General Mills shares fell at the beginning of the US cash session after the package food company reported a decline in quarterly sales. It slashed its annual organic sales forecast to flat because of softening demand for snacks and breakfast foods.

The maker of Cheerios and Cocoa Puffs reported Wednesday that second-quarter sales for the three months ended Nov. 26 were $5.14 billion, down 2% from a year ago and below the Bloomberg estimate of $5.35 billion.

Here's the second quarter earnings snapshot (courtesy of Bloomberg):

-

Adjusted EPS $1.25 vs. $1.10 y/y, estimate $1.16 (Bloomberg Consensus)

-

Adjusted gross margin 35% vs. 33.2% y/y, estimate 33.9%

Net sales $5.14 billion, -1.6% y/y, estimate $5.35 billion

-

North America Retail Net Sales $3.31 billion, -2% y/y, estimate $3.42 billion

-

North America Foodservice Net Sales $582.0 million, -0.2% y/y, estimate $602.9 million

-

Pet Segment Net Sales $569.3 million, -4% y/y, estimate $616.9 million

-

International net sales $683.1 million, +1.7% y/y, estimate $723.7 million

-

Organic net sales -2%, estimate +2.82%

-

North America Retail organic net sales -2%, estimate +2%

-

Pet organic net sales -4%, estimate +3.69%

Organic sales volume -4.0 pts, estimate -1.77

-

North America retail organic sales volume -5.0 pts, estimate -3.05

-

Pet organic sales volume -11.0 pts, estimate -0.07

-

North America foodservice organic sales volume -1.0 pts

-

International organic sales volume -4.0 pts, estimate -2.47

Organic sales price/mix +3.0 pts, estimate +4.41

-

North America retail organic sales price/mix +4.0 pts, estimate +4.6

-

Pet organic sales price/mix +7.0 pts, estimate +3.91

-

North America foodservice organic sales price/mix +1.0, estimate +1.0

-

International organic sales price/mix +3.0 pts, estimate +6.91

General Mills warned about a slower recovery in sales volumes for the current fiscal year, citing a "more cautious consumer economic outlook" and increased competition on supermarket shelves.

"While we saw a slower-than-expected volume recovery in the second quarter amid a continued challenging consumer landscape, we generated bottom-line growth thanks primarily to strong HMM cost savings," Chief Executive Officer Jeff Harmening said in prepared remarks.

Harmening warned about a weakening consumer environment: "We're seeing consumers continue to display stronger-than-anticipated value-seeking behaviors across our key markets, and this dynamic is delaying volume recovery in our categories."

As for the full-year forecast, the Lucky Charms maker cut its fiscal 2024 organic net sales down 1% to flat, from a year ago, compared with its earlier forecast for growth of 3% to 4%. Bloomberg estimates were around 2.75%.

More color on the full-year forecast (courtesy of Bloomberg):

-

Sees organic net sales -1% to 0%, saw +3% to +4%, estimate +2.75%

-

Sees adj. EPS in constant currency +4% to +5%, saw +4% to +6%

-

Sees Adjusted operating profit constant-currency +4% to +5%, saw +4% to +6%

"For the full year, we've revised our topline outlook to account for a slower volume recovery, narrowed our profit and EPS expectations within our original guidance ranges, and maintained our outlook for strong free cash flow conversion," Harmening said.

Shares of General Mills are down nearly 3% in the first 30 minutes of US trading. During the year, shares have tumbled into a bear market.

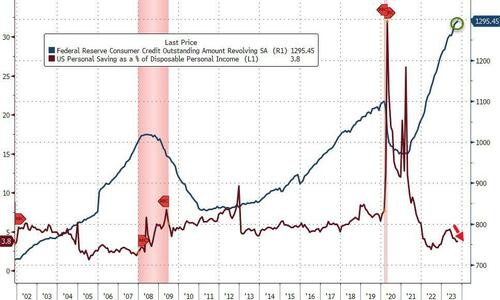

Several retailers this past earnings season have warned about a weakening consumer. The latest consumer credit data shows consumers are in the worst financial shape in years.

