Authored by Alasdair Macleod via GoldMoney.com,

Our proprietary gold price model has done a very good job tracking gold prices since we introduced it to our readers for the first time in 2016. As we have explained before, the intent of our gold price model is not to provide trading signals. Instead, we find the model a very useful tool to thoroughly understand the basic drivers of gold prices. Over the years, we have written extensively about the relationship between the price of gold and the underlying variables we identified. Readers can catch up on these discussions in our three-part framework report here (Gold Price Framework Vol. 2: The energy side of the equation, 28 May 2018), here (Part II, 10 July 2018) and here (Part III, 24 August 2018), as well as some follow up reports that built on the model (Gold Price Framework Update – the New Cycle Accelerates, 28 January 2021) and (Gold prices continue to weather the rate storm, 13 April, 2022.

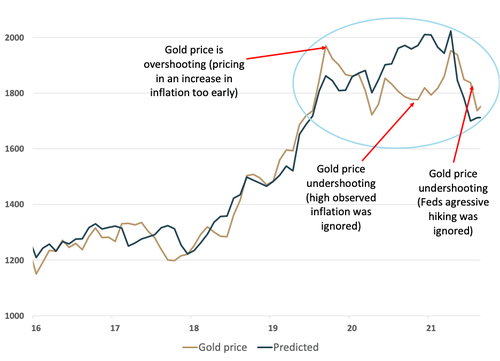

As with all models that aim to explain the price of an asset based on underlying variables over time, there are periods where the observed price and the model-predicted price diverge meaningfully. These instances were always the most interesting to us. When it happens, it raises the question of whether the gold market is pricing something in that the underlying variables don’t, or, whether the gold market does not fully reflect the information the underlying variables provide.

In some instances in the past, prices converged as the model-predicted prices moved towards the observed prices. This happens when the gold market preempts some of the moves in the underlying drivers or prices of the underlying variables are distorted for some reason. For example, long-term inflation expectations implied in the TIPS market (one of the drivers) may be too low or high for technical reasons. At some point over the past few years, the Fed owned a much larger share of all outstanding TIPS than it did for nominal treasuries, and both the building up of this position and the winding down distorted implied inflation expectations in our view. In that case, we suggested that the gold market was reflecting “true” inflation expectations better than the TIPS market. And when these distortions disappeared, model-predicted prices converged towards the observed gold price.

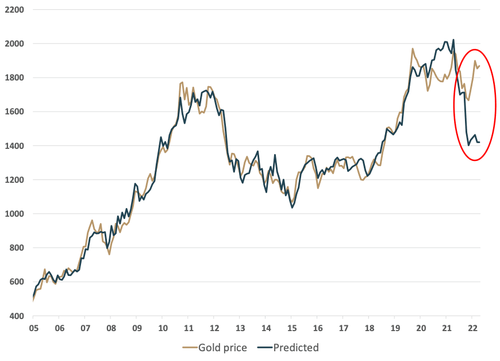

In other instances, prices converged as observed prices moved towards predicted prices. In those cases, the gold market was mispriced relative to the underlying variables, which, in hindsight, turned out to reflect the state of the market more accurately. The last time that happened was in mid-2020 when the gold price quickly moved to $2200 on the back of the unprecedented expansion of central bank balance sheets. The market suddenly became very concerned about the inflationary impact of that latest round of QE. However, while real-interest rate expectations dropped sharply, they stopped around -1.2%. This arguably marked a new low, but the gold market had priced in even higher long-term inflation expectations and thus lower real-interest rate expectations (see Exhibit 1). And when these long-term inflation expectations didn’t materialize in the TIPS market, gold prices corrected lower. However, inflation DID start to rise sharply in 2021, which also impacted long-term inflation expectations in the TIPS. This meant that our model predicted prices began to rise. The gold market resisted moving with observed inflation for a long time but finally capitulated and gold moved again towards $2000/ozt, where the model had been already for a while (see Exhibit 1). Ironically, when prices finally converged, our gold price model already predicted a sharp correction in the price on the back of the Fed’s aggressive rate hike rhetoric (which pushed TIPS yields up over 2% in a very short amount of time). Again, the observed gold price followed only with a lag. In this entire period, the model predicted price was leading the observed gold price (see Exhibit 1).

