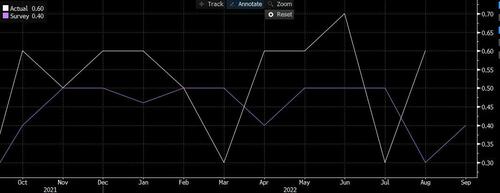

It's understandable that traders, both retail and hedge funds, will be nervous ahead of tomorrow's CPI print: as we noted earlier, with just one exception - the CPI report for July - the S&P 500's response has been to slide every time the data was released as inflation has chronically come in hotter than expected. In fact, as shown in the chart below, core CPI has come in at or above expectations on 9 of the past 11 occasions.

But this nervous?

According to Goldman's Prime Brokerage, ahead of the CPI print, as US stocks tested YTD lows yesterday, the pace of net selling from hedge funds accelerated with the overall Prime book seeing the largest notional net selling since mid-September (-1.7 SDs 1-year), driven by short sales outpacing long buys ~5 to 1.

Furthermore, as stocks across all regions were net sold led in notional terms by North America, Europe, and EM Asia, US equities were net sold for a 5th straight day and saw the largest notional net selling in nearly a month (-1.0 SDs), driven by short sales outpacing long buys nearly 4 to 1.

- Both Single Stocks and Macro Products (ETF and Index combined) were both net sold and made up 62% and 38% of the notional net selling, respectively.

- 8 of 11 sectors were net sold, led in notional terms by Info Tech, Industrials, Energy, and Financials, while Consumer Disc, Staples, and Health Care were the only net bought sectors.

- Info Tech stocks were net sold for a 4th straight day and saw the largest notional net selling in nearly 6 months (-1.8 SDs), driven by short sales and to a lesser extent long sales (4 to 1).

- Info Tech was by far the most net sold sector yesterday, accounting for over 60% of the notional net selling across all Single Stocks.

- All Tech subsectors were net sold yesterday, led in notional terms by Semis & Semi Equip, Software, and IT Services.

- US Semis & Semi Equip long/short ratio ended yesterday at 0.94 – the lowest level ever on our record. For perspective, US Semis & Semi Equip long/short ratio was at 1.94 at the start of 2022.

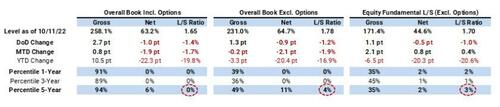

Amid all this bearish momentum, Goldman calculates that net equity positioning fell to fresh 5-year lows ahead of the US CPI data, for the overall Prime book as well as Fundamental L/S managers:

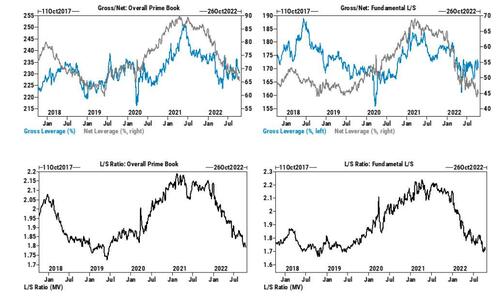

And visually:

Translation: sentiment has completely bombed out - yes the CPI may come in hot, and will likely lead to more selling, at least initially, but everyone is already positioned for this. A dovish surprise, on the other hand, and risk will see a huge flush higher as underinvested and short hedge funds are squeezed. Come to think of it, with the midterms in less than a month, would Biden want a crash going into November 8 or a meltup? We doubt that even demented, old Joe is stupid enough not to realize what's at stake and that the S&P crashing another 20% from here will hardly help Democrat chances and keep his son out of prison...

It’s understandable that traders, both retail and hedge funds, will be nervous ahead of tomorrow’s CPI print: as we noted earlier, with just one exception – the CPI report for July – the S&P 500’s response has been to slide every time the data was released as inflation has chronically come in hotter than expected. In fact, as shown in the chart below, core CPI has come in at or above expectations on 9 of the past 11 occasions.

But this nervous?

According to Goldman’s Prime Brokerage, ahead of the CPI print, as US stocks tested YTD lows yesterday, the pace of net selling from hedge funds accelerated with the overall Prime book seeing the largest notional net selling since mid-September (-1.7 SDs 1-year), driven by short sales outpacing long buys ~5 to 1.

Furthermore, as stocks across all regions were net sold led in notional terms by North America, Europe, and EM Asia, US equities were net sold for a 5th straight day and saw the largest notional net selling in nearly a month (-1.0 SDs), driven by short sales outpacing long buys nearly 4 to 1.

- Both Single Stocks and Macro Products (ETF and Index combined) were both net sold and made up 62% and 38% of the notional net selling, respectively.

- 8 of 11 sectors were net sold, led in notional terms by Info Tech, Industrials, Energy, and Financials, while Consumer Disc, Staples, and Health Care were the only net bought sectors.

- Info Tech stocks were net sold for a 4th straight day and saw the largest notional net selling in nearly 6 months (-1.8 SDs), driven by short sales and to a lesser extent long sales (4 to 1).

- Info Tech was by far the most net sold sector yesterday, accounting for over 60% of the notional net selling across all Single Stocks.

- All Tech subsectors were net sold yesterday, led in notional terms by Semis & Semi Equip, Software, and IT Services.

- US Semis & Semi Equip long/short ratio ended yesterday at 0.94 – the lowest level ever on our record. For perspective, US Semis & Semi Equip long/short ratio was at 1.94 at the start of 2022.

Amid all this bearish momentum, Goldman calculates that net equity positioning fell to fresh 5-year lows ahead of the US CPI data, for the overall Prime book as well as Fundamental L/S managers:

And visually:

Translation: sentiment has completely bombed out – yes the CPI may come in hot, and will likely lead to more selling, at least initially, but everyone is already positioned for this. A dovish surprise, on the other hand, and risk will see a huge flush higher as underinvested and short hedge funds are squeezed. Come to think of it, with the midterms in less than a month, would Biden want a crash going into November 8 or a meltup? We doubt that even demented, old Joe is stupid enough not to realize what’s at stake and that the S&P crashing another 20% from here will hardly help Democrat chances and keep his son out of prison…