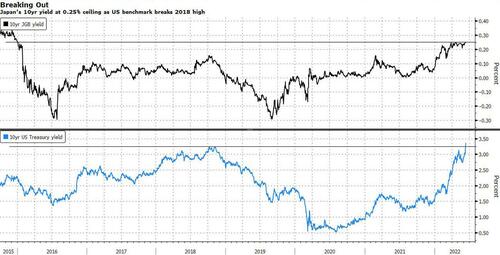

Less than a week ago, we wrote that "As Yen Crash Accelerates, It Puts Catastrophic End Of MMT Experiment In The Spotlight" a less than cheerful assessment about the endgame in Japan echoed on Monday morning by Bloomberg, which wrote that "Japan Starting to Crack as Yen Tumbles With Stocks and Bonds" in which it wrote that despite the yen crashing to a 24-year low (for the same reasons we have repeated again and again, namely you can't keep your 10Y yield at 0.25% and avoid a currency collapse in a scorching inflationary environment), Tokyo stocks were down the most since March (the plunged again on Tuesday).

Meanwhile, also on Monday, Deutsche Bank's head of FX George Saravelos came the closest of any establishment banker to warn what we have been saying for years - the great MMT experiment is ending, and its unwind will begin in Japan, that "Guniea Pig" for all major central bank experiments (first ZIRP, first QE, first ZIRP, first central bank buying of ETFs, etc).

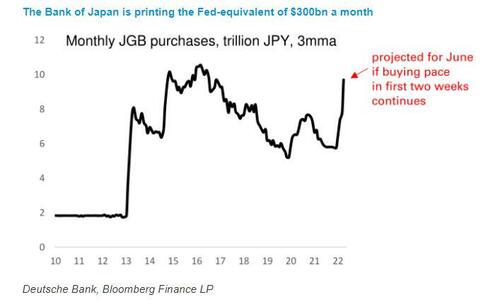

In a piece titled, "The printer is on overdrive", Saravelos wrote that if the current pace of buying persists, "the bank will have bought approximately 10 trillion yen in June. To put that number in context, it is roughly equivalent to the Fed doing more than $300bn of QE per month when adjusting for GDP!"

Saravelos also echoed what we said in our preview of the end of MMT, writing that he worries that "the currency and Japanese financial markets are in the process of losing any sort of fundamental-based valuation anchor" adding that "the more global inflation picks up, the more the BoJ prints. But the more easing accelerates, the higher the need to press hard on the brake when the (inflation) cliff approaches and the more dangerous it becomes. As a result, we will soon enter a phase where dramatic and unpredictable non-linearities in Japanese financial markets would kick in." The DB strategist concluded by asking "if it becomes obvious to the market that the clearing level of JGB yields is above the BoJ's 25 basis point target, what is the incentive to hold bonds any more?"

Of course, without skin in the game all these perceptive observations are just that, and meanwhile - well - only money talks... and when it comes to Japan, so many have been steamrolled when their money talked and shorted Japanese bonds, only to be crushed by the world's most famous "widowmaker" trade.

But this time is different: at least that's the view of BlueBay Asset Management - one of the world's biggest hedge funds - as it gears up to become this generation's George Soros caught in a crushing battle with the Bank of England Bank of Japan.

As the BOJ escalates attempts to keep a lid on bond yields, BlueBay is betting that our thesis laid out in March is right, and that the central bank will be forced to abandon a policy that’s increasingly out of sync with global peers. Echoing what we said just a few days ago, Mark Dowding, BlueBay’s London-based chief investment officer, said that the BOJ’s so-called yield curve control is “untenable."

"We have a sizable short on JGBs," Dowding, whose firm oversees about $127 billion across hedge funds and other fixed income products, said in an interview with Bloomberg on Monday. BlueBay started shorting Japan’s sovereign debt when the yen slid close to the 130 per dollar level several weeks ago, not too long after we wrote that "Yen At Risk Of "Explosive" Downward Spiral With Kuroda Trapped."

Dowding is not the only one to agree with our core thesis that the beginning of the end of MMT will start in Japan: he joins other market veterans such as former Goldman "BRIC" economist Jim O’Neill and JPM's Seamus Mac Gorain in predicting the BOJ will eventually alter its stance on yields, just as Australia’s central bank did last November.

As we noted on Monday, as global yields have exploded higher ahead of the Fed's first 75bps rate hike since 1994, yields on 10-year Japanese bonds breached the upper, 25bps bound of the BOJ’s target on Monday and have remained at elevated levels even after the central bank accelerated its planned bond-purchase operations and included longer maturities.

