In a market where traders are increasingly stumped by daily, violent gyrations that take place with no seeming rhyme or reason, we have frequently said that just two things matter: first, the market will only stop panicking when the Fed starts panicking...

"Markets stop panicking when central bankers start panicking" - Michael Hartnett

— zerohedge (@zerohedge) May 6, 2022

getting very close

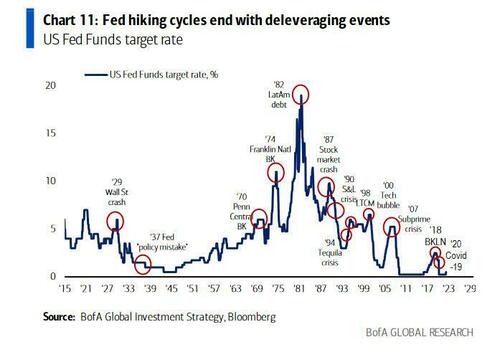

... and two, the market will panic when it crashes, which will be soon enough as every single Fed tightening cycle ends in a - you guessed it - financial crisis, default and bankruptcy of governments, banks and investors (ironic, because Janet Yellen vowed a few years ago there would be no more financial crises in her lifetime - spoiler alert: there will be).

In short, the only cure to the terrible "liquidity affliction" that is dragging stocks lower every day is... a crash, and as history has shown amply, and as we recently concluded in our simplistic view of markets, the moment the Fed capitulates is when everything will explode higher.

The instant Powell hints he won't be hiking to 4%, spoos will go limit up.

— zerohedge (@zerohedge) May 18, 2022

This morning, strategists at both Goldman and Bank of America agreed that the only thing that will push stocks higher is a capitulation by the Biden Fed.

In a note from BofA's Benajmin Bowler, the derivatives guru writes that “the Fed has offered no help to risk assets and appears far from stepping in,” and adds that market stress indicators, such as credit spreads and liquidity in S&P 500 futures, are now at levels seen during previous Fed interventions.

And, channeling Zero Hedge, he next says that “markets will continue to test the Fed put, but that it will take more market panic for the Fed to start panicking."

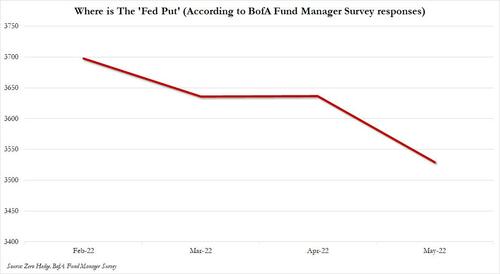

Conveniently, just yesterday we discussed where the Fed Put resides, and noted that amid a monthly slide in the BofA Fund Manager Survey, which now sees the put strike slide to 3529...

... which however is still too high for Morgan Stanley strategist Michael Wilson who said that it is still "too early to get bullish" as the real Fed Put is at (or below) 3,400.

And while we wait to see just what S&P price will finally trigger the Fed, Goldman strategist Vickie Chang echoed BofA and said what is by now patently obvious to all, namely that the selloff will only bottom once the Fed signals the end of tightening--which may not happen until recession is apparent.

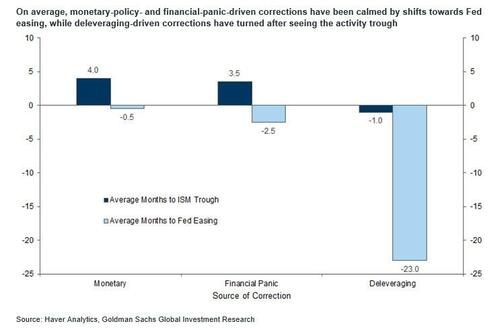

In a note published on Monday (and available to professional subscribers), Chang said that “it may be necessary for the market to become more confident than it is that financial conditions tightening has been sufficient and that the Fed has delivered and signaled enough tightening... Monetary policy has historically stopped tightening about three months before equities bottom, and shifted to easing about two months afterwards.”

In the past, such monetary tightening-fueled stock market corrections have tended to bottom when the Fed pivoted toward easing, regardless of a trough in economic activity as investors bet that activity will rise anyways thanks to rate cuts, according to Goldman. Chang said this time equities investors are unlikely to get a clear signal from the Fed about a policy shift until there’s solid evidence of moderating growth and cooling prices... which they just got thanks to today's catastrophic new home sales.

“Using history as a guide, in order for equities to come off their recent lows (and stop declining), this kind of monetary-tightening induced contraction is most likely to end when the Fed itself shifts,” Chang said. “It may be that the market needs to see signs of the inflation deceleration that our US economists expect in the second half of the year in order to see sustained relief.”

So how should one trade this no-man's land in stocks which will lead to more pain until the Fed panics? Well, as Bloomberg notes, the BofA strategists recommend owning local S&P 500 skew near 10-year lows through December put ratios to position for further market declines, where investors test the “Fed put” - when the central bank alters policy to prop up equity markets after a sharp decline - to find that it’s “heavily compromised in the face of inflation.”

Meanwhile, Goldman chimes in that “a shift to Fed easing is unlikely without a clear move into recession, but - as in late 2018 - a clear signal that tightening risks are receding may be sufficient."

We agree, and is why yesterday we highlighted Bostic's warning that a September pause may be coming...

