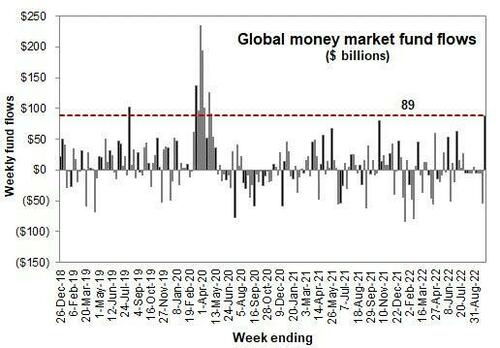

One week ago, Goldman trader Scott Rubner made a bold prediction: when looking at the latest fund flows, and especially the huge spike in money market funds (a proxy for risk selling)...

... Rubner concluded that "Retail Has Finally Blinked. Capitulation Is Near." Well, as so often happens, Goldman's flow guru was well ahead of the curve as usual, and as BofA's Michael Hartnett (who explained in his latest note "The Bear Hug" why he sees stocks sliding with occasional bear markets until early 2023) writes in the bank's latest monthly global Fund Manager Survey (available to pro subs in the usual place) that stocks are now in "macro capitulation, investor capitulation, and start of policy capitulation" for reasons regular readers are aware of.

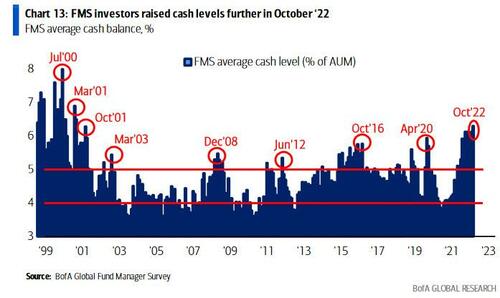

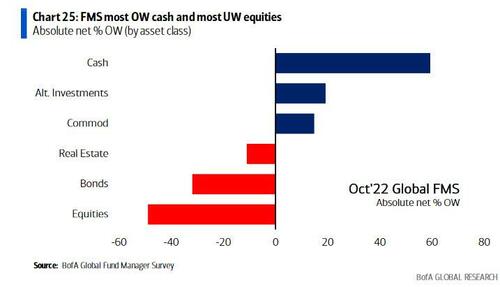

The survey which polled 371 panelists managing some $1.1 trillion between October 7 and 13, found that cash levels hit 6.3% from 6.1% in September, the highest since April’01...

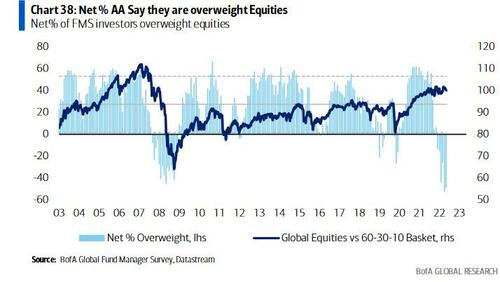

... that investors are now 3-sigma Underweight equities, surpassing even the full-blown panic during the peak of the global financial crisis...

... which according to Hartnett is "tasty morsels for another bear rally", so long as TSY yields stay <4%.

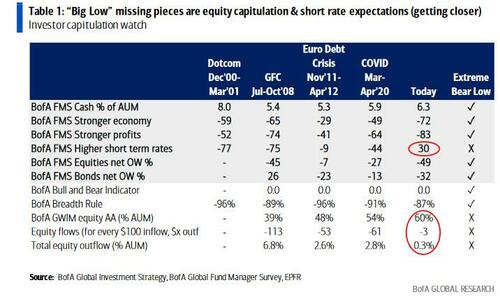

And while one could buy here and ride the coming bear market rally (as even that other uber-bear Mike Wilson yesterday said), Hartnett's core position is that the “big low”, “big rally” hits in H1’23 when Fed cuts become consensus (28% expect lower short rates in Oct FMS).

Next, we take a closer looks at the three capitulations listed by Hartnett:

Macro Capitulation - done: global growth expectations net -72%, near all-time low...