Exhibit 1: From early 2020 until mid-2022, our model-predicted price was leading observed gold prices by several months both to the up and the downside

Source: Goldmoney Research

Importantly, when observed gold prices and our model predicted prices diverged in the past, it was for either one of these two reasons. However, there was always a third possibility: Several times in the past, when we saw large discrepancies between the two, we asked ourselves whether what we were observing was a paradigm shift and the model simply didn’t work anymore. Had we come to a point where the relationship between gold and the underlying variables that we identified had broken down?

As we highlighted before, this has never happened so far. Whenever observed gold prices detached from the model-predicted prices, they always converged back eventually. Hence, even though central banks have continuously pushed unprecedented monetary policies, we have not yet seen a shift in paradigm where gold prices sustainably detached from the underlying drivers. However, we eventually expect such a paradigm shift to happen once central banks lose control over the monetary environment.

We ask ourselves again whether this is now the point of a shift in paradigm.

Over the past few months, the gold price has once again detached from the model’s predicted price. And it has done so in a remarkable way. First, the delta between the observed gold price and the model-predicted price has reached an all-time high. Current gold prices are more than $400/ozt over model predicted prices (See Exhibit 2). The previous all-time high was $200/ozt and it only lasted for a short period of time.

Exhibit 2: Observed gold prices are substantially higher than the model-predicted price

Source: Goldmoney Research

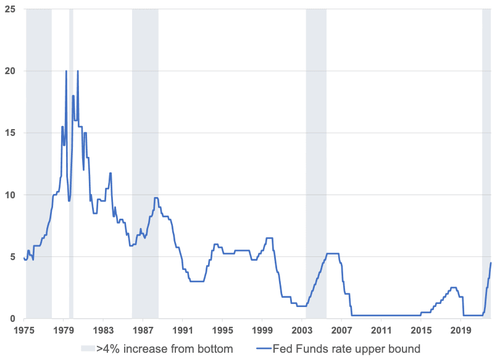

Second, this is happening in the most unlikely of all environments. The Fed has been aggressively hiking rates for the past 12 months to fight the highest inflation in over 40 years. The Fed raised the Fed Funds rate from 0% to 4.5% in just 12 months. It is very rare that we see such large rate hikes from cycle bottoms. In fact, this has only happened five times since 1975 that the Fed raised rates more than 4% from the bottom (see Exhibit 3).

Exhibit 3: It happened only 5 times since 1975 that the Fed raised rates by more than 4% from the cycle lows

Source: FRED, Goldmoney Research

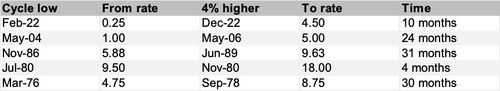

And the speed at which this recent rate hike happened is also remarkable (see table 1). Only the rate hike in 1980 was faster (just 4 months for a 8.5% hike), but arguably that was a policy correction due to a fine-tuning error in a 20% inflation/rate environment (More specifically, the Fed had lowered rates too quickly, from 20% in March 1980 to 9.5% just three months later. It was then forced to raise it quickly back to 18%. We would thus argue that this was just a blip in the easing period that followed the Volker shock). In the other three instances when the Fed raised rates by 4% or more from the bottom, it did so over a period of 28 months on average. This means the recent hike cycle was the sharpest in over 50 years. Moreover, it is the only one that started from the zero bound.

Table 1: The speed of the latest Fed rate hike is unprecedented

Source: FRED, Goldmoney Research

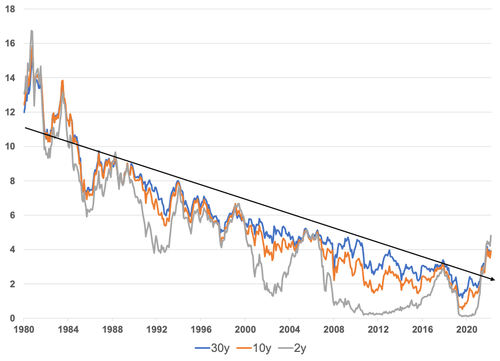

In addition, the Fed funds rate has now clearly broken the 45-year downtrend they have been in. The same happened to the entire fixed income market (see Exhibit 4).

