After flirting with the "nice, round number" earlier this week, Gold - which soared by $150 in the past two weeks amid the relentless bank crisis - has just topped $2000 for the first time since March 2022 and then, since the Covid crash before it, when the Fed unleashed $10+ trillion in emergency liquidity.

The latest surge comes just hours after none other than Goldman Sachs raised its price target on gold from $1950 to $2050 overnight in a note titled "Fear is contagion" (full note available to pro subs).

We excerpt several key sections from the note below:

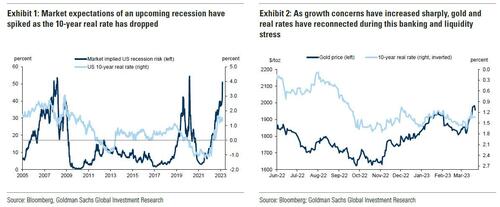

Gold has rallied by over $150/toz over the past two weeks on the back of banking stress, captured by US 2-year yields recording the largest decline since 1987, which triggered a significant risk appetite reversal. The speed at which markets repriced a Fed pivot from 100bp tightening to 50bp in rate cuts by year-end has been unprecedented, leading to a spike in rates volatility to levels last seen in the depth of the 2008 financial crisis. During the sell-off, gold outperformed risk assets such as equities or credit, turning it into an effective hedge in the risk-off rotation. Cyclical commodities like oil and base metals fell sharply, largely on a liquidity shock as opposed to any change in underlying micro fundamentals that have, if anything, strengthened. Financially, this was a VaR shock that started in rates as SVB’s collapse forced a rethink on the path of the Fed Funds Rate.

Gold has oscillated between growth and inflation risks for some time, with the first quarter of this year only highlighting the fickleness of market sentiment. Initially, a ‘goldilocks’ scenario of fast recovering ex-US growth on China’s reopening and a lower USD lifted gold to $1950/toz, before strong US macro and core inflation data quickly changed the narrative, pushing gold back down again. With concerns around the stress in the US banking system now looking to persist as a result of higher rates, and policymakers forced to intervene to ensure financial stability before price stability, gold has re-aligned with real rates, the USD and credit risk more broadly. Put differently, the sharp spike in gold prices through our 12-month target of $1950/toz is, in our view, almost entirely explained by an increase in fear-related demand for gold, in line with the fall in 10-year real rates.

As we have said before, ‘fear’ is the key medium to short-term driver for gold. While there is a close link to growth expectations, many risk factors are relevant in this context. In addition to real rates, debasement risks, sovereign balance sheet risks, geopolitical risk and other market tail risks matter because gold is a safe haven asset. As uncertainty rises, preference shifts towards more gold in the portfolio, driving prices higher. Generally, we have found in our framework that fear is a far more important driver of gold investment demand than the opportunity cost of holding gold, as measured by short-term US rates.

The catalyst for the current rise in ‘fear’ was not only banking and funding stress, to levels last seen in March 2020, but also a sharp rise in the market-implied probability of a US recession in the next year. With bank deposits at smaller regional banks now declining at speed and risks of this capital flight persisting, there is a direct pass-through to the real economy via higher funding costs that is hard to ignore. Our US economists commensurately shaved their growth projections for 2023 Q4/Q4 by 0.3pp on a pullback in lending that reduces capex, and raised the probability of the US moving into recession within 1 year to 35%, from 25% previously. The structure of the Credit Suisse resolution further raises the risk of a lingering effect of higher bank funding costs on the European economy. While the situation remains fluid, fear is contagious, and has led to a spike in COMEX net speculative positions in gold as the USD fell (on latest data up to 14 March when gold was at $1907/toz). We expect this Friday’s CFTC report to show a further jump in speculative buying for gold, coming from historically low levels. The fact that macro markets have become unusually fragile or ‘gappy’ in the recent period, likely driven by policy uncertainty, positioning risk and illiquidity, could further fuel fear-driven demand for gold, suggesting this may be a slow grind higher for gold prices. In particular, uncertainty over when central banks will eventually pivot in the face of record macro data volatility may prevail, fueling the risk of sharp, hard-to-anticipate and uncharacteristically large moves in asset prices.

In this particular case Goldman is right of course, and the chart below shows the dramatic disconnect between gold and various now failed bank stocks.

Finally, here is the justification for Goldman's price target:

On net, these factors suggest gold is poised to move higher, although it may be more of a slow grind than continued spike. While gold has struggled over the past year in a macro environment lacking ‘fear and wealth’, we believe both factors are stacked in this favor this year. We introduce a new flat target for gold of $2050/toz versus our previous 3/6/12m forecast of $1850/1950/1950/toz. In our view, it will be challenging for gold to move sustainably above $2100/toz without a Fed cutting rates in a US recession scenario that sees it pivot towards growth support.

What slow grind? What "challenging $2100"? At this rate Gold will be at a new all time high of $2,100 in a few days as the market discounts the absolute sheer panic that will follow shortly once a handful more banks fail; that price target will be reached even faster when, not if, the Treasury finally capitulates and unleashes uniform deposit insurance, something which as we explained earlier will be the beginning of the end for the US dollar.