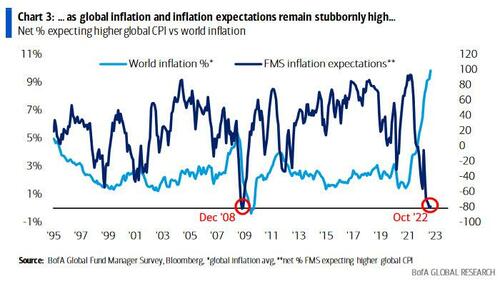

...even as global inflation remains stubbornly high, although FMS inflation expectations are now finally tumbling as markets price in the coming recession.

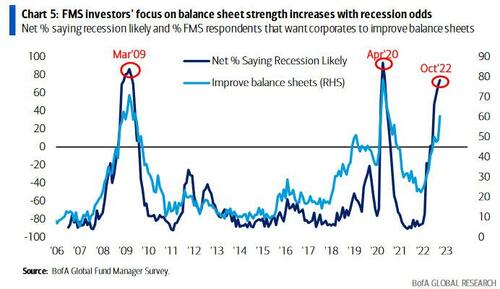

Past 4 cycles say “macro panic” over only once FMS growth expectations up >40pps from lows; note huge 87% expect inflation to fall (see Chart 1 above); CIOs message to CEOs: reduce debt 60%, increase capex 17%, increase buybacks/dividends 17%.

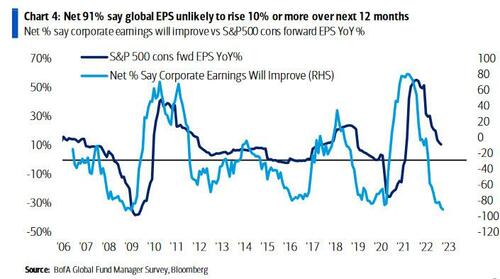

And for once, at least, the fund managers have realistic expectations: some 91% of FMS investors (net) say that global corporate earnings are unlikely to rise 10% or more in the next year, the most since the GFC, suggesting further downside for forward EPS consensus projections for the S&P 500 index.

Investor Capitulation – done: relative to FMS +20-year history investors are 2.6-sigma OW cash...

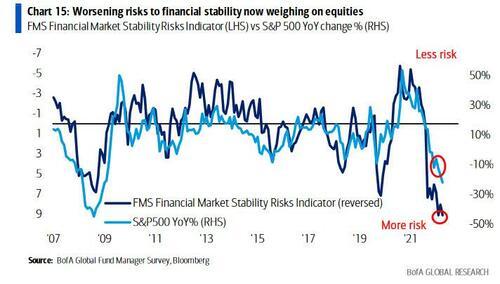

... 3.0-sigma UW equities (chart 38 above); also in “doesn’t get much worse” territory: BofA's FMS financial market stability risk metrics are at all-time high...

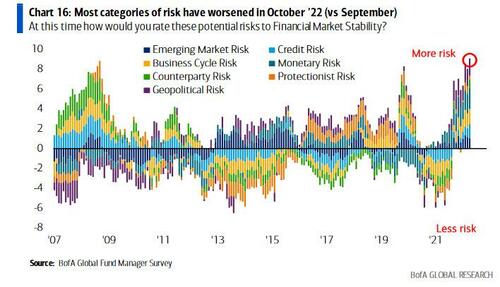

... driven by “monetary" & “credit” concerns.

