Yesterday we quoted from the latest weekly JPMorgan Prime Brokerage report, "Signs US Shorting Getting Extreme...EU Bought, China Not, Credit / FI ETFs Turn Risk Off" (note available here), which laid out several reasons why a tech short-squeeze is looking increasingly likely; specifically, according to JPM Prime, hedge funds have been on a shorting stampede and high short interest stocks in the US have seen a 6 week period of persistent short additions: "The magnitude and duration of these short additions is on par with the largest we’ve seen in past years and the cumulative additions put shorts in these types of stocks back at multi-year highs."

Today we compare JPM's data with the latest Prime Brokerage data, this time from Goldman (full note available here), and find that hedge funds are indeed running for the hills, and shorting everything tech-related in the process.

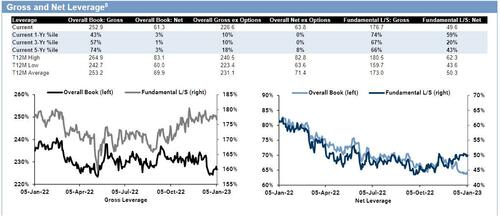

According to GS Prime, overall Book Net leverage ended the week at the lowest level since Jun '19, even as Fundamental L/S Net leverage is off the lows and currently around one-year average, with the recent rise driven in part by increased net exposure across China focused L/S managers.

Gross trading flow increased for a 2nd straight week, which resulted in modest net selling (-0.6 SDs) driven by short sales outpacing long buys ~2 to 1. Single Stocks saw the largest net selling in 7 weeks, while Macro Products were modestly net bought. North America was by far the most notionally net sold region, driven by short sales, while EM Asia and Europe were the most net bought, both driven by long buys. 8 of 11 global sectors were net sold on the week, led in notional terms by Info Tech, Health Care, Comm Svcs, and Energy, while Financials, Real Estate, and Materials were net bought.

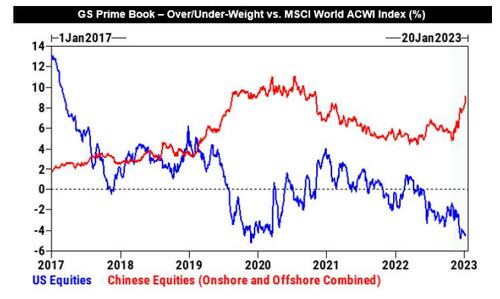

Additionally, while US equities were net sold in each day last week, "driven mainly by short sales", Chinese stocks were net bought in each of the past 13 days on the Prime book, pushing the weighting vs. MSCI World to +9.5%, the most O/W level since Oct ’20. Some more details:

- In notional terms globally, US was by far the most net sold market while China was the most net bought on the Prime book this week, which points to continued regional rotation by hedge funds.

- Chinese stocks were net bought for a 3rd straight week (5 of the last 6) and saw the largest net buying since early December, driven entirely by long buys led by A-shares and to a lesser extent ADRs. Chinese stocks were net bought in each of the past 13 days – weighting vs. MSCI World now stands at +9.5%, the most O/W level since Oct ’20.

- In contrast, US equities were net sold in each of the past sessions, driven mainly by short sales. US weighting vs. MSCI World is at -4.9%, the most U/W level since Nov ’19.

- Positioning thru thematic baskets tells a similar story. Aggregate L/S ratio across SPX constituents now stands at 1.9, near 5-year lows. On the other hand, aggregate L/S ratio in China ADRs (GSXUCADR) is at 4.1, at 1-year highs and in the 67th percentile on a 5-year lookback.

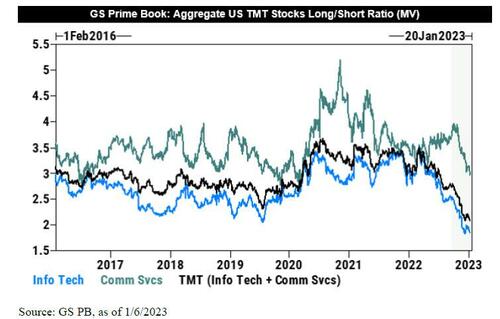

Looking at just the former market darling, the TMT (Tech/Media) sector, here Goldman finds that the TMT long/short ratio fell to the lowest level on Goldman record (since 2016) amid the largest net selling in 9 months.

