Authored by James Turk, Founder of GoldMoney,

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said.

“Gradually and then suddenly.”

Ernest Hemingway, The Sun Also Rises, 1926

The financial position of the federal government of the United States has been gradually deteriorating for decades.

It is now rushing headlong to the financial tipping point that will cause it to default on its promises yet again.

What kind of default will it be this time?

Previous U.S. Government Defaults

Will it be like the 1933 default when the federal government reneged on its debt and stopped the deflationary spiral in the dollar caused by the unwinding of the 1920’s credit bubble instigated by banks? Or will the federal government repay its debt by pretending to fulfil its promises with a worthless currency, repeating what occurred in the 1780s with the country’s first currency, the continental?

In my books and articles over the years I have been making the case that it will be the latter. The dollar has been on a path leading to its collapse. It is the path of least resistance for politicians and their captive central bankers to take, as evidenced by the dozens of currencies that have failed just in living memory, let alone those from monetary history buried in the fiat currency graveyard and long forgotten.

The erosion of the dollar’s purchasing power so far has been gradual, but it is accelerating. Nevertheless, there is still time for political leaders to act.

The right thing to do is simply walk away from the debt and start over. That is what the framers of the Constitution did. So starting over this time would not be starting from scratch. We do not need to relearn from experience what Americans endured from the collapse of the continental two and one-half centuries ago. We can act now before the decline in the dollar’s purchasing power accelerates by simply returning to the constitutional monetary system that existed from the Mint Act of 1792 until 1913 when the Federal Reserve was created.

In fact, we need to unravel all the harmful legislation as well as overturn the constitutional amendments from the late 19th and early 20th century foisted on the American public by the so-called ‘progressives’ of the socialistic radical left and reject their fascism. But this article is about the inevitability of a default and the collapse of fiat currency, not politics.

The Math Pointing to Default & Hyperinflation

Defaults are the outcome of poor financial management, whether individuals, companies, or governments. Defaults rest upon numbers, specifically the cash-flow of revenue and outlays and their relation to the amount of debt. Hyperinflation is the result when governments fund their ever-growing expenses, budget deficits, and debt with new paper currency issued by the central bank and/or deposit currency originating within the banking system.

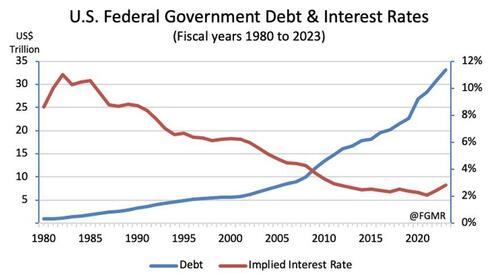

The following chart illustrates the relationship between the federal government’s $33 trillion debt and the interest rate paid on it. Up to now a default has been avoided by manipulating interest rates.

Notwithstanding the surge of federal government debt, the annual average interest rate paid on its debt has been declining since the 1980s and has remained artificially low since the end of the 2008 financial crisis. Only recently has it started to inch up from a post-pandemic low of 2.07%. The consequence of this artificially low interest rate was a manageable interest expense burden while the total debt soared, an unrepeatable circumstance that is now setting the stage for dollar hyperinflation.

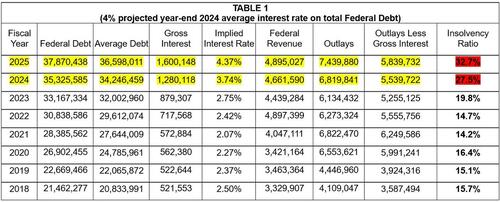

The data in the following table presents the federal government’s financial results with my 2-year projection. The Implied Interest Rate is Gross Interest paid by the government divided by the year’s Average Debt. The key measure is the Insolvency Ratio, which is Gross Interest divided by Federal Revenue.

In 1980 when Federal Reserve Chairman Paul Volcker was raising interest rates to fight inflation, the Implied Interest Rate on the Average Debt that year was 8.61%. The Insolvency Ratio was 14.5% and manageable. Although interest rates soon peaked and began declining, the Insolvency Ratio continued climbing because of irresponsible federal government spending that resulted in continual budget deficits and a growing federal debt through the rest of that decade.

The ratio hit 27.1% in 1991 , a year in which Federal Revenue and its Outlays were both adversely impacted by the recession then prevailing. Alarm bells began ringing. A 30% Insolvency Ratio is generally seen as the tipping point that typically ignites a monetary, economic, and banking crisis. Importantly, it also signals the point at which inflation accelerates into hyperinflation as government outlays and debt grow faster than its revenue, and the resulting deficits are paid for with new currency emanating from a compliant banking system.

