After the first two Mag7 companies were a study in market paradoxes, when TSLA missed across the board and soared (after guiding much better than expected) and META beat across the board but plunged (after guiding weaker than expected while boosting its spending forecast), moments ago two of the Mag7 giants, GOOGL and MSFT, both reported and this time there was far less drama: both beat, and saw their stock soaring after hours.

Focusing on Google parent Alphabet, Goldman said ahead of earnings that positioning here was not as excessive (at 7/10) which may be why the stock is soaring some 13% after the close on what otherwise appears to be a solid beat. Here are the details:

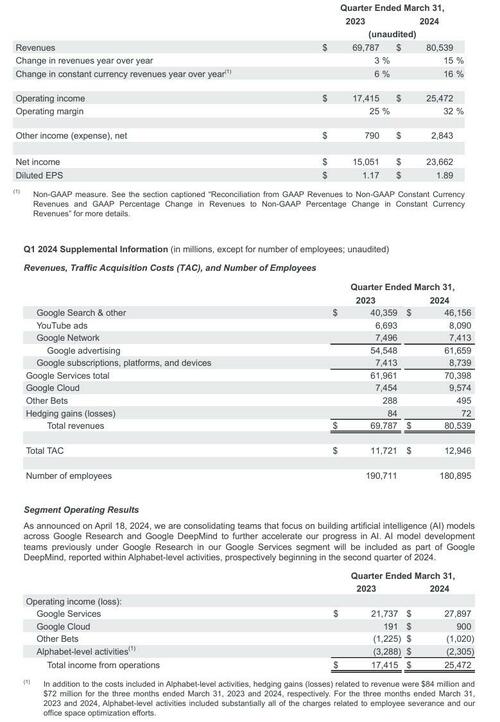

- EPS $1.89, beating estimate $1.53, and up more than 50% vs the $1.17 a year ago.

- Q1 Revenue $80.54 billion, beating the estimate of $79.04 billion, and up 15% YoY

- Google advertising revenue $61.66 billion, beating the estimate $60.18 billion

- YouTube ads revenue $8.09 billion, beating the estimate $7.73 billion

- Google Services revenue $70.40 billion, beating the estimate $69.06 billion

- Google Cloud revenue $9.57 billion, beating the estimate $9.37 billion

- Other Bets revenue $495 million, beating estimate $372.4 million

- Operating income $25.47 billion, beating estimate $22.4 billion

- Google Services operating income $27.90 billion, beating the estimate $24.3 billion

- Google Cloud operating income $900 million, beating the estimate $672.4 million

- Other Bets operating loss $1.02 billion, beating the estimate loss $1.12 billion

- Operating margin 32%, beating the estimate 28.6%

- Capital expenditure $12.01 billion, beating the estimate $10.32 billion

- Number of employees 180,895, down from 190,711

A quick point on YouTube: it was bought by Google in 2006 for $1.65 billion; YouTube now generates $1.65 billion of revenue every 18 days.

The results visually:

While Google's cloud numbers were stellar, with revenue rising from $7.5BN to $9.6BN, and beating estimates of $9.4BN, what investors wanted to hear was more about the company's progress on AI. This is what it had to say:

As announced on April 18, 2024, we are consolidating teams that focus on building artificial intelligence (AI) models across Google Research and Google DeepMind to further accelerate our progress in AI. AI model development teams previously under Google Research in our Google Services segment will be included as part of Google DeepMind, reported within Alphabet-level activities, prospectively beginning in the second quarter of 2024.

Like other Big Tech companies, Alphabet has been plowing money into developing artificial intelligence, a strategy that has helped drive demand for its cloud services, which saw revenue rise 28% in the first quarter. While Google remains a distant third in the cloud computing market, trailing Amazon and Microsoft, the company’s prowess in AI could help it close the gap.

Google has developed much of the underlying technology being used in the AI boom today, and has woven it into products from web search to its suite of enterprise software from Gmail to Google Docs. Yet ever since OpenAI’s ChatGPT was released in late 2022, Google has been battling the perception that it’s lagging behind Microsoft and OpenAI in rolling out new generative AI tools. The arrival of popular chatbots such as ChatGPT — which answers questions in a conversational tone rather than providing lists of links to other websites — has posed a threat to Google’s two-decade stranglehold on search. The company is struggling to compete in generative AI without cannibalizing its core profit machine.

