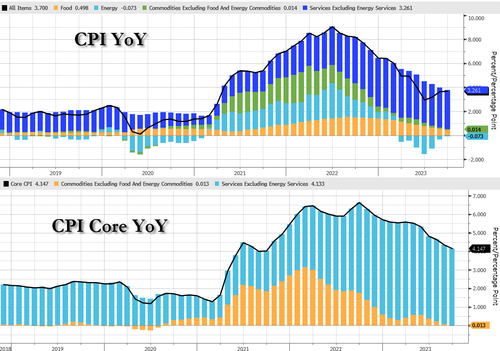

Following August's bigger than expected jump (driven by surging energy prices and healthcare methodology changes)., September's CPI was expected to slow (+0.3% MoM) with the YoY pace inching back lower (from 3.7% to 3.6%) after rebounding for two straight months.

However, headline CPI came in modestly hot at +0.4%, with YoY at 3.7% - that is the 3rd monthly rebound in a row.

Source: Bloomberg

Core CPI rose 0.3% MoM, with YoY sliding to +4.1% YoY (as expected)... it still hasnt been below 4.00% since May 2021....

Source: Bloomberg

Food and Commodities contribution to YoY CPI slowed while Services increased...

Goods inflation dipped back to unchanged YoY and Services CPI slowed to +5.7%...

Services stands out on A MoM basis...

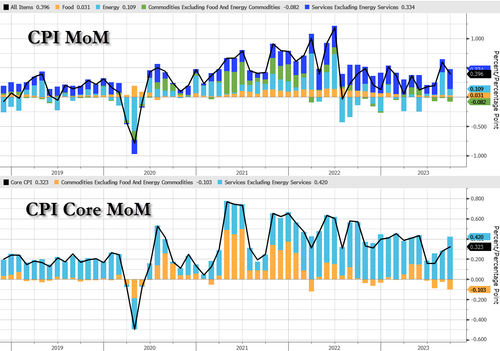

Under the hood, gasoline continues to rise and used car prices drop...

The index for all items less food and energy rose 0.3 percent in September, as it did in August.

-

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy.

-

The shelter index increased 0.6 percent in September, after rising 0.3 percent the previous month. The index for rent rose 0.5 percent in September, and the index for owners’ equivalent rent increased 0.6 percent over the month.

-

The lodging away from home index increased 3.7 percent in September, ending a string of 3 consecutive monthly decreases.

-

Among the other indexes that rose in September was the index for motor vehicle insurance, which increased 1.3 percent after rising 2.4 percent the preceding month.

-

The indexes for recreation, personal care, new vehicles, and household furnishings and operations also increased in September.

-

The medical care index rose 0.2 percent in September, as it did in August.

-

The index for hospital services increased 1.5 percent over the month, and the index for physicians’ services was unchanged.

-

The prescription drugs index fell 0.7 percent in September.

-

The index for used cars and trucks fell 2.5 percent in September, after decreasing 1.2 percent in August.

-

The apparel index declined 0.8 percent over the month, and the communication index was unchanged.

The index for all items less food and energy rose 4.1 percent over the past 12 months.

-

The shelter index increased 7.2 percent over the last year, accounting for over 70% of the total increase in all items less food and energy.

-

Other indexes with notable increases over the last year include motor vehicle insurance (+18.9 percent), recreation (+3.9 percent), personal care (+6.1 percent), and new vehicles (+2.5 percent).

Gasoline prices continue to rise...

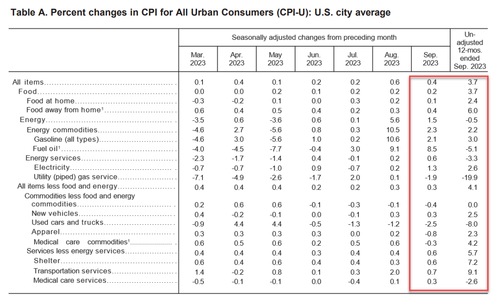

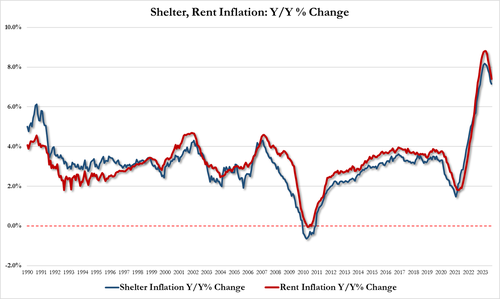

Shelter costs are slowing, but accounted for the largest part of core CPI...