So politicians back then faced a dilemma. They had to reverse course and stop their uncontrolled spending or find a solution to perpetuate endless deficits and borrowing. They came up with a shameful response – more market intervention.

The Federal Reserve would manipulate interest rates, forcing them below levels determined by market participants, artificially lessening the cost of capital and skewing the free market process. This harmful policy of financial repression eased the government’s interest expense burden but did so with irreparable damage to savers, the backbone of capitalism and the principal means by which the middle class accumulates purchasing power to prepare for an uncertain future.

It was a wicked tactic to buy time and retain the status quo; it was not a solution. The proverbial can was kicked down the road for the umpteenth time.

That beaten-up can is now about to go over the cliff and take the dollar with it because artificially low interest rates have encouraged even greater amounts of borrowing that have resulted in even more accumulated debt. The time bought by this tactic is now ending as interest rates have begun their inevitable return to levels better reflecting the heightened credit and counterparty risk of the federal government’s debt mountain, which is rapidly approaching $34 trillion.

Rushing Toward the Tipping Point

As the debt rises, so does the interest expense burden from carrying that debt. Without a cut in outlays in other areas of the government, which is unlikely, the growing interest expense deepens the deficit and requires more borrowing. Those steps initiate a vicious spiral of bigger deficits that require more debt with a growing interest expense burden, all of which is paid for with newly created currency by the Federal Reserve working in tandem with the banking system. The resulting currency debasement – the erosion of its purchasing power – is the inflation that is causing so much financial distress and worry, and now the deficit spiral is deepening.

Alarm bells are ringing like they did in the early 1990s. The never-ending deficits and higher interest rates heighten the risk of default, which explains why the federal government is losing its triple-A credit rating.

My projections in Table 1 assume a 4% and 5% year-end interest rate for the federal government for 2024 and 2025 respectively, leading to an Implied Interest Rate of 3.74% and 4.37% for those years. I also assume that Outlays in both years grow at 5.5%, which is their CAGR from 1980 to 2023, while Revenue grows at its 5.0% historical CAGR. These are modest assumptions, so the projection can easily be disrupted and made worse by a recession, or even just a low level of economic growth.

In particular, note the 5-point jump in the Insolvency Ratio from 2022 to 2023. The federal government spent less last year to meet its regular operating expenses – Outlays Less Gross Interest declined $301 billion. But Federal Revenue declined $458 billion, which is $363 billion less than the government budgeted in January. This troubling -9.4% decline in annual revenue not only highlights the precariousness of the federal government’s financial position, it also indicates that the U.S. economy is rolling over and may have already entered a recession. This observation is supported by the Leading Economic Index, which just recorded its sixteenth consecutive monthly decline.

Typically in a recession revenue declines while outlays increase, as happened in the Great Recession. In 2009 Federal Revenue fell -16.6%, while Outlays jumped 17.9%. A repeat of those magnitudes would send the Insolvency Ratio soaring because the debt today is 3-times greater than it was in 2009 while Federal Revenue is only 2-times greater.

Regardless of whether a recession has begun, the federal government’s debt and its interest expense burden are accelerating because of the rise in interest rates that began last year. Worryingly, even if interest rates do not rise further, my projections in Table 1 calculate that the 30% tipping point will be reached in 2025 as maturing low interest rate debt will be refinanced at higher interest rates.

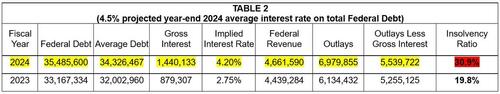

Any further increase in interest rates beyond my projected level would mean the tipping point is reached even sooner. For example, the 30% tipping point is reached in 2024 if the year-end interest rate paid by the federal government on its debt is 4.5%, instead of 4% as projected in Table 1. This relatively small increase in rates highlights the federal government’s precarious position. As seen in the Table 2, it has a fatal sensitivity to higher rates because of the huge amount of its debt in relation to its ability to generate revenue, even if Federal Revenue grows in 2024 and the economy somehow avoids a recession.

In contrast to the 1990s, there are no can-kicking alternatives for politicians to grasp on to. Reducing interest rates before inflation is under control will lead to a flight from the dollar as people seek alternatives like gold, silver, and other useful tangible assets to protect their purchasing power. Even if interest rates do not rise further, the tipping point is near simply because of the amount of accumulated debt.