Google has been scrambling to reassert its early lead in AI, after its early efforts were marred by embarrassing blunders, including a scandal over how its AI model Gemini handled race that forced the company to suspend image generation of people.

Commenting on the results, CFO Ruth Porat said: “Our strong financial results for the first quarter reflect revenue strength across the company and ongoing efforts to durably reengineer our cost base. We delivered revenues of $80.5 billion, up 15% year-on-year, and operating margin expansion.”

It certainly delivered, and just to make sure the market rewarded it, the company not only announced the start of new cash dividend at 20 cents...

Alphabet’s Board of Directors today approved the initiation of a cash dividend program, and declared a cash dividend of $0.20 per share that will be paid on June 17, 2024, to stockholders of record as of June 10, 2024, on each of the company’s Class A, Class B, and Class C shares.

... but also announced a new stock buyback program for $70 billion!

Alphabet’s Board of Directors today authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares in a manner deemed in the best interest of the company and its stockholders, taking into account the economic cost and prevailing market conditions, including the relative trading prices and volumes of the Class A and Class C shares.

While investors have shown they are excited about the prospects of AI, they want tech companies to continue to focus on revenue and profit in the meantime. Meta, which competes with Google in AI and also digital advertising, suffered its worst stock decline since October 2022 after reporting that it would spend billions of dollars more this year on AI efforts and projecting weaker revenue for the current quarter. For its part, Google - which does not do forecasts - paid $12BN in capex in the quarter, $1.7 billion more than estimated.

For all the hoopla about AI, search advertising remains the engine of Google’s lucrative business, and the company is facing heightened competition there, too. Meta has been seeding AI tools throughout its advertising business and Snap Inc. has also undergone a total revamp of its ad business to improve ad targeting. The digital ad market is recovering from a post-pandemic slump, buoyed by the Olympics Games this summer, but Google is increasingly vying for those ad dollars with Meta and Snap.

If consumers gravitate from Google search to the new wave of chatbots, that could imperil the company’s search advertising juggernaut, which is expected to generate nearly $200 billion in revenue this year and the bulk of Alphabet’s profit.

Cloud has been a bright spot for Google, after it first became profitable early last year. Many young AI startups are founded by former Google employees, creating a strong pipeline of cloud clients.

For now, however, these concerns were on the backburner, with GOOGL stock exploding about 12% after hours, and trading at a new all time high.

After the first two Mag7 companies were a study in market paradoxes, when TSLA missed across the board and soared (after guiding much better than expected) and META beat across the board but plunged (after guiding weaker than expected while boosting its spending forecast), moments ago two of the Mag7 giants, GOOGL and MSFT, both reported and this time there was far less drama: both beat, and saw their stock soaring after hours.

Focusing on Google parent Alphabet, Goldman said ahead of earnings that positioning here was not as excessive (at 7/10) which may be why the stock is soaring some 13% after the close on what otherwise appears to be a solid beat. Here are the details:

- EPS $1.89, beating estimate $1.53, and up more than 50% vs the $1.17 a year ago.

- Q1 Revenue $80.54 billion, beating the estimate of $79.04 billion, and up 15% YoY

- Google advertising revenue $61.66 billion, beating the estimate $60.18 billion

- YouTube ads revenue $8.09 billion, beating the estimate $7.73 billion

- Google Services revenue $70.40 billion, beating the estimate $69.06 billion

- Google Cloud revenue $9.57 billion, beating the estimate $9.37 billion

- Other Bets revenue $495 million, beating estimate $372.4 million

- Operating income $25.47 billion, beating estimate $22.4 billion

- Google Services operating income $27.90 billion, beating the estimate $24.3 billion

- Google Cloud operating income $900 million, beating the estimate $672.4 million

- Other Bets operating loss $1.02 billion, beating the estimate loss $1.12 billion

- Operating margin 32%, beating the estimate 28.6%

- Capital expenditure $12.01 billion, beating the estimate $10.32 billion

- Number of employees 180,895, down from 190,711

A quick point on YouTube: it was bought by Google in 2006 for $1.65 billion; YouTube now generates $1.65 billion of revenue every 18 days.

