UMich inflation expectations re-surged, retail sales were a disaster, and manufacturing production plunged... but apart from that stagflationary set-up, everything is awesome (because headline industrial production rose more than expected, core retail sales was a smidge less terrible than expected, and headline UMich sentiment improved).

It was a hard week for both 'soft' data and 'real' data as they both showed serial disappointment (a positive for some assets in the case of inflation signals) but overall, 'hope' - the spread between hard and soft data - is at its lowest since March 2001...

Source: Bloomberg

Amid all that, traders shifted their short-term views on The Fed hawkishly, spurred on by the UMich inflation exp spike and The Fed's Waller who made it clear there was more 'pain' to come:

“Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further,”

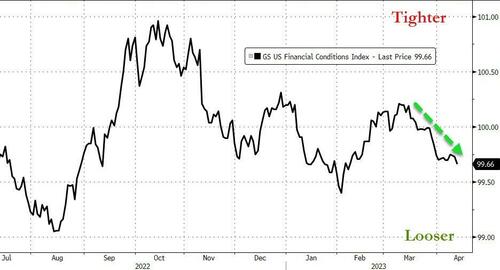

He is not wrong...financial conditions are easing and that's not what The Fed wants...

Source: Bloomberg

The odds of a 25bs hike in May now up to 85% - almost back to pre-SVB levels...

Source: Bloomberg

US equities ended the week mixed with the Nasdaq basically unchanged and The Dow outperforming (these are changes from Friday's early futures close). The day was a bit chaotic as hawkish comments (and data) battled bonanza bank earnings (BA and UNH weighed the Dow down -177pts opposing GS and JPM's gains +90pts)...

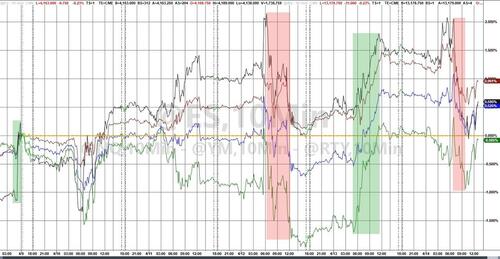

The early ugliness in stocks (QQQ below) was led by negative delta 0DTE traders' flow which turned at the key gamma strike level and dropped all the way down to the Hedge Wall before rebounding...

Banks dominated today's price action after earnings and along with energy stocks were the week's winners. Utes and real estate were the ugliest horses in the glue factory...

Source: Bloomberg

With JPM up over 7% today (and C soaring too)...

Source: Bloomberg

But as the big banks soared, the small banks pushed back to the post-SVB lows...

Source: Bloomberg

Another week with a big divergence between defensives (lower) and cyclicals (higher)... which is odd given the hawkish shift in rates...

Source: Bloomberg

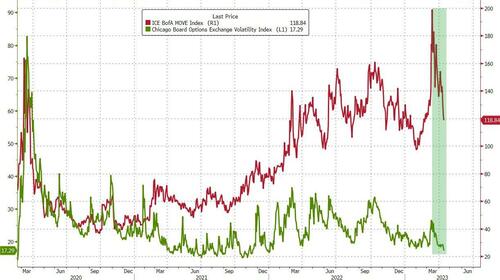

Both Equity (VIX) and bond (MOVE) implied vol plunged this week with the former trading with a 17 handle - its lowest since Jan '22. Bond vol is still significantly elevated but has come down dramatically...

Source: Bloomberg

Treasury yields surged today dragging the entire curve higher on the week - in an oddly uniform manner (all maturities up 10-12bps)...

Source: Bloomberg

The 2Y yield spiked today back above 4.00% to its highest since the start of April...

Source: Bloomberg

The dollar rebounded off the February lows today, reversing much of the week's losses BUT still down for the 5th week in a row...

Source: Bloomberg

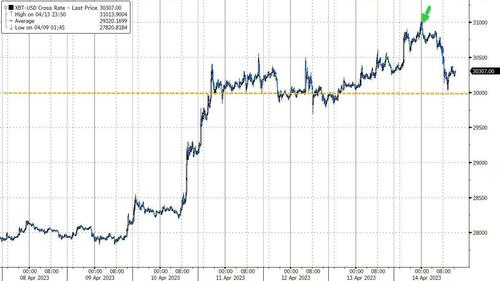

Crypto had a good week with Bitcoin holding above $30,000 (hitting $31k overnight)...

Source: Bloomberg

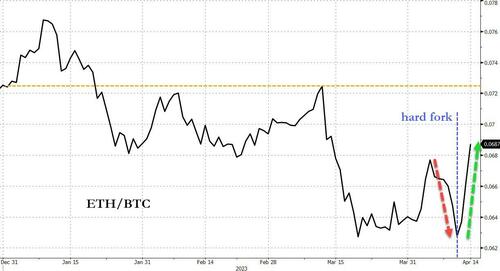

But Ethereum was the biggest winner, soaring above $2100 after the hard fork FUD failed to show up...