Full Goldman note available to pro subs here.

After flirting with the “nice, round number” earlier this week, Gold – which soared by $150 in the past two weeks amid the relentless bank crisis – has just topped $2000 for the first time since March 2022 and then, since the Covid crash before it, when the Fed unleashed $10+ trillion in emergency liquidity.

The latest surge comes just hours after none other than Goldman Sachs raised its price target on gold from $1950 to $2050 overnight in a note titled “Fear is contagion” (full note available to pro subs).

We excerpt several key sections from the note below:

Gold has rallied by over $150/toz over the past two weeks on the back of banking stress, captured by US 2-year yields recording the largest decline since 1987, which triggered a significant risk appetite reversal. The speed at which markets repriced a Fed pivot from 100bp tightening to 50bp in rate cuts by year-end has been unprecedented, leading to a spike in rates volatility to levels last seen in the depth of the 2008 financial crisis. During the sell-off, gold outperformed risk assets such as equities or credit, turning it into an effective hedge in the risk-off rotation. Cyclical commodities like oil and base metals fell sharply, largely on a liquidity shock as opposed to any change in underlying micro fundamentals that have, if anything, strengthened. Financially, this was a VaR shock that started in rates as SVB’s collapse forced a rethink on the path of the Fed Funds Rate.

Gold has oscillated between growth and inflation risks for some time, with the first quarter of this year only highlighting the fickleness of market sentiment. Initially, a ‘goldilocks’ scenario of fast recovering ex-US growth on China’s reopening and a lower USD lifted gold to $1950/toz, before strong US macro and core inflation data quickly changed the narrative, pushing gold back down again. With concerns around the stress in the US banking system now looking to persist as a result of higher rates, and policymakers forced to intervene to ensure financial stability before price stability, gold has re-aligned with real rates, the USD and credit risk more broadly. Put differently, the sharp spike in gold prices through our 12-month target of $1950/toz is, in our view, almost entirely explained by an increase in fear-related demand for gold, in line with the fall in 10-year real rates.

As we have said before, ‘fear’ is the key medium to short-term driver for gold. While there is a close link to growth expectations, many risk factors are relevant in this context. In addition to real rates, debasement risks, sovereign balance sheet risks, geopolitical risk and other market tail risks matter because gold is a safe haven asset. As uncertainty rises, preference shifts towards more gold in the portfolio, driving prices higher. Generally, we have found in our framework that fear is a far more important driver of gold investment demand than the opportunity cost of holding gold, as measured by short-term US rates.

The catalyst for the current rise in ‘fear’ was not only banking and funding stress, to levels last seen in March 2020, but also a sharp rise in the market-implied probability of a US recession in the next year. With bank deposits at smaller regional banks now declining at speed and risks of this capital flight persisting, there is a direct pass-through to the real economy via higher funding costs that is hard to ignore. Our US economists commensurately shaved their growth projections for 2023 Q4/Q4 by 0.3pp on a pullback in lending that reduces capex, and raised the probability of the US moving into recession within 1 year to 35%, from 25% previously. The structure of the Credit Suisse resolution further raises the risk of a lingering effect of higher bank funding costs on the European economy. While the situation remains fluid, fear is contagious, and has led to a spike in COMEX net speculative positions in gold as the USD fell (on latest data up to 14 March when gold was at $1907/toz). We expect this Friday’s CFTC report to show a further jump in speculative buying for gold, coming from historically low levels. The fact that macro markets have become unusually fragile or ‘gappy’ in the recent period, likely driven by policy uncertainty, positioning risk and illiquidity, could further fuel fear-driven demand for gold, suggesting this may be a slow grind higher for gold prices. In particular, uncertainty over when central banks will eventually pivot in the face of record macro data volatility may prevail, fueling the risk of sharp, hard-to-anticipate and uncharacteristically large moves in asset prices.

In this particular case Goldman is right of course, and the chart below shows the dramatic disconnect between gold and various now failed bank stocks.

Finally, here is the justification for Goldman’s price target:

On net, these factors suggest gold is poised to move higher, although it may be more of a slow grind than continued spike. While gold has struggled over the past year in a macro environment lacking ‘fear and wealth’, we believe both factors are stacked in this favor this year. We introduce a new flat target for gold of $2050/toz versus our previous 3/6/12m forecast of $1850/1950/1950/toz. In our view, it will be challenging for gold to move sustainably above $2100/toz without a Fed cutting rates in a US recession scenario that sees it pivot towards growth support.

What slow grind? What “challenging $2100”? At this rate Gold will be at a new all time high of $2,100 in a few days as the market discounts the absolute sheer panic that will follow shortly once a handful more banks fail; that price target will be reached even faster when, not if, the Treasury finally capitulates and unleashes uniform deposit insurance, something which as we explained earlier will be the beginning of the end for the US dollar.

Full Goldman note available to pro subs here.

Loading…