A few days after Goldman's Thomas Evans advised clients to "keep pressing shorts" on natural gas through December, the NatGas futures market in New York exploded Thursday, spiking up to 10%. Another Goldman analyst wrote on Friday morning that the magnitude of this surge signals "short CTA/positioning unwinds." The price surge may have been sparked by a new cold weather forecast for the Lower 48 and or reports of multiple outages stretching from Norway to the US, heightening concerns about a market tightening ahead of the Northern Hemisphere winter.

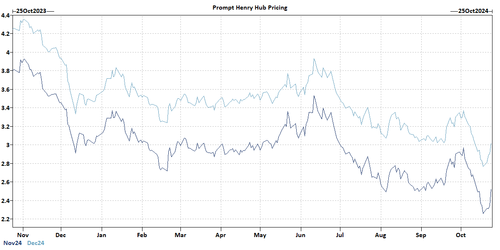

On Thursday, NatGas futures spiked as much as 10%. From the low of about $2.25 per million British thermal to start the week, prices have surged 15% to as high as $2.57. Prices are still locked in a multi-year lateral base, with $3 marking a critical level to watch for a potential breakout.

Goldman's Tallulah Adams told clients that yesterday's rally in NatGas futures was due to the "possibility of a less than warm November inviting a positioning unwind into a vacuum."

Here's more from Adams' note:

For the past few weeks, weather runs have consistently rolled warm and October 2024 HDDs will likely end the month the 3rd lowest in the past 50 years. As a result, the whole curve came off in the first 2 weeks of October, led by an almost 70c selloff in X24.

While the front-end of the curve had started to find bids this week, it was likely the Euro Ensemble run on Wednesday afternoon that ignited this move yesterday. Until that weather run, most signs pointed to November weather being more of the same as October. X24 was up 18c, Z24 up 11c, and Cal25 up ~7c.

The scale of the move is suggestive of short CTA/positioning unwinds – it's hard to say that the weather runs from Wednesday alone justify this kind of move. Yesterday was also the first day of limits, so it's possible unwinding shorts ahead of 2:30 to stay under might have contributed, but we wouldn't expect the impact of that to be large.

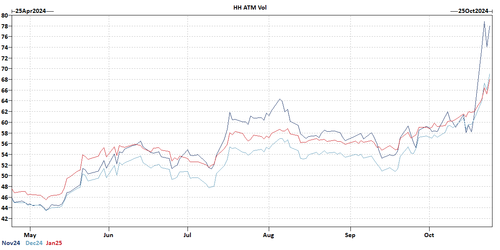

As one would expect, vol and call skew throughout the winter rallied on the flat price move, though the bid for vol really started picking up on the back of large x24 put buying on Monday:

Risk/Reward at this point is a bit tough. With X now closer to 250, rather than 230, it's harder to make the argument that producers won't give more production next month and your ability to meet heating demand in the back half of winter is low and therefore you should own price. Furthermore, after yesterday's +80 EIA number (surprise to upside), we conceivably could end the season with ~3.95 TCF in storage and a warm Nov could make it very hard for cash to perform. On the other hand, as far as we can tell CTAs were max short into this week and it's unclear what stage we are in of the unwind.

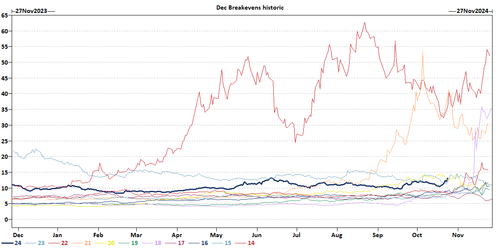

The best risk-reward to us looks like short vol at the moment. Z24 breakevens are seasonally high, and the burden to outrealize them at this point is quite high. That being said, it's early in winter and winter vols can rally substantially off of not much news (this week for example). It's probably a positive expected value trade, but we're sympathetic to wanting to wait until you get a better look at your November weather maps or for X24 to roll off the board.

Building on this note, multiple reports of gas outages from Norway to the US threatened to tighten the market further ahead of the winter heating season.