Source: Bloomberg

For context, ETH notably underperformed BTC into the fork then ripped back to one-month highs relative to BTC after...

Source: Bloomberg

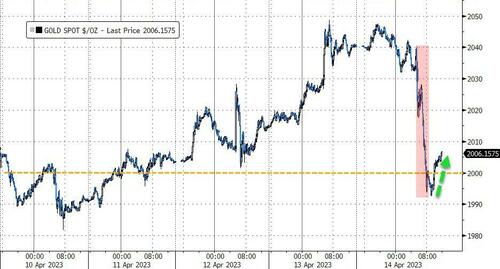

Gold was having a great week, rallying up to near record highs before today's news sent the precious plummeting back below $2000. However, late in the day, spot gold rallied back above that Maginot Line...

Oil rallied for the 4th straight week with WTI closing above $82.50 - the highest weekly close since early Nov '22...

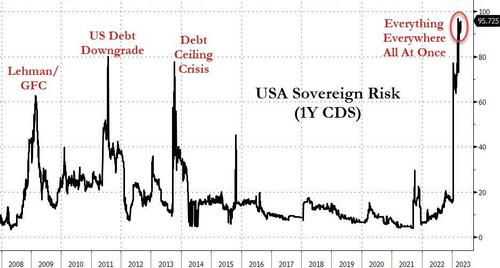

Finally, and most ominously, the sovereign credit risk of the USA soared to a record high this week...

Source: Bloomberg

But hey, it's probably nothing...

UMich inflation expectations re-surged, retail sales were a disaster, and manufacturing production plunged… but apart from that stagflationary set-up, everything is awesome (because headline industrial production rose more than expected, core retail sales was a smidge less terrible than expected, and headline UMich sentiment improved).

It was a hard week for both ‘soft’ data and ‘real’ data as they both showed serial disappointment (a positive for some assets in the case of inflation signals) but overall, ‘hope’ – the spread between hard and soft data – is at its lowest since March 2001…

Source: Bloomberg

Amid all that, traders shifted their short-term views on The Fed hawkishly, spurred on by the UMich inflation exp spike and The Fed’s Waller who made it clear there was more ‘pain’ to come:

“Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further,”

He is not wrong…financial conditions are easing and that’s not what The Fed wants…

Source: Bloomberg

The odds of a 25bs hike in May now up to 85% – almost back to pre-SVB levels…

Source: Bloomberg

US equities ended the week mixed with the Nasdaq basically unchanged and The Dow outperforming (these are changes from Friday’s early futures close). The day was a bit chaotic as hawkish comments (and data) battled bonanza bank earnings (BA and UNH weighed the Dow down -177pts opposing GS and JPM’s gains +90pts)…

The early ugliness in stocks today (QQQ below) was led by negative delta 0DTE traders’ flow which turned at the key gamma strike level and dropped all the way down to the Hedge Wall before rebounding…

Additionally we note that S&P Net Spec positioning rose last week…

Source: Bloomberg

…from the ‘most short’ since 2011…

Source: Bloomberg

Banks dominated today’s price action after earnings and along with energy stocks were the week’s winners. Utes and real estate were the ugliest horses in the glue factory…

Source: Bloomberg

With JPM up over 7% today (and C soaring too)…

Source: Bloomberg

But as the big banks soared, the small banks pushed back to the post-SVB lows…

Source: Bloomberg

Another week with a big divergence between defensives (lower) and cyclicals (higher)… which is odd given the hawkish shift in rates…

Source: Bloomberg

Both Equity (VIX) and bond (MOVE) implied vol plunged this week with the former trading with a 17 handle – its lowest since Jan ’22. Bond vol is still significantly elevated but has come down dramatically…

Source: Bloomberg

Treasury yields surged today dragging the entire curve higher on the week – in an oddly uniform manner (all maturities up 10-12bps)…

Source: Bloomberg

The 2Y yield spiked today back above 4.00% to its highest since the start of April…

Source: Bloomberg

The dollar rebounded off the February lows today, reversing much of the week’s losses BUT still down for the 5th week in a row…

Source: Bloomberg

Crypto had a good week with Bitcoin holding above $30,000 (hitting $31k overnight)…

Source: Bloomberg

But Ethereum was the biggest winner, soaring above $2100 after the hard fork FUD failed to show up…

Source: Bloomberg

For context, ETH notably underperformed BTC into the fork then ripped back to one-month highs relative to BTC after…

Source: Bloomberg

Gold was having a great week, rallying up to near record highs before today’s news sent the precious plummeting back below $2000. However, late in the day, spot gold rallied back above that Maginot Line…

Oil rallied for the 4th straight week with WTI closing above $82.50 – the highest weekly close since early Nov ’22…

Finally, and most ominously, the sovereign credit risk of the USA soared to a record high this week…

Source: Bloomberg

But hey, it’s probably nothing…

Loading…