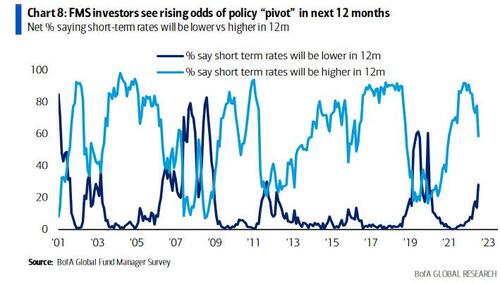

Policy Capitulation - this is the most important one, and it is starting (as Hartnett discussed extensively last Friday): at all “big lows” investors forecast rate cuts (see Capitulation Watch);

FMS expectations of lower short rates was 5% in March, now 28% up from 14%, but was 65% at prior “big lows”. Conversely, the share of FMS investors expecting higher short-term rates continues to decline from the Jan/Feb ’22 peak (92%) to 59% in October ’22 (vs 78% last month)

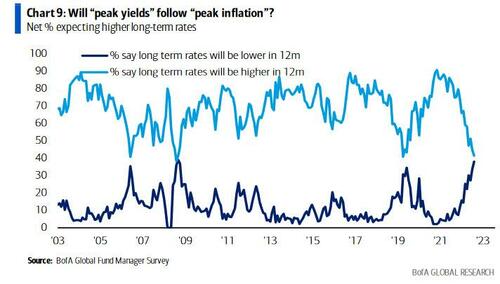

Also, most investors since Nov’08 expect lower bond yields next 12 months...

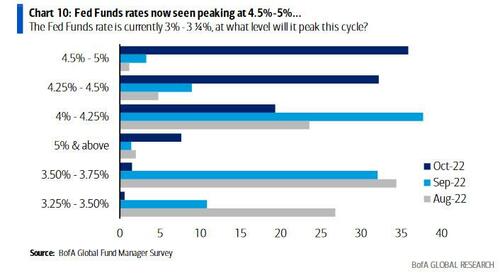

... as the Fed funds rate is now seen peaking around 4.5% - 5.0%, up 50bps in the past month.

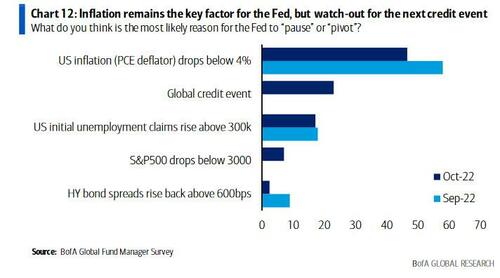

... but FMS says US PCE deflator <4% needed for Fed pivot.

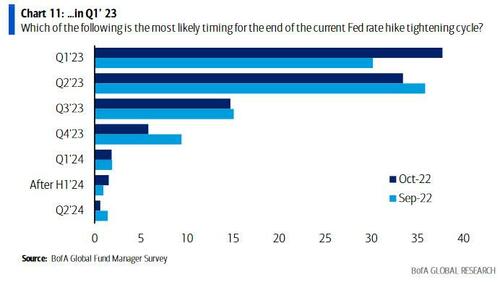

... something which the majority sees happening some time in Q1 2023, which is when a majority or 38% of FMS investors expect the Fed tightening cycle to end, one quarter faster than a month ago.

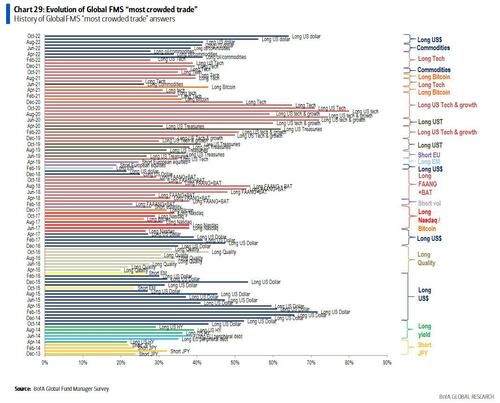

With the pivot on deck and the market lows coming in just a few months, how should one positioned to capitalize on this best? According to Hartnett, the most crowded FMS trades are:

investors are very Overweight cash, utilities, staples, the US dollar, and very Underweight stocks, sterling, Eurozone, tech.

And, as one would expect, by far and away, the most “crowded trade” is long US dollar. It's why Hartnett's top trade for 2023 is to short the USD.

Finally, some contrarian trades for those seeking to frontrun the unwind of the current set of portfolios: long sterling vs US$, long stocks vs cash, long EU stocks vs US, long consumer discretionary vs healthcare..