- Ahead of US NFP data, HFs heavily net sold TMT stocks which accounted for ~70% of the notional net selling across all US single stocks

- HFs have net sold TMT stocks in 10 of the past 12 weeks. This week’s notional net selling in US TMT is the largest in 9 months and ranks in the 98th percentile vs. the past 5 years, driven by long-and- short sales. Nearly all subsectors were net sold on the week (sans Entertainment), led in notional terms by IT Svcs, Semis & Semi Equip, and Software.

- The aggregate US Info Tech and TMT long/short ratios ended the week at 1.85 and 2.08, respectively, both at the lowest levels on Goldman's record since early 2016. On a micro level, aggregate L/S ratios are either at or near 5-year lows across Semis & Semi Equip, Mega Caps (GSTMTMEG), Growth Software (GSCBSF8X), and Non-Profitable Tech (GSXUNPTC) stocks.

- US TMT over/under-weight vs. SPX ended the week at -4.6% U/W, near 5-year lows in the 1st percentile

In light of this shorting frenzy, it's not a surprise that yesterday morning we saw a scramble among the HF community to cover crowded shorts in growth software: as Goldman notes, "our growth software basket (GSCBSF8X) squeezed +327bps."

Finally, for those who missed it, here is JPMorgan explaining why it, too, is concerned about a powerful tech squeeze (more here):

- HFs Keep Shorting High SI stocks in the US…but will it persist?: When looking at N. America gross flows, they rebounded from a -2z level to a +2.6z level in late Dec. In particular, High SI stocks in the US have seen a ~6 week period of persistent short additions. The magnitude and duration of these short additions is on par with the largest we’ve seen in past years and the cumulative additions put shorts in these types of stocks back at multi-year highs

- US Themes…Energy and Defensives Bought and Airlines flip: From a sector perspective, HFs appeared to be buying the dip in Energy this past week, alongside buying Defensives vs. selling Financials (led by Banks), Comm Services, Cons Disc. At a more granular level, there’s been a big reversal in Airlines from shorting to buying, though net exp remains low as shorts are still high. In contrast, while there’s still a lot of negativity towards Tech in general, broader Software (JP1SFT) has seen some net buying over the past week and month (via longs and shorts). This is NOT so much the case for Expensive Software (JP1XSFT) where flows remain nearly paired off

More in the full Goldman prime note available to professional subscribers.

Yesterday we quoted from the latest weekly JPMorgan Prime Brokerage report, “Signs US Shorting Getting Extreme…EU Bought, China Not, Credit / FI ETFs Turn Risk Off” (note available here), which laid out several reasons why a tech short-squeeze is looking increasingly likely; specifically, according to JPM Prime, hedge funds have been on a shorting stampede and high short interest stocks in the US have seen a 6 week period of persistent short additions: “The magnitude and duration of these short additions is on par with the largest we’ve seen in past years and the cumulative additions put shorts in these types of stocks back at multi-year highs.”

Today we compare JPM’s data with the latest Prime Brokerage data, this time from Goldman (full note available here), and find that hedge funds are indeed running for the hills, and shorting everything tech-related in the process.

According to GS Prime, overall Book Net leverage ended the week at the lowest level since Jun ’19, even as Fundamental L/S Net leverage is off the lows and currently around one-year average, with the recent rise driven in part by increased net exposure across China focused L/S managers.

Gross trading flow increased for a 2nd straight week, which resulted in modest net selling (-0.6 SDs) driven by short sales outpacing long buys ~2 to 1. Single Stocks saw the largest net selling in 7 weeks, while Macro Products were modestly net bought. North America was by far the most notionally net sold region, driven by short sales, while EM Asia and Europe were the most net bought, both driven by long buys. 8 of 11 global sectors were net sold on the week, led in notional terms by Info Tech, Health Care, Comm Svcs, and Energy, while Financials, Real Estate, and Materials were net bought.

