General Motors continues reversing its pandemic-era hiring spree, during which it hired thousands of engineering and software development employees to bolster its ambitions in the electric vehicle space and connected-car services. As the downturn in the EV market persists, consumer demand weakens, and recession risks rise, the legacy automaker is preparing to cut at least a thousand tech employees to streamline operations.

CNBC reported Monday that layoffs at GM will affect at least 1,000 salaried employees globally in its software and services division. The layoffs will include 600 jobs at the company's tech campus near Detroit. This comes five months after the automaker's software chief, Mike Abbott, stepped down, citing 'health reasons.'

In June, GM promoted two former Apple executives, Baris Cetinok and Dave Richardson, to advance its electric, autonomous, and connected vehicles. Both executives were hired under Abbott last year.

"As we build GM's future, we must simplify for speed and excellence, make bold choices, and prioritize the investments that will have the greatest impact," a GM spokesman said in an emailed statement, adding, "As a result, we're reducing certain teams within the Software and Services organization. We are grateful to those who helped establish a strong foundation that positions GM to lead moving forward."

The layoffs will account for approximately 1.3% of the company's global salaried workforce of 76,000 as of the end of last year, including about 53,000 US salaried employees.

In April 2023, about 5,000 salaried workers opted to take GM's buyout offer. The legacy automaker has been aiming for $2 billion in cost cuts over the next few years after cutting hundreds of executive-level and salaried jobs earlier in that year.

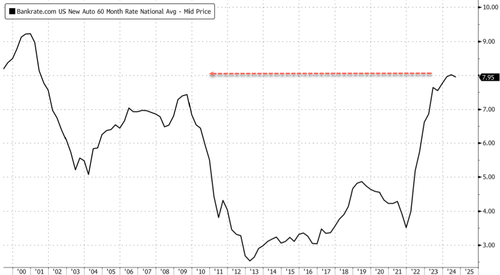

GM's cost-cutting measures come as concerns of an industry-wide downturn grow, particularly with the slowdown in the EV space. With interest rates at multi-decade highs and elevated new and used auto prices, affordability concerns persist among consumers.

Shares of GM are well off the pandemic highs.

Only interest rate cuts will save the struggling EV market.

General Motors continues reversing its pandemic-era hiring spree, during which it hired thousands of engineering and software development employees to bolster its ambitions in the electric vehicle space and connected-car services. As the downturn in the EV market persists, consumer demand weakens, and recession risks rise, the legacy automaker is preparing to cut at least a thousand tech employees to streamline operations.

CNBC reported Monday that layoffs at GM will affect at least 1,000 salaried employees globally in its software and services division. The layoffs will include 600 jobs at the company’s tech campus near Detroit. This comes five months after the automaker’s software chief, Mike Abbott, stepped down, citing ‘health reasons.’

In June, GM promoted two former Apple executives, Baris Cetinok and Dave Richardson, to advance its electric, autonomous, and connected vehicles. Both executives were hired under Abbott last year.

“As we build GM’s future, we must simplify for speed and excellence, make bold choices, and prioritize the investments that will have the greatest impact,” a GM spokesman said in an emailed statement, adding, “As a result, we’re reducing certain teams within the Software and Services organization. We are grateful to those who helped establish a strong foundation that positions GM to lead moving forward.”

The layoffs will account for approximately 1.3% of the company’s global salaried workforce of 76,000 as of the end of last year, including about 53,000 US salaried employees.

In April 2023, about 5,000 salaried workers opted to take GM’s buyout offer. The legacy automaker has been aiming for $2 billion in cost cuts over the next few years after cutting hundreds of executive-level and salaried jobs earlier in that year.

GM’s cost-cutting measures come as concerns of an industry-wide downturn grow, particularly with the slowdown in the EV space. With interest rates at multi-decade highs and elevated new and used auto prices, affordability concerns persist among consumers.

Shares of GM are well off the pandemic highs.

Only interest rate cuts will save the struggling EV market.

Loading…