The latest Bloomberg MLIV Pulse survey of over 600 professional and retail investors revealed more than half of them anticipate that the downturn in 'green' energy stocks will persist into next year, posing challenges for some investors who have been trying to catch the 'falling knife.'

The survey, conducted Nov. 13-24 globally among Bloomberg News users on the Terminal, asked a series of questions about the green energy industry.

One of those questions asked Terminal users: With the iShares Global Clean Energy ETF down more than 30% this year and on track for its worst year since 2011. What do you think happens next?

Most respondents, 57% (or 353), expect the selloff to continue next year. And 43% (or 267) expect green stocks will find a near-term bottom, and now is the time to buy.

The ownership portfolio of the iShares Global Clean Energy ETF reveals that the fund is heavily invested in solar, wind, and hydrogen stocks, including SolarEdge, First Solar, Sunrun, Orsted, and Plug Power, which have been clubbed like a baby seal this year.

Waning demand and higher interest rates have been reasons for the green bubble's epic bursting.

Take a look at iShares Global Clean Energy ETF versus the Nasdaq... Whoops!

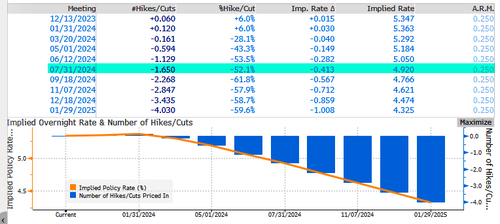

One of the ways the green bubble can avoid total extinction is for the Federal Reserve to reverse course on the interest rate hiking cycle. Swap traders believe this could occur as early as next summer.

This is one bubble the Biden administration might want to save. Otherwise, the implosion of these companies could derail it from hitting carbon-free targets in the years ahead.

The latest Bloomberg MLIV Pulse survey of over 600 professional and retail investors revealed more than half of them anticipate that the downturn in ‘green’ energy stocks will persist into next year, posing challenges for some investors who have been trying to catch the ‘falling knife.’

The survey, conducted Nov. 13-24 globally among Bloomberg News users on the Terminal, asked a series of questions about the green energy industry.

One of those questions asked Terminal users: With the iShares Global Clean Energy ETF down more than 30% this year and on track for its worst year since 2011. What do you think happens next?

Most respondents, 57% (or 353), expect the selloff to continue next year. And 43% (or 267) expect green stocks will find a near-term bottom, and now is the time to buy.

The ownership portfolio of the iShares Global Clean Energy ETF reveals that the fund is heavily invested in solar, wind, and hydrogen stocks, including SolarEdge, First Solar, Sunrun, Orsted, and Plug Power, which have been clubbed like a baby seal this year.

Waning demand and higher interest rates have been reasons for the green bubble’s epic bursting.

Take a look at iShares Global Clean Energy ETF versus the Nasdaq… Whoops!

One of the ways the green bubble can avoid total extinction is for the Federal Reserve to reverse course on the interest rate hiking cycle. Swap traders believe this could occur as early as next summer.

This is one bubble the Biden administration might want to save. Otherwise, the implosion of these companies could derail it from hitting carbon-free targets in the years ahead.

Loading…