Consumer sentiment lifted modestly today (headline Conf Board) but under the hood it was a shit-show with labor market weakness accelerating and purchasing-plans puking. Regional Fed surveys were also ugly (as home prices hit new record highs).

That 'bad' news prompted a dovish shift in rate-cut expectations (with attention once again shifting to 2024 from 2025)...

Source: Bloomberg

The slight easing sent gold to a new record high...

Source: Bloomberg

Treasury yields were mixed on the day with the short-end outperforming (2Y -3bps, 30Y +2bps), which dragged the 2Y yield lower on the week. Note that bonds were bid from early in the US session after an ugly EU session...

Source: Bloomberg

Nasdaq outperformed on the day (after all the majors were weak out of the gate). Small Caps were the biggest loser with The Dow unchanged...

NVDA was the notable outperformer among the Mag7 today...

Source: Bloomberg

Most notably, 0-DTE traders piled aggressively into calls today (but late on were more conservative with buying straddles)...

Source: SpotGamma

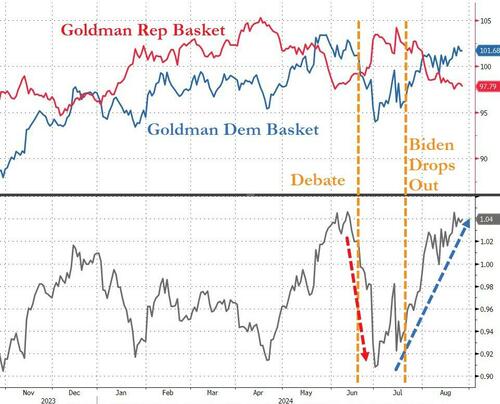

Notably, it has been Dem-policy-driven stocks that have outperformed in the last couple of weeks (but notice the lower pane shows we are at a key relative strength level for Dems/Reps right now)...

Source: Bloomberg

The dollar was unchanged on the day, unable to recover any more of the post-J-Hole losses...

Source: Bloomberg

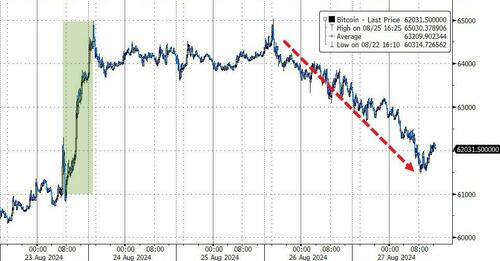

As gold rallied, the other alternative currency (Bitcoin) crumbled back to pre-J-Hole levels...

Source: Bloomberg

Oil prices fell today, seemingly stalling at recent resistance...

Source: Bloomberg

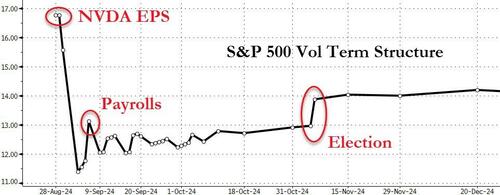

Finally, it's the big one tomorrow... NVDA's earnings. The S&P 500 vol market is ready...

Source: Bloomberg

Are you?

Source: Bloomberg

Of course, it's different this time.

Consumer sentiment lifted modestly today (headline Conf Board) but under the hood it was a shit-show with labor market weakness accelerating and purchasing-plans puking. Regional Fed surveys were also ugly (as home prices hit new record highs).

That ‘bad’ news prompted a dovish shift in rate-cut expectations (with attention once again shifting to 2024 from 2025)…

Source: Bloomberg

The slight easing sent gold to a new record high…

Source: Bloomberg

Treasury yields were mixed on the day with the short-end outperforming (2Y -3bps, 30Y +2bps), which dragged the 2Y yield lower on the week. Note that bonds were bid from early in the US session after an ugly EU session…

Source: Bloomberg

Nasdaq outperformed on the day (after all the majors were weak out of the gate). Small Caps were the biggest loser with The Dow unchanged…

NVDA was the notable outperformer among the Mag7 today…

Source: Bloomberg

Most notably, 0-DTE traders piled aggressively into calls today (but late on were more conservative with buying straddles)…

Source: SpotGamma

Notably, it has been Dem-policy-driven stocks that have outperformed in the last couple of weeks (but notice the lower pane shows we are at a key relative strength level for Dems/Reps right now)…

Source: Bloomberg

The dollar was unchanged on the day, unable to recover any more of the post-J-Hole losses…

Source: Bloomberg

As gold rallied, the other alternative currency (Bitcoin) crumbled back to pre-J-Hole levels…

Source: Bloomberg

Oil prices fell today, seemingly stalling at recent resistance…

Source: Bloomberg

Finally, it’s the big one tomorrow… NVDA’s earnings. The S&P 500 vol market is ready…

Source: Bloomberg

Are you?

Source: Bloomberg

Of course, it’s different this time.

Loading…