While the move in the S&P over the past few days may not have been exactly brutal, for many traders last week has a distinct March 2020 feel to it, for one simple reason: every trade that had worked in the past year, suddenly hit a brick wall and cratered: everything from the Mag 7 (the most popular stock strategy), to the yen short (the most popular FX carry trade), to gold (the most popular anti-fiscal stupidity trade), to bitcoin, suddenly crashed and burned. Indeed, as BofA's Michael Hartnett writes in his latest Flow Show note(available to pro subs in the usual place), the past 2 weeks have seen gold (an asset inflation play) tumble -8% in Japanese yen (an asset deflation play) as rates (Powell cuts) and politics (Trump wins) drove the liquidation of world's most crowded trades (such as short yen, long copper, long AI).

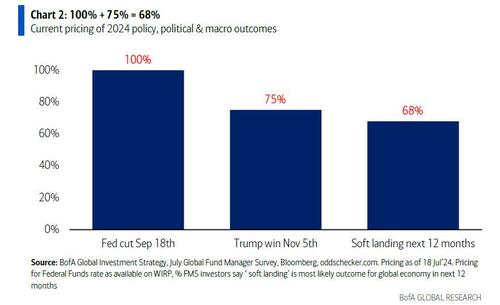

And while many bulls have argued the correction was healthy, Hartnett warns that key levels that must hold are the following: yen (JPY) 152, copper (HG1) 9000, tech (NDX) 18700. Those same bulls will also say that as long as these levels hold, this will be just another dip-buying opportunity as some of the froth clears out; that's because - as Hartnett wrote last week - investors had fully priced-in the bullish combo of Fed cut (100%), Trump victory (75%), and soft landing (68%)...

... and critically credit spreads - the "glue" for Wall St - have thus far been well-behaved… but this changes if IG CDX spreads (51bps) break above 60bps.

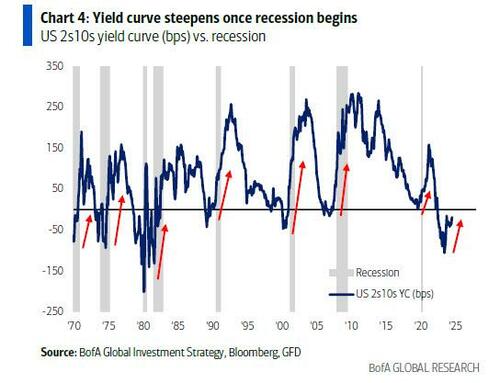

Meanwhile, the bears will counter that a steeper yield curve is recessionary...

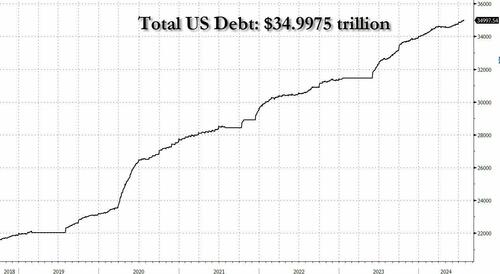

... that bond vigilantes won’t allow Fed cuts to work (since US debt is up $2tn past 317 days to $35tn)...

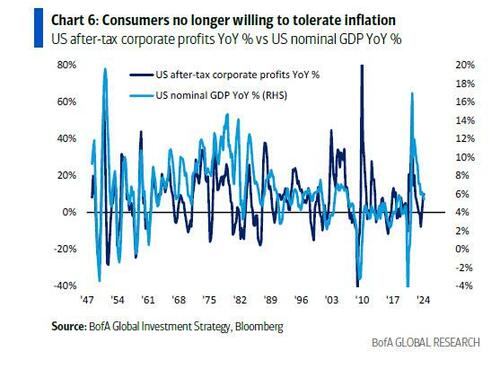

... consumers are no longer willing to tolerate inflation (lower nominal GDP = lower not higher EPS)...

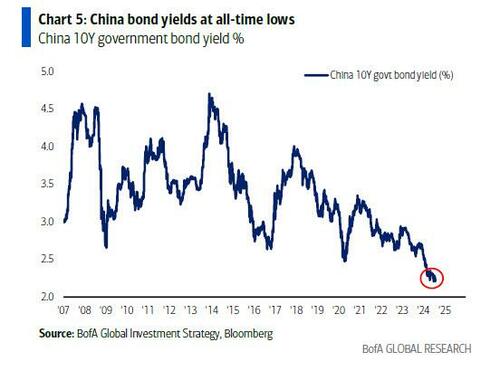

... commodity prices confirm global economy ill (China bond yields at all-time lows)...