-

Rent inflation 7.41%, down from 7.76% in August and the lowest since Sept 2022

-

Shelter inflation 7.15%, down from 7.27% in August and the lowest since Nov 2022

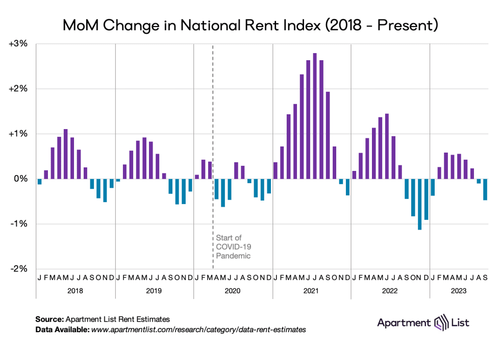

Bear in mind that while CPI very stale data is rising over 7%, real-time rent indicators are in freefall. Apt List's Sept rent drop was the biggest on record...

Is this third straight monthly increase in CPI YoY an inflection point? Or is M2 still leading the trend?

Turning from the cost of things to the ability to pay, "real" wages contracted 0.1% YoY (after 3 months positive)...

This is not the soft-landing cruise lower in inflation that the market (and The Fed) was hoping for...

Following August’s bigger than expected jump (driven by surging energy prices and healthcare methodology changes)., September’s CPI was expected to slow (+0.3% MoM) with the YoY pace inching back lower (from 3.7% to 3.6%) after rebounding for two straight months.

However, headline CPI came in modestly hot at +0.4%, with YoY at 3.7% – that is the 3rd monthly rebound in a row.

Source: Bloomberg

Core CPI rose 0.3% MoM, with YoY sliding to +4.1% YoY (as expected)… it still hasnt been below 4.00% since May 2021….

Source: Bloomberg

Food and Commodities contribution to YoY CPI slowed while Services increased…

Goods inflation dipped back to unchanged YoY and Services CPI slowed to +5.7%…

Services stands out on A MoM basis…

Under the hood, gasoline continues to rise and used car prices drop…

The index for all items less food and energy rose 0.3 percent in September, as it did in August.

-

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy.

-

The shelter index increased 0.6 percent in September, after rising 0.3 percent the previous month. The index for rent rose 0.5 percent in September, and the index for owners’ equivalent rent increased 0.6 percent over the month.

-

The lodging away from home index increased 3.7 percent in September, ending a string of 3 consecutive monthly decreases.

-

Among the other indexes that rose in September was the index for motor vehicle insurance, which increased 1.3 percent after rising 2.4 percent the preceding month.

-

The indexes for recreation, personal care, new vehicles, and household furnishings and operations also increased in September.

-

The medical care index rose 0.2 percent in September, as it did in August.

-

The index for hospital services increased 1.5 percent over the month, and the index for physicians’ services was unchanged.

-

The prescription drugs index fell 0.7 percent in September.

-

The index for used cars and trucks fell 2.5 percent in September, after decreasing 1.2 percent in August.

-

The apparel index declined 0.8 percent over the month, and the communication index was unchanged.

The index for all items less food and energy rose 4.1 percent over the past 12 months.

-

The shelter index increased 7.2 percent over the last year, accounting for over 70% of the total increase in all items less food and energy.

-

Other indexes with notable increases over the last year include motor vehicle insurance (+18.9 percent), recreation (+3.9 percent), personal care (+6.1 percent), and new vehicles (+2.5 percent).

Gasoline prices continue to rise…

Shelter costs are slowing, but accounted for the largest part of core CPI…

-

Rent inflation 7.41%, down from 7.76% in August and the lowest since Sept 2022

-

Shelter inflation 7.15%, down from 7.27% in August and the lowest since Nov 2022

Bear in mind that while CPI very stale data is rising over 7%, real-time rent indicators are in freefall. Apt List’s Sept rent drop was the biggest on record…

And perhaps most importantly, one silver lining is that The Fed’s new favorite inflation signal – Core Services CPI Ex-Shelter YoY slowed to +3.74% (despite jumping 0.46% MoM). That is the lowest YoY since Dec 2021…

Is this third straight monthly increase in CPI YoY an inflection point? Or is M2 still leading the trend?

Turning from the cost of things to the ability to pay, “real” wages contracted 0.1% YoY (after 3 months positive)…

This is not the soft-landing cruise lower in inflation that the market (and The Fed) was hoping for…

Loading…