The federal government is on a knife-edge, with default looming in the near future. This dire outcome is simply a reflection of math, which is undeniable. Actual results of revenue, outlays, and debt along with the above projections highlight past decades of financial mismanagement.

The Lesson To Be Learned

There is a critically important lesson to be learned, though ‘re-learned’ is more accurate given that history is replete with recurring examples of political folly and government repression. A command economy eventually ends in unmitigated failure regardless of the political ideology that promotes it.

We know that conclusion to be true from the economic and currency collapse of the Soviet Union, Venezuela, and other countries that propagandise false social doctrines that disparage capitalism and free markets. They share a common thread of eventual economic failure due to their rigging of interest rates and other heinous schemes of financial repression.

Tragically, their repression is not just financial. They all erode the liberty of their citizens, which is the inescapable outcome from political control of currency and interest rates in a command economy. By pursuing in the twentieth century an unconstitutional monetary system, America has inexcusably fallen into this fiendish trap.

Controls On Government from Issuing Money

By abandoning key provisions of the Constitution, the monetary process has spun out of control. Gold and silver – the moneys of the Constitution – are only mined when it is profitable to do so. The framers and their successors for the following century understood that the unbendable limits of nature[9] and prudent capitalism together harmoniously control the weight of metal mined each year. With their careful crafting of Article I, Sections 8 & 10 that limits federal power to the coining of money (not printing it), they purposefully kept the creation of new money out of the hands of politicians and central bankers. We are experiencing the calamitous consequences of jettisoning these essential constitutional requirements put there by the framers after they lived through and learned from the collapse of the continental currency.

There are no limits restricting how many unconstitutional dollars can be created. Even the debt limit has been cast aside. Dollars are being conjured up with reckless abandon that has enabled the growth in the federal government’s debt. A compliant Federal Reserve and a banking system spurred on by huge – but insupportable – profits provide whatever amount of fiat currency is needed to meet the unrealistic spending aspirations of the federal political class.

We know from monetary history that continual credit expansion cannot be sustained. When it eventually ends, the debt mountain crashes and takes along with it the fiat currency that built it.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” Ludwig von Mises

America’s politicians need to make some tough decisions, and so do the voters who put them into a position of responsibility. Sensible leadership is needed to move the country back to a constitutional republic of honest money. Otherwise the country will continue plunging ahead recklessly on the road to default with the unpredictable social and political consequences arising from the collapse of the dollar’s purchasing power.

To prepare for another default, own physical gold and physical silver, not their paper representations. Many of those promises will be defaulted too, repeating what the US Treasury did in 1933 by defaulting on its paper gold certificates and its paper silver certificates in 1965.

Authored by James Turk, Founder of GoldMoney,

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said.

“Gradually and then suddenly.”

Ernest Hemingway, The Sun Also Rises, 1926

The financial position of the federal government of the United States has been gradually deteriorating for decades.

It is now rushing headlong to the financial tipping point that will cause it to default on its promises yet again.

What kind of default will it be this time?

Previous U.S. Government Defaults

Will it be like the 1933 default when the federal government reneged on its debt and stopped the deflationary spiral in the dollar caused by the unwinding of the 1920’s credit bubble instigated by banks? Or will the federal government repay its debt by pretending to fulfil its promises with a worthless currency, repeating what occurred in the 1780s with the country’s first currency, the continental?

In my books and articles over the years I have been making the case that it will be the latter. The dollar has been on a path leading to its collapse. It is the path of least resistance for politicians and their captive central bankers to take, as evidenced by the dozens of currencies that have failed just in living memory, let alone those from monetary history buried in the fiat currency graveyard and long forgotten.

The erosion of the dollar’s purchasing power so far has been gradual, but it is accelerating. Nevertheless, there is still time for political leaders to act.

The right thing to do is simply walk away from the debt and start over. That is what the framers of the Constitution did. So starting over this time would not be starting from scratch. We do not need to relearn from experience what Americans endured from the collapse of the continental two and one-half centuries ago. We can act now before the decline in the dollar’s purchasing power accelerates by simply returning to the constitutional monetary system that existed from the Mint Act of 1792 until 1913 when the Federal Reserve was created.

In fact, we need to unravel all the harmful legislation as well as overturn the constitutional amendments from the late 19th and early 20th century foisted on the American public by the so-called ‘progressives’ of the socialistic radical left and reject their fascism. But this article is about the inevitability of a default and the collapse of fiat currency, not politics.

