Redditors and momentum chasers are being led into a burning building by 'meme' stock trader Keith Gill's (aka Roaring Kitty) on the latest pump as GameStop shares erase overnight gains following the announcement of sharp revenue declines in the first quarter and an "at-the-market offering" program to sell more shares.

The grift continues:

— zerohedge (@zerohedge) June 7, 2024

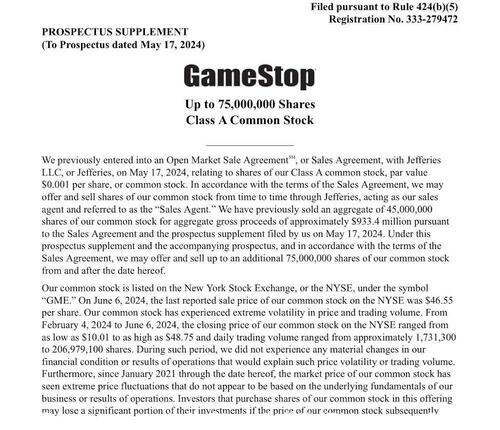

*GAMESTOP MAY SELL UP TO 75M SHARES OF CLASS A STOCK

Let's begin by describing the source of the latest pump. Roaring Kitty's YouTube live event, slated for 1200ET, was announced on Thursday afternoon, which sent shares doubling from around $26 in cash session to as high as $66 in after-hours trading.

In premarket trading, shares were above the $60 handle, then crashed 40% to around $38 following the news that GME filed an at-the-market offering to sell 75 million shares of the company's Class A common stock.

Jefferies is the 'Sales Agent' on the deal.

Earlier, GME reported first-quarter results showing net sales of 881.80 million, down from $1.237 billion year over year. Net sales missed Wall Street's consensus estimate of $995.30 million.

GME also reported an EPS loss of 12 cents, missing the average estimate of 9 cents. According to Reuters, this miss highlights customers' shift to online video games and collectibles, while the retailer continued to rely on its brick-and-mortar stores.

Just weeks ago, during another pump by Gill, GME announced it sold 45 million shares of common stock for about $933.4 million. CEO Ryan Cohen is effectively using Gill's pumps to dump millions of shares into mom-and-pop retail, chasing momentum.

momentum chasers are literally giving their money to Ryan Cohen

— zerohedge (@zerohedge) June 7, 2024

At 1200 ET, Gill will have to re-explain his investment thesis in GME, as first-quarter earnings show a sharp decline, and Cohen is dumping endless shares.

Meanwhile, reports suggest that ETrade might take action against Gill, and at least one securities regulator is currently investigating him for potential stock manipulation.

Redditors and momentum chasers are being led into a burning building by ‘meme’ stock trader Keith Gill’s (aka Roaring Kitty) on the latest pump as GameStop shares erase overnight gains following the announcement of sharp revenue declines in the first quarter and an “at-the-market offering” program to sell more shares.

The grift continues:

*GAMESTOP MAY SELL UP TO 75M SHARES OF CLASS A STOCK

— zerohedge (@zerohedge) June 7, 2024

Let’s begin by describing the source of the latest pump. Roaring Kitty’s YouTube live event, slated for 1200ET, was announced on Thursday afternoon, which sent shares doubling from around $26 in cash session to as high as $66 in after-hours trading.

In premarket trading, shares were above the $60 handle, then crashed 40% to around $38 following the news that GME filed an at-the-market offering to sell 75 million shares of the company’s Class A common stock.

Jefferies is the ‘Sales Agent’ on the deal.

Earlier, GME reported first-quarter results showing net sales of 881.80 million, down from $1.237 billion year over year. Net sales missed Wall Street’s consensus estimate of $995.30 million.

GME also reported an EPS loss of 12 cents, missing the average estimate of 9 cents. According to Reuters, this miss highlights customers’ shift to online video games and collectibles, while the retailer continued to rely on its brick-and-mortar stores.

Just weeks ago, during another pump by Gill, GME announced it sold 45 million shares of common stock for about $933.4 million. CEO Ryan Cohen is effectively using Gill’s pumps to dump millions of shares into mom-and-pop retail, chasing momentum.

momentum chasers are literally giving their money to Ryan Cohen

— zerohedge (@zerohedge) June 7, 2024

At 1200 ET, Gill will have to re-explain his investment thesis in GME, as first-quarter earnings show a sharp decline, and Cohen is dumping endless shares.

[embedded content]

Meanwhile, reports suggest that ETrade might take action against Gill, and at least one securities regulator is currently investigating him for potential stock manipulation.

Loading…