“The last man standing continues to be the BOJ and to be honest the more the market attacks the Fed and the ECB the more likely it is that the BOJ own forward guidance (in the form of YCC) will end very messily with huge implications for global rates,” Deutsche Bank macro strategist Jim Reid added to the pile up in Tuesday note to clients.

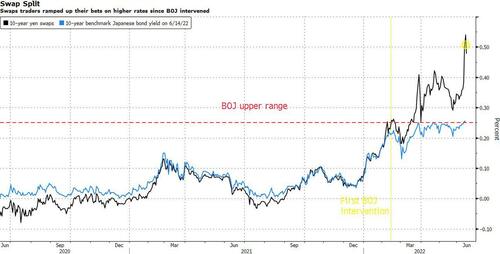

Ten-year yen swap rates have also surged, breaking their close relationship with domestically driven yields. At over 0.50%, the former have pushed well past the central bank’s 0.25% ‘line in the sand’ for benchmark bonds, suggesting international traders believe higher yields and a policy change in Japan are inevitable.

There is “little downside to being short Japan rates via futures or yen swaps,” Dowding said. “Yield curve control is designed so that the more the Fed hikes, the more the BOJ is going to need to ease and grow its balance sheet. This is what makes it untenable.”

He is correct of course, and at some point the BOJ will pull a BOE, or SNB, and will decide that waste billions more to defend a largely arbitrary level is not worth it, at which point Japanese yields will spike higher... only instead of stopping at the next barrier, they will continue rising higher and higher, as traders from around the globe pile on in what may be the biggest central bank failure of the 21st century. Of course, it won't be the last, because the inevitable loss by the BOJ will also be a loss for the idiotic economic theory behind much of modern economics, MMT. And when that too is discredited, all bets are off as the entire fiat financial system becomes unglued.

All this will happen... but not just yet. For now, Japan’s central bankers are dutifully defending their yield target. The central bank boosted scheduled purchases of five-to-10-year debt to 800 billion yen ($6 billion) Tuesday from an expected 500 billion yen after the benchmark yield climbed to 0.255%. It also announced an unscheduled operation to buy longer-dated debt after the 30-year yield surged to 1.28% -- the highest since 2016. Japan’s central bank also bought 2.2 trillion yen worth of government notes through its fixed-rate operation on Tuesday, the biggest amount on record since the program began in 2016.

Meanwhile, since defense of YCC means continued collapse of the yen (or vice verse), the yen tumbled to a fresh 24-year low of 135.60 per dollar amid the growing policy divergence between the BOJ and the Fed.

“We do think that the BOJ will be forced to capitulate at some point,” Russel Matthews, senior portfolio manager at BlueBay, said in an interview with Bloomberg Television. And while a normal response would be for the yen to spike even as yields surge, what will be the worst possible outcome is for both the yen and JGBs to both plunge at the same time.

If and when that happens, it's game over for Japan, MMT and fiat.

Less than a week ago, we wrote that “As Yen Crash Accelerates, It Puts Catastrophic End Of MMT Experiment In The Spotlight” a less than cheerful assessment about the endgame in Japan echoed on Monday morning by Bloomberg, which wrote that “Japan Starting to Crack as Yen Tumbles With Stocks and Bonds” in which it wrote that despite the yen crashing to a 24-year low (for the same reasons we have repeated again and again, namely you can’t keep your 10Y yield at 0.25% and avoid a currency collapse in a scorching inflationary environment), Tokyo stocks were down the most since March (the plunged again on Tuesday).

Meanwhile, also on Monday, Deutsche Bank’s head of FX George Saravelos came the closest of any establishment banker to warn what we have been saying for years – the great MMT experiment is ending, and its unwind will begin in Japan, that “Guniea Pig” for all major central bank experiments (first ZIRP, first QE, first ZIRP, first central bank buying of ETFs, etc).

In a piece titled, “The printer is on overdrive“, Saravelos wrote that if the current pace of buying persists, “the bank will have bought approximately 10 trillion yen in June. To put that number in context, it is roughly equivalent to the Fed doing more than $300bn of QE per month when adjusting for GDP!”

Saravelos also echoed what we said in our preview of the end of MMT, writing that he worries that “the currency and Japanese financial markets are in the process of losing any sort of fundamental-based valuation anchor” adding that “the more global inflation picks up, the more the BoJ prints. But the more easing accelerates, the higher the need to press hard on the brake when the (inflation) cliff approaches and the more dangerous it becomes. As a result, we will soon enter a phase where dramatic and unpredictable non-linearities in Japanese financial markets would kick in.” The DB strategist concluded by asking “if it becomes obvious to the market that the clearing level of JGB yields is above the BoJ’s 25 basis point target, what is the incentive to hold bonds any more?”