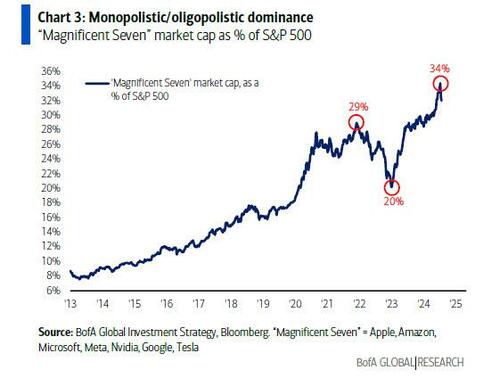

... and we are one bad payroll away from cracking monopolistic/oligopolistic dominance.

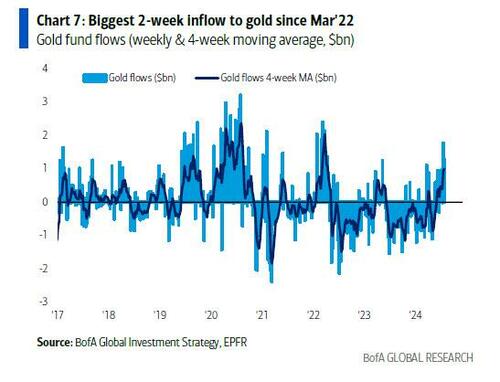

Perhaps, but for now investors continue to flee cash and allocate to risky assets expecting the Fed to cut if not next week then definitely in September, and the latest weekly fund flows confirm it: according to EPFR data cited by Hartnett, the last week saw $22.2BN to equities, $16.1BN to bonds, $1.3BN to gold, $1.2BN to crypto... and $42.3BN out of cash, as investors start to frontrun the coming rate cuts.

And while cash saw its largest outflow in 3 months, the following inflows were especially notable:

- Gold: biggest 2-week inflow since Mar'22 ($1.3bn this week – Chart 7);

- IG bonds: 39th week of inflows ($8.8bn this week)

- EM equities: largest inflow since Feb'24 ($11.1bn)

- China: largest inflow since Feb'24 ($8.3bn)

- Japan: largest inflow in 3 months ($4.1bn)

Yet while markets keep pressing continued risk-on trades, Hartnett won't tired of doing just the opposite, and echoing what he has said for much of 2024, he remains bullish on bonds in the second half of 2024 as the contrarian reversals of the first half's ABB "Anything But Bonds" trades continue to outperform, to wit:

- "leverage" (REITs, small cap),

- "value" (e.g. UK FTSE…the "anti-Nasdaq"),

- "duration" (e.g. biotech);

... but the black swan - as Hartnett himself admits - is that the fiscal excess of 2020s can flip cyclical bond bull script.

That said, if the coming recession and spike in unemployment cause higher government bond yields as markets discount a fiscal policy panic to avert social & political unrest, e.g. politicians tell Fed to fund deficit and address AI-led unemployment via QE or yield curve control (AI = UBI = YCC), and Fed cuts in H2 and yields rise vs. fall, this will all be hugely bullish crypto/commodities, and hugely bearish US dollar.

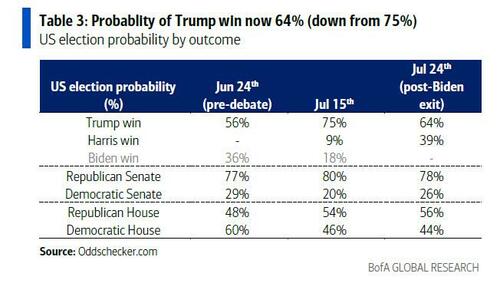

Hartnett concludes his latest note by discussing the latest weekly political trends, where we have seen the probability of a Trump win drop to 64% (was 75% last week)...

... and of Harris win rising to 39% (was 28% Biden/Harris last week);

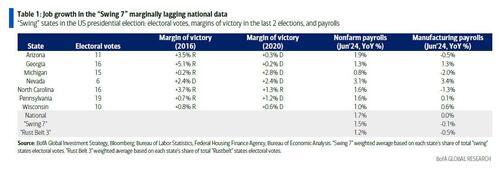

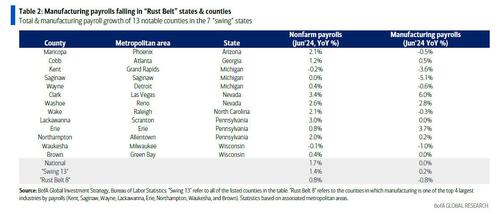

Still, the US President is elected by an electoral college (not popular vote) and the 2024 election will be determined by 7 “swing" states of Arizona, Georgia, Nevada, Michigan, North Carolina, Pennsylvania, Wisconsin (states that flipped between 2016/2020 elections or won by <3% margin in 2020). So some observations about the fundamentals on the ground: job growth in "Swing 7" states (1.5%) marginally lagging national data (US payrolls grew 1.7% in June); but note weaker job growth in critical "Rust Belt 3" of PA, MI, WI (payrolls up 1.2% in June)...

... driven by the manufacturing sector (focus of trade policy). The result is that manufacturing payrolls falling 0.5% YoY in "Rust Belt 3" states and falling 0.8% YoY in the "swing counties" in Pennsylvania, Michigan & Wisconsin.

