Gold prices have been on a tear, with bullion prices ripping upward since the outbreak of war in the Middle East late last year. While mining stocks have gone up as well, physical gold has been leaving them in the dust:

Gold stock performance is obviously tied to much more than just the bullion price. For one, shareholder value can always be diluted when you’re holding stocks, regardless of the industry. Gold mining companies also have overhead for exploration, extraction, processing, and storage. There are also price fluctuations in oil, materials, and labor that gold miners have to contend with. Physical gold also comes with some overhead — mainly with regard to storage, transportation, and security — but the costs are lower in comparison.

Still, gold mining stocks have the added benefit of paying dividends. They just come with the need to consider a longer list of variables like executive management, the cost of exploration, and aging equipment that could require repair or replacement. When the broader economy isn’t doing great and overhead costs are lower, winning gold miners can fare extremely well.

In fact, winning gold miners can be very profitable and at times can outperform bullion, especially in the shorter and medium-term. That’s why Peter Schiff still recommends allocating capital to gold miners as part of a diversified precious metals portfolio. However, to protect your wealth in the long run in spite of macroeconomic trends, you should also always hold the metal itself. Regardless of which gold mining stocks you choose, nothing beats physical bullion as a safe haven in an inflationary environment where central bank money printing is running amok.

That’s especially true during times like these, when the Fed is expected to start cutting interest rates and printing money to finance meddling in a rapidly-expanding Middle East conflict. If inflation rockets back up, it allows gold miners to set higher prices for their bullion, but increases their overhead due to having to cover their costs in a devalued currency. This doesn’t negate the wisdom of holding the right mining stocks, but reinforces that gold bullion remains the top safe haven asset when it comes to easy money policies and the chaos of war.

Peter Schiff commented on the Commodity Culture podcast:

“To the extent that the Fed just tolerates higher inflation and continues to ease in the face of it, that’s going to destroy the dollar, and then gold’s just going to go through the roof.”

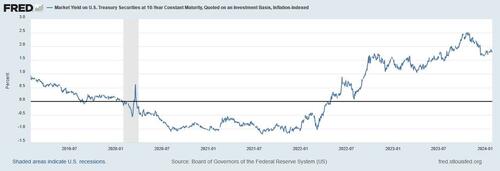

Speaking of inflation, a divergence in the gold with the price of Treasury Inflation-Protected Securities could indicate that the market is far from assured that the Fed really has inflation under control. The two split in 2022, with a gap that’s threatening to widen even more in the coming months if the gold price accelerates upward.

Owning stock in the right mining companies is essential for any well-rounded gold investor. The right picks can yield higher returns than physical gold, given certain conditions. But change is one of life’s few guarantees, and with Keynesians still firmly in charge, so is money printing. Physical gold remains the king of stable long-term protection against central bank monetary tinkering and general global chaos.

Gold prices have been on a tear, with bullion prices ripping upward since the outbreak of war in the Middle East late last year. While mining stocks have gone up as well, physical gold has been leaving them in the dust:

Gold stock performance is obviously tied to much more than just the bullion price. For one, shareholder value can always be diluted when you’re holding stocks, regardless of the industry. Gold mining companies also have overhead for exploration, extraction, processing, and storage. There are also price fluctuations in oil, materials, and labor that gold miners have to contend with. Physical gold also comes with some overhead — mainly with regard to storage, transportation, and security — but the costs are lower in comparison.

Still, gold mining stocks have the added benefit of paying dividends. They just come with the need to consider a longer list of variables like executive management, the cost of exploration, and aging equipment that could require repair or replacement. When the broader economy isn’t doing great and overhead costs are lower, winning gold miners can fare extremely well.

In fact, winning gold miners can be very profitable and at times can outperform bullion, especially in the shorter and medium-term. That’s why Peter Schiff still recommends allocating capital to gold miners as part of a diversified precious metals portfolio. However, to protect your wealth in the long run in spite of macroeconomic trends, you should also always hold the metal itself. Regardless of which gold mining stocks you choose, nothing beats physical bullion as a safe haven in an inflationary environment where central bank money printing is running amok.

That’s especially true during times like these, when the Fed is expected to start cutting interest rates and printing money to finance meddling in a rapidly-expanding Middle East conflict. If inflation rockets back up, it allows gold miners to set higher prices for their bullion, but increases their overhead due to having to cover their costs in a devalued currency. This doesn’t negate the wisdom of holding the right mining stocks, but reinforces that gold bullion remains the top safe haven asset when it comes to easy money policies and the chaos of war.

Peter Schiff commented on the Commodity Culture podcast:

“To the extent that the Fed just tolerates higher inflation and continues to ease in the face of it, that’s going to destroy the dollar, and then gold’s just going to go through the roof.”

Speaking of inflation, a divergence in the gold with the price of Treasury Inflation-Protected Securities could indicate that the market is far from assured that the Fed really has inflation under control. The two split in 2022, with a gap that’s threatening to widen even more in the coming months if the gold price accelerates upward.

Owning stock in the right mining companies is essential for any well-rounded gold investor. The right picks can yield higher returns than physical gold, given certain conditions. But change is one of life’s few guarantees, and with Keynesians still firmly in charge, so is money printing. Physical gold remains the king of stable long-term protection against central bank monetary tinkering and general global chaos.

Loading…