would be less costly to the economy vs. a further devaluation in the yen. It also adds an additional level of uncertainty to the BoJ/MoF reaction function - which speculators (long carry trades) don’t like.

Meanwhile, FX intervention - which unfortunately looks to be the MoF/BoJ’s preferred route based on recent history - is not even a short-term fix anymore. USD/JPY dips would be quickly bought into based on recent market chatter. A hike goes a bit further towards solving the root cause of yen weakness - even it’s only a marginally better option.

However, not everyone is convinced intervention is imminent.

In a note late last week, Deutsche Bank says the currency's decline is warranted and finally marks the day where the market realizes that Japan is following a policy of benign neglect for the yen.

We have long argued that FX intervention is not credible and the toning down of verbal jawboning from the finance minister overnight is on balance a positive from a credibility perspective. The possibility of intervention can't be ruled out if the market turns disorderly, but it is also notable that Governor Ueda played down the importance of the yen in his press conference today as well as signalling no urgency to hike rates. We would frame the ongoing yen collapse around the following points.

Yen weakness is simply not that bad for Japan. The tourism sector is booming, profit margins on the Nikkei are soaring and exporter competitiveness is increasing. True, the cost of imported items is going up. But growth is fine, the government is helping offset some of the cost via subsidies and core inflation is not accelerating. Most importantly, the Japanese are huge foreign asset owners via Japan’s positive net international investment position. Yen weakness therefore leads to huge capital gains on foreign bonds and equities, most easily summarized in the observation that the government pension fund (GPIF) has roughly made more profits over the last two years than the last twenty years combined.

There simply isn't an inflation problem. Japan's core CPI is around 2% and has been decelerating in recent months. The Tokyo CPI overnight was 1.7% excluding one-off effects. To be sure, inflation may well accelerate again helped by FX weakness and high wage growth. But the starting point of inflation is entirely different to the post-COVID hiking cycles of the Fed and ECB. By extension, the inflation pain is far less and the urgency to hike far less too. No where is this more obvious than the fact that Japanese consumer confidence are close to their cycle highs.

Negative real rates are great. There is a huge attraction to running negative real rates for the consolidated government balance sheet. As we demonstrated last year, it creates fiscal space via a $20 trillion carry trade while also generating asset gains for Japan's wealthy voting base. This encourages the persistent domestic capital outflows we have been highlighting as a key driver of yen weakness over the last year and that have pushed Japan's broad basic balance to being one of the weakest in the world. It is not speculators that are weakening the yen but the Japanese themselves.

The bottom line, Deutscxhe concludes, is that for the JPY to turn stronger the Japanese need to unwind their carry trade. But for this to make sense the Bank of Japan needs to engineer an expedited hiking cycle similar to the post-COVID experiences of other central banks. Time will tell if the BoJ is moving too slow and generating a policy mistake. A shift in BoJ inflation forecasts to well above 2% over their forecast horizon would be the clearest signal of a shift in reaction function. But this isn’t happening now.

The Japanese are enjoying the ride.

Finally, it goes without saying that the only true circuit-breaker for yen weakness is lower US yields/weak US macro, which is unlikely until the election if, as so many now speculate, there has been a directive by the Biden admin to make the economy look as good as possible ahead of the elections, even if that means manipulating the data to a grotesque degree.

One added complexity for MoF/BoJ is that their two options for tackling yen weakness indirectly adds upward pressure to global rates/yields. They’re caught between a rock and a hard place… and speculators know (enjoy) this.

And finally there is China: the longer BOJ/MoF does nothing to curb the collapse of the yen, a move which is seen a pumping up the country's exporting base at the expense of other mercantilist nations such as China, the higher the probability Beijing will retaliate against Tokyo by devaluing its own currency. At which point all hell will break loose.

But, one way or another, as Goldman noted, it's crunch time for USDJPY.

The yen crashed in early Asia trading, tumbling to match is exact lows from April 1990 in what is being blamed on a ‘fat finger’ trade or multiple barrier-option trades being triggered, by sources that have literally no idea.

The plunge extended Friday’s big drop which followed BoJ Governor Ueda’s apparent lack of interest in doing anything about the yen’s decline, claiming it had ‘no impact’ on the currency’s inflation picture.

“Currency rates is not a target of monetary policy to directly control,” he said.

“But currency volatility could be an important factor in impacting the economy and prices. If the impact on underlying inflation becomes too big to ignore, it may be a reason to adjust monetary policy.”

In fact, policymakers have repeatedly warned that depreciation won’t be tolerated if it goes too far too fast.

Finance Minister Shunichi Suzuki reiterated after the BoJ meeting that the government will respond appropriately to foreign exchange moves.

Potential triggers for interventions are public holidays in Japan on Monday and Friday next week, which bring the risk of volatility amid thin trading.

“Should the yen fall further from here, like after the BOJ decision in September 2022, the possibility of intervention will increase,” said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking Corp.

“It is not the level but it’s the speed that will trigger the action.”

Well currency volatility is what he has now…

Source: Bloomberg

The sudden drop pushed USDJPY perfectly to its April 1990 highs to the tick…

Source: Bloomberg

The currency pain was all focused in the Japanese market as EUR and GBP strengthened against the USD…

Source: Bloomberg

Perhaps even more notably, the yen puked relative to the Chinese yuan, hitting 22 for the first time since 1992 and putting further pressure on Beijing to potentially do something…

Source: Bloomberg

The question is, of course, what will Japan’s MoF/BoJ do now – if anything as their recent excuses about ‘velocity’ or some such spin are now out of the window after a 6-handle standalone surge in their currency in a few short days (when the rest of the world’s currencies are not).