It's only a matter of time before consumers buckle under the weight of elevated inflation and failed 'Bidenomics.'

General Mills shares fell at the beginning of the US cash session after the package food company reported a decline in quarterly sales. It slashed its annual organic sales forecast to flat because of softening demand for snacks and breakfast foods.

The maker of Cheerios and Cocoa Puffs reported Wednesday that second-quarter sales for the three months ended Nov. 26 were $5.14 billion, down 2% from a year ago and below the Bloomberg estimate of $5.35 billion.

Here’s the second quarter earnings snapshot (courtesy of Bloomberg):

-

Adjusted EPS $1.25 vs. $1.10 y/y, estimate $1.16 (Bloomberg Consensus)

-

Adjusted gross margin 35% vs. 33.2% y/y, estimate 33.9%

Net sales $5.14 billion, -1.6% y/y, estimate $5.35 billion

-

North America Retail Net Sales $3.31 billion, -2% y/y, estimate $3.42 billion

-

North America Foodservice Net Sales $582.0 million, -0.2% y/y, estimate $602.9 million

-

Pet Segment Net Sales $569.3 million, -4% y/y, estimate $616.9 million

-

International net sales $683.1 million, +1.7% y/y, estimate $723.7 million

-

Organic net sales -2%, estimate +2.82%

-

North America Retail organic net sales -2%, estimate +2%

-

Pet organic net sales -4%, estimate +3.69%

Organic sales volume -4.0 pts, estimate -1.77

-

North America retail organic sales volume -5.0 pts, estimate -3.05

-

Pet organic sales volume -11.0 pts, estimate -0.07

-

North America foodservice organic sales volume -1.0 pts

-

International organic sales volume -4.0 pts, estimate -2.47

Organic sales price/mix +3.0 pts, estimate +4.41

-

North America retail organic sales price/mix +4.0 pts, estimate +4.6

-

Pet organic sales price/mix +7.0 pts, estimate +3.91

-

North America foodservice organic sales price/mix +1.0, estimate +1.0

-

International organic sales price/mix +3.0 pts, estimate +6.91

General Mills warned about a slower recovery in sales volumes for the current fiscal year, citing a “more cautious consumer economic outlook” and increased competition on supermarket shelves.

“While we saw a slower-than-expected volume recovery in the second quarter amid a continued challenging consumer landscape, we generated bottom-line growth thanks primarily to strong HMM cost savings,” Chief Executive Officer Jeff Harmening said in prepared remarks.

Harmening warned about a weakening consumer environment: “We’re seeing consumers continue to display stronger-than-anticipated value-seeking behaviors across our key markets, and this dynamic is delaying volume recovery in our categories.”

As for the full-year forecast, the Lucky Charms maker cut its fiscal 2024 organic net sales down 1% to flat, from a year ago, compared with its earlier forecast for growth of 3% to 4%. Bloomberg estimates were around 2.75%.

More color on the full-year forecast (courtesy of Bloomberg):

-

Sees organic net sales -1% to 0%, saw +3% to +4%, estimate +2.75%

-

Sees adj. EPS in constant currency +4% to +5%, saw +4% to +6%

-

Sees Adjusted operating profit constant-currency +4% to +5%, saw +4% to +6%

“For the full year, we’ve revised our topline outlook to account for a slower volume recovery, narrowed our profit and EPS expectations within our original guidance ranges, and maintained our outlook for strong free cash flow conversion,” Harmening said.

Shares of General Mills are down nearly 3% in the first 30 minutes of US trading. During the year, shares have tumbled into a bear market.

Several retailers this past earnings season have warned about a weakening consumer. The latest consumer credit data shows consumers are in the worst financial shape in years.

It’s only a matter of time before consumers buckle under the weight of elevated inflation and failed ‘Bidenomics.’

Loading…