There is much more in the full fund manager survey available to pro subs in the usual place.

One week ago, Goldman trader Scott Rubner made a bold prediction: when looking at the latest fund flows, and especially the huge spike in money market funds (a proxy for risk selling)…

… Rubner concluded that “Retail Has Finally Blinked. Capitulation Is Near.” Well, as so often happens, Goldman’s flow guru was well ahead of the curve as usual, and as BofA’s Michael Hartnett (who explained in his latest note “The Bear Hug” why he sees stocks sliding with occasional bear markets until early 2023) writes in the bank’s latest monthly global Fund Manager Survey (available to pro subs in the usual place) that stocks are now in “macro capitulation, investor capitulation, and start of policy capitulation” for reasons regular readers are aware of.

The survey which polled 371 panelists managing some $1.1 trillion between October 7 and 13, found that cash levels hit 6.3% from 6.1% in September, the highest since April’01…

… that investors are now 3-sigma Underweight equities, surpassing even the full-blown panic during the peak of the global financial crisis…

… which according to Hartnett is “tasty morsels for another bear rally”, so long as TSY yields stay <4%.

And while one could buy here and ride the coming bear market rally (as even that other uber-bear Mike Wilson yesterday said), Hartnett’s core position is that the “big low”, “big rally” hits in H1’23 when Fed cuts become consensus (28% expect lower short rates in Oct FMS).

Next, we take a closer looks at the three capitulations listed by Hartnett:

Macro Capitulation – done: global growth expectations net -72%, near all-time low…

…even as global inflation remains stubbornly high, although FMS inflation expectations are now finally tumbling as markets price in the coming recession.

Past 4 cycles say “macro panic” over only once FMS growth expectations up >40pps from lows; note huge 87% expect inflation to fall (see Chart 1 above); CIOs message to CEOs: reduce debt 60%, increase capex 17%, increase buybacks/dividends 17%.

And for once, at least, the fund managers have realistic expectations: some 91% of FMS investors (net) say that global corporate earnings are unlikely to rise 10% or more in the next year, the most since the GFC, suggesting further downside for forward EPS consensus projections for the S&P 500 index.

Investor Capitulation – done: relative to FMS +20-year history investors are 2.6-sigma OW cash…

… 3.0-sigma UW equities (chart 38 above); also in “doesn’t get much worse” territory: BofA’s FMS financial market stability risk metrics are at all-time high…

… driven by “monetary” & “credit” concerns.

Policy Capitulation – this is the most important one, and it is starting (as Hartnett discussed extensively last Friday): at all “big lows” investors forecast rate cuts (see Capitulation Watch);

FMS expectations of lower short rates was 5% in March, now 28% up from 14%, but was 65% at prior “big lows”. Conversely, the share of FMS investors expecting higher short-term rates continues to decline from the Jan/Feb ’22 peak (92%) to 59% in October ’22 (vs 78% last month)

Also, most investors since Nov’08 expect lower bond yields next 12 months…

… as the Fed funds rate is now seen peaking around 4.5% – 5.0%, up 50bps in the past month.

… but FMS says US PCE deflator <4% needed for Fed pivot.

… something which the majority sees happening some time in Q1 2023, which is when a majority or 38% of FMS investors expect the Fed tightening cycle to end, one quarter faster than a month ago.

With the pivot on deck and the market lows coming in just a few months, how should one positioned to capitalize on this best? According to Hartnett, the most crowded FMS trades are:

investors are very Overweight cash, utilities, staples, the US dollar, and very Underweight stocks, sterling, Eurozone, tech.

And, as one would expect, by far and away, the most “crowded trade” is long US dollar. It’s why Hartnett’s top trade for 2023 is to short the USD.

Finally, some contrarian trades for those seeking to frontrun the unwind of the current set of portfolios: long sterling vs US$, long stocks vs cash, long EU stocks vs US, long consumer discretionary vs healthcare..

There is much more in the full fund manager survey available to pro subs in the usual place.