Bloomberg Intelligence's Vincent Piazza and Even Lee commented on US outages and shrinking surplus:

The US natural gas storage surplus continues to shrink, despite a bearish addition of 80 billion cubic feet (bcf) in the week ended Oct. 18, higher than our view and consensus. Daily production continued its downward trend during the week to below 101 bcf on Oct. 24, which may not be sustained in the near term. Feedgas demand -- hurt by reduced flows at Cameron LNG and Sabine Pass -- dropped to 12 bcf, while pipeline exports to Mexico were softer too. Weather is offering a slightly more bullish tilt for power generation, residential and commercial consumption as well. Yet weakness early in the week ending Oct. 25 may mute the recent constructive tack.

The $3 level is on watch...

Winter is coming:

-

NatGas Bulls Rejoice: Colder Winter Lower 48 Forecasts May "Place Upward Pressure" On Prices

-

"Wet Winter Whirlwind": Farmers' Almanac Releases New Winter Forecast For US

Brr.

A few days after Goldman’s Thomas Evans advised clients to “keep pressing shorts” on natural gas through December, the NatGas futures market in New York exploded Thursday, spiking up to 10%. Another Goldman analyst wrote on Friday morning that the magnitude of this surge signals “short CTA/positioning unwinds.” The price surge may have been sparked by a new cold weather forecast for the Lower 48 and or reports of multiple outages stretching from Norway to the US, heightening concerns about a market tightening ahead of the Northern Hemisphere winter.

On Thursday, NatGas futures spiked as much as 10%. From the low of about $2.25 per million British thermal to start the week, prices have surged 15% to as high as $2.57. Prices are still locked in a multi-year lateral base, with $3 marking a critical level to watch for a potential breakout.

Goldman’s Tallulah Adams told clients that yesterday’s rally in NatGas futures was due to the “possibility of a less than warm November inviting a positioning unwind into a vacuum.”

Here’s more from Adams’ note:

For the past few weeks, weather runs have consistently rolled warm and October 2024 HDDs will likely end the month the 3rd lowest in the past 50 years. As a result, the whole curve came off in the first 2 weeks of October, led by an almost 70c selloff in X24.

While the front-end of the curve had started to find bids this week, it was likely the Euro Ensemble run on Wednesday afternoon that ignited this move yesterday. Until that weather run, most signs pointed to November weather being more of the same as October. X24 was up 18c, Z24 up 11c, and Cal25 up ~7c.

The scale of the move is suggestive of short CTA/positioning unwinds – it’s hard to say that the weather runs from Wednesday alone justify this kind of move. Yesterday was also the first day of limits, so it’s possible unwinding shorts ahead of 2:30 to stay under might have contributed, but we wouldn’t expect the impact of that to be large.

As one would expect, vol and call skew throughout the winter rallied on the flat price move, though the bid for vol really started picking up on the back of large x24 put buying on Monday:

Risk/Reward at this point is a bit tough. With X now closer to 250, rather than 230, it’s harder to make the argument that producers won’t give more production next month and your ability to meet heating demand in the back half of winter is low and therefore you should own price. Furthermore, after yesterday’s +80 EIA number (surprise to upside), we conceivably could end the season with ~3.95 TCF in storage and a warm Nov could make it very hard for cash to perform. On the other hand, as far as we can tell CTAs were max short into this week and it’s unclear what stage we are in of the unwind.

The best risk-reward to us looks like short vol at the moment. Z24 breakevens are seasonally high, and the burden to outrealize them at this point is quite high. That being said, it’s early in winter and winter vols can rally substantially off of not much news (this week for example). It’s probably a positive expected value trade, but we’re sympathetic to wanting to wait until you get a better look at your November weather maps or for X24 to roll off the board.

Building on this note, multiple reports of gas outages from Norway to the US threatened to tighten the market further ahead of the winter heating season.

Bloomberg Intelligence’s Vincent Piazza and Even Lee commented on US outages and shrinking surplus:

The US natural gas storage surplus continues to shrink, despite a bearish addition of 80 billion cubic feet (bcf) in the week ended Oct. 18, higher than our view and consensus. Daily production continued its downward trend during the week to below 101 bcf on Oct. 24, which may not be sustained in the near term. Feedgas demand — hurt by reduced flows at Cameron LNG and Sabine Pass — dropped to 12 bcf, while pipeline exports to Mexico were softer too. Weather is offering a slightly more bullish tilt for power generation, residential and commercial consumption as well. Yet weakness early in the week ending Oct. 25 may mute the recent constructive tack.

The $3 level is on watch…

Winter is coming:

Brr.

Loading…