The results visually:

While Google’s cloud numbers were stellar, with revenue rising from $7.5BN to $9.6BN, and beating estimates of $9.4BN, what investors wanted to hear was more about the company’s progress on AI. This is what it had to say:

As announced on April 18, 2024, we are consolidating teams that focus on building artificial intelligence (AI) models across Google Research and Google DeepMind to further accelerate our progress in AI. AI model development teams previously under Google Research in our Google Services segment will be included as part of Google DeepMind, reported within Alphabet-level activities, prospectively beginning in the second quarter of 2024.

Like other Big Tech companies, Alphabet has been plowing money into developing artificial intelligence, a strategy that has helped drive demand for its cloud services, which saw revenue rise 28% in the first quarter. While Google remains a distant third in the cloud computing market, trailing Amazon and Microsoft, the company’s prowess in AI could help it close the gap.

Google has developed much of the underlying technology being used in the AI boom today, and has woven it into products from web search to its suite of enterprise software from Gmail to Google Docs. Yet ever since OpenAI’s ChatGPT was released in late 2022, Google has been battling the perception that it’s lagging behind Microsoft and OpenAI in rolling out new generative AI tools. The arrival of popular chatbots such as ChatGPT — which answers questions in a conversational tone rather than providing lists of links to other websites — has posed a threat to Google’s two-decade stranglehold on search. The company is struggling to compete in generative AI without cannibalizing its core profit machine.

Google has been scrambling to reassert its early lead in AI, after its early efforts were marred by embarrassing blunders, including a scandal over how its AI model Gemini handled race that forced the company to suspend image generation of people.

Commenting on the results, CFO Ruth Porat said: “Our strong financial results for the first quarter reflect revenue strength across the company and ongoing efforts to durably reengineer our cost base. We delivered revenues of $80.5 billion, up 15% year-on-year, and operating margin expansion.”

It certainly delivered, and just to make sure the market rewarded it, the company not only announced the start of new cash dividend at 20 cents…

Alphabet’s Board of Directors today approved the initiation of a cash dividend program, and declared a cash dividend of $0.20 per share that will be paid on June 17, 2024, to stockholders of record as of June 10, 2024, on each of the company’s Class A, Class B, and Class C shares.

… but also announced a new stock buyback program for $70 billion!

Alphabet’s Board of Directors today authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares in a manner deemed in the best interest of the company and its stockholders, taking into account the economic cost and prevailing market conditions, including the relative trading prices and volumes of the Class A and Class C shares.

While investors have shown they are excited about the prospects of AI, they want tech companies to continue to focus on revenue and profit in the meantime. Meta, which competes with Google in AI and also digital advertising, suffered its worst stock decline since October 2022 after reporting that it would spend billions of dollars more this year on AI efforts and projecting weaker revenue for the current quarter. For its part, Google – which does not do forecasts – paid $12BN in capex in the quarter, $1.7 billion more than estimated.

For all the hoopla about AI, search advertising remains the engine of Google’s lucrative business, and the company is facing heightened competition there, too. Meta has been seeding AI tools throughout its advertising business and Snap Inc. has also undergone a total revamp of its ad business to improve ad targeting. The digital ad market is recovering from a post-pandemic slump, buoyed by the Olympics Games this summer, but Google is increasingly vying for those ad dollars with Meta and Snap.

If consumers gravitate from Google search to the new wave of chatbots, that could imperil the company’s search advertising juggernaut, which is expected to generate nearly $200 billion in revenue this year and the bulk of Alphabet’s profit.

Cloud has been a bright spot for Google, after it first became profitable early last year. Many young AI startups are founded by former Google employees, creating a strong pipeline of cloud clients.

For now, however, these concerns were on the backburner, with GOOGL stock exploding about 12% after hours, and trading at a new all time high.

Loading…