General Motors has postponed its annual Investor Day scheduled for Nov. 16, prioritizing negotiations for a new labor deal with United Auto Workers. This delay has led some on Wall Street to speculate that an immediate tentative agreement with UAW might not be on the horizon.

Auto blog GM Authority reports GM's explanation of why Investor Day was postponed revolves around "Our leadership team's focus right now is on securing a new labor agreement in the United States. We'll update the investor site as soon as the new date is determined."

GM tends to hold its Investor Day in October or November. Executives provide investors with financial forecasts and review future products, business models, and other revenue opportunities. Last year, GM told investors it would make more money selling electric vehicles, and its EV segment would reach profitability by 2025.

The postponement signals worries across Wall Street that a tentative agreement with the union for a new four-year labor contract is not in the immediate future.

"That's a sign they aren't expecting an end soon," David Whiston, auto analyst at Morningstar, said, adding, "I only see this ending in October if the automakers give the union everything it's asking for, which I don't think is likely."

Wedbush Securities Managing Director and Senior Equity Analyst Dan Ives told the Detroit Free Press that GM could achieve a tentative agreement before Nov. 16 but noted the automaker's fight with the union feels like "an entrenched" battle. He also pointed out that GM moving the Investor Day date is not a good sign.

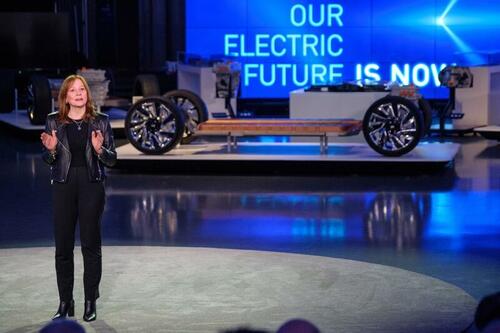

"The UAW debacle has been a tornado for GM, Ford and Stellantis and there's no way that (GM CEO) Mary (Barra) and the team could hold an Investor Day when the foundation of the company is up in the air due to this UAW torpedo.

"It's created such a time of uncertainty in what should have been a period of celebration going into a transformational electric vehicle (EV) cycle," Ives said.

The month-long UAW strikes against GM, Ford Motor, and Stellantis, the company that makes Dodge, Jeep, Chrysler, Ram, and Fiat vehicles, continue to expand - now across 38 plants and involves about 34,000 union members.

On Monday, JPMorgan analyst Ryan Brinkman revealed in a note to clients that GM's overall strike-related costs amount to $507 million and $517 for Ford (so far).

Brinkman said strikes at Ford's Kentucky Truck could make it even more costly for the automaker in the weeks ahead.

Wedbush's Ives said beyond the financial costs, the prolonged strikes could jeopardize GM's future:

"If this goes back to mid-November, we get into the danger zone of what could be significant delays in the EV strategy in 2024. It's frustrating for investors to watch a strategy that was years in the making to go up in flames."

What's also going up in flames are the jobs of thousands of workers who have been sacked by automakers due to ongoing strikes.

General Motors has postponed its annual Investor Day scheduled for Nov. 16, prioritizing negotiations for a new labor deal with United Auto Workers. This delay has led some on Wall Street to speculate that an immediate tentative agreement with UAW might not be on the horizon.

Auto blog GM Authority reports GM’s explanation of why Investor Day was postponed revolves around “Our leadership team’s focus right now is on securing a new labor agreement in the United States. We’ll update the investor site as soon as the new date is determined.”

GM tends to hold its Investor Day in October or November. Executives provide investors with financial forecasts and review future products, business models, and other revenue opportunities. Last year, GM told investors it would make more money selling electric vehicles, and its EV segment would reach profitability by 2025.

The postponement signals worries across Wall Street that a tentative agreement with the union for a new four-year labor contract is not in the immediate future.

“That’s a sign they aren’t expecting an end soon,” David Whiston, auto analyst at Morningstar, said, adding, “I only see this ending in October if the automakers give the union everything it’s asking for, which I don’t think is likely.”

Wedbush Securities Managing Director and Senior Equity Analyst Dan Ives told the Detroit Free Press that GM could achieve a tentative agreement before Nov. 16 but noted the automaker’s fight with the union feels like “an entrenched” battle. He also pointed out that GM moving the Investor Day date is not a good sign.

“The UAW debacle has been a tornado for GM, Ford and Stellantis and there’s no way that (GM CEO) Mary (Barra) and the team could hold an Investor Day when the foundation of the company is up in the air due to this UAW torpedo.

“It’s created such a time of uncertainty in what should have been a period of celebration going into a transformational electric vehicle (EV) cycle,” Ives said.

The month-long UAW strikes against GM, Ford Motor, and Stellantis, the company that makes Dodge, Jeep, Chrysler, Ram, and Fiat vehicles, continue to expand – now across 38 plants and involves about 34,000 union members.

On Monday, JPMorgan analyst Ryan Brinkman revealed in a note to clients that GM’s overall strike-related costs amount to $507 million and $517 for Ford (so far).

Brinkman said strikes at Ford’s Kentucky Truck could make it even more costly for the automaker in the weeks ahead.

Wedbush’s Ives said beyond the financial costs, the prolonged strikes could jeopardize GM’s future:

“If this goes back to mid-November, we get into the danger zone of what could be significant delays in the EV strategy in 2024. It’s frustrating for investors to watch a strategy that was years in the making to go up in flames.”

What’s also going up in flames are the jobs of thousands of workers who have been sacked by automakers due to ongoing strikes.

Loading…