Almost exactly 10 years ago, billionaire corporate raider Carl Icahn dueled wih fellow billionaire and hedge fund manager Bill Ackman as the latter unveiled a massive short in Herbalife which the former mocked, loaded up on longs and squeezed Ackman for millions in losses.

Icahn remarked at the time:

"If you're short, you go short and hey, if it goes down you make money. You don't go out and get a roomful of people to badmouth the company. If you want to be in that business, why don't you go out and join the SEC?"

Adding that Ackman could face "the mother of all short squeezes" by announcing his major short position, giving other traders something to shoot against.

10 years later, Bloomberg reports that, according to people familiar with the matter, Icahn began shorting GameStop Corp. during the height of the meme-stock frenzy around January 2021 and still holds a large position in the video-game retailer.

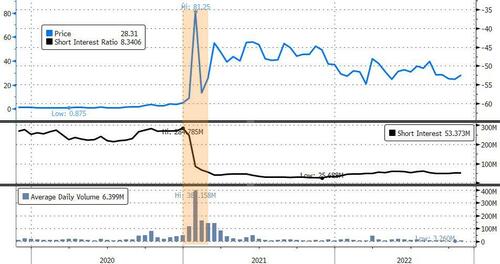

Of course, GameStop is different as it was at the center of the massive short-squeeze in early 2021 that left various major (short) hedge fund managers bleeding heavily...

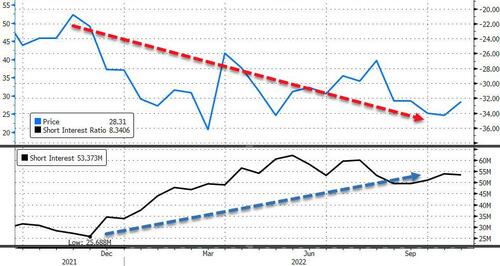

The last few months have seen GME short interest rising modestly (as GME prices have declined)...

The early response to Icahn’s short on social media was relatively measured. News of the wager was shared on Reddit in at least two threads, including in the popular WallStreetBets forum, garnering more than 250 comments as of 9:54 a.m. in Singapore. That pales in comparison to the thousands of responses to GameStop posts during the height of meme mania.

Nevertheless, GME is trading higher overnight (squeeze beginning) after a bloodbath of a day yesterday...

More than one-fifth of GameStop’s shares available for trading are currently sold short, according to data compiled by S3 Partners, more than double the level seen this time last year. That compares to a peak of more than 140% in January 2021 when the retail trading crowd flooded chatrooms on Stocktwits and used memes and GIFs to pump bets on forums like Reddit’s WallStreetBets.

We wonder if Bill Ackman will take a shot?

Almost exactly 10 years ago, billionaire corporate raider Carl Icahn dueled wih fellow billionaire and hedge fund manager Bill Ackman as the latter unveiled a massive short in Herbalife which the former mocked, loaded up on longs and squeezed Ackman for millions in losses.

Icahn remarked at the time:

“If you’re short, you go short and hey, if it goes down you make money. You don’t go out and get a roomful of people to badmouth the company. If you want to be in that business, why don’t you go out and join the SEC?”

Adding that Ackman could face “the mother of all short squeezes” by announcing his major short position, giving other traders something to shoot against.

10 years later, Bloomberg reports that, according to people familiar with the matter, Icahn began shorting GameStop Corp. during the height of the meme-stock frenzy around January 2021 and still holds a large position in the video-game retailer.

Of course, GameStop is different as it was at the center of the massive short-squeeze in early 2021 that left various major (short) hedge fund managers bleeding heavily…

The last few months have seen GME short interest rising modestly (as GME prices have declined)…

The early response to Icahn’s short on social media was relatively measured. News of the wager was shared on Reddit in at least two threads, including in the popular WallStreetBets forum, garnering more than 250 comments as of 9:54 a.m. in Singapore. That pales in comparison to the thousands of responses to GameStop posts during the height of meme mania.

Nevertheless, GME is trading higher overnight (squeeze beginning) after a bloodbath of a day yesterday…

More than one-fifth of GameStop’s shares available for trading are currently sold short, according to data compiled by S3 Partners, more than double the level seen this time last year. That compares to a peak of more than 140% in January 2021 when the retail trading crowd flooded chatrooms on Stocktwits and used memes and GIFs to pump bets on forums like Reddit’s WallStreetBets.

We wonder if Bill Ackman will take a shot?