Exhibit 4: US rates have clearly broken their 45-year downtrend

Source: Goldmoney Research

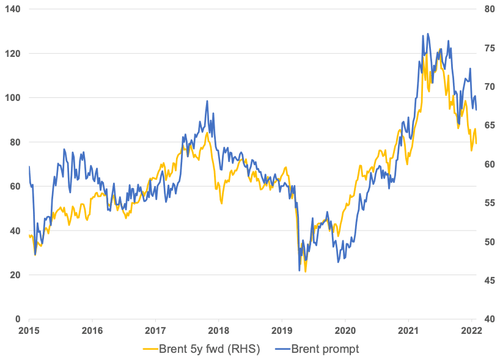

At the same time, while CPI inflation remains high, commodity prices have retraced substantially. This has two effects. It lowers input costs for gold production as long-dated energy prices have declined with the broader commodity markets (see Exhibit 5)…

Exhibit 5: Both short and long-term energy prices have declined significantly

Source: Goldmoney Research

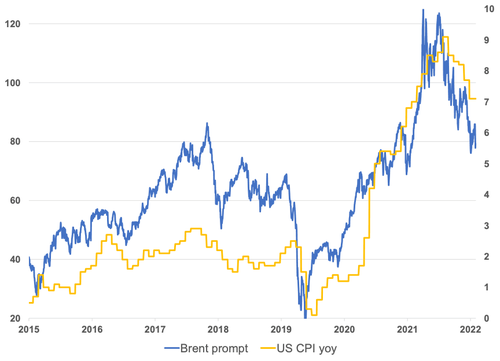

…and it also suggests that CPI inflation will likely slow down over the coming months (see Exhibit 6), which could affect long term inflation expectations and thus real interest rate expectations even further (Exhibit 7).

Exhibit 6: Energy prices vs CPI

Source: Goldmoney Research

Exhibit 7: long-term energy price vs inflation expectations

Source: Goldmoney Research

Yet despite all this, gold prices have not just held their ground; they have actually risen! Arguably, it could be that the gold market once again has simply got ahead of itself. Or we really do see a paradigm shift this time.

Before we continue exploring this thought, we must add one caveat here. In our models, we use publicly available data for net central bank sales/purchases. The official data from the IMF is notoriously lagging and incomplete, and we are certain that the reported net purchase numbers are much too low. The World Gold Council (WGC), for example, reports net additions of 1136 tonnes in 2022, more than double the 450 tonnes bought by central banks in 2021. It’s no secret that central banks have been on a buying spree in the second half of last year. But exactly how much gold they added remains a bit of a mystery. That said, even assuming that true central bank gold purchases exceeded the WGC estimates by a massive 50% would bring the model-predicted price only about $70/ozt closer to the observed price. We believe this is partially a shortcoming of our model, as it is based on historical data, and we have not seen a lot of volatility in CB gold purchases in the past. However, we have had years with large central bank purchases before, and we had years with higher overall gold demand from all sectors, and yet this didn’t lead to large distortions in our model. Hence, we don’t think central bank purchases can explain the current huge discrepancy between predicted and observed prices.

Therefore, in our view, the only reason for gold prices to detach from the underlying variables in our model by such a large amount and for such a long time is that the gold market finally starts pricing in that there is a risk central banks, particularly the Fed, are losing control over inflation, which is remarkable given the prevailing narrative that the Fed is willing and able to do whatever it takes to bring inflation under control.

In the second part of this report, we will dive deeper into the current market environment. We will explain why so far it was relatively easy for the Fed to raise rates, why this is about to change and why the gold market may indeed price in a shift in paradigm.