The Math Pointing to Default & Hyperinflation

Defaults are the outcome of poor financial management, whether individuals, companies, or governments. Defaults rest upon numbers, specifically the cash-flow of revenue and outlays and their relation to the amount of debt. Hyperinflation is the result when governments fund their ever-growing expenses, budget deficits, and debt with new paper currency issued by the central bank and/or deposit currency originating within the banking system.

The following chart illustrates the relationship between the federal government’s $33 trillion debt and the interest rate paid on it. Up to now a default has been avoided by manipulating interest rates.

Notwithstanding the surge of federal government debt, the annual average interest rate paid on its debt has been declining since the 1980s and has remained artificially low since the end of the 2008 financial crisis. Only recently has it started to inch up from a post-pandemic low of 2.07%. The consequence of this artificially low interest rate was a manageable interest expense burden while the total debt soared, an unrepeatable circumstance that is now setting the stage for dollar hyperinflation.

The data in the following table presents the federal government’s financial results with my 2-year projection. The Implied Interest Rate is Gross Interest paid by the government divided by the year’s Average Debt. The key measure is the Insolvency Ratio, which is Gross Interest divided by Federal Revenue.

In 1980 when Federal Reserve Chairman Paul Volcker was raising interest rates to fight inflation, the Implied Interest Rate on the Average Debt that year was 8.61%. The Insolvency Ratio was 14.5% and manageable. Although interest rates soon peaked and began declining, the Insolvency Ratio continued climbing because of irresponsible federal government spending that resulted in continual budget deficits and a growing federal debt through the rest of that decade.

The ratio hit 27.1% in 1991 , a year in which Federal Revenue and its Outlays were both adversely impacted by the recession then prevailing. Alarm bells began ringing. A 30% Insolvency Ratio is generally seen as the tipping point that typically ignites a monetary, economic, and banking crisis. Importantly, it also signals the point at which inflation accelerates into hyperinflation as government outlays and debt grow faster than its revenue, and the resulting deficits are paid for with new currency emanating from a compliant banking system.

So politicians back then faced a dilemma. They had to reverse course and stop their uncontrolled spending or find a solution to perpetuate endless deficits and borrowing. They came up with a shameful response – more market intervention.

The Federal Reserve would manipulate interest rates, forcing them below levels determined by market participants, artificially lessening the cost of capital and skewing the free market process. This harmful policy of financial repression eased the government’s interest expense burden but did so with irreparable damage to savers, the backbone of capitalism and the principal means by which the middle class accumulates purchasing power to prepare for an uncertain future.

It was a wicked tactic to buy time and retain the status quo; it was not a solution. The proverbial can was kicked down the road for the umpteenth time.

That beaten-up can is now about to go over the cliff and take the dollar with it because artificially low interest rates have encouraged even greater amounts of borrowing that have resulted in even more accumulated debt. The time bought by this tactic is now ending as interest rates have begun their inevitable return to levels better reflecting the heightened credit and counterparty risk of the federal government’s debt mountain, which is rapidly approaching $34 trillion.

Rushing Toward the Tipping Point

As the debt rises, so does the interest expense burden from carrying that debt. Without a cut in outlays in other areas of the government, which is unlikely, the growing interest expense deepens the deficit and requires more borrowing. Those steps initiate a vicious spiral of bigger deficits that require more debt with a growing interest expense burden, all of which is paid for with newly created currency by the Federal Reserve working in tandem with the banking system. The resulting currency debasement – the erosion of its purchasing power – is the inflation that is causing so much financial distress and worry, and now the deficit spiral is deepening.

Alarm bells are ringing like they did in the early 1990s. The never-ending deficits and higher interest rates heighten the risk of default, which explains why the federal government is losing its triple-A credit rating.

My projections in Table 1 assume a 4% and 5% year-end interest rate for the federal government for 2024 and 2025 respectively, leading to an Implied Interest Rate of 3.74% and 4.37% for those years. I also assume that Outlays in both years grow at 5.5%, which is their CAGR from 1980 to 2023, while Revenue grows at its 5.0% historical CAGR. These are modest assumptions, so the projection can easily be disrupted and made worse by a recession, or even just a low level of economic growth.

