By John Cheng, Bloomberg markets live reporter and strategist

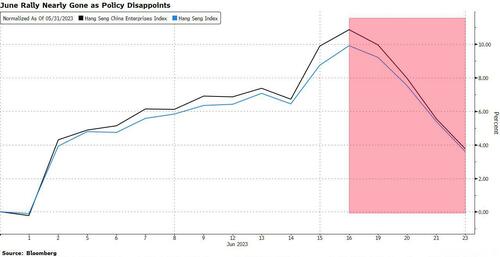

Losses in Chinese assets are mounting again as Beijing’s modest stimulus disheartens investors.

The Hang Seng China Enterprises Index of Hong Kong-listed Chinese firms slumped more than 6% last week to cap its steepest drop since March. The CSI 300 Index of mainland shares fell 2.5% through Wednesday before markets closed for holidays. The yuan also tumbled to the weakest since November, with analysts bracing for more declines.

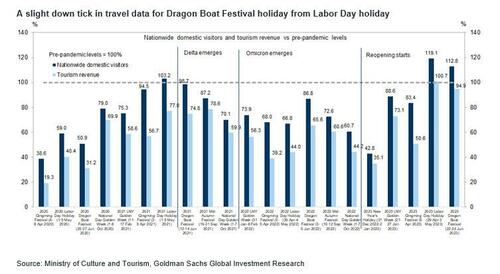

There’s little reason for mainland traders to be optimistic when markets reopen on Monday. China’s travel spending during the dragon boat festival holiday fell short of pre-Covid levels, underscoring the slowdown in consumption. Preliminary estimates from the Passenger Car Association showed over the weekend that passenger vehicle sales for June are expected to drop 5.9% year-on-year.

Gloom is setting in after authorities refrained from adding major policy support even as the economy has lost momentum. Beijing is making it clear that any easing will be targeted and measured, bidding farewell to the days of massive stimulus that drove leveraged buying and inflated asset prices — a distortion that the nation’s leaders are determined not to repeat.

“This is an expectation mismatch in my opinion,” said Zhikai Chen, head of Asian and global emerging-market equities at BNP Paribas Asset Management. “It is a very awkward situation where positioning is light, valuation is undemanding yet sentiment is very bearish.”

To be sure, China has been rolling out measures to stimulate its economy, including a series of reductions in interest rates and extended tax breaks for consumers buying clean cars. Market reactions have been muted as traders are skeptical whether these steps will reinvigorate an economy weighed down by record debt levels, slowing global demand, and weak confidence among businesses and consumers rattled by years of unpredictable policy shifts.

An analysis by Morgan Stanley’s quantitative team shows active long-only managers have remained net sellers of China’s growth and tech stocks in May and June. Meanwhile, hedge funds have been adding bearish bets as outstanding short positions by the cohort jumped 32% in June, they found.

“It is telling that the market has been unable to put up a sustained rally year-to-date despite policy easing,” said Eli Lee, head of investment strategy at Bank of Singapore Ltd. “The incremental easing approach taken by policymakers, as they remain determined to curtail the long-term rise of leverage in the economy, may not move the needle.”

That’s not to say bulls are giving up. Goldman Sachs’ strategists including Kinger Lau said in a June 19 note that a tactical trading window for Chinese stocks is “open once again” given inexpensive valuations. They recommended buying policy-easing beneficiaries, as well as artificial intelligence themes and state-owned companies. The MSCI China Index is trading at 10.1 times forward earnings, below the five-year average of around 12.1.

“There’s a lot of negativity but I think a lot of it is built into the price already,” Ken Peng, head of Asia Pacific investment strategy at Citi Global Wealth Investments, said in a press briefing last week. “The prospect of better growth in the second half is there, but it’s coming at a much more gradual pace.”

By John Cheng, Bloomberg markets live reporter and strategist

Losses in Chinese assets are mounting again as Beijing’s modest stimulus disheartens investors.

The Hang Seng China Enterprises Index of Hong Kong-listed Chinese firms slumped more than 6% last week to cap its steepest drop since March. The CSI 300 Index of mainland shares fell 2.5% through Wednesday before markets closed for holidays. The yuan also tumbled to the weakest since November, with analysts bracing for more declines.

There’s little reason for mainland traders to be optimistic when markets reopen on Monday. China’s travel spending during the dragon boat festival holiday fell short of pre-Covid levels, underscoring the slowdown in consumption. Preliminary estimates from the Passenger Car Association showed over the weekend that passenger vehicle sales for June are expected to drop 5.9% year-on-year.

Gloom is setting in after authorities refrained from adding major policy support even as the economy has lost momentum. Beijing is making it clear that any easing will be targeted and measured, bidding farewell to the days of massive stimulus that drove leveraged buying and inflated asset prices — a distortion that the nation’s leaders are determined not to repeat.

“This is an expectation mismatch in my opinion,” said Zhikai Chen, head of Asian and global emerging-market equities at BNP Paribas Asset Management. “It is a very awkward situation where positioning is light, valuation is undemanding yet sentiment is very bearish.”

To be sure, China has been rolling out measures to stimulate its economy, including a series of reductions in interest rates and extended tax breaks for consumers buying clean cars. Market reactions have been muted as traders are skeptical whether these steps will reinvigorate an economy weighed down by record debt levels, slowing global demand, and weak confidence among businesses and consumers rattled by years of unpredictable policy shifts.

An analysis by Morgan Stanley’s quantitative team shows active long-only managers have remained net sellers of China’s growth and tech stocks in May and June. Meanwhile, hedge funds have been adding bearish bets as outstanding short positions by the cohort jumped 32% in June, they found.

“It is telling that the market has been unable to put up a sustained rally year-to-date despite policy easing,” said Eli Lee, head of investment strategy at Bank of Singapore Ltd. “The incremental easing approach taken by policymakers, as they remain determined to curtail the long-term rise of leverage in the economy, may not move the needle.”

That’s not to say bulls are giving up. Goldman Sachs’ strategists including Kinger Lau said in a June 19 note that a tactical trading window for Chinese stocks is “open once again” given inexpensive valuations. They recommended buying policy-easing beneficiaries, as well as artificial intelligence themes and state-owned companies. The MSCI China Index is trading at 10.1 times forward earnings, below the five-year average of around 12.1.

“There’s a lot of negativity but I think a lot of it is built into the price already,” Ken Peng, head of Asia Pacific investment strategy at Citi Global Wealth Investments, said in a press briefing last week. “The prospect of better growth in the second half is there, but it’s coming at a much more gradual pace.”

Loading…