Republicans are in strong shape to win the House majority in the Nov. 8 midterm elections, and three GOP lawmakers are already jockeying to become chairman of Congress’s top tax-writing panel, the Ways and Means Committee.

Should House Republicans net at least six seats in the 435-member chamber, enough to grab the majority, the Ways and Means Committee chairmanship will be open thanks to the retirement after the elections of its current top GOP member, Rep. Kevin Brady (R-TX).

Brady took over as Ways and Means chairman in November 2015 to replace Rep. Paul Ryan (R-WI), who ascended to House speaker, as chairman Brady took the lead in writing the Tax Cuts and Jobs Act of 2017. The $1.5 trillion law made deep cuts to corporate taxes while lowering individual rates for a decade, among other provisions.

The tax law, former President Donald Trump’s singular domestic achievement, illustrated the unique power of the Ways and Means Committee, which is arguably more influential than its counterpart across the Capitol, the Senate Finance Committee. That’s because, under the Constitution, all revenue bills must originate in the House, so the Ways and Means Committee gets the first crack at writing tax and finance legislation.

Brady got demoted to the ranking Republican member of the Ways and Means Committee when Democrats won the House majority in 2018. He’s set to leave Congress in early January after 26 years in office, which sets up the battle for the committee’s top spot.

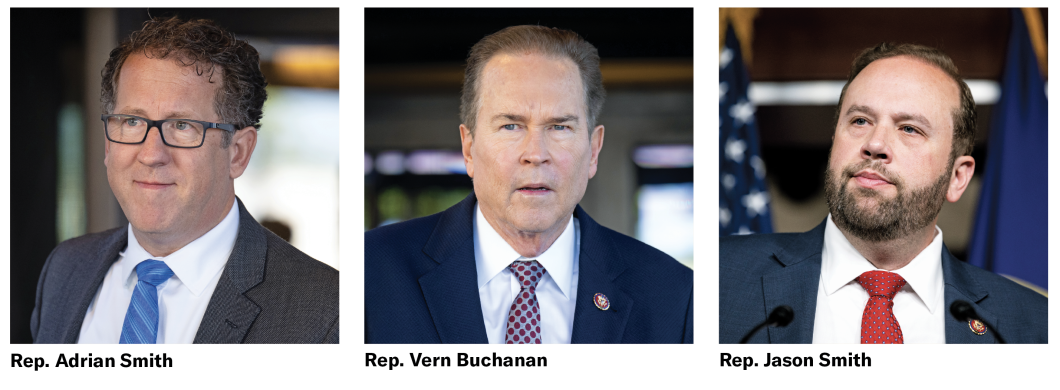

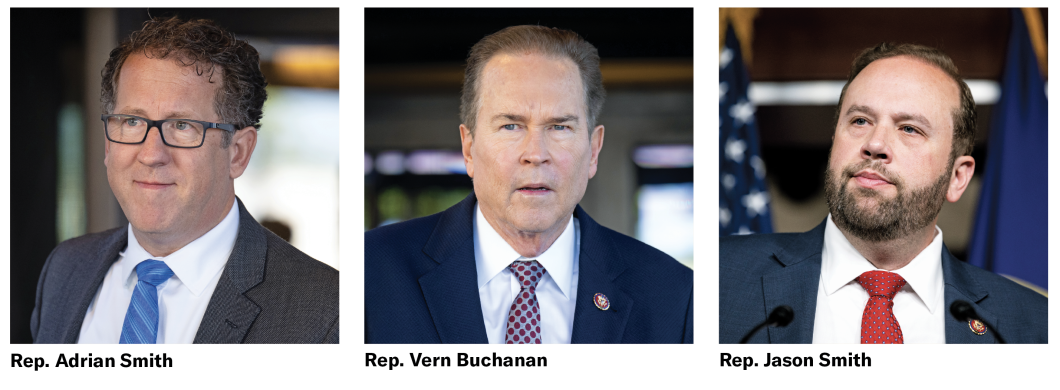

Reps. Vern Buchanan of Florida, Adrian Smith of Nebraska, and Jason Smith of Missouri are fighting each other for the role. Buchanan, the most senior committee member, was considered by some to be Brady’s heir apparent, although the Smiths have shaken up the action and made the contest competitive.