Authored by Alasdair Macleod via GoldMoney.com,

Our proprietary gold price model has done a very good job tracking gold prices since we introduced it to our readers for the first time in 2016. As we have explained before, the intent of our gold price model is not to provide trading signals. Instead, we find the model a very useful tool to thoroughly understand the basic drivers of gold prices. Over the years, we have written extensively about the relationship between the price of gold and the underlying variables we identified. Readers can catch up on these discussions in our three-part framework report here (Gold Price Framework Vol. 2: The energy side of the equation, 28 May 2018), here (Part II, 10 July 2018) and here (Part III, 24 August 2018), as well as some follow up reports that built on the model (Gold Price Framework Update – the New Cycle Accelerates, 28 January 2021) and (Gold prices continue to weather the rate storm, 13 April, 2022.

As with all models that aim to explain the price of an asset based on underlying variables over time, there are periods where the observed price and the model-predicted price diverge meaningfully. These instances were always the most interesting to us. When it happens, it raises the question of whether the gold market is pricing something in that the underlying variables don’t, or, whether the gold market does not fully reflect the information the underlying variables provide.

In some instances in the past, prices converged as the model-predicted prices moved towards the observed prices. This happens when the gold market preempts some of the moves in the underlying drivers or prices of the underlying variables are distorted for some reason. For example, long-term inflation expectations implied in the TIPS market (one of the drivers) may be too low or high for technical reasons. At some point over the past few years, the Fed owned a much larger share of all outstanding TIPS than it did for nominal treasuries, and both the building up of this position and the winding down distorted implied inflation expectations in our view. In that case, we suggested that the gold market was reflecting “true” inflation expectations better than the TIPS market. And when these distortions disappeared, model-predicted prices converged towards the observed gold price.

In other instances, prices converged as observed prices moved towards predicted prices. In those cases, the gold market was mispriced relative to the underlying variables, which, in hindsight, turned out to reflect the state of the market more accurately. The last time that happened was in mid-2020 when the gold price quickly moved to $2200 on the back of the unprecedented expansion of central bank balance sheets. The market suddenly became very concerned about the inflationary impact of that latest round of QE. However, while real-interest rate expectations dropped sharply, they stopped around -1.2%. This arguably marked a new low, but the gold market had priced in even higher long-term inflation expectations and thus lower real-interest rate expectations (see Exhibit 1). And when these long-term inflation expectations didn’t materialize in the TIPS market, gold prices corrected lower. However, inflation DID start to rise sharply in 2021, which also impacted long-term inflation expectations in the TIPS. This meant that our model predicted prices began to rise. The gold market resisted moving with observed inflation for a long time but finally capitulated and gold moved again towards $2000/ozt, where the model had been already for a while (see Exhibit 1). Ironically, when prices finally converged, our gold price model already predicted a sharp correction in the price on the back of the Fed’s aggressive rate hike rhetoric (which pushed TIPS yields up over 2% in a very short amount of time). Again, the observed gold price followed only with a lag. In this entire period, the model predicted price was leading the observed gold price (see Exhibit 1).

Exhibit 1: From early 2020 until mid-2022, our model-predicted price was leading observed gold prices by several months both to the up and the downside

Source: Goldmoney Research

Importantly, when observed gold prices and our model predicted prices diverged in the past, it was for either one of these two reasons. However, there was always a third possibility: Several times in the past, when we saw large discrepancies between the two, we asked ourselves whether what we were observing was a paradigm shift and the model simply didn’t work anymore. Had we come to a point where the relationship between gold and the underlying variables that we identified had broken down?

As we highlighted before, this has never happened so far. Whenever observed gold prices detached from the model-predicted prices, they always converged back eventually. Hence, even though central banks have continuously pushed unprecedented monetary policies, we have not yet seen a shift in paradigm where gold prices sustainably detached from the underlying drivers. However, we eventually expect such a paradigm shift to happen once central banks lose control over the monetary environment.

We ask ourselves again whether this is now the point of a shift in paradigm.

Over the past few months, the gold price has once again detached from the model’s predicted price. And it has done so in a remarkable way. First, the delta between the observed gold price and the model-predicted price has reached an all-time high. Current gold prices are more than $400/ozt over model predicted prices (See Exhibit 2). The previous all-time high was $200/ozt and it only lasted for a short period of time.