*BOSTIC: MAY MAKE SENSE TO PAUSE IN SEPT., DEPENDING ON ECONOMY

— zerohedge (@zerohedge) May 23, 2022

And there it is: the first "pause" hint

Expect many more, and then a hard stop

... and sure enough moments ago - after this morning's horrendous housing data - we get this:

- FED SWAPS DOWNGRADE CHANCE OF A HALF-POINT HIKE IN SEPTEMBER

To be sure, it will be extremely embarrassing - if not outright humiliating - for the Fed to be forced to pause tightening before it has even done any real QT but it no longer has a choice. And while we wait for Powell to capitulate, investors are looking ahead to this week’s minutes of the most recent FOMC meeting to get some more insight into the US central bank’s tightening path, which now appears woefully obsolete.

Both Goldman and BofA reports are available to pro subs in the usual place.

In a market where traders are increasingly stumped by daily, violent gyrations that take place with no seeming rhyme or reason, we have frequently said that just two things matter: first, the market will only stop panicking when the Fed starts panicking…

“Markets stop panicking when central bankers start panicking” – Michael Hartnett

getting very close

— zerohedge (@zerohedge) May 6, 2022

… and two, the market will panic when it crashes, which will be soon enough as every single Fed tightening cycle ends in a – you guessed it – financial crisis, default and bankruptcy of governments, banks and investors (ironic, because Janet Yellen vowed a few years ago there would be no more financial crises in her lifetime – spoiler alert: there will be).

In short, the only cure to the terrible “liquidity affliction” that is dragging stocks lower every day is… a crash, and as history has shown amply, and as we recently concluded in our simplistic view of markets, the moment the Fed capitulates is when everything will explode higher.

The instant Powell hints he won’t be hiking to 4%, spoos will go limit up.

— zerohedge (@zerohedge) May 18, 2022

This morning, strategists at both Goldman and Bank of America agreed that the only thing that will push stocks higher is a capitulation by the Biden Fed.

In a note from BofA’s Benajmin Bowler, the derivatives guru writes that “the Fed has offered no help to risk assets and appears far from stepping in,” and adds that market stress indicators, such as credit spreads and liquidity in S&P 500 futures, are now at levels seen during previous Fed interventions.

And, channeling Zero Hedge, he next says that “markets will continue to test the Fed put, but that it will take more market panic for the Fed to start panicking.”

Conveniently, just yesterday we discussed where the Fed Put resides, and noted that amid a monthly slide in the BofA Fund Manager Survey, which now sees the put strike slide to 3529…

… which however is still too high for Morgan Stanley strategist Michael Wilson who said that it is still “too early to get bullish” as the real Fed Put is at (or below) 3,400.

And while we wait to see just what S&P price will finally trigger the Fed, Goldman strategist Vickie Chang echoed BofA and said what is by now patently obvious to all, namely that the selloff will only bottom once the Fed signals the end of tightening–which may not happen until recession is apparent.

In a note published on Monday (and available to professional subscribers), Chang said that “it may be necessary for the market to become more confident than it is that financial conditions tightening has been sufficient and that the Fed has delivered and signaled enough tightening… Monetary policy has historically stopped tightening about three months before equities bottom, and shifted to easing about two months afterwards.”

In the past, such monetary tightening-fueled stock market corrections have tended to bottom when the Fed pivoted toward easing, regardless of a trough in economic activity as investors bet that activity will rise anyways thanks to rate cuts, according to Goldman. Chang said this time equities investors are unlikely to get a clear signal from the Fed about a policy shift until there’s solid evidence of moderating growth and cooling prices… which they just got thanks to today’s catastrophic new home sales.

“Using history as a guide, in order for equities to come off their recent lows (and stop declining), this kind of monetary-tightening induced contraction is most likely to end when the Fed itself shifts,” Chang said. “It may be that the market needs to see signs of the inflation deceleration that our US economists expect in the second half of the year in order to see sustained relief.”

So how should one trade this no-man’s land in stocks which will lead to more pain until the Fed panics? Well, as Bloomberg notes, the BofA strategists recommend owning local S&P 500 skew near 10-year lows through December put ratios to position for further market declines, where investors test the “Fed put” – when the central bank alters policy to prop up equity markets after a sharp decline – to find that it’s “heavily compromised in the face of inflation.”

Meanwhile, Goldman chimes in that “a shift to Fed easing is unlikely without a clear move into recession, but – as in late 2018 – a clear signal that tightening risks are receding may be sufficient.”

We agree, and is why yesterday we highlighted Bostic’s warning that a September pause may be coming…

*BOSTIC: MAY MAKE SENSE TO PAUSE IN SEPT., DEPENDING ON ECONOMY

And there it is: the first “pause” hint

Expect many more, and then a hard stop— zerohedge (@zerohedge) May 23, 2022

… and sure enough moments ago – after this morning’s horrendous housing data – we get this:

- FED SWAPS DOWNGRADE CHANCE OF A HALF-POINT HIKE IN SEPTEMBER

To be sure, it will be extremely embarrassing – if not outright humiliating – for the Fed to be forced to pause tightening before it has even done any real QT but it no longer has a choice. And while we wait for Powell to capitulate, investors are looking ahead to this week’s minutes of the most recent FOMC meeting to get some more insight into the US central bank’s tightening path, which now appears woefully obsolete.

Both Goldman and BofA reports are available to pro subs in the usual place.