Brady hasn’t given his blessing to any of the candidates and has refrained from commenting on the individual pros and cons of the three men. He’s instead deferred to the panel that will make the decision on committee assignments when the new Congress convenes, the House Republican Steering Committee, on which party leaders have significant sway.

The Washington Examiner conducted interviews with all three congressmen in October to ask about how they would approach running the influential committee. Each said that curbing the growth of the Internal Revenue Service would be a top priority, a politically topical area of focus since the Inflation Reduction Act, enacted in August by President Joe Biden and the current Democratic-majority Congress, provides $80 billion to hire 87,000 new IRS employees.

Their concerns about the IRS echo remarks by House Minority Leader Kevin McCarthy (R-CA), who would likely wield the speaker’s gavel should the GOP prevail in November. McCarthy said that the first bill under a Republican-led House would be to repeal the new IRS employees, which Democrats contend is necessary to make sure tax revenue owed to the federal government is actually collected.

Rep. Vern Buchanan

Buchanan, 71, was first sworn into Congress in 2007 and brings with him a successful business pedigree that he hopes will set him apart from his competitors. Buchanan, whose district starting in January will cover the southern Tampa suburbs and Bradenton area, argues he is someone who has experienced firsthand how tax law affects businesses small and large.

He grew up in the Detroit area and started a print shop business before franchising it and expanding out into hundreds of stores. Buchanan eventually moved to Florida and got into the car business, opening dealerships in the Ocala area in the central part of the Sunshine State. Eventually, the business expanded to more than two dozen car dealerships.

Buchanan has a wide breadth of experience on the Ways and Means Committee and has led five of the six subcommittees on Ways and Means over the years. He is hoping that his deep well of experience both on the committee and in the private sector will be considered when Republicans decide who to make chairman.

Buchanan said making some of the tax provisions under the 2017 tax law permanent is a major priority for him if he is entrusted to lead the committee. He also brought up full expensing, which has long been a priority of the GOP. Full expensing allows businesses to write off the cost of new investments immediately.

“It would be a big lift to the business community, [the] small-business community,” he said.

Buchanan pointed out that he was also the Republican leader on the trade subcommittee when the United States-Mexico-Canada Agreement passed. He said he wants to push for more free trade agreements and said that he’s noticed on trips to Africa how the Chinese are building roads and infrastructure and that the U.S. under the Biden administration has been lacking in trade policy.

“There’s a lot of opportunities around the world that we could be much more aggressive in terms of trade,” he said.

Buchanan said it is also important to find ways to ensure Social Security and Medicare are viable for seniors on a long-term basis. He said that the issues need to be dealt with in a bipartisan fashion and that the longer nothing is done, the bigger of a challenge it will be in the future.

In terms of the IRS, Buchanan said that as chairman, he will conduct rigorous oversight, adding it’s an issue that concerns voters in his district. The incoming version of Buchanan’s district in 2020 would have backed Trump over Biden by 54% to 45.1%.

“Obviously, in 2024, there will be a lot more we can do, but I think in terms of the oversight of this, there is a lot we can be fairly focused on, pretty aggressive on, that needs to be dealt with quickly because a lot of people are very concerned about the IRS,” he said.

Rep. Adrian Smith

Adrian Smith was born and raised in Nebraska, which his family has called home for six generations. He has perhaps attracted less attention than the others in the contest for chairman, although he has garnered a reputation for himself as a policy devotee during his dozen years on the Ways and Means Committee.