Additionally, while US equities were net sold in each day last week, “driven mainly by short sales”, Chinese stocks were net bought in each of the past 13 days on the Prime book, pushing the weighting vs. MSCI World to +9.5%, the most O/W level since Oct ’20. Some more details:

- In notional terms globally, US was by far the most net sold market while China was the most net bought on the Prime book this week, which points to continued regional rotation by hedge funds.

- Chinese stocks were net bought for a 3rd straight week (5 of the last 6) and saw the largest net buying since early December, driven entirely by long buys led by A-shares and to a lesser extent ADRs. Chinese stocks were net bought in each of the past 13 days – weighting vs. MSCI World now stands at +9.5%, the most O/W level since Oct ’20.

- In contrast, US equities were net sold in each of the past sessions, driven mainly by short sales. US weighting vs. MSCI World is at -4.9%, the most U/W level since Nov ’19.

- Positioning thru thematic baskets tells a similar story. Aggregate L/S ratio across SPX constituents now stands at 1.9, near 5-year lows. On the other hand, aggregate L/S ratio in China ADRs (GSXUCADR) is at 4.1, at 1-year highs and in the 67th percentile on a 5-year lookback.

Looking at just the former market darling, the TMT (Tech/Media) sector, here Goldman finds that the TMT long/short ratio fell to the lowest level on Goldman record (since 2016) amid the largest net selling in 9 months.

- Ahead of US NFP data, HFs heavily net sold TMT stocks which accounted for ~70% of the notional net selling across all US single stocks

- HFs have net sold TMT stocks in 10 of the past 12 weeks. This week’s notional net selling in US TMT is the largest in 9 months and ranks in the 98th percentile vs. the past 5 years, driven by long-and- short sales. Nearly all subsectors were net sold on the week (sans Entertainment), led in notional terms by IT Svcs, Semis & Semi Equip, and Software.

- The aggregate US Info Tech and TMT long/short ratios ended the week at 1.85 and 2.08, respectively, both at the lowest levels on Goldman’s record since early 2016. On a micro level, aggregate L/S ratios are either at or near 5-year lows across Semis & Semi Equip, Mega Caps (GSTMTMEG), Growth Software (GSCBSF8X), and Non-Profitable Tech (GSXUNPTC) stocks.

- US TMT over/under-weight vs. SPX ended the week at -4.6% U/W, near 5-year lows in the 1st percentile

In light of this shorting frenzy, it’s not a surprise that yesterday morning we saw a scramble among the HF community to cover crowded shorts in growth software: as Goldman notes, “our growth software basket (GSCBSF8X) squeezed +327bps.”

Finally, for those who missed it, here is JPMorgan explaining why it, too, is concerned about a powerful tech squeeze (more here):

- HFs Keep Shorting High SI stocks in the US…but will it persist?: When looking at N. America gross flows, they rebounded from a -2z level to a +2.6z level in late Dec. In particular, High SI stocks in the US have seen a ~6 week period of persistent short additions. The magnitude and duration of these short additions is on par with the largest we’ve seen in past years and the cumulative additions put shorts in these types of stocks back at multi-year highs

- US Themes…Energy and Defensives Bought and Airlines flip: From a sector perspective, HFs appeared to be buying the dip in Energy this past week, alongside buying Defensives vs. selling Financials (led by Banks), Comm Services, Cons Disc. At a more granular level, there’s been a big reversal in Airlines from shorting to buying, though net exp remains low as shorts are still high. In contrast, while there’s still a lot of negativity towards Tech in general, broader Software (JP1SFT) has seen some net buying over the past week and month (via longs and shorts). This is NOT so much the case for Expensive Software (JP1XSFT) where flows remain nearly paired off

More in the full Goldman prime note available to professional subscribers.

Loading…