Exhibit 2: Observed gold prices are substantially higher than the model-predicted price

Source: Goldmoney Research

Second, this is happening in the most unlikely of all environments. The Fed has been aggressively hiking rates for the past 12 months to fight the highest inflation in over 40 years. The Fed raised the Fed Funds rate from 0% to 4.5% in just 12 months. It is very rare that we see such large rate hikes from cycle bottoms. In fact, this has only happened five times since 1975 that the Fed raised rates more than 4% from the bottom (see Exhibit 3).

Exhibit 3: It happened only 5 times since 1975 that the Fed raised rates by more than 4% from the cycle lows

Source: FRED, Goldmoney Research

And the speed at which this recent rate hike happened is also remarkable (see table 1). Only the rate hike in 1980 was faster (just 4 months for a 8.5% hike), but arguably that was a policy correction due to a fine-tuning error in a 20% inflation/rate environment (More specifically, the Fed had lowered rates too quickly, from 20% in March 1980 to 9.5% just three months later. It was then forced to raise it quickly back to 18%. We would thus argue that this was just a blip in the easing period that followed the Volker shock). In the other three instances when the Fed raised rates by 4% or more from the bottom, it did so over a period of 28 months on average. This means the recent hike cycle was the sharpest in over 50 years. Moreover, it is the only one that started from the zero bound.

Table 1: The speed of the latest Fed rate hike is unprecedented

Source: FRED, Goldmoney Research

In addition, the Fed funds rate has now clearly broken the 45-year downtrend they have been in. The same happened to the entire fixed income market (see Exhibit 4).

Exhibit 4: US rates have clearly broken their 45-year downtrend

Source: Goldmoney Research

At the same time, while CPI inflation remains high, commodity prices have retraced substantially. This has two effects. It lowers input costs for gold production as long-dated energy prices have declined with the broader commodity markets (see Exhibit 5)…

Exhibit 5: Both short and long-term energy prices have declined significantly

Source: Goldmoney Research

…and it also suggests that CPI inflation will likely slow down over the coming months (see Exhibit 6), which could affect long term inflation expectations and thus real interest rate expectations even further (Exhibit 7).

Exhibit 6: Energy prices vs CPI

Source: Goldmoney Research

Exhibit 7: long-term energy price vs inflation expectations

Source: Goldmoney Research

Yet despite all this, gold prices have not just held their ground; they have actually risen! Arguably, it could be that the gold market once again has simply got ahead of itself. Or we really do see a paradigm shift this time.

Before we continue exploring this thought, we must add one caveat here. In our models, we use publicly available data for net central bank sales/purchases. The official data from the IMF is notoriously lagging and incomplete, and we are certain that the reported net purchase numbers are much too low. The World Gold Council (WGC), for example, reports net additions of 1136 tonnes in 2022, more than double the 450 tonnes bought by central banks in 2021. It’s no secret that central banks have been on a buying spree in the second half of last year. But exactly how much gold they added remains a bit of a mystery. That said, even assuming that true central bank gold purchases exceeded the WGC estimates by a massive 50% would bring the model-predicted price only about $70/ozt closer to the observed price. We believe this is partially a shortcoming of our model, as it is based on historical data, and we have not seen a lot of volatility in CB gold purchases in the past. However, we have had years with large central bank purchases before, and we had years with higher overall gold demand from all sectors, and yet this didn’t lead to large distortions in our model. Hence, we don’t think central bank purchases can explain the current huge discrepancy between predicted and observed prices.

Therefore, in our view, the only reason for gold prices to detach from the underlying variables in our model by such a large amount and for such a long time is that the gold market finally starts pricing in that there is a risk central banks, particularly the Fed, are losing control over inflation, which is remarkable given the prevailing narrative that the Fed is willing and able to do whatever it takes to bring inflation under control.

In the second part of this report, we will dive deeper into the current market environment. We will explain why so far it was relatively easy for the Fed to raise rates, why this is about to change and why the gold market may indeed price in a shift in paradigm.

Loading…