Of course, without skin in the game all these perceptive observations are just that, and meanwhile – well – only money talks… and when it comes to Japan, so many have been steamrolled when their money talked and shorted Japanese bonds, only to be crushed by the world’s most famous “widowmaker” trade.

But this time is different: at least that’s the view of BlueBay Asset Management – one of the world’s biggest hedge funds – as it gears up to become this generation’s George Soros caught in a crushing battle with the Bank of England Bank of Japan.

As the BOJ escalates attempts to keep a lid on bond yields, BlueBay is betting that our thesis laid out in March is right, and that the central bank will be forced to abandon a policy that’s increasingly out of sync with global peers. Echoing what we said just a few days ago, Mark Dowding, BlueBay’s London-based chief investment officer, said that the BOJ’s so-called yield curve control is “untenable.”

“We have a sizable short on JGBs,” Dowding, whose firm oversees about $127 billion across hedge funds and other fixed income products, said in an interview with Bloomberg on Monday. BlueBay started shorting Japan’s sovereign debt when the yen slid close to the 130 per dollar level several weeks ago, not too long after we wrote that “Yen At Risk Of “Explosive” Downward Spiral With Kuroda Trapped.“

Dowding is not the only one to agree with our core thesis that the beginning of the end of MMT will start in Japan: he joins other market veterans such as former Goldman “BRIC” economist Jim O’Neill and JPM’s Seamus Mac Gorain in predicting the BOJ will eventually alter its stance on yields, just as Australia’s central bank did last November.

As we noted on Monday, as global yields have exploded higher ahead of the Fed’s first 75bps rate hike since 1994, yields on 10-year Japanese bonds breached the upper, 25bps bound of the BOJ’s target on Monday and have remained at elevated levels even after the central bank accelerated its planned bond-purchase operations and included longer maturities.

“The last man standing continues to be the BOJ and to be honest the more the market attacks the Fed and the ECB the more likely it is that the BOJ own forward guidance (in the form of YCC) will end very messily with huge implications for global rates,” Deutsche Bank macro strategist Jim Reid added to the pile up in Tuesday note to clients.

Ten-year yen swap rates have also surged, breaking their close relationship with domestically driven yields. At over 0.50%, the former have pushed well past the central bank’s 0.25% ‘line in the sand’ for benchmark bonds, suggesting international traders believe higher yields and a policy change in Japan are inevitable.

There is “little downside to being short Japan rates via futures or yen swaps,” Dowding said. “Yield curve control is designed so that the more the Fed hikes, the more the BOJ is going to need to ease and grow its balance sheet. This is what makes it untenable.”

He is correct of course, and at some point the BOJ will pull a BOE, or SNB, and will decide that waste billions more to defend a largely arbitrary level is not worth it, at which point Japanese yields will spike higher… only instead of stopping at the next barrier, they will continue rising higher and higher, as traders from around the globe pile on in what may be the biggest central bank failure of the 21st century. Of course, it won’t be the last, because the inevitable loss by the BOJ will also be a loss for the idiotic economic theory behind much of modern economics, MMT. And when that too is discredited, all bets are off as the entire fiat financial system becomes unglued.

All this will happen… but not just yet. For now, Japan’s central bankers are dutifully defending their yield target. The central bank boosted scheduled purchases of five-to-10-year debt to 800 billion yen ($6 billion) Tuesday from an expected 500 billion yen after the benchmark yield climbed to 0.255%. It also announced an unscheduled operation to buy longer-dated debt after the 30-year yield surged to 1.28% — the highest since 2016. Japan’s central bank also bought 2.2 trillion yen worth of government notes through its fixed-rate operation on Tuesday, the biggest amount on record since the program began in 2016.

Meanwhile, since defense of YCC means continued collapse of the yen (or vice verse), the yen tumbled to a fresh 24-year low of 135.60 per dollar amid the growing policy divergence between the BOJ and the Fed.

“We do think that the BOJ will be forced to capitulate at some point,” Russel Matthews, senior portfolio manager at BlueBay, said in an interview with Bloomberg Television. And while a normal response would be for the yen to spike even as yields surge, what will be the worst possible outcome is for both the yen and JGBs to both plunge at the same time.

If and when that happens, it’s game over for Japan, MMT and fiat.