“Authorities may say they don’t target levels per se, but they do pay close attention to the trend and the rate of change and current levels suggest they have to act soon or risk facing a credibility crisis,” said Chris Weston, head of research at Pepperstone Group Ltd.

“The FX market is almost taking them on like the bond vigilantes of old.”

Specifically as SocGen’s FX strategist Kit Juckes noted on Friday, the yen’s decline is becoming disorderly, which points to a final, potentially sharp, decline before it finds a floor.

However, as we detailed last week, the problem with intervention is that once the genie is out of the bottle… it’s hard to put it back in.

In other words, the onus should be on the BOJ to step in with a much more hawkish move than the market expects.

As Viraj Patel from Vanda Research goes on to note that “we’re at a stage where MoF/BoJ have no choice but to intervene. The best way would be for BoJ to hike 25bps this week. It’s not about the macro anymore (BoJ should’ve normalized policy faster last year).”

Instead, what is going on is that Japan’s disastrous handling of its currency has evolved into a game between speculators and officials: Specs are short yen for good fundamental reasons (carry). At this stage, a “surprise” hike to send a signal to markets that they are concerned about ongoing FX weakness (and don’t test us) would be less costly to the economy vs. a further devaluation in the yen. It also adds an additional level of uncertainty to the BoJ/MoF reaction function – which speculators (long carry trades) don’t like.

Meanwhile, FX intervention – which unfortunately looks to be the MoF/BoJ’s preferred route based on recent history – is not even a short-term fix anymore. USD/JPY dips would be quickly bought into based on recent market chatter. A hike goes a bit further towards solving the root cause of yen weakness – even it’s only a marginally better option.

However, not everyone is convinced intervention is imminent.

In a note late last week, Deutsche Bank says the currency’s decline is warranted and finally marks the day where the market realizes that Japan is following a policy of benign neglect for the yen.

We have long argued that FX intervention is not credible and the toning down of verbal jawboning from the finance minister overnight is on balance a positive from a credibility perspective. The possibility of intervention can’t be ruled out if the market turns disorderly, but it is also notable that Governor Ueda played down the importance of the yen in his press conference today as well as signalling no urgency to hike rates. We would frame the ongoing yen collapse around the following points.

Yen weakness is simply not that bad for Japan. The tourism sector is booming, profit margins on the Nikkei are soaring and exporter competitiveness is increasing. True, the cost of imported items is going up. But growth is fine, the government is helping offset some of the cost via subsidies and core inflation is not accelerating. Most importantly, the Japanese are huge foreign asset owners via Japan’s positive net international investment position. Yen weakness therefore leads to huge capital gains on foreign bonds and equities, most easily summarized in the observation that the government pension fund (GPIF) has roughly made more profits over the last two years than the last twenty years combined.

There simply isn’t an inflation problem. Japan’s core CPI is around 2% and has been decelerating in recent months. The Tokyo CPI overnight was 1.7% excluding one-off effects. To be sure, inflation may well accelerate again helped by FX weakness and high wage growth. But the starting point of inflation is entirely different to the post-COVID hiking cycles of the Fed and ECB. By extension, the inflation pain is far less and the urgency to hike far less too. No where is this more obvious than the fact that Japanese consumer confidence are close to their cycle highs.

Negative real rates are great. There is a huge attraction to running negative real rates for the consolidated government balance sheet. As we demonstrated last year, it creates fiscal space via a $20 trillion carry trade while also generating asset gains for Japan’s wealthy voting base. This encourages the persistent domestic capital outflows we have been highlighting as a key driver of yen weakness over the last year and that have pushed Japan’s broad basic balance to being one of the weakest in the world. It is not speculators that are weakening the yen but the Japanese themselves.

The bottom line, Deutscxhe concludes, is that for the JPY to turn stronger the Japanese need to unwind their carry trade. But for this to make sense the Bank of Japan needs to engineer an expedited hiking cycle similar to the post-COVID experiences of other central banks. Time will tell if the BoJ is moving too slow and generating a policy mistake. A shift in BoJ inflation forecasts to well above 2% over their forecast horizon would be the clearest signal of a shift in reaction function. But this isn’t happening now.

The Japanese are enjoying the ride.

Finally, it goes without saying that the only true circuit-breaker for yen weakness is lower US yields/weak US macro, which is unlikely until the election if, as so many now speculate, there has been a directive by the Biden admin to make the economy look as good as possible ahead of the elections, even if that means manipulating the data to a grotesque degree.

One added complexity for MoF/BoJ is that their two options for tackling yen weakness indirectly adds upward pressure to global rates/yields. They’re caught between a rock and a hard place… and speculators know (enjoy) this.

And finally there is China: the longer BOJ/MoF does nothing to curb the collapse of the yen, a move which is seen a pumping up the country’s exporting base at the expense of other mercantilist nations such as China, the higher the probability Beijing will retaliate against Tokyo by devaluing its own currency. At which point all hell will break loose.

But, one way or another, as Goldman noted, it’s crunch time for USDJPY.

Loading…