In particular, note the 5-point jump in the Insolvency Ratio from 2022 to 2023. The federal government spent less last year to meet its regular operating expenses – Outlays Less Gross Interest declined $301 billion. But Federal Revenue declined $458 billion, which is $363 billion less than the government budgeted in January. This troubling -9.4% decline in annual revenue not only highlights the precariousness of the federal government’s financial position, it also indicates that the U.S. economy is rolling over and may have already entered a recession. This observation is supported by the Leading Economic Index, which just recorded its sixteenth consecutive monthly decline.

Typically in a recession revenue declines while outlays increase, as happened in the Great Recession. In 2009 Federal Revenue fell -16.6%, while Outlays jumped 17.9%. A repeat of those magnitudes would send the Insolvency Ratio soaring because the debt today is 3-times greater than it was in 2009 while Federal Revenue is only 2-times greater.

Regardless of whether a recession has begun, the federal government’s debt and its interest expense burden are accelerating because of the rise in interest rates that began last year. Worryingly, even if interest rates do not rise further, my projections in Table 1 calculate that the 30% tipping point will be reached in 2025 as maturing low interest rate debt will be refinanced at higher interest rates.

Any further increase in interest rates beyond my projected level would mean the tipping point is reached even sooner. For example, the 30% tipping point is reached in 2024 if the year-end interest rate paid by the federal government on its debt is 4.5%, instead of 4% as projected in Table 1. This relatively small increase in rates highlights the federal government’s precarious position. As seen in the Table 2, it has a fatal sensitivity to higher rates because of the huge amount of its debt in relation to its ability to generate revenue, even if Federal Revenue grows in 2024 and the economy somehow avoids a recession.

In contrast to the 1990s, there are no can-kicking alternatives for politicians to grasp on to. Reducing interest rates before inflation is under control will lead to a flight from the dollar as people seek alternatives like gold, silver, and other useful tangible assets to protect their purchasing power. Even if interest rates do not rise further, the tipping point is near simply because of the amount of accumulated debt.

The federal government is on a knife-edge, with default looming in the near future. This dire outcome is simply a reflection of math, which is undeniable. Actual results of revenue, outlays, and debt along with the above projections highlight past decades of financial mismanagement.

The Lesson To Be Learned

There is a critically important lesson to be learned, though ‘re-learned’ is more accurate given that history is replete with recurring examples of political folly and government repression. A command economy eventually ends in unmitigated failure regardless of the political ideology that promotes it.

We know that conclusion to be true from the economic and currency collapse of the Soviet Union, Venezuela, and other countries that propagandise false social doctrines that disparage capitalism and free markets. They share a common thread of eventual economic failure due to their rigging of interest rates and other heinous schemes of financial repression.

Tragically, their repression is not just financial. They all erode the liberty of their citizens, which is the inescapable outcome from political control of currency and interest rates in a command economy. By pursuing in the twentieth century an unconstitutional monetary system, America has inexcusably fallen into this fiendish trap.

Controls On Government from Issuing Money

By abandoning key provisions of the Constitution, the monetary process has spun out of control. Gold and silver – the moneys of the Constitution – are only mined when it is profitable to do so. The framers and their successors for the following century understood that the unbendable limits of nature[9] and prudent capitalism together harmoniously control the weight of metal mined each year. With their careful crafting of Article I, Sections 8 & 10 that limits federal power to the coining of money (not printing it), they purposefully kept the creation of new money out of the hands of politicians and central bankers. We are experiencing the calamitous consequences of jettisoning these essential constitutional requirements put there by the framers after they lived through and learned from the collapse of the continental currency.

There are no limits restricting how many unconstitutional dollars can be created. Even the debt limit has been cast aside. Dollars are being conjured up with reckless abandon that has enabled the growth in the federal government’s debt. A compliant Federal Reserve and a banking system spurred on by huge – but insupportable – profits provide whatever amount of fiat currency is needed to meet the unrealistic spending aspirations of the federal political class.

We know from monetary history that continual credit expansion cannot be sustained. When it eventually ends, the debt mountain crashes and takes along with it the fiat currency that built it.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” Ludwig von Mises

America’s politicians need to make some tough decisions, and so do the voters who put them into a position of responsibility. Sensible leadership is needed to move the country back to a constitutional republic of honest money. Otherwise the country will continue plunging ahead recklessly on the road to default with the unpredictable social and political consequences arising from the collapse of the dollar’s purchasing power.

To prepare for another default, own physical gold and physical silver, not their paper representations. Many of those promises will be defaulted too, repeating what the US Treasury did in 1933 by defaulting on its paper gold certificates and its paper silver certificates in 1965.

Loading…