Since the last FOMC statement on May 1st, bonds, stocks, and gold have rallied strongly while crude prices have declined with a small drop in the dollar...

Source: Bloomberg

Rate-cut expectations have dovishly increased (but are well off the post-CPI spike highs)..

Source: Bloomberg

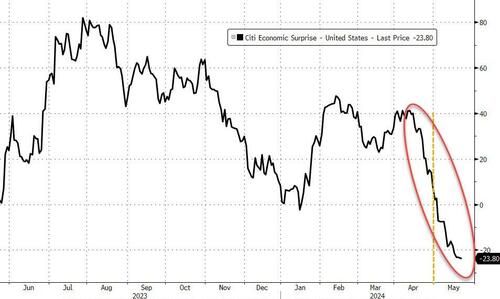

With US Macro data serially surprising to the downside (with both 'hard' and 'soft' data deteriorating rapidly with CPI and Retail Sales printing after the last meeting)...

Source: Bloomberg

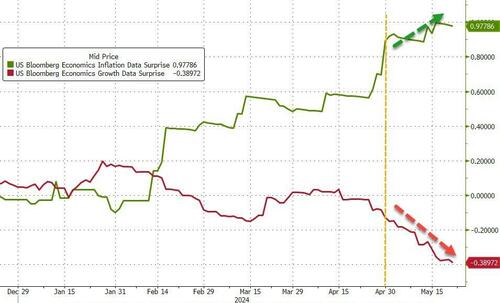

Growth-based macro factors have weakened considerably since the last FOMC meeting while inflation-related factors have increased.

Source: Bloomberg

So, with stagflationary signals abounding, what will The Fed want us to read into the Minutes today...

Expectations were for confirmation that rate-hikes are off the table... The Fed still expects growth without inflation... the Fed remains focused on shelter inflation...

Headlines from the Minutes include:

On Rate-Hikes:

Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.

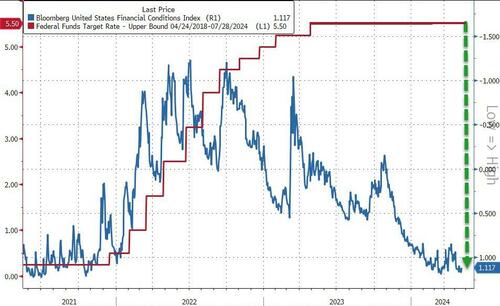

On Financial Conditions:

A number of participants noted uncertainty regarding the degree of restrictiveness of current financial conditions and the associated risk that such conditions were insufficiently restrictive on aggregate demand and inflation.

Although monetary policy was seen as restrictive, many participants commented on their uncertainty about the degree of restrictiveness.

Who can blame them for worrying...

On Growth upside and downside:

Several participants commented that increased efficiencies and technological innovations could raise productivity growth on a sustained basis, which might allow the economy to grow faster without raising inflation.

Participants also noted downside risks to economic activity, including slowing economic growth in China, a deterioration in conditions in domestic CRE markets, or a sharp tightening in financial conditions

On disinflation:

Participants suggested that the disinflation process would likely take longer than previously thought.

On tapering QT:

Almost all participants supported decision to begin to slow pace of decline of central bank's securities holdings; a few could have supported continuation of current pace.

On financial stability:

Participants who commented noted vulnerabilities to the financial system that they assessed warranted monitoring.

On balance, the staff continued to characterize the system's financial vulnerabilities as notable but raised the assessment of vulnerabilities in asset valuations to elevated, as valuations across a range of markets appeared high relative to risk-adjusted cash flows.

Read the full Minutes below:

Since the last FOMC statement on May 1st, bonds, stocks, and gold have rallied strongly while crude prices have declined with a small drop in the dollar…

Source: Bloomberg

Rate-cut expectations have dovishly increased (but are well off the post-CPI spike highs)..

Source: Bloomberg

With US Macro data serially surprising to the downside (with both ‘hard’ and ‘soft’ data deteriorating rapidly with CPI and Retail Sales printing after the last meeting)…

Source: Bloomberg

Growth-based macro factors have weakened considerably since the last FOMC meeting while inflation-related factors have increased.

Source: Bloomberg

So, with stagflationary signals abounding, what will The Fed want us to read into the Minutes today…

Expectations were for confirmation that rate-hikes are off the table… The Fed still expects growth without inflation… the Fed remains focused on shelter inflation…

Headlines from the Minutes include:

On Rate-Hikes:

Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.

On Financial Conditions:

A number of participants noted uncertainty regarding the degree of restrictiveness of current financial conditions and the associated risk that such conditions were insufficiently restrictive on aggregate demand and inflation.

Although monetary policy was seen as restrictive, many participants commented on their uncertainty about the degree of restrictiveness.

Who can blame them for worrying…

On Growth upside and downside:

Several participants commented that increased efficiencies and technological innovations could raise productivity growth on a sustained basis, which might allow the economy to grow faster without raising inflation.

Participants also noted downside risks to economic activity, including slowing economic growth in China, a deterioration in conditions in domestic CRE markets, or a sharp tightening in financial conditions

On disinflation:

Participants suggested that the disinflation process would likely take longer than previously thought.

On tapering QT:

Almost all participants supported decision to begin to slow pace of decline of central bank’s securities holdings; a few could have supported continuation of current pace.

On financial stability:

Participants who commented noted vulnerabilities to the financial system that they assessed warranted monitoring.

On balance, the staff continued to characterize the system’s financial vulnerabilities as notable but raised the assessment of vulnerabilities in asset valuations to elevated, as valuations across a range of markets appeared high relative to risk-adjusted cash flows.

Read the full Minutes below:

Loading…