Ignoring core CPI and the stickiness of Core Services (ex-shelter) and Goods inflation re-acclerating... the market saw a headline CPI below expectations (barely) and celebrated the end of The Fed hiking cycle (again) by lowering rate expectations, and buying bonds, stocks and gold.

Bloomberg Economics’ Jonathan Church:

“Headline CPI inflation that came in slightly below expectations in March will provide a bit of relief for the Fed. But still-elevated core prices show inflation remains sticky, and recent OPEC+ production cuts suggest the good news on headline inflation is likely to be short-lived.

“A strong disinflationary push is expected from shelter over the summer, but given ongoing strength in the labor market and OPEC+’s cuts — as well as pressure from labor-intensive services industries — we still expect the Fed to hike rates by 25 basis points when it meets next month.”

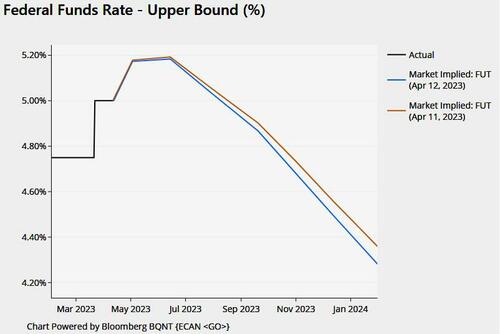

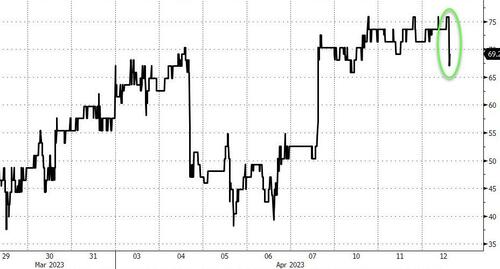

Odds of a 25bps hike in May fell...

With the whole STIRs curve dovishly declining...

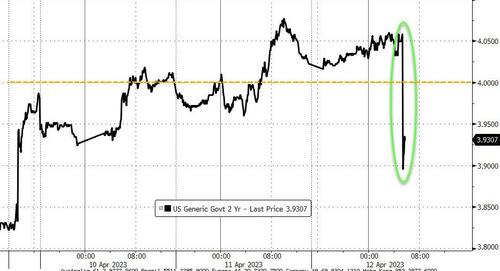

Treasury yields tumbled across the board, with the short-end notably outperforming...

With the 2Y Yield back below 4.00%...

Gold futures have spared back above $2040..

And stocks soared (but are giving some back)...which shouldn't be a huge surprise given that S&P futures shorts are near record highs...

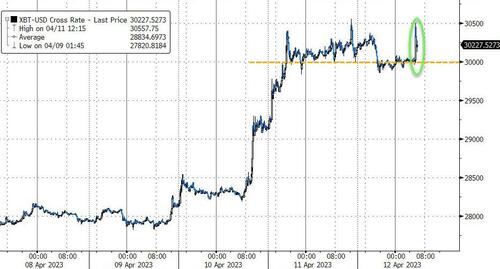

Bitcoin is also up - holding above $30,000...

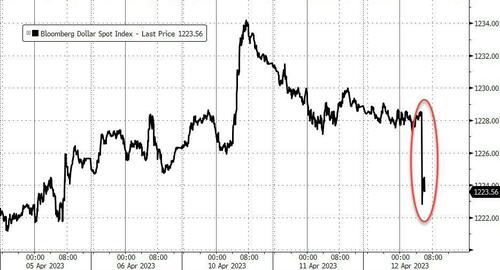

...as the dollar declines...

Finally, before everyone gets carried away again, Jeff Rosenberg, BlackRock’s senior portfolio manager, told Bloomberg Television that he wouldn’t read too much into this report when it comes to giving the “all clear.” But he added that it’s indeed positive in a sense that it wasn’t a huge negative surprise.

Ignoring core CPI and the stickiness of Core Services (ex-shelter) and Goods inflation re-acclerating… the market saw a headline CPI below expectations (barely) and celebrated the end of The Fed hiking cycle (again) by lowering rate expectations, and buying bonds, stocks and gold.

Bloomberg Economics’ Jonathan Church:

“Headline CPI inflation that came in slightly below expectations in March will provide a bit of relief for the Fed. But still-elevated core prices show inflation remains sticky, and recent OPEC+ production cuts suggest the good news on headline inflation is likely to be short-lived.

“A strong disinflationary push is expected from shelter over the summer, but given ongoing strength in the labor market and OPEC+’s cuts — as well as pressure from labor-intensive services industries — we still expect the Fed to hike rates by 25 basis points when it meets next month.”

Odds of a 25bps hike in May fell…

With the whole STIRs curve dovishly declining…

Treasury yields tumbled across the board, with the short-end notably outperforming…

With the 2Y Yield back below 4.00%…

Gold futures have spared back above $2040..

And stocks soared (but are giving some back)…which shouldn’t be a huge surprise given that S&P futures shorts are near record highs…

Bitcoin is also up – holding above $30,000…

…as the dollar declines…

Finally, before everyone gets carried away again, Jeff Rosenberg, BlackRock’s senior portfolio manager, told Bloomberg Television that he wouldn’t read too much into this report when it comes to giving the “all clear.” But he added that it’s indeed positive in a sense that it wasn’t a huge negative surprise.

Loading…