First elected to the House in 2006, Adrian Smith has IRS oversight in his crosshairs should he rise to chairman of the Ways and Means Committee. Smith has already introduced legislation to defund the Biden administration’s plan to grow the IRS workforce. He thinks that his sprawling western Nebraska district, where in 2020 Trump would have crushed Biden 74.9% to 23.1%, provides a unique vantage to attack the IRS funding plan due to its many small businesses, particularly in agriculture.

Adrian Smith, 51, said as chairman of the Ways and Means Committee he would conduct aggressive oversight not only for the IRS but other agencies. Oversight needs to result in tangible legislation to fix issues and prevent problems from occurring in the future, Smith added.

He’s also looking to tap the expertise of House GOP colleagues.

“I think hearing from the entire conference is very important. Obviously, each member of the Ways and Means Committee is very important in this mix, and there are other members that have ideas too,” he said. “We’ve got a lot of good ideas that come from various perspectives, various parts of the country, various industries, and so we need all hands on deck.”

One key policy area in need of reform is the nation’s welfare system. That could draw bipartisan interest in change, including reform to Temporary Assistance for Needy Families, Adrian Smith said.

“I think we have too many programs that end up keeping people in poverty rather than having the expectation that these programs should be helping people out of poverty,” he said.

Enforcing the rules of current trade laws is another priority for Smith, which he contends has been neglected in recent years due to the supply chain crisis triggered by the COVID-19 pandemic.

Talking with the Washington Examiner, Adrian Smith said he embraces his reputation on Capitol Hill of being a bit of a policy wonk and hopes to translate that devotion to the nuts and bolts of policy to his leadership on the Ways and Means Committee.

“I think I’m the one who can be most effective, and I’m respected in policy and hearing out the various perspectives but ultimately being effective at getting things done. The body of my work points to this,” he said.

Rep. Jason Smith

Jason Smith is a lifelong Missourian from a rural part of the state and attended undergrad at the University of Missouri. The southeastern Missouri district Smith represents is where the late conservative broadcaster and political commentator Rush Limbaugh grew up. The new version of the district, the lines of which take effect when the new Congress opens on Jan. 3, 2023, would have given Trump a whopping 75% of its vote to only 23.6% for Biden.

Jason Smith, 42, is the only GOP candidate seeking the Ways and Means Committee who is not a member of the panel. He is currently the top Republican lawmaker on the House Budget Committee.

Jason Smith is pitching himself as the candidate who will most effectively conduct oversight at the helm of the committee. During an interview, he noted that while leading Republicans on the Budget Committee, they were the first to raise concerns over the $80 billion IRS funding provision that became law and a now-scrapped proposal that all bank transactions of more than $600 be reported to the IRS.

The congressman vowed not only to work to peel back the $80 billion in funding but also to investigate other aspects of the IRS that have concerned voters. That includes a still-unexplained leak last year of the tax returns of thousands of the nation’s wealthiest people.

Jason Smith pointed out that the leak happened while the Biden administration was pushing tax policy and proposals that asserted the wealthiest people in the U.S. are not paying their fair share in taxes.

“This kind of information is the oversight that the American people are demanding, and when I’m chairman of the Ways and Means Committee that I will be commanding and looking into it. I want to know how and why this has happened,” Jason Smith said.

He said that a big priority is ensuring work requirements for welfare and preventing the abuse of government handouts. He also put a major emphasis on bolstering U.S. production and independence.

“When you look at tax policy, we need to make sure that we got a tax code that works for working-class Americans, and we need to make sure our tax code incentivizes U.S. energy independence and food security and medical security,” Jason Smith said. “And we’ve got to use trade policies to make sure that the U.S. is energy secure, medical secured, and food secured.”

Jason Smith, 42, said he thinks the committee needs to hit the road. As chairman, he would hold hearings not just in Washington, D.C., but across the country, “where we can hear firsthand with boots on the ground what it’s like outside of Washington, D.C.,” Jason Smith said.