And with the US election focus turning toward US manufacturing as Trump presses on with his favorite tariffs, this too is bearish for the US dollar.

Much more in the full BofA note available to pro subscribers.

While the move in the S&P over the past few days may not have been exactly brutal, for many traders last week has a distinct March 2020 feel to it, for one simple reason: every trade that had worked in the past year, suddenly hit a brick wall and cratered: everything from the Mag 7 (the most popular stock strategy), to the yen short (the most popular FX carry trade), to gold (the most popular anti-fiscal stupidity trade), to bitcoin, suddenly crashed and burned. Indeed, as BofA’s Michael Hartnett writes in his latest Flow Show note(available to pro subs in the usual place), the past 2 weeks have seen gold (an asset inflation play) tumble -8% in Japanese yen (an asset deflation play) as rates (Powell cuts) and politics (Trump wins) drove the liquidation of world’s most crowded trades (such as short yen, long copper, long AI).

And while many bulls have argued the correction was healthy, Hartnett warns that key levels that must hold are the following: yen (JPY) 152, copper (HG1) 9000, tech (NDX) 18700. Those same bulls will also say that as long as these levels hold, this will be just another dip-buying opportunity as some of the froth clears out; that’s because – as Hartnett wrote last week – investors had fully priced-in the bullish combo of Fed cut (100%), Trump victory (75%), and soft landing (68%)…

… and critically credit spreads – the “glue” for Wall St – have thus far been well-behaved… but this changes if IG CDX spreads (51bps) break above 60bps.

Meanwhile, the bears will counter that a steeper yield curve is recessionary…

… that bond vigilantes won’t allow Fed cuts to work (since US debt is up $2tn past 317 days to $35tn)…

… consumers are no longer willing to tolerate inflation (lower nominal GDP = lower not higher EPS)…

… commodity prices confirm global economy ill (China bond yields at all-time lows)…

… and we are one bad payroll away from cracking monopolistic/oligopolistic dominance.

Perhaps, but for now investors continue to flee cash and allocate to risky assets expecting the Fed to cut if not next week then definitely in September, and the latest weekly fund flows confirm it: according to EPFR data cited by Hartnett, the last week saw $22.2BN to equities, $16.1BN to bonds, $1.3BN to gold, $1.2BN to crypto… and $42.3BN out of cash, as investors start to frontrun the coming rate cuts.

And while cash saw its largest outflow in 3 months, the following inflows were especially notable:

- Gold: biggest 2-week inflow since Mar’22 ($1.3bn this week – Chart 7);

- IG bonds: 39th week of inflows ($8.8bn this week)

- EM equities: largest inflow since Feb’24 ($11.1bn)

- China: largest inflow since Feb’24 ($8.3bn)

- Japan: largest inflow in 3 months ($4.1bn)

Yet while markets keep pressing continued risk-on trades, Hartnett won’t tired of doing just the opposite, and echoing what he has said for much of 2024, he remains bullish on bonds in the second half of 2024 as the contrarian reversals of the first half’s ABB “Anything But Bonds” trades continue to outperform, to wit:

- “leverage” (REITs, small cap),

- “value” (e.g. UK FTSE…the “anti-Nasdaq”),

- “duration” (e.g. biotech);

… but the black swan – as Hartnett himself admits – is that the fiscal excess of 2020s can flip cyclical bond bull script.

That said, if the coming recession and spike in unemployment cause higher government bond yields as markets discount a fiscal policy panic to avert social & political unrest, e.g. politicians tell Fed to fund deficit and address AI-led unemployment via QE or yield curve control (AI = UBI = YCC), and Fed cuts in H2 and yields rise vs. fall, this will all be hugely bullish crypto/commodities, and hugely bearish US dollar.

Hartnett concludes his latest note by discussing the latest weekly political trends, where we have seen the probability of a Trump win drop to 64% (was 75% last week)…

… and of Harris win rising to 39% (was 28% Biden/Harris last week);

Still, the US President is elected by an electoral college (not popular vote) and the 2024 election will be determined by 7 “swing” states of Arizona, Georgia, Nevada, Michigan, North Carolina, Pennsylvania, Wisconsin (states that flipped between 2016/2020 elections or won by <3% margin in 2020). So some observations about the fundamentals on the ground: job growth in “Swing 7” states (1.5%) marginally lagging national data (US payrolls grew 1.7% in June); but note weaker job growth in critical “Rust Belt 3” of PA, MI, WI (payrolls up 1.2% in June)…

… driven by the manufacturing sector (focus of trade policy). The result is that manufacturing payrolls falling 0.5% YoY in “Rust Belt 3” states and falling 0.8% YoY in the “swing counties” in Pennsylvania, Michigan & Wisconsin.

And with the US election focus turning toward US manufacturing as Trump presses on with his favorite tariffs, this too is bearish for the US dollar.

Much more in the full BofA note